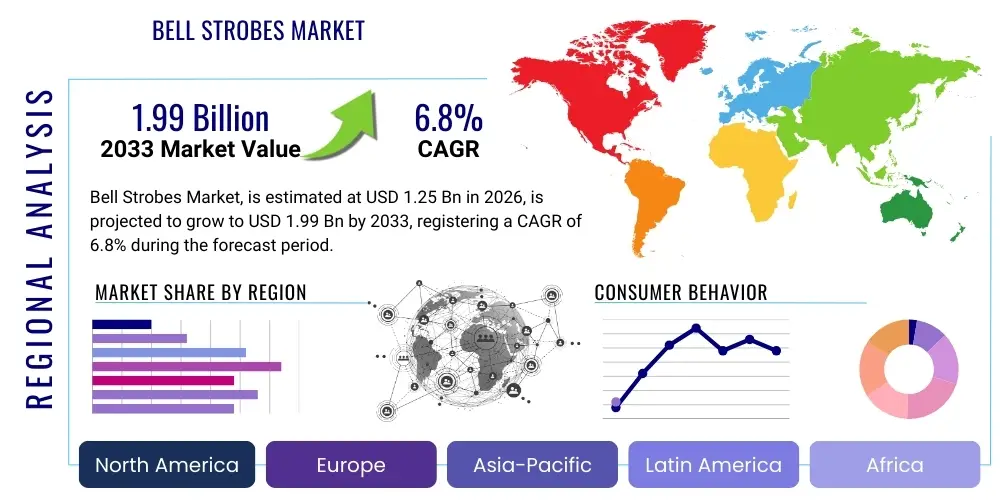

Bell Strobes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438320 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Bell Strobes Market Size

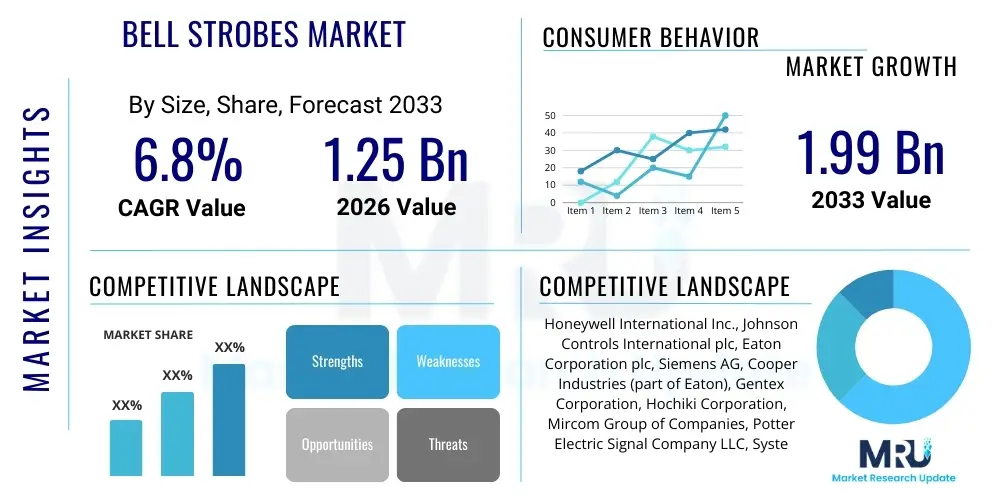

The Bell Strobes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.99 Billion by the end of the forecast period in 2033.

Bell Strobes Market introduction

Bell strobes are integral components of modern life safety systems, serving the dual purpose of providing audible notification (bells or horns) and visual warning signals (strobes) during emergency events, primarily fires. These devices are mandated in commercial, institutional, and increasingly, multi-family residential structures to ensure that all occupants, including those with hearing impairments, are promptly alerted. The visual component, the strobe light, is crucial for compliance with the Americans with Disabilities Act (ADA) in the United States and similar accessibility standards globally, ensuring effective communication of danger regardless of ambient noise levels or an individual's auditory capabilities. Product innovation is heavily focused on increasing efficiency, reducing current draw, and improving synchronization across large installations to prevent photo-epileptic incidents.

The primary applications of bell strobes span a vast spectrum, including hospitals, schools, universities, manufacturing facilities, high-rise office buildings, and hotels. Their effectiveness is fundamentally tied to their ability to produce a sufficiently loud and intense warning signal that cuts through typical operational noise levels, while the strobes must meet specific candela ratings and flash rates as defined by relevant national and international fire codes, such as NFPA 72. Recent market evolution sees a significant shift towards Addressable Bell Strobes, which allow the fire alarm control panel (FACP) to pinpoint the exact location of the device in distress or the device that has been activated, greatly enhancing maintenance efficiency and response times for first responders. This advanced diagnostic capability is a key driver for replacement cycles in mature markets.

Key driving factors propelling the growth of this market include rigorous enforcement of building safety codes globally, particularly in densely populated urban centers undergoing rapid vertical construction. Governments and regulatory bodies continually update life safety standards, often requiring backward compatibility or mandatory replacement of older, less efficient Xenon-based strobes with modern, low-current LED technology. Furthermore, the increasing complexity of building layouts, coupled with the rising global focus on mass notification systems (MNS) that integrate fire alarms with general emergency communications, necessitates the deployment of highly reliable, synchronized bell strobes capable of integrating seamlessly into sophisticated network architectures. These factors collectively ensure sustained demand across maintenance, repair, and new construction sectors.

Bell Strobes Market Executive Summary

The Bell Strobes Market is characterized by steady, regulation-driven growth, underpinned by mandatory safety standards across commercial and institutional sectors. Current business trends heavily favor the adoption of low-power LED technology due to its superior efficiency, longevity, and reduced operational costs compared to traditional Xenon flash tubes. Furthermore, synchronization capability is now a non-negotiable feature, vital for ADA compliance and minimizing occupant disorientation. The competitive landscape is dominated by established global fire safety equipment manufacturers who invest heavily in achieving certifications (UL, FM, CE) essential for market entry. Strategic trends include consolidation, with major players acquiring specialized technology firms focusing on wireless communication and advanced integration into building management systems (BMS).

Regional trends indicate North America and Europe retaining mature market status, driven primarily by stringent regulatory compliance and replacement demand for aging infrastructure. These regions emphasize advanced features like multi-candela settings and sophisticated diagnostic capabilities. Conversely, the Asia Pacific (APAC) region is emerging as the fastest-growing market, propelled by massive urbanization, infrastructure development, and the subsequent adoption of international fire safety codes, particularly in rapidly expanding economies like China and India. This growth is focused on new installations, favoring cost-effective and scalable solutions. Latin America and the Middle East and Africa (MEA) are also exhibiting robust growth, motivated by large-scale commercial and hospitality construction projects requiring certified life safety infrastructure.

Segmentation trends highlight the dominance of the commercial application segment (office buildings, retail, education) due to high population density and stringent code requirements. Technology-wise, LED strobes are rapidly displacing Xenon technology, offering superior current management capabilities crucial for larger systems where power draw is a significant constraint. In terms of product type, combination devices (horn/bell strobes) remain the most popular choice, maximizing coverage efficiency while minimizing installation costs and ceiling footprint. Future growth is projected strongly in the segment of interconnected and addressable systems, moving away from conventional wiring to intelligent, network-managed safety devices that provide real-time fault reporting and predictive maintenance alerts.

AI Impact Analysis on Bell Strobes Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the Bell Strobes Market primarily revolve around how AI can enhance the reliability and efficiency of fire alarm systems, moving beyond passive alerts to proactive safety management. Key user concerns focus on AI's potential in reducing nuisance alarms, automating compliance reporting, and optimizing system maintenance schedules. There is significant interest in AI's role in synthesizing data from multiple sensors (smoke, heat, video analytics) to confirm genuine emergencies before triggering the bell strobes, thereby minimizing business disruption caused by false alarms. Furthermore, users question how AI can facilitate predictive maintenance of the physical strobe devices themselves, ensuring batteries, LEDs, and wiring remain compliant and operational without continuous manual inspection. The central expectation is that AI will transform the FACP from a simple controller into an intelligent safety hub, improving life safety outcomes and reducing total cost of ownership through operational efficiencies.

While bell strobes remain fundamentally electromechanical signaling devices, the intelligence layer provided by AI and machine learning is profoundly impacting their operation and integration within the broader fire safety ecosystem. AI algorithms are being deployed in fire alarm control panels and cloud-based monitoring systems to analyze alarm patterns, environmental data, and sensor readings in real-time. This sophisticated analysis allows the system to differentiate between genuine fire threats and environmental anomalies (e.g., steam, dust, cooking smoke), drastically reducing the prevalence of false alarms that unnecessarily trigger the audible/visual warnings. This enhanced verification process ensures that when the bell strobes activate, the alert is credible, improving occupant response and mitigating alert fatigue.

Moreover, AI is pivotal in automating the regulatory and compliance burden associated with life safety systems. Machine learning models can process continuous performance data from addressable strobes—such as current consumption, flash synchronization status, and supervisory alerts—to generate mandated inspection logs and compliance reports automatically. This capability significantly reduces the labor hours required for system verification and documentation, ensuring that facilities adhere to dynamic regulations like NFPA standards. Additionally, AI-driven predictive maintenance scheduling uses historical performance metrics to flag bell strobes or associated wiring that are nearing failure thresholds, enabling replacement before a regulatory inspection or, more critically, before an actual emergency necessitates their function. This shift from reactive maintenance to proactive asset management represents a core value proposition of AI integration in the market.

- AI integration enhances alarm verification through multi-sensor data analysis, minimizing false alarms.

- Predictive maintenance algorithms analyze strobe performance data (current draw, synchronization) to preempt component failure.

- AI facilitates automated generation of compliance reports and inspection logs, ensuring adherence to NFPA, UL, and ADA standards.

- Optimization of large-scale system synchronization protocols to guarantee simultaneous flashing across multiple zones as per safety codes.

- Integration of AI with video surveillance for visual confirmation of emergencies before activating bells and strobes.

- Development of smart notification hierarchies that tailor the alert intensity based on occupancy and real-time risk assessment.

DRO & Impact Forces Of Bell Strobes Market

The Bell Strobes Market is structurally driven by non-negotiable regulatory requirements governing life safety in built environments globally. Key drivers include stringent national and international fire and building codes (such as NFPA 72 in the US, EN 54 in Europe, and comparable standards in APAC), which mandate the installation of synchronized visual and audible notification appliances in all public and commercial buildings. The continuous expansion of the construction sector, particularly the development of high-density commercial and residential complexes in emerging economies, provides a persistent demand floor. However, the market faces restraints, primarily high initial installation costs associated with wiring conventional systems and the complex regulatory landscape requiring specialized certified installers. Opportunities abound in the development of sophisticated wireless and IoT-enabled bell strobes, which significantly reduce wiring costs and installation complexity, making advanced systems more accessible for retrofitting existing structures and simplifying integration with smart building platforms. These factors—mandatory compliance, technological efficiency gains, and construction growth—collectively create a strong impact force ensuring stable market expansion despite economic fluctuations.

Segmentation Analysis

The Bell Strobes Market is comprehensively segmented based on technology, product type, application, and geography, reflecting the diverse regulatory and functional requirements across end-user verticals. The technology segmentation is witnessing a critical transition from older, high-current consuming Xenon flash tubes to energy-efficient Light Emitting Diode (LED) strobes, driven by the need for lower current draw, essential for powering large networks of devices from a centralized fire alarm control panel. Product type segmentation distinguishes between pure bells, pure strobes, and the highly popular combination horn/strobe units, which offer integrated audible and visual alerts. The application segment is dominated by the commercial and institutional sectors, which face the strictest regulatory mandates for life safety systems, while the increasing adoption of these devices in high-end residential and multi-family units signals diversification of demand. Understanding these segments is crucial for manufacturers tailoring product offerings to meet specific compliance standards and power budget constraints.

- By Product Type:

- Bell Strobes (Combination Units)

- Horn Strobes (Combination Units)

- Bells Only (Audible Appliances)

- Strobes Only (Visual Appliances)

- By Technology:

- LED-Based Strobes (Low Current Draw)

- Xenon-Based Strobes (Traditional)

- By Application/End-User:

- Commercial Buildings (Offices, Retail, Data Centers)

- Institutional (Hospitals, Schools, Government Facilities)

- Industrial (Manufacturing Plants, Warehouses)

- Residential (Multi-Family Housing, High-Rise Apartments)

- By Candela Rating:

- Low Candela (e.g., 15/30 cd)

- High Candela (e.g., 75/110/185 cd)

- Multi-Candela (Field-Selectable Settings)

Value Chain Analysis For Bell Strobes Market

The value chain for the Bell Strobes Market begins with the upstream procurement of specialized raw materials, primarily focusing on high-quality plastics and polymers for housing durability, advanced electronic components (capacitors, control chips, LED emitters), and acoustical components for the audible signaling devices. Due to the critical life safety function, material sourcing must adhere to strict fire-retardant and smoke-emission standards. Manufacturing involves precision assembly, rigorous quality control, and obtaining critical certifications (UL, FM, CE) which add significant value and complexity at this stage. Economies of scale are essential for managing manufacturing costs due to the relatively standardized nature of the components, though complexity increases significantly for addressable and wireless systems.

Midstream activities are characterized by robust product development and system integration. Manufacturers differentiate themselves not just on the performance of the bell strobe itself (candela intensity, sound output, current draw) but on the sophistication of the communication protocol used to synchronize these devices and interface with the main Fire Alarm Control Panel (FACP). Distribution channels are highly structured and regulatory-dependent. The primary channel is indirect, utilizing large national and regional distributors specializing in fire safety and electrical equipment. These distributors hold inventory and provide logistical support to the key downstream players: licensed fire safety system integrators and electrical contractors. Direct sales are typically reserved for large, national accounts or governmental projects.

Downstream activities center on installation, commissioning, and long-term maintenance. Installation requires certified professionals who ensure the devices are installed according to precise local building codes, including specifications related to mounting height, spacing, and candela rating relative to room size and ambient lighting. System integrators play a vital role in programming and commissioning the FACP to properly communicate with the addressable bell strobes, ensuring full synchronization across all devices within a structure. The recurring revenue stream derived from mandated annual inspection, testing, and maintenance (ITM) services provides long-term stability for the specialized downstream service providers, reinforcing the crucial link between product deployment and ongoing regulatory compliance.

Bell Strobes Market Potential Customers

Potential customers for Bell Strobes are primarily organizational entities mandated by law to provide comprehensive life safety systems within their occupied or constructed premises. The largest segment comprises commercial property developers and real estate investment trusts (REITs) engaged in constructing new high-rise office towers, shopping malls, and mixed-use complexes, where initial system installation is required for occupancy permits. A secondary, but equally important, customer base includes institutional entities such as public and private school districts, universities, and healthcare networks (hospitals and clinics). These institutions frequently undergo renovations or expansions, driving significant demand for both new installations and retrofits, often necessitating the shift to modern, ADA-compliant, addressable systems.

Furthermore, governmental agencies, including municipal buildings, military bases, and correctional facilities, represent stable, high-volume customers due to rigorous adherence to safety standards and cyclical infrastructure modernization projects. Industrial sectors, encompassing heavy manufacturing facilities, data centers, and large logistics warehouses, constitute another key customer segment, particularly those requiring specialized, ruggedized bell strobes capable of operating effectively in high-noise or harsh environmental conditions. The increasing regulatory pressure on existing structures means that building owners and facility managers of older buildings are perpetual customers for system upgrades and replacement parts, driven by the need to maintain certification and insurance compliance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.99 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Honeywell International Inc., Johnson Controls International plc, Eaton Corporation plc, Siemens AG, Cooper Industries (part of Eaton), Gentex Corporation, Hochiki Corporation, Mircom Group of Companies, Potter Electric Signal Company LLC, System Sensor (part of Honeywell), Tyco Fire Protection Products, Fire-Lite Alarms, Silent Knight, SimplexGrinnell (part of Johnson Controls), Fike Corporation, Nittan Group, Kidde Fire Safety, Securiton AG, Reliable Automatic Sprinkler Co., Inc., Maple Armor Fire Safety. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bell Strobes Market Key Technology Landscape

The technological landscape of the Bell Strobes Market is undergoing rapid modernization, moving distinctly toward solutions that prioritize efficiency, network intelligence, and simplified installation. The most significant shift involves the pervasive adoption of Light Emitting Diode (LED) technology, which has fundamentally redefined the power management aspects of fire alarm systems. LED strobes require significantly less current draw compared to legacy Xenon flash tubes, enabling system designers to install more notification appliances on a single circuit or utilize smaller gauge wiring, directly reducing overall material and installation costs. Furthermore, LED longevity far surpasses that of Xenon tubes, minimizing maintenance requirements and ensuring compliance over longer operational periods. This technological migration is essential for meeting the power demands of expansive, high-density installations common in contemporary commercial architecture.

A second critical technological evolution is the proliferation of addressable and synchronized communication protocols. Addressable technology embeds unique identification chips within each bell strobe, allowing the FACP to communicate bidirectionally with the device. This capability provides real-time status updates, including fault detection, operational status, and even precise candela settings, facilitating remote diagnostics and regulatory testing. Synchronization technology ensures that all visual appliances within a viewing area flash simultaneously, preventing the potentially hazardous flicker effect that can occur with non-synchronized strobes. Compliance with ADA and NFPA 72 mandates the use of synchronized strobes, making this technology a baseline requirement for new market entrants and product releases.

The emerging technological frontier focuses on wireless communication and integration with the Internet of Things (IoT). Wireless bell strobes, utilizing robust, proprietary mesh networking protocols, are gaining traction, particularly for retrofitting historical buildings or complex structures where traditional wiring is disruptive or cost-prohibitive. These wireless systems require battery power, necessitating sophisticated power management and frequent supervisory checks to ensure constant readiness. Integration with broader smart building ecosystems allows fire safety data to be centralized within a Building Management System (BMS), enabling advanced features such as automated elevator recall, HVAC shutdown, and direct communication with emergency services, significantly improving overall facility response capability.

Regional Highlights

North America: This region, encompassing the United States and Canada, represents the most mature and highly regulated market for bell strobes. Growth is primarily driven by rigorous enforcement of codes established by organizations such as the National Fire Protection Association (NFPA 72) and the Americans with Disabilities Act (ADA). The market here is characterized by high demand for multi-candela, addressable, and synchronized devices, as system specifications often exceed minimum requirements. Replacement and retrofit demand constitutes a significant portion of the market activity, especially as older conventional systems are upgraded to comply with modern efficiency and connectivity standards. Due to the high regulatory barriers and liability concerns, manufacturers must maintain premium certifications (UL, FM), leading to higher product standardization and cost relative to other regions.

Europe: The European market is governed by the stringent harmonized standards of the European Union, notably the EN 54 series, which dictates specifications for fire detection and alarm systems. The market is moderately mature, with growth driven by continuous infrastructure investment and strict national implementations of the EN standards. A key differentiator in Europe is the greater emphasis on voice alarm systems integrated with visual notification, moving beyond simple tones to provide clear, instructive messages during an emergency. The shift towards sustainable construction also favors low-power LED technology. The fragmented nature of the construction industry across various member states means manufacturers must navigate a diverse set of local purchasing habits and installation requirements, although the core product standards remain unified under the CE mark mandate.

Asia Pacific (APAC): APAC is the fastest-growing region, fueled by unprecedented levels of urbanization, massive industrial expansion, and rapid development of commercial infrastructure, particularly in China, India, and Southeast Asia. As these emerging economies adopt international safety benchmarks, there is substantial demand for new installations of certified bell strobes. While cost sensitivity remains a factor, the increasing prevalence of international investment and construction projects necessitates adherence to global standards, driving up the quality and complexity of installed systems. Manufacturers entering this market must focus on scalable solutions, flexible production capacity, and strategic partnerships with local distributors and installers to capitalize on the immense volume opportunity present in both new construction and regulatory upgrades across metropolitan areas.

- North America (US and Canada): Dominant market, driven by NFPA 72 and ADA compliance, focused on replacement cycles and addressable systems.

- Europe: Stable growth regulated by EN 54 standards, strong focus on integrated voice alarm systems and mandatory CE certification.

- Asia Pacific (APAC): Highest growth rate, fueled by rapid urbanization, new construction, and increasing adoption of international fire safety codes.

- Latin America (LATAM): Growth tied to commercial construction (hospitality, retail); increasing emphasis on certified products due to rising insurance requirements.

- Middle East and Africa (MEA): Significant demand from large-scale development projects (e.g., smart cities, mega-resorts), requiring robust, high-specification systems suitable for hot, sometimes dusty environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bell Strobes Market.- Honeywell International Inc.

- Johnson Controls International plc

- Eaton Corporation plc (Including Cooper Industries)

- Siemens AG

- Gentex Corporation

- Hochiki Corporation

- Mircom Group of Companies

- Potter Electric Signal Company LLC

- System Sensor (part of Honeywell)

- Tyco Fire Protection Products (part of Johnson Controls)

- Fire-Lite Alarms (part of Honeywell)

- Silent Knight (part of Honeywell)

- SimplexGrinnell (part of Johnson Controls)

- Fike Corporation

- Nittan Group

- Kidde Fire Safety (part of Carrier Global Corporation)

- Securiton AG

- Reliable Automatic Sprinkler Co., Inc.

- Maple Armor Fire Safety

- Zeta Alarm Systems

Frequently Asked Questions

Analyze common user questions about the Bell Strobes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between a conventional and an addressable bell strobe system?

Conventional systems wire devices into zones, providing notification that an alert originated within a general area but not the specific device. Addressable bell strobe systems utilize embedded communication chips to assign a unique electronic identity to each device, allowing the fire control panel (FACP) to pinpoint the exact location and status of the specific strobe or bell, drastically improving diagnostic speed and maintenance efficiency. This individual monitoring capability is vital for complex, large-scale installations.

Why are LED bell strobes replacing Xenon flash tubes in new construction projects?

LED bell strobes are preferred due to their superior energy efficiency and lower current draw, which is critical for maximizing the number of notification appliances that can be supported by a centralized fire alarm control panel circuit. LEDs also offer substantially longer service life and provide a highly reliable, consistent flash output that meets modern safety standards (like NFPA 72) while reducing the total cost of ownership over the system's lifespan compared to older, power-intensive Xenon technology.

What is the regulatory requirement regarding strobe synchronization in life safety systems?

Strobe synchronization is mandated by key regulatory bodies, including the Americans with Disabilities Act (ADA) and NFPA 72, to ensure that all visual notification appliances within a single field of view flash simultaneously. This synchronization prevents the creation of chaotic, non-synchronized light patterns that could potentially induce seizures in sensitive individuals (photo-epilepsy) or confuse occupants during an evacuation. Modern bell strobes utilize sophisticated communication protocols to achieve sub-millisecond synchronization across large networks.

How does the candela rating of a bell strobe impact its installation and coverage area?

The candela (cd) rating defines the intensity of the light output and directly determines the coverage area of a visual notification device. Higher candela ratings (e.g., 185 cd) are required for larger rooms, areas with high ambient light, or installations exceeding maximum mounting heights, ensuring the visual alert is visible throughout the space as required by NFPA 72 spacing tables. Lower candela ratings (e.g., 15 cd) are typically sufficient for smaller, less expansive areas like hallways and bathrooms. Multi-candela strobes offer adjustable settings, providing flexibility for installers to comply with varied room specifications using a single product type.

What role do wireless bell strobes play in the market, and what are their limitations?

Wireless bell strobes are essential for retrofitting historical buildings, leased office spaces, or complex structures where running new conduit and wiring is impractical or too costly. They connect via robust mesh networking protocols to the FACP, significantly reducing installation time and material costs. However, their primary limitation is reliance on internal battery power, which requires regular maintenance, inspection, and replacement cycles to guarantee operational readiness, unlike hardwired systems which draw continuous power from the main panel.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager