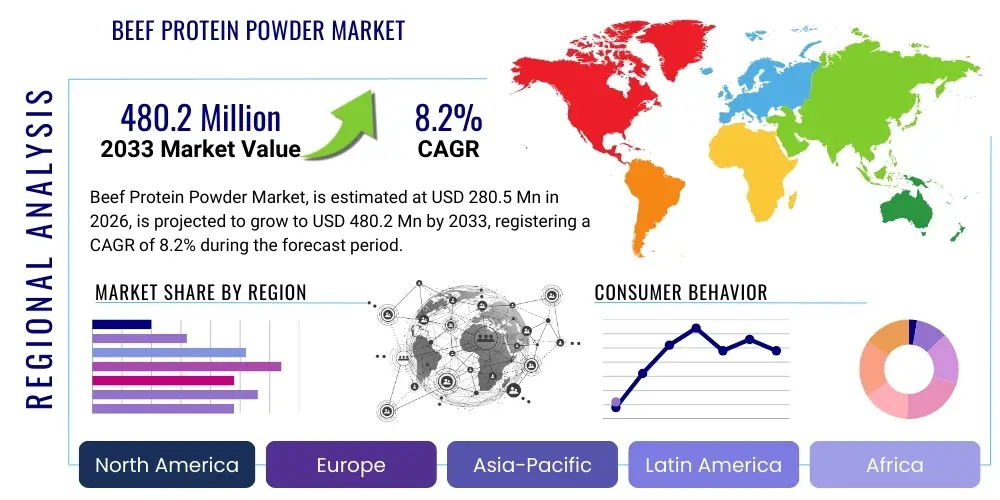

Beef Protein Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435995 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Beef Protein Powder Market Size

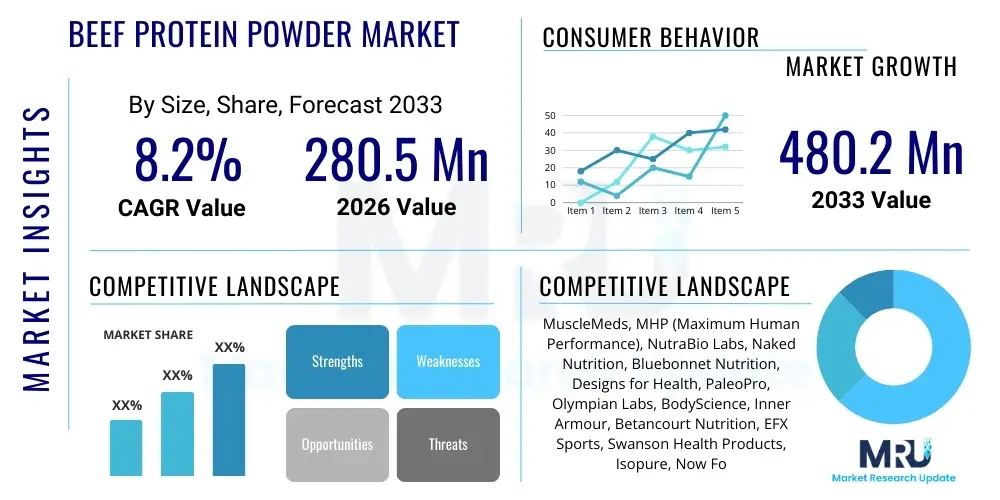

The Beef Protein Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.2% between 2026 and 2033. The market is estimated at USD 280.5 Million in 2026 and is projected to reach USD 480.2 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the increasing global consumer preference for dairy-free and highly bioavailable protein sources, specifically catering to individuals with lactose intolerance or allergies seeking high-quality muscle synthesis support.

Beef Protein Powder Market introduction

The Beef Protein Powder Market encompasses nutritional supplements derived from bovine sources, typically processed through advanced filtration and enzymatic hydrolysis to yield a highly concentrated protein substance. This product category is distinguished by its complete amino acid profile, including high levels of essential amino acids (EAAs) and branched-chain amino acids (BCAAs), making it an exceptionally effective tool for muscle repair, recovery, and hypertrophy. Unlike whey and casein, beef protein is inherently lactose and dairy-free, positioning it as a premium alternative for performance athletes, bodybuilders, and general health consumers adhering to specific dietary regimens like Paleo or Keto diets. Its application is widespread, ranging from sports nutrition formulations and weight management products to clinical nutrition designed for post-operative recovery and managing sarcopenia in aging populations. The primary benefits driving market penetration include superior digestibility, rapid absorption, and the ability to avoid common dairy-related digestive discomfort.

Key drivers propelling the adoption of beef protein powders include the global shift towards high-protein diets, increased awareness regarding the benefits of protein supplementation beyond athletic circles, and the strategic marketing positioning of beef protein as a "cleaner" and more ancestral source compared to plant-based or standard dairy proteins. Furthermore, manufacturers are continually improving the palatability and mixability of these powders, historically perceived as challenging due to the raw material source, through advanced flavor masking technologies and sophisticated processing techniques like ultra-filtration. The increasing prevalence of food allergies, particularly lactose intolerance affecting a significant portion of the global population, creates a structural advantage for beef protein isolates (BPI) as a readily available, high-performance, hypoallergenic alternative.

The market also benefits significantly from the rising disposable incomes in emerging economies, enabling consumers to invest in premium dietary supplements. Major applications are concentrated in the sports nutrition sector, where the focus remains on maximizing lean muscle mass and optimizing recovery periods. However, the use in functional foods, medical nutrition, and specialized dietary products (e.g., meal replacement shakes for sensitive digestive systems) is experiencing exponential growth, diversifying the revenue streams beyond the core bodybuilding demographic. Continuous innovation in product delivery, such as pre-mixed drinks and fortified bars utilizing beef protein hydrolysates, further enhances accessibility and convenience, cementing the product's role as a staple in modern nutritional science.

Beef Protein Powder Market Executive Summary

The Beef Protein Powder Market is currently characterized by robust expansion, fueled primarily by structural business trends focusing on clean label ingredients and specialized dietary needs. Business trends indicate a strong move towards vertically integrated supply chains, allowing manufacturers to ensure ethical sourcing, traceability, and high quality control, thus maintaining consumer trust in a premium product category. Innovation in flavor science and texture modification remains a competitive differentiator, with companies investing heavily in R&D to overcome the historically challenging sensory attributes of bovine-derived protein isolates. Furthermore, strategic partnerships between ingredient suppliers and consumer packaged goods (CPG) companies are accelerating the introduction of beef protein into mainstream functional food and beverage categories, moving it beyond the traditional supplement aisle and expanding its total addressable market (TAM).

Regionally, North America maintains market dominance due to high consumer awareness, a deeply ingrained sports nutrition culture, and significant prevalence of high-protein diet trends such as Paleo and Keto. However, the Asia Pacific (APAC) region is poised for the fastest growth, driven by rapid urbanization, increasing health consciousness, and the burgeoning sports and fitness industry, particularly in countries like China and India. European growth is steady, stimulated by stringent quality standards and a growing demand for non-GMO and hormone-free protein sources, particularly within the specialized fitness and clinical nutrition segments. Latin America and the Middle East and Africa (MEA) represent significant future opportunities, as fitness centers proliferate and disposable incomes rise, enabling greater investment in performance-enhancing supplements.

Segment trends reveal that the Beef Protein Isolate (BPI) segment holds the largest market share due to its high protein concentration (typically 90% or higher), minimal fat, and zero carbohydrate content, appealing directly to the performance and keto consumer base. Conversely, the Hydrolyzed Beef Protein segment is experiencing the highest growth rate, attributed to its superior digestibility and faster absorption profile, making it highly desirable for post-workout recovery and clinical applications. Application-wise, Sports Nutrition remains the dominant end-user category, but the Functional Foods and Beverages segment is rapidly gaining ground, demonstrating the product’s successful transition from a niche supplement to a versatile, high-value ingredient utilized across broader consumer markets seeking dairy-free, complete protein solutions.

AI Impact Analysis on Beef Protein Powder Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Beef Protein Powder Market typically center on three core areas: personalized nutrition recommendations, supply chain efficiency and transparency, and advanced quality control/flavor optimization. Users are highly interested in how AI can move beyond general dietary advice to provide bespoke beef protein dosing and timing recommendations based on individual genetic profiles, microbiome data, and wearable fitness trackers. Furthermore, there is significant consumer expectation regarding AI's role in verifying the ethical sourcing and quality of beef raw materials, assuring transparency from farm to supplement. Finally, the historical issue of beef protein taste and texture dominates queries, with users expecting AI-driven predictive modeling to rapidly iterate and perfect flavor formulations, making previously challenging products highly palatable.

- AI-Driven Personalized Dosing: Algorithms analyze individual physiological data (activity, body composition, metabolic rate) to optimize beef protein intake timing and amount for maximum effectiveness.

- Predictive Supply Chain Optimization: Utilizing machine learning to forecast demand fluctuations, manage inventory of raw beef materials, and optimize cold chain logistics, reducing waste and cost.

- Enhanced Traceability via Blockchain and AI: Employing AI to verify data entered into blockchain systems, ensuring immutable records of bovine sourcing, processing history, and purity testing for consumer transparency.

- Automated Quality Control (AQC): AI-powered spectral analysis and sensor technology deployed in manufacturing lines to detect contaminants, verify amino acid profiles, and ensure batch consistency in real-time.

- Advanced Flavor Formulation: Machine learning models predict consumer preferences and identify optimal flavor masking agents and sweeteners, significantly reducing R&D cycles needed to improve palatability and mixability.

- Market Trend Forecasting: AI analyzes vast consumer data (social media, purchase history, search queries) to predict emerging dietary trends (e.g., specific peptide demands) relevant to beef protein powder development.

DRO & Impact Forces Of Beef Protein Powder Market

The dynamics of the Beef Protein Powder Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively exert significant Impact Forces on market trajectories. A primary Driver is the substantial global increase in diagnosed lactose intolerance and dairy allergies, pushing a growing consumer base toward highly effective, dairy-free alternatives. This demographic shift, coupled with the rising popularity of ancestral and low-carb diets (Paleo, Keto), structurally favors beef protein. The superior biological value and complete amino acid profile derived from beef, often marketed as a foundational nutrient source, further reinforce its position as a high-performance supplement, appealing strongly to professional and amateur athletes seeking maximum muscle gains without digestive compromise.

However, the market faces significant Restraints that temper its growth rate. The foremost challenge is the relatively high cost of production compared to conventional whey protein, primarily due to the complex enzymatic hydrolysis required to create high-quality isolates, coupled with the expense of sourcing high-grade, traceable bovine raw materials. Furthermore, despite technological advancements, flavor and texture challenges persist; achieving a completely neutral taste and smooth mixability remains an ongoing R&D hurdle, occasionally deterring general consumers accustomed to the neutral profile of whey protein. Negative consumer perceptions related to the environmental impact of beef production also present a latent restraint, forcing manufacturers to invest in sustainable sourcing narratives and certifications to mitigate reputational risk.

Opportunities for expansion are abundant, particularly in integrating beef protein hydrolysates into the rapidly expanding functional food and clinical nutrition sectors. Developing specific beef collagen peptides for joint health, skin elasticity, and gut health represents a lucrative diversification strategy, broadening the product's appeal beyond muscle building. Furthermore, geographical expansion into high-growth potential markets in Asia Pacific and targeted efforts to educate consumers on the benefits of beef protein over highly processed plant alternatives offer pathways for accelerated revenue generation. The cumulative impact force of these DRO factors suggests a strong upward trajectory, provided R&D investment successfully addresses cost and palatability challenges, allowing beef protein to capture a larger share of the overall multi-billion dollar protein supplement market by positioning itself as the premium, hypoallergenic performance standard.

Segmentation Analysis

The Beef Protein Powder Market is structurally segmented based on crucial factors including Product Type, Application, and Distribution Channel, reflecting varying consumer needs and market accessibility. This analysis provides a granular view of revenue generation and growth hotspots within the ecosystem. The segmentation by Product Type is essential, differentiating between high-purity isolates, which offer maximum protein content, and concentrates, which are more cost-effective but contain slightly higher levels of fat and carbohydrates. This differentiation drives pricing strategies and targets distinct consumer demographics: the isolate appeals to competitive bodybuilders and keto dieters, while the concentrate caters to mass market consumers seeking a value-based, high-protein source.

Application segmentation reveals the primary utilization pathways for beef protein powder. While Sports Nutrition, covering pre-workout, post-workout, and general muscle maintenance, historically dominates the revenue landscape, the emerging segments of Functional Food and Beverages, and Clinical Nutrition are demonstrating accelerated growth. The integration of beef protein into functional foods, such as protein bars and fortified snacks, increases convenience and broadens market penetration beyond the dedicated supplement user. Clinical Nutrition, focused on sarcopenia management, bariatric recovery, and addressing protein deficiencies in vulnerable populations, values the highly bioavailable and hypoallergenic nature of beef protein isolates.

Lastly, segmentation by Distribution Channel highlights the shift in consumer purchasing behavior. The online retail channel (e-commerce) currently holds the largest market share and is growing fastest due to convenience, extensive product selection, and competitive pricing often facilitated by direct-to-consumer (D2C) brand strategies. Conversely, brick-and-mortar stores, including specialty health stores, pharmacies, and supermarkets, remain crucial for impulse purchases, immediate need fulfillment, and providing critical in-person product consultation, particularly in regions where e-commerce penetration is still developing. Understanding these segment dynamics is paramount for market players seeking to optimize product development portfolios and distribution strategies for maximum market reach and profitability.

- By Product Type:

- Beef Protein Isolate (BPI)

- Beef Protein Concentrate (BPC)

- Hydrolyzed Beef Protein (HBP)

- By Application:

- Sports Nutrition

- Functional Food and Beverages

- Clinical Nutrition and Supplements

- Weight Management

- By Distribution Channel:

- Online Retail (E-commerce)

- Brick-and-Mortar Retail (Specialty Stores, Pharmacies, Supermarkets)

- By Form:

- Powder

- Ready-to-Drink (RTD)

- Capsules/Tablets (Less common, mostly isolates)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Beef Protein Powder Market

The Beef Protein Powder value chain is intricate, commencing with the sourcing and slaughtering of bovine livestock, predominantly focused on high-quality muscle and connective tissues. The upstream segment involves securing raw materials—typically non-muscle tissue components rich in collagen and protein, often sourced as byproducts from the meat industry. This phase necessitates stringent quality control regarding hormone and antibiotic use, geographical origin, and ethical farming practices, as these factors directly impact the final product's purity and marketability as a "clean label" supplement. Key upstream stakeholders include specialized slaughterhouses, meat processing facilities, and ingredient manufacturers who perform the initial extraction and raw protein concentration, adhering to strict food safety and regulatory standards.

The midstream segment involves the highly technical processing phase, where raw protein material undergoes enzymatic hydrolysis. This process breaks down large protein molecules into smaller, easily digestible peptides (hydrolysates) and isolates, maximizing bioavailability and removing undesirable components like fat and residual carbohydrates. Manufacturing facilities utilize advanced filtration technologies, such as ultra-filtration and micro-filtration, followed by spray drying to create the final powder form. Innovation in this segment centers on improving hydrolysis efficiency to minimize bitter taste profiles, a common challenge in beef protein production, while maximizing protein yield and solubility. Quality assurance and third-party testing for heavy metals and contaminants are critical components of this central stage.

The downstream segment encompasses distribution and final consumption. Distribution channels are bifurcated into direct and indirect routes. Direct sales are predominantly executed through e-commerce platforms and brand-specific websites, allowing for higher margins and direct consumer engagement, which is vital for relationship building and personalized marketing. Indirect channels involve wholesalers, large-scale retail distributors, specialty supplement stores (e.g., GNC, Vitamin Shoppe), and large supermarket chains. Due to the premium pricing of beef protein, effective shelf placement, high-impact packaging, and point-of-sale education are crucial for stimulating demand. Ultimately, the consumer, whether an athlete, a health enthusiast, or a clinical patient, completes the value chain, driven by product effectiveness, dietary compatibility, and brand transparency.

Beef Protein Powder Market Potential Customers

The primary End-Users and Buyers of Beef Protein Powder can be broadly categorized into several distinct, high-value segments, all seeking highly bioavailable, complete protein sources compatible with specialized diets. The most prominent demographic remains the sports and performance nutrition segment, including professional bodybuilders, high-intensity endurance athletes, and dedicated fitness enthusiasts. These consumers prioritize muscle recovery, synthesis, and strength gains, viewing beef protein isolate (BPI) as a superior, often cleaner alternative to standard dairy proteins, especially during stringent cutting phases where minimizing carbohydrate and fat intake is critical. Their buying behavior is heavily influenced by performance efficacy, amino acid profile transparency, and endorsement by respected athletic figures and nutritionists.

A rapidly expanding segment consists of consumers with specific dietary restrictions or allergies, particularly those suffering from lactose intolerance, dairy allergies (casein or whey sensitivity), or soy sensitivities. For this group, beef protein powder is often one of the few viable, non-plant-based options that delivers a complete protein profile without causing digestive distress. This segment places high value on hypoallergenic certification, clean label ingredients, and guaranteed purity, often favoring hydrolyzed forms for easier digestion. They typically seek professional recommendations from dietitians or general practitioners and are willing to pay a premium for guaranteed compatibility and effectiveness.

Furthermore, the clinical and aging population represents a significant long-term growth opportunity. Geriatric patients needing sarcopenia intervention, individuals recovering from surgery, and bariatric patients require concentrated, high-quality protein for tissue repair and maintenance. Beef protein, due to its high concentration of specific amino acids like glycine and proline (beneficial for connective tissue), and its excellent digestibility, is increasingly recommended in clinical settings. These institutional buyers (hospitals, nursing homes, clinical suppliers) prioritize bulk supply reliability, quality assurance documentation, and suitability for medical-grade nutritional formulation, often purchasing large volumes of neutral-flavored, highly soluble beef protein hydrolysates.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 280.5 Million |

| Market Forecast in 2033 | USD 480.2 Million |

| Growth Rate | 8.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | MuscleMeds, MHP (Maximum Human Performance), NutraBio Labs, Naked Nutrition, Bluebonnet Nutrition, Designs for Health, PaleoPro, Olympian Labs, BodyScience, Inner Armour, Betancourt Nutrition, EFX Sports, Swanson Health Products, Isopure, Now Foods. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Beef Protein Powder Market Key Technology Landscape

The technological landscape of the Beef Protein Powder market is primarily defined by advancements in protein separation, hydrolysis, and sensory science aimed at maximizing product purity and consumer acceptance. The fundamental technology utilized is enzymatic hydrolysis, where specific proteases are employed to cleave the long protein chains from the raw bovine material into smaller, short-chain peptides. This process is critical for producing hydrolyzed beef protein, which significantly enhances absorption rates and reduces the risk of allergic reactions, making the protein highly desirable for clinical and rapid recovery applications. Manufacturers continuously refine enzyme selection and reaction parameters (pH, temperature, time) using advanced bioreactors to achieve optimal hydrolysis yields while simultaneously attempting to mitigate the naturally occurring bitter taste profile associated with highly hydrolyzed protein, representing a crucial competitive technology.

Furthermore, advanced filtration techniques are essential for creating high-grade Beef Protein Isolates (BPI). Technologies such as ultra-filtration and nano-filtration are utilized to selectively remove fats, carbohydrates (lactose, if any residual exists), and impurities, resulting in a protein concentration exceeding 90%. Spray drying technology is the final and critical step, transforming the liquid protein solution into a stable, highly soluble powder form. Recent innovations focus on cold processing methods to minimize protein denaturation, thereby preserving the structural integrity and biological activity of the amino acids and peptides. These technological refinements ensure that the end product maintains maximum bioactivity, crucial for justifying the premium price point in the market.

Beyond core processing, the integration of advanced flavor masking and encapsulation technologies is rapidly gaining prominence. Flavor houses are developing sophisticated systems to neutralize the inherent savory notes of beef protein, allowing for palatable final products in flavors such as chocolate, vanilla, and various fruits. Microencapsulation, though expensive, is being explored to shield the protein peptides from direct contact with taste receptors until ingestion. Additionally, technology related to supply chain transparency, utilizing tools like near-infrared spectroscopy (NIR) for rapid quality testing and blockchain platforms for tracking raw material origin, is becoming standard practice. These technologies not only ensure regulatory compliance but also meet the burgeoning consumer demand for verifiable sourcing and clean ingredient decks.

Regional Highlights

Regional dynamics heavily influence the consumption and growth rates of beef protein powder, dictated by local dietary trends, disposable income, and the maturity of the sports nutrition sector. North America, comprising the United States and Canada, stands as the global leader in market value. This dominance is attributed to a high consumer propensity for dietary supplements, a robust culture of fitness and bodybuilding, and the widespread adoption of specific high-protein diets such as Paleo, which strongly promotes beef-derived products. Furthermore, the region benefits from highly sophisticated distribution networks, aggressive marketing campaigns by major supplement brands, and significant R&D investment focused on improving palatability and developing novel beef protein formulations, including collagen peptides.

Europe represents a mature but steadily expanding market, driven largely by consumer demands for high-quality, non-GMO, and traceable protein sources. Western European countries, particularly the UK, Germany, and France, exhibit strong market penetration, supported by well-established regulatory frameworks that ensure product safety and quality. The demand here is increasingly bifurcated between high-performance athletes seeking isolates and general wellness consumers utilizing beef protein for digestive health and joint support. Eastern Europe, while smaller, offers substantial latent growth potential as health and fitness awareness increases and modern retail channels develop.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid acceleration is fueled by several macroeconomic factors: burgeoning middle-class populations with increased purchasing power, escalating urbanization leading to lifestyle changes and greater health consciousness, and the rapid expansion of the fitness and gym industry, especially in populous markets like China, India, and Australia. While traditionally dominated by plant proteins in some areas, the rising focus on sports performance and the influence of Western dietary trends are significantly boosting the adoption of premium animal-derived proteins like beef isolate. Marketing strategies in APAC must focus heavily on product education and overcoming initial cultural barriers regarding bovine consumption in certain regions.

- North America (US and Canada): Market leader, driven by Paleo/Keto trends, high disposable income, and established sports nutrition industry. Focus on isolates and hydrolyzed forms for maximum performance.

- Europe (Germany, UK, France): Strong demand for clean label, traceable, and hormone-free protein. Steady growth supported by clinical and specialized nutrition applications.

- Asia Pacific (China, India, Australia, Japan): Fastest-growing region, fueled by urbanization, increasing health awareness, expansion of fitness infrastructure, and rising penetration of international supplement brands.

- Latin America (Brazil, Mexico): Emerging market with growing interest in sports supplements; growth hampered slightly by economic instability but driven by increasing availability through e-commerce.

- Middle East and Africa (UAE, South Africa): Niche market focused on luxury fitness supplements and clinical nutrition; growth is primarily concentrated in urban hubs with high expatriate populations and high-end fitness facilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Beef Protein Powder Market.- MuscleMeds

- MHP (Maximum Human Performance)

- NutraBio Labs

- Naked Nutrition

- Bluebonnet Nutrition

- Designs for Health

- PaleoPro

- Olympian Labs

- BodyScience

- Inner Armour

- Betancourt Nutrition

- EFX Sports

- Swanson Health Products

- Isopure (a division focusing on specialized protein sources)

- Now Foods (offering specialized protein variants)

- Ultimate Nutrition

- Xtend (Scivation)

- San Nutrition

- Glanbia Performance Nutrition (through diversified brand portfolio)

- Transparent Labs

Frequently Asked Questions

Analyze common user questions about the Beef Protein Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of choosing beef protein over traditional whey protein?

Beef protein's primary advantages are its complete amino acid profile, including high amounts of muscle-building BCAAs, and its status as a dairy-free, hypoallergenic option. It is ideal for individuals with lactose intolerance or dairy allergies, offering excellent digestibility and rapid absorption, particularly in its hydrolyzed isolate form.

Is Beef Protein Powder suitable for individuals following a Paleo or Keto diet?

Yes, beef protein powder is exceptionally suitable for both Paleo and Keto diets. High-quality beef protein isolates contain minimal to zero carbohydrates and fats, aligning perfectly with the strict low-carb requirements of Keto, while also adhering to the ancestral, whole-food principles emphasized by the Paleo lifestyle.

How does the production cost of beef protein compare to other protein sources?

Beef protein powder generally has a higher production cost compared to whey protein due to the complex enzymatic hydrolysis process required to produce high-purity isolates (BPI) and hydrolysates, coupled with the need for high-quality, traceable bovine raw materials. This premium cost is reflected in the final retail price.

Which regions are driving the current growth of the Beef Protein Powder Market?

North America currently holds the largest market share due to mature consumer awareness, but the Asia Pacific (APAC) region, driven by rising disposable incomes and expanding fitness culture in countries like China and India, is projected to register the fastest growth rate in the forecast period.

What technological advancements are improving the taste and mixability of beef protein?

Key technological advancements include enhanced enzymatic hydrolysis methods that minimize bitterness, combined with sophisticated flavor masking techniques and microencapsulation technologies. These R&D efforts are crucial for neutralizing the inherent savory notes and improving the solubility and overall consumer palatability of the final powdered product.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager