Bearing Cage and Separator Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440482 | Date : Jan, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Bearing Cage and Separator Market Size

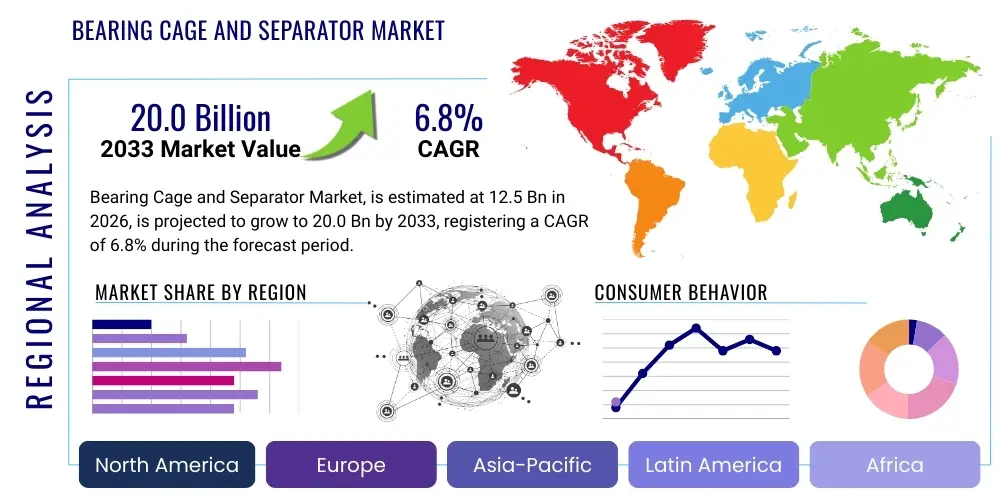

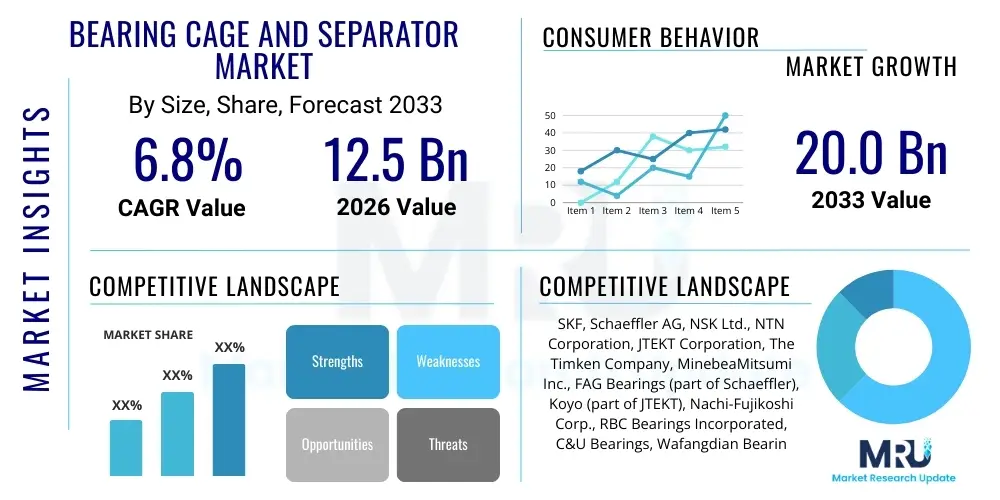

The Bearing Cage and Separator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 12.5 Billion in 2026 and is projected to reach USD 20.0 Billion by the end of the forecast period in 2033.

Bearing Cage and Separator Market introduction

The Bearing Cage and Separator Market forms a pivotal segment within the broader industrial components landscape, providing essential elements that ensure the optimal functionality and longevity of rolling bearings. Bearing cages, also known as retainers or separators, are critical components designed to maintain the proper spacing between rolling elements (balls or rollers) in a bearing. This precise spacing prevents direct contact between the rolling elements, reducing friction, heat generation, and wear, thereby enhancing the bearing's overall efficiency and operational lifespan. Beyond simply maintaining separation, cages also guide the rolling elements, ensuring their uniform distribution and contributing to smoother rotation and reduced noise levels, particularly at high speeds or under varying load conditions. The materials used for these components vary widely, ranging from stamped steel and machined brass to advanced polymer composites, each selected based on the specific application's requirements for strength, weight, temperature resistance, and corrosion resistance.

The product description encompasses a diverse array of cage types tailored for different bearing configurations, including ball bearing cages, cylindrical roller bearing cages, spherical roller bearing cages, and tapered roller bearing cages. Each design is meticulously engineered to fit the geometric and operational demands of its respective bearing type. Major applications for bearing cages and separators span across a vast spectrum of industries, including automotive (for engines, transmissions, wheel hubs), industrial machinery (pumps, motors, gearboxes, machine tools), aerospace (aircraft engines, landing gear systems), wind energy (turbines), agriculture (tractors, harvesters), and heavy construction equipment. These components are indispensable wherever rotational motion needs to be precisely controlled and supported, enduring demanding operational environments.

The core benefits derived from high-quality bearing cages and separators are multifaceted. They significantly contribute to enhanced bearing life by minimizing wear and preventing skidding of rolling elements, which can otherwise lead to premature failure. Furthermore, they facilitate reduced noise and vibration, crucial for applications requiring quiet operation or high precision. Improved operational efficiency is another key advantage, as the optimized spacing and guidance of rolling elements translate into lower internal friction and energy consumption. Driving factors for this market's sustained growth include the ongoing industrialization across emerging economies, the burgeoning demand for high-performance and lightweight bearings in the automotive sector (especially with the rise of electric vehicles), the expansion of renewable energy infrastructure, and the continuous innovation in material science and manufacturing processes enabling superior cage designs. The increasing adoption of automation and robotics in manufacturing also fuels the need for reliable and efficient bearing solutions, directly impacting the demand for specialized cages and separators.

Bearing Cage and Separator Market Executive Summary

The Bearing Cage and Separator Market is experiencing dynamic growth driven by evolving demands across key industrial sectors and continuous technological advancements. Business trends indicate a strong focus on material innovation, with manufacturers increasingly exploring high-performance polymers, composite materials, and advanced metal alloys to meet stringent requirements for weight reduction, higher operating temperatures, and improved durability. There is a discernible shift towards customized solutions, as end-users seek specific cage designs that offer optimized performance for specialized applications, moving beyond standard catalog products. Furthermore, the market is witnessing consolidation among major players through strategic mergers and acquisitions, aimed at expanding product portfolios, enhancing technological capabilities, and strengthening global market presence. The integration of advanced manufacturing techniques, such as additive manufacturing for complex geometries and precision machining for high-tolerance components, is also a prominent business trend, driving efficiency and enabling novel designs.

Regional trends highlight Asia Pacific as the leading and fastest-growing market, primarily due to rapid industrialization, robust growth in the automotive manufacturing sector (including electric vehicles), and extensive investments in infrastructure development across countries like China, India, and Southeast Asian nations. Europe and North America continue to be significant markets, characterized by demand for high-precision, high-performance bearings driven by advanced manufacturing, aerospace, and renewable energy sectors. These regions are also at the forefront of adopting smart bearing technologies and advanced material research. Latin America and the Middle East & Africa are emerging as promising markets, buoyed by investments in resource extraction, infrastructure projects, and increasing industrial activity, though they typically lag in terms of technological adoption compared to developed regions.

Segmentation trends reveal significant growth within the polymer and composite material segments, driven by their lightweight properties, corrosion resistance, and ability to operate effectively in harsh environments. These materials are gaining traction over traditional metallic cages in applications where weight reduction and noise dampening are critical, such as in electric vehicles and consumer appliances. By product type, cages for cylindrical roller bearings and ball bearings continue to hold substantial market shares due to their widespread use in general industrial machinery and automotive applications. However, demand for spherical roller bearing cages is steadily growing, supported by heavy machinery and wind energy sectors requiring robust solutions for high radial and axial loads. Application-wise, the automotive sector remains a primary consumer, with electric vehicle proliferation necessitating specialized, high-speed, and low-noise bearing cages. Industrial machinery, aerospace, and wind energy sectors are also key contributors, each driving specific demands for performance, reliability, and material science innovation within the bearing cage and separator market.

AI Impact Analysis on Bearing Cage and Separator Market

The integration of Artificial Intelligence (AI) is set to significantly revolutionize various facets of the Bearing Cage and Separator Market, addressing common user questions related to predictive maintenance, design optimization, quality assurance, and supply chain efficiency. Users are keenly interested in how AI can move beyond traditional maintenance schedules to anticipate component failure, thereby minimizing downtime and operational costs. There is also a strong curiosity about AI's role in accelerating the design and prototyping phases, allowing for the creation of more robust and application-specific cage geometries. Concerns often revolve around the initial investment required for AI infrastructure, the need for skilled personnel to manage AI systems, and the reliability of AI algorithms in complex industrial environments. Expectations are high for AI to enhance overall product quality, streamline manufacturing processes, and create more resilient supply chains in an increasingly interconnected global market.

AI's influence extends to enabling smarter manufacturing processes where machine learning algorithms can analyze production data in real-time to detect anomalies, optimize machine parameters, and reduce scrap rates. This leads to higher precision and consistency in cage manufacturing, which is crucial for bearing performance. Furthermore, AI-driven quality control systems, utilizing computer vision and advanced sensor data, can inspect bearing cages and separators at unprecedented speeds and accuracy, identifying microscopic defects that human inspectors might miss. This proactive quality assurance improves product reliability and reduces the likelihood of field failures, directly impacting customer satisfaction and brand reputation.

Beyond manufacturing, AI is poised to transform the entire product lifecycle. In design, generative AI can explore thousands of design variations for bearing cages based on specified operational parameters, material properties, and weight constraints, leading to innovative designs that push performance boundaries. For supply chain management, AI algorithms can predict demand fluctuations, optimize inventory levels, and identify potential disruptions, leading to more efficient logistics and reduced lead times for raw materials and finished components. The increasing complexity of modern industrial systems and the drive for greater efficiency and sustainability make AI an indispensable tool for manufacturers and end-users in the bearing cage and separator market.

- AI-driven predictive maintenance for bearing systems, anticipating cage wear and failure.

- Generative design for optimal cage geometries, enhancing performance and material efficiency.

- AI-powered quality control through computer vision for defect detection in manufacturing.

- Supply chain optimization using AI for demand forecasting and inventory management.

- Real-time process optimization in manufacturing, reducing waste and improving production consistency.

DRO & Impact Forces Of Bearing Cage and Separator Market

The Bearing Cage and Separator Market is profoundly shaped by a complex interplay of drivers, restraints, and opportunities, influenced by broader economic and technological forces. The primary drivers underpinning market expansion include the sustained growth of the global automotive industry, particularly the accelerating transition towards electric vehicles (EVs) which demand specialized, quieter, and often lighter bearing components operating at higher speeds. Industrialization in developing economies continues to fuel demand for machinery and equipment, directly translating into increased consumption of bearings and their constituent cages and separators. Furthermore, the burgeoning renewable energy sector, especially wind power, relies heavily on large, robust bearings and cages capable of withstanding extreme environmental conditions and heavy loads. The continuous advancements in industrial automation and robotics also necessitate high-precision, durable bearing components, thereby boosting market demand. Technological innovation in bearing design, pushing for higher performance, longer life, and greater energy efficiency, creates a ripple effect, driving demand for innovative cage materials and designs.

However, the market also faces significant restraints that temper its growth trajectory. Volatility in raw material prices, particularly for steel, brass, and specialized polymers, poses a constant challenge, impacting manufacturing costs and profit margins for producers. Global economic slowdowns, trade protectionism, and geopolitical instabilities can significantly reduce industrial output and capital expenditure, consequently dampening demand for industrial components like bearing cages. The manufacturing complexity involved in producing high-precision cages, coupled with stringent quality requirements, also presents a barrier to entry and can lead to higher production costs. Moreover, the increasing prevalence of counterfeit bearing products in certain regions not only poses a safety risk but also erodes market share and profitability for legitimate manufacturers. Environmental regulations regarding material sourcing and manufacturing processes also add to operational complexities and costs.

Despite these restraints, numerous opportunities are poised to drive future growth and innovation. The development and adoption of lightweight and high-performance materials, such as advanced polymer composites and ceramics, offer avenues for superior cage designs that can meet the evolving demands of industries like aerospace and EVs. The advent of smart bearings, equipped with sensors for condition monitoring, presents an opportunity for integrated cage designs that support these functionalities. Emerging markets, with their rapidly expanding industrial bases and infrastructure projects, represent untapped potential for market penetration. Furthermore, the increasing demand for customized bearing solutions, tailored to specific application requirements, encourages manufacturers to invest in flexible production capabilities and advanced engineering. Additive manufacturing (3D printing) technologies are opening new frontiers for producing highly complex and optimized cage geometries that were previously impossible to achieve with traditional methods, promising significant innovation in design and functionality.

Segmentation Analysis

The Bearing Cage and Separator Market is extensively segmented to reflect the diverse applications, material compositions, and functional requirements of these critical bearing components. Understanding these segments is crucial for market participants to identify niche opportunities, tailor product development, and refine marketing strategies. The primary segmentation categories typically include classification by material type, product type, and end-use application, each presenting unique market dynamics and growth trajectories influenced by technological advancements and industry-specific demands. This detailed segmentation allows for a granular analysis of market trends, competitive landscapes, and regional consumption patterns, providing a comprehensive overview of the market's structure and potential growth areas across various dimensions.

- By Material Type:

- Steel Cages (Stamped, Machined)

- Brass Cages (Machined, Stamped)

- Polymer Cages (e.g., Polyamide (PA66), PEEK, PTFE)

- Other Materials (e.g., Ceramic, Bronze, Composite)

- By Product Type:

- Ball Bearing Cages

- Cylindrical Roller Bearing Cages

- Spherical Roller Bearing Cages

- Tapered Roller Bearing Cages

- Thrust Bearing Cages

- Needle Roller Bearing Cages

- By Application:

- Automotive (Passenger Vehicles, Commercial Vehicles, Electric Vehicles)

- Industrial Machinery (Pumps, Motors, Gearboxes, Machine Tools, Robotics)

- Aerospace and Defense

- Wind Energy

- Agriculture and Construction Equipment

- Railway

- Medical and Healthcare

- Consumer Appliances

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

Value Chain Analysis For Bearing Cage and Separator Market

The value chain for the Bearing Cage and Separator Market is a multi-tiered process, beginning with raw material extraction and processing, moving through component manufacturing and bearing assembly, and culminating in distribution and end-user application. Upstream analysis reveals that the market is heavily dependent on suppliers of high-quality raw materials such as steel alloys (e.g., carbon steel, stainless steel), brass, and various engineering plastics like Polyamide (PA66), PEEK, and PTFE. These suppliers convert raw minerals and chemicals into standardized forms (sheets, rods, granules) that meet stringent specifications for strength, durability, and temperature resistance. Material selection at this stage is critical, as it dictates the performance characteristics and cost structure of the final cage product. Any disruptions or price volatility in these raw material markets can significantly impact the entire value chain, affecting production costs and lead times for bearing manufacturers.

Midstream activities involve the specialized manufacturing of cages and separators. This segment includes both independent cage manufacturers and integrated bearing companies that produce their own cages. Manufacturing processes are highly technical and include precision stamping for steel and brass cages, CNC machining for more complex metallic designs, and injection molding for polymer cages. Additive manufacturing is an emerging technology also gaining traction for highly customized or intricate geometries. Quality control at this stage is paramount, employing advanced inspection techniques to ensure dimensional accuracy, material integrity, and surface finish. Downstream analysis focuses on the assembly of these cages into complete bearings, typically performed by integrated bearing manufacturers. These manufacturers combine cages with rolling elements (balls, rollers) and rings to produce a functional bearing unit. The performance of the cage directly impacts the overall bearing's efficiency, noise levels, and lifespan, making it a critical component within the assembly process.

The distribution channel plays a vital role in connecting bearing manufacturers with their diverse end-users. Direct sales are common for large Original Equipment Manufacturers (OEMs) in sectors like automotive and heavy industrial machinery, where long-term contracts and tailored supply agreements are standard. This direct approach allows for close collaboration on design and technical specifications. Indirect distribution, predominantly through a network of industrial distributors, wholesalers, and retailers, serves the aftermarket segment and smaller OEM clients. These distributors provide inventory management, logistical support, and often technical expertise, ensuring the availability of replacement parts and catering to varied regional demands. The efficiency and reach of these distribution channels are crucial for market penetration and customer satisfaction, impacting the overall accessibility and availability of bearing cages and separators across different application sectors globally.

Bearing Cage and Separator Market Potential Customers

The potential customers for the Bearing Cage and Separator Market represent a broad and diverse spectrum of industries, all reliant on the critical function of rolling bearings for their machinery and equipment. These end-users are primarily Original Equipment Manufacturers (OEMs) who integrate bearings into their final products, and also include the aftermarket segment consisting of maintenance, repair, and overhaul (MRO) operations. The core demand stems from sectors requiring rotational motion, high load-bearing capacity, and precision engineering. Understanding the specific needs and procurement cycles of these customer segments is fundamental for manufacturers to develop targeted products and effective sales strategies.

Foremost among potential customers are Automotive OEMs, encompassing manufacturers of passenger cars, commercial vehicles (trucks, buses), and an increasingly significant segment, Electric Vehicles (EVs). Bearings, and thus their cages, are integral to engines, transmissions, wheel hubs, steering systems, and various ancillary components. The shift towards EVs demands specialized bearing cages that can withstand higher speeds, operate silently, and contribute to weight reduction. Following closely are Industrial Machinery Manufacturers, producing a vast array of equipment such as pumps, motors, gearboxes, machine tools, textile machinery, and material handling systems. These customers require robust and reliable cages for continuous operation in demanding industrial environments. The Wind Energy sector is another major customer, utilizing massive bearings in wind turbine gearboxes, main shafts, and yaw and pitch systems, necessitating extremely durable and high-performance cages capable of enduring harsh weather conditions and heavy, cyclical loads.

Additional significant customer groups include Aerospace and Defense manufacturers, who demand cages made from advanced, lightweight materials for aircraft engines, landing gear, and control systems, where precision and reliability are paramount. Agricultural and Construction Equipment OEMs also represent a substantial customer base, requiring rugged and contaminant-resistant bearing cages for tractors, excavators, loaders, and other heavy machinery operating in challenging environments. The Railway industry, with its need for reliable wheelset bearings, and the Medical and Healthcare sector, for precision instruments and diagnostic equipment, further diversify the customer landscape. Finally, the aftermarket segment, comprising maintenance companies, repair shops, and industrial distributors, continuously generates demand for replacement bearing cages and separators, ensuring the longevity and operational continuity of existing machinery across all these industries. Each of these customer groups has distinct technical requirements, purchasing criteria, and regulatory considerations that influence their choice of bearing cages and separators.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.5 Billion |

| Market Forecast in 2033 | USD 20.0 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SKF, Schaeffler AG, NSK Ltd., NTN Corporation, JTEKT Corporation, The Timken Company, MinebeaMitsumi Inc., FAG Bearings (part of Schaeffler), Koyo (part of JTEKT), Nachi-Fujikoshi Corp., RBC Bearings Incorporated, C&U Bearings, Wafangdian Bearing Group (ZWZ), Luoyang LYC Bearing Co., Ltd., Suzhou Newway Bearings Co., Ltd., Hangzhou New Hongda Bearings Co., Ltd., THK Co., Ltd., GGB, Igus GmbH, Kaydon Corporation (part of SKF) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bearing Cage and Separator Market Key Technology Landscape

The Bearing Cage and Separator Market is characterized by a dynamic and evolving technology landscape, driven by the continuous pursuit of higher performance, greater durability, reduced weight, and improved efficiency in bearing applications. Key technological advancements are centered on material science, manufacturing processes, and design optimization tools. In materials, the shift from traditional stamped steel and machined brass is increasingly towards advanced polymer composites, such as Polyamide (PA66) with glass fiber reinforcement, PEEK (Polyether Ether Ketone), and PTFE (Polytetrafluoroethylene). These high-performance polymers offer significant advantages in terms of weight reduction, self-lubricating properties, corrosion resistance, and the ability to operate effectively in high-speed, high-temperature, or chemically aggressive environments. Ceramic materials are also gaining traction for niche applications requiring extreme hardness, wear resistance, and electrical insulation properties, particularly in specialized industrial and aerospace contexts.

Manufacturing technologies are at the forefront of innovation, enabling the production of increasingly complex and precise cage geometries. Precision stamping, while mature, continues to evolve with advanced tooling and automation for metallic cages, ensuring high volume and cost efficiency. CNC machining remains critical for producing intricate brass or steel cages with tight tolerances, especially for large-scale or high-precision industrial bearings. Injection molding is the cornerstone for polymer cages, with advancements in mold design and process control allowing for complex shapes, integrated features, and consistent quality. A transformative technology emerging in this landscape is Additive Manufacturing (3D printing), particularly for metal and high-performance polymer cages. This allows for the creation of customized, lightweight, and topologically optimized cage designs that are impossible with conventional manufacturing methods, offering unprecedented design freedom and reducing material waste, especially for prototyping and low-volume, high-value applications.

Furthermore, the technology landscape includes advanced design and simulation tools. Finite Element Analysis (FEA) and Computational Fluid Dynamics (CFD) software are extensively used to model cage behavior under various load, speed, and temperature conditions, predicting stress distribution, deformation, and lubrication flow. This allows engineers to optimize designs virtually, reducing the need for costly physical prototypes and accelerating product development cycles. Surface treatment technologies, such as coatings and heat treatments, are also vital for enhancing the wear resistance, fatigue life, and corrosion protection of metallic cages. Finally, advanced metrology and quality control systems, including coordinate measuring machines (CMMs), vision inspection systems, and non-destructive testing (NDT) methods, ensure that manufactured cages adhere to stringent quality standards, which is paramount for the reliability and safety of the final bearing product across all demanding applications.

Regional Highlights

- Asia Pacific (APAC): This region dominates the Bearing Cage and Separator Market, driven by its robust manufacturing sector, rapid industrialization, and significant growth in automotive production, particularly in China and India. The expanding electronics industry, heavy machinery manufacturing, and burgeoning infrastructure development projects further fuel demand. Investments in renewable energy, especially wind power, also contribute significantly to the consumption of high-performance bearing cages. APAC benefits from a vast consumer base and lower manufacturing costs, positioning it as a global production hub and a major market.

- Europe: Characterized by a strong emphasis on precision engineering, advanced manufacturing, and technological innovation, Europe represents a mature but growing market. Demand is robust from the automotive sector (including luxury and electric vehicles), aerospace, and industrial machinery industries. The region is a leader in renewable energy technologies, such as wind energy, which requires specialized and durable bearing components. Strict quality standards and environmental regulations also drive innovation in material science and manufacturing processes for bearing cages.

- North America: This region demonstrates steady demand, primarily from its well-established automotive industry, aerospace and defense sector, and heavy industrial machinery. The focus here is on high-performance, durable, and reliable components, often incorporating advanced materials. The market is also influenced by significant investments in manufacturing automation, oil and gas exploration, and an increasing adoption of electric vehicles, all requiring specific bearing cage solutions. Technological advancements and customization capabilities are key drivers in this region.

- Latin America: The market in Latin America is an emerging one, primarily driven by growth in resource extraction (mining, oil & gas), agricultural machinery, and infrastructure development projects. Brazil and Mexico are key contributors to regional demand, with some automotive manufacturing presence. While smaller in scale compared to APAC or Europe, consistent industrial growth and foreign investments are gradually expanding the market for bearing cages and separators, though often focusing on cost-effective and reliable solutions.

- Middle East and Africa (MEA): This region is witnessing growth spurred by ongoing infrastructure development, investments in the oil and gas sector, and some industrial diversification initiatives. Countries like Saudi Arabia and UAE are expanding their manufacturing capabilities, leading to an increased demand for industrial components. While the market size is relatively smaller, the long-term growth potential is significant, particularly with efforts to reduce reliance on oil and gas through industrialization and manufacturing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bearing Cage and Separator Market.- SKF

- Schaeffler AG

- NSK Ltd.

- NTN Corporation

- JTEKT Corporation

- The Timken Company

- MinebeaMitsumi Inc.

- FAG Bearings (part of Schaeffler)

- Koyo (part of JTEKT)

- Nachi-Fujikoshi Corp.

- RBC Bearings Incorporated

- C&U Bearings

- Wafangdian Bearing Group (ZWZ)

- Luoyang LYC Bearing Co., Ltd.

- Suzhou Newway Bearings Co., Ltd.

- Hangzhou New Hongda Bearings Co., Ltd.

- THK Co., Ltd.

- GGB

- Igus GmbH

- Kaydon Corporation (part of SKF)

Frequently Asked Questions

Analyze common user questions about the Bearing Cage and Separator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a bearing cage and separator?

The primary function of a bearing cage and separator is to maintain consistent spacing between the rolling elements (balls or rollers) within a bearing. This prevents direct contact between them, minimizing friction and heat generation, and ensures uniform distribution, which contributes to smoother rotation, reduced noise, and extended bearing life, particularly under various operational conditions.

What are the key materials used for manufacturing bearing cages and separators?

Bearing cages and separators are manufactured from various materials tailored to specific application requirements. Common materials include stamped steel (carbon steel, stainless steel) for strength and cost-effectiveness, machined brass for higher speeds and temperatures, and advanced polymers such as Polyamide (PA66), PEEK, or PTFE, valued for their lightweight properties, corrosion resistance, and low friction in demanding environments.

How does AI impact the Bearing Cage and Separator Market?

AI significantly impacts the market by enabling predictive maintenance for bearings, optimizing cage designs through generative AI, and enhancing manufacturing quality control with AI-powered vision systems for defect detection. It also improves supply chain efficiency by forecasting demand and managing inventory, ultimately leading to more reliable, cost-effective, and precisely engineered bearing components.

What are the main growth drivers for the Bearing Cage and Separator Market?

The main growth drivers include the continuous expansion of the global automotive industry, particularly the rise of electric vehicles demanding high-performance components. Additionally, rapid industrialization in emerging economies, the burgeoning renewable energy sector (especially wind power), and increasing adoption of automation and robotics in manufacturing are key factors fueling market growth.

Which industries are the major end-users of bearing cages and separators?

Major end-user industries include automotive (passenger, commercial, EVs), industrial machinery (pumps, motors, gearboxes), aerospace and defense, wind energy, agriculture and construction equipment, and railway. These sectors rely on reliable bearings for critical operational functions, driving consistent demand for high-quality cages and separators.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager