Bed Mattress Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437037 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Bed Mattress Market Size

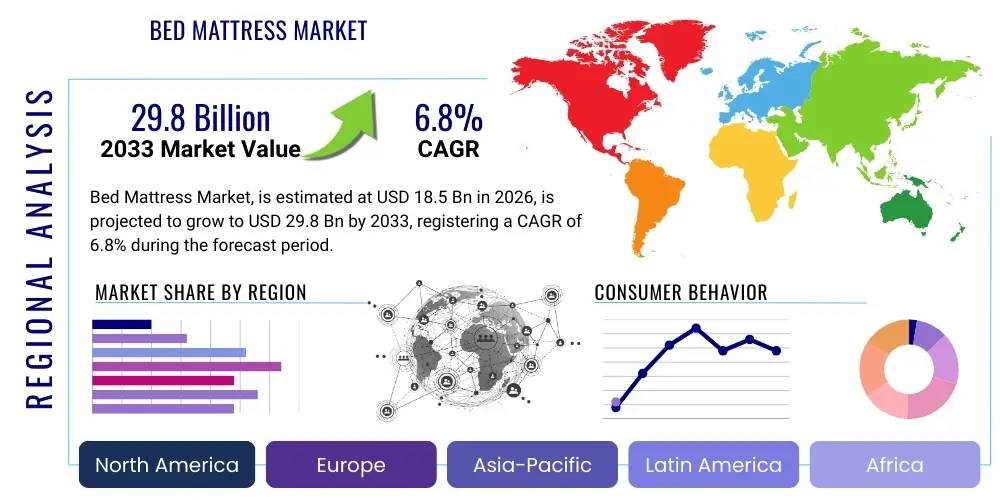

The Bed Mattress Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 29.8 Billion by the end of the forecast period in 2033.

Bed Mattress Market introduction

The global bed mattress market encompasses the manufacturing, distribution, and sale of various sleep surfaces designed to support the human body during rest. Products range widely by material, including innerspring, memory foam, latex, hybrid, and air mattresses, catering to diverse consumer needs related to comfort, orthopaedic support, temperature regulation, and price point. The fundamental purpose of a mattress is to provide a hygienic, supportive, and comfortable foundation that enhances sleep quality, directly influencing physical and mental health. This market is intrinsically linked to real estate development, hospitality sector expansion, and growing consumer awareness regarding the critical role of sleep health in overall well-being. Furthermore, the longevity and replacement cycle of these products dictate continuous demand, supplemented by technological advancements in materials science.

The evolution of the bed mattress industry is characterized by a significant shift towards specialized and premium products. Modern mattresses are no longer simple foam or coil assemblies; they often incorporate advanced cooling gels, phase change materials, adjustable firmness zones, and smart connectivity features. This innovation drive is a direct response to rising disposable incomes in emerging economies and increasing consumer willingness to invest in lifestyle products that promise measurable health benefits. The market sees major demand generation through residential consumer purchases, driven by home ownership rates, renovation cycles, and demographic changes such as new household formation. The advent of Direct-to-Consumer (DTC) brands has fundamentally reshaped the competitive landscape, offering competitive pricing, simplified purchasing experiences, and extensive trial periods, which has democratized access to high-quality sleep technology.

Major applications of bed mattresses span both the residential and commercial sectors. Residential demand is primary, covering standard beds for homes, guest rooms, and specialized uses such as adjustable beds for geriatric populations. In the commercial sphere, the hospitality industry, including hotels, resorts, and short-term rentals, represents a significant volume buyer, prioritizing durability, fire safety standards, and guest comfort ratings. Healthcare facilities, such as hospitals and nursing homes, also constitute a vital application area, requiring specialized pressure-relieving and adjustable medical mattresses. The core benefits driving market growth include improved posture support, alleviation of chronic pain, enhanced thermal regulation, and overall better restorative sleep, positioning mattresses as essential health investment rather than just a household commodity.

Bed Mattress Market Executive Summary

The global bed mattress market is experiencing robust growth fueled by several converging factors: rapid urbanization and housing growth globally, increased focus on sleep hygiene as a component of preventative healthcare, and disruptive innovation within distribution channels, notably the rise of e-commerce and mattress-in-a-box models. Key business trends indicate a strategic pivot by major manufacturers toward Hybrid and Memory Foam segment leadership, prioritizing materials that offer customizable support and temperature control. Companies are focusing heavily on brand storytelling and consumer education to justify premium pricing for advanced materials and smart features, moving away from purely commodity-based competition. Sustainability is also emerging as a pivotal competitive differentiator, with growing consumer preference for organic, natural latex, and eco-friendly manufacturing processes. Consolidation among traditional manufacturers and aggressive venture capital funding in DTC startups define the current competitive dynamics.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, driven by massive population density, rising middle-class disposable income, and increasing awareness of Western sleep standards, particularly in China and India. North America and Europe remain mature but high-value markets, characterized by frequent product replacement cycles and high adoption rates of premium and smart mattresses. The Middle East and Latin America are showing strong latent demand, influenced by booming tourism and hospitality infrastructure development. Specific segment trends show that the Residential application category dominates volume, but the Commercial sector, specifically high-end hotels, provides greater profit margins due to bulk orders and strict quality specifications. Online sales channels are steadily increasing their market share, challenging traditional brick-and-mortar retailers and necessitating an omnichannel strategy for all major market players.

The market faces operational challenges related to the volatility of petrochemical-derived raw materials (for memory foam) and lengthy, complex supply chains, which were severely tested during recent global logistics disruptions. However, opportunities abound in leveraging sensor technology for personalized sleep data and integrating mattresses into the broader smart home ecosystem. Success in this evolving environment requires brands to master seamless omnichannel distribution, deliver clear value propositions centered around personalized sleep health, and maintain agile inventory management to meet fluctuating demand. The overall outlook remains highly positive, underpinned by the fundamental, non-negotiable human need for quality sleep, making the mattress market resilient against short-term economic fluctuations.

AI Impact Analysis on Bed Mattress Market

User inquiries concerning the impact of Artificial Intelligence on the bed mattress market predominantly revolve around three critical themes: personalization in the purchasing journey, the integration of AI-driven sleep tracking technology, and the optimization of manufacturing and supply chain logistics. Consumers frequently ask how AI can recommend the perfect mattress firmness based on their body type, sleeping habits, and health data, indicating a strong desire for hyper-personalized product matching that eliminates trial-and-error. Furthermore, there is significant interest in 'smart mattresses' that use embedded sensors and machine learning algorithms to analyze sleep patterns, offer real-time adjustments (e.g., firmness, temperature), and provide actionable health insights. On the business side, manufacturers are keenly exploring how AI can predict demand fluctuations, optimize raw material stocking, and improve factory throughput, reducing waste and lead times in a traditionally slow-moving industry. The core expectation is that AI will move mattresses from passive household items to active, data-generating health devices, fundamentally shifting the value proposition.

AI's initial influence is most evident in the retail and customer service space. Chatbots and AI-powered recommendation engines on DTC websites guide customers through complex purchasing decisions by analyzing thousands of data points—from body mass index and preferred sleeping position to common pain points and previous mattress satisfaction levels—to suggest an ideal product match. This sophisticated data analytics capability drastically reduces return rates, a significant cost factor in the 'mattress-in-a-box' model. By creating highly accurate predictive models, companies can tailor marketing campaigns to individual consumer segments, enhancing ad efficiency and brand recall. This retail layer integration allows smaller, nimble brands to compete effectively against established giants by offering a superior, data-backed consultative sales experience.

In the product development and manufacturing domain, AI is instrumental in material science innovation and operational efficiency. Machine learning is used to analyze feedback from physical sensor data, allowing R&D teams to quickly prototype and refine foam densities, coil configurations, and ergonomic designs for optimal pressure distribution. Furthermore, in the factory, AI optimizes the cutting and assembly processes for different components, minimizing material waste (especially expensive memory foam) and streamlining production lines. Predictive maintenance algorithms monitor machinery health, ensuring minimal downtime and consistent quality output. The long-term vision involves fully adaptive mattresses where embedded AI dynamically adjusts internal components, such as air chambers or micro-coils, throughout the night in response to the user's changing sleep stage and body position, truly merging comfort with continuous health monitoring.

- AI powers personalized product recommendation engines, significantly reducing return rates and enhancing customer satisfaction.

- Integration of machine learning algorithms enables sophisticated, real-time sleep tracking and analysis through smart mattresses.

- AI optimizes supply chain management and predictive demand forecasting, improving inventory efficiency and reducing warehousing costs.

- Generative AI assists in designing new material compositions and ergonomic structures based on large datasets of user physiological responses.

- Automated quality control systems utilize computer vision to detect manufacturing defects in real time, ensuring high product consistency.

- AI facilitates dynamic pricing strategies and highly targeted marketing campaigns based on analyzed consumer behavioral data.

DRO & Impact Forces Of Bed Mattress Market

The Bed Mattress Market's trajectory is primarily driven by mounting consumer awareness regarding the health implications of poor sleep and the pervasive penetration of digital commerce channels that have simplified product access. The central driver is the global acknowledgment of sleep quality as a key determinant of overall health and productivity, motivating consumers to invest in premium, high-performance sleep systems. This driver is supported by continuous innovation in material technology, particularly hybrid and cooling gels, which solve traditional comfort issues like heat retention. Conversely, the market is restrained by the relatively long replacement cycle of mattresses (typically 7–10 years) and the high capital investment required for new manufacturing facilities that comply with stringent fire safety and environmental regulations. Opportunities lie in the burgeoning market for specialized products tailored for specific demographics, such as orthopaedic mattresses for the elderly or hypoallergenic materials for allergy sufferers, alongside the expansion of the hospitality and medical sectors in emerging economies. These forces collectively create a dynamic competitive environment where technological agility and strategic brand positioning are paramount for market penetration and sustained growth.

A significant impact force reshaping the market structure is the democratization of sales through the Direct-to-Consumer (DTC) model. This shift has drastically lowered the barrier to entry for innovative startups, leading to increased competition and forcing established legacy brands to overhaul their distribution and marketing strategies. The transparency offered by DTC brands regarding materials, sourcing, and pricing has increased consumer expectations for value and quality. This movement has also amplified the importance of robust post-purchase support and generous return policies, creating a new standard for customer service across the entire industry. The rising cost and volatility of raw materials, particularly petroleum-based polyols used in traditional foams, present a constant threat to manufacturing margins, pushing companies towards alternative, sustainable, or plant-derived materials, which itself becomes an opportunity for green-focused market positioning.

Furthermore, globalization and trade policies act as critical external forces. Tariffs and international trade agreements influence the profitability of sourcing materials and exporting finished products, especially between major manufacturing hubs in Asia and consumption markets in North America and Europe. Socio-cultural factors, such as changing home sizes due to urbanization, influence preferences towards smaller or multi-functional mattresses (e.g., futons or sofa beds in high-density areas), while increased discretionary spending in developing nations drives demand for higher-end queen and king sizes. Successfully navigating these forces requires manufacturers to adopt flexible, regionalized supply chains and invest heavily in patented technologies that offer distinct, defensible advantages over generic commodity products, ensuring that innovation remains the primary engine for overcoming market friction and achieving superior growth rates.

Segmentation Analysis

The bed mattress market is primarily segmented based on material type, product type, application, and distribution channel, reflecting the varied needs and preferences of the global consumer base. Material segmentation is crucial, distinguishing between traditional Innerspring mattresses, the highly popular Memory Foam variants, natural Latex products, and increasingly dominant Hybrid mattresses which combine foam layers with coil systems for optimal support and comfort. Product type segmentation typically differentiates between standard beds, airbeds, waterbeds, and specialized medical mattresses. Application analysis delineates the market into Residential use, which accounts for the vast majority of volume, and Commercial use, encompassing hotels, hospitals, and institutional settings. The rapidly evolving distribution channel segmentation contrasts traditional sales (brick-and-mortar stores, department stores) with modern e-commerce platforms and brand-owned online portals, which are driving market expansion through convenience and competitive pricing. Understanding these segmented demands is essential for manufacturers seeking to tailor their product portfolios and marketing efforts effectively across different geographical and demographic landscapes.

The dominance of the Residential application segment continues to anchor market volume, driven by demographic growth, housing market activity, and the typical replacement cycle. Within this segment, Hybrid mattresses are gaining significant traction, particularly in mature markets like North America and Western Europe, as they offer the best attributes of both coil systems (support and breathability) and foam layers (pressure relief). These premium offerings appeal to consumers seeking an optimal blend of comfort and durability, justifying their higher price points. Conversely, the Commercial application sector, while smaller in volume, demands exceptional durability, fire retardancy, and standardized sizes, making it a lucrative target for B2B specialists who can handle large, recurring procurement contracts, often requiring specialized certifications and bulk supply capabilities.

Distribution channel dynamics are fundamentally shifting the market structure. The Online/E-commerce segment has exhibited explosive growth, largely due to the successful marketing of the 'mattress-in-a-box' concept, which leverages vacuum compression technology to simplify logistics and consumer handling. This channel offers transparency, extensive product reviews, and consumer-friendly return policies, attracting younger, digitally native buyers. Traditional channels, while losing share, remain critical for consumers who prefer to physically test mattresses before purchase, particularly in the premium segment or among older demographics. Manufacturers are increasingly adopting an integrated omnichannel strategy, using physical showrooms to drive online sales and vice versa, recognizing that consumer journeys often involve both digital research and in-person trials before commitment.

- By Material Type:

- Memory Foam

- Innerspring

- Latex

- Hybrid

- Others (Airbeds, Waterbeds)

- By Product Type:

- Standard Mattress

- Air Mattress

- Water Bed

- Medical Mattress

- By Application:

- Residential

- Commercial (Hotels, Hospitals, Institutions)

- By Distribution Channel:

- Offline (Specialty Stores, Furniture Stores, Department Stores)

- Online (E-commerce Platforms, Company Websites)

Value Chain Analysis For Bed Mattress Market

The bed mattress value chain begins with upstream activities involving raw material procurement, which is a critical determinant of product cost and quality. Key raw materials include steel wires for innerspring coils, petrochemical derivatives like polyols and isocyanates for polyurethane and memory foams, natural or synthetic latex derived from rubber trees, and various fabrics (cotton, polyester, Tencel) for covers and upholstery. Upstream analysis focuses on managing commodity price volatility and ensuring sustainable sourcing practices. Manufacturers must secure reliable supply contracts, often engaging in backward integration or long-term partnerships with chemical and textile suppliers to mitigate risks. The manufacturing stage is complex, involving foam pouring, coil assembly, quilting, cutting, and final assembly, requiring specialized machinery and compliance with stringent fire safety regulations (e.g., CFR 1633 in the US). Efficiency in the manufacturing process, particularly minimizing scrap material in foam cutting, is vital for maintaining competitive pricing and high margins in a volume-driven market.

Downstream analysis focuses heavily on sales, distribution, and post-sales service, where the most significant market shifts have occurred in recent years. The distribution channel is bifurcated into direct and indirect methods. Indirect distribution traditionally relied on a vast network of physical retailers, furniture stores, and specialty mattress outlets, incurring high inventory costs and requiring significant floor space. This model allowed consumers to physically test products but often added significant markups. Direct distribution, primarily through e-commerce and brand-owned websites (DTC), bypasses intermediaries, leading to reduced pricing for consumers and greater margin control for manufacturers. The success of the DTC model hinges on efficient logistics for shipping compressed, boxed mattresses and managing the reverse logistics of returns, which must be handled smoothly to maintain brand reputation. This shift has necessitated substantial investment in logistics partnerships and warehousing capabilities.

The ultimate success of a mattress brand in the current market depends on optimizing the integration between manufacturing efficiency and distribution agility. Direct channels offer unparalleled opportunities for consumer data collection, which feeds back into R&D and marketing strategies, creating a virtuous cycle of product improvement and targeted sales. However, indirect channels remain important for reaching demographics less comfortable with online purchasing and for providing a physical touchpoint for high-end luxury brands. Ensuring seamless coordination between manufacturing schedules, distribution centers, and last-mile delivery partners is paramount. Value addition throughout the chain is increasingly focused on intangible assets such as brand perception, warranty assurance, and customer service quality, elevating the product from a mere commodity to a specialized wellness investment, thus justifying premium pricing and sustained consumer loyalty.

Bed Mattress Market Potential Customers

Potential customers for the bed mattress market are broadly categorized into Residential Consumers and Commercial/Institutional Buyers, each driven by distinct purchasing criteria and volume requirements. Residential consumers, who represent the largest volume segment, are segmented further based on demographics, lifestyle, and income levels. Key consumer groups include Millennials and Gen Z establishing new households, who are highly receptive to the convenience and value proposition of DTC, e-commerce brands, often prioritizing hybrid and specialized foam options. This group heavily utilizes online research, values transparency, and often seeks mattresses with smart technology integration. Another crucial segment is the affluent consumer base (Gen X and Baby Boomers) in mature markets, who prioritize luxury, brand reputation, premium materials (such as natural latex and high-end springs), and comprehensive warranty packages, often preferring to purchase through established physical retailers to ensure personalized consultation and high-touch service. Additionally, individuals seeking health and wellness benefits, such as orthopaedic support for chronic back pain, form a targeted segment driven by medical recommendations and specialized product features.

Commercial potential customers encompass entities that purchase mattresses in bulk for institutional use, demanding high durability, consistent quality, and strict adherence to commercial safety standards, particularly concerning fire resistance. The hospitality sector, including global hotel chains, boutique resorts, and burgeoning short-term rental operators (like high-volume Airbnb hosts), represents a primary commercial buyer. These buyers prioritize mattresses that offer universal comfort appealing to a wide range of guests, withstand rigorous cleaning protocols, and maintain structural integrity over intensive use cycles. The growth of global tourism directly correlates with demand in this sector, requiring large-scale contracts and reliable global supply chains. Furthermore, healthcare facilities—hospitals, rehabilitation centers, and elderly care homes—form a specialized commercial segment requiring medical-grade mattresses. These products must offer pressure redistribution capabilities to prevent bedsores, ease of cleaning for hygiene control, and often integrate adjustable positioning features, requiring specialized certification and material compositions.

A rapidly expanding segment of potential customers includes specialized institutions such as military barracks, student dormitories, and government housing projects, which demand extreme durability and cost-effectiveness. These contracts often involve government tenders and prioritize longevity over luxury features. For all potential customers, the purchasing decision is increasingly influenced by environmental, social, and governance (ESG) factors. Buyers, both commercial and residential, are showing growing preference for products that utilize sustainably sourced materials, have low Volatile Organic Compound (VOC) emissions, and are manufactured using ethical labor practices. Therefore, manufacturers that clearly communicate their sustainability credentials and provide robust product certifications are better positioned to capture market share across all these diverse customer segments. Successfully addressing these varied requirements necessitates a multi-tiered product strategy, offering basic, mid-range, and premium tiers tailored to specific end-user needs and budgetary constraints.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 29.8 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Serta Simmons Bedding, Tempur Sealy International, Paramount Sleep, King Koil, Relyon Beds, Spring Air International, Corsicana Mattress, Select Comfort (Sleep Number), Kurlon, Emma Sleep, Saatva, Purple, Casper Sleep, Leesa Sleep, IKEA, Hilding Anders, Restonic, Southerland, McRoskey Mattress, Therapedic International |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bed Mattress Market Key Technology Landscape

The technological landscape of the bed mattress market is rapidly evolving beyond simple spring and foam construction, driven primarily by innovations in material science, sensor integration, and manufacturing efficiency. Key material advancements include the development of advanced phase change materials (PCMs) and specialized cooling gel infusions embedded in foams, which are engineered to absorb and release heat, actively regulating the microclimate of the sleep surface. This addresses the traditional drawback of memory foam—heat retention—and significantly enhances comfort, particularly in warmer climates. Furthermore, the proliferation of hybrid construction, combining pocketed micro-coils with layers of responsive foam or latex, allows for superior zonal support, minimizing motion transfer while providing the buoyancy often lacking in pure foam mattresses. These material innovations are pivotal in supporting premium pricing and differentiating products in a crowded market.

The most disruptive technological trend is the integration of ‘smart’ technology, transforming passive sleep surfaces into active health monitoring devices. Smart mattresses utilize embedded non-invasive sensors (piezoelectric, optical, or capacitive) to track vital statistics such as heart rate, respiratory rate, movement, and sleep stages (REM, deep, light). This data is processed by onboard microprocessors and AI algorithms to provide personalized sleep scores and actionable recommendations via connected smartphone applications. Some high-end smart mattresses further incorporate dynamic features, such as inflatable air chambers that automatically adjust firmness or integrated heating/cooling elements that respond to environmental changes or the user’s monitored body temperature fluctuations. This technological sophistication positions mattresses as part of the broader Internet of Things (IoT) ecosystem within the home, appealing heavily to health-conscious consumers and technology enthusiasts.

Manufacturing technologies are also undergoing transformation. Advanced robotic cutting systems ensure precision and reduce waste in foam block conversion, especially crucial for complex contoured designs found in orthopaedic mattresses. Furthermore, advancements in compression and packaging technology (the 'mattress-in-a-box' model) have revolutionized logistics and reduced shipping costs, directly impacting the profitability of DTC brands. New bio-based and sustainable chemical formulations, such as those utilizing plant-derived polyols or rapidly renewable materials, are also prominent, addressing both environmental concerns and increasingly stringent consumer demand for non-toxic, low Volatile Organic Compound (VOC) certified products. This commitment to 'green' technology requires significant R&D investment but offers a distinct competitive edge in the mature Western markets.

Regional Highlights

- Asia Pacific (APAC): APAC is forecasted to be the fastest-growing region, driven by massive urbanization, rising middle-class disposable incomes, and increasing health consciousness, particularly in India and China. The rapid expansion of the hospitality and real estate sectors creates substantial commercial demand. Furthermore, the shift from traditional sleeping mats to modern Western-style mattresses is accelerating, fueling high volume growth. Local manufacturers are rapidly adopting advanced technology, often collaborating with international brands to meet evolving quality standards, while the region’s large population base supports the high demand for cost-effective, durable products.

- North America: North America is the dominant market in terms of value and technological maturity. The region has the highest penetration of premium, hybrid, and smart mattresses. High consumer awareness regarding sleep disorders and a cultural willingness to invest in wellness products underpin consistent demand. The market is highly competitive, dominated by established multinational corporations and innovative DTC brands like Saatva and Purple. Stringent fire safety regulations (like 16 CFR 1633) necessitate continuous material and manufacturing innovation, ensuring a high barrier to entry but also high product quality.

- Europe: Europe is a mature market characterized by diverse national preferences and a strong emphasis on sustainability and material quality. Germany, the UK, and France are major contributors, exhibiting strong demand for eco-friendly products, such as natural latex and organic certified foams. The market is fragmented, with strong regional players alongside major international brands. Consumer focus on long-term durability and orthopaedic features drives the demand for high-quality, specialized products, often leading to slower adoption of the cheapest 'mattress-in-a-box' models compared to North America.

- Latin America (LATAM): The LATAM market is poised for strong growth, albeit starting from a lower base compared to North America and Europe. Economic stabilization in key markets like Brazil and Mexico, coupled with increasing infrastructure investment in tourism, drives both residential and commercial demand. Price sensitivity remains high, favoring locally produced innerspring and basic foam mattresses, but demand for premium imports and international brands is growing among the burgeoning affluent population, particularly in urban centers.

- Middle East and Africa (MEA): MEA growth is heavily reliant on massive governmental infrastructure projects and expansion in the luxury hospitality sector across the Gulf Cooperation Council (GCC) countries. The demand here is skewed towards large, luxury mattresses for five-star hotels and high-end residential real estate. Africa, while offering immense long-term potential due to population growth, currently focuses primarily on basic, budget-friendly foam mattresses, requiring localized production and distribution strategies to penetrate the highly segmented consumer base effectively.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bed Mattress Market.- Serta Simmons Bedding, LLC

- Tempur Sealy International, Inc.

- Paramount Sleep Company

- King Koil Licensing Company, Inc.

- Relyon Beds Limited

- Spring Air International

- Corsicana Mattress Company

- Select Comfort Corporation (Sleep Number)

- Kurlon Enterprise Limited

- Hilding Anders International AB

- Emma Sleep GmbH

- Saatva, Inc.

- Purple Innovation, Inc.

- Casper Sleep, Inc.

- Leesa Sleep, LLC

- Restonic Mattress Corporation

- Southerland, Inc.

- McRoskey Mattress Company

- Therapedic International

- Auping B.V.

Frequently Asked Questions

Analyze common user questions about the Bed Mattress market and generate a concise list of summarized FAQs reflecting key topics and concerns.What material type currently dominates the global bed mattress market?

Hybrid mattresses are rapidly gaining market share due to their ability to combine the pressure relief of foam (like memory foam or latex) with the robust support and breathability of innerspring coils. However, traditional innerspring mattresses still hold significant volume, particularly in developing economies and budget segments, while memory foam remains strong in the specialty segment.

How is the rise of e-commerce impacting traditional mattress retailers?

E-commerce, driven by the 'mattress-in-a-box' model, significantly disrupts traditional brick-and-mortar sales by offering lower prices, greater transparency, and generous home trial periods. This forces traditional retailers to adopt an omnichannel strategy, focusing on providing essential physical try-out experiences and enhanced customer consultation to retain relevance.

What is the primary driving force behind the growth of the premium mattress segment?

The primary driver is the increasing consumer awareness linking quality sleep directly to long-term health and well-being. This shift views the mattress not merely as furniture, but as a crucial health investment, driving demand for specialized features like cooling technology, orthopaedic support, and smart monitoring capabilities, justifying higher price points.

What is a 'Smart Mattress' and why is this technology important?

A smart mattress integrates non-invasive sensors and AI algorithms to actively monitor sleep metrics, heart rate, and respiration. This technology is important as it offers personalized data insights and, in advanced models, dynamic firmness or temperature adjustments, positioning the mattress as an active component of the smart home health ecosystem.

Which geographical region offers the highest growth potential for the bed mattress industry?

The Asia Pacific (APAC) region offers the highest growth potential. This is primarily fueled by rapid urbanization, significant growth in disposable incomes across countries like China and India, and expanding infrastructure in the residential and commercial (hotel) sectors, leading to a substantial increase in demand for modern bedding solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Bed Mattress Market Size Report By Type (Innerspring Mattress, Foam Mattress, Latex Mattress, Others), By Application (Private Households, Hotels, Hospitals, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Bed Mattress Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Innerspring Mattress, Foam Mattress, Latex Mattress), By Application (Private Households, Hotels, Hospitals), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager