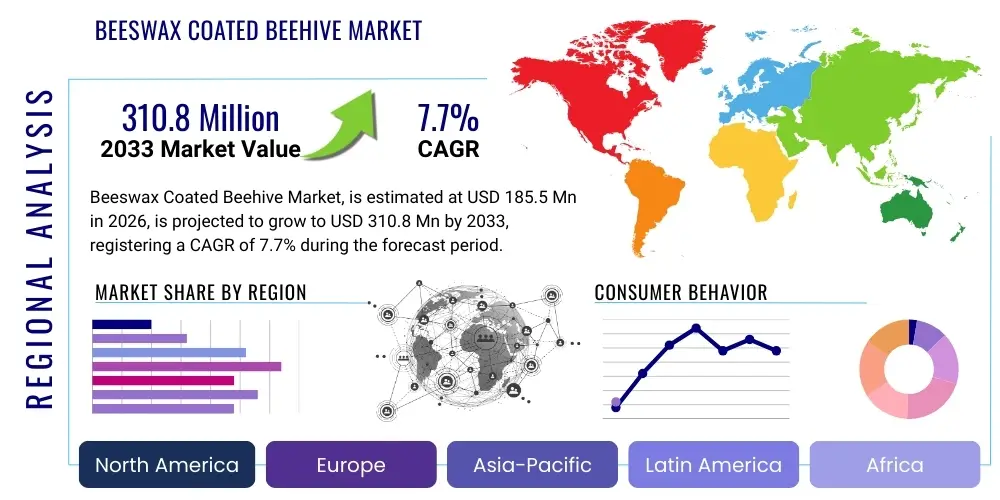

Beeswax Coated Beehive Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434755 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Beeswax Coated Beehive Market Size

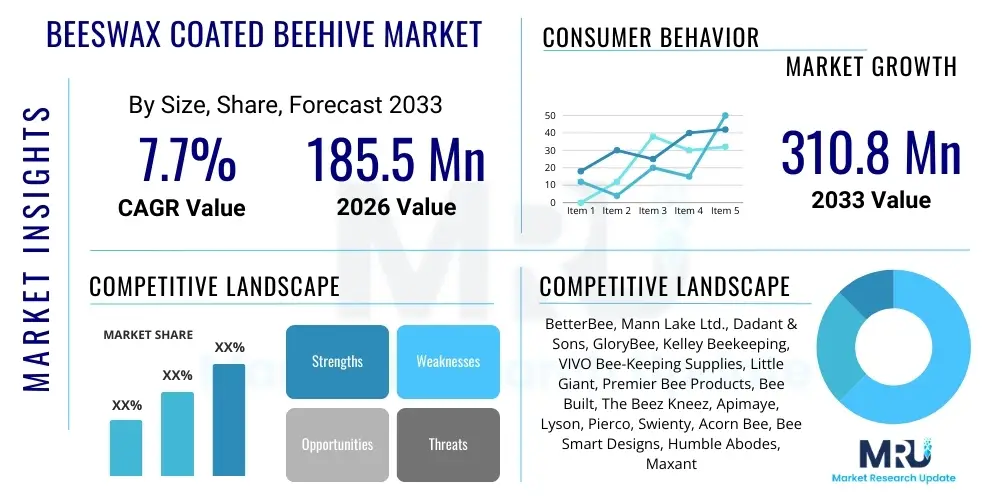

The Beeswax Coated Beehive Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.7% between 2026 and 2033. The market is estimated at $185.5 Million in 2026 and is projected to reach $310.8 Million by the end of the forecast period in 2033.

Beeswax Coated Beehive Market introduction

The Beeswax Coated Beehive Market encompasses the manufacturing, distribution, and sale of beehive components, primarily wooden or sometimes composite materials, that have been externally and sometimes internally treated with natural beeswax rather than traditional paints or synthetic sealants. This specialized market segment addresses the rising demand from beekeepers—both commercial and hobbyist—for sustainable, non-toxic, and highly durable hive solutions. Beeswax coating acts as a superior moisture barrier, enhancing the longevity of the wood, and crucially, provides a natural, appealing environment that encourages quicker acceptance by bee colonies, mitigating chemical risks associated with conventional coatings, thereby promoting overall colony health and productivity.

Key products within this market include complete hive kits (Langstroth, Warre, Top Bar), supers, deep boxes, frames, and lids, all pre-coated with pharmaceutical-grade or refined natural beeswax. Major applications span commercial apiculture operations seeking to minimize maintenance and replacement costs, small-scale hobbyist beekeepers prioritizing natural materials and bee welfare, and agricultural entities utilizing bees for crop pollination services. The market's growth is inherently linked to global trends in sustainable agriculture, increasing consumer interest in natural honey products, and the imperative need to combat Colony Collapse Disorder (CCD) by providing optimum, low-stress environments for honeybees.

Driving factors for this market segment are significant and multifaceted. The established benefit of natural beeswax acting as a preservative, coupled with its inherent resistance to minor pests like wax moths, positions these hives as a premium offering. Furthermore, increasing regulatory pressures and consumer preference away from petrochemical-based products in food production systems amplify the attractiveness of beeswax coatings. The ease of use, as these hives are often sold fully assembled and ready for immediate deployment, reduces the initial setup burden for new beekeepers, contributing to robust market penetration across various geographical regions.

Beeswax Coated Beehive Market Executive Summary

The Beeswax Coated Beehive Market is experiencing robust expansion driven by environmental consciousness and the professionalization of global apiculture. Business trends indicate a strong shift towards vertically integrated supply chains, where manufacturers control sourcing of both wood and high-quality beeswax to ensure product consistency and natural origin claims, a key differentiator for premium products. There is also a notable increase in e-commerce platforms and direct-to-consumer models, leveraging the educational aspect of natural beekeeping to drive sales among hobbyists globally. Innovations are focused on optimizing coating application techniques for deeper penetration and longer lifespan, alongside the development of modular and standardized coated components to facilitate easier hive management for large commercial operators.

Regionally, North America and Europe currently dominate the market due to established beekeeping cultures, stringent quality standards for bee products, and high disposable incomes supporting the adoption of premium, higher-priced coated hives over standard untreated or painted boxes. However, the Asia Pacific (APAC) region, particularly China and India, is emerging as the fastest-growing market segment. This growth is fueled by massive agricultural needs for pollination services and governmental initiatives promoting modern, sustainable beekeeping practices to improve yields and diversify rural incomes. Latin America is also showing potential, focusing on exporting high-quality, naturally produced honey, thereby boosting demand for premium hive construction materials.

Segment trends reveal that the Langstroth hive design, due to its standardized dimensions and global acceptance, remains the dominant product type within the coated segment. The commercial beekeeping application segment holds the largest market share, prioritizing durability and reduced maintenance. However, the hobbyist segment is demonstrating the highest CAGR, driven by the strong emphasis hobbyists place on organic practices and natural materials. Material segmentation highlights Cedar and Pine as preferred wood types for coating, offering the best balance between cost, structural integrity, and wax adherence. Furthermore, the market sees increasing adoption of pre-assembled, coated hive components, streamlining the entry process for novice beekeepers.

AI Impact Analysis on Beeswax Coated Beehive Market

User queries regarding AI's influence on the Beeswax Coated Beehive Market primarily revolve around operational efficiency, pest detection, predictive maintenance, and optimizing the beeswax coating process itself. Common concerns focus on whether AI-powered hive monitoring systems can accurately measure the insulation and preservation benefits provided by beeswax coating, and how predictive analytics might influence inventory management for these specialized, high-demand components. Users are keen to understand if AI can streamline the manufacturing process, such as robotic application of the coating or quality control checks for uniform thickness and adherence, thereby lowering the cost and increasing the scalability of these premium hives without compromising the natural material integrity.

The analysis indicates that while AI is not directly involved in the material composition of the beehive coating, its impact is profound in the adjacent operational ecosystems. Beekeepers are increasingly adopting AI-driven monitoring solutions (e.g., internal hive sensors, weight trackers, acoustic analysis) to track colony health. These systems generate vast amounts of data that can be used to compare the performance (e.g., humidity, temperature regulation, disease prevention) of beeswax-coated hives versus traditional hives, thereby providing quantifiable validation of the coating's benefits and further fueling consumer confidence and market demand for coated products. This data validation cycle strengthens the product's value proposition significantly.

In manufacturing, AI and machine learning algorithms are beginning to optimize the logistics and production scheduling for large hive component manufacturers. This includes forecasting demand for specific coated hive types based on regional climate predictions and agricultural cycles, ensuring timely availability of components. Moreover, sophisticated image recognition software integrated into assembly lines can perform immediate quality checks on the beeswax application—checking for coverage completeness, curing uniformity, and structural integrity—ensuring that the high standards expected of a naturally preserved product are consistently met before shipping to distributors globally. This technological integration enhances scalability and operational resilience.

- AI-driven sensor data validates the superior thermal and moisture regulation properties of beeswax-coated hives, driving product validation.

- Predictive analytics optimize inventory and logistics, ensuring timely supply of high-demand coated components to commercial apiculturists.

- Machine Vision systems improve manufacturing quality control, automating the inspection of beeswax coating uniformity and adherence.

- AI-powered pest detection (e.g., Varroa mites) informs beekeepers, potentially emphasizing the need for robust, well-sealed hives provided by quality coatings.

- Robotics integrated with AI can automate the precise and efficient application of melted beeswax, enhancing production scalability.

DRO & Impact Forces Of Beeswax Coated Beehive Market

The Beeswax Coated Beehive Market is shaped by powerful forces encompassing environmental shifts, consumer preferences for natural products, and operational economics within the apiculture industry. Drivers include the proven longevity and natural preservation qualities of beeswax, which significantly reduce the maintenance cycles and replacement costs associated with traditional wooden hives. Restraints primarily involve the higher initial cost of beeswax-coated hives compared to standard untreated or painted alternatives, and fluctuations in the global price and supply chain stability of high-grade natural beeswax. Opportunities lie in expanding into nascent organic honey production markets and developing standardized, customizable coating services that cater to existing beekeepers looking to upgrade their current equipment without full replacement.

The core Drivers propel market growth by appealing directly to both commercial viability and ethical beekeeping practices. Beekeepers recognize that minimizing chemical exposure in the hive leads to healthier colonies and higher-quality honey, aligning with strong consumer trends toward sustainability and organic sourcing. Furthermore, the longevity provided by beeswax coating translates into a lower Total Cost of Ownership (TCO) over the hive's lifespan, providing a compelling financial argument despite the higher initial outlay. This combination of ecological benefit and economic efficiency forms the backbone of market traction.

Impact forces are critical in shaping market dynamics. The threat of substitutes, traditionally being standard oil-based paint or synthetic treatments, remains a constant challenge, especially in cost-sensitive markets. However, the bargaining power of buyers (large commercial apiaries) is moderated by the necessity of high-quality, durable equipment for their operations, making them less price-sensitive for proven, natural solutions. The bargaining power of suppliers (of beeswax and high-grade wood) is relatively high due to specialization requirements and the push for natural sourcing integrity. Overall, the increasing environmental regulations and consumer demands for pesticide-free honey production elevate the importance of natural coating solutions, placing a strong positive impact on future market expansion.

Segmentation Analysis

The Beeswax Coated Beehive Market is systematically segmented based on Hive Type, Material, and Application, reflecting the diverse needs of the global beekeeping community. Understanding these segments is crucial for manufacturers to tailor product offerings, pricing strategies, and distribution channels effectively. The primary segment by type is dominated by standardized models optimized for commercial efficiency, while the material segmentation highlights the preference for durable, weather-resistant woods that complement the natural properties of the beeswax coating. The application segmentation clearly delineates between the volume-driven commercial sector and the value-driven hobbyist sector, each exhibiting distinct purchasing behaviors and quality demands.

The differentiation in hive type addresses varying regional preferences and beekeeping methodologies. Langstroth hives, recognized globally for their ease of frame manipulation and standardization, account for the majority of the market share in the coated segment. Conversely, Warre and Top Bar hives, favored by natural beekeepers who prioritize minimal intervention and bee-centric approaches, represent a faster-growing niche within the coated market. The appeal of beeswax coating is particularly strong among natural beekeepers as it aligns perfectly with their philosophy of utilizing only organic and non-toxic materials within the hive environment, thus solidifying its market position across diverse user philosophies.

Analyzing the application segments reveals a significant driver of innovation. Commercial beekeepers demand robust, weather-resistant coating that can withstand frequent transportation and large-scale, often mechanical, manipulation, focusing on industrial-grade coating longevity. Hobbyists, while smaller in volume, demand extremely high-quality craftsmanship, aesthetic appeal, and certified organic sourcing for the beeswax, viewing the hive not just as equipment but as a long-term investment in a personal pursuit. This dual demand profile compels manufacturers to maintain both high production standards for commercial volume and meticulous quality control for the premium hobbyist market. The research/educational sector, though small, drives demand for specialized observation hives and detailed tracking of coating performance under varying experimental conditions.

- Hive Type

- Langstroth Hives (Dominant due to standardization and commercial scalability)

- Top Bar Hives (Growing niche favored by natural beekeepers)

- Warre Hives (Niche market focused on vertical, insulated beekeeping)

- Nucleus Hives (Smaller, coated units for starting or splitting colonies)

- Material

- Cedar (Premium, highly weather-resistant, naturally durable)

- Pine (Cost-effective, widely available, requires quality coating)

- Fir (Mid-range durability and weight)

- Composite/Plywood (Smaller segment utilizing durable composite wood, coated for sealing)

- Application

- Commercial Beekeeping (Focus on high volume, durability, and low maintenance)

- Hobbyist Beekeeping (Focus on natural materials, quality, and aesthetics)

- Research and Educational Institutions (Focus on controlled studies and specific testing environments)

Value Chain Analysis For Beeswax Coated Beehive Market

The value chain for the Beeswax Coated Beehive Market begins with the sourcing of primary raw materials—high-grade lumber (Cedar, Pine) and purified natural beeswax. Upstream analysis involves rigorous quality checks on lumber for moisture content and durability, alongside ensuring the beeswax is free from contaminants, which is crucial for a product positioned on natural integrity and bee health. Key upstream activities include sustainable logging, sawmilling, timber seasoning, and the specialized refining or filtering of raw beeswax. Suppliers with established certifications for sustainable forestry and organic beeswax production hold significant leverage and contribute directly to the final product's premium pricing.

The core manufacturing stage involves precision cutting, joining, and assembly of the beehive components, followed by the highly specialized process of beeswax coating. This midstream activity requires specific heated dipping tanks or spraying machinery to ensure uniform and deep penetration of the beeswax into the wood fibers, maximizing preservation effectiveness. Manufacturers in this segment often invest heavily in patented or proprietary coating methods to differentiate their products based on coating thickness, longevity, and purity. Efficiency at this stage directly influences production costs and ultimately, market competitiveness, necessitating optimization techniques to minimize wax usage while maximizing coverage quality.

Downstream analysis focuses on distribution and sales channels, which are segmented between high-volume commercial supply and targeted retail/e-commerce. Direct distribution to large commercial apiaries allows for bulk sales and specialized logistics handling. Indirect channels, including specialized beekeeping supply stores, garden centers, and robust e-commerce platforms, cater extensively to the geographically dispersed hobbyist market. The final stage involves extensive customer education and after-sales support, emphasizing the benefits and maintenance requirements of beeswax-coated products, thereby reinforcing brand loyalty and justifying the premium price point relative to traditional painted hives.

Beeswax Coated Beehive Market Potential Customers

The primary customer base for the Beeswax Coated Beehive Market encompasses professional entities and individual enthusiasts dedicated to sustainable apiculture. Commercial beekeepers represent the largest volume purchasers, requiring durable equipment that minimizes labor costs associated with maintenance and hive treatment. These customers prioritize the reduced need for repainting and the enhanced pest resistance offered by natural coatings, translating directly into operational efficiencies and minimized downtime across extensive apiary operations. Their purchasing decisions are heavily influenced by proven durability statistics, bulk pricing, and reliable supply chain logistics capable of delivering large quantities of standardized components.

The second major group consists of hobbyist and sideline beekeepers, who are typically highly focused on the purity of their honey and the welfare of their colonies. For this demographic, the natural, non-toxic aspect of the beeswax coating is a major selling point, aligning with organic or natural beekeeping philosophies (e.g., treatment-free apiculture). They value craftsmanship, aesthetic quality, and the knowledge that the materials introduced into the hive environment are entirely safe and natural. This segment is characterized by higher price acceptance for premium, specialized products and relies heavily on reviews, educational content, and specialized retail outlets for purchasing decisions.

Additionally, agricultural corporations, particularly those involved in large-scale contract pollination services, form a growing customer segment. These corporations often purchase hives for rent or maintenance and require equipment that guarantees colony health and resilience throughout the pollination season. They view the beeswax coating as an investment in asset protection and reliable biological service delivery. Furthermore, governmental and non-governmental organizations involved in environmental conservation, ecological research, and agricultural extension services are important, albeit smaller, customers who purchase coated hives for educational programs, research projects investigating natural colony resilience, and supporting developing beekeeping communities globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185.5 Million |

| Market Forecast in 2033 | $310.8 Million |

| Growth Rate | 7.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BetterBee, Mann Lake Ltd., Dadant & Sons, GloryBee, Kelley Beekeeping, VIVO Bee-Keeping Supplies, Little Giant, Premier Bee Products, Bee Built, The Beez Kneez, Apimaye, Lyson, Pierco, Swienty, Acorn Bee, Bee Smart Designs, Humble Abodes, Maxant Industries, Brushy Mountain Bee Farm, Bee Box Factory |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Beeswax Coated Beehive Market Key Technology Landscape

The technology landscape for the Beeswax Coated Beehive Market is centered not on radical invention but on optimization, precision, and certification processes necessary to deliver a consistently high-quality natural product at scale. A core technological area involves the development of specialized heating and dipping systems for the application of beeswax. These systems use precise temperature control and immersion timing algorithms to ensure optimal penetration depth into the wood grain without damaging the wood structure or overheating the natural wax, which could compromise its protective properties. Vacuum infusion technology is also being explored by premium manufacturers to maximize wax absorption, particularly in less dense wood types, thereby enhancing overall water resistance and longevity.

Another crucial technological element is the refinement and quality testing of the beeswax itself. Advanced filtration techniques, including microfiltration and specialized centrifugation, are utilized to remove impurities and residues (such as pesticide traces or heavy metals) from the raw wax sourced from beekeepers. Manufacturers must employ laboratory testing and certification technologies, often requiring third-party validation, to guarantee that the beeswax meets high standards of purity, especially for products marketed to organic or natural beekeeping consumers. This rigorous testing minimizes the risk of introducing contaminants into the sensitive hive environment, a key competitive advantage.

Furthermore, automation and computer-aided manufacturing (CAM) play a significant role in improving the cost-efficiency of production. Automated wood cutting and assembly lines ensure dimensional accuracy, which is vital for standardized hive components like Langstroth boxes. Coupled with this, real-time monitoring of the coating process using industrial cameras and sensors helps maintain quality control by detecting uneven coverage or wax pooling. This integration of precise robotics and process monitoring allows companies to scale production while adhering to the strict quality requirements demanded by beekeepers who invest in premium, naturally preserved equipment, ultimately supporting global market expansion.

Regional Highlights

The Beeswax Coated Beehive Market exhibits significant regional variations in adoption rate, market maturity, and preferred product types, largely influenced by local beekeeping traditions, agricultural intensity, and regulatory frameworks concerning chemical usage in apiculture.

- North America (U.S. and Canada): This region represents a mature market segment, characterized by large commercial migratory operations and a substantial, well-informed hobbyist community. The demand is robust, driven by the need for durable, low-maintenance hives to withstand varied climate conditions and frequent transportation. The U.S. is a major consumer, valuing the enhanced durability and natural appeal of beeswax coating as a defense against moisture and pests, leading to high adoption rates of premium coated Langstroth components.

- Europe: European markets, particularly Germany, France, and the UK, prioritize organic and natural honey production, aligning perfectly with the ethos of beeswax-coated hives. Regulatory stringency regarding chemicals in agricultural practices accelerates the adoption of natural preservation methods. The demand is diverse, encompassing both standardized Langstroth equipment and a strong niche interest in non-traditional hives like Warre and Top Bar, where the natural coating is seen as integral to the hive philosophy.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region. Countries like India, China, and Australia are rapidly modernizing their agricultural sectors, increasing dependence on efficient pollination services. Governmental support for sustainable beekeeping, coupled with the immense scale of agricultural demand, drives volume growth. While often price-sensitive, increasing awareness regarding the long-term benefits and durability of coated hives is shifting purchasing priorities toward quality, particularly in high-value export markets like New Zealand and Australia.

- Latin America: This region is a major exporter of honey, focusing heavily on quality and organic certifications to access premium international markets. The demand for beeswax-coated hives is concentrated among exporters and large-scale producers seeking to meet these high standards. Durable coating is essential due to tropical and subtropical climates, where humidity and high temperatures accelerate wood degradation, making the superior moisture barrier of beeswax highly valuable for operational longevity.

- Middle East and Africa (MEA): Market penetration is currently lower but exhibits significant potential in specific countries like South Africa and parts of the Levant where commercial beekeeping is expanding. Challenges include establishing reliable supply chains for quality wood and beeswax. However, localized initiatives promoting sustainable beekeeping to combat desertification and support local food security are gradually driving the need for durable, naturally protected hive equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Beeswax Coated Beehive Market.- BetterBee

- Mann Lake Ltd.

- Dadant & Sons

- GloryBee

- Kelley Beekeeping

- VIVO Bee-Keeping Supplies

- Little Giant

- Premier Bee Products

- Bee Built

- The Beez Kneez

- Apimaye

- Lyson

- Pierco

- Swienty

- Acorn Bee

- Bee Smart Designs

- Humble Abodes

- Maxant Industries

- Brushy Mountain Bee Farm

- Bee Box Factory

Frequently Asked Questions

Analyze common user questions about the Beeswax Coated Beehive market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of beeswax coating over traditional paint or sealants for beehives?

Beeswax coating offers distinct advantages in bee health and hive durability. It is entirely natural and non-toxic, preventing the introduction of volatile organic compounds (VOCs) and chemical residues into the hive, which can stress colonies. Functionally, beeswax provides a superior moisture barrier, penetrating the wood grain to minimize warping, cracking, and rot, thereby significantly extending the hive's lifespan (often 2–3 times longer than untreated wood) and reducing the frequency of maintenance or repainting required by synthetic sealants. Furthermore, bees readily accept the natural wax smell, often resulting in quicker colonization and reduced stress during establishment.

How does the beeswax coating impact the thermal regulation and structural integrity of the beehive components?

The natural properties of beeswax enhance the thermal regulation of the beehive. When applied correctly, the coating acts as a mild insulator, helping the colony maintain a stable internal temperature by minimizing heat loss during winter and reducing solar heat gain during summer months, which is critical for brood development and overall colony survival. Structurally, by sealing the wood deeply against moisture infiltration, the beeswax prevents the expansion and contraction cycles that typically weaken wooden joints and lead to component failure, thus maintaining the precise dimensional integrity necessary for seamless frame and box compatibility over many years of use.

Is the higher initial cost of beeswax-coated beehives justified by the long-term economic benefits for commercial beekeepers?

Yes, the higher initial investment for beeswax-coated beehives is generally justified for commercial operations through a lower Total Cost of Ownership (TCO). While the upfront expense is greater than that of raw or painted hives, commercial beekeepers realize substantial savings by dramatically reducing labor costs associated with routine maintenance, scraping, sanding, and repainting. The extended service life of the components, coupled with reduced hive loss due to rot and weathering, translates directly into fewer replacements and a more reliable asset base, enhancing the overall economic efficiency and sustainability of large-scale apiary management across the forecast period.

What criteria should beekeepers use when selecting the quality of beeswax coating, and how can purity be ensured?

Beekeepers should prioritize coating quality based on the purity, thickness, and method of application. High-grade coatings use purified, often food-grade or pharmaceutical-grade beeswax, free from pesticides, heavy metals, or synthetic additives. Purity is best ensured by selecting suppliers who provide certificates of analysis or third-party laboratory verification of their beeswax sources. Regarding application, look for descriptions of deep immersion or vacuum-assisted coating processes, as surface-level application provides insufficient weather resistance. A thicker, well-cured coating provides superior longevity and protection compared to thinly sprayed or brushed-on layers, ensuring maximum protective benefit for the colony.

How do regional climate differences affect the performance and lifespan of beeswax-coated beehives?

Beeswax-coated hives perform exceptionally well across diverse climates, yet specific regional differences necessitate minor operational considerations. In high-humidity or tropical climates (like parts of Latin America and Southeast Asia), the beeswax coating's superior moisture barrier is highly critical, preventing fungal growth and wood rot accelerated by humidity. In extremely arid or hot environments (like the Middle East or Southwestern U.S.), the coating helps reflect some heat and prevents the wood from drying out too quickly, though beekeepers must ensure adequate ventilation. In temperate zones with freeze-thaw cycles, the coating prevents water penetration that leads to cracking, making the hives significantly more resilient to harsh seasonal changes than standard wooden components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager