Battery Storage Inverter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435423 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Battery Storage Inverter Market Size

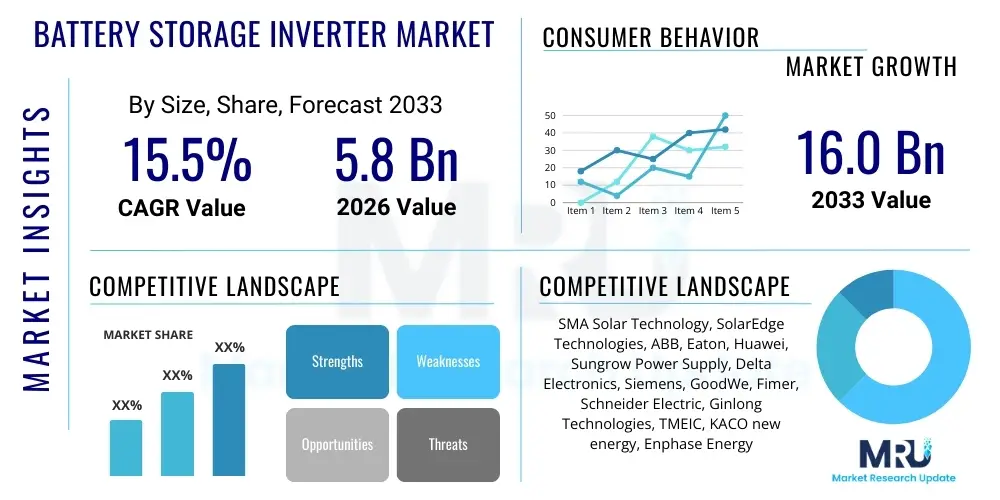

The Battery Storage Inverter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 16.0 Billion by the end of the forecast period in 2033.

Battery Storage Inverter Market introduction

The Battery Storage Inverter Market encompasses sophisticated power electronics designed to manage the flow of energy between a renewable energy source (like solar PV), the battery storage system, and the electrical grid or load. These inverters are crucial components, performing bidirectional DC-to-AC and AC-to-DC conversion, ensuring optimal charging and discharging cycles of the battery, thereby maximizing the efficiency and longevity of the entire energy storage system. Their primary function is not only power conversion but also sophisticated grid management, enabling services such as frequency regulation, peak shaving, and voltage support, which are increasingly vital for stabilizing modern electrical infrastructure characterized by high intermittent renewable penetration.

The necessity for robust battery storage inverters is driven primarily by the global energy transition away from fossil fuels and towards decentralized renewable generation. Applications range widely, from small-scale residential backup systems ensuring continuity of supply during outages, to massive utility-scale installations supporting grid stability and arbitrage opportunities. Key benefits include enhanced energy independence, reduced carbon footprint, improved grid resilience, and the economic value derived from time-of-use optimization. The product landscape includes hybrid inverters combining solar and battery management, and dedicated battery inverters optimized solely for storage integration, allowing system integrators flexibility based on project specific needs and existing infrastructure.

Driving factors propelling market growth include aggressive governmental targets for renewable energy deployment, favorable regulatory frameworks promoting energy storage incentives (such as federal tax credits and state-level mandates in key markets), and the steep decline in the cost of lithium-ion batteries, which makes storage solutions economically viable across residential, commercial, and utility segments. Furthermore, the increasing frequency of extreme weather events necessitating reliable backup power is accelerating the adoption rate, particularly in regions with aging or vulnerable grid infrastructure that suffers frequent disruptions, placing resilience at the forefront of purchasing decisions.

Battery Storage Inverter Market Executive Summary

The Battery Storage Inverter Market is exhibiting robust growth, underpinned by significant technological advancements in power density and thermal management, facilitating integration into increasingly constrained physical spaces. Business trends indicate a strong move towards modular and scalable inverter designs, allowing system integrators greater flexibility in sizing systems for varied client needs, from small commercial enterprises requiring demand charge reduction to large utility farms requiring instantaneous reactive power compensation. Competition is intensifying, forcing established inverter manufacturers to merge advanced software capabilities, including predictive analytics and machine learning algorithms, directly into their hardware platforms to enhance system performance monitoring, predictive maintenance efficiency, and optimize participation in highly complex ancillary service markets managed by grid operators.

Regionally, the market is highly dynamic and segmented. Asia Pacific, specifically driven by China and India, maintains the largest volume share due to immense population size, rapid industrialization, and massive government investment in renewable energy infrastructure, including gigawatt-scale storage projects necessary to stabilize their rapidly expanding grids. North America, particularly the United States, demonstrates the highest growth rate (CAGR), fueled by significant policy support like the Inflation Reduction Act (IRA) and high electricity prices incentivizing homeowners and businesses to maximize self-consumption and participate in virtual power plant (VPP) initiatives, favoring technologically sophisticated hybrid inverters. Europe focuses heavily on decarbonization targets, with Germany and the UK leading the charge in developing sophisticated ancillary services markets that heavily rely on advanced, secure battery inverter functionality.

Segmentation analysis highlights the dominance of utility-scale applications in terms of megawatt deployed, driven by large power purchase agreements and government tenders, while the residential segment exhibits the fastest unit volume growth, largely driven by the popularity of hybrid inverters that streamline installations and reduce overall balance-of-system costs. Three-phase inverters dominate the commercial and utility sectors due to higher power handling requirements and strict grid connection standards for integration into medium and high voltage networks, whereas single-phase solutions remain the standard for residential installations across most developed economies. Lithium-ion compatible inverters constitute the overwhelming majority of the market due to the superior energy density and lifecycle performance of Li-ion chemistries, though specialized inverters supporting flow batteries and other emerging chemistries are gaining traction for long-duration storage projects requiring enhanced safety and minimal long-term degradation characteristics.

AI Impact Analysis on Battery Storage Inverter Market

User queries regarding AI in the Battery Storage Inverter Market frequently revolve around optimizing energy arbitrage, predictive maintenance, and enhancing grid responsiveness. Common questions include: "How can AI reduce battery degradation by optimizing charging strategies?" "What role does machine learning play in forecasting dynamic residential energy load and solar generation?" and "Can AI-driven inverters improve synchronization and participation in complex VPP programs to maximize revenue?" This widespread user interest confirms that stakeholders are seeking tangible, operational benefits derived from intelligent systems that move beyond basic setpoint control. The core theme is leveraging AI to move battery storage inverters beyond simple power conversion devices into sophisticated, self-optimizing energy managers. Users expect AI to translate complex, multivariate data—such as high-resolution weather forecasts, real-time dynamic grid pricing signals, historical usage patterns, and critical battery state-of-health data—into instantaneous, optimal control decisions, thereby maximizing economic returns and system reliability while significantly minimizing operational expenditures and manual intervention.

The application of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the value proposition of battery storage inverters, shifting the focus from static hardware capability to intelligent, adaptive software performance and service delivery. AI algorithms are increasingly embedded within the inverter control systems (or hosted on cloud platforms integrated with the entire inverter fleet) to execute highly complex operational strategies that are impossible to manage manually. For instance, ML models can accurately predict electricity price volatility and system constraints hours or even days in advance, allowing the inverter to preemptively charge or discharge the battery to capture peak energy price differentials, participate optimally in capacity markets, or ensure regulatory compliance regarding ramp rates when injecting power into the distribution network. This predictive precision significantly increases the financial yield of the asset for owners and operators across residential, commercial, and utility scales.

Furthermore, AI significantly enhances the reliability and extends the longevity of the entire energy storage system, addressing the critical concern of battery replacement cost. By continuously monitoring high-resolution data on battery temperature, voltage fluctuations, current spikes, and overall state-of-health (SoH) in real-time, ML models can identify subtle acoustic, thermal, or electrical anomalies indicative of potential component failure or accelerated degradation long before conventional monitoring systems trigger basic alarms. This advanced predictive maintenance capability allows operators to schedule proactive interventions, reducing costly unscheduled downtime and, critically, implementing charging and discharging profiles specifically tailored to minimize electrochemical stress on the battery cells. Such fine-tuned control over duty cycles ensures extended battery lifespan, which is a key driver of total cost of ownership (TCO) reduction for BESS owners.

- AI-Driven Energy Arbitrage: Optimization of charge/discharge cycles based on real-time and predictive electricity pricing and consumption forecasts, maximizing financial returns.

- Predictive Maintenance (PdM): Use of ML to analyze operational data patterns and forecast component failure or critical battery degradation events, ensuring proactive servicing and achieving higher system uptime.

- Enhanced Grid Services Autonomy: Intelligent regulation of reactive power, inertial response, and frequency support required by utility operators, allowing the inverter to act as a more capable grid asset.

- Virtual Power Plant (VPP) Orchestration: AI manages synchronized charging and discharging across distributed fleets of inverters to fulfill complex, aggregated grid contracts effectively and minimize imbalances.

- Optimal Battery State-of-Health Management: Dynamic control of charging voltage and current profiles, minimizing thermal and electrical stress to maximize the total operational lifespan and warranted cycles of the battery pack.

- Cybersecurity Enhancements: ML models detect and mitigate anomalous behavior indicative of unauthorized access attempts or suspicious network communications within the inverter and EMS infrastructure, enhancing data integrity and system security.

DRO & Impact Forces Of Battery Storage Inverter Market

The market dynamics are defined by a strong confluence of compelling growth drivers and persistent operational restraints, balanced by substantial long-term opportunities, all of which exert significant pressure on technology development, cost structures, and market segmentation. The primary underlying driver is the global imperative to integrate massive quantities of intermittent renewable energy (solar and wind), demanding high-speed, reliable balancing power provided by battery energy storage systems (BESS), which are entirely dependent on advanced power conversion systems (inverters) for interface, control, and performance optimization. However, challenges persist, particularly related to the high initial capital expenditure of BESS projects, regulatory fragmentation that hinders standardization, and complex grid interconnection processes, which inverter manufacturers must continuously address through cost optimization and enhanced efficiency.

Drivers: Governmental support through mandates and powerful financial incentives (e.g., long-term investment tax credits, Renewable Portfolio Standards, state-level storage targets) provides the foundational economic stimulus for BESS adoption globally. Secondly, the rapidly falling cost trajectory of crucial components, particularly lithium-ion batteries, is enhancing the overall economic viability and Return on Investment (ROI) of storage projects, thereby creating a proportional and substantial demand for compatible, high-efficiency inverters. Third, increasing grid instability caused by higher climate event frequency, aging transmission infrastructure, and rising energy demand necessitates immediate deployment of BESS for resilience and frequency support, particularly in critical infrastructure sectors. Finally, the growing consumer desire for energy independence, paired with the expansion of electric vehicle (EV) charging infrastructure, significantly drives the demand for reliable hybrid and bi-directional inverter systems in residential and C&I settings.

Restraints: Significant restraints include the complex and often fragmented regulatory landscape across different regional electricity markets and jurisdictions, which complicates the standardization of inverter features and grid compliance requirements. Moreover, the initial high capital cost of high-power, high-efficiency inverters, especially those certified for utility-scale deployment with stringent grid requirements, can hinder project financing, particularly in emerging markets. Technical constraints also exist, such as the inherent challenges in managing extreme thermal stress in high-density power electronics and ensuring stringent, evolving cybersecurity across a large, distributed fleet of connected devices, which demands continuous and costly R&D investment. Finally, the supply chain volatility for key semiconductor components (SiC/GaN) and the skilled labor shortage for complex system installation and maintenance also present logistical hurdles limiting deployment speed.

Opportunities: Major opportunities lie in the development of specialized inverters compatible with next-generation, high-performance storage technologies, such as sodium-ion or solid-state batteries, and long-duration storage solutions like aqueous or flow batteries, which require unique voltage, current, and control management protocols, opening high-value niche markets for innovation. The rapid expansion of Vehicle-to-Grid (V2G) and Vehicle-to-Home (V2H) technology, utilizing electric vehicle batteries as distributed storage assets, opens a new, high-volume market requiring specific bi-directional EV charging/storage inverters. Lastly, the pervasive integration of advanced software features, leveraging AI and cloud connectivity for enhanced operational efficiency, remote diagnostics, and monetization of ancillary services (e.g., through VPPs), represents a key pathway for product differentiation, value creation, and long-term market capture beyond basic hardware sales.

Segmentation Analysis

The Battery Storage Inverter Market is strategically segmented based on crucial technical and application criteria, enabling manufacturers to tailor products to specific market needs and regulatory environments while addressing varying requirements related to power handling and integration complexity. This structured segmentation allows for a clearer and more granular understanding of technological demand, regional adoption patterns, competitive dynamics, and future growth areas. Key segmentations include differentiating inverter architecture (hybrid vs. dedicated battery inverters), power rating and phase configuration (single vs. three-phase), battery chemistry compatibility (Lithium-ion dominant, but others emerging), and, most critically, the end-use application (residential, commercial, or utility-scale), which dictates required power handling capacity, lifetime warranty requirements, certification levels, and the complexity of required monitoring and control software.

The utility-scale segment commands the largest market share by total installed capacity (MW), driving demand for high-power (MW-scale), highly efficient, three-phase, central inverters designed for maximum energy conversion efficiency and robust compliance with complex grid codes imposed by TSOs. In contrast, the residential sector, typically utilizing smaller (up to 10 kW), single-phase, string, or micro-inverter solutions paired with DC-coupled storage, exhibits the fastest rate of unit volume growth, fueled by consumer adoption of solar-plus-storage systems for backup power and load shifting driven by time-of-use tariffs. Hybrid inverters are particularly successful in the residential and light commercial segments as they simplify installation by managing both PV input, maximum power point tracking (MPPT), and battery charge/discharge through a single, often aesthetically appealing, integrated unit, significantly reducing overall system complexity and installation cost.

Furthermore, the segmentation by inverter type and connectivity is pivotal, as performance requirements vary dramatically based on the intended function. For standard grid-tied commercial systems primarily focused on peak shaving and energy arbitrage, high-efficiency, standardized grid-tied battery inverters suffice. However, microgrid and remote off-grid applications require specialized inverters with advanced features for robust black start capability, fault handling during islanding operation, and extremely precise voltage and frequency synchronization without reliance on external grid support. This distinction highlights the diversity of technical requirements driving specialized product development and competitive strategies across various power conversion functionalities demanded by end-users operating in different electricity access environments.

- By Type:

- Hybrid Inverters (Integrating PV input and Battery Management)

- Battery Storage Inverters (Dedicated for BESS connection only, typically AC-coupled systems)

- By Phase:

- Single-Phase Inverters (Primarily Residential and small C&I)

- Three-Phase Inverters (Dominant in large Commercial and Utility-Scale installations)

- By Application/End-Use:

- Residential (Backup power, maximizing self-consumption, resilience against outages)

- Commercial & Industrial (C&I) (Demand charge reduction, uninterruptible power supply, EV charging integration)

- Utility-Scale (Grid stability, frequency regulation, energy arbitrage, capacity market participation)

- By Connectivity:

- Grid-Tied (Designed to operate synchronized with the utility grid)

- Off-Grid/Islanded (Capable of forming and managing an isolated microgrid independently)

- By Power Rating:

- Less than 10 kW (Typically Residential)

- 10 kW to 100 kW (Small to Medium Commercial)

- Greater than 100 kW (Large Commercial and Utility scale, including MW-scale central inverters)

Value Chain Analysis For Battery Storage Inverter Market

The value chain for battery storage inverters is an intricate sequence starting with high-tech upstream activities and concluding with long-term downstream service provision. The upstream segment involves intensive raw material procurement, specialized semiconductor manufacturing (crucially, Wide Bandgap materials like SiC and GaN), and the production of high-specification passive components (capacitors, inductors, sophisticated cooling systems). This foundational stage is highly critical, as the transient performance, long-term reliability, and overall efficiency of the final inverter heavily rely on the quality and thermal rating of internal power electronics, such as fast-switching MOSFETs and high-current IGBT modules. Inverter manufacturers often engage in strict, long-term strategic partnerships with semiconductor suppliers and electronic component specialists to secure reliable supply chains and ensure component specifications meet the rigorous demands of power conversion in high-stress environments, especially given the global volatility in advanced electronic component availability.

The midstream segment encompasses the core manufacturing, assembly, rigorous quality control, and system integration of the inverter unit, including the development of proprietary control software, firmware, and advanced communication protocols (e.g., Modbus, CAN bus, SunSpec) necessary for reliable interoperability with diverse battery management systems (BMS) and compliance with strict global and regional grid codes. Distribution channels are complex and multifaceted, utilizing both direct sales models to large utility developers and Independent Power Producers (IPPs) for utility-scale projects (often requiring bespoke engineering support) and indirect distribution through a wide network of specialized energy solution integrators, authorized regional distributors, and wholesale electrical suppliers, particularly for the high-volume residential and commercial & industrial (C&I) markets. The selection of the optimal channel depends heavily on the scale, technical complexity, and required localized support for the inverter product.

The downstream segment focuses intensively on professional installation, precise commissioning, ongoing operation, and complex maintenance services required throughout the asset lifecycle. This phase is characterized by specialized, manufacturer-certified installers who integrate the inverter seamlessly with the BESS, PV array (if applicable), and the grid connection point, ensuring full compliance with local and national electrical and safety codes. Post-installation activities, which are increasingly managed through sophisticated, cloud-based monitoring platforms, include remote performance diagnostics, over-the-air firmware updates to maintain security and compliance, and execution of predictive maintenance services driven by AI. The effectiveness of the indirect channel is paramount here, as rigorous installer training and robust certification programs provided by the inverter manufacturer ensure proper system setup, which is absolutely essential for maximizing long-term performance, minimizing operational risk, and reducing costly warranty claims over the typical 10-20 year lifespan of the battery storage asset.

Battery Storage Inverter Market Potential Customers

The target audience for battery storage inverters is highly stratified, spanning multiple energy-intensive sectors and driven by distinct, often financially motivated, criteria related to energy cost, resilience planning, and corporate sustainability targets. The largest and most demanding customer segment by power capacity is the Utility Sector, which includes Independent Power Producers (IPPs), large private renewable developers, Transmission System Operators (TSOs), and Distribution System Operators (DSOs). These customers purchase extremely high-capacity, three-phase, often central inverters primarily for revenue-generating grid stabilization services, renewable energy firming (smoothing intermittent output), frequency regulation, and load leveling over multiple hours, requiring products with extremely stringent reliability metrics, advanced power quality features, and full, independently verified compliance with complex utility-specific grid codes.

The Commercial and Industrial (C&I) segment represents a high-value customer base motivated primarily by tangible financial savings, specifically through sophisticated demand charge management, mitigation of peak consumption penalties, and proactive energy arbitrage. Customers in this sector—including high-load data centers, complex manufacturing plants, large cold storage facilities, and sprawling university campuses—seek robust, mid-range battery inverters (10kW to 1MW) to store excess energy during lower tariff periods and discharge strategically during peak demand windows, significantly reducing monthly operational energy expenditure. For these enterprise customers, high reliability, seamless software integration with existing Building Management Systems (BMS), and scalability are key purchase criteria, favoring modular and remotely manageable three-phase solutions with guaranteed performance metrics and robust service level agreements.

Lastly, the Residential sector is characterized by individual homeowners or small multi-family dwelling owners seeking a combination of energy independence, essential backup power during disruptive outages (resilience), and maximizing cost savings through self-consumption of rooftop solar generation, particularly in regions with unfavorable net metering policies. This market typically purchases single-phase, highly integrated hybrid inverters that simplify system design. Their buying decision is heavily influenced by ease of installation, overall system cost competitiveness, aesthetic design (for indoor installation), and the seamless integration of smart home technologies and rapid shut-off safety features. Furthermore, system aggregators organizing large Virtual Power Plants (VPPs) are increasingly critical customers, as they integrate distributed residential storage into a centralized resource, requiring inverters with advanced, secure communication capabilities to participate effectively in lucrative grid ancillary service markets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 16.0 Billion |

| Growth Rate | 15.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SMA Solar Technology, SolarEdge Technologies, ABB, Eaton, Huawei, Sungrow Power Supply, Delta Electronics, Siemens, GoodWe, Fimer, Schneider Electric, Ginlong Technologies, TMEIC, KACO new energy, Enphase Energy |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Battery Storage Inverter Market Key Technology Landscape

The technological landscape of battery storage inverters is defined by a relentless push towards achieving significantly higher efficiency, greater power density, and increased embedded intelligence and cybersecurity capabilities. The core advancement centers on the commercial adoption of Wide Bandgap (WBG) semiconductors, particularly Silicon Carbide (SiC) and, to a lesser extent, Gallium Nitride (GaN). SiC MOSFETs are rapidly replacing traditional silicon-based IGBTs in high-power inverters due to their intrinsic ability to operate at much higher switching frequencies, coupled with higher temperatures and significantly reduced switching losses. This fundamental technological shift directly translates to smaller, lighter, and more efficient inverter units, which are critical for utility-scale projects where maximizing power output within a minimal physical footprint and minimizing cooling loads are paramount engineering goals. The parallel integration of advanced thermal management techniques, such as liquid cooling systems and improved heat sink designs, further supports these high-density designs, ensuring high reliability under continuous, heavy-load operational conditions.

Beyond hardware efficiency, software and sophisticated communication technologies are now key differentiators driving market competitiveness. Modern battery inverters are expected to be fully compliant with various stringent international and regional grid codes (e.g., UL 1741, IEEE 1547, VDE standards), requiring highly robust and complex control algorithms for specialized features like Low Voltage Ride Through (LVRT), High Voltage Ride Through (HVRT), and precise reactive power injection or absorption capabilities. Furthermore, cloud connectivity, integrated IoT sensors, and robust data logging capabilities are now standard features, enabling remote diagnostics, rapid over-the-air firmware updates for security and compliance, and the real-time aggregation of operational data required for AI-driven optimization services, VPP participation, and proactive performance monitoring. Cybersecurity compliance is rapidly moving from an optional feature to a technological necessity, prompting manufacturers to embed secure hardware elements and implement sophisticated encryption and intrusion detection protocols to protect distributed, connected energy assets from increasing cyber threats.

A crucial ongoing technological trend is the proliferation of modular design principles and enhanced standardization protocols aimed at system simplification and scalability. Modular inverter architectures allow BESS systems to be scaled linearly by adding units, minimizing initial capital investment and simplifying future expansion or component replacement. Furthermore, standardization efforts are focused on achieving seamless interoperability between the inverter's control system and the Battery Management System (BMS) through standardized APIs and communication interfaces, significantly simplifying integration challenges for system assemblers and accelerating time-to-market. For the high-growth residential segment, the current technological trajectory leads to the development of highly integrated energy management systems (EMS) where the hybrid inverter acts as the central intellectual hub, managing not only the PV and battery storage but also smart home loads, heat pumps, and integrated EV charging, thereby maximizing the overall value proposition and energy efficiency for the end-users by moving the inverter from a passive converter to an active, intelligent energy management platform.

Regional Highlights

The global market for Battery Storage Inverters exhibits distinct regional growth patterns, largely dictated by local regulatory incentives, the unique structure of regional electricity markets, and the maturity of renewable energy penetration within the grid. Asia Pacific (APAC) currently dominates the market in terms of installed capacity, driven primarily by China’s massive investments in centralized utility-scale storage projects to manage its extensive solar and wind capacity, and South Korea’s early adoption of BESS for mandatory grid stability services. China’s "new infrastructure" initiatives heavily prioritize large-scale energy storage integration, demanding immense volumes of high-power three-phase central inverters, making the region the global manufacturing and consumption powerhouse for high-capacity units. India is rapidly emerging as a significant growth center, focusing heavily on both large-scale commercial tenders and enhancing grid resilience in remote and rural areas through localized microgrid installations, a strategy requiring robust, off-grid compatible inverter solutions capable of seamless black-start functionality and sophisticated management of decentralized energy flows under challenging conditions.

North America, particularly the United States, is projected to be the fastest-growing region, characterized by robust, long-term government support, notably the long-term extension of investment tax credits (ITCs) under the Inflation Reduction Act (IRA) and ambitious state-level storage mandates (e.g., California, New York, Massachusetts). The American market shows high demand across all segments, with a particular emphasis on sophisticated hybrid inverters for the residential sector, enabling both economic savings and crucial resilience against frequent power outages, leveraging extremely high retail electricity rates for enhanced financial benefit through strategic peak shifting. The increasing severity and frequency of weather-related outages in regions like Texas and California further incentivize residential and commercial adoption of solar-plus-storage. Furthermore, the complexity of diverse grid interconnection standards across different states drives the need for highly flexible and compliant inverter technology capable of handling complex ancillary services required by independent system operators (ISOs), such as reactive power compensation and ultra-fast frequency response, constantly pushing technological envelopes for North American suppliers.

Europe demonstrates stable, high-value growth, focused heavily on distributed generation models and achieving stringent, legally binding decarbonization targets set by the European Union. Germany and the UK lead in residential and commercial storage adoption, prioritizing maximizing solar self-consumption, minimizing reliance on grid imports, and sophisticated VPP integration to monetize stored energy in balancing markets. European demand heavily favors highly reliable, technically mature products that can successfully navigate complex VPP operations, meet stringent safety standards (e.g., VDE, CE), and comply with evolving safety standards, such as those related to fire safety and isolation requirements in densely populated urban environments. The transition away from historical Feed-in Tariffs (FiTs) to models prioritizing self-consumption and active grid service participation is a powerful market accelerator for advanced inverter adoption across the continent. Eastern European markets are also beginning to prioritize grid modernization and renewable integration, often supported by EU funding mechanisms targeting energy infrastructure upgrades that incorporate modern, secure battery storage solutions.

- Asia Pacific (APAC): Highest volume and capacity deployment; dominance driven by China's national BESS mandates and large-scale industrial projects in South Korea and Australia, focused on manufacturing scale and centralized utility applications demanding high-power central inverters.

- North America: Highest CAGR, fueled by the U.S. Inflation Reduction Act (IRA), high consumer electricity prices, utility resilience requirements, and increasing demand for residential resilience against power outages, focusing on advanced hybrid, software integration, and stringent grid code compliance.

- Europe: Focus on decentralization, maximizing solar self-consumption, and sophisticated VPP integration; strong regulatory push for high safety and performance standards in Germany and the UK, prioritizing grid participation, reliability, and technical maturity.

- Latin America (LATAM): Emerging market driven by systemic grid stability issues and successful renewable energy auctions; initial focus on utility-scale and remote commercial applications in nations like Brazil, Chile, and Mexico, where renewable resources are abundant but grid infrastructure requires modernization.

- Middle East and Africa (MEA): Growth driven by large-scale solar projects (e.g., UAE, Saudi Arabia, Morocco) and the necessity for off-grid/mini-grid solutions in remote African regions, requiring robust, thermally tolerant inverters capable of enduring high ambient temperatures and managing fluctuating power quality effectively for critical loads.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Battery Storage Inverter Market. These companies are actively engaged in product innovation, strategic partnerships, geographical expansion, and the integration of digital services to solidify their market position in the rapidly evolving energy storage ecosystem. They leverage core competencies in advanced power electronics, digital controls, thermal management, and system integration to deliver highly efficient and reliable storage solutions across residential, commercial, and utility segments globally.- SMA Solar Technology AG

- SolarEdge Technologies Inc.

- ABB Ltd.

- Eaton Corporation plc

- Huawei Technologies Co., Ltd.

- Sungrow Power Supply Co., Ltd.

- Delta Electronics, Inc.

- Siemens Energy AG

- GoodWe Power Supply Technology Co., Ltd.

- Fimer S.p.A.

- Schneider Electric SE

- Ginlong Technologies Co., Ltd. (Solis)

- TMEIC Corporation

- KACO new energy GmbH (A Siemens Company)

- Enphase Energy, Inc.

- Vitesco Technologies GmbH

- Ingeteam S.A.

- Yaskawa Solectria Solar

- Kehua Digital Energy Tech Co., Ltd.

- Chint Power Systems (CPS)

Frequently Asked Questions

Analyze common user questions about the Battery Storage Inverter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a hybrid inverter and a dedicated battery inverter?

A hybrid inverter integrates the functions of a solar photovoltaic (PV) inverter and a battery inverter into a single unit, managing both DC power conversion from solar panels and bidirectional charge/discharge of the battery efficiently. A dedicated battery inverter (or AC-coupled inverter) focuses solely on managing the energy flow between the battery storage system and the AC load or grid, requiring pairing with a separate, existing standard PV inverter.

How does the decline in battery cost affect the demand for storage inverters?

The sharp decline in the cost of lithium-ion batteries makes the entire energy storage system (ESS) significantly more economically viable for a broader range of applications (residential, C&I, utility). This enhanced affordability acts as a powerful and direct demand driver, creating a proportional and substantial increase in the need for reliable, cost-effective, and highly functional battery storage inverters to manage these newly deployed, cost-effective battery assets.

What are the key technical challenges facing high-power utility-scale inverters?

Key technical challenges include managing extreme thermal stress during continuous high-power operation, ensuring stringent compliance with complex and rapidly evolving grid codes (such as those concerning fault ride-through and reactive power compensation), and maintaining robust cybersecurity across vast, geographically dispersed fleets, necessitating advanced liquid cooling systems and the adoption of Wide Bandgap (SiC) semiconductor technology.

Which geographical region exhibits the highest growth potential (CAGR) for battery storage inverters in the forecast period?

North America, particularly the United States, is projected to exhibit the highest Compound Annual Growth Rate (CAGR) from 2026 to 2033. This accelerating growth is primarily fueled by large-scale, consistent federal incentives (e.g., the U.S. Inflation Reduction Act), high retail electricity prices driving economic payback, and increasing state-level mandates for utility-scale and distributed energy storage deployment for grid resilience.

How is artificial intelligence (AI) enhancing the operational performance of battery inverters and VPPs?

AI improves operational performance by enabling advanced predictive energy management, optimizing charge and discharge cycles based on real-time market pricing and hyper-accurate load forecasts (arbitrage), and facilitating predictive maintenance by analyzing high-resolution system performance data to anticipate potential component failures or battery degradation, thereby maximizing system uptime, profitability, and effectiveness within Virtual Power Plants (VPPs).

What role do Wide Bandgap (WBG) semiconductors play in new inverter designs?

WBG materials, such as Silicon Carbide (SiC) and Gallium Nitride (GaN), enable battery storage inverters to operate at much higher switching frequencies and elevated temperatures compared to traditional silicon. This capability allows manufacturers to design significantly smaller, lighter, and more highly efficient inverters with lower power losses and higher power density, which are crucial attributes for high-performance and compact energy storage solutions demanded across all market segments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager