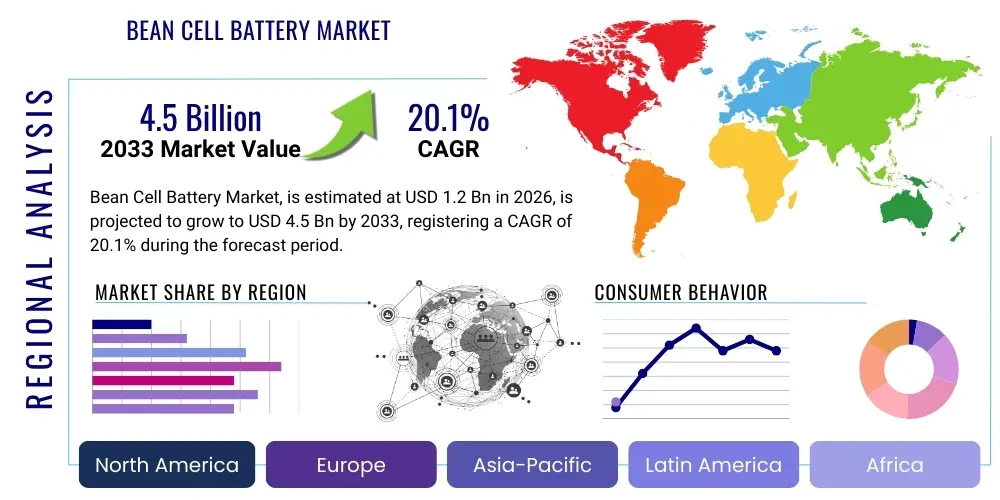

Bean Cell Battery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437050 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Bean Cell Battery Market Size

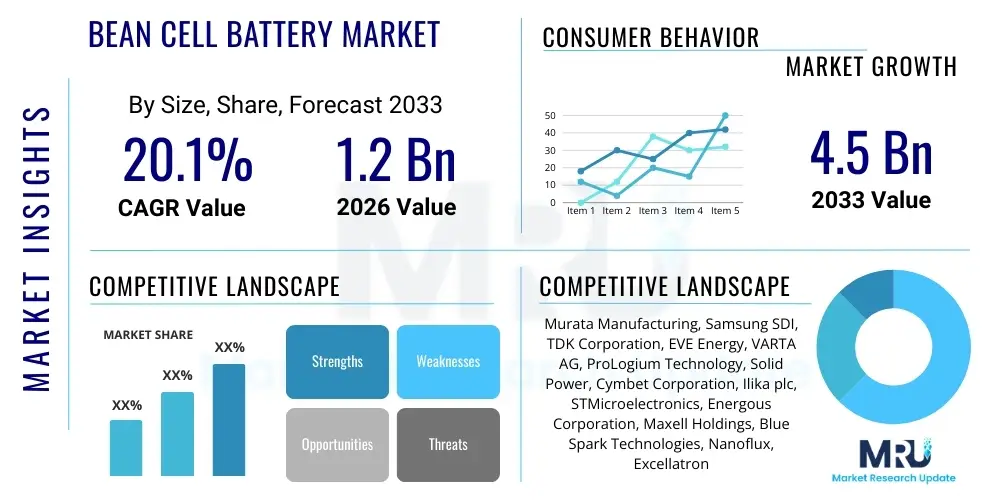

The Bean Cell Battery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 20.1% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 4.5 Billion by the end of the forecast period in 2033.

Bean Cell Battery Market introduction

The Bean Cell Battery Market encompasses the development, manufacturing, and distribution of highly miniaturized, high-energy-density power sources designed specifically for next-generation portable electronics, implantable medical devices, and sophisticated Internet of Things (IoT) sensors. These batteries, often leveraging advanced solid-state electrolyte or novel micro-lithium polymer chemistries, are characterized by their extremely small form factor, enhanced safety profiles, and superior energy retention compared to traditional coin or button cells. Their unique physical attributes, including flexibility and resistance to physical stress, make them indispensable for applications where size and reliability are paramount, such as smart contact lenses, ingestible sensors, and sophisticated wearables that require seamless integration into constrained spaces.

Major applications driving this market include high-precision medical monitoring (pacemakers, continuous glucose monitors), consumer electronics integration (hearables, smart jewelry), and industrial IoT deployment where sensors must operate reliably for extended periods without maintenance. The primary benefit of Bean Cell Batteries lies in their volumetric energy density, enabling manufacturers to significantly reduce the size and weight of end products while maintaining or extending operational life. Furthermore, their solid-state variants inherently offer better thermal stability and lower risk of leakage compared to liquid-electrolyte counterparts, addressing critical safety concerns, especially in biomedical applications.

The market growth is primarily driven by the escalating global demand for miniaturization across all electronic sectors, coupled with significant technological advancements in material science that are improving electrode and electrolyte performance within ultra-small volumes. Key factors include the proliferation of 5G and subsequent 6G connectivity requiring dense sensor networks, the aging global population driving demand for sophisticated medical implants, and the competitive consumer market demanding thinner, lighter, and more powerful wearable devices. Regulatory approvals for new solid-state battery chemistries and increased R&D investment by semiconductor and medical device manufacturers are further accelerating the commercialization timeline of these specialized power solutions.

Bean Cell Battery Market Executive Summary

The Bean Cell Battery Market is poised for exponential growth, characterized by intense innovation centered around solid-state chemistries and enhanced volumetric energy density tailored for extreme miniaturization. Business trends highlight strategic partnerships between material science firms and medical device manufacturers, aiming to secure long-term supply chains for high-reliability components. Furthermore, significant capital investment is being channeled into advanced manufacturing techniques, such as additive manufacturing and micro-assembly lines, necessary to achieve the ultra-precise tolerances required for these micro-batteries. The competitive landscape is shifting, moving beyond traditional battery giants to include specialized micro-electronics startups focused exclusively on specialized power solutions for niche high-value applications like ingestible diagnostics and neural interface technologies.

Regionally, Asia Pacific (APAC) currently dominates the manufacturing volume, leveraging established supply chains in consumer electronics production, particularly in China, South Korea, and Japan, which are pioneering mass production techniques for flexible and ultra-thin batteries. North America and Europe, however, lead in application development, driven by strong R&D ecosystems in medical technology and high-end industrial IoT. These regions emphasize high-margin, specialized battery solutions that meet stringent regulatory requirements for safety and longevity, focusing on integration into regulated medical and defense sectors rather than purely volume manufacturing.

In terms of segmentation, the Application segment focusing on Medical Devices is expected to witness the highest CAGR, propelled by the transition from external monitoring to continuous implantable diagnostics requiring extremely long service lives and biocompatibility. Technology-wise, solid-state Bean Cells are rapidly gaining market share over conventional micro-polymer chemistries due to inherent advantages in safety, cycle life, and power output, fulfilling the stringent demands of advanced IoT and complex biomedical applications where operational failure is unacceptable. Investment trends suggest a continued pivot towards materials that support rapid charging and extended temperature ranges, crucial for broad industrial adoption.

AI Impact Analysis on Bean Cell Battery Market

Common user questions regarding AI's impact on the Bean Cell Battery Market often revolve around optimizing material composition, predicting battery lifespan under varied operational loads, and enhancing manufacturing precision in the highly sensitive micro-fabrication process. Users frequently inquire if AI-driven simulations can drastically reduce the R&D cycle time for novel electrolyte or electrode combinations, which traditionally require extensive, time-consuming physical testing. Furthermore, a major concern is the potential for AI to manage distributed power systems utilizing thousands of tiny Bean Cells in smart cities or large-scale IoT networks, ensuring optimal power distribution and predictive maintenance across the grid. The overarching themes are the acceleration of design, enhancement of predictive reliability, and the optimization of resource allocation through intelligent manufacturing systems.

AI is already playing a transformative role in accelerating the discovery of new materials capable of achieving the necessary energy density and stability for Bean Cell technology. Machine learning algorithms analyze vast datasets of material properties, predicting optimal chemical structures and manufacturing parameters far quicker than conventional trial-and-error methods. This capability is critical for overcoming current limitations related to electrode instability and interface impedance in solid-state systems, directly impacting the commercial viability of next-generation Bean Cells. By optimizing the complex micro-scale geometry, AI ensures consistency and efficiency, minimizing waste in the high-cost production environment necessary for these miniaturized components.

The implementation of predictive maintenance and intelligent battery management systems (BMS) powered by AI represents another significant impact area. In applications such as high-value medical implants or remote industrial sensors, knowing the exact state-of-health (SOH) and predicted lifespan is vital. AI models process real-time usage data, temperature fluctuations, and charge/discharge cycles to provide highly accurate lifespan forecasts, which informs replacement schedules and guarantees uninterrupted performance. Moreover, in manufacturing, AI-driven computer vision systems monitor micro-assembly lines to detect defects invisible to human operators, thereby significantly increasing yield and maintaining the ultra-high quality standards mandated by regulatory bodies for miniaturized high-tech batteries.

- AI accelerates R&D cycles by simulating novel material combinations (electrolytes, cathodes) for improved energy density.

- Predictive modeling enhances battery lifespan estimation (State of Health - SOH) critical for implantable devices and long-term IoT sensors.

- AI-driven optimization improves micro-manufacturing precision, reducing defect rates in complex assembly processes.

- Intelligent Battery Management Systems (BMS) utilize machine learning for real-time thermal management and power allocation in dense sensor networks.

- Computer vision systems enable automated quality control (QC) necessary for validating ultra-small, high-tolerance components.

- AI assists in designing optimal charging protocols tailored to the unique electrochemical properties of micro-solid-state cells.

DRO & Impact Forces Of Bean Cell Battery Market

The Bean Cell Battery Market growth is fundamentally driven by the relentless pursuit of device miniaturization across medical, consumer electronics, and defense sectors, coupled with significant material science breakthroughs improving energy density and safety profiles. Restraints primarily involve the high complexity and capital expenditure required for micro-fabrication, coupled with supply chain fragilities surrounding specialized raw materials like high-purity lithium compounds and novel solid electrolytes. Opportunities abound in emerging applications such as bio-integrated electronics, next-generation haptics, and the proliferation of low-power wide-area network (LPWAN) IoT devices that require sustainable, ultra-small power sources. These factors interact as powerful impact forces, where the high investment threshold (restraint) is offset by the enormous, untapped potential of bio-medical integration (opportunity), driving sustained, if challenging, market expansion.

Key drivers include the global shift towards preventative and continuous health monitoring, demanding smaller, less invasive, and longer-lasting batteries for wearable patches and implantables. The consumer electronics sector, particularly hearables and high-end smartwatches, consistently drives demand for thinner profiles and longer standby times, making Bean Cells an ideal replacement for traditional prismatic or coin cells. Furthermore, the development of solid-state versions addresses major regulatory concerns regarding flammability and chemical leakage, allowing for safer deployment in sensitive environments. The ability of these batteries to withstand high stress and repeated flexing is a unique performance advantage directly fueling adoption in advanced flexible electronics.

However, the market faces significant hurdles. Scaling production efficiently while maintaining micron-level precision is technically demanding and capital-intensive, limiting the number of viable manufacturers. Another restraint is the relatively higher cost per watt-hour compared to large-format batteries, which restricts use primarily to high-value applications. The regulatory landscape, especially for medical-grade implantable batteries, presents a lengthy and costly barrier to entry due to stringent safety and biocompatibility requirements. Opportunities are defined by the convergence of 5G/6G communication with edge computing, creating a massive addressable market for decentralized, intelligently powered micro-sensors, opening avenues for developing novel, sustainable chemistries that reduce reliance on critical raw materials facing geopolitical instability.

- Drivers:

- Exponential demand for device miniaturization in wearables and implantable medical technology.

- Advancements in solid-state chemistry offering superior safety, cycle life, and thermal stability.

- Proliferation of high-density IoT sensors and distributed edge computing devices requiring optimized micro-power.

- Integration into flexible electronics and smart textiles requiring bendable and stress-tolerant power sources.

- Restraints:

- High capital investment required for specialized micro-fabrication and precision manufacturing techniques.

- Technical challenges in achieving high power output alongside ultra-miniaturization and high energy density simultaneously.

- Supply chain constraints for highly specialized, high-purity electrode and electrolyte materials.

- Regulatory complexities and lengthy approval processes, especially for bio-integrated applications.

- Opportunities:

- Development of bio-compatible and bio-absorbable Bean Cell variants for temporary medical procedures.

- Expansion into high-volume, low-cost micro-power applications enabled by economies of scale in next-gen fabs.

- Integration with energy harvesting technologies (e.g., thermal, kinetic) to create self-sustaining power modules.

- Growth in defense and aerospace sectors requiring robust, lightweight power sources for tactical gear and micro-drones.

- Impact Forces:

- Technological Obsolescence: Rapid innovation cycles mandate continuous R&D investment to maintain market relevance.

- Regulatory Compliance: Strict adherence to ISO and medical device standards dictates market access and trust.

- Economies of Scale: Achieving competitive pricing hinges on successful high-volume, defect-free production scaling.

Segmentation Analysis

The Bean Cell Battery Market is strategically segmented primarily by Product Type (Solid-State vs. Polymer), Application (Medical Devices, Wearable Electronics, Industrial IoT), and Capacity Range (Low, Medium, High). This segmentation provides a granular view of market dynamics, revealing that growth is disproportionately driven by high-value, highly technical segments requiring superior safety and longevity, such as implantable medical devices. The shift towards solid-state technology is a core trend across all segments, indicating a market preference for enhanced reliability and safety, even at a higher initial cost. Understanding these segments is crucial for strategic investment and product development planning, allowing manufacturers to tailor their production lines and R&D efforts to specific end-user requirements, particularly concerning temperature tolerance and discharge rates.

The Application segmentation highlights the divergence in product requirements. Wearable electronics demand high flexibility and fast charging capabilities, favoring micro-polymer lithium-ion variants. Conversely, Medical Devices require absolute reliability, extremely low self-discharge rates, and high-temperature sterilization compatibility, making solid-state Bean Cells the material of choice. The Industrial IoT segment focuses on balancing cost, longevity, and robust performance in harsh environmental conditions. The segmentation by Capacity Range helps distinguish between products used for continuous low-power sensing (Low Capacity) versus those requiring periodic bursts of high power, such as wireless transmission or haptic feedback (High Capacity).

Geographically, market segmentation reflects the division between high-volume manufacturing hubs in APAC and high-value application centers in North America and Europe. Companies are increasingly employing a hybrid strategy, establishing R&D centers close to major medical technology clusters while maintaining core production facilities in regions offering cost and supply chain advantages. The future competitive landscape will be defined by manufacturers who can successfully standardize the manufacturing process for solid-state Bean Cells, thereby making them accessible to a wider array of consumer and industrial applications currently constrained by cost and complexity.

- By Product Type:

- Solid-State Bean Cells

- Polymer Bean Cells (Micro-Lithium Polymer)

- Thin-Film Bean Cells

- By Application:

- Wearable Electronics (Hearables, Smart Jewelry, Fitness Trackers)

- Medical Devices (Implantables, Continuous Monitoring Systems, Drug Delivery Patches)

- Industrial IoT & Sensor Networks (Asset Tracking, Environmental Sensing)

- Defense & Aerospace Micro-Systems

- By Capacity Range:

- Low Capacity (Under 5 mAh)

- Medium Capacity (5 mAh – 20 mAh)

- High Capacity (Above 20 mAh)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Bean Cell Battery Market

The value chain for the Bean Cell Battery Market is highly specialized and begins with the upstream sourcing of critical, high-purity raw materials, including specialized cathode and anode powders (often nickel, cobalt, manganese oxides, or advanced silicon composites) and the complex synthesis of solid electrolytes (such as specialized polymer or ceramic compounds). The upstream phase is characterized by intense intellectual property control, as material formulation is a key differentiator in performance and safety. Due to the high-tech nature of the components, sourcing is often geographically consolidated among a few specialized chemical manufacturers and material science firms. This concentration presents potential supply chain risks that market participants actively seek to mitigate through dual-sourcing strategies and backward integration into material processing.

The midstream phase involves the highly technical and capital-intensive manufacturing process, including thin-film deposition, micro-assembly, and precise packaging in cleanroom environments. Unlike standard battery production, Bean Cell fabrication utilizes semiconductor-like processes (e.g., photolithography, precision etching) to achieve micron-level accuracy. Distribution channels are highly dependent on the end application. For high-volume consumer electronics, indirect channels involving large-scale electronics assemblers and distributors in APAC dominate. Conversely, for medical devices, distribution is primarily direct, involving rigorous qualification processes and close collaboration between the battery manufacturer and the device OEM to ensure regulatory compliance and integration integrity.

Downstream analysis focuses on end-use application integration, where the battery is seamlessly embedded into the final product, such as a continuous glucose monitor or a sophisticated smart ring. Post-sale services, including extended warranty, failure analysis, and end-of-life management (recycling/disposal), are crucial, particularly for high-cost, regulated products. Direct distribution ensures greater control over quality and minimizes handling risks for sensitive components, while indirect channels leverage existing distribution networks to achieve market penetration rapidly in high-volume sectors. The efficiency of this value chain is determined by the speed of material innovation and the ability to scale micro-fabrication without compromising the critical precision required.

Bean Cell Battery Market Potential Customers

The primary customers for Bean Cell Batteries are Original Equipment Manufacturers (OEMs) operating within highly technical and miniaturization-focused industries. These include major multinational corporations specializing in implantable medical devices, such as cardiac rhythm management systems and neurostimulation devices, where product reliability over a decade or more is non-negotiable and the physical size constraint is severe. Another critical customer segment is the consumer electronics industry, specifically companies pioneering next-generation hearables (wireless earbuds) and advanced wearables (smartwatches, rings) that require exceptionally high power density in ultra-thin, customizable form factors, enabling sleek industrial designs without sacrificing operational time.

Beyond these high-profile sectors, significant potential lies within specialized industrial and defense segments. Industrial IoT integrators, responsible for deploying massive networks of remote, low-maintenance sensors for infrastructure monitoring, oil and gas, and smart logistics, represent a rapidly growing customer base. These buyers prioritize extreme longevity and robustness in challenging operational environments, often requiring specialized coatings or temperature tolerances that standard batteries cannot meet. The defense sector demands lightweight power solutions for soldier-worn technology, micro-drones, and tactical communication gear, emphasizing energy density, reliable performance under shock/vibration, and thermal extremes.

Ultimately, the typical buyer of Bean Cell Batteries is a highly sophisticated engineering team focused on creating a product differentiation through miniaturization and extended functionality. Procurement decisions are heavily influenced not just by cost, but by proven reliability track records, certification (e.g., ISO 13485 for medical), and the supplier's technical ability to customize form factors and optimize battery chemistry for specific load profiles. Therefore, strategic partnerships and deep technical support are essential components of customer acquisition in this specialized market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 4.5 Billion |

| Growth Rate | 20.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Murata Manufacturing, Samsung SDI, TDK Corporation, EVE Energy, VARTA AG, ProLogium Technology, Solid Power, Cymbet Corporation, Ilika plc, STMicroelectronics, Energous Corporation, Maxell Holdings, Blue Spark Technologies, Nanoflux, Excellatron Solid State, Ultralife Corporation, Panasonic Corporation, Hitachi Maxell, Enfucell Oy, Saft (TotalEnergies) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bean Cell Battery Market Key Technology Landscape

The technological backbone of the Bean Cell Battery Market revolves around overcoming fundamental electrochemical and physical constraints at the micro-scale. The most significant advancement is the transition towards solid-state electrolytes, moving away from liquid or gel polymers that pose safety risks and limit miniaturization potential. Solid-state Bean Cells utilize materials like thin-film ceramics or specialized glass electrolytes, enabling non-flammable operation, higher cycle stability, and the ability to operate across a wider temperature spectrum crucial for demanding applications like aerospace and implantables. Furthermore, R&D is heavily focused on developing high-capacity cathode materials, such as nickel-rich layered oxides and silicon-based anodes, which can deliver increased energy density within the constrained volume of a Bean Cell. Integration with MEMS (Micro-Electro-Mechanical Systems) technology is also key, allowing for the co-packaging of the battery directly with the sensor or microprocessor on a single chip or substrate, drastically reducing overall device footprint.

Another crucial technological area is advanced micro-fabrication, drawing heavily from semiconductor processes. Techniques such as pulsed laser deposition (PLD), atomic layer deposition (ALD), and screen printing are used to precisely deposit electrode layers and solid electrolytes, often only a few microns thick, to create high-efficiency stacks. This precision is vital for minimizing internal resistance and maximizing power output. Flexibility and mechanical robustness are also significant technology drivers; innovations in substrate materials and encapsulants allow batteries to bend and twist repeatedly without cracking or failure, addressing the specific needs of smart textiles and flexible displays. The sophistication of the manufacturing process directly correlates with the final product's performance and cost.

Furthermore, the development of sophisticated power management integrated circuits (PMICs) tailored specifically for the low-current, high-efficiency requirements of Bean Cells is a parallel technological trend. These specialized PMICs ensure optimal charging, prevent deep discharge, and manage intermittent power requirements efficiently, thereby extending the overall operational life of the device far beyond what the battery capacity alone might suggest. Future technology development is expected to focus on bio-integrated materials, allowing Bean Cells to be safely implanted or even dissolve harmlessly after their operational lifespan, opening up completely new paradigms in transient medical monitoring and temporary therapeutic devices.

Regional Highlights

- Asia Pacific (APAC) Dominance in Manufacturing and Consumer Adoption: APAC is the global leader in the production and mass-market consumption of Bean Cell Batteries, primarily due to the region's concentration of leading consumer electronics manufacturers (South Korea, Japan, China). These companies drive continuous innovation in high-volume, cost-effective micro-battery solutions for wearables, hearables, and smartphones. Favorable government policies supporting semiconductor and advanced manufacturing, combined with established raw material supply chains, solidify APAC's role as the primary manufacturing hub. The immense domestic market demand for miniaturized devices further accelerates product commercialization and cost optimization through rapid scaling.

- North America (NA) Leadership in R&D and High-Value Applications: North America holds a commanding position in high-value, research-intensive applications, particularly in the medical device and aerospace sectors. Strict regulatory frameworks (FDA) necessitate the use of premium, ultra-reliable solid-state Bean Cells, leading to high average selling prices (ASPs). The presence of major technology hubs, extensive venture capital funding, and collaborations between universities and tech companies foster rapid advancement in bio-integrated and custom micro-power solutions, making it the primary region for cutting-edge application development and early-stage commercialization of highly specialized battery chemistries.

- Europe (EU) Focus on Industrial IoT and Regulatory Standards: Europe is characterized by strong adoption in advanced Industrial IoT, automotive electronics, and specialized defense applications. The region prioritizes adherence to stringent environmental, safety, and performance standards (e.g., REACH, RoHS), favoring manufacturers capable of demonstrating long-term sustainability and reliability. Germany and Switzerland are key markets, driven by their robust engineering and medical technology bases. European firms are heavily focused on leveraging Bean Cells for asset tracking and smart factory integration, where long battery life and secure operation are paramount, often driving development in enhanced thermal stability and low self-discharge rates.

- Latin America (LATAM) and Middle East & Africa (MEA) Emerging Markets: LATAM and MEA represent emerging markets with growth potential tied to increasing digitalization and infrastructure development. Adoption is currently slower, often relying on imported finished goods. However, growing investment in smart city projects and localized medical infrastructure is expected to spur future demand for cost-effective Bean Cell solutions for localized sensor networks and basic monitoring devices. Market penetration is closely linked to economic stability and technological maturity in these regions, signaling significant long-term growth opportunities once core infrastructure is established.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bean Cell Battery Market.- Murata Manufacturing Co., Ltd.

- Samsung SDI Co., Ltd.

- TDK Corporation

- EVE Energy Co., Ltd.

- VARTA AG

- ProLogium Technology Co., Ltd.

- Solid Power, Inc.

- Cymbet Corporation

- Ilika plc

- STMicroelectronics N.V.

- Energous Corporation

- Maxell Holdings, Ltd.

- Blue Spark Technologies, Inc.

- Nanoflux Ltd.

- Excellatron Solid State, LLC

- Ultralife Corporation

- Panasonic Corporation

- Hitachi Maxell, Ltd.

- Enfucell Oy

- Saft (TotalEnergies)

Frequently Asked Questions

Analyze common user questions about the Bean Cell Battery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a Bean Cell Battery and how does it differ from traditional batteries?

A Bean Cell Battery is a highly miniaturized, often micro-solid-state or specialized polymer lithium-based cell characterized by its ultra-small, customizable form factor suitable for constrained spaces. Unlike traditional coin or cylindrical batteries, Bean Cells prioritize high volumetric energy density, enhanced safety (especially solid-state variants which are non-flammable), and mechanical flexibility, making them ideal for integration into medical implants, advanced hearables, and smart jewelry where size and reliability are the primary engineering challenges. Their unique geometry and robust packaging facilitate seamless integration into complex, multi-layered electronic assemblies.

Which applications are driving the highest demand for solid-state Bean Cell technology?

The highest demand is driven by implantable medical devices (such as pacemakers and neurostimulators) and sophisticated bio-integrated electronics, requiring exceptionally high safety profiles, ultra-low self-discharge rates, and guaranteed longevity often exceeding five to ten years. The solid-state architecture eliminates the risk of electrolyte leakage and thermal runaway, which is crucial for internal human use. Furthermore, next-generation high-end wearable devices, seeking to maximize uptime and minimize device thickness, are also rapidly adopting solid-state Bean Cells due to their superior cycle life and rapid charging capabilities compared to older micro-polymer technologies.

What are the primary technological challenges currently limiting the mass adoption of Bean Cell Batteries?

The primary limitations stem from scaling the complex micro-fabrication process required to manufacture these precision components efficiently and cost-effectively. Achieving uniform deposition of thin-film electrode and electrolyte materials at high volumes without defects remains a technical hurdle, leading to high initial production costs compared to conventional batteries. Additionally, while energy density is high volumetrically, current solid-state materials often struggle to deliver sufficient pulse power for applications requiring immediate, high current draw (like complex wireless transmission), necessitating continuous innovation in interface resistance reduction and specialized packaging to dissipate heat effectively.

How is the Bean Cell Battery market influenced by global supply chain volatility and raw material pricing?

The Bean Cell Battery market is highly sensitive to supply chain volatility, particularly concerning critical raw materials like high-purity lithium compounds, specialized ceramic powders for solid electrolytes, and high-grade cathode materials (e.g., cobalt, nickel). Since Bean Cells are primarily used in high-value, mission-critical applications, price fluctuations in these specialized inputs directly affect manufacturing costs and market stability. Manufacturers are mitigating this through diversification strategies, exploring materials with lower dependency on geopolitically sensitive metals, and focusing R&D on non-lithium or low-cobalt chemistries suitable for miniaturization while maintaining performance parity, thereby reducing overall risk exposure.

What role does advanced manufacturing, such as 3D printing, play in the future development of Bean Cell Batteries?

Advanced manufacturing techniques, including specialized 3D printing (additive manufacturing) and precision screen printing, are crucial for the next wave of Bean Cell innovation. These methods enable the creation of customized, complex internal geometries that maximize surface area within the tiny volume, drastically improving energy storage and power output characteristics. 3D printing also allows rapid prototyping of novel designs and form factors specific to unique device integration challenges (e.g., non-rectangular shapes for curved wearables), ultimately accelerating the design-to-market cycle and supporting the shift towards truly flexible and shape-conforming power solutions that are essential for future bio-integrated and smart textile applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager