BBQ Sauces & Rubs Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434890 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

BBQ Sauces & Rubs Market Size

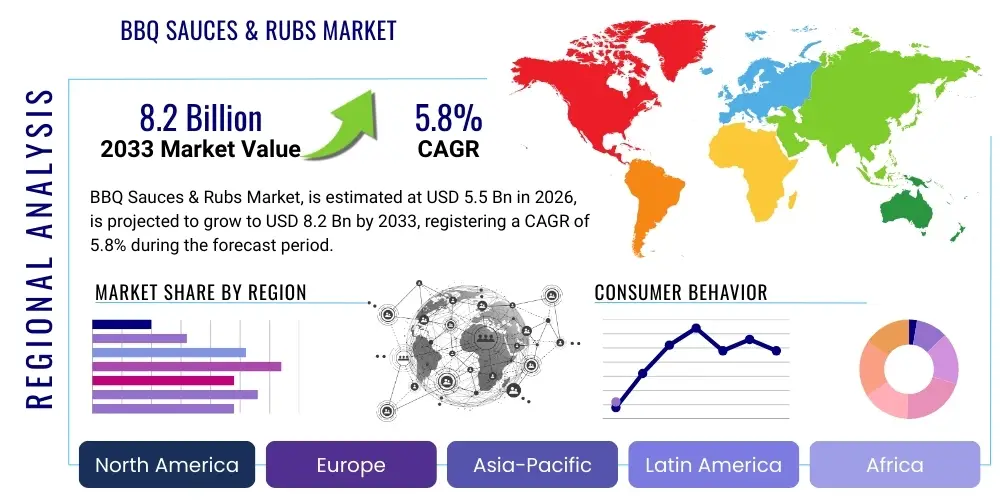

The BBQ Sauces & Rubs Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $5.5 Billion in 2026 and is projected to reach $8.2 Billion by the end of the forecast period in 2033.

BBQ Sauces & Rubs Market introduction

The BBQ Sauces & Rubs Market encompasses the production, distribution, and sale of flavored liquid condiments (sauces) and dry seasoning mixtures (rubs) primarily designed for grilling, smoking, and roasting meats, vegetables, and other food items. These products enhance flavor, provide tenderness, and create distinctive regional profiles, catering to the deeply rooted global culture of barbecuing and outdoor cooking. The market offers a wide array of flavors, ranging from traditional smoky and sweet profiles to exotic, regional, and specialty variants such as Carolina vinegar-based, Kansas City molasses-rich, and Texas brisket rubs.

Major applications of these products include direct marinating, basting during the cooking process, and serving as dipping sauces post-cooking in both residential settings and commercial foodservice establishments. The inherent benefits include convenience, consistency in flavor application, and the ability to quickly transform basic ingredients into complex, satisfying meals. The driving factors behind market expansion are the increasing consumer interest in gourmet cooking, the rising popularity of global cuisine, the continuous launch of innovative, health-conscious, and natural ingredient-based products, and the persistent growth of outdoor entertaining and home grilling activities, particularly in developed economies.

Furthermore, the market benefits significantly from seasonality, with peak sales during summer months, alongside year-round demand fueled by convenience foods and quick meal solutions. Product diversification, including organic, sugar-free, low-sodium, and gluten-free options, is critical to capturing niche consumer segments, ensuring sustained market relevance and expansion beyond traditional demographics. The intense competition among manufacturers necessitates continuous flavor innovation and strategic marketing focused on authenticity and regional specialization.

BBQ Sauces & Rubs Market Executive Summary

The BBQ Sauces & Rubs market is characterized by robust business trends centered on premiumization, natural ingredient sourcing, and personalized flavor profiles. Manufacturers are focusing on differentiating their offerings through clean labels, ethical sourcing, and specialized product lines catering to specific dietary restrictions, such as vegan and keto-friendly options. Strategic mergers, acquisitions, and partnerships are common as large players seek to integrate craft and specialty brands to immediately gain access to unique flavor intellectual property and established niche consumer bases, driving consolidation and increased efficiency in the supply chain.

Regionally, North America remains the dominant market owing to its deep-seated grilling culture, high disposable income, and the established presence of major market players. However, Asia Pacific is projected to exhibit the highest growth rates, driven by the rapid Westernization of diets, increasing urbanization, and the growing penetration of organized retail channels in countries like China and India. European growth is sustained by rising consumer interest in global barbecue traditions and the expansion of outdoor living spaces, demanding authentic and versatile seasoning solutions. Regulatory environments regarding food safety and labeling standards necessitate tailored approaches for regional market entry.

In terms of segmentation, the Sauce category dominates the market share due to its versatility and established consumer usage habits, while the Rubs category is experiencing faster growth, reflecting consumer sophistication and the desire for deeper flavor integration during the cooking process. Key trends within ingredients include the shift away from high-fructose corn syrup towards natural sweeteners like honey and molasses, and the incorporation of fermented ingredients for complex umami flavors. Distribution channel effectiveness is heavily reliant on e-commerce platforms, which facilitate the direct-to-consumer delivery of specialized and artisanal products that might not be available through conventional supermarket chains, thus optimizing reach and market coverage.

AI Impact Analysis on BBQ Sauces & Rubs Market

User queries regarding AI's influence in the BBQ Sauces & Rubs sector frequently revolve around how artificial intelligence can optimize flavor consistency, personalize seasoning recommendations, streamline supply chain logistics, and predict evolving consumer taste preferences. Consumers are curious about whether AI can help create the "perfect" regional flavor profile or assist small-batch producers in scaling up production without compromising artisanal quality. The key themes emerging include the potential for AI-driven ingredient sourcing optimization to reduce costs, the use of predictive analytics for inventory management based on seasonal demand forecasting, and the application of machine learning in food science for rapid prototype development and quality assurance, addressing concerns about consistency and efficiency in a high-volume manufacturing environment.

- AI-Powered Flavor Profiling: Utilizing machine learning algorithms to analyze massive datasets of consumer reviews, ingredient combinations, and chemical profiles to predict and develop highly successful new flavor combinations, reducing the R&D cycle time.

- Demand Forecasting & Inventory Optimization: Deploying predictive analytics to accurately forecast seasonal spikes (e.g., summer grilling season) and regional demand variances, minimizing waste and ensuring optimal stock levels across disparate distribution centers.

- Quality Control & Consistency: Implementing computer vision and AI sensors on production lines to monitor ingredient measurements, blending times, and bottling consistency in real-time, ensuring stringent quality standards are met for every batch.

- Personalized Recommendation Engines: Integrating AI into e-commerce platforms and smart appliance interfaces to suggest specific sauces or rubs based on the user's current meal (e.g., cut of meat, cooking method) and stated flavor preferences.

- Supply Chain Traceability: Using blockchain and AI interfaces to enhance transparency, tracking ingredients from farm to factory, ensuring authenticity, sustainability claims, and compliance with ethical sourcing mandates.

DRO & Impact Forces Of BBQ Sauces & Rubs Market

The dynamics of the BBQ Sauces & Rubs market are primarily shaped by robust driving factors such as the global fascination with grilling and outdoor cooking traditions, coupled with an increasing desire among consumers for bold, authentic, and exotic flavor experiences. The continuous innovation in product offerings, including low-sugar, organic, and globally-inspired profiles, strongly supports market growth. However, this growth is constrained by significant restraints, particularly the volatility in the prices of key raw materials like spices, tomatoes, and natural sweeteners, which impacts manufacturing costs and retail prices. Furthermore, intense competition from private labels and local artisanal producers necessitates continuous differentiation and high marketing spend to maintain brand visibility and loyalty. Opportunities for market players are abundant, primarily through strategic geographical expansion into untapped emerging economies, the development of functional products that offer perceived health benefits, and leveraging digital marketing and e-commerce channels to reach specialty consumer segments directly.

Segmentation Analysis

The BBQ Sauces & Rubs market is broadly segmented based on product type (Sauces and Rubs), ingredient base (Natural/Organic and Conventional), flavor profile (Sweet/Smoky, Spicy/Hot, Savory/Umami, others), distribution channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Foodservice), and application (Residential and Commercial). This structure allows for granular analysis of consumer behavior and market trends. The Sauce segment remains the largest by revenue, driven by its traditional usage and wide availability, while the Rubs segment, catering to grilling enthusiasts seeking deeper flavor penetration and more authentic slow-cooking results, is demonstrating superior growth momentum. The shift towards natural and organic ingredient bases is a persistent trend influencing all sub-segments, reflecting global clean-label demands.

- Product Type: Sauces, Rubs

- Ingredient Base: Natural/Organic, Conventional

- Flavor Profile: Sweet & Smoky, Spicy & Hot, Savory & Umami, Vinegar-based, Mustard-based, Regional Specialties

- Distribution Channel: Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Foodservice, Specialty Stores

- Application: Residential, Commercial (Restaurants, Catering, Institutional)

Value Chain Analysis For BBQ Sauces & Rubs Market

The value chain for the BBQ Sauces & Rubs market begins with upstream activities involving the sourcing of agricultural commodities. This includes acquiring raw materials such as tomatoes, peppers, vinegar, molasses, and a vast array of spices and herbs. Quality control at this stage is paramount, as the final flavor profile is directly dependent on the quality and freshness of these agricultural inputs. Manufacturers often engage in long-term contracts with specialized spice and farming suppliers to ensure consistency and manage the volatile pricing associated with commodity markets. Ethical sourcing and sustainability certifications (e.g., fair trade) are becoming integral parts of the upstream process, driven by consumer scrutiny and corporate social responsibility goals.

The midstream phase focuses on manufacturing, which encompasses R&D, formulation, blending, cooking, and aseptic packaging. This stage is highly capital-intensive, requiring specialized machinery for high-speed blending and bottling to maintain product safety and extend shelf life. Efficient operations involve precise scaling and quality assurance to ensure batch-to-batch consistency—a key consumer expectation for branded products. Innovations in manufacturing technology, such as automated batch processing and advanced sterilization techniques, are essential for meeting high-volume demand while adhering to stringent food safety regulations set by global bodies.

Downstream activities involve distribution, which is characterized by a mix of direct and indirect channels. Indirect distribution through third-party logistics (3PL) providers is dominant for mass-market penetration, utilizing extensive networks of wholesalers and distributors to reach supermarkets, convenience stores, and foodservice companies. Direct distribution, primarily through e-commerce platforms and specialty retail partnerships, allows artisanal and premium brands to maintain higher margins and direct consumer engagement. The rise of refrigerated transport and optimized warehousing is crucial for certain product variants, ensuring product integrity until the point of sale and effectively managing the logistical challenges associated with perishable components in some fresh rubs and sauces.

BBQ Sauces & Rubs Market Potential Customers

The primary segment of potential customers for BBQ sauces and rubs encompasses residential consumers who actively engage in home cooking and grilling. This segment includes passionate barbecue enthusiasts (pitmasters), casual home cooks seeking convenience, and individuals focused on meal preparation. Demographic factors like age (Millennials and Gen Z showing interest in global flavors) and disposable income heavily influence purchasing decisions, steering consumers toward either economical mass-market brands or premium, regionally authentic, small-batch products. The growth of smart appliances and backyard entertainment spaces further solidifies the importance of the residential consumer base, which consistently demands variety and specific dietary options.

A significant, high-volume customer segment resides within the Commercial Food Service industry. This includes full-service restaurants, quick-service restaurants (QSRs), catering services, and institutional food providers (schools, hospitals, corporate cafeterias). These commercial buyers prioritize consistency, bulk packaging, cost efficiency, and specific formulation requirements (e.g., high-heat stability, allergen control). QSR chains, in particular, often rely on custom formulations supplied under strict proprietary agreements to maintain signature flavors and brand consistency across thousands of locations globally.

Furthermore, major retailers and mass merchandisers serve as crucial potential customers through their demand for private label manufacturing. Retailers seek high-quality, cost-effective BBQ sauces and rubs produced under their own branding, allowing them to capture higher margins and offer competitive pricing. Other niche buyers include specialty gourmet food stores, health food chains focusing exclusively on organic and clean-label products, and international importers looking to introduce localized flavors into foreign markets, underscoring the fragmented yet expansive nature of the market demand.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.5 Billion |

| Market Forecast in 2033 | $8.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The Kraft Heinz Company, McCormick & Company Inc., Conagra Brands, Inc., Hormel Foods Corporation, Goya Foods, Inc., Stubb’s Legendary Bar-B-Q, Sweet Baby Ray's, KC Masterpiece, T. Marzetti Company, Kinder's, Rufus Teague, Bad Byron's Butt Rub, Traeger Grills (Pellet Rubs), Fiesta Brand Spices, Pappy’s Choice. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

BBQ Sauces & Rubs Market Key Technology Landscape

The key technology landscape in the BBQ Sauces & Rubs market is focused heavily on optimizing manufacturing processes for consistency, enhancing product shelf stability, and enabling sophisticated flavor delivery. Advanced blending and homogenization equipment are central to sauce production, ensuring that complex emulsions (mixing oil and water-based ingredients) remain stable over extended periods without separation. Furthermore, high-pressure processing (HPP) and advanced aseptic packaging technologies are increasingly deployed, particularly for preservative-free and natural ingredient formulations, to extend shelf life while minimizing the impact of heat on delicate flavors and nutritional content, aligning with clean-label trends.

In product development, technologies related to flavor encapsulation and release systems are gaining traction. Flavor encapsulation involves micro-packaging specific ingredients (like smoke flavor or highly volatile spices) so they are only released under certain conditions (e.g., high heat during cooking). This prevents flavor degradation during storage and ensures maximum impact upon consumption. Additionally, sensory analysis technologies, including sophisticated chromatography and spectrometric tools, are utilized in R&D labs to precisely map the chemical compounds responsible for complex flavor profiles, enabling manufacturers to replicate authentic regional flavors consistently and scale recipes effectively from small-batch artisanal origins to industrial volumes.

Finally, technology plays a pivotal role in supply chain management and consumer interaction. QR codes and blockchain technology are being integrated into packaging to provide end-to-end traceability of ingredients, satisfying consumer demand for transparency and combating food fraud. On the consumer front, digital platforms leverage data analytics and user feedback to inform flavor selection and marketing strategy. Manufacturers are also exploring the use of 3D printing technology in R&D to quickly create texture and flavor prototypes, rapidly accelerating the cycle time required for new product launches, allowing for faster response to evolving culinary trends and competitive pressures within the highly dynamic food industry segment.

Regional Highlights

- North America: Dominates the global market, driven by a deeply ingrained cultural tradition of backyard grilling, high consumer spending on food specialty products, and the continuous innovation fostered by major US-based food corporations. Demand is particularly strong for high-quality, authentic regional barbecue styles (Texas, Carolina, Memphis), fueling growth in the premium rub segment.

- Europe: Experiencing significant growth, particularly in the UK and Germany, fueled by the rising adoption of American and global grilling techniques and an increase in outdoor leisure activities. The market here favors cleaner labels, lower sugar content, and specialized marinades reflecting European dietary preferences and regulatory standards.

- Asia Pacific (APAC): Poised for the highest CAGR. Growth is spurred by rapid Westernization of diets, rising middle-class disposable income, and the expansion of modern retail chains. Consumers in this region show high demand for fusion flavors, blending traditional Asian spices (e.g., soy, ginger, chili) with classic barbecue profiles, driving tailored product development.

- Latin America: Characterized by strong traditional grilling cultures (e.g., Argentine Asado, Brazilian Churrasco), resulting in high consumption. The market is often price-sensitive but shows increasing demand for convenient, packaged rubs and sauces that complement local meat preparations and enhance efficiency in home cooking.

- Middle East and Africa (MEA): A nascent but growing market. Demand is driven by urbanization and the influx of Western food culture. Key regional challenges include supply chain logistics and cultural preferences, with product adaptation focusing on Halal certification and specific local spice blends.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the BBQ Sauces & Rubs Market.- The Kraft Heinz Company

- McCormick & Company Inc.

- Conagra Brands, Inc.

- Hormel Foods Corporation

- Goya Foods, Inc.

- Stubb’s Legendary Bar-B-Q (A McCormick brand)

- Sweet Baby Ray's (Owned by Ken's Foods)

- KC Masterpiece (A Kraft Heinz Brand)

- T. Marzetti Company (Retail Sauces)

- Kinder's Meats & Deli

- Rufus Teague

- Bad Byron's Butt Rub

- Traeger Grills (Focus on Pellet Grill Rubs)

- Fiesta Brand Spices

- Pappy’s Choice

- Famous Dave’s of America

- Weber-Stephen Products LLC

- Southeastern Mills, Inc.

- Adolph’s Ltd.

- MasterFoods (Mars, Incorporated)

Frequently Asked Questions

Analyze common user questions about the BBQ Sauces & Rubs market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving growth in the BBQ Sauces & Rubs Market?

The primary driver is the increasing global adoption and popularity of outdoor grilling and home cooking, coupled with a growing consumer demand for specialized, gourmet, and ethnically diverse flavor profiles that offer convenience and consistent quality.

Which product segment is expected to show the highest growth rate?

The Rubs segment is projected to exhibit a higher compound annual growth rate (CAGR) than the Sauce segment, driven by the increasing sophistication of grilling enthusiasts who prefer dry rubs for deep flavor penetration in slow-cooked and smoked meats.

How does the shift towards 'clean labels' affect product innovation?

The demand for clean labels necessitates product innovation focusing on the replacement of artificial additives, preservatives, and high-fructose corn syrup with natural ingredients, organic certifications, and alternative natural sweeteners like honey and molasses.

Which geographical region holds the largest market share for BBQ Sauces & Rubs?

North America currently holds the largest market share globally due to its established grilling culture, high per capita consumption, and the strong presence of influential market leaders and specialty regional brands.

How significant is e-commerce in the distribution of specialty rubs and sauces?

E-commerce is highly significant, acting as a crucial channel for small-batch and artisanal brands to reach consumers directly, offering extensive product variety and facilitating the efficient distribution of premium, niche, and regionally specific flavor profiles.

Detailed Market Dynamics and Competitive Landscape

The BBQ Sauces & Rubs Market operates within a highly competitive landscape characterized by fragmentation at the artisanal level and consolidation among major global food manufacturers. Market dynamics are heavily influenced by flavor seasonality and cultural trends. The competitive environment requires continuous investment in research and development to quickly launch new, trending flavors, such as those incorporating fermentation techniques (e.g., kimchi, kombucha) or unique spice combinations reflective of lesser-known global cuisines. Furthermore, the shelf space competition in brick-and-mortar retail pushes manufacturers towards premium packaging and high-impact marketing campaigns to achieve product visibility.

A significant dynamic shaping the market is the rapid rise of health consciousness among consumers. This is not limited to avoiding sugar and sodium but extends to ingredient transparency, demanding non-GMO verification, organic certification, and the clear identification of allergens. Companies that successfully navigate this regulatory and consumer scrutiny by formulating transparent, high-quality products are gaining substantial market traction. This paradigm shift requires sophisticated supply chain management capable of tracing specialty, high-cost organic ingredients back to their source, ensuring the integrity of health claims.

The entry barrier for small, artisanal rub producers is relatively low, fostering continuous innovation at the grassroots level. However, scaling production and achieving national or international distribution remains challenging without significant capital investment or acquisition by a major player. Large incumbents, therefore, maintain market dominance not only through established brand loyalty and distribution networks but also through strategic bolt-on acquisitions of successful regional brands, allowing them to instantly diversify their flavor portfolio and capture niche consumer enthusiasm without extensive internal R&D cycles. This dual structure—large centralized production coupled with dynamic, decentralized flavor innovation—defines the contemporary competitive strategy.

Product Type Analysis: Sauces vs. Rubs

The Sauces segment commands the larger share of the BBQ market revenue, primarily due to its versatility and consumer familiarity. BBQ sauces are used extensively not only for grilling but also as everyday condiments, dipping sauces, and bases for slow-cooker recipes. The market for sauces is mature but continues to evolve, driven by flavor innovation, particularly in the sweet and smoky, and spicy profiles. Consumers often categorize sauces regionally (e.g., Memphis, Carolina, Texas), driving demand for authentic, thick, or vinegar-based formulations. Manufacturers are heavily invested in optimizing texture and viscosity, often using starches and natural thickeners to appeal to specific regional preferences.

Conversely, the Rubs segment, although smaller, is the faster-growing category. Rubs cater to a more dedicated segment of consumers—the grilling and smoking aficionados—who understand that dry seasoning applied hours before cooking yields a superior flavor crust (bark) and deeper seasoning penetration. Growth in this segment is fueled by the popularity of pellet smokers and specialized grilling equipment that encourages low-and-slow cooking methods. Rubs typically boast complex, multi-layered spice combinations, emphasizing regional specificity (e.g., coffee-based rubs for beef brisket, or paprika-heavy rubs for pork shoulder). Innovation here is focused on creating precise grind sizes and blends that adhere well to meat and resist burning at high temperatures.

The distinction between the two product types is blurring as manufacturers introduce hybrid products, such as "wet rubs" or sauce/rub combination kits, offering consumers the best of both worlds. The strategic focus for both segments involves reducing sodium content and improving nutrient profiles without sacrificing the intense, satisfying flavors expected by barbecue consumers. This delicate balance requires advanced food chemistry and ingredient technology to maintain palatability while meeting evolving dietary standards.

Flavor Profile Analysis: Trends and Preferences

Flavor profile remains the single most critical determinant of consumer purchase in the BBQ market. The traditional Sweet & Smoky profile, often achieved through molasses, brown sugar, and liquid smoke or actual smoked ingredients, retains significant market share, particularly in mass-market retail channels across North America. This profile provides a widely acceptable, comforting flavor base. However, market growth is increasingly shifting towards more nuanced and bolder flavor combinations that reflect global culinary influences, moving beyond standard hickory or mesquite flavors.

The Spicy & Hot profile is experiencing robust expansion, driven by younger consumers seeking heat and excitement. The incorporation of exotic chili varieties, such as Ghost Pepper, Scotch Bonnet, and Carolina Reaper, allows manufacturers to create extreme heat sauces and rubs that attract dedicated enthusiasts. Alongside intense heat, there is a parallel trend toward Savory & Umami profiles. These flavors, often derived from ingredients like mushrooms, fermented soy products, or high-quality sea salts, enhance the natural meat flavor rather than masking it, appealing to high-end and gourmet cooks who prioritize ingredient quality and depth of taste.

Furthermore, regional specialty profiles, such as the tart, vinegary tang of Carolina BBQ sauces or the yellow, mustard-heavy bases popular in certain Southern states, are being commercialized and distributed nationwide. This democratization of regional flavors allows consumers globally to experiment with authentic cooking styles without needing deep regional knowledge. Successful flavor profile management requires continuous trend monitoring, quick sourcing of newly popular spices, and the ability to scale complex, multi-ingredient formulations accurately across production batches.

Distribution Channel Dynamics

The market relies on a diversified distribution network, with Supermarkets and Hypermarkets collectively representing the dominant channel. These channels offer visibility, convenience, and volume sales for established, mainstream brands. Effective shelf placement, promotional activity, and strategic pricing are essential for success in this high-volume environment. Retailers often utilize private label brands in this channel to compete directly with national brands based on price sensitivity, driving overall market efficiency.

Online Retail and Direct-to-Consumer (D2C) channels are demonstrating the highest growth velocity. E-commerce platforms overcome the physical limitations of retail stores, allowing small, niche, and highly specialized brands (which might focus only on organic or extremely hot flavors) to gain national and international exposure without relying on complex wholesale logistics. The D2C model provides manufacturers with better control over branding, pricing, and direct consumer data, which is invaluable for product development and personalized marketing efforts. Subscription box models specifically targeting grilling and barbecue enthusiasts are also fueling growth in this digital sphere.

The Foodservice segment, comprising restaurants, catering, and institutional buyers, demands bulk supply and exceptional consistency. While this segment requires stricter regulatory compliance and often custom-developed proprietary recipes, it represents a stable source of large-volume revenue. Manufacturers supplying this channel must ensure their products are highly heat-stable, perform consistently in commercial kitchens, and meet specialized requirements for high-output environments, often necessitating customized packaging solutions and supply chain agreements to manage large, recurring orders efficiently.

Convenience Stores and specialty Gourmet Food Stores fulfill specific consumer needs. Convenience stores cater to immediate, unplanned purchases, often stocking smaller sizes and popular, established brands. Gourmet stores, conversely, focus on premiumization, offering unique, limited-edition, and internationally sourced rubs and sauces, attracting consumers willing to pay a premium for high-quality or artisanal ingredients and unique flavor narratives. This fragmentation across channels reflects the diverse nature of consumption occasions—from rapid meal preparation to dedicated, weekend grilling events.

Application Analysis: Residential vs. Commercial

The Residential application segment accounts for the largest share of market revenue. This is driven by the global increase in disposable incomes, a persistent cultural emphasis on home cooking and grilling as a leisure activity, and the widespread use of sauces and rubs in daily meal preparation beyond just barbecuing. Residential consumers seek variety, value, and convenience, driving demand for innovative, user-friendly packaging (e.g., squeeze bottles, shaker tins) and formulations that cater to specific dietary needs (e.g., keto, vegan, gluten-free). The segment is highly influenced by digital media, including food blogs, cooking shows, and social media influencers who promote new recipes and product usage ideas.

The Commercial application segment, encompassing the entire foodservice ecosystem, is critical for stability and volume. Demand here is characterized by the need for bulk supply, stringent quality control, and cost-effective solutions. Commercial buyers value operational efficiency; thus, products that require minimal preparation time and deliver consistent results are preferred. Major QSR chains often dictate product specifications, demanding custom, confidential formulations to maintain their proprietary flavor profiles, ensuring uniqueness and brand loyalty among their patrons. Consistency is paramount, as any variation in flavor across chain outlets can negatively impact brand perception.

Market expansion in the Commercial segment is linked to the overall growth of the dining out culture globally, particularly in emerging economies where organized foodservice is rapidly displacing traditional, smaller-scale eateries. Manufacturers leverage specialized R&D teams to develop products specifically optimized for commercial cooking environments, addressing challenges such as high-heat tolerance, extended holding times (e.g., for buffet sauces), and allergen segregation to comply with local health regulations and protect the commercial customer's brand integrity.

Ingredient Base Analysis: Organic and Conventional

The Conventional ingredient base still holds the majority share of the market, primarily due to cost efficiency and wide availability of raw materials. Conventional products leverage economies of scale and standardized sourcing of ingredients like traditional sugars, corn syrups, and standard spices, allowing for competitive pricing in mass-market retail. These products often rely on chemical preservatives and coloring agents to ensure extended shelf life and visual appeal, characteristics that are acceptable to a large, price-sensitive consumer base.

However, the Natural/Organic ingredient base segment is growing significantly faster. This growth is a direct response to rising consumer awareness regarding diet, health, and sustainable agricultural practices. Organic certification ensures that ingredients are grown without synthetic pesticides or fertilizers, appealing to consumers seeking a cleaner, more wholesome product. Natural formulations focus on using recognizable, whole ingredients and relying on traditional methods or advanced non-thermal technologies (like HPP) to preserve freshness, completely eliminating artificial additives and preservatives.

The challenge for manufacturers in the Natural/Organic space is managing the higher cost of certified raw materials and maintaining flavor consistency without the aid of standardized flavor enhancers. This often results in a higher retail price point, positioning organic and natural products in the premium tier. Companies are mitigating this through strategic long-term sourcing partnerships and vertical integration where possible, ensuring a steady supply of certified ingredients. The increasing availability of affordable organic components in major agricultural markets is expected to gradually narrow the price gap, further boosting the segment’s penetration across broader consumer demographics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager