Beauty Products Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433919 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Beauty Products Market Size

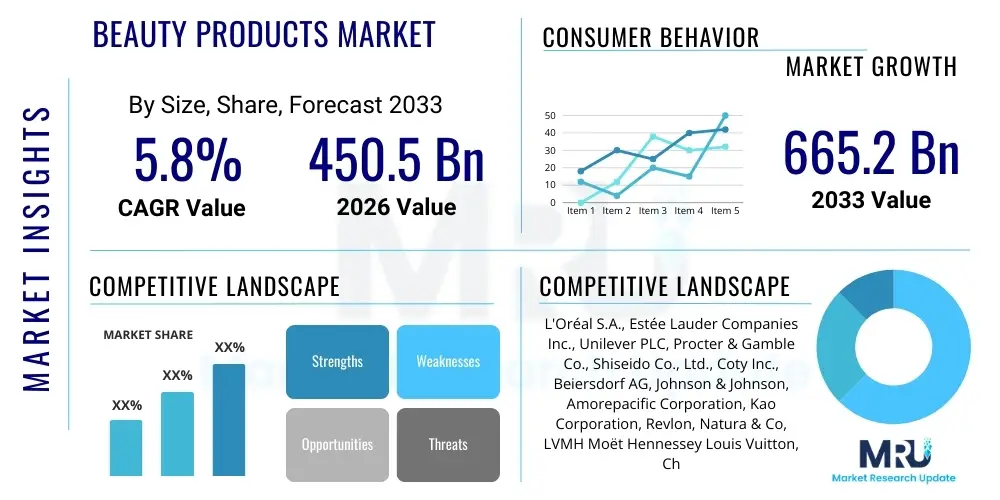

The Beauty Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450.5 Billion in 2026 and is projected to reach USD 665.2 Billion by the end of the forecast period in 2033.

Beauty Products Market introduction

The global Beauty Products Market encompasses a vast array of consumer goods designed for personal care, hygiene, and aesthetic enhancement. These products span several categories, including skincare (the largest and fastest-growing segment), haircare, color cosmetics, fragrances, and toiletries. Market evolution is heavily driven by shifting consumer preferences towards clean label products, sustainability, personalized beauty solutions enabled by artificial intelligence, and the increasing influence of social media platforms which democratize beauty standards and accelerate product adoption cycles. Key applications range from daily moisturizing and protection against environmental stressors to specialized treatments for anti-aging and dermatological concerns, making these products integral to modern consumer health and self-expression routines.

Product descriptions vary widely based on their functional purpose. Skincare products include serums, moisturizers, sunscreens, and cleansers; color cosmetics comprise foundations, lipsticks, and eye shadows; and haircare involves shampoos, conditioners, and styling agents. Major applications are geared toward maintaining skin health, enhancing physical appearance, and promoting well-being. The primary benefits derived by consumers include improved self-confidence, better physical protection (e.g., UV protection), and adherence to personal hygiene standards. The ongoing premiumization trend, particularly in developed economies, reflects consumer willingness to invest in high-efficacy, specialized formulations often containing advanced biotechnology ingredients, driving up the average selling price and overall market value.

Driving factors sustaining market expansion include the increasing disposable income in emerging economies, particularly in Asia Pacific, rapid urbanization leading to greater exposure to pollution and the subsequent need for specialized protective skincare, and the rising awareness among male consumers regarding grooming and self-care routines, leading to the rapid growth of the men's personal care segment. Furthermore, significant investments in research and development (R&D) focused on developing natural, organic, and ethically sourced ingredients are continually refreshing product lines, maintaining consumer interest, and ensuring regulatory compliance across diverse international markets. The shift toward direct-to-consumer (D2C) models facilitated by e-commerce has also drastically expanded market reach and lowered barriers to entry for niche and specialized brands.

Beauty Products Market Executive Summary

The Beauty Products Market is characterized by robust resilience and dynamic growth, underpinned by significant shifts in consumer values and technological integration. Key business trends indicate a strong focus on digital transformation, with e-commerce channels rapidly surpassing traditional retail footprints, especially post-2020. Companies are heavily investing in omnichannel strategies to provide seamless consumer experiences, blending personalized virtual try-ons and digital consultations with in-store accessibility. Furthermore, consolidation within the market remains high, as major players acquire niche, innovative D2C brands to quickly integrate advanced technology, clean formulations, and targeted demographic reach, thereby maintaining competitive relevance and diversifying their portfolios against evolving consumer demands.

Regionally, Asia Pacific (APAC) stands out as the primary engine of global market growth, driven by massive population density, rising middle-class affluence, and the profound cultural emphasis on skincare and K-beauty/J-beauty trends. While North America and Europe remain mature and highly innovative markets, focused on sustainability, clinical efficacy, and ethical sourcing, APAC’s sheer volume and accelerating demand for premium products ensure its dominance in market share expansion. Latin America and the Middle East & Africa (MEA) are also experiencing accelerated growth, particularly in the premium fragrance and specialized haircare sectors, buoyed by improving economic conditions and increased global brand penetration.

Segment-wise, skincare remains the largest and most lucrative category, propelled by an aging global population seeking anti-aging and preventive care solutions, alongside younger demographics focusing on minimalist, wellness-oriented routines. Color cosmetics are experiencing a rebound, moving away from heavy, full-coverage looks towards natural, multi-functional products that align with hybrid work environments. Sustainability mandates are redefining product development across all segments, leading to a proliferation of refillable packaging, waterless formulations, and comprehensive ingredient transparency. The influence of personalized diagnostics (e.g., DNA analysis, AI skin scans) is beginning to segment the market at the individual level, creating hyper-niche opportunities that major manufacturers are actively pursuing.

AI Impact Analysis on Beauty Products Market

Common user questions regarding AI's impact on the Beauty Products Market center on personalization capabilities, job security for beauty consultants, data privacy, and the efficacy of AI-driven diagnostics. Users frequently inquire about how AI enables customized product formulations based on individual skin microbiomes or genetic data, whether virtual try-on technology truly replaces in-store experiences, and the ethical implications of using deep learning for analyzing facial aesthetics and consumer behavior patterns. There is a high expectation that AI will revolutionize product discovery and ingredient sourcing, while simultaneously raising concerns about the potential for algorithmic bias in recommended products and the necessity for robust regulatory frameworks to govern biometric data captured by beauty tech devices. The prevailing theme suggests AI is viewed as an accelerator for hyper-personalization, efficiency in supply chain management, and enhanced customer engagement, moving the industry towards data-driven, rather than trend-driven, manufacturing.

- AI facilitates hyper-personalized product recommendations based on real-time skin analysis and environmental factors.

- Generative AI accelerates new product development by simulating ingredient efficacy and formulation stability.

- Machine learning optimizes inventory management, reducing waste and improving supply chain resilience across global operations.

- AI-powered virtual try-on (VTO) tools enhance e-commerce conversion rates by mimicking physical product testing.

- Data analytics driven by AI provide deeper insights into consumer purchasing patterns and cross-channel engagement.

- Robotics and automation, guided by AI, increase precision and speed in manufacturing and packaging lines.

DRO & Impact Forces Of Beauty Products Market

The dynamic interplay of drivers, restraints, and opportunities creates significant impact forces shaping the trajectory of the Beauty Products Market. Major drivers include the global demographic shift towards wellness and self-care, the pervasive influence of social media magnifying brand visibility and accelerating trend cycles, and increasing penetration of e-commerce platforms which offer unprecedented market access. These forces collectively push manufacturers toward innovation in active ingredients and sustainable packaging solutions. However, the market faces strong restraints, notably stringent regulatory requirements concerning chemical safety and labeling across different jurisdictions (e.g., EU regulations vs. FDA guidelines) and the persistent challenge of counterfeiting and intellectual property theft, which erodes consumer trust and brand revenue, particularly for high-end products.

Key opportunities are centered around technological integration and unmet consumer needs. The opportunity to leverage biotechnology and synthetic biology for creating highly sustainable, functional ingredients (e.g., lab-grown collagen or fermented actives) promises significant disruption. Furthermore, the burgeoning demand for specialized, clinical, and dermocosmetic products addressing specific issues like pollution damage or sensitive skin represents a high-margin growth avenue. The primary impact forces driving competition are sustainability demands (forcing rapid supply chain transformation) and the speed of digital engagement (requiring real-time, interactive consumer communication). Companies that successfully manage the complexity of global regulatory harmonization while excelling in digital customer experience are best positioned for long-term market leadership.

Ultimately, the impact forces compel a continuous cycle of innovation and adaptation. The rapid shifts in consumer ethical considerations—moving beyond animal testing concerns to encompass ingredient sourcing, labor practices, and carbon footprint—act as powerful constraints and drivers simultaneously. Brands must invest heavily not only in R&D but also in transparent reporting and verifiable supply chain certifications. Failure to adapt to these ethical demands poses a significant restraint, while successful adaptation opens doors to premium market segments and enhanced brand loyalty. The market is thus driven by a convergence of scientific advancement, digital access, and ethical consumerism.

Segmentation Analysis

The Beauty Products Market is meticulously segmented based on product type, distribution channel, gender, and consumer age group, allowing for granular analysis of market dynamics and targeted strategic investment. Product segmentation highlights the dominance of skincare, followed closely by haircare and color cosmetics, each exhibiting unique growth trajectories influenced by cultural trends and technological advancements. Distribution channels are undergoing massive disruption, with non-store-based retailing (e-commerce and direct selling) capturing increasing shares from traditional brick-and-mortar outlets. Understanding these segmentations is critical for market players aiming to optimize their product portfolios and go-to-market strategies effectively across diverse global demographics and purchasing behaviors.

- Product Type: Skincare, Haircare, Color Cosmetics, Fragrances, Toiletries, Others (e.g., oral care, nail care).

- Distribution Channel: Hypermarkets/Supermarkets, Specialty Stores, Online Retail, Pharmacies/Drug Stores, Direct Selling.

- Gender: Women, Men, Unisex/Gender-Neutral.

- Price Range: Mass Market, Mid-Range, Premium/Luxury.

- End-Use: Professional Use, Personal Use.

Value Chain Analysis For Beauty Products Market

The value chain of the Beauty Products Market begins with the upstream segment, primarily focused on raw material sourcing and ingredient synthesis. This stage involves the procurement of natural extracts, chemical compounds, and advanced biotechnological ingredients. Strong emphasis is placed on ethical sourcing, quality control, and securing supply agreements for specialized, high-efficacy actives, such as peptides, hyaluronic acid derivatives, and proprietary botanical extracts. R&D activities, which are integral to the upstream process, dictate the ultimate performance and safety profile of the final product, necessitating heavy investment in formulation science and clinical testing before mass production commences.

The midstream phase encompasses manufacturing, primary packaging, and logistics. Manufacturing involves precise blending, filling, and quality assurance processes, often adhering to Good Manufacturing Practices (GMP) and ISO standards. Packaging design is a critical component, moving towards sustainable and innovative materials (e.g., post-consumer recycled plastics, glass, or refillable components) to address growing consumer and regulatory demands for environmental responsibility. Efficient logistics networks are crucial for handling volatile components, managing expiration dates, and ensuring timely global distribution, especially for sensitive products like organic formulations.

The downstream segment involves distribution, marketing, and sales. Distribution channels are highly diversified, including direct channels (D2C via proprietary websites), indirect channels (retailers, e-commerce marketplaces like Amazon, specialty beauty stores), and specialized channels (professional spas, salons). Digital marketing, leveraging influencers and social media platforms, dominates consumer awareness and education. Direct interaction with the end consumer allows brands to gather vital feedback quickly. The entire chain is heavily optimized for speed-to-market and transparency, ensuring that novel ingredients and trending formulations can transition from R&D to consumer shelves rapidly while maintaining verifiable claims regarding sustainability and efficacy.

Beauty Products Market Potential Customers

Potential customers for the Beauty Products Market are broadly segmented but can be categorized into several distinct profiles: the routine consumer, the prestige purchaser, the wellness seeker, and the technologically engaged consumer. The routine consumer seeks value and reliability, predominantly purchasing mass-market products through supermarkets and drug stores for essential hygiene and basic care needs. The prestige purchaser, however, is driven by brand legacy, luxurious experience, and high-efficacy ingredients, often focusing on anti-aging and specialized treatment products available through specialty retail or luxury e-commerce platforms, representing the highest margin segment.

The wellness seeker prioritizes health, safety, and environmental impact, driving demand for clean beauty, organic, vegan, and cruelty-free certifications. This customer segment is highly informed, reads ingredient labels meticulously, and often prefers transparent, minimalist branding. They are frequent users of personalized beauty diagnostics and apps. Furthermore, the technologically engaged consumer, predominantly younger demographics (Gen Z and Millennials), heavily relies on social proof, influencer endorsements, and interactive digital experiences (e.g., virtual try-ons). This group frequently purchases through D2C websites and fast-fashion e-retailers, valuing novelty, inclusivity, and rapid trend adoption.

Beyond individual consumers, professional end-users represent a vital customer base, including dermatologists, cosmetologists, aestheticians, and salon operators. These customers require professional-grade formulations, often in bulk or specialized packaging, for use in clinical treatments, spa services, and high-end hair styling. Their purchasing decisions are driven by clinical effectiveness, regulatory compliance for professional use, and training support provided by the manufacturer. Catering to both the aspirational individual and the specialized professional requires highly differentiated product lines and distribution strategies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Billion |

| Market Forecast in 2033 | USD 665.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | L'Oréal S.A., Estée Lauder Companies Inc., Unilever PLC, Procter & Gamble Co., Shiseido Co., Ltd., Coty Inc., Beiersdorf AG, Johnson & Johnson, Amorepacific Corporation, Kao Corporation, Revlon, Natura & Co, LVMH Moët Hennessey Louis Vuitton, Chanel, Kose Corporation, Oriflame Holding AG, Mary Kay Inc., Rodan + Fields, Clarins, Henkel AG & Co. KGaA. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Beauty Products Market Key Technology Landscape

The Beauty Products Market is increasingly reliant on technological innovation, moving beyond traditional chemical synthesis into advanced biotechnology and digital integration. Key technological advancements include the use of synthetic biology to engineer sustainable, high-purity active ingredients, such as microbial fermentation to produce clean alternatives to common cosmetic ingredients like squalane or hyaluronic acid. This not only addresses sustainability concerns but also ensures ingredient consistency and purity. Furthermore, microencapsulation technology is widely employed to enhance the stability and targeted delivery of volatile actives (like Vitamin C or retinol), ensuring maximum efficacy upon application and improving product shelf-life, thereby meeting consumer demands for demonstrable results.

On the consumer interface side, the integration of Artificial Intelligence (AI) and Augmented Reality (AR) is revolutionizing the shopping experience. AI-powered diagnostic tools analyze user skin conditions (e.g., pore size, hydration levels, hyperpigmentation) via smartphone cameras to recommend tailored product regimens, often linked directly to bespoke product manufacturing systems. AR applications allow for virtual try-ons of color cosmetics, dramatically reducing the friction in online purchasing and enhancing consumer confidence. These digital technologies act as powerful bridges between the online and physical retail worlds, crucial for maintaining relevance in an omnichannel landscape and providing personalized customer journeys that scale globally.

Moreover, advancements in 'Internet of Things' (IoT) devices are creating new market segments centered on smart beauty tools. These include connected hair styling tools that adjust heat based on hair type or smart skin patches that monitor environmental exposure and recommend reapplication of sunscreen or moisturizer. Data generated by these devices provides manufacturers with invaluable real-time insights into product usage, efficacy, and consumer habits, fueling the next generation of highly targeted and performance-driven products. The move toward biodegradable packaging materials and carbon-neutral production processes also leverages material science and sustainable engineering breakthroughs, further solidifying technology as a core competitive differentiator.

Regional Highlights

The global Beauty Products Market exhibits diverse regional dynamics driven by unique cultural norms, economic maturity, and regulatory frameworks. Asia Pacific (APAC) commands the highest market share and is expected to record the fastest growth, primarily fueled by consumer obsession with high-end skincare, known broadly as K-beauty and J-beauty influences. Countries like China, Japan, and South Korea are not only major consumption centers but also global innovation hubs, particularly in ingredient technology and device integration. Rising disposable incomes across Southeast Asia further bolster demand for premium imported brands, making APAC the undisputed focal point for market expansion strategies.

North America, characterized by its mature and highly competitive environment, is defined by rapid innovation in the clean beauty segment and a strong emphasis on brand transparency and clinical efficacy. Consumer spending in the US and Canada is robust, particularly on specialized dermocosmetics and sophisticated wellness products. This region is a leading adopter of cutting-edge technology, including personalized beauty services utilizing AI diagnostics and direct-to-consumer digital marketing models. Regulatory clarity and high consumer litigation standards necessitate rigorous safety and claims substantiation processes for products entering the market.

Europe represents a stable yet highly fragmented market, defined by strict environmental and safety regulations (such as the EU Cosmetics Regulation). The market growth is sustained by strong demand for luxury fragrances, sustainable packaging, and products certified organic or natural. The emphasis on environmental, social, and governance (ESG) factors is perhaps strongest here, compelling companies to achieve verifiable sustainability goals across their entire supply chain. Meanwhile, Latin America (LATAM) shows significant potential, characterized by high consumption of haircare and fragrances, often distributed effectively through direct sales channels, while the Middle East and Africa (MEA) presents high growth in the luxury fragrance and color cosmetics sectors, driven by affluent consumer bases in the GCC countries.

- Asia Pacific (APAC): Market leader and fastest growth region due to rising affluence, urbanization, and strong cultural emphasis on skincare and anti-aging routines, particularly in China and South Korea.

- North America: Highly advanced market focused on clean beauty, biotechnology, digital customization, and specialized clinical skincare (dermocosmetics).

- Europe: Mature market emphasizing sustainability, high regulatory standards, strong demand for natural/organic certified products, and significant consumption of premium fragrances.

- Latin America (LATAM): Growth driven by strong demand for haircare and fragrances; prominent market presence of direct selling models.

- Middle East and Africa (MEA): High growth potential fueled by luxury goods, color cosmetics, and male grooming segments, especially in oil-rich economies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Beauty Products Market.- L'Oréal S.A.

- Estée Lauder Companies Inc.

- Unilever PLC

- Procter & Gamble Co.

- Shiseido Co., Ltd.

- Coty Inc.

- Beiersdorf AG

- Johnson & Johnson

- Amorepacific Corporation

- Kao Corporation

- Revlon

- Natura & Co

- LVMH Moët Hennessy Louis Vuitton

- Chanel

- Kose Corporation

- Oriflame Holding AG

- Mary Kay Inc.

- Rodan + Fields

- Clarins

- Henkel AG & Co. KGaA

Frequently Asked Questions

Analyze common user questions about the Beauty Products market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the Beauty Products Market?

The market growth is primarily driven by technological advancements enabling hyper-personalized products, the rapid shift towards e-commerce and digital engagement, rising consumer focus on wellness and self-care, and increasing disposable incomes in key emerging markets, especially within the Asia Pacific region.

Which segment holds the largest share in the global Beauty Products Market?

The Skincare segment holds the largest market share globally. This dominance is attributed to high consumer expenditure on anti-aging, moisturizing, and specialized treatment products, alongside increased daily usage prompted by environmental concerns and a growing preventative health mindset.

How is Artificial Intelligence (AI) being utilized in the beauty industry?

AI is used extensively for advanced personalized diagnostics (skin analysis), virtual try-ons (AR/VR), optimizing supply chain logistics, and accelerating product development through data-driven ingredient simulation and efficacy prediction, leading to tailored product creation at scale.

What are the primary restraints impacting market expansion?

Key restraints include the complexity and stringency of global regulatory standards regarding ingredient safety and labeling, the persistent threat of product counterfeiting and intellectual property infringement, and the high initial investment required for sustainable and clean formulation research and development.

Which geographical region offers the highest growth potential?

The Asia Pacific (APAC) region, particularly China, South Korea, and India, is projected to offer the highest growth potential due to rapid urbanization, expanding middle-class populations, and the cultural influence of K-beauty trends driving consumer adoption of advanced and premium beauty products.

What is the significance of "Clean Beauty" trends in the market?

Clean Beauty signifies a major shift towards transparency, non-toxic ingredients, and ethical sourcing. It drives brands to eliminate specific controversial chemicals and adopt sustainable packaging, responding to a consumer demand for safer, healthier, and environmentally responsible cosmetic options.

How are male grooming products affecting market segmentation?

The rise of male grooming products, extending beyond basic shaving kits to include specialized skincare, anti-aging creams, and color correcting cosmetics, is rapidly expanding the Men's segment, forcing companies to develop gender-specific and unisex product lines and dedicated marketing campaigns.

What is the role of Direct-to-Consumer (D2C) channels?

D2C channels, primarily through brand websites and social media shops, reduce reliance on traditional retail, provide greater control over pricing and customer data, and allow emerging brands to build authentic relationships and offer highly customized subscription boxes and services directly to consumers.

What innovations are shaping cosmetic packaging?

Innovations are focused on sustainability, including the widespread adoption of Post-Consumer Recycled (PCR) plastics, lightweight glass, biodegradable components, and modular refill systems. The objective is to significantly reduce plastic waste and minimize the overall carbon footprint of product delivery.

What is the market outlook for luxury fragrances?

The market outlook for luxury fragrances remains positive, especially in mature economies and the Middle East. Growth is supported by limited edition releases, personalized scent creation services, and the use of natural, high-cost raw materials, maintaining the segment's high-margin status despite economic fluctuations.

How does biotechnology influence new product development?

Biotechnology allows for the sustainable production of high-performance active ingredients, such as lab-grown collagen or fermented peptides, offering superior purity and efficacy compared to traditionally sourced materials, thereby setting new standards for premium skincare formulations.

What are the main challenges related to supply chain resilience?

Main challenges include managing global logistics complexities, ensuring the ethical sourcing of botanicals and rare ingredients, mitigating risks associated with climate change affecting natural supplies, and navigating tariffs and geopolitical instability impacting manufacturing and distribution networks.

How are social media influencers affecting purchasing decisions?

Social media influencers are crucial in driving consumer education and immediate purchasing decisions, especially for younger demographics. Brands rely on authentic endorsements and detailed product demonstrations on platforms like Instagram and TikTok to quickly build trust and viral marketing momentum.

What is the significance of microbiome-friendly products?

Microbiome-friendly products represent a frontier in skincare, focusing on balancing the skin's natural microbial environment. These products, often incorporating prebiotics and probiotics, address chronic skin conditions and general wellness, moving consumer focus from harsh cleansing to gentle biological balance.

What is the current trend in color cosmetics?

The current trend in color cosmetics emphasizes multi-functional products, minimalist routines ("skinimalism"), and formulations that provide a natural, breathable finish. There is a strong focus on high-efficacy ingredients that also offer skincare benefits (e.g., foundation with SPF and anti-oxidants).

How important is product certification in today's market?

Product certification (e.g., Organic, Vegan, Cruelty-Free, Dermatologist Tested) is extremely important as consumers prioritize transparency and ethics. Certifications act as third-party assurances that validate brand claims, significantly influencing trust and purchasing loyalty, particularly among younger, ethically conscious consumers.

What role do pharmacies and drug stores play in distribution?

Pharmacies and drug stores remain critical distribution channels, particularly for dermocosmetics, clinical skincare brands, and mass-market hygiene products. These outlets are valued for their perceived authority, accessibility, and the association of products sold there with health and professional recommendation.

How does urbanization impact beauty consumption patterns?

Urbanization increases consumer exposure to pollution and stress, boosting demand for specialized preventative and restorative skincare products, such as anti-pollution barriers and intensive repair treatments. It also centralizes retail exposure and accelerates trend adoption.

What regulatory trends are affecting the market?

Regulatory trends are moving towards greater scrutiny of ingredient safety, stricter enforcement of marketing claims (preventing 'greenwashing'), and demands for clearer allergen labeling. The harmonization of ingredient lists across regions remains a major operational challenge for global companies.

How is personalized beauty transforming manufacturing?

Personalized beauty is pushing manufacturing towards modular, small-batch production and 'mass customization,' using robotics and flexible supply chains. This allows companies to create unique product formulas rapidly based on individual consumer data rather than relying solely on large-scale, standardized batches.

Which emerging economies are key targets for market expansion?

Key emerging targets include India, Brazil, Indonesia, and Saudi Arabia. These markets exhibit rapidly growing middle-class populations, increasing digital connectivity, and developing local manufacturing capabilities, making them attractive for both mass-market and premium segment expansion.

What are the technological shifts impacting haircare products?

Technological shifts in haircare include advanced scalp microbiome research, personalized hair analysis devices, and the development of sustainable, waterless formulations (e.g., solid shampoos). The focus is shifting from surface conditioning to long-term scalp health and fiber structure repair.

How do economic downturns typically affect the beauty products sector?

The beauty sector often exhibits high resilience during economic downturns, sometimes termed the "Lipstick Effect," where consumers cut back on major luxury purchases but maintain small indulgences like cosmetics or high-end skincare, keeping demand stable, especially in the mass-market and mid-range segments.

What are the ethical concerns surrounding biometric data use in beauty tech?

Ethical concerns include data privacy and security related to capturing sensitive biometric data (facial scans, skin imagery) used for personalization. Consumers are increasingly worried about how this data is stored, shared, and utilized for future marketing or algorithmic profiling.

What differentiates premium/luxury products from mass market products?

Premium products differentiate themselves through higher concentrations of scientifically validated active ingredients, exclusive packaging materials, superior sensorial experience, limited distribution channels, and often substantial investment in brand heritage and clinical research backing proprietary formulations.

What defines the market landscape in Latin America?

The Latin American market is characterized by high consumption frequency, a robust reliance on direct selling models for market penetration, and significant demand for value-added products in categories such as body care and intensive hair treatments, reflecting regional hair and climate requirements.

How do brands achieve transparency in ingredient sourcing?

Brands achieve transparency by utilizing blockchain technology to track ingredients from farm to factory, obtaining third-party ethical certifications (e.g., Fair Trade), providing detailed origin stories for key botanicals, and implementing clear, minimalist ingredient lists on packaging and digital platforms.

What is the growth outlook for the fragrance segment?

The fragrance segment anticipates moderate but steady growth, heavily concentrated in the luxury sector. Key drivers include increased demand for artisanal and niche perfumes, consumer interest in custom blending, and the sustained ritualistic use of fragrances for emotional well-being and personal identity projection.

How do regulatory complexities vary between the EU and the US?

The EU operates under stricter pre-market regulation, banning thousands of chemicals and requiring comprehensive safety dossiers. The US adopts a more reactive, post-market approach, relying heavily on manufacturers' responsibility, although this is shifting with modernizing legislation seeking greater FDA oversight on cosmetic ingredients.

What is the emerging role of waterless beauty products?

Waterless beauty products (e.g., concentrated solids or powders) are emerging as a sustainability trend, aimed at reducing water consumption in both formulation and shipping weight, thereby lowering the environmental footprint. They appeal particularly to the eco-conscious consumer and improve product stability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Personalized Beauty Products Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Snail Beauty Products Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Coffee Beauty Products Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- CBD Oil in Beauty Products Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Facial cream, Lotion, Oil), By Application (Skin disease, Skin care), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Natural Bath and Beauty Products Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Hair Care Products, Skin Care Products, Fragrance, Oral Care Products, Others), By Application (Male Use, Female Use), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager