Beauveria Bassiana Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437931 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Beauveria Bassiana Market Size

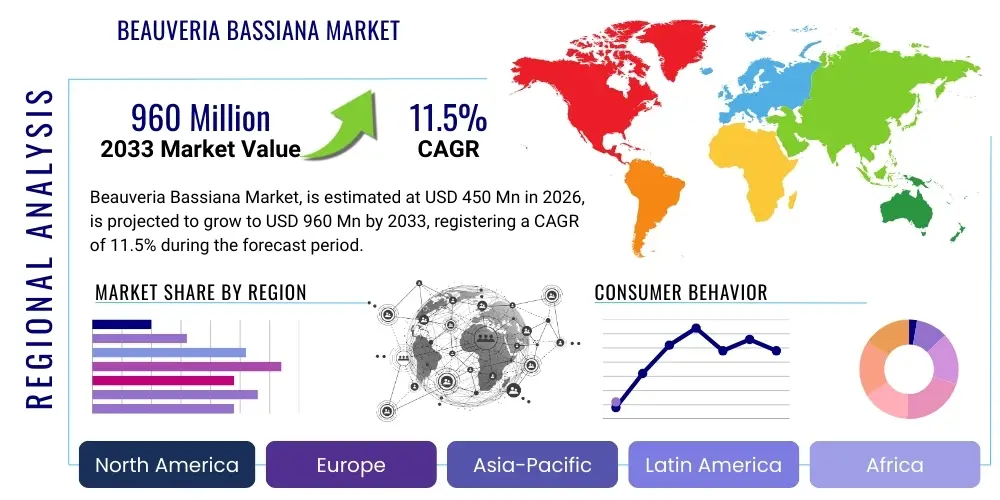

The Beauveria Bassiana Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 960 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global demand for sustainable pest management solutions, particularly in high-value horticulture and organic farming sectors where chemical residues are a significant concern. The efficacy of Beauveria bassiana, a potent entomopathogenic fungus, across a broad spectrum of agricultural pests, positions it as a cornerstone in integrated pest management (IPM) strategies worldwide.

Market growth is further catalyzed by technological advancements in fungal strain optimization, mass production techniques (submerged and solid-state fermentation), and enhanced formulation development, which collectively improve shelf life and field persistence. Regulatory bodies in key agricultural regions, including North America and Europe, are increasingly favoring biopesticides over synthetic chemicals, creating a conducive environment for market penetration. Furthermore, rising public and consumer awareness regarding the environmental impact of conventional pesticides strongly supports the transition toward biological control agents like Beauveria bassiana.

Geographically, Asia Pacific, led by agricultural powerhouses like China and India, represents the fastest-growing region, driven by substantial arable land, favorable government subsidies for organic farming, and a high incidence of pest resistance to traditional insecticides. However, challenges related to the fungal product’s sensitivity to environmental conditions (UV radiation, temperature, humidity) and the need for rigorous cold chain logistics temper the market's trajectory, prompting continuous innovation in delivery systems such as microencapsulation and granular formulations.

Beauveria Bassiana Market introduction

The Beauveria Bassiana Market encompasses the production, distribution, and application of biopesticides derived from the entomopathogenic fungus Beauveria bassiana. This naturally occurring fungus acts as a highly effective biological control agent, infecting and killing a wide array of insect pests, including aphids, whiteflies, thrips, mites, and various beetles, by penetrating the insect cuticle and proliferating internally. The primary product formulates the fungal spores (conidia) into wettable powders, oil dispersions, or emulsifiable concentrates for field application. Major applications span broad-acre crops, protected agriculture (greenhouses), fruits and vegetables, and turf and ornamental plant protection. The key benefits include targeted pest control, minimal environmental impact, reduced risk of resistance development, and suitability for organic certification programs, directly addressing the growing global need for sustainable agriculture. Driving factors include stringent regulations on synthetic pesticides, the global push towards organic and residue-free food production, and significant investment in research and development to improve product stability and field performance.

Beauveria bassiana formulations are increasingly replacing conventional chemical insecticides due to their specificity and favorable ecological profile. Unlike broad-spectrum chemicals, Beauveria bassiana poses minimal threat to beneficial insects such as pollinators and natural predators, making it an essential tool in integrated pest management systems designed to maintain ecological balance in agricultural ecosystems. The market is characterized by a high degree of technological sophistication in strain isolation and mass production, requiring specialized fermentation capabilities and quality control measures to ensure consistent viability and virulence of the fungal spores. This introduction of high-efficacy biologicals is fundamentally reshaping the agrochemical landscape, moving it toward bio-intensive strategies. Furthermore, the rising incidence of pesticide resistance in major pest populations worldwide necessitates the adoption of alternative modes of action provided uniquely by fungal biopesticides.

The global market structure is fragmented, featuring large agrochemical corporations integrating biopesticides into their portfolios, alongside specialized biotech firms focusing solely on microbial pest control. Product differentiation often revolves around the specific fungal strain used, as different strains exhibit varying levels of efficacy against target pests and resilience under different climatic conditions. Key end-users include commercial farms, contract farming organizations, organic producers, and professional landscapers. The regulatory pathway for biopesticides is generally less burdensome than for traditional chemicals, encouraging faster market entry for innovative products, though registration still requires extensive data demonstrating safety and efficacy, further fueling the market's dynamic growth trajectory.

Beauveria Bassiana Market Executive Summary

The Beauveria Bassiana Market demonstrates robust growth, primarily fueled by global sustainability mandates and the transition toward organic farming practices, necessitating the replacement of synthetic insecticides with natural alternatives. Business trends highlight strategic mergers, acquisitions, and partnerships between conventional agrochemical giants and specialized biopesticide manufacturers, aiming to achieve portfolio diversification and leverage established distribution channels for biological products. Key manufacturers are heavily investing in advanced encapsulation and formulation technologies to overcome inherent biological challenges related to UV degradation and moisture sensitivity, thereby extending product shelf life and improving field residual activity. The market is witnessing a major shift toward high-concentration, liquid formulations that offer ease of application and improved handling for large-scale agricultural operations, driving competitive differentiation based on formulation excellence and spore viability guarantees. Furthermore, digital agriculture platforms are increasingly incorporating biological controls, enabling precision application which maximizes the cost-effectiveness of these premium products.

Regional trends indicate Asia Pacific leading the market in terms of consumption volume, spurred by massive rice, cotton, and vegetable cultivation, coupled with aggressive government support for biocontrol initiatives in countries like Australia and South Korea. North America and Europe, however, lead in terms of technological adoption and market value due to stringent Maximum Residue Limits (MRLs) enforced by regulatory bodies, driving premium pricing and rapid uptake in high-value protected cultivation sectors (greenhouses). Latin America, particularly Brazil, represents a significant untapped potential dueised by extensive soy and sugarcane production, necessitating efficient, large-scale biopesticide solutions to combat endemic pests. Infrastructure limitations regarding cold storage and technical expertise in application methodologies pose temporary restraints in emerging economies, requiring focused training and supportive governmental policies to unlock full regional potential.

Segment trends reveal that the liquid formulation segment holds a dominant market share due to ease of mixing and application compatibility with existing spraying equipment, while wettable powders remain strong in emerging markets due to cost-effectiveness and storage stability. In application analysis, field crops and horticulture constitute the largest segments, but the use of Beauveria bassiana in turf and ornamental management is projected to exhibit the highest Compound Annual Growth Rate, driven by regulations limiting chemical use in urban and recreational areas. The primary end-user segment remains commercial farmers, yet the rapid rise of sophisticated greenhouse operators, requiring continuous pest control with zero-day pre-harvest intervals, acts as a pivotal growth driver. Strategic focus for market players involves developing strains tailored for specific persistent pests, ensuring localized product efficacy across diverse climatic zones and agricultural systems.

AI Impact Analysis on Beauveria Bassiana Market

User queries regarding AI's influence on the Beauveria Bassiana Market frequently revolve around optimizing biological efficacy, automating quality control in production, and enhancing precision agriculture applications. Users are primarily concerned with how AI and machine learning (ML) can address the core challenges of biopesticides: inconsistent field performance and high production costs. Key themes emerging from these queries include the potential for AI algorithms to predict optimal application timing based on real-time environmental data (weather, humidity, pest pressure), thereby maximizing the fungal pathogen's success rate. Furthermore, there is strong interest in using AI for optimizing the complex fermentation process—specifically tuning parameters like temperature, pH, and nutrient feed rates—to ensure maximum spore yield and virulence consistency batch-to-batch, minimizing operational variance, a historic constraint in microbial manufacturing.

The integration of AI is transforming the entire value chain, starting with strain selection. ML models can rapidly analyze vast genomic and phenotypic data of various Beauveria bassiana strains to identify those exhibiting superior traits—such as resistance to UV radiation or enhanced thermal stability—significantly accelerating R&D cycles. In the downstream application phase, AI-powered image recognition systems integrated into drone and satellite imagery are enabling instantaneous identification and quantification of pest infestations, allowing for hyper-localized, spot application of the biopesticide, which dramatically reduces input costs and improves environmental targeting efficiency. This precision approach not only enhances efficacy but also makes biopesticides more competitive against conventional chemicals by optimizing resource use and ensuring targeted action.

Furthermore, supply chain logistics and inventory management, critical for maintaining the viability of live fungal products, are being optimized through predictive analytics. AI models forecast regional demand spikes and calculate optimal cold chain routing and storage conditions, reducing spoilage rates and ensuring product freshness upon delivery. This technological overlay addresses a major constraint associated with the live nature of the product, thereby increasing farmer confidence and accelerating market adoption, especially in regions with complex or unreliable supply infrastructure. The future of Beauveria bassiana rests heavily on AI-driven data systems to move from generalized application protocols to dynamic, predictive, and strain-specific treatments.

- AI optimizes large-scale fermentation processes by predicting optimal bioreactor parameters for maximum spore yield and virulence.

- Machine Learning (ML) accelerates R&D by screening fungal strains for improved stress tolerance (UV resistance, thermal stability) and target specificity.

- Predictive analytics determine ideal application timing based on localized weather patterns and real-time pest life cycle modeling, enhancing field efficacy.

- Drone-based imagery combined with AI vision systems enables precision, variable-rate application, reducing product waste and costs.

- AI-driven supply chain management improves cold chain integrity and logistics planning, minimizing product degradation and extending shelf life.

- Chatbots and expert systems provide farmers with real-time technical support on mixing ratios and compatibility, improving user adoption.

DRO & Impact Forces Of Beauveria Bassiana Market

The Beauveria Bassiana Market is fundamentally shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively constitute the primary Impact Forces determining its growth trajectory. The chief Driver is the increasing consumer demand for organic and residue-free food, necessitating the shift away from synthetic pesticides and accelerating the adoption of biological control agents across global agriculture. This is powerfully supported by global governmental and regulatory pressures, such as the European Union's Farm to Fork strategy, which actively promotes biopesticide use. Major Restraints include the inherent biological limitations of Beauveria bassiana, such as its susceptibility to high temperatures, low humidity, and UV radiation, which result in variable field efficacy and the need for frequent re-applications. The requirement for a robust cold chain during storage and transport also adds significant logistical complexity and cost compared to stable chemical counterparts. Opportunities are predominantly centered on technological breakthroughs in microencapsulation and genetic optimization of fungal strains to enhance environmental resilience and shelf stability, alongside market expansion into underpenetrated large-acreage crops like corn and soy, where current cost-of-application hurdles can be overcome through advanced formulation.

The Impact Forces are heavily skewed toward sustainability drivers. Regulatory acceleration of biopesticide registrations and consumer-led demands for transparency regarding food production methods exert strong, positive pressure on the market. These external forces compel agrochemical companies to prioritize biological solutions. Conversely, the high production complexity and the steep learning curve required for farmers to successfully integrate biopesticides into existing schedules act as significant moderating restraints. Product stability remains the paramount technical hurdle; overcoming the viability challenge is crucial for widespread acceptance. However, the expanding research into synergy, where Beauveria bassiana is combined with other microbial agents or low-dose chemical actives, represents a significant opportunity to broaden the product's scope and reliability, offering comprehensive pest management solutions that bridge the gap between biological and conventional controls.

The market’s dynamism is further enhanced by the rising incidence of insect pest resistance to multiple chemical classes. This severe biological pressure provides a non-negotiable Opportunity for Beauveria bassiana, which operates via a unique mechanical and enzymatic mode of action (cuticular penetration), making cross-resistance highly improbable. This makes the biopesticide invaluable in resistance management programs. The combination of strong regulatory tailwinds, consumer preference, and biological necessity ensures that the Drivers currently possess greater long-term gravitational force than the short-term logistical and technical Restraints. Strategic investment in formulation science and targeted marketing to educated agricultural segments will be key to capitalizing on these powerful growth forces, transitioning the product from a niche solution to a mainstream staple in commercial agriculture globally.

Segmentation Analysis

The Beauveria Bassiana Market is comprehensively segmented based on Type, Formulation, Application, and Geography, providing granular insights into specific market dynamics and growth potential across various product categories and end-use industries. Segmentation by Type primarily involves differentiating between various strains of Beauveria bassiana, such as ATCC 74040 or commercially optimized proprietary strains, which exhibit varying degrees of virulence and spectrum of target pests. Formulation segmentation, crucial for end-user adoption and product stability, divides the market into Wettable Powders (WPs), Oil Dispersions (ODs), Liquid Formulations (ECs/AS), and Granules. The Application segmentation dictates the primary end-user needs, encompassing Field Crops, Horticultural Crops (Fruits & Vegetables), Turf & Ornamentals, and Post-Harvest applications. Geographic segmentation provides regional market assessment, identifying key growth hubs and regulatory differences that influence product uptake.

The formulation segment is particularly critical as it directly addresses the fungal spores' environmental sensitivity. Wettable Powders dominate in terms of historical use and stable storage, particularly favored in markets where cold chain logistics are underdeveloped. However, liquid formulations (Oil Dispersions and Emulsifiable Concentrates) are rapidly gaining share due to their ease of mixing, improved dispersion characteristics, and enhanced protection against environmental stresses like desiccation, leading to superior field performance. Oil-based formulations are often preferred in arid or semi-arid climates as the oil base helps maintain moisture around the spore, facilitating successful germination and infection.

In terms of application, the Horticultural Crops segment, including protected cultivation (greenhouses), exhibits the highest growth rate and value share. This is attributed to the high-value nature of these crops, the necessity for frequent pest control, and strict MRL standards that virtually mandate the use of zero-residue biologicals like Beauveria bassiana. While field crops (corn, soy, cotton) currently represent larger volumetric consumption, the economic incentive and regulatory environment surrounding fruits and vegetables accelerate innovation and adoption, making it the most dynamic segment. Strategic market players must prioritize development of stable, high-virulence formulations tailored specifically for these protected environments to capture maximum market value.

- By Type:

- Proprietary Strains

- Publicly Available Strains (e.g., ATCC derived)

- By Formulation:

- Wettable Powders (WP)

- Oil Dispersions (OD)

- Emulsifiable Concentrates (EC)

- Granules and Pellets

- Aqueous Suspensions (AS)

- By Application:

- Field Crops (Corn, Soy, Cotton, Cereals)

- Horticultural Crops (Fruits, Vegetables, Vineyards)

- Turf and Ornamentals

- Forestry and Public Health

- Post-Harvest Treatments

- By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Beauveria Bassiana Market

The Value Chain for the Beauveria Bassiana Market is characterized by highly specialized upstream processes, complex manufacturing logistics, and diversified distribution channels. Upstream analysis involves the initial stages of strain identification, screening, and selection of high-virulence, high-yield strains suitable for commercialization. This phase requires intensive R&D and proprietary knowledge in mycology and genomics. Following selection, the production phase utilizes specialized large-scale fermentation (both solid-state and submerged) to mass-produce the fungal spores. This manufacturing stage is capital-intensive and highly sensitive, as quality control must ensure spore viability, titer (concentration), and freedom from contamination, directly impacting the final product's effectiveness and shelf life. The subsequent formulation stage involves combining the spores with inert carriers, stabilizers, and adjuvants to create marketable products (WP, OD, EC) that enhance field performance and storage stability.

The downstream analysis focuses on market access and application. Distribution channels are varied, involving both direct sales to large commercial farms and indirect distribution through established agricultural input retailers, cooperatives, and specialized biopesticide distributors. Direct channels are critical for large-volume sales and providing technical support required for effective biopesticide use, while indirect channels ensure wider market penetration, especially in fragmented agricultural landscapes. A key challenge in the downstream segment is maintaining the cold chain throughout the distribution network to preserve spore viability, especially for liquid and high-concentration formulations. Effective marketing emphasizes the product's biological advantages (unique mode of action, organic compliance) and integrates technical support and farmer training to overcome application hesitancy.

The value chain exhibits a trend toward vertical integration, where large biopesticide companies are acquiring formulation expertise or even R&D capabilities to control quality from strain selection to final product delivery. The indirect distribution channel, leveraging existing agrochemical networks, remains dominant due to scale, but specialized distributors focusing solely on biologicals offer superior technical guidance. Efficiency in the logistics of transporting live material is a significant competitive differentiator. Companies optimizing formulation to reduce cold chain dependency—for instance, developing highly stabilized dry granules—gain substantial competitive advantage by lowering distribution costs and expanding reach into remote or temperature-challenging markets.

Beauveria Bassiana Market Potential Customers

The potential customers for the Beauveria Bassiana Market are diverse, spanning the entire agricultural and land management ecosystem, but can be primarily categorized based on their commitment to sustainable and integrated pest management (IPM) practices. The largest customer segment comprises commercial farming enterprises focused on high-value crops, particularly fruits, vegetables, vineyards, and specialty crops grown under strict Maximum Residue Limit (MRL) standards imposed by retailers and export markets. These growers prioritize products with zero or minimal pre-harvest intervals and are willing to pay a premium for certified organic and sustainable inputs that guarantee market access. Secondarily, the organic farming sector represents a critical customer base, as Beauveria bassiana is a core tool for pest control in certified organic systems where synthetic chemicals are prohibited, ensuring their compliance and yield maintenance under strict environmental stewardship rules.

Another rapidly growing customer segment is the protected agriculture sector, including greenhouse and hydroponic operations. These controlled environments require constant pest suppression, and the enclosed nature of the space amplifies the risks of chemical accumulation and resistance development. Greenhouse operators highly value the fungal biopesticide's safety profile for workers and its compatibility with beneficial insect releases (biological control), making it an essential component of their high-intensity, year-round production systems. Furthermore, governmental bodies and public health departments constitute a niche but significant customer segment, utilizing Beauveria bassiana for vector control (e.g., mosquitoes, flies) and in forestry management where environmental sensitivity restricts conventional chemical usage over large, sensitive ecosystems.

Finally, the turf and ornamental industry, including professional golf course managers and landscaping companies, represent strategic customers. Urban and recreational areas often face municipal restrictions on pesticide application due to proximity to residential areas and waterways. These end-users utilize Beauveria bassiana for grub control, scale insects, and other ornamental pests, satisfying both regulatory compliance and public demand for safer, greener maintenance practices. Education and technical outreach are paramount for securing these customers, as successful biological control often depends on precise timing, application technique, and understanding the pest's life cycle, requiring intensive support from the product supplier to ensure high customer satisfaction and repeat purchase behavior.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 960 Million |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bayer CropScience, Syngenta AG, BASF SE, Corteva Agriscience, Certis Biologicals, Koppert Biological Systems, BioWorks, Inc., Novozymes A/S, Marrone Bio Innovations, Nufarm Limited, Lallemand Plant Care, FMC Corporation, Stockton Bio-AG, W. Neudorff GmbH KG, Andermatt Biocontrol, Advanced Biological Marketing (ABM), Biocare, Troy Biosciences, Bionema, and E. I. du Pont de Nemours and Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Beauveria Bassiana Market Key Technology Landscape

The Beauveria Bassiana Market is driven by sophisticated technology focused on overcoming the inherent biological limitations of the live fungal product to ensure stable, high-virulence, and field-ready formulations. A central technological pillar is advanced submerged liquid fermentation (SLF) and solid-state fermentation (SSF) techniques. SLF offers higher throughput, better control over physical parameters, and superior consistency, crucial for scaling production to meet global demand. SSF, while traditionally more complex, can often yield spores with higher natural resilience and virulence. Continuous process optimization, often leveraging sensor technology and AI analytics, is employed to maximize the metabolic output of the fungal culture, ensuring the cost-effective production of highly concentrated spore suspensions that meet rigorous commercial specifications for titer and viability.

Another crucial area is formulation science, where breakthroughs in microencapsulation and nanotechnology are revolutionizing product stability. Microencapsulation involves embedding the vulnerable fungal spores within protective polymer matrices or lipid layers. This shield significantly enhances resistance to degradation from ultraviolet (UV) light, desiccation, and fluctuating temperatures during storage and field application, effectively addressing the primary technical restraint of biopesticides. These advanced formulations allow for longer shelf life at ambient temperatures and improved residual activity post-application, making the product more reliable for farmers in diverse climatic conditions, particularly in regions prone to intense solar radiation or drought stress.

Furthermore, genetic and molecular techniques are playing an increasingly important role in optimizing the biological efficacy of the active ingredient. Selective breeding and genetic stabilization programs are used to isolate and propagate strains that exhibit superior tolerance to environmental stresses and higher virulence against specific target pests (e.g., highly resistant strains of whiteflies or thrips). While genetic modification (GM) remains contentious in many markets, non-GM techniques, such as induced mutagenesis and protoplast fusion, are actively employed to create proprietary strains with enhanced properties, thereby guaranteeing competitive differentiation and localized efficacy. The ability to guarantee a consistent, high-performing strain tailored to regional pests is paramount to technological leadership in this market.

Regional Highlights

The Beauveria Bassiana Market exhibits distinct growth patterns and adoption rates across major geographical regions, influenced by localized agricultural practices, regulatory frameworks, and climate suitability. North America, encompassing the U.S. and Canada, represents a mature market characterized by high awareness, stringent food safety standards, and robust investment in protected agriculture. Adoption is strongly driven by organic certification standards and the widespread use of Integrated Pest Management (IPM) systems in high-value specialty crops (berries, tomatoes, cannabis). The region benefits from established cold chain infrastructure and the presence of leading biotechnology firms focused on advanced formulation development and localized strain selection, ensuring high product efficacy and accessibility for sophisticated commercial growers.

Europe stands out due to its proactive regulatory environment, notably the European Green Deal and the Farm to Fork Strategy, which explicitly mandate the reduction of chemical pesticide use, providing unparalleled governmental support for the adoption of biological controls. Countries like Germany, France, and the Netherlands, with highly productive greenhouse sectors, are major consumers. However, the lengthy and often complex biopesticide registration process within the EU remains a regional challenge, requiring significant data packages, yet once approved, products enjoy high market confidence and premium pricing driven by consumer desire for residue-free food and strong retailer support for sustainable sourcing initiatives. The focus here is on novel formulations that are fully compatible with automated greenhouse application systems.

Asia Pacific (APAC) is projected to be the fastest-growing region both in volume and value, propelled by its massive agricultural base (rice, cotton, tea), rapid mechanization, and increasing national initiatives promoting chemical-free agriculture, particularly in China, India, and Southeast Asia. Governments in these countries are actively subsidizing biopesticide use to combat high pest resistance levels and address environmental pollution resulting from heavy chemical usage. Although price sensitivity and infrastructural gaps (lack of widespread cold storage) present obstacles, the sheer scale of arable land and rising middle-class demand for quality food creates exponential growth potential. Latin America, particularly Brazil and Argentina, offers another significant growth frontier, where Beauveria bassiana is essential for managing key pests in large-scale row crops like soy and coffee, driven by the need for cost-effective and large-volume biological inputs.

- North America (U.S., Canada): High-value market focused on IPM in horticulture and specialty crops; strong R&D in formulation and strain optimization; demand driven by consumer preference for organic food.

- Europe (Germany, France, Netherlands): Growth accelerated by strict government mandates (Farm to Fork strategy) to reduce chemical use; concentrated adoption in protected cultivation; strict, though complex, registration pathways.

- Asia Pacific (China, India, Australia): Fastest volume growth driven by large arable land, governmental support, and increasing pest resistance; challenges include cold chain development and farmer education.

- Latin America (Brazil, Argentina): Significant potential in large-acreage crops (soy, sugarcane) where cost-effective, bulk biological solutions are needed; market growth tied to governmental phytosanitary programs.

- Middle East & Africa (MEA): Emerging market primarily driven by food security concerns and the necessity for sustainable pest control in arid regions; slow growth constrained by water scarcity and limited access to necessary infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Beauveria Bassiana Market.- Bayer CropScience

- Syngenta AG

- BASF SE

- Corteva Agriscience

- Certis Biologicals

- Koppert Biological Systems

- BioWorks, Inc.

- Novozymes A/S

- Marrone Bio Innovations (now part of Bioceres Crop Solutions)

- Nufarm Limited

- Lallemand Plant Care

- FMC Corporation

- Stockton Bio-AG

- W. Neudorff GmbH KG

- Andermatt Biocontrol

- Advanced Biological Marketing (ABM)

- Biocare

- Troy Biosciences

- Bionema

- E. I. du Pont de Nemours and Company

Frequently Asked Questions

Analyze common user questions about the Beauveria Bassiana market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary mode of action of Beauveria bassiana and why is it effective in resistance management?

Beauveria bassiana infects insects through contact; its spores germinate on the cuticle, penetrate the exoskeleton, and proliferate inside the host, killing it via mechanical damage and fungal toxins. This unique, physical mode of action is fundamentally different from synthetic chemical insecticides, making cross-resistance development in pests highly unlikely and establishing it as a crucial tool for insecticide resistance management programs.

What are the main constraints impacting the commercial viability and widespread adoption of Beauveria bassiana products?

The chief constraints are the environmental sensitivity of the fungal spores to high temperatures, low humidity, and UV radiation, leading to inconsistent field performance compared to stable chemical pesticides. Additionally, the necessity for specialized cold chain logistics during storage and transportation significantly increases costs and logistical complexity for suppliers and distributors globally.

How are advanced formulation technologies improving the performance of Beauveria bassiana?

Advanced formulation technologies, particularly microencapsulation and oil dispersions, protect the active fungal spores from environmental degradation. Microencapsulation provides a protective barrier against UV light and desiccation, enhancing product shelf life at ambient temperatures and improving the residual activity (persistence) of the biopesticide on the crop foliage after application, thereby ensuring more reliable control.

Which geographical region is expected to demonstrate the highest growth rate for the Beauveria bassiana market?

The Asia Pacific (APAC) region is projected to experience the fastest growth rate, driven by the massive scale of agricultural production in countries like China and India, coupled with strong government support and subsidies aimed at promoting the use of sustainable and environmentally friendly biological control agents to mitigate chemical pesticide overuse and pollution.

Is Beauveria bassiana compatible with organic farming standards and integrated pest management (IPM) programs?

Yes, Beauveria bassiana is highly compatible with, and often essential for, certified organic farming as it is a naturally derived biological agent with zero chemical residues. In IPM programs, it is a preferred tool because it specifically targets pests while posing minimal risk to non-target beneficial insects, such as pollinators (bees) and natural predators, thereby preserving the ecological balance of the agroecosystem.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager