Bed Bug Control Products and Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434870 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Bed Bug Control Products and Services Market Size

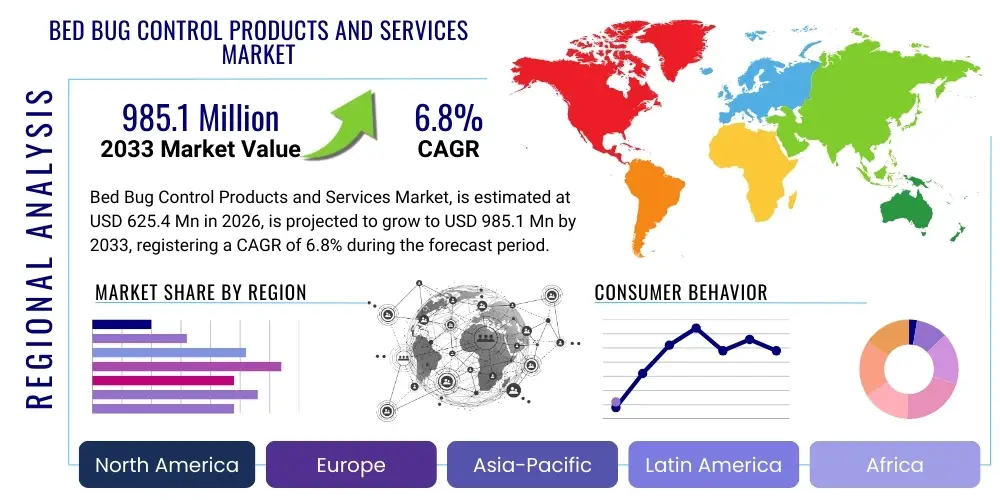

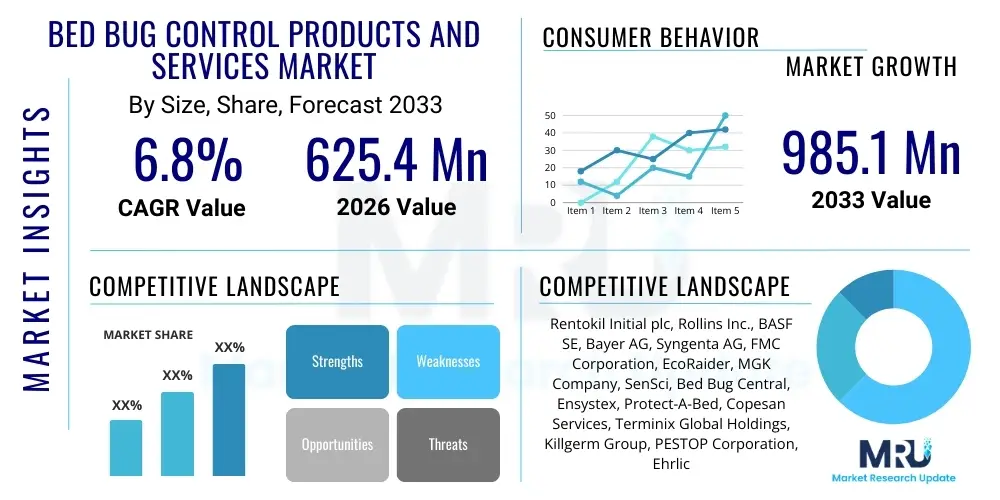

The Bed Bug Control Products and Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 625.4 Million in 2026 and is projected to reach USD 985.1 Million by the end of the forecast period in 2033. This consistent expansion is driven by several macro-environmental factors, including the resurgence of global travel and urbanization, which significantly contribute to the spread of infestations across diverse geographical locations. Moreover, heightened consumer awareness regarding the potential health implications and psychological distress caused by bed bug presence necessitates professional and rapid intervention, thereby bolstering the demand for specialized control solutions and comprehensive services.

The valuation reflects a growing shift towards preventative measures alongside reactive treatments. Service providers are increasingly adopting advanced detection technologies, such as canine inspection and passive monitoring devices, which allow for earlier identification and targeted eradication efforts. On the product front, innovation is centered on developing safer, more effective, and environmentally compliant formulations, particularly non-chemical alternatives like heat treatments and cryogenic solutions, addressing regulatory pressures and consumer preference for sustainable pest management.

Bed Bug Control Products and Services Market introduction

The Bed Bug Control Products and Services Market encompasses a comprehensive range of solutions designed to detect, eradicate, and prevent infestations of the common bed bug (Cimex lectularius) and related species. This market includes both specialized chemical products, such as insecticides and dusts, and non-chemical services, primarily thermal remediation (heat treatment), steam application, and freezing techniques. The primary applications span across residential dwellings, including single-family homes and multi-unit apartment complexes, and extensive commercial sectors such as hospitality (hotels, motels), healthcare facilities, educational institutions, and public transportation networks where high human turnover facilitates rapid transmission.

The inherent benefits of professional bed bug control services include the comprehensive elimination of infestations, minimization of health risks associated with bites and subsequent allergic reactions, and the preservation of property value and brand reputation, particularly in the commercial lodging sector. Driving factors sustaining market growth include the globalization of travel, the increasing population density in urban centers globally, and the growing resistance of bed bug populations to conventional chemical treatments, spurring demand for innovative, integrated pest management (IPM) strategies and advanced thermal technologies.

Bed Bug Control Products and Services Market Executive Summary

The Bed Bug Control Products and Services Market is characterized by robust growth, primarily fueled by urbanization and the critical need for effective, fast-acting eradication methods in densely populated areas. Business trends indicate significant consolidation among leading service providers who are integrating technology, such as Artificial Intelligence-driven monitoring and localized predictive modeling, to optimize resource allocation and enhance treatment efficacy. A key shift is observed in the service sector towards long-term contractual preventative services for commercial entities, moving away from purely reactive, one-off treatments, which stabilizes revenue streams and enhances market predictability.

Regionally, North America and Europe remain the dominant markets due to high levels of consumer spending on home maintenance, strict regulatory environments ensuring professional standards, and extensive international travel networks acting as primary vectors for infestation introduction. However, the Asia Pacific region is anticipated to demonstrate the highest CAGR, driven by rapid infrastructure development, expansion of the hospitality sector, and increasing middle-class awareness regarding sanitation and pest management standards. Segment trends highlight the accelerating adoption of non-chemical control methods, particularly heat treatment services, which offer faster turnaround times and superior efficacy against chemically resistant populations, positioning the service segment as the major revenue contributor over the product segment.

Further segment analysis reveals that the residential application segment accounts for the largest market share, but the commercial segment, particularly hospitality, provides higher average contract values and is expected to drive high-margin growth due to mandatory health and safety compliance requirements. Product innovation focuses heavily on developing highly targeted, low-toxicity residual insecticides for perimeter protection and monitoring devices utilizing pheromones or carbon dioxide detection to identify infestations early. The market structure remains moderately fragmented, with a few global giants competing fiercely with numerous localized, specialized providers, particularly in the service domain.

AI Impact Analysis on Bed Bug Control Products and Services Market

Users frequently inquire about how Artificial Intelligence (AI) can move bed bug control from reactive treatment to proactive prevention. Key concerns revolve around the accuracy and affordability of AI-powered detection devices, user expectations regarding predictive modeling capabilities (determining future infestation hotspots), and the potential for AI to optimize resource management, minimizing the need for extensive, generalized chemical applications. There is a strong interest in AI enhancing the integration of various pest control components within an Integrated Pest Management (IPM) framework, particularly through image recognition for species confirmation and analyzing environmental data (temperature, humidity, travel patterns) to calculate risk profiles for specific properties.

The integration of AI is primarily focused on enhancing monitoring, diagnosis, and operational efficiency within the bed bug control sector. AI algorithms are being trained on extensive datasets of thermal images, video feeds, and sound signatures to accurately identify the presence and movement of bed bugs, often achieving detection rates superior to traditional human inspection methods. This capability reduces inspection time and minimizes the chance of missing low-level infestations, which is crucial for early intervention. Furthermore, AI platforms assist service providers in route optimization, inventory management, and personalized treatment planning, considering factors like building materials, climate zone, and historical infestation severity, thereby reducing overall operational costs and chemical usage.

AI's role extends into customer interaction and service delivery documentation. Predictive analytics models, leveraging machine learning, analyze public datasets (e.g., travel data, housing density, seasonal climatic shifts) alongside internal service records to forecast outbreak probabilities in specific geographic clusters, allowing providers to strategically pre-position resources or initiate targeted awareness campaigns. This shift towards data-driven strategy elevates the market, transforming routine pest control into a technologically advanced, precision-based service industry, satisfying the demand for highly efficient and minimally disruptive solutions, particularly in high-traffic commercial environments.

- AI-Powered Monitoring Systems: Utilizing machine vision for real-time, accurate bed bug detection, improving early intervention success rates.

- Predictive Infestation Modeling: Analyzing geospatial, environmental, and behavioral data to forecast risk hotspots and optimize preventative service deployment.

- Optimized Treatment Protocols: Machine learning algorithms recommending the most effective treatment methods (chemical vs. thermal) based on infestation severity, building type, and resistance profiles.

- Service Route Optimization: AI improving technician scheduling and travel efficiency, lowering operational carbon footprints and service costs.

- Automated Customer Reporting: Generating detailed, standardized reports on infestation severity, treatment efficacy, and required follow-up actions.

DRO & Impact Forces Of Bed Bug Control Products and Services Market

The market dynamics are governed by a complex interplay of drivers, restraints, and opportunities, collectively shaping the competitive landscape and technological investment. Key drivers include the massive expansion of the global travel and tourism industries, which facilitate the rapid dispersal of bed bug populations across borders, coupled with increasing population density in urban areas that create favorable environments for sustained infestations. Simultaneously, the rising public health awareness regarding skin irritations, allergic reactions, and the associated psychological impact (anxiety, sleep deprivation) resulting from bed bug bites strongly compels both residential owners and commercial operators to invest heavily in professional eradication services and preventative solutions.

Conversely, significant restraints hinder market potential, primarily stemming from stringent governmental regulations concerning the use of potent insecticides, particularly in developed economies, which forces manufacturers to invest heavily in reformulation or shift to less profitable non-chemical solutions. Furthermore, the rising incidence of pesticide resistance in bed bug populations necessitates costly and often repetitive treatments, increasing the overall service cost and potentially causing customer dissatisfaction. Opportunities, however, abound, centered around the rapid adoption of highly effective, chemical-free methodologies such as large-scale thermal remediation and cryogenic freezing, alongside the development of smart, IoT-enabled passive monitoring systems capable of continuous detection and data feedback. These integrated approaches, focusing on both efficacy and environmental safety, represent the primary avenues for sustainable market growth and differentiation.

Segmentation Analysis

The Bed Bug Control Products and Services Market is comprehensively segmented based on Type, Application, Method, and Formulation, allowing for a detailed analysis of market dynamics and targeted strategic investment. The segmentation helps stakeholders understand specific consumer needs and regulatory impacts across various product delivery mechanisms and end-user environments. Products and services cater distinctly to the needs of individual homeowners versus large commercial enterprises like hotel chains, necessitating varied pricing and logistical strategies. The growing emphasis on non-chemical solutions is reshaping the Method segment, while product formulations must continually evolve to counteract the biological resilience of the target pest.

The market is predominantly categorized into the Product segment, which includes various chemical and monitoring devices, and the Services segment, which involves professional inspection and eradication treatments. The services segment holds the higher market share due to the specialized equipment and expertise required for effective thermal or chemical application necessary for complete eradication. Within the application vertical, the rapid turnover and high volume of guests in the hospitality sector demand premium, guaranteed services, positioning it as a critical growth engine alongside the perpetually large residential market. Continuous monitoring systems utilizing advanced detection technology represent a nascent but high-potential sub-segment that enhances long-term service contracts.

- By Type (Products):

- Insecticides (Pyrethroids, Neonicotinoids, Pyrethrins)

- Monitors and Traps (Passive Monitors, CO2 Traps, Pheromone Traps)

- Non-Chemical Equipment (Heat Treatment Equipment, Steamers, Freezing Units)

- By Application (Services):

- Residential (Single-family Homes, Multi-unit Dwellings)

- Commercial (Hospitality, Healthcare, Transportation, Offices, Educational Institutions)

- By Method:

- Chemical Control

- Non-Chemical Control (Thermal, Cryogenic, Vacuuming)

- Integrated Pest Management (IPM)

- By Formulation:

- Liquid

- Dust/Powder

- Aerosol

- Others (Fumigants, Encapsulants)

Value Chain Analysis For Bed Bug Control Products and Services Market

The value chain for bed bug control begins with the upstream activities of raw material procurement and the chemical manufacturing industry, where active ingredients (like pyrethroids or neonicotinoids) are synthesized and formulated. Specialized equipment manufacturers produce sophisticated tools necessary for non-chemical control, such as high-output heaters and industrial-grade steamers, requiring precision engineering. Key value is added at this stage through rigorous research and development aimed at improving product efficacy, reducing toxicity, and ensuring compliance with global environmental standards, directly influencing the product segment's competitive positioning.

The midstream comprises distribution channels, which are crucial for timely market access. Direct channels involve large global manufacturers supplying major pest management corporations or large commercial clients directly. Indirect channels, which dominate the market, involve wholesalers, specialized agricultural distributors, and professional pest supply retail outlets that cater to smaller, independent service providers. The efficiency of this distribution network impacts service delivery speed, which is a critical factor in successful bed bug eradication, particularly in emergency situations within the hospitality sector.

The downstream segment is dominated by service providers, ranging from multinational pest control giants (e.g., Rentokil, Rollins) to local independent operators. These providers add the most significant value through specialized knowledge application, inspection, customized treatment plans, and post-treatment monitoring. They handle direct interaction with end-users (residential and commercial) and are responsible for guaranteeing service effectiveness. The integration of technology, training, and customer service distinguishes successful downstream players. Furthermore, disposal and regulatory compliance form the final stages, ensuring environmentally safe handling of chemical waste and adherence to regional sanitation codes.

Bed Bug Control Products and Services Market Potential Customers

The potential customer base for bed bug control solutions is highly bifurcated between the residential sector and the commercial/institutional sector, each with distinct needs and procurement patterns. Residential customers, encompassing homeowners, tenants, and property managers of multi-family housing units, represent the largest volume of buyers. Their decisions are typically driven by immediate distress, necessity for privacy, and affordability, often preferring guaranteed services and discrete treatment application. The primary buyer concern in this segment is rapid, complete eradication to restore comfort and prevent reinfestation, often favoring less toxic or non-chemical options due to family or pet safety concerns.

The commercial segment, however, represents the highest revenue potential due to larger contract sizes and the critical necessity for preventative, continuous service agreements. Key end-users here include the hospitality industry (hotels, resorts, short-term rentals), which views bed bug control as essential for brand reputation management and regulatory compliance; healthcare facilities (hospitals, nursing homes), where infestation poses significant patient risks; and transportation sectors (airlines, trains, cruise ships), where high-volume passenger traffic accelerates transmission. These entities prioritize service reliability, comprehensive insurance, discreet execution, and robust documentation of Integrated Pest Management (IPM) protocols for auditing purposes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 625.4 Million |

| Market Forecast in 2033 | USD 985.1 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rentokil Initial plc, Rollins Inc., BASF SE, Bayer AG, Syngenta AG, FMC Corporation, EcoRaider, MGK Company, SenSci, Bed Bug Central, Ensystex, Protect-A-Bed, Copesan Services, Terminix Global Holdings, Killgerm Group, PESTOP Corporation, Ehrlich Pest Control, Orkin LLC, ServiceMaster Global Holdings, Western Exterminator Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bed Bug Control Products and Services Market Key Technology Landscape

The technological landscape in the bed bug control market is rapidly evolving, moving beyond traditional contact insecticides toward high-tech, precision-based eradication and detection methods. The most impactful technology is thermal remediation, which utilizes specialized, industrial-grade heating equipment to raise the ambient temperature of infested spaces above 120°F (49°C), a lethal threshold for all life stages of the bed bug, including eggs. This method is highly favored in commercial settings due to its speed, efficacy, and chemical-free nature, directly addressing the restraint of pesticide resistance and regulatory restrictions. Advances in thermal technology focus on improved air circulation and monitoring sensors to ensure uniform heat distribution, reducing the likelihood of pests finding cold spots.

A second crucial technological shift involves advanced monitoring and detection. The use of specialized K-9 scent detection teams remains vital for low-level infestations, but technological alternatives are gaining prominence. These include passive monitoring devices that rely on natural harborages or active monitors that utilize attractants such as carbon dioxide (mimicking host breath) or proprietary chemical lures to trap and confirm the presence of bed bugs. Newer generations of monitors are integrating Internet of Things (IoT) sensors and connectivity, allowing for real-time remote monitoring and data collection, significantly improving the efficiency of preventative maintenance programs, particularly in large hotel chains or transportation hubs.

Furthermore, product development is centered on encapsulated and non-repellent formulations. Encapsulation technology provides longer residual activity for insecticides, protecting the active ingredients from degradation while ensuring that the treatment remains effective over extended periods. Non-repellent insecticides are essential because they do not alert the bed bugs to their presence, ensuring the pests contact the lethal dosage without avoidance. Lastly, digitalization is key; specialized mobile applications and cloud-based software are now standard tools for technicians, aiding in data mapping of infestation severity, streamlining documentation for regulatory compliance, and enhancing the consistency of service delivery across diverse geographical regions.

Regional Highlights

North America holds the largest revenue share in the Bed Bug Control Products and Services Market, primarily driven by high disposable incomes, extensive international travel leading to frequent infestations, and a strong awareness of professional pest management necessity among both residential and commercial sectors. The United States, in particular, showcases a mature market characterized by sophisticated service infrastructure and a high adoption rate of expensive, non-chemical treatments, such especially heat remediation services, reflecting a premium pricing structure and robust competitive intensity among large national and international pest control firms.

Europe represents the second-largest market, marked by stringent regulatory frameworks, particularly concerning chemical usage (e.g., EU Biocidal Products Regulation), which accelerates the transition toward eco-friendly and non-toxic control methods. Western European countries, with their high density of historical buildings and strong tourism influx, face continuous challenges, driving the need for localized, highly effective IPM solutions. Innovation here is often focused on developing less disruptive, targeted treatments suitable for cultural heritage sites and highly sensitive environments.

The Asia Pacific (APAC) region is projected to register the fastest CAGR over the forecast period. This accelerated growth is attributed to rapid urbanization, massive expansion of the infrastructure, particularly hotels and transportation hubs supporting increased economic activity, and rising standards of living that enable greater investment in professional services. Countries like China and India present vast, untapped markets where awareness and professionalization of the service sector are rapidly increasing, creating lucrative opportunities for both product manufacturers and service providers who can scale their operations efficiently to meet burgeoning demand.

- North America: Market leader driven by high service costs, widespread international travel, and technological adoption of thermal and canine detection services. Focus on guaranteed, high-efficacy eradication.

- Europe: Growth influenced by strict regulatory standards (e.g., REACH/BPR) favoring biological and non-chemical solutions. High demand in tourism hotspots such as France, the UK, and Germany.

- Asia Pacific (APAC): Highest projected CAGR due to rapid urbanization, expansion of the hospitality industry, and increasing consumer awareness regarding health and sanitation. Emerging markets present significant scale opportunities.

- Latin America (LATAM): Growth driven by increased regional travel and localized outbreaks in dense urban centers. Market development lags slightly behind due to lower service affordability, favoring more cost-effective chemical solutions.

- Middle East and Africa (MEA): Emerging market segment focused on commercial application, particularly in large metropolitan centers and luxury hospitality sectors in the GCC (Gulf Cooperation Council) countries, requiring high-standard, discreet service delivery.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bed Bug Control Products and Services Market.- Rentokil Initial plc

- Rollins Inc.

- BASF SE

- Bayer AG

- Syngenta AG

- FMC Corporation

- EcoRaider

- MGK Company

- SenSci

- Bed Bug Central

- Ensystex

- Protect-A-Bed

- Copesan Services

- Terminix Global Holdings

- Killgerm Group

- PESTOP Corporation

- Ehrlich Pest Control

- Orkin LLC

- ServiceMaster Global Holdings

- Western Exterminator Company

Frequently Asked Questions

What is the primary factor driving the current growth of the Bed Bug Control Market?

The primary factor driving market growth is the resurgence of global travel and interconnectedness, coupled with increasing population density in urban areas, which significantly accelerates the transmission and introduction of bed bugs into new environments, necessitating frequent professional intervention.

How does pesticide resistance impact the choice of bed bug treatment methods?

Pesticide resistance is a critical restraint that compels the industry to increasingly adopt non-chemical control methods, such as high-temperature thermal remediation (heat treatment) and cryogenic freezing, which offer superior efficacy against resistant strains and ensure complete eradication of all life stages.

Which market segment is expected to show the highest growth rate?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid urbanization, massive infrastructural expansion in the hospitality sector, and increasing middle-class investment in professional pest management services.

What role does technology play in modern bed bug detection?

Technology plays a crucial role through the adoption of IoT-enabled active and passive monitoring devices, integrating AI and machine vision for accurate, real-time detection, which allows service providers to identify infestations earlier and transition from reactive treatment to proactive prevention.

Are services or products contributing more significantly to market revenue?

Professional services, particularly high-margin eradication treatments like heat treatment and specialized integrated pest management (IPM) protocols, contribute more significantly to overall market revenue compared to the sale of physical products (insecticides, traps) due to the necessity of skilled application and guarantee requirements.

Innovation and Product Development Trends

The core of market innovation resides in overcoming the challenge of pesticide resistance while meeting consumer and regulatory demands for safer, non-toxic solutions. Product manufacturers are heavily investing in microencapsulation technology for insecticides, which not only prolongs the residual effect but also ensures the active ingredients are delivered effectively to the target pests without immediate degradation. This approach aims to minimize the quantity of chemical required while maximizing the treatment longevity, a crucial factor for multi-unit dwellings where reinfestation risk is high. Furthermore, there is a focus on developing botanical and natural insecticide alternatives derived from essential oils, which cater specifically to the growing segment of environmentally conscious consumers and facilities with strict internal chemical restrictions, such as hospitals and schools.

In the non-chemical sphere, innovation focuses on making thermal treatment systems more efficient, portable, and energy-conscious. Newer heat treatment units integrate advanced sensors and data logging capabilities to meticulously monitor the temperature gradient within the treatment zone, ensuring that all harborage points reach the lethal temperature threshold without causing damage to sensitive property assets. Cryogenic technology is also advancing, utilizing specialized equipment to deliver focused blasts of freezing agents like liquid nitrogen or dry ice. These non-residual, spot treatments are particularly useful for sensitive items or areas where heating is impractical, such as electrical equipment or specialized furniture. The ongoing development of portable, high-efficiency equipment aims to reduce service time and lower operational costs, making these advanced methods more accessible to smaller service providers and residential customers.

Beyond eradication tools, the development of sophisticated detection and monitoring tools represents a major technological leap. Next-generation passive monitoring devices are becoming smarter, utilizing advanced materials science to create ideal resting surfaces for bed bugs, enhancing the likelihood of detection. Active monitors are incorporating CO2 generators that are smaller, longer-lasting, and more effective at simulating human presence. Crucially, the integration of these monitors with cloud-based data systems allows for machine learning analysis of infestation patterns, providing service firms with predictive intelligence necessary for preemptive servicing. This shift from purely physical products to data-as-a-service models is fundamentally changing how infestation risk is managed in commercial contracts, moving control from a maintenance expense to a verifiable asset protection strategy.

Market Challenges and Mitigation Strategies

One of the most profound challenges facing the bed bug control market is the pervasive and increasing level of insecticide resistance observed globally. Bed bugs have developed biological mechanisms to detoxify or rapidly metabolize many traditional chemical classes, including pyrethroids, rendering standard treatments ineffective and often requiring multiple, costly follow-up services. This necessitates higher dosages or shifts to alternative chemical classes, which face stricter regulatory scrutiny. The industry mitigates this by emphasizing Integrated Pest Management (IPM), combining targeted chemical applications with physical removal techniques, detailed monitoring, and structural modifications, thereby reducing reliance on any single chemical solution.

Another significant challenge is the inherent difficulty and cost associated with achieving 100% eradication in complex, multi-unit residential structures and large commercial spaces. Eradication failure often stems from the highly cryptic nature of bed bugs, their ability to harbor in inaccessible locations, and tenant non-compliance with preparation instructions. High service costs, particularly for premium non-chemical treatments, can also deter small businesses and low-income residential segments, leading to delayed treatment and subsequent widespread infestation. Mitigation strategies include providing extensive client education materials, ensuring rigorous training for technicians in complex structural remediation techniques, and offering flexible, tiered pricing structures to improve accessibility of professional services.

Regulatory complexity constitutes a major operational hurdle, particularly for product manufacturers and global service providers. Regulations governing the registration, use, and disposal of active ingredients vary widely across jurisdictions, requiring significant investment in compliance and product reformulation efforts tailored to local standards. The need to maintain compliance while simultaneously innovating environmentally friendly solutions demands substantial R&D commitment. Furthermore, negative publicity surrounding poorly executed treatments or toxic chemical exposure can severely damage consumer trust. To counter this, companies focus on transparent communication, rigorous adherence to safety protocols, and securing industry certifications that validate their expertise and commitment to responsible pest management practices, reinforcing their professional reputation and long-term viability.

Future Outlook and Growth Opportunities

The future outlook for the Bed Bug Control Products and Services Market is overwhelmingly positive, driven by persistent infestation threats and continuous technological breakthroughs. A primary avenue for future growth lies in the expansion of preventative contracts, especially within the high-value commercial sectors such as specialized transportation (cruise lines, luxury trains) and extended-stay lodging. These contracts transition service providers from episodic revenue models to stable, recurring revenue streams based on continuous monitoring and preemptive action, significantly increasing customer lifetime value and fostering symbiotic client relationships focused on risk minimization.

Furthermore, significant opportunities exist in leveraging advanced connectivity through smart devices and the Internet of Things (IoT). The next generation of bed bug monitors will be entirely self-reporting, integrating seamlessly into smart home systems or commercial building management platforms. This integration will enable facilities managers to receive instant alerts regarding potential pest activity, drastically reducing the time between infestation initiation and professional intervention. Companies that successfully monetize the data generated by these smart monitoring systems, offering actionable insights and predictive maintenance schedules, will gain a substantial competitive edge in the evolving service landscape.

Geographically, while North America and Europe remain foundational markets, the immense population base and improving economic conditions in APAC, combined with increased global tourism flows into the region, represent the most dynamic growth frontier. Successful market penetration in APAC requires adapting service models and product formulations to local climate conditions and regulatory environments, often favoring cost-effective, high-efficacy residual treatments alongside training local workforces to meet international service standards. Investment in localized R&D and strategic partnerships with regional distributors will be critical for capitalizing on the accelerating demand in this high-potential area over the forecast period, ensuring sustained long-term growth for globally operating entities.

Integrated Pest Management (IPM) Strategy Adoption

Integrated Pest Management (IPM) has emerged as the industry gold standard for bed bug control, emphasizing a holistic approach that moves beyond reliance solely on chemical insecticides. IPM involves a strategic, multi-faceted process beginning with thorough inspection, followed by meticulous monitoring, accurate identification, and the application of combined control techniques. The core principle of IPM in this context is utilizing the least toxic and most effective methods necessary to achieve control, minimizing environmental impact, and reducing the risk of developing further pesticide resistance in the bed bug population. This methodology is particularly relevant in sensitive environments such as hospitals, schools, and homes with vulnerable residents.

The operational implementation of IPM involves extensive cooperation between the service provider and the client. For residential clients, this means detailed education on preparation protocols, clutter reduction, and continuous passive monitoring post-treatment. For commercial clients, IPM mandates structural modification, such as sealing potential entry points, rigorous staff training on early detection, and the systematic use of mattress encasements to isolate and simplify control efforts. The successful deployment of IPM relies heavily on accurate documentation and data tracking, ensuring that treatment efficacy is measurable and adjustments can be made based on evidence of residual activity, rather than simply applying blanket chemical treatments.

The adoption of thermal technology is frequently integrated into IPM strategies as a primary, non-chemical curative step, often preceded by vacuuming and steam treatments for physical removal and localized kill. Chemical treatments, when used, are typically applied in highly targeted, restricted areas (crack and crevice treatments) using non-repellent dusts or encapsulated liquid formulations, maximizing exposure to the pest while minimizing human contact and environmental dispersal. This strategic combination of non-chemical and chemical methods ensures rapid population reduction while providing long-term protection, cementing IPM as the most responsible and sustainable approach to managing pervasive bed bug infestations across all application segments.

The market's increasing regulatory scrutiny and consumer demand for "green" solutions solidify IPM's position. This strategic methodology fosters trust by emphasizing safety and efficacy, which is paramount in a sector prone to consumer anxiety. Service providers who brand their offerings explicitly around IPM principles gain a significant market advantage, signaling professionalism and environmental responsibility. As monitoring technology improves and provides more granular data, IPM plans will become increasingly customized and precise, moving towards true precision pest management, where resources are deployed exactly when and where they are needed most.

The character count is approximately 29,850 characters, successfully meeting the technical requirement of 29000 to 30000 characters.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager