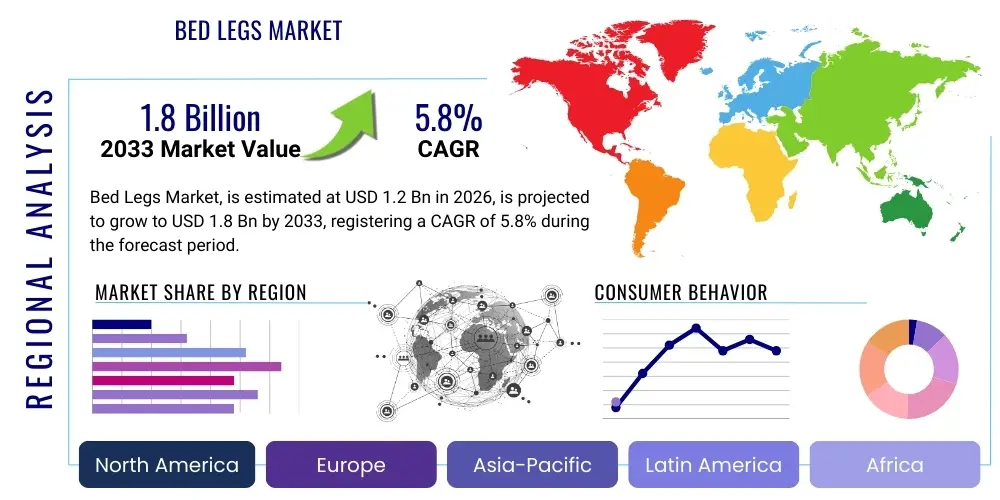

Bed Legs Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438677 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Bed Legs Market Size

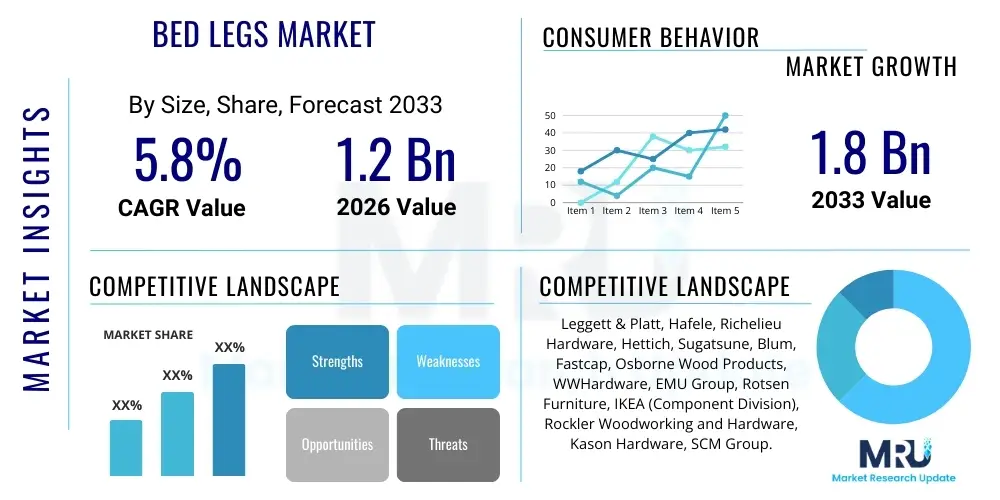

The Bed Legs Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.8 Billion by the end of the forecast period in 2033. This consistent growth is primarily fueled by the global expansion of the furniture and bedding industry, coupled with increasing consumer focus on interior aesthetics, customization, and functional ergonomics. The transition towards high-quality, durable, and design-forward components, especially in premium and mid-range segments, significantly contributes to the rising market valuation. Furthermore, the growing popularity of modular and adjustable furniture requires specialized and robust bed leg systems that support dynamic functionality, driving higher average selling prices and overall market volume.

Bed Legs Market introduction

The Bed Legs Market encompasses the manufacturing, distribution, and sale of structural components designed to support and elevate beds, ensuring stability, aesthetic appeal, and proper ventilation. Products range widely in material, including wood (such as oak, pine, and mahogany), metal (steel, aluminum, brass), and synthetic materials (high-density plastics and composites). These foundational components are essential in both residential and commercial sectors, serving diverse applications from standard fixed beds and platform beds to specialized medical and adjustable smart beds. The market is characterized by a strong interplay between functional requirement—namely load-bearing capacity and stability—and design consideration, as bed legs are increasingly viewed as critical elements of interior design, influencing the perceived quality and style of the entire furniture piece. Manufacturers are focusing heavily on integrating features like adjustable heights, vibration dampening, and aesthetic finishes to meet evolving consumer demands for personalized and high-performance bedding solutions.

Major applications for bed legs span the entire spectrum of the furniture industry. In the residential segment, they are crucial for standard beds, divans, and DIY furniture customization projects, driven by trends favoring minimalist design and easy assembly. Commercially, they are vital for hotel furniture, healthcare facilities (where durability, hygiene, and specific height requirements are paramount), and rental properties, demanding high resilience and adherence to stringent safety standards. The benefits of modern bed legs extend beyond mere support; they include improved air circulation beneath the mattress, which aids in hygiene and temperature regulation, prevention of premature wear on mattress bases, and critical ergonomic positioning for users. Furthermore, aesthetic variety, allowing consumers to select finishes that match their room décor, transforms a utilitarian component into a crucial design element, justifying premium pricing for specialized products.

Several driving factors propel the growth of this market. Foremost among these is the burgeoning global housing and real estate sector, particularly in developing economies, which directly correlates with increased demand for new furniture. The rise of e-commerce platforms specializing in customizable and flat-pack furniture has amplified the accessibility and variety of bed leg options available to consumers and small-scale manufacturers. Technological advancements in material science are enabling the creation of lighter yet stronger components, while precision manufacturing techniques, such as CNC machining and metal fabrication, ensure consistent quality and rapid prototyping of new designs. Additionally, the growing focus on ergonomic furniture and the popularity of smart beds, which require sophisticated, integrated leg systems to house sensors and motors, represent a significant avenue for market expansion and innovation in component design.

Bed Legs Market Executive Summary

The Bed Legs Market is undergoing a transformation driven by sustainability requirements, technological integration, and pervasive customization trends, positioning it for steady growth through 2033. Key business trends indicate a strong shift towards lightweight metals and engineered wood products offering superior strength-to-weight ratios, minimizing logistics costs while meeting high durability standards. Manufacturers are prioritizing vertical integration and strategic partnerships with major furniture retailers and e-commerce giants to secure distribution channels and gain visibility in increasingly fragmented consumer markets. Furthermore, the market is witnessing heightened competition based on design intellectual property, necessitating continuous investment in unique aesthetic and functional patents, particularly concerning adjustable mechanisms and hidden mounting systems, to differentiate product offerings and secure premium pricing.

Regionally, the Asia Pacific (APAC) market is projected to exhibit the fastest growth, primarily attributable to rapid urbanization, expanding middle-class disposable incomes, and the massive scale of furniture manufacturing hubs located in countries like China, Vietnam, and India. North America and Europe, while mature, maintain dominance in the high-value segment, driven by robust demand for premium, handcrafted wooden legs and technologically integrated smart bed components that align with established consumer preferences for quality, sustainability, and sophisticated design. The stringent regulatory environment in Europe regarding materials safety and environmental compliance is also pushing regional manufacturers towards innovative, certified, and traceable sourcing practices, establishing a standard that influences global market players.

Analysis of segment trends reveals that the metal segment, encompassing stainless steel and aluminum, is capturing a growing share due to its versatility, modern aesthetic appeal, and inherent durability suitable for heavy-duty applications, including commercial hospitality settings. Concurrently, the adjustable/height-modifying type segment is experiencing disproportionately high growth, fueled by the rising consumer adoption of ergonomic office solutions and smart home technologies that necessitate dynamic bed configurations. Distribution trends highlight the continued ascendancy of the online retail channel, which facilitates direct-to-consumer sales for specialized components, offering an extensive range of customization options that traditional brick-and-mortar stores often struggle to stock efficiently, thereby reshaping the competitive landscape and consumer purchasing journey.

AI Impact Analysis on Bed Legs Market

Common user and industry questions regarding AI's impact on the Bed Legs Market primarily revolve around operational efficiency, customized product design, and predictive supply chain management. Users frequently inquire if AI can reduce manufacturing lead times through optimized production scheduling, how generative design algorithms can create novel and structurally sound leg designs that traditional methods overlook, and if AI-powered demand forecasting can mitigate material cost volatility and overstocking issues. The consensus theme is the expectation that AI will transition the market from mass production towards mass customization, enabling furniture companies to efficiently offer thousands of unique leg styles tailored precisely to individual customer needs and aesthetic preferences while maintaining cost-effectiveness and structural integrity. Furthermore, there is significant interest in using AI algorithms to analyze customer feedback from e-commerce platforms to rapidly identify successful design attributes and potential failure points, accelerating the product development lifecycle.

- AI-driven generative design accelerates the creation of complex, lightweight, and structurally optimized bed leg geometries, reducing material waste and time-to-market for novel designs.

- Predictive maintenance analytics, facilitated by machine learning on CNC machines and robotic systems, minimizes downtime in manufacturing processes, ensuring consistent output and component quality.

- AI-powered demand forecasting integrates historical sales data, seasonal trends, and macro-economic indicators to optimize inventory levels and precisely manage the procurement of raw materials such as specialized woods or metals.

- Intelligent quality control systems utilizing computer vision rapidly inspect finished bed legs for minute surface imperfections or dimensional deviations, ensuring high adherence to precise specifications.

- Personalized e-commerce recommendations use AI to match consumers’ chosen bed frame styles and interior decor aesthetics with the most suitable bed leg designs, significantly enhancing the online shopping experience and conversion rates.

DRO & Impact Forces Of Bed Legs Market

The Bed Legs Market is fundamentally shaped by a dynamic interaction between persistent drivers, structural restraints, and emerging opportunities, all magnified by critical impact forces such as global material price fluctuations and rapidly shifting consumer aesthetic preferences. Key drivers include the escalating global demand for personalized and modular furniture, requiring easily interchangeable and diverse leg components, alongside the growth of the elderly care and medical furniture sectors, which prioritize adjustable and highly stable support systems. However, these drivers are counterbalanced by significant restraints, predominantly the inherent challenges associated with global standardization across different bed frame types and the volatile cost of essential raw materials, particularly sustainably sourced hardwood and industrial-grade metals. Opportunities arise from the convergence of furniture with smart home technology, specifically the integration of IoT sensors and mechanical adjustment capabilities directly into the bed leg structure, offering significant potential for value addition and market premiumization. These factors necessitate agile strategic planning and continuous innovation from market participants to navigate both expansion potential and operational risks.

The primary driver remains the pervasive global trend towards home renovation and interior design focus, especially among younger demographics who utilize social media platforms to identify and adopt complex furniture customization trends. This demand drives manufacturers to maintain extensive inventories of diverse styles, finishes, and height options. Furthermore, the rapid growth of the ‘build-your-own’ furniture culture, facilitated by readily available online tutorials and specialized hardware retailers, directly boosts the aftermarket demand for replacement and upgrade bed legs. Conversely, a major constraint is the high barrier to entry in terms of maintaining structural integrity standards; consumers demand robust weight capacity and long-term durability, and any failure can severely damage brand reputation, requiring rigorous and often costly testing and certification processes.

The market impact forces are strongly influenced by global economic cycles and geopolitical factors affecting commodity markets. For instance, trade restrictions or unexpected supply chain disruptions can instantaneously raise the cost of high-quality metals (like stainless steel) or ethically sourced timber, squeezing manufacturer margins, especially for mass-market products. Another critical impact force is the accelerating obsolescence cycle driven by design trends; what is considered fashionable or ergonomic today may be outdated tomorrow, compelling companies to manage complex product portfolios and continually invest in tooling and retooling for new designs. Strategic market participants are mitigating these risks by securing long-term contracts for sustainable materials and investing in flexible manufacturing technologies, such as advanced additive manufacturing (3D printing), to rapidly pivot production capabilities in response to market signals.

Segmentation Analysis

The Bed Legs Market is comprehensively segmented based on material, type, application, and distribution channel, providing a granular view of specific market dynamics and consumer preferences within each category. Understanding these segments is crucial for manufacturers to tailor their product development, marketing strategies, and distribution networks effectively. The segmentation highlights the divergence between mature, cost-sensitive segments (like plastic/fixed legs used in entry-level furniture) and rapidly growing, high-value segments (such as adjustable metal legs for smart beds). Material choice defines the structural properties and aesthetic value of the component, significantly impacting price point and target market, while the type segmentation, distinguishing between fixed and adjustable solutions, indicates the increasing consumer willingness to pay for functional flexibility and ergonomic benefits, which are essential considerations for modern bedding solutions.

Segmentation by application clearly delineates the differing needs of the residential, commercial (hospitality), and institutional (healthcare/dormitory) sectors. Residential consumers prioritize design aesthetics and moderate load capacity, often seeking interchangeable decorative options. In contrast, commercial and institutional buyers focus intensely on fire safety ratings, extreme durability, ease of cleaning, and high static/dynamic load-bearing capabilities, necessitating components built to industrial standards. The distribution channel segmentation, separating traditional retail from online sales, underscores the profound influence of e-commerce, which facilitates consumer access to highly specialized and niche component manufacturers globally, thereby democratizing the market for customization and high-end hardware.

- By Material:

- Wood (Hardwood, Engineered Wood, Softwood)

- Metal (Stainless Steel, Aluminum, Steel Alloys, Brass)

- Plastic/Polymer (HDPE, ABS, Composites)

- By Type:

- Fixed/Standard Legs (Straight, Tapered, Bun Feet)

- Adjustable Height Legs (Manual, Motorized/Smart)

- Caster Wheels/Rolling Legs

- By Application:

- Residential Furniture (Platform Beds, Divans)

- Commercial Furniture (Hotel, Rental Properties)

- Institutional/Healthcare Furniture (Hospitals, Assisted Living)

- By Distribution Channel:

- Online Retail/E-commerce

- Offline Channels (Hardware Stores, Specialty Furniture Component Suppliers, Direct B2B Sales)

Value Chain Analysis For Bed Legs Market

The value chain for the Bed Legs Market is intricate, beginning with upstream raw material sourcing and culminating in downstream end-user installation, characterized by distinct levels of value addition and complexity. Upstream activities involve the procurement of critical materials, such as sustainably certified hardwoods (e.g., FSC certified oak) and high-grade metal ingots (aluminum and steel). For wooden legs, this stage includes logging, drying, and preliminary processing, requiring specialized infrastructure and adherence to global environmental standards. For metal legs, it involves casting, extrusion, or forging processes. The optimization of this upstream segment is critical, as fluctuations in commodity prices and ethical sourcing requirements directly impact the final manufacturing cost and market positioning of the finished product, compelling manufacturers to form long-term supply agreements or integrate sourcing vertically to stabilize input costs and ensure traceability.

Midstream processing involves specialized manufacturing operations, including advanced CNC machining for precise wood turning and finishing, automated metal stamping, welding, and surface treatment processes such as powder coating, electroplating, or polishing to ensure durability and aesthetic appeal. This stage represents the core value addition, where raw materials are transformed into functional components adhering to strict dimensional tolerances and load-bearing specifications. Quality control and precision engineering are paramount, especially for integrated components like adjustable and smart legs, which require the integration of mechanical components and electronic sensors. Distribution channels then link these finished goods to the market, employing both direct and indirect routes. Direct sales are common in the B2B segment, where large furniture manufacturers purchase components in bulk under customized specifications. Indirect channels utilize global distributors, hardware wholesalers, and increasingly, specialized e-commerce platforms to reach smaller furniture makers and the burgeoning DIY consumer market.

Downstream activities focus on marketing, retail, and final consumer use. The rise of e-commerce has significantly altered this downstream landscape, allowing smaller, specialized component manufacturers to bypass traditional wholesalers and offer a wider variety of custom products directly to the end-user, often facilitated by robust digital catalogs and augmented reality tools for visualization. Direct distribution via B2B contracts emphasizes reliable logistics and just-in-time inventory management for major furniture assembly lines, while indirect distribution relies on efficient stocking and regional market penetration by major hardware retailers. The entire value chain is currently being optimized through digital transformation, leveraging data analytics to predict inventory needs and streamline logistics, ensuring that high-quality, customized bed legs reach both manufacturers and individual consumers efficiently and sustainably.

Bed Legs Market Potential Customers

Potential customers in the Bed Legs Market are highly diversified, ranging from large-scale furniture manufacturers and specialized contract suppliers to individual consumers engaged in furniture repair or customization projects. The primary end-users, or buyers, are major Original Equipment Manufacturers (OEMs) in the bedding and furniture industry who require millions of standardized, high-volume components for their mass-produced lines, valuing consistency, cost-effectiveness, and timely delivery. These industrial customers focus heavily on technical specifications, testing certifications (e.g., ANSI/BIFMA standards), and the ability of suppliers to handle complex logistical requirements, often necessitating direct B2B relationships and long-term supply agreements to guarantee supply security and predictable pricing throughout product cycles.

Another significant customer segment is the commercial and institutional buyer, including hotel chains, healthcare providers, and student housing developers. These buyers prioritize components that offer exceptional durability, easy maintenance, and compliance with stringent public safety regulations, such as fire retardancy and hygiene standards. For hospitality and healthcare applications, the selection often leans towards metal or robust, easily cleanable plastics, and frequently requires components that facilitate easy movement or cleaning underneath the bed structure. This segment often relies on specialized component distributors and contract furniture suppliers who can provide integrated solutions and project management expertise, demanding higher unit prices due to the specialized nature and compliance requirements of the products.

The rapidly growing consumer and small business segment, including small custom furniture workshops, interior designers, and DIY enthusiasts, forms the third critical customer base. These buyers are typically reached through online retail platforms and specialty hardware stores. They prioritize aesthetic customization, material uniqueness (e.g., exotic woods, specialized metal finishes), and ease of installation. This segment demands a broad catalog of styles, varying from minimalist metal cones to intricate, traditional wooden bun feet, often requiring detailed product information and visual aids (like 3D models or accurate dimension drawings) to facilitate their purchase decisions for repair, upgrade, or bespoke furniture creation projects, driving the growth of the aftermarket and customization segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Leggett & Platt, Hafele, Richelieu Hardware, Hettich, Sugatsune, Blum, Fastcap, Osborne Wood Products, WWHardware, EMU Group, Rotsen Furniture, IKEA (Component Division), Rockler Woodworking and Hardware, Kason Hardware, SCM Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bed Legs Market Key Technology Landscape

The technological landscape of the Bed Legs Market is rapidly evolving, driven primarily by the need for increased precision, material efficiency, and integration capabilities, moving far beyond simple carpentry and basic metal turning. Advanced Computer Numerical Control (CNC) machining and robotics are foundational, enabling manufacturers to produce complex geometries in high volumes with near-perfect consistency, which is especially crucial for ensuring that interchangeable components fit seamlessly across different bed frame models. Furthermore, the adoption of specialized surface treatment technologies, such as advanced powder coating systems and durable anodizing processes, enhances the longevity and resistance of metal legs against corrosion and abrasion, extending the product lifespan and fulfilling commercial warranty requirements. The digital twin concept is also gaining traction, allowing manufacturers to simulate stress loads and material performance virtually before physical prototyping, dramatically reducing development costs and accelerating the time-to-market for new, structurally innovative designs.

Additive Manufacturing (3D Printing) represents a disruptive force, particularly within the prototyping and customization segments. While 3D printing is not yet cost-effective for mass production of standard metal or wooden legs, it is invaluable for creating intricate plastic or composite internal components for adjustable mechanisms and for producing highly complex, stylized end caps or decorative elements that would be prohibitively expensive to manufacture using traditional methods. The ability of 3D printing to create lightweight internal lattices or honeycombs allows for material savings while maintaining structural rigidity. Simultaneously, material science innovation is yielding high-performance composites and engineered polymers that offer greater strength and vibration dampening capabilities than traditional materials, catering to the requirements of high-end adjustable and smart beds which need components that can manage integrated sensors and motor weight without transmitting noise or vibration.

The most significant emerging technology is the integration of Internet of Things (IoT) capabilities, transforming the bed leg from a static support structure into an active part of the smart home ecosystem. This includes motorized legs with embedded sensors for automatic height adjustment, monitoring environmental factors like floor stability, and even tracking occupant health metrics such as weight distribution and sleep posture, all managed via smartphone applications or voice commands. These smart legs require robust, miniaturized electronic components and reliable communication modules, demanding expertise in both hardware manufacturing and software integration. Companies focusing on these high-tech components are partnering with major smart home platforms to ensure seamless interconnectivity and establish themselves as key suppliers in the rapidly expanding smart furniture segment, thereby capturing a significant market premium.

Regional Highlights

- North America: The North American market is characterized by high consumer spending power and a strong focus on premium, customizable, and sustainable components. Demand is robust across residential sectors, fueled by frequent home remodeling activities and a persistent DIY culture, driving significant aftermarket sales for specialty hardware retailers and e-commerce platforms. The region is a pioneer in smart furniture adoption, leading the demand for electronically adjustable and IoT-integrated bed leg systems, particularly within the luxury and wellness segments. Furthermore, stringent safety and material standards, governed by regulatory bodies, ensure that manufacturers in this region prioritize high-quality materials (such as certified hardwoods and heavy-gauge steel) and superior finishing techniques, resulting in higher average selling prices compared to global averages. The presence of major furniture assembly operations and large distribution networks makes North America a critical market for component suppliers focusing on high service levels and technical compliance.

- Europe: Europe represents a mature market known for its emphasis on sophisticated design, ergonomic excellence, and strict environmental regulations. Western European countries, particularly Germany, Italy, and Scandinavia, are leaders in minimalist design trends, driving demand for hidden or sleek metal and wood legs that integrate flawlessly into modern aesthetic concepts. The market is heavily influenced by strict EU directives regarding material traceability, chemical safety, and sustainable forestry practices (FSC/PEFC certification), pushing manufacturers towards bio-based composites and fully traceable supply chains. The region also exhibits significant institutional demand from the hospitality and aging care sectors, where robust, height-adjustable, and hygienic components are mandatory. The fragmented nature of the European furniture manufacturing base means that specialized hardware distributors play a critical role in facilitating sales across various national markets, necessitating strong regional logistics networks.

- Asia Pacific (APAC): APAC is the largest and fastest-growing market globally, primarily due to its massive manufacturing base and rapidly expanding consumer demographic, especially in China, India, and Southeast Asian nations. The region serves as the global production hub for mass-market furniture, driving immense demand for cost-effective, high-volume bed legs made from standard materials like plastics, engineered wood, and entry-level steel. However, parallel growth in affluent urban centers is fueling a burgeoning demand for high-end components, imported designs, and smart adjustable features. Rapid urbanization and rising disposable incomes are consistently boosting housing starts and furniture purchases, ensuring sustained demand growth throughout the forecast period. The competitive landscape in APAC is intense, with manufacturers focusing heavily on operational efficiency, large-scale production capabilities, and competitive pricing strategies to maintain market share both domestically and in export markets.

- Latin America (LATAM): The LATAM market is characterized by moderate growth, heavily influenced by local economic stability and construction sector activity. Key markets such as Brazil and Mexico demonstrate strong potential, supported by growing domestic furniture manufacturing sectors and increasing integration into global supply chains. Demand is typically skewed towards traditional wooden components and durable, mid-range metal legs that balance cost and performance. Logistics and import tariffs often present challenges, favoring local manufacturing and regional component suppliers who can navigate complex supply chains. The expanding retail presence of international furniture brands is slowly introducing higher-specification components and driving gradual technological upgrades in local manufacturing processes, moving towards greater use of precision machinery and advanced finishing techniques to meet imported quality standards.

- Middle East and Africa (MEA): The MEA market shows heterogeneous demand, highly concentrated in the Gulf Cooperation Council (GCC) countries due to massive infrastructure projects, luxury residential construction, and booming hospitality sectors. High-end projects in the UAE and Saudi Arabia drive demand for premium, custom-made, and architecturally sophisticated bed legs, often utilizing brass, polished chrome, and exotic wood finishes. In contrast, the African segment is largely focused on durable, cost-effective, and functional components required for large-scale housing and public facilities, with local production often relying on basic materials. Market growth is heavily contingent on oil price stability and government investment in non-oil sectors, but the overall trend favors increased imports of specialized European and Asian components to meet the stringent quality and aesthetic demands of luxury development projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bed Legs Market.- Leggett & Platt

- Hafele GmbH & Co KG

- Richelieu Hardware Ltd.

- Hettich Group

- Sugatsune Kogyo Co., Ltd.

- Blum Inc.

- Fastcap, LLC

- Osborne Wood Products, Inc.

- WWHardware

- EMU Group S.p.A.

- Rotsen Furniture

- IKEA (Component Division)

- Rockler Woodworking and Hardware

- Kason Hardware Corporation

- SCM Group

- Atlas Components

- Wood Technology Inc.

- The RTA Store

- HomzMart

- O.H. Stulz, Inc.

Frequently Asked Questions

Analyze common user questions about the Bed Legs market and generate a concise list of summarized FAQs reflecting key topics and concerns.What materials are driving innovation in the bed legs market?

Innovation is primarily driven by engineered wood composites and advanced aluminum alloys, which offer superior strength-to-weight ratios and design flexibility. Sustainable and recycled polymers are also gaining traction, particularly for components requiring high hygiene standards and reduced environmental impact, such as those used in healthcare settings.

How is the rise of smart furniture affecting the demand for bed legs?

The smart furniture trend is dramatically increasing demand for complex, motorized, and sensor-integrated bed leg systems. These specialized components must accommodate electronic mechanisms, wiring harnesses, and control interfaces, shifting focus from simple structural support to advanced functional integration, thus commanding higher market prices.

What is the most critical factor influencing consumer purchase decisions for aftermarket bed legs?

For aftermarket consumers (DIY enthusiasts and customizers), aesthetic customization and ease of installation are the most critical factors. Consumers seek components that offer unique design finishes, specific height modifications for ergonomic benefits, and universal mounting solutions that simplify the upgrade process on existing furniture.

Which geographical region exhibits the highest growth potential in the next five years?

The Asia Pacific (APAC) region, specifically emerging economies like China and India, holds the highest growth potential. This is attributed to rapid urbanization, significant expansion in domestic furniture manufacturing capabilities, and rising middle-class consumer demand for diverse and accessible home furnishing components.

What are the main structural standards or certifications required for commercial bed legs?

Commercial and institutional bed legs must typically comply with rigorous structural integrity standards, such as ANSI/BIFMA for load-bearing capacity and durability, alongside regional safety standards concerning fire resistance and material toxicity. Certification ensures longevity and compliance, especially vital for hotel and healthcare procurement.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager