Bee Hive Monitoring Sensor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436596 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Bee Hive Monitoring Sensor Market Size

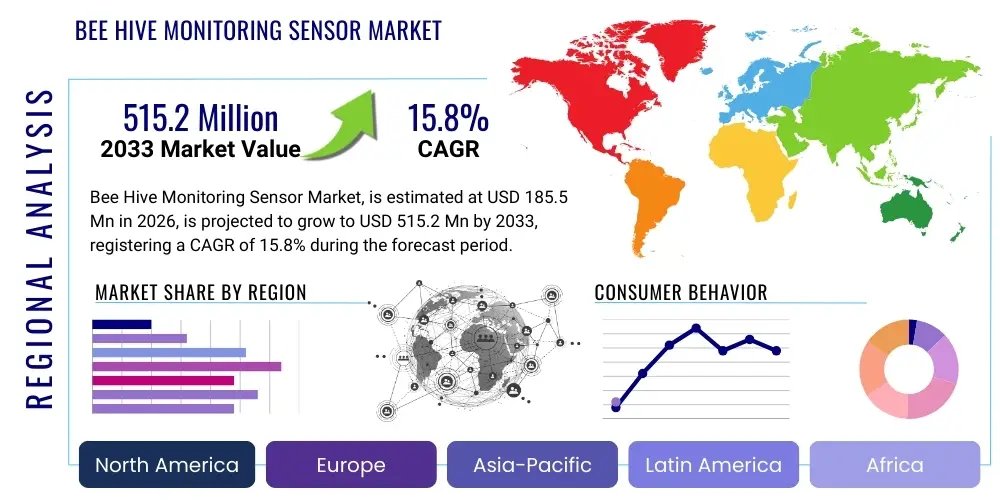

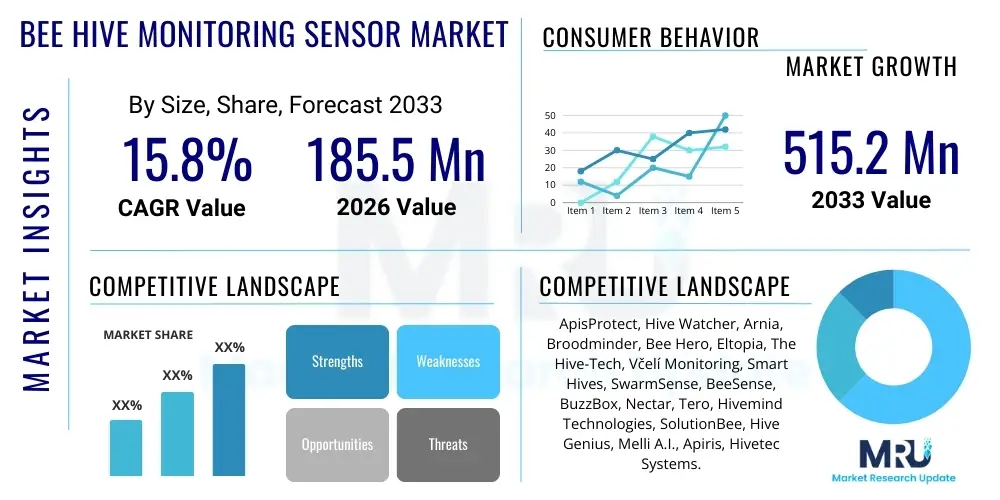

The Bee Hive Monitoring Sensor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at $185.5 Million in 2026 and is projected to reach $515.2 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global concern regarding colony collapse disorder (CCD), coupled with the increasing adoption of precision agriculture techniques across the apiculture industry. Commercial beekeepers are recognizing the indispensable value proposition of real-time data collection, which allows for proactive management of hive health, optimization of pollination schedules, and minimization of operational losses associated with undetected issues such as pests, diseases, or swarming events. The underlying technology advancements in miniaturization, power efficiency, and connectivity standards, particularly LoRaWAN and Narrowband IoT (NB-IoT), are lowering the barrier to entry and making sophisticated monitoring solutions accessible to a wider range of beekeeping operations, from large-scale commercial entities to specialized hobbyists.

The financial growth trajectory is also influenced by critical governmental and non-governmental initiatives aimed at promoting pollinator health and biodiversity. Subsidies, research grants, and favorable regulatory environments in key agricultural regions like North America and Europe incentivize the integration of sensor technology into traditional apiaries. Furthermore, the convergence of sensor data with advanced analytical platforms, often leveraging artificial intelligence (AI) and machine learning (ML), transforms raw environmental measurements into actionable insights. This shift from reactive crisis management to predictive hive maintenance enhances the overall return on investment for beekeepers. The development of integrated platforms that combine multiple sensor modalities—such as weight, temperature, humidity, and acoustic analysis—into a single, robust system is driving premium segment growth, offering unparalleled diagnostic capability and operational efficiency for high-value pollination services.

Bee Hive Monitoring Sensor Market introduction

The Bee Hive Monitoring Sensor Market encompasses the design, manufacture, and deployment of specialized electronic devices and software platforms used to continuously track and analyze the internal and external conditions of honeybee colonies without intrusive intervention. These systems typically integrate various types of sensors, including thermistors for temperature monitoring, capacitive sensors for humidity detection, load cells for hive weight tracking (indicating nectar flow or honey reserves), and microphones for acoustic analysis (identifying swarming readiness or queen status). The primary product offering is a complete Internet of Things (IoT) solution that transmits collected data wirelessly to cloud-based analytical dashboards or mobile applications, enabling remote management and predictive diagnostics. Major applications span commercial apiculture, where maximizing colony yield and minimizing losses are paramount; hobbyist beekeeping, offering convenience and educational data; and research institutions focused on entomology, ecology, and climate impact studies on pollinators.

The benefits derived from adopting these technologies are numerous and transformative for the apiculture industry. Key advantages include early detection of critical issues like pest infestations (e.g., Varroa mites), disease onset (e.g., American foulbrood), unexpected queenlessness, and rapid starvation due to environmental stress. By providing precise, granular data, these sensors reduce the necessity for frequent manual inspections, which are often stressful to the bees and labor-intensive for the beekeeper. The ability to track weight gain allows for optimization of honey extraction times, while internal temperature logging ensures the colony is maintaining its critical thermal regulation, especially during winter months. This operational efficiency is a major driving factor, mitigating the rising labor costs and skill shortages prevalent in modern commercial beekeeping.

The market is predominantly driven by the pervasive threat of global bee population decline, recognized as a severe risk to global food security given the crucial role of bees in crop pollination. The economic incentive to protect high-value bee assets is strong. Technological drivers include the continued maturation and cost-effectiveness of wireless sensor networks (WSN), improved battery longevity allowing for year-long deployment without maintenance, and the enhanced capabilities of data platforms that simplify complex data visualization. Furthermore, the increasing consumer demand for traceable and sustainably sourced honey and agricultural products compels beekeepers to adopt transparency and best practices facilitated by sensor data validation, thereby cementing the market's long-term growth viability.

Bee Hive Monitoring Sensor Market Executive Summary

The Bee Hive Monitoring Sensor Market is experiencing robust acceleration, underscored by significant business trends focusing on integration, data standardization, and global expansion into emerging agricultural economies. Business trends highlight a movement towards end-to-end service models, where hardware provision is bundled with subscription-based software services offering advanced analytics and predictive modeling capabilities, ensuring recurring revenue streams for key market players. Consolidation is observable, particularly among technology providers and specialized apiculture firms, leading to the creation of comprehensive smart apiary solutions that cover monitoring, inventory management, and logistics. A critical development is the emphasis on interoperability, allowing sensor data to be easily shared with broader agricultural management systems, further cementing these solutions within the precision agriculture ecosystem and optimizing resource allocation across farm operations.

Regionally, North America and Europe maintain market leadership due to high technological readiness, significant commercial apiculture operations, and strong regulatory support for pollinator health initiatives, translating into high adoption rates. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by substantial government investment in modernizing agricultural practices in countries like China and India, where large populations rely heavily on agriculture and beekeeping is an essential sideline industry. Latin America and the Middle East & Africa (MEA) are emerging markets, primarily driven by the export potential of agricultural goods that require intensive pollination, necessitating better bee management practices to ensure compliance with international quality standards and stable yield generation.

Segmentation trends indicate that the Sensors component segment holds the largest market share, specifically the integration of weight and temperature sensors due to their fundamental utility in managing food reserves and detecting thermal stress. Concurrently, the Software/Platform segment is poised for the highest growth, reflecting the rising valuation placed on data processing and sophisticated analytical tools, particularly those incorporating AI to automate diagnostic tasks. By Application, commercial beekeeping dominates the expenditure due to the scale of operations and the high economic risks associated with colony failure, while the Hobbyist segment presents a scalable opportunity as DIY-friendly and lower-cost solutions gain traction, democratizing access to professional-grade hive management insights.

AI Impact Analysis on Bee Hive Monitoring Sensor Market

Common user questions regarding AI's impact on the Bee Hive Monitoring Sensor Market often revolve around the efficacy of predictive diagnostics, the affordability of advanced AI services, and the necessity of data ownership and privacy. Users frequently inquire whether AI can reliably distinguish between acoustic signatures of different hive activities (e.g., swarming vs. queen piping), and if machine learning models can accurately forecast Colony Collapse Disorder (CCD) years or months in advance based on subtle sensor data shifts. Another core theme is the expected reduction in human labor; beekeepers seek clarity on how automation, driven by AI, will minimize time spent on manual inspections while improving the quality of decision-making. These inquiries underscore a high expectation that AI will move monitoring systems beyond simple alerts to provide genuine, actionable, and complex insights, fundamentally transforming apiculture into a high-tech, predictive industry.

AI's role in this market is transformative, shifting the primary value proposition from raw data provision to automated, predictive intelligence. Machine learning algorithms are crucial for processing the high volume and velocity of sensor data—including continuous temperature readings, weight changes, and complex acoustic patterns—to identify anomalies that precede colony failure. Specifically, AI excels at acoustic analysis, interpreting the subtle buzzing and chirping frequencies to determine hive status, detect the presence and health of the queen, and predict swarming events with higher accuracy than manual observation. This predictive capability allows beekeepers to intervene precisely when needed, minimizing disturbances and optimizing resource utilization such as supplemental feeding or pest treatment timing.

The integration of AI also significantly enhances the scalability and robustness of monitoring platforms. Deep learning models can be trained across vast datasets aggregated from thousands of hives globally, allowing for generalized insights into disease propagation or environmental resilience. This collective intelligence benefits all users. Furthermore, AI facilitates the development of automated treatment recommendations, generating highly specific alerts such as "Varroa mite treatment window opens in 7 days, optimize dosage based on current brood status." This level of automation and diagnostic precision positions AI as the critical factor accelerating the market's trajectory towards precision apiculture, ensuring that advanced monitoring solutions offer not just visibility but prescriptive operational advice, justifying the higher capital expenditure associated with sophisticated sensor deployments.

- AI enables highly accurate predictive diagnostics for pests (Varroa mites) and diseases (foulbrood) using multi-sensor fusion.

- Machine learning algorithms significantly improve acoustic monitoring accuracy, automatically identifying queen status and swarming behavior.

- Deep learning facilitates cross-apiary comparison and environmental correlation analysis, establishing localized health baselines.

- AI optimizes resource management by predicting nectar flow and honey yield, automating feeding and extraction schedules.

- Automated anomaly detection minimizes false alarms and focuses the beekeeper's attention on high-risk colonies, maximizing operational efficiency.

DRO & Impact Forces Of Bee Hive Monitoring Sensor Market

The Bee Hive Monitoring Sensor Market is shaped by a powerful interplay of Driving forces (D), Restraints (R), and Opportunities (O), which together define the competitive dynamics and long-term growth potential. The primary Drivers revolve around the necessity for sustainable apiculture driven by global food security concerns and the devastating economic impact of Colony Collapse Disorder (CCD). This is amplified by technological advancements that have made IoT sensors more durable, energy-efficient, and affordable. Conversely, the market faces significant Restraints, notably the high initial capital expenditure required for comprehensive deployment, the technical complexity associated with managing large datasets for non-technical users, and issues related to reliable connectivity in remote agricultural areas. The primary Opportunities lie in expanding adoption among small and medium-sized beekeeping operations through subscription models, developing integrated systems that couple monitoring with automated treatment dispensers, and leveraging government initiatives focused on environmental and agricultural technology subsidies.

The Impact Forces governing this market relate directly to the technology adoption curve and industry structure. The bargaining power of suppliers is moderate; while raw sensor components are commoditized, specialized apiculture software and proprietary data algorithms grant significant leverage to established solution providers. The bargaining power of buyers (beekeepers) is also moderate, influenced by the fragmentation of the customer base but constrained by the clear necessity of the technology for risk mitigation. The threat of new entrants is moderate, lowered by the complexity of developing robust, field-tested hardware and the need for extensive training data for AI models, but slightly raised by the influx of general IoT tech companies pivoting to agriculture. The threat of substitutes is low, as manual inspection remains the only substitute, which is inherently time-consuming, intrusive, and lacks the predictive capability of sensor systems.

Ultimately, the market trajectory is strongly influenced by the environmental imperative and economic risk management. As climatic variability increases, the stress on bee colonies intensifies, making predictive monitoring an economic necessity rather than a luxury. This persistent demand driver, coupled with continuous component price erosion and governmental backing, ensures that while adoption hurdles (Restraints) exist, the overwhelming value proposition and technological enablement (Opportunities and Drivers) will sustain high growth rates. Furthermore, the standardization of communication protocols, particularly within the LoRaWAN ecosystem, is significantly mitigating the connectivity challenge, improving deployment ease and maintenance costs, thereby stabilizing the market's foundational structure against short-term economic fluctuations.

Segmentation Analysis

The Bee Hive Monitoring Sensor Market is segmented based on critical technical components, application demographics, and connectivity methods, reflecting the diverse needs of the global apiculture industry. Analysis of the segments reveals that the market structure is evolving from simple hardware sales towards integrated, data-as-a-service models. The component segmentation highlights the dominance of basic environmental sensors, but future growth will be concentrated in sophisticated analytical platforms. Application segmentation clearly delineates the high-volume needs of commercial operations versus the cost sensitivity and ease-of-use requirements of hobbyists. Connectivity segmentation underscores the technological shift towards low-power wide-area networks (LPWAN) like LoRaWAN, which are optimized for the wide geographical spread typical of apiaries, providing long-range, energy-efficient data transmission capabilities crucial for remote monitoring success.

The segmentation structure is crucial for market participants as it dictates product development and strategic pricing. For instance, commercial beekeepers prioritize comprehensive, ruggedized systems offering acoustic monitoring and cellular connectivity, justifying a higher price point due to the scale of their potential losses. Conversely, hobbyists are typically driven by cost-effective solutions focusing on essential parameters like weight and temperature, often utilizing cheaper, short-range Wi-Fi or Bluetooth connectivity for local data retrieval. Successfully navigating this segmented landscape requires providers to offer tiered product portfolios that balance advanced feature sets, such as AI-driven swarm prediction, with accessible entry-level options, ensuring maximum market penetration across the entire spectrum of beekeeping operations, from small backyard setups to large migratory operations supporting major agricultural pollination contracts.

- By Component:

- Sensors (Temperature, Humidity, Weight/Load Cells, Acoustic, GPS/Location)

- Connectivity Modules (Gateways, Transmitters)

- Software & Analytics Platform (Cloud-based Dashboards, Mobile Applications, Predictive Modeling Tools)

- Power & Energy Management Systems (Solar Panels, Batteries)

- By Connectivity Technology:

- Cellular (2G/3G/4G/5G, NB-IoT)

- Low-Power Wide-Area Network (LPWAN) (LoRaWAN, Sigfox)

- Short-Range Wireless (Wi-Fi, Bluetooth)

- By Application:

- Commercial Apiculture (Large-scale operations, migratory beekeeping)

- Hobbyist & Backyard Beekeeping

- Research & Development (Academic institutions, Government agencies)

- By End-Use Vertical:

- Agriculture and Farming

- Environmental Monitoring

Value Chain Analysis For Bee Hive Monitoring Sensor Market

The value chain of the Bee Hive Monitoring Sensor Market is complex, involving specialized steps from raw component sourcing to the delivery of actionable beekeeping insights. The upstream segment involves the procurement and manufacture of sophisticated microprocessors, specialized sensors (load cells, acoustic microphones, temperature probes), and wireless connectivity modules (LoRa chips, cellular modems). This stage is characterized by moderate concentration, dominated by global electronics suppliers. Key challenges upstream include ensuring the ruggedness and long-term calibration stability of sensors operating in harsh outdoor and internal hive environments, requiring specialized material science and encapsulation techniques to protect electronics from moisture, heat, and corrosive propolis. Effective upstream management focuses on sourcing miniaturized, energy-efficient components to maximize battery life and minimize the sensor footprint within the hive environment.

The core midstream activities include system integration, firmware development, and the creation of proprietary analytical software. This is where market differentiation occurs, as providers integrate diverse sensors, develop proprietary algorithms for acoustic analysis or swarm prediction, and create user-friendly software interfaces. The midstream players often maintain a closed ecosystem, linking their specific hardware to their cloud platform to ensure data integrity and proprietary insights. Downstream analysis focuses on distribution and service delivery. Direct channels, often via proprietary e-commerce platforms, are common, especially for commercial clients requiring tailored solutions and direct technical support. Indirect channels involve partnerships with agricultural equipment distributors, beekeeping supply houses, and telecommunications providers who can offer integrated connectivity packages. Effective downstream strategy emphasizes robust technical support and high-quality educational resources to assist beekeepers in interpreting the complex data streams generated by the monitoring systems.

Direct distribution allows manufacturers maximum control over pricing and customer feedback, essential for rapidly iterating hardware and software improvements based on real-world field performance. This channel is crucial for establishing long-term relationships with large commercial apiaries, often involving custom installation and maintenance contracts. Indirect distribution, leveraging established agricultural supply networks, is vital for achieving broad geographical reach and accessing the fragmented hobbyist market segment. Regardless of the channel, the ultimate value delivery rests on translating raw data into clear, prescriptive advice. The most valuable part of the chain is not the sensor hardware itself, but the proprietary data analytics platform, which provides the critical leap from simple data recording to true predictive hive management, justifying the recurring subscription fees charged to the end-user.

Bee Hive Monitoring Sensor Market Potential Customers

The primary potential customers and end-users of Bee Hive Monitoring Sensor technology span three distinct but overlapping categories: commercial apiculture operations, private hobbyist and small-scale beekeepers, and governmental or academic research institutions. Commercial beekeepers represent the largest segment by revenue expenditure. These customers operate hundreds to thousands of hives, relying on optimal colony health for lucrative pollination contracts and high honey yields. Their purchasing decisions are driven by Return on Investment (ROI), focusing on systems that minimize colony mortality, automate labor-intensive inspections, and provide highly accurate, scalable data insights. They seek durable, robust, and cellular-connected systems capable of managing large, geographically dispersed apiaries with minimal manual intervention, often valuing sophisticated fleet management software over simple sensor readings.

Hobbyist and small-scale beekeepers constitute a high-volume, cost-sensitive customer segment. These individuals typically manage between one and twenty hives and prioritize ease of installation, low cost, and user-friendly mobile application interfaces. While they may not require the same level of complex, integrated AI analysis as commercial users, they value the ability to monitor key parameters like temperature and weight remotely to mitigate common beginner errors and ensure winter survival. This segment is highly responsive to entry-level pricing, subscription flexibility, and DIY installation kits, driving the demand for LoRaWAN and short-range wireless solutions over more expensive cellular options. Educational benefits, such as data visualization that helps them understand bee behavior, are also a key purchase motivator for this segment.

The third significant customer group includes universities, entomological research centers, and governmental agricultural departments. These customers use monitoring sensors as crucial data collection tools to study the effects of pesticides, climate change, and various pathogens on colony health across diverse geographies. Their requirements emphasize data accuracy, long-term logging capabilities, system flexibility for customized sensor integration, and the ability to export raw data for statistical modeling. Government agricultural bodies are also increasingly adopting these sensors to establish national benchmarks for pollinator health, guide policy decisions, and provide early warning systems for regional pest outbreaks, thereby validating the technology's importance beyond commercial profitability and into environmental stewardship.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185.5 Million |

| Market Forecast in 2033 | $515.2 Million |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ApisProtect, Hive Watcher, Arnia, Broodminder, Bee Hero, Eltopia, The Hive-Tech, Včelí Monitoring, Smart Hives, SwarmSense, BeeSense, BuzzBox, Nectar, Tero, Hivemind Technologies, SolutionBee, Hive Genius, Melli A.I., Apiris, Hivetec Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bee Hive Monitoring Sensor Market Key Technology Landscape

The technological landscape of the Bee Hive Monitoring Sensor market is defined by the convergence of low-power sensor technology, robust wireless communication protocols, and sophisticated cloud-based data processing. Core hardware technologies include highly sensitive load cells for measuring minute changes in hive weight, crucial for tracking nectar flow and consumption rates. Thermistors and humidity sensors, encapsulated in durable materials, provide essential environmental data regarding brood health and potential mold formation. A significant technological advancement is the use of high-fidelity acoustic sensors and signal processing algorithms, which analyze the subtle sounds within the hive to determine queen presence, swarming preparations, or stress levels, providing a non-invasive diagnostic tool that dramatically reduces the need for disruptive manual inspections. The efficiency and accuracy of these sensors, particularly in maintaining calibration under fluctuating environmental conditions, are paramount to market adoption.

Connectivity remains a crucial determinant of solution viability, especially given the remote locations of many apiaries. The market is increasingly adopting Low-Power Wide-Area Network (LPWAN) technologies, primarily LoRaWAN and Narrowband IoT (NB-IoT). LoRaWAN offers excellent range (often several kilometers) with minimal power consumption, making it ideal for large apiaries scattered across agricultural land, dramatically extending battery life to often span an entire season or more without intervention. NB-IoT, leveraging existing cellular infrastructure, provides reliability and higher data throughput where coverage is available, appealing to high-value commercial operations requiring near-real-time updates. The shift to LPWAN reduces the total cost of ownership (TCO) by minimizing maintenance cycles and ensuring consistent data transmission, overcoming one of the major historical restraints of earlier, power-hungry cellular or short-range Wi-Fi systems.

At the software level, the key technology is the integration of cloud computing with machine learning (ML) and artificial intelligence (AI). Sensor platforms aggregate vast quantities of raw data, which ML models then process to identify complex patterns indicative of specific health issues or behavioral changes. This includes training models to accurately predict the onset of swarming based on subtle acoustic and temperature shifts weeks in advance. The technological focus is on enhancing the analytical platform's capability to deliver prescriptive intelligence—moving beyond "what is happening" to "what action should be taken." This predictive analytics layer, often delivered through intuitive mobile dashboards, is the highest value-add component of the modern Bee Hive Monitoring solution, requiring continuous investment in data science and entomological expertise to maintain a competitive edge and ensure high user satisfaction.

Regional Highlights

The Bee Hive Monitoring Sensor Market exhibits distinct characteristics and growth patterns across key geographic regions, reflecting variations in beekeeping scale, technological maturity, and governmental regulatory environments. North America, encompassing the United States and Canada, currently holds the largest market share by revenue. This dominance is driven by the region's massive commercial apiculture industry, which is essential for multi-billion dollar pollination services, such as the almond industry. High labor costs and the acute economic threat posed by CCD mandate the adoption of high-tech, scalable monitoring solutions. North American beekeepers generally favor cellular and robust, integrated IoT platforms featuring advanced AI diagnostics, supported by venture capital funding and established agricultural technology infrastructure.

Europe represents a highly mature market characterized by strong governmental support for sustainable apiculture and biodiversity protection. Countries in Western Europe, such as Germany, the UK, and France, are frontrunners in adopting LoRaWAN-based solutions, driven by strong regulatory incentives and a high concentration of sophisticated, often research-focused, beekeeping operations. The European market emphasizes data privacy and interoperability standards, often integrating hive monitoring data with broader farm management and environmental monitoring systems. Eastern Europe is emerging rapidly, seeking modern solutions to optimize honey production for export markets, often focusing on cost-effective sensor solutions suitable for smaller, family-run apiaries.

Asia Pacific (APAC) is projected to be the fastest-growing region, albeit starting from a smaller base. The sheer scale of agricultural output in countries like China, India, and Australia, coupled with increasing governmental focus on modernizing traditional farming techniques, provides immense market potential. Adoption is currently fragmented but driven by large agricultural cooperatives and state-sponsored initiatives seeking to improve pollination efficiency and honey yield stability. Challenges include fragmented infrastructure, particularly reliable wireless connectivity, and the need for culturally adapted, low-cost solutions. Latin America and the Middle East & Africa (MEA) are developing markets, where growth is primarily tied to export-oriented cash crops (e.g., avocados, coffee in Latin America) that depend heavily on managed pollination. Adoption in MEA is often concentrated in high-value, centralized research projects or large-scale commercial farms utilizing the technology for quality control and adherence to international sustainability standards.

- North America: Market leader; driven by large-scale commercial pollination services, high tech adoption, and necessity for risk mitigation against CCD. Focus on cellular and AI-driven predictive analytics.

- Europe: High adoption rate; supported by environmental regulations and subsidies. Strong preference for LoRaWAN connectivity and solutions focused on scientific research and biodiversity monitoring.

- Asia Pacific (APAC): Fastest growing; driven by agricultural modernization efforts, government investment, and increasing demand for traceable honey. Focus on developing cost-effective, scalable solutions for diverse climates.

- Latin America: Emerging market; centered around export crops requiring intensive pollination management. Growth stimulated by foreign investment and need for stable yield production.

- Middle East & Africa (MEA): Growth concentrated in high-value commercial farming and academic research; adoption tied to water management and climate resilience studies in arid environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bee Hive Monitoring Sensor Market.- ApisProtect

- Hive Watcher

- Arnia

- Broodminder

- Bee Hero

- Eltopia

- The Hive-Tech

- Včelí Monitoring

- Smart Hives

- SwarmSense

- BeeSense

- BuzzBox

- Nectar

- Tero

- Hivemind Technologies

- SolutionBee

- Hive Genius

- Melli A.I.

- Apiris

- Hivetec Systems

Frequently Asked Questions

Analyze common user questions about the Bee Hive Monitoring Sensor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary benefits of implementing bee hive monitoring sensors for commercial beekeepers?

The primary benefits for commercial beekeepers include significant reduction in colony losses (due to early detection of disease, pests, and starvation), enhanced operational efficiency by minimizing labor-intensive manual inspections, and optimization of honey production timing based on real-time weight gain data. These systems provide a robust ROI through preventative care and data-driven management.

Which connectivity technologies are most prevalent in remote apiary locations?

Low-Power Wide-Area Network (LPWAN) technologies, specifically LoRaWAN and NB-IoT (Narrowband IoT), are most prevalent. LoRaWAN is favored for its extended range and ultra-low power consumption, making it ideal for geographically dispersed, remote apiaries lacking traditional cellular coverage, ensuring long battery life and consistent data transmission.

How does Artificial Intelligence (AI) enhance the value of hive monitoring data?

AI significantly enhances value by processing complex sensor data, particularly acoustic signatures, to provide predictive diagnostics. AI models can accurately forecast critical events like swarming, detect subtle signs of queenlessness, or identify pest infestations (e.g., Varroa mites) long before a human inspection would, transforming raw data into actionable, prescriptive intelligence.

What are the major restraints hindering the widespread adoption of these monitoring systems?

Major restraints include the high initial capital investment required for comprehensive, multi-sensor hardware deployment across large apiaries, the challenge of maintaining reliable wireless connectivity in rural or mountainous areas, and the necessity for beekeepers to acquire technical expertise to effectively utilize and interpret the complex analytical software platforms.

Which sensor parameters are considered most essential for determining overall hive health?

The most essential sensor parameters are hive weight (measured via load cells), which indicates honey flow, consumption, and overall colony strength; internal temperature (measured via thermistors), which confirms optimal brood rearing and cluster health; and internal humidity, which detects potential risks of mold or moisture-related diseases.

Is the Bee Hive Monitoring Sensor market primarily driven by regulatory compliance or economic necessity?

While regulatory incentives for pollinator health exist, the market is primarily driven by economic necessity. Commercial beekeepers invest in sensors to mitigate the enormous financial risk associated with colony collapse disorder (CCD) and maximize the efficiency and predictability of their high-value pollination services, ensuring stability of both yield and income.

How does the segmentation between commercial and hobbyist users affect product development?

Product development is tiered: commercial users require ruggedized, scalable, cellular-connected systems with complex fleet management software, justifying higher price points. Hobbyists demand simpler, lower-cost, user-friendly solutions, often utilizing Wi-Fi or Bluetooth, prioritizing ease of installation over advanced features, leading to distinct hardware and software offerings.

What role do acoustic sensors play in modern hive monitoring systems?

Acoustic sensors are vital for non-invasive behavioral diagnostics. They capture subtle hive sounds, which AI algorithms analyze to determine if the queen is present, whether the colony is preparing to swarm (through "piping" sounds), or if the colony is distressed due to external threats or starvation, providing real-time insight into colony status.

How long can a typical Bee Hive Monitoring Sensor battery last in the field?

Modern Bee Hive Monitoring Sensors utilizing LPWAN technologies like LoRaWAN are optimized for ultra-low power consumption and can typically last between 12 months and 3 years on a single battery pack, depending on the frequency of data transmission and the integration of supplemental power sources like small solar panels.

What is the forecasted CAGR for the Bee Hive Monitoring Sensor Market between 2026 and 2033?

The Bee Hive Monitoring Sensor Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033, driven by increasing technological maturity, cost reduction of sensor components, and escalating global urgency surrounding pollinator preservation and agricultural yield stability.

In the value chain, where is the highest value generated: hardware or software?

The highest value is increasingly generated in the software and analytics platform segment. While the hardware (sensors) is necessary, the proprietary algorithms and AI-driven platforms that translate raw data into prescriptive, actionable management insights are the key differentiators, driving recurring subscription revenue and providing the core competitive advantage.

How do hive monitoring sensors help mitigate the impact of Varroa mites?

Sensors help mitigate Varroa mite impact indirectly by tracking hive temperature and weight, correlating sudden changes with potential stress or infestation. More advanced systems use AI to monitor behavioral changes or detect specific acoustic patterns associated with mite stress, allowing beekeepers to time chemical treatments precisely for maximum effectiveness and minimum impact on brood cycles.

What are the key differences between Wi-Fi and LoRaWAN connectivity for apiaries?

Wi-Fi is suitable for apiaries close to a power source and existing infrastructure, offering high bandwidth but limited range and high power consumption. LoRaWAN is designed for low power consumption and extremely long range (essential for remote fields), but provides much lower data rates, making it ideal for the small, intermittent data packets generated by hive sensors.

Which geographical region is anticipated to experience the fastest growth in this market?

The Asia Pacific (APAC) region is anticipated to experience the fastest market growth, driven by large-scale agricultural modernization programs, increasing consumer demand for quality honey products, and supportive governmental policies aimed at improving agricultural efficiency and resource management across high-population economies.

What is precision apiculture and how do sensors facilitate it?

Precision apiculture is the management of honeybee colonies using high-resolution, real-time data to optimize health outcomes and resource efficiency. Sensors facilitate this by continuously providing granular metrics on internal conditions, allowing beekeepers to apply targeted, timely interventions (e.g., feeding, treating, or harvesting) based on specific needs rather than generalized schedules.

Are subsidies available for beekeepers purchasing sensor technology?

Yes, in several key agricultural regions, particularly within the European Union and certain US states, beekeepers can access subsidies, grants, or tax incentives designed to promote the adoption of agricultural technologies, including smart apiculture systems, as part of broader environmental and sustainable farming programs.

What is the role of GPS sensors in bee hive monitoring?

GPS sensors primarily serve to track the location of the hive, which is critical for migratory beekeeping operations to ensure asset security and accurate fleet management. Location data is also vital for correlating hive health parameters with local environmental factors such as proximity to pesticides or specific flora bloom times.

How do temperature and humidity sensors specifically aid in preventing disease?

Temperature sensors ensure the beekeeper knows if the colony is successfully thermoregulating, which is essential for healthy brood development. Humidity sensors detect excessive moisture, which can lead to mold and fungal diseases like chalkbrood. Early detection of atypical temperature/humidity patterns allows for corrective intervention before severe outbreak.

Is the integration of solar power common in hive monitoring systems?

Yes, the integration of small, highly efficient solar panels is becoming increasingly common, particularly for long-term deployments utilizing cellular or high-frequency data transmission. Solar power helps maintain battery charge, significantly extends the system's operational lifespan, and reduces the frequency of maintenance visits to the apiary.

What factors contribute to the projected growth rate of 15.8% CAGR?

The high projected CAGR is attributed to three main factors: intensifying global environmental pressure on bee populations, continuous reduction in the cost and size of IoT sensor components, and the growing demand from agricultural businesses for precise, traceable, and sustainable pollination services facilitated by data-driven technology adoption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager