Beam Stacker Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435404 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Beam Stacker Market Size

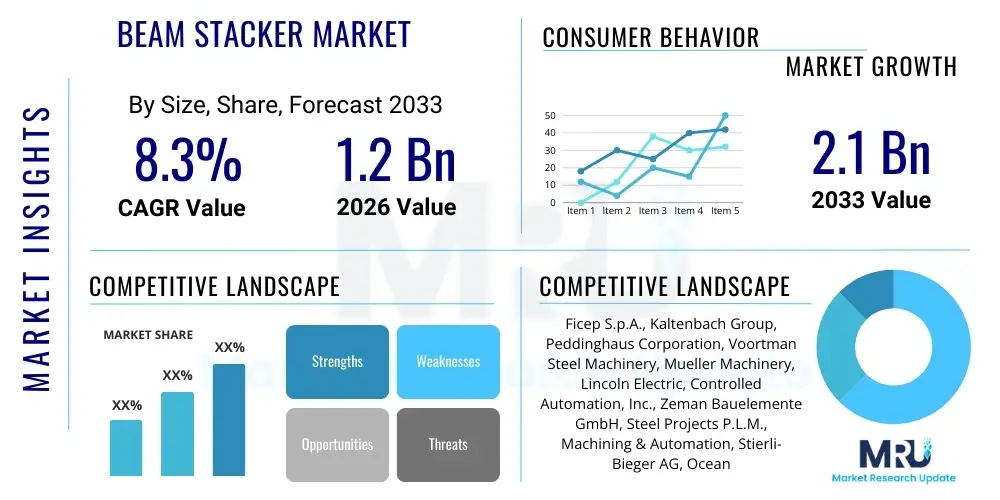

The Beam Stacker Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.3% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.1 Billion by the end of the forecast period in 2033.

Beam Stacker Market introduction

The Beam Stacker Market encompasses specialized industrial machinery designed for the automated handling, sorting, and stacking of large structural materials, predominantly steel beams, girders, and profiles used extensively in construction and heavy manufacturing sectors. These sophisticated systems are integral to modern steel fabrication facilities, optimizing yard management and ensuring material readiness for sequential processing or shipment. Key products include gantry-based stackers, cantilevered systems, and automated sorting conveyors, all engineered to handle significant payloads with high precision and speed. The primary operational objective of a beam stacker is to reduce manual intervention, enhance safety, and maximize storage density in areas where structural steel components are processed or temporarily warehoused.

Major applications for beam stackers are concentrated within large-scale construction projects, infrastructure development (such as bridges and commercial high-rises), and shipyards. The core benefits derived from their implementation include substantial improvements in operational efficiency, marked reduction in material damage, and significant labor cost savings. Furthermore, these automated systems integrate seamlessly with upstream processes like cutting, drilling, and welding lines, forming a holistic, digitized production workflow. The capability to manage diverse beam dimensions and weights efficiently positions beam stackers as critical assets for companies focused on high-throughput fabrication and just-in-time delivery models.

Driving factors propelling the expansion of this market include the global resurgence in infrastructure spending, particularly in emerging economies focused on urbanization and modernizing transportation networks. Technological advancements, such as the incorporation of Industrial Internet of Things (IIoT) sensors, predictive maintenance protocols, and advanced motion control systems, further solidify the investment justification for these machines. Increased regulatory focus on workplace safety and ergonomics also mandates the adoption of automated handling solutions, minimizing risks associated with moving extremely heavy and cumbersome structural components, thereby accelerating market penetration across established industrial regions.

Beam Stacker Market Executive Summary

The global Beam Stacker Market is exhibiting robust growth, fundamentally driven by the imperative for industrial automation and the need for higher throughput in steel fabrication and logistics. Current business trends emphasize the shift towards highly customizable and modular stacking solutions that can adapt to variable production volumes and diverse material types. Key market players are prioritizing the integration of advanced software for real-time inventory tracking and optimization of stacking algorithms, enhancing overall supply chain visibility. Strategic partnerships between machinery manufacturers and software providers are becoming common, aiming to offer turnkey solutions that minimize deployment complexities and maximize return on investment for end-users, especially in competitive construction materials markets.

Regionally, the Asia Pacific (APAC) market is poised to demonstrate the most significant Compound Annual Growth Rate (CAGR), fueled by massive government investments in infrastructure projects in China, India, and Southeast Asian nations. North America and Europe, characterized by high labor costs and stringent safety regulations, exhibit strong demand for fully automated systems, focusing on operational longevity and energy efficiency. European manufacturers are leading innovation in precision engineering and sustainable manufacturing practices related to beam stacking machinery. Meanwhile, the Middle East and Africa (MEA) region is experiencing steady adoption due to large-scale urban development and industrial diversification initiatives, creating a fertile ground for specialized heavy equipment deployment.

Segment trends reveal a strong preference for Automatic Beam Stackers over semi-automatic and manual variants, driven by the increasing affordability and reliability of robotic and gantry systems. In terms of end-use, the construction sector remains the dominant segment, though the manufacturing sector, particularly large machinery production and shipbuilding, is showing accelerated adoption rates as they seek to streamline internal logistics. The rise of standardized beam specifications in modular construction techniques is also simplifying the integration of automated stacking solutions, further solidifying the market's trajectory towards digitalization and fully autonomous material flow management.

AI Impact Analysis on Beam Stacker Market

Common user questions regarding AI's influence on the Beam Stacker Market primarily revolve around operational efficiency gains, predictive maintenance capabilities, and integration complexity. Users frequently inquire about how Artificial Intelligence can optimize stacking patterns (Is AI optimizing beam sequencing?), minimize yard footprint (Can AI algorithms increase storage density?), and reduce unexpected downtime (How does machine learning predict failures in hydraulics or motors?). Key concerns also focus on the initial capital outlay required for implementing AI-driven control systems and the necessary training for existing personnel. This collective inquiry highlights user expectation that AI will transition beam stacking from a programmed mechanical process to a highly adaptive, self-optimizing logistical operation that maximizes resource utilization and ensures structural integrity of stacked materials.

The integration of AI and Machine Learning (ML) algorithms is fundamentally reshaping the operational landscape of the Beam Stacker Market. ML models analyze vast datasets generated by IIoT sensors regarding beam dimensions, weight, handling history, and required delivery sequence. This analysis allows the stacking system to dynamically adjust stacking height, orientation, and sequencing in real-time to prevent structural instability, minimize search time during retrieval, and optimize storage capacity. Furthermore, AI-powered vision systems are used for immediate quality inspection, identifying surface defects or warping in beams before they are stacked, ensuring only compliant materials proceed downstream. This level of autonomous decision-making translates directly into reduced human error and substantial operational throughput improvements.

Beyond immediate operational enhancement, AI is crucial for establishing true predictive maintenance protocols within beam stacking machinery. By continuously monitoring vibration, temperature, current draw, and cycle times of critical components (motors, gearboxes, lifting mechanisms), ML models can identify subtle anomalies indicative of impending component failure. This shift from reactive or preventive maintenance to predictive intervention significantly extends the lifespan of expensive equipment, minimizes unplanned production halts, and drastically reduces the total cost of ownership (TCO). The deployment of deep learning networks for advanced pattern recognition is rapidly becoming a standard feature in high-end beam stacking solutions, promising near-zero downtime environments for heavy fabrication facilities.

- AI-driven sequence optimization maximizes yard storage density and throughput.

- Machine learning algorithms enable highly accurate predictive maintenance of motors and hydraulics.

- Real-time visual inspection systems utilize AI for defect detection and quality assurance of materials.

- Autonomous path planning and collision avoidance systems enhance operational safety.

- Reduced reliance on human operators for complex stacking pattern generation.

- Adaptive control systems adjust handling speeds based on beam weight and material properties.

DRO & Impact Forces Of Beam Stacker Market

The Beam Stacker Market is propelled by strong systemic Drivers, moderated by specific Restraints, and presents compelling Opportunities, all shaped by significant Impact Forces. Key drivers include the global push for industrial automation to offset rising labor costs, and the urgent need for enhanced safety protocols when handling large, heavy steel structures. These drivers are intrinsically linked to the increasing complexity and scale of modern construction projects, demanding precise material flow management. However, market growth is often restrained by the high initial capital investment required for these sophisticated automated systems and the lack of standardization in beam specifications across various global regions, which can complicate machinery interoperability and integration into legacy systems.

Significant opportunities arise from the rapid expansion of smart factory concepts and Industry 4.0 initiatives, facilitating the seamless integration of beam stackers into wider digital ecosystems through IoT connectivity and centralized control platforms. Furthermore, the burgeoning demand for prefabricated and modular construction methods offers a specialized, high-volume niche for precision stacking and sequencing equipment. The primary impact forces influencing this market trajectory include accelerated technological evolution, particularly in sensor technology and robotic controls, which continually enhance system performance and reliability. Economic volatility, particularly fluctuations in steel prices and global construction investment cycles, represents an external impact force that dictates short-term demand variability.

The market faces the challenge of managing technical integration with diverse Enterprise Resource Planning (ERP) and Manufacturing Execution Systems (MES) currently used by end-users. While customization offers flexibility, it often adds cost and complexity, acting as a soft restraint. Successfully mitigating these restraints by developing plug-and-play standardized interfaces represents a substantial growth opportunity. The underlying force driving investment remains return on investment (ROI) derived from reduced operational expenditure (OpEx) through increased operational uptime and minimized labor requirements, making automated beam stacking solutions an increasingly necessary capital expenditure for achieving competitive advantage in heavy material handling logistics.

Segmentation Analysis

The Beam Stacker Market is comprehensively segmented based on Type, Operation Mode, and End-Use Industry, reflecting the varied needs of industrial clients globally. Type segmentation distinguishes between Gantry Stackers, known for high capacity and flexibility across wide areas, and Overhead Stackers, typically integrated into existing overhead crane systems. Operation Mode dictates the degree of automation, ranging from fully Automatic systems, which utilize advanced robotics and software control, to Semi-Automatic and Manual systems, catering to smaller operations or those with lower capital budgets. End-Use segmentation highlights the primary consumers of structural beams and profiles, defining market volume and application specificity across distinct industrial sectors.

- By Type:

- Gantry Beam Stackers

- Overhead Beam Stackers

- Cantilevered Stacking Systems

- By Operation Mode:

- Automatic Systems

- Semi-Automatic Systems

- Manual Systems

- By End-Use Industry:

- Construction & Infrastructure

- Manufacturing & Fabrication

- Logistics & Warehousing

- Shipbuilding & Energy

- Mining

Value Chain Analysis For Beam Stacker Market

The value chain for the Beam Stacker Market begins with Upstream Analysis, which focuses on the sourcing of critical components and raw materials. Key inputs include high-grade structural steel and specialized aluminum alloys for the stacker frame, advanced electronic components such as Programmable Logic Controllers (PLCs), servo motors, sensors (proximity, load, and vision systems), and complex hydraulic and pneumatic systems. The competitive advantage at this stage often lies in securing stable supply contracts and maintaining stringent quality control over electrical and mechanical sub-systems, as component reliability directly impacts the stacker’s overall uptime and precision performance. Strong relationships with specialized motion control and automation suppliers are essential for innovation and cost management.

The core value creation process involves the design, engineering, manufacturing, and assembly of the beam stacking machinery. Manufacturers invest heavily in R&D to optimize stacking algorithms, improve mechanical stability under dynamic loads, and enhance software integration capabilities. The distribution channel is bifurcated into Direct and Indirect sales models. Direct sales, involving specialized sales teams and application engineers, are preferred for large, customized, and complex automated gantry systems, ensuring deep technical consultation and tailored installation support. Indirect channels, utilizing regional distributors and system integrators, are often employed for standardized, smaller, or semi-automatic units, offering broader market reach and localized support services, particularly in emerging markets where direct manufacturer presence is limited.

Downstream analysis covers the installation, commissioning, training, and extensive post-sale maintenance and service contracts. Given the high capital outlay and critical role of beam stackers in production flow, customers prioritize manufacturers offering robust service agreements, digital monitoring solutions for remote diagnostics, and guaranteed spare parts availability. The ultimate value delivery is realized at the customer site through sustained operational efficiency and optimized material flow. Continuous feedback from end-users regarding operational challenges and performance metrics is crucial for the manufacturer to drive iterative product improvements and maintain a competitive edge through lifecycle management and system upgrades, ensuring alignment with evolving industry standards and structural steel specifications.

Beam Stacker Market Potential Customers

Potential customers for Beam Stacker systems are predominantly heavy material handling entities that require precision, speed, and safety in managing large volumes of structural steel components. The primary End-Users/Buyers fall within the steel fabrication industry, where structural members are cut, drilled, welded, and prepped for construction projects. These customers operate large, multi-bay fabrication shops and seek automated solutions to minimize floor space usage, improve inventory accuracy, and accelerate the staging process for large assemblies. Their buying decisions are heavily influenced by factors such as system throughput capacity, compatibility with existing facility layouts and crane infrastructure, and the vendor’s reputation for industrial reliability and long-term service support.

Another crucial segment consists of major engineering and construction firms that often integrate or mandate the use of automated stacking solutions in their supply chain partners to ensure project timelines are met and material handling risks are minimized. Logistics and specialized warehousing providers that handle interim storage or transshipment of large structural elements also represent a growing customer base. For these logistics providers, the ability of beam stackers to rapidly reorganize inventory based on outbound shipping schedules and optimize truck loading sequences is a decisive purchasing factor. These customers often seek modular systems that can be rapidly deployed or relocated, prioritizing flexibility and scalability.

Moreover, the shipbuilding and heavy machinery manufacturing sectors, which deal with exceptionally large and uniquely shaped beams and profiles, constitute high-value niche customers. Their requirements often demand highly customized, heavy-duty beam stacking machinery capable of managing non-standard weights and sizes while adhering to strict safety tolerances. The decision-makers in these sectors—typically production managers, chief engineers, and procurement directors—prioritize proven case studies demonstrating high Mean Time Between Failures (MTBF) and seamless integration with their complex production planning software, ensuring that the automation investment directly supports complex, large-scale assembly operations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.1 Billion |

| Growth Rate | 8.3% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ficep S.p.A., Kaltenbach Group, Peddinghaus Corporation, Voortman Steel Machinery, Mueller Machinery, Lincoln Electric, Controlled Automation, Inc., Zeman Bauelemente GmbH, Steel Projects P.L.M., Machining & Automation, Stierli-Bieger AG, Ocean Machinery Inc., HE&M Saw, Inc., Daito Seiki Co., Ltd., Vermaport Ltd., SteelFab Systems, Ltd., TrakSYS, Ltd., O.M.I.G. S.r.l., Beamline Automation, Automated Fabrication Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Beam Stacker Market Key Technology Landscape

The technological landscape of the Beam Stacker Market is rapidly evolving, moving beyond simple mechanized handling towards highly sophisticated, digitized systems. Central to this evolution is the implementation of advanced motion control technologies, primarily using precision servo motors and integrated sensor feedback loops. These components ensure millimeter-level accuracy during beam manipulation and stacking, critical for maintaining structural integrity and tight tolerances required for modern fabrication. Furthermore, the adoption of Programmable Logic Controllers (PLCs) with enhanced processing capabilities allows for rapid execution of complex stacking algorithms and seamless communication with external systems like Manufacturing Execution Systems (MES), ensuring that the physical handling process is perfectly synchronized with the digital production schedule.

The Industrial Internet of Things (IIoT) plays a significant role in providing real-time operational visibility and driving predictive maintenance strategies. Beam stackers are increasingly equipped with integrated smart sensors that monitor crucial operational parameters such as hydraulic pressure, motor temperature, vibration analysis, and energy consumption. This data is transmitted to centralized cloud platforms for analysis, enabling machine learning models to predict component failure points well in advance, drastically reducing unplanned downtime. Digital Twin technology is also emerging as a pivotal innovation, allowing manufacturers and end-users to simulate complex stacking sequences and optimize facility layout virtually before physical deployment, ensuring maximal efficiency and mitigating costly design errors.

Another key technological differentiator is the integration of advanced vision systems and laser scanning equipment. These systems allow the beam stacker to automatically identify the precise dimensions, orientation, and unique identification codes (e.g., RFID or QR codes) of structural beams entering the stacking area. This capability ensures that the correct material is stacked in the correct location according to the pre-determined plan, eliminating human identification errors and ensuring complete material traceability throughout the supply chain. Ongoing research and development are focused on incorporating collaborative robotics (cobots) for specific auxiliary tasks within the stacking envelope, further enhancing flexibility and improving the safety profile of the entire operation.

Regional Highlights

The North American Beam Stacker Market is characterized by high adoption rates of fully automated and premium-priced solutions. This maturity stems from stringent occupational safety regulations and consistently high labor costs, making the ROI on automation immediate and measurable. The US and Canada are major consumers, driven by significant investments in commercial construction, large-scale infrastructural renewal (bridges, highways), and oil and gas sector expansion. Manufacturers in this region focus on ruggedized equipment designed for extreme operational environments and seamless integration with complex North American ERP systems. The trend here leans toward modular and scalable systems that support rapidly changing project requirements, alongside demand for sophisticated software tools that optimize yard logistics and material staging processes to meet tight project deadlines.

The European market is dominated by precision engineering, energy efficiency, and regulatory compliance (e.g., CE marking and EU safety standards). Western European countries, particularly Germany, Italy, and the Nordic regions, are key innovators, pioneering the use of low-energy servo drives and advanced diagnostic capabilities in their stacking machinery. The demand is strong for systems that integrate effectively into highly complex, multi-stage fabrication lines, driven by the continent's robust automotive, aerospace, and general manufacturing base, alongside steady infrastructure refurbishment projects. There is a notable focus on sustainable manufacturing, pushing vendors to develop stackers built from recyclable materials and optimized for minimal operational waste and noise pollution, aligning with European Green Deal objectives and corporate sustainability mandates.

Asia Pacific (APAC) stands as the largest and fastest-growing regional market, propelled by unprecedented levels of urbanization and industrial growth, particularly in China, India, and Southeast Asia. The enormous scale of infrastructure and residential development necessitates high-throughput handling capabilities, driving demand for both semi-automatic, cost-effective models and large-scale, automated gantry systems. While price sensitivity remains a factor in certain segments, the massive volume of steel processed dictates a rapid shift toward automation to maintain cost competitiveness and safety standards. Government-backed initiatives aimed at expanding manufacturing capacity and modernizing ports and logistic hubs further cement APAC’s leading position in terms of unit volume adoption over the forecast period.

Latin America (LATAM) presents a developing market for beam stackers, driven primarily by investments in mining infrastructure, energy projects, and selective public works. Brazil and Mexico are the principal markets, showing gradual adoption of automated solutions to increase productivity in their domestic steel fabrication industries. Market growth is often intermittent, linked closely to commodity price cycles and foreign investment flows, but the long-term trend favors automation as labor costs rise and quality demands increase. Equipment requirements often balance automation features with operational simplicity and resilience against fluctuating power supply and maintenance challenges, necessitating robust mechanical designs.

The Middle East and Africa (MEA) region, particularly the Gulf Cooperation Council (GCC) countries, showcases significant demand due to ambitious mega-projects related to futuristic cities, tourism infrastructure, and non-oil economic diversification efforts. These projects demand specialized, high-capacity stackers capable of operating reliably in harsh climate conditions (high heat and dust). The key market drivers here are the large, continuous investment in construction and the desire for state-of-the-art technology deployment. African markets, while nascent, are showing increasing interest in automated solutions linked to mineral processing and logistical hub development, focused initially on modular and lower-entry-cost semi-automatic systems to gain initial efficiency improvements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Beam Stacker Market.- Ficep S.p.A.

- Kaltenbach Group

- Peddinghaus Corporation

- Voortman Steel Machinery

- Mueller Machinery

- Lincoln Electric

- Controlled Automation, Inc.

- Zeman Bauelemente GmbH

- Steel Projects P.L.M.

- Machining & Automation

- Stierli-Bieger AG

- Ocean Machinery Inc.

- HE&M Saw, Inc.

- Daito Seiki Co., Ltd.

- Vermaport Ltd.

- SteelFab Systems, Ltd.

- TrakSYS, Ltd.

- O.M.I.G. S.r.l.

- Beamline Automation

- Automated Fabrication Systems

Frequently Asked Questions

Analyze common user questions about the Beam Stacker market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Beam Stacker Market?

The Beam Stacker Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of 8.3% during the forecast period from 2026 to 2033. This growth is primarily attributed to accelerating industrial automation adoption and increasing global infrastructure spending, particularly in the Asia Pacific region.

Which segments are driving the highest demand for automated beam stacking systems?

The Automatic Systems segment, categorized by Operation Mode, is experiencing the highest growth due to increased efficiency, reduced labor costs, and enhanced safety features enabled by robotics and advanced control software. The Construction & Infrastructure end-use segment remains the largest consumer, driven by large-scale commercial and civil engineering projects requiring high-volume steel throughput.

How does AI technology impact the operational efficiency of beam stackers?

AI technology, specifically Machine Learning (ML) and computer vision, significantly impacts operational efficiency by optimizing stacking sequences to maximize storage density (yard optimization), minimizing retrieval times, and enabling predictive maintenance. This shift reduces unexpected downtime and ensures high precision in material handling, crucial for complex fabrication schedules.

What are the primary restraints affecting the expansion of the Beam Stacker Market?

The primary restraints include the high initial capital investment required for deploying large, automated gantry systems, which can be prohibitive for smaller fabrication shops. Additionally, challenges related to the complex integration of new automated stackers with diverse, often proprietary, legacy Manufacturing Execution Systems (MES) or ERP platforms pose significant technical hurdles.

Which geographical region is anticipated to lead the market in terms of volume and growth?

The Asia Pacific (APAC) region is anticipated to lead the Beam Stacker Market in terms of both volume and growth rate. This dominance is sustained by aggressive government investments in massive infrastructure and urbanization projects across key countries like China, India, and various Southeast Asian nations, fueling immense demand for automated steel handling solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager