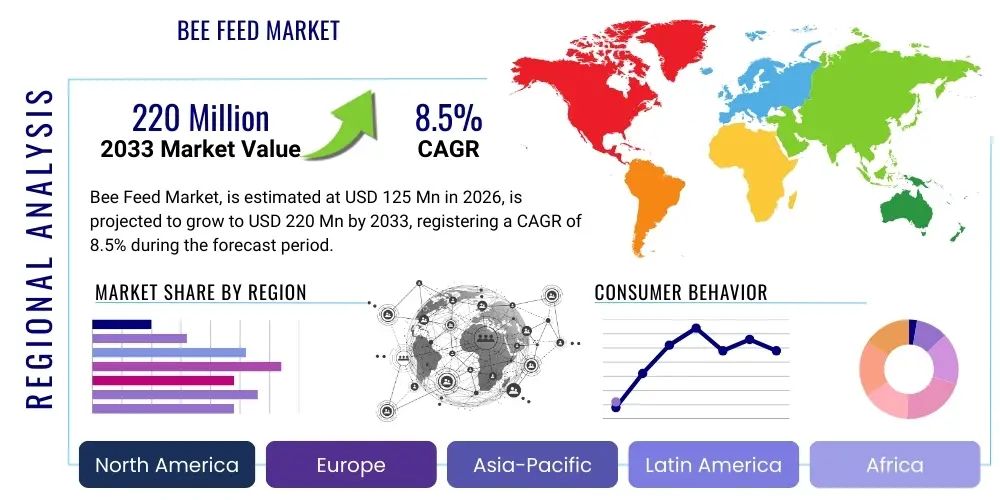

Bee Feed Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437528 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Bee Feed Market Size

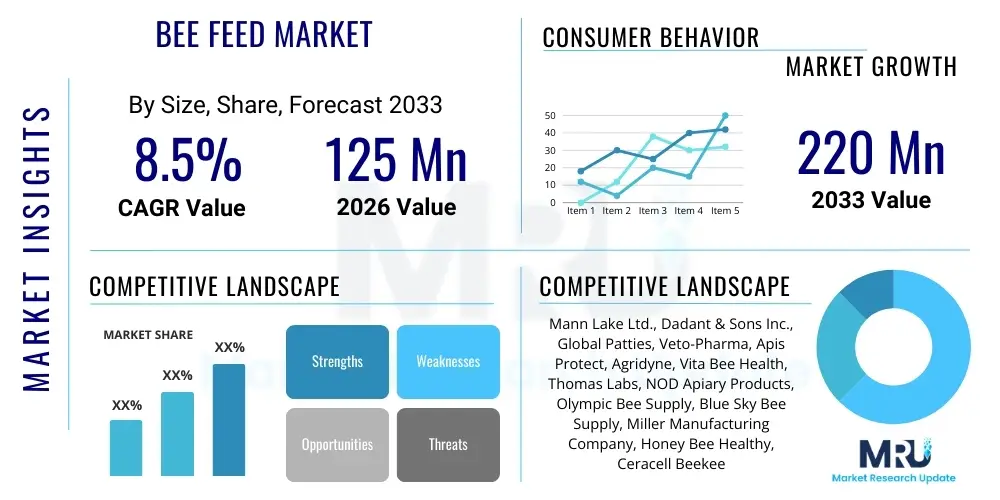

The Bee Feed Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $125 Million in 2026 and is projected to reach $220 Million by the end of the forecast period in 2033. This robust growth trajectory is primarily driven by increasing awareness regarding the importance of apiary health management, coupled with the global decline in natural forage sources resulting from intensive agricultural practices and climate change. Furthermore, the commercial necessity of maintaining strong, productive colonies for pollination services, particularly in industrialized agricultural economies, significantly contributes to the sustained demand for high-quality nutritional supplements and specialized feeds designed to mimic natural pollen and nectar sources.

Bee Feed Market introduction

The Bee Feed Market encompasses a range of nutritional products engineered to supplement or replace the natural diet of honey bees, providing essential proteins, carbohydrates, lipids, and micronutrients necessary for colony maintenance, growth, and immune function. These products, which include specialized pollen substitutes (protein sources) and various sugar syrups (carbohydrate sources), are critical tools utilized by beekeepers to manage nutritional stress during periods of environmental dearth, adverse weather conditions, or intensive migratory pollination cycles. Major applications involve stimulating brood rearing, bolstering colony strength before major nectar flows, and ensuring overwintering success, thereby directly impacting agricultural yield quality and quantity through improved pollination efficiency across a variety of crops, including fruits, nuts, and vegetables.

The primary benefit of utilizing formulated bee feed lies in its ability to mitigate nutritional deficiencies that lead to suppressed immune systems, reduced lifespan, and increased susceptibility to pests and pathogens such as Varroa mites and American Foulbrood. Driving factors fueling market expansion include the escalating global demand for crop pollination services, the observable impact of climate variability on natural floral resources, and the corresponding necessity for beekeepers to strategically manage colony nutrition to stabilize bee populations. Additionally, advancements in nutritional science have led to the development of highly palatable and bioavailable feeds, optimizing their absorption and effectiveness, thereby positioning bee feeding as an indispensable component of modern apicultural practices globally.

Product descriptions typically categorize bee feed based on its primary nutritional component: carbohydrate feeds, which are usually high-fructose corn syrup, sucrose syrup, or dry granulated sugar, provide immediate energy; and protein feeds, often formulated from soy flour, yeast, and various nutrient blends, which support larval development and adult bee health. The critical intersection of these applications and the necessity for sustainable agricultural production ensures that the Bee Feed Market remains dynamic, focusing heavily on research and development to create feeds that maximize colony viability and reduce reliance on inconsistent natural floral resources.

Bee Feed Market Executive Summary

The Bee Feed Market is characterized by robust commercial trends emphasizing the development of highly specialized, functional feeds that address specific nutritional deficits arising from environmental degradation and modern agricultural monoculture. Business trends indicate a strong move toward functional ingredients, including probiotics, prebiotics, and specific micronutrient packages designed to enhance bee gut health and boost resistance to common diseases. Regionally, North America and Europe currently represent the largest revenue share due to high levels of commercial beekeeping and advanced regulatory frameworks prioritizing bee health, yet the Asia Pacific region is demonstrating the highest growth trajectory, fueled by rapid expansion of pollination-dependent agriculture in countries such as India and China. Segment-wise, the Pollen Substitute segment holds significant importance, driven by the critical need for protein during early spring and late autumn dearth periods, while liquid feed formats are preferred by large commercial operators for ease of application and scale, further solidifying the market’s trajectory toward scientific precision in nutritional management.

Key strategic shifts observed across the competitive landscape include consolidation among major ingredient suppliers and increased focus on traceable, non-GMO, and organic feed options, responding directly to consumer preference and regulatory pressures in end-use markets. The market’s resilience is underpinned by the essential role of bees in global food security, making investment in high-quality nutritional support a necessity rather than a discretionary expense for beekeepers. This necessity dictates consistent demand, even amid macroeconomic fluctuations. The emphasis on sustainability and minimizing environmental impact also influences product innovation, prompting the industry to research novel, locally sourced protein alternatives and sustainable carbohydrate sources that reduce the carbon footprint associated with feed production and distribution.

Furthermore, segmentation trends highlight the increasing diversification of products tailored for specific phases of the colony cycle—for example, winter patties formulated for slow, consistent energy release versus high-protein liquids aimed at rapid spring buildup. This tailored approach optimizes resource allocation and minimizes waste, appealing to professional beekeepers focused on maximizing operational efficiency. The confluence of these business, regional, and segment dynamics suggests a future where bee feed is increasingly sophisticated, integrated into smart apiary management systems, and recognized as a critical factor in ensuring global agricultural stability and ecosystem health, driving the market toward achieving its projected valuation by 2033.

AI Impact Analysis on Bee Feed Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Bee Feed Market predominantly center on how technology can optimize nutritional delivery, improve disease surveillance, and streamline supply chains for better ingredient management. Common questions explore AI’s capacity to predict colony health based on environmental and physiological data, determine optimal feed formulations customized to local floral resources and stress levels, and automate precision feeding systems. Key user themes reveal expectations that AI will transition bee feeding from a generalized supplemental activity to a data-driven, precise nutritional intervention, reducing feed wastage and enhancing the cost-effectiveness of large-scale beekeeping operations. The summary of user concerns suggests that while AI promises substantial benefits in efficiency and health monitoring, integration challenges, data privacy concerns regarding apiary monitoring systems, and the initial high capital expenditure required for sophisticated AI-powered feeders remain significant discussion points requiring resolution before widespread adoption.

- AI-powered predictive analytics enable beekeepers to forecast periods of nutritional dearth based on climate patterns and historical floral data, optimizing the timing and quantity of supplemental feeding.

- Machine learning algorithms analyze bee population metrics, honey production, and physiological stress markers to recommend customized feed formulations (protein-to-carbohydrate ratios, micronutrient supplements) for specific colony needs.

- Precision feeding systems integrated with AI monitor individual hive weight and consumption rates, automating the delivery of exact feed quantities, thereby minimizing waste and labor costs in commercial apiaries.

- AI facilitates rapid diagnosis of colony diseases (e.g., Nosema, viral infections) by analyzing audio, visual, and sensor data, allowing for immediate nutritional adjustments to boost bee immune response through targeted feed supplements.

- Optimization of the bee feed supply chain using AI for forecasting demand and managing inventory of raw materials (soy, yeast, sugars) ensures ingredient freshness and stability, contributing to higher feed quality and market resilience.

DRO & Impact Forces Of Bee Feed Market

The Bee Feed Market dynamics are governed by powerful environmental and economic forces, where the increasing severity of colony collapse disorder (CCD) and general bee mortality necessitates proactive nutritional management (Driver). However, the market faces significant restraints, including the fluctuating prices and supply volatility of key raw ingredients, such as soy protein and specific sugars, alongside a lack of global standardization in nutritional requirements and feed quality verification, which impacts consumer trust and market penetration. Opportunities abound in the development of novel, highly specialized protein substitutes derived from sustainable sources like algae or insect protein, offering superior nutritional profiles and addressing supply chain risks associated with traditional agricultural inputs. These dynamics create a strong impact force, compelling the industry towards innovation in product efficacy and sustainability, ultimately supporting the global agricultural ecosystem by ensuring the viability of commercial pollinators.

Drivers: A primary driver is the accelerating decline in natural biodiversity and forage availability globally, primarily due to expanding monoculture farming practices and extensive pesticide use, which makes supplemental feeding essential for colony survival outside of peak flowering seasons. Furthermore, the commercial beekeeping sector, driven by high demand for contract pollination services in high-value crops like almonds and blueberries, requires exceptionally strong and healthy colonies, necessitating reliable, high-quality formulated feeds for rapid population buildup and sustained performance. The growing scientific understanding of bee nutrition and its direct link to disease resistance also fuels the demand for advanced, nutrient-fortified products that go beyond simple carbohydrate replacement.

Restraints: The market faces considerable restraints concerning the cost structure of specialized protein feeds, which can be prohibitive for small and mid-sized beekeeping operations, thereby limiting broader market adoption. Regulatory complexity regarding veterinary products and feed supplements across different jurisdictions creates barriers for international trade and standardization, hindering streamlined global market growth. Additionally, traditional beekeepers often rely on cheaper, homemade sugar syrups, perceiving commercial feeds as overly expensive or unnecessary, which represents a persistent behavioral hurdle that requires sustained educational outreach and demonstration of commercial feed efficacy.

Opportunities: Significant market opportunities exist in capitalizing on the trend towards organic and natural apiculture, driving the demand for organically certified bee feeds and non-GMO ingredients, aligning with consumer demand for sustainable food production. Technological integration, particularly through smart apiary systems, offers opportunities for precision feeding tailored to real-time colony needs, maximizing nutritional impact while minimizing resource waste. Moreover, substantial scope exists for developing region-specific formulations that utilize locally abundant, sustainable protein sources (e.g., regional plant extracts, novel protein sources), reducing logistics costs and enhancing the nutritional relevance of the feed for endemic bee populations.

Segmentation Analysis

The Bee Feed Market is systematically segmented based on Product Type, Form, Application, and Distribution Channel, allowing for detailed strategic analysis of specific market niches and consumer behaviors. Segmentation by Product Type is crucial, as it differentiates between the energy-providing carbohydrate feeds and the growth-sustaining protein feeds, reflecting different nutritional needs throughout the bee lifecycle. The Form segmentation, distinguishing between liquid, solid, and powder formats, dictates handling, storage requirements, and suitability for various scales of operation, with large commercial beekeepers often preferring liquid solutions for automated distribution. Application segmentation splits the market between commercial apiculture, which drives the bulk volume, and backyard/hobbyist beekeeping, which often focuses on premium, easy-to-use packages, while the distribution channel highlights the importance of specialized agricultural supply stores versus direct sales models.

Understanding these segments provides clarity on market demand dynamics; for instance, the dominance of the commercial segment reflects the reliance of modern agriculture on managed pollination services, ensuring sustained volume demand. Conversely, the growth in the backyard segment signals increasing interest in local food production and conservation efforts, favoring smaller, value-added packaging. Analyzing the interplay between Product Type and Distribution Channel, it becomes evident that high-volume sugar syrups are often distributed directly or through specialized bulk distributors, whereas specialized protein patties may rely more heavily on veterinary or apicultural advisory channels where technical guidance is also provided to the end-user. This layered segmentation analysis is fundamental to developing targeted marketing strategies and optimizing supply chain logistics within the market.

The market’s intrinsic dependence on agricultural cycles and seasonal variations means that segment performance is not static; for example, demand for protein patties peaks in early spring to stimulate colony build-up, while carbohydrate syrup demand surges during late fall for winter preparation. Therefore, a comprehensive segmentation strategy enables manufacturers to accurately forecast demand fluctuations and allocate resources effectively across different geographical markets and end-user types. The increasing complexity of feed formulations, incorporating specific vitamins, minerals, and natural immunity boosters, is leading to further sub-segmentation within the protein substitute category, targeting specific nutritional deficiencies or regional health challenges, ensuring continued innovation and differentiation within the competitive landscape.

- By Product Type:

- Pollen Substitutes (Protein Feeds)

- Sugar Syrups (Carbohydrate Feeds)

- Supplements (Vitamins, Minerals, Probiotics, Prebiotics)

- By Form:

- Liquid (Syrups and Solutions)

- Solid/Semi-Solid (Patties and Cakes)

- Powder/Dry Mixes

- By Application:

- Commercial Beekeeping

- Hobbyist/Backyard Beekeeping

- Research & Development Institutions

- By Distribution Channel:

- Specialty Agricultural Stores (Apicultural Supply Shops)

- Online Retail

- Direct Sales (Bulk Contracts)

- Veterinary Channels

Value Chain Analysis For Bee Feed Market

The value chain for the Bee Feed Market begins with the sourcing and procurement of primary raw materials (Upstream Analysis), predominantly consisting of high-quality proteins such as yeast and soy derivatives, and carbohydrate sources like sucrose and high-fructose corn syrup, alongside specialized micronutrients. This upstream phase is critical, as the quality and purity of these agricultural commodities directly determine the efficacy and safety of the final feed product, requiring stringent quality control and sustainable sourcing practices. The subsequent phase involves complex manufacturing and blending processes, where ingredients are formulated into stable, palatable, and nutritious products (patties, liquid syrups, or powders) through specialized food processing techniques designed to enhance shelf life and bioavailability, incurring significant operational costs related to sterilization and packaging.

The distribution network plays a vital role in connecting manufacturers to beekeepers, utilizing both direct and indirect channels. Direct sales are common for large commercial contracts, often involving bulk liquid deliveries, ensuring customized supply agreements and favorable pricing. Indirect distribution relies heavily on specialized agricultural input retailers, beekeeping supply houses, and, increasingly, e-commerce platforms, offering convenience and smaller package sizes catering to the substantial backyard beekeeping segment. Downstream activities involve the actual utilization of the feed by beekeepers (End-User/Buyers), focusing on strategic feeding practices throughout the seasonal cycle to maximize colony health and pollination services, ultimately linking the value chain output to the global food system through improved agricultural yields.

The efficiency of this value chain is continuously being enhanced through vertical integration, particularly among large feed manufacturers who seek to secure stable supply of volatile raw ingredients. The increasing role of technology, including digital platforms for inventory management and direct-to-consumer sales, optimizes the efficiency of the distribution channel, reducing lead times and ensuring product freshness. Ultimately, the successful execution of the Bee Feed value chain depends on collaboration between ingredient suppliers, specialized feed formulators, and distributors who provide necessary technical support and training to beekeepers, thereby ensuring that the specialized nutritional needs of honey bees are consistently met across varied global climatic and agricultural environments.

Bee Feed Market Potential Customers

The potential customers and primary end-users of the Bee Feed Market are diverse but predominantly centered around entities engaged in apiculture, ranging from large-scale commercial operators providing managed pollination services to small hobbyist beekeepers focused on local honey production and environmental conservation. Commercial beekeepers represent the largest volume segment, as their business viability is intrinsically linked to maintaining thousands of strong, healthy colonies that require consistent and substantial supplemental feeding during times of stress or preparation for migratory pollination contracts, such as the almond bloom in North America. These professional users prioritize cost-effectiveness, consistency in nutritional content, and ease of bulk application, driving demand for liquid syrups and large-format protein patties formulated for high efficacy and stability.

A rapidly growing customer base includes government-sponsored research institutions, agricultural universities, and private biological research facilities that utilize bee colonies for scientific studies related to crop science, toxicology, and entomology. These customers require highly specific, standardized, and often laboratory-grade feeds to ensure controlled variables in their experimental setups, placing a premium on purity and verifiable nutritional consistency. Furthermore, the burgeoning segment of hobbyist and sustainable beekeepers, driven by environmental consciousness and a desire for local food systems, constitutes a key customer group focused on premium, often organic or non-GMO, smaller-packaged feed supplements, often purchased through online or specialized local supply stores.

Finally, agricultural corporations that directly rely on robust local bee populations for fruit and vegetable cultivation are emerging as indirect customers. While they may not purchase the feed directly, they often subsidize or contract beekeeping services that mandate the use of high-quality supplementary nutrition to maximize pollination success, thus setting the quality standards for the feed used. This broad customer landscape, from high-volume commercial users prioritizing operational efficiency to research facilities demanding precision and hobbyists valuing sustainable ingredients, dictates the varied product offerings and distribution strategies utilized across the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $125 Million |

| Market Forecast in 2033 | $220 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mann Lake Ltd., Dadant & Sons Inc., Global Patties, Veto-Pharma, Apis Protect, Agridyne, Vita Bee Health, Thomas Labs, NOD Apiary Products, Olympic Bee Supply, Blue Sky Bee Supply, Miller Manufacturing Company, Honey Bee Healthy, Ceracell Beekeeping Supplies, Hive Alive, GloryBee, The Bee Supply, Hives for Humanity, Bee Smart Designs, The Humble Bee |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bee Feed Market Key Technology Landscape

The technology landscape of the Bee Feed Market is increasingly centered on optimizing nutritional delivery, improving ingredient stability, and integrating feed solutions with smart apicultural management systems. Modern feed formulation leverages advanced food science to ensure high palatability and maximize the bioavailability of essential micronutrients, utilizing technologies such as microencapsulation to protect sensitive ingredients like vitamins and probiotics from environmental degradation before ingestion. This technological sophistication is crucial for creating functional feeds that not only provide basic sustenance but also actively support bee immune systems, leading to better outcomes against common pathogens and stressors. Manufacturing techniques are shifting towards high-pressure processing and aseptic blending to ensure product sterility, particularly for liquid feeds, minimizing the risk of introducing molds or contaminants into the hives, thereby safeguarding bee health.

Furthermore, innovation in dispensing technology is a major focus, driven by the needs of commercial beekeepers for efficient scaling. This includes the development of automated, precision-dosing feeders integrated with Internet of Things (IoT) sensors within smart hives. These systems utilize connectivity to monitor consumption rates and ambient conditions, allowing beekeepers to remotely adjust feeding schedules and volumes, optimizing resource usage and reducing manual labor. The use of polymer technology in feed patty production ensures slow, controlled release of nutrients, mimicking natural foraging patterns and maximizing the utilization period of the supplement, enhancing the cost-effectiveness of solid feed formats compared to traditional methods.

The integration of advanced diagnostics is also becoming integral, enabling feed manufacturers to create evidence-based formulations. Research utilizes genomics and metabolomics to identify specific nutritional requirements under varying environmental stresses or disease loads, leading to the development of highly targeted feed supplements. For instance, feeds enriched with specific amino acids or botanicals are designed to combat the negative effects of pesticide exposure or enhance detoxification pathways. This technological convergence across formulation science, automated delivery mechanisms, and advanced diagnostics is fundamentally transforming the bee feed sector from a simple commodity market to a sophisticated nutritional technology domain, focusing on maximizing the genetic potential and resilience of bee colonies globally.

Regional Highlights

The market dynamics of the Bee Feed Market exhibit significant regional variations influenced by beekeeping practices, regulatory environments, and dominant agricultural profiles. North America, encompassing the United States and Canada, currently holds the largest market share due to its reliance on vast migratory commercial beekeeping operations required for large-scale crops like almonds, apples, and cherries. The intensive nature of these operations necessitates reliable, high-volume supplemental feeding, driving demand for sophisticated protein substitutes and liquid carbohydrate feeds. Regulatory standards, particularly in the US, emphasize nutritional support as a key element of bee health programs, further bolstering market growth and innovation in feed quality and efficacy.

Europe represents another mature market, characterized by stringent quality controls, strong public awareness regarding pollinator protection, and a large proportion of small to medium-sized beekeeping enterprises focusing on high-quality, specialty honey production. The demand in Europe leans toward organic, non-GMO, and highly traceable feeds, often incorporating regionally specific natural ingredients. Countries such as Germany, France, and the UK demonstrate steady growth, supported by government subsidies and conservation efforts aimed at mitigating habitat loss. The regulatory landscape, including directives from the European Food Safety Authority (EFSA), drives innovation towards veterinary-grade nutritional supplements designed to enhance colony vitality and mitigate stress caused by Varroa mites and European foulbrood.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is driven by the massive scale of agriculture, particularly in China and India, where managed pollination is becoming increasingly necessary due to urbanization and industrial agriculture impacting native pollinator populations. While beekeeping practices in APAC are historically less industrialized than in the West, rapid modernization and professionalization of the sector, coupled with government initiatives promoting commercial farming, are creating immense demand for imported and locally manufactured high-quality bee feeds. Latin America and the Middle East & Africa (MEA) currently hold smaller market shares, but increasing exports of high-value crops (e.g., avocados, coffee) that rely on effective pollination are stimulating growth, especially in countries like Brazil and South Africa, focusing on adapting formulations to tropical and semi-arid conditions.

- North America: Dominant market share due to large-scale commercial migratory beekeeping, particularly in the US, with high demand for bulk liquid and specialized protein supplements for intense pollination cycles.

- Europe: Characterized by stringent quality regulations and strong demand for organic, non-GMO feeds; focus on sustainable beekeeping and veterinary-grade supplements to combat prevalent diseases.

- Asia Pacific (APAC): Fastest-growing market, propelled by the modernization of agricultural practices in populous countries like India and China, creating vast, unmet demand for reliable supplemental nutrition for rapidly professionalizing apiculture.

- Latin America: Emerging market driven by the expansion of pollination-dependent cash crops and increasing awareness among commercial beekeepers regarding the necessity of supplemental feeding during tropical dry seasons.

- Middle East & Africa (MEA): Growth stimulated by local efforts to enhance food security and the establishment of structured apiculture programs, requiring feeds tailored to harsh desert and arid climatic conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bee Feed Market.- Mann Lake Ltd.

- Dadant & Sons Inc.

- Global Patties

- Veto-Pharma

- Vita Bee Health

- NOD Apiary Products

- Thomas Labs

- Agridyne LLC

- Olympic Bee Supply

- Blue Sky Bee Supply

- Miller Manufacturing Company

- Honey Bee Healthy

- Ceracell Beekeeping Supplies

- Hive Alive (Advanced Science Ltd.)

- GloryBee

- The Bee Supply

- Bee Smart Designs

- Hives for Humanity

- Apis Protect

- Lyson Beekeeping

Frequently Asked Questions

Analyze common user questions about the Bee Feed market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth in the Bee Feed Market?

The primary drivers are the accelerating decline of natural forage due to changing climate and monoculture farming, the necessity of maintaining robust colonies for commercial pollination services vital to global agriculture, and increasing scientific evidence linking supplementary feeding to enhanced bee immunity and survival rates against pests and diseases.

How does the segmentation by Product Type influence purchasing decisions for beekeepers?

Segmentation by Product Type (Pollen Substitutes vs. Sugar Syrups) directly addresses different seasonal needs. Beekeepers purchase protein-rich pollen substitutes primarily in early spring and late autumn to stimulate brood growth and pre-winter preparation, while carbohydrate-rich sugar syrups are used year-round for energy maintenance and preventing starvation, dictating varied seasonal purchasing volumes.

What is the role of AI and IoT in modern bee feeding practices?

AI and IoT enable precision feeding by utilizing sensors to monitor colony health and consumption rates, optimizing the timing and quantity of feed delivery. This integration minimizes waste, reduces manual labor, and allows for customized nutritional interventions based on real-time data analysis of environmental stress and hive conditions, significantly enhancing operational efficiency.

Which region currently dominates the Bee Feed Market in terms of revenue?

North America currently dominates the Bee Feed Market in terms of revenue. This leadership is attributed to the presence of large-scale commercial beekeeping operations involved in intensive, migratory pollination contracts, generating substantial volume demand for high-quality, reliable, and standardized bee nutritional products.

What are the key technological advancements expected to shape future Bee Feed formulations?

Future formulations will be shaped by the integration of microencapsulation technology to improve the stability and bioavailability of vitamins and probiotics, the development of sustainable, novel protein sources (e.g., insect or algal proteins), and research into functional feeds containing targeted compounds to enhance detoxification and immunity against environmental toxins.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager