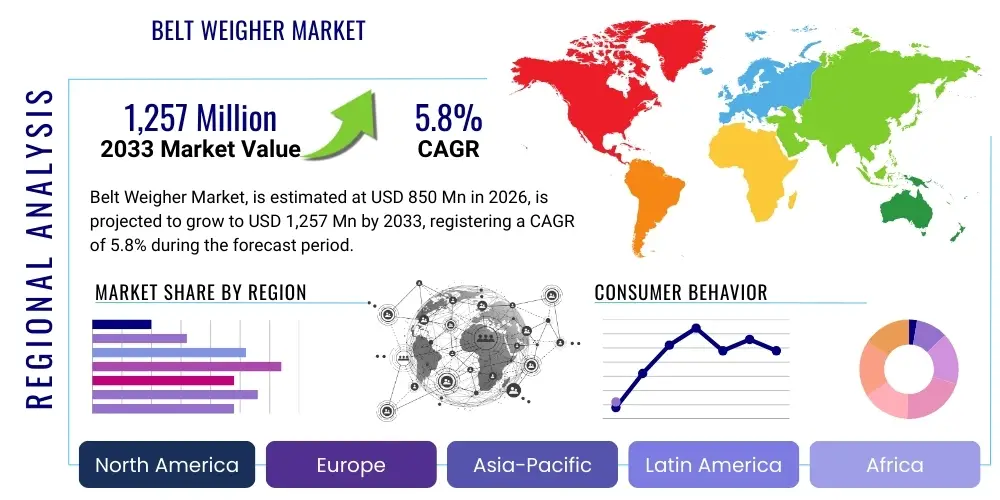

Belt Weigher Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439139 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Belt Weigher Market Size

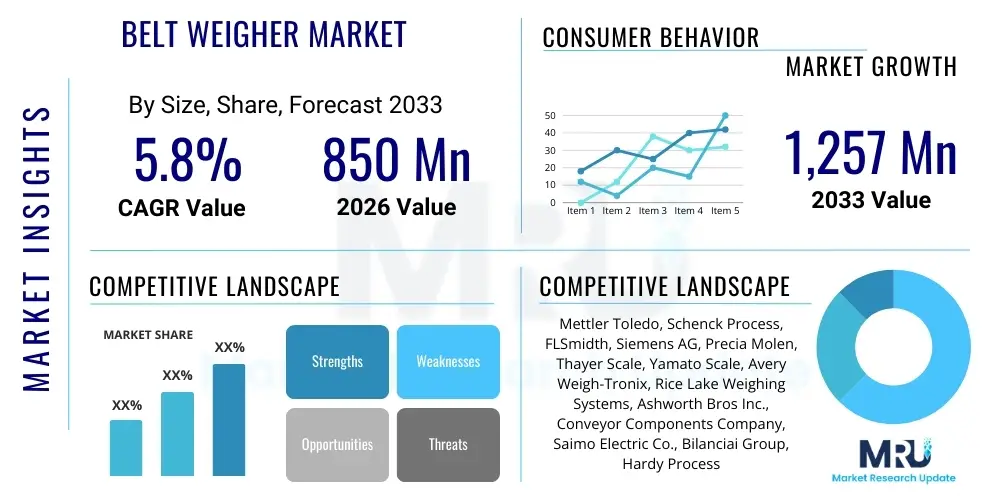

The Belt Weigher Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,257 Million by the end of the forecast period in 2033.

Belt Weigher Market introduction

Belt weighers, often referred to as conveyor belt scales or weigh feeders, constitute essential industrial equipment designed for continuous, dynamic weighing of bulk materials transported on conveyor belts. These systems integrate precision load cells, speed sensors, and advanced electronic integrators to measure the material flow rate (mass per unit time) and totalized throughput with high accuracy. The core function involves monitoring inventory, controlling blending ratios, managing production efficiency, and ensuring regulatory compliance across material handling operations. The demand for these sophisticated measurement tools is intrinsically linked to global industrial activity, particularly in sectors where the movement of high-volume, continuous solids is routine, such as mining, construction aggregates, power generation, and primary material processing.

The operational mechanism of a belt weigher relies on gravimetric measurement, where the weight of the material segment resting on the weigh bridge is measured by the load cells, while the speed sensor simultaneously measures the belt velocity. The electronic integrator then calculates the flow rate and total mass accumulation. This real-time data is crucial for process optimization, allowing operators to make immediate adjustments to upstream feeding mechanisms, ensuring quality control, and preventing material wastage. Furthermore, modern belt weighers are increasingly being engineered with features such as digital signal processing, temperature compensation, and remote diagnostics capabilities, significantly enhancing their reliability and reducing the frequency of complex manual calibrations required for maintaining precise measurement integrity.

Major applications of belt weighers span the entire bulk material supply chain, from the initial extraction and crushing stages in mining to the final loadout in ports and logistical hubs. Benefits derived from their implementation include highly accurate inventory tracking, minimization of over- or under-loading shipments, consistent quality assurance in continuous mixing operations (like cement and chemicals), and regulatory compliance with environmental emission limits based on material throughput. Key driving factors propelling market growth include sustained global infrastructure development, the increasing automation of material handling processes, and stringent regulatory requirements mandating precise quantification of conveyed materials across various heavy industries globally.

Belt Weigher Market Executive Summary

The Belt Weigher Market is characterized by a strong convergence of industrial automation and the demand for enhanced measurement accuracy in bulk material handling. Current business trends indicate a significant shift towards high-precision multi-idler belt scales equipped with advanced digital load cells and IIoT integration capabilities. This digital transformation allows end-users, particularly in high-value material sectors like coal and specialty chemicals, to achieve superior inventory management and predictive maintenance. While the market sees consolidation among established instrumentation specialists, emerging players are focusing on modular, cost-effective solutions tailored for smaller aggregate operations. The pressure on global supply chains to increase efficiency and minimize energy consumption further drives the adoption of automated weighing solutions that provide real-time data feedback to Enterprise Resource Planning (ERP) and SCADA systems.

Regionally, the Asia Pacific (APAC) stands out as the predominant growth engine, primarily fueled by massive infrastructure projects, robust mining activity, and rapid industrialization in countries such as China, India, and Indonesia. These regions necessitate large-scale, continuous material flow measurement. North America and Europe, conversely, exhibit high demand for sophisticated, high-accuracy systems driven by stringent quality control standards and a focus on upgrading aging industrial infrastructure with advanced digital measurement tools. European markets place particular emphasis on compliance with Measurement Instruments Directive (MID) standards for trade applications, demanding verifiable precision in belt scale systems used for commercial transactions.

Segmentation trends highlight the dominance of the Mining and Metallurgy segment due to the vast volumes of raw materials processed, requiring reliable totalization. However, the Food & Beverage and Chemical sectors are rapidly increasing their market share, driven by the need for precise proportioning and blending accuracy in continuous manufacturing processes. Furthermore, the Multi-Idler scale segment, despite its higher initial cost, is preferred for critical applications requiring accuracy levels below 0.5%, reflecting a growing industry priority towards minimizing measurement errors and associated financial losses in high-throughput operations.

AI Impact Analysis on Belt Weigher Market

Users frequently inquire about how Artificial Intelligence (AI) can move belt weighers beyond simple static weighing and calculation, specifically focusing on overcoming traditional challenges such as calibration drift, material variations, and dynamic noise interference. Key user questions revolve around the feasibility and cost-effectiveness of implementing AI for continuous, autonomous calibration (self-tuning), predictive fault detection in load cells, and advanced process control integration. There is a strong expectation that AI will deliver significant improvements in totalization accuracy by compensating for complex variables like belt tension, splice impacts, and fluctuating material density, which current linear compensation models struggle to address. Users are also keen to understand the return on investment (ROI) associated with AI-driven predictive maintenance, aiming to minimize unplanned downtime often caused by subtle load cell failures or sensor degradation.

The deployment of machine learning algorithms is poised to fundamentally transform the maintenance and operational reliability of belt weigher systems. AI facilitates the continuous analysis of vast datasets comprising speed, load, vibration, and environmental factors (temperature, humidity), allowing the system to identify subtle patterns that precede measurement drift or component failure. This capability shifts the maintenance paradigm from reactive repairs to predictive interventions, significantly extending the time between manual calibrations and enhancing the overall mean time between failures (MTBF). For instance, an AI model can detect non-linearity errors caused by slight structural changes or thermal expansion long before they trigger standard alarm thresholds, ensuring sustained measurement integrity.

Beyond maintenance, AI is critical for optimizing process control loops in complex blending and feed-rate applications. By analyzing the historical performance and comparing real-time output against desired setpoints, AI algorithms can dynamically adjust the feeder rates upstream, ensuring extremely precise material proportioning—a vital requirement in cement production, fertilizer manufacturing, and coal blending for power plants. This enhanced control precision minimizes material waste, reduces energy consumption associated with rework, and guarantees that the final product consistently meets specified quality metrics. The long-term impact involves creating self-optimizing, adaptive weighing environments that minimize the dependency on specialized technicians for calibration and troubleshooting.

- AI-driven Predictive Maintenance: Analyzing load cell data and environmental conditions to forecast equipment failures and calibration drift, reducing unexpected downtime.

- Autonomous Calibration and Self-Tuning: Machine learning algorithms continuously adjust calibration factors in real-time to compensate for belt tension, material density variation, and temperature effects.

- Anomaly Detection: Identifying non-typical weighing patterns caused by belt damage, material hang-up, or faulty components with greater sensitivity than traditional threshold alarms.

- Enhanced Process Optimization: Utilizing deep learning to fine-tune feeder and mixer control rates for superior blending accuracy and minimal material waste in continuous production lines.

- Data Integration and Insights: Providing actionable intelligence through advanced analytics dashboards, allowing operators to understand long-term performance degradation and efficiency metrics.

DRO & Impact Forces Of Belt Weigher Market

The dynamics of the Belt Weigher Market are shaped by powerful Drivers promoting technological adoption, significant Restraints challenging implementation, key Opportunities for market expansion, and impactful External Forces influencing strategic direction. The core driver remains the global escalation of bulk material handling operations across mining, construction, and power generation sectors, coupled with increasingly stringent regulatory standards (e.g., Weights and Measures compliance) that mandate highly accurate measurement for trade and inventory control. Restraints primarily involve the high initial capital expenditure required for installing high-accuracy multi-idler systems, complex site-specific calibration procedures which demand specialized technical skill, and performance vulnerability to extreme environmental conditions (dust, vibration, temperature fluctuations) inherent in industrial settings. Opportunities lie in the accelerated integration of these systems with Industrial Internet of Things (IIoT) infrastructure, enabling remote diagnostics, cloud-based data management, and the lucrative penetration into emerging economies undergoing rapid infrastructure modernization. These forces collectively dictate the pace of innovation, market accessibility, and competitive strategy within the belt weigher industry.

Drivers are heavily concentrated in the industrial necessity for efficiency and accountability. The rising global cost of raw materials necessitates precise inventory tracking to minimize shrinkage and optimize procurement strategies. Furthermore, the drive toward automated facilities pushes companies to replace older, lower-accuracy mechanical scales with modern, digital electronic systems capable of seamless integration into sophisticated process control architectures (SCADA/DCS). Specific governmental investments in large-scale infrastructure projects—such as new port facilities, railway extensions, and highway construction—generate substantial, long-term demand for belt weighing solutions used in the continuous movement of aggregates, cement, and minerals. The continuous growth of the global population and subsequent demand for resources solidifies the need for reliable, high-throughput material quantification.

Conversely, Restraints often stem from the technical complexities of gravimetric measurement in dynamic environments. Maintaining certified accuracy (e.g., 0.1% or 0.25% of full span) requires continuous calibration and maintenance, which can be costly and time-consuming. The variability of the bulk material itself—including factors like moisture content, particle size distribution, and density changes—introduces errors that are difficult to eliminate without expensive, sophisticated systems. Moreover, economic downturns or political instability affecting major commodity markets (like iron ore or coal) can cause significant fluctuations in capital expenditure budgets for new equipment installation, acting as a major short-term market restraint. The specialized nature of calibration often leads to high reliance on OEM service contracts, increasing the total cost of ownership (TCO).

Opportunities are predominantly found in technological advancements and untapped regional markets. The rapid evolution of sensor technology, particularly the shift from analog to digital load cells, offers higher signal integrity, noise immunity, and better diagnostics, opening pathways for new product development. The focus on sustainability and optimized resource utilization creates a strong opportunity for weigh feeders used in optimizing fuel mixtures for power generation or precise dosing in recycling operations. Geographically, Latin America and parts of Africa, rich in mining resources but possessing underdeveloped automation infrastructure, represent significant untapped potential for providers capable of offering robust, scalable, and remotely supportable belt weighing solutions. These opportunities encourage manufacturers to invest heavily in R&D focusing on remote sensing, IIoT compatibility, and advanced materials for enhanced durability in harsh environments.

Segmentation Analysis

The Belt Weigher Market segmentation provides a granular view of the industry structure based on scale type, application, and end-user requirements, reflecting varied precision needs and operational scales globally. The primary segmentation by type distinguishes between Single Idler and Multi-Idler systems, directly correlating to the required level of accuracy. Multi-idler systems, incorporating two or more weigh bridges, provide superior averaging and linearity correction, making them indispensable for commercial transactions (custody transfer) and high-value materials where accuracy levels of 0.1% or better are mandatory. Conversely, single-idler systems are cost-effective and suitable for lower-accuracy applications such as inventory control or general process monitoring in non-critical applications where a 1–2% margin of error is acceptable.

Application segmentation illustrates the breadth of industries relying on continuous weighing technology. The Mining, Quarrying, and Mineral Processing sector dominates in terms of volume demand, utilizing belt weighers for monitoring extracted material tonnage, ensuring balanced input to crushers, and tracking loadout quantities. The Power Generation sector relies on these systems for precise fuel (coal, biomass) feed-rate control to optimize combustion efficiency and monitor energy input. The Chemical and Cement industries utilize belt weighers and specialized weigh feeders for critical proportioning of raw ingredients, where deviations in the blend ratio directly impact product quality and structural integrity, thereby demanding exceptional reliability and accuracy in the weighing equipment deployed.

The strategic differentiation between segments is driven by technological requirements. High-precision sectors demand load cells with low hysteresis, advanced digital filtering, and structural designs that minimize effects from belt tension variation. In contrast, sectors prioritizing resilience and robustness, such as heavy quarrying, often opt for systems designed for high throughput and resistance to severe shock loading and abrasive materials, sometimes compromising marginal accuracy for enhanced durability and lower maintenance overhead. The continuous evolution of digital communication standards (e.g., Ethernet/IP, Profibus) is increasingly blurring the lines between system types, allowing even mid-range scales to integrate complex diagnostics previously reserved only for premium models, thus reshaping competitive dynamics across all key segmentation dimensions.

- By Type:

- Single Idler Belt Weigher (Cost-effective, lower accuracy, used for inventory monitoring)

- Multi-Idler Belt Weigher (High precision, superior linearity, mandatory for custody transfer)

- Weigh Feeder (Integrated weighing and material feeding control for precise dosing/blending)

- By Application:

- Mining and Metallurgy

- Cement and Construction Aggregates

- Power Generation (Coal/Biomass Feed Control)

- Chemical and Fertilizer Manufacturing

- Ports and Terminal Handling (Loadout and Ship Loading)

- Food and Beverage Processing

- By Component:

- Load Cells and Sensors (Digital vs. Analog)

- Weigh Bridge Structure

- Integrators and Controllers

- Speed Sensors (Tachometers)

Value Chain Analysis For Belt Weigher Market

The Value Chain for the Belt Weigher Market commences with Upstream Analysis, focusing on the procurement of critical components, predominantly high-precision load cells, advanced sensor electronics, and specialized steel alloys for the weigh bridge structure. The load cell manufacturing segment—where accuracy and reliability are determined—is highly specialized and often dominated by a few global technology providers. Suppliers in this phase must adhere to stringent quality control standards, ensuring components offer excellent linearity, temperature stability, and resistance to environmental ingress. The quality of the core components directly dictates the final belt weigher’s performance metrics, thereby giving significant leverage to specialized component providers in the early stages of the chain.

Moving into the core manufacturing and integration phase, Original Equipment Manufacturers (OEMs) procure these components and integrate them into complete weighing systems, focusing heavily on engineering the weigh bridge and the electronic integrator unit. This stage involves complex mechanical design to minimize measurement interference from belt tension and vibration, coupled with developing proprietary software for signal processing and calibration routines. Distribution Channels play a crucial role in market penetration. Direct sales are often utilized for large, customized industrial projects where engineering consultation and site-specific calibration services are required. In contrast, indirect sales, relying on specialized industrial distributors, system integrators, and value-added resellers (VARs), are common for standard, off-the-shelf belt weighers, providing localized support and rapid delivery to small and medium enterprises (SMEs).

The Downstream Analysis centers on the installation, calibration, and long-term maintenance services provided to the End-Users. Installation typically requires highly specialized technical expertise to ensure proper mechanical mounting and initial calibration, often governed by national metrology standards (e.g., NTEP in the US, MID in Europe). After-sales service, including periodic re-calibration, component replacement, and software upgrades, forms a substantial and recurring revenue stream. The trend toward IIoT connectivity enables remote monitoring and diagnostics, which optimizes the service delivery process, moving away from expensive, unplanned on-site visits. The effectiveness of the service network often determines brand loyalty and market reputation, particularly for mission-critical applications in mining and port operations where downtime is extremely costly.

Belt Weigher Market Potential Customers

Potential customers for belt weighers are defined by their engagement in continuous bulk material handling processes where mass flow measurement is either critical for process control, financial transaction validation, or mandatory for regulatory compliance. The primary cohort of End-Users resides within the heavy industrial sectors that manage vast quantities of mined or processed raw materials. The quintessential buyer profile requires robust equipment capable of functioning reliably in harsh, often corrosive or dusty, environments with minimal maintenance intervention, prioritizing system durability and totalization accuracy over marginal cost savings. These customers view belt weighers not merely as instruments but as indispensable assets central to their production efficiency and inventory accountability mechanisms.

The largest segment of buyers is the Mining and Mineral Processing Industry, encompassing companies involved in the extraction and processing of coal, iron ore, copper, gold, and bauxite. These companies utilize belt weighers extensively at various points: pit-to-plant transfer, stockpile management, and final loadout to trains or vessels. Accuracy in this sector is vital for reconciliating extracted quantities against processing yields. Similarly, the Cement and Construction Aggregates Industry represents a major customer base, where belt weighers are used to precisely measure and blend raw materials (limestone, clay, gypsum) before the kiln process, ensuring consistent quality and optimizing energy consumption during heating, a crucial factor in this energy-intensive sector.

Furthermore, critical infrastructure customers like Electric Power Utilities (managing coal and biomass input) and Logistics and Port Authorities (managing material throughput for import/export duties and custody transfer) are high-value potential customers. The latter group, particularly port operators, frequently requires certified, high-accuracy multi-idler belt scales that comply with strict global trade standards, as the measurements directly form the basis of invoicing and customs declarations. Lastly, manufacturers in the Chemical and Fertilizer Sector demand highly specialized, often corrosion-resistant, weigh feeders that provide extremely accurate dosing for blending complex chemical compounds, where minute errors in proportioning can lead to significant product quality failures or safety hazards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,257 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mettler Toledo, Schenck Process, FLSmidth, Siemens AG, Precia Molen, Thayer Scale, Yamato Scale, Avery Weigh-Tronix, Rice Lake Weighing Systems, Ashworth Bros Inc., Conveyor Components Company, Saimo Electric Co., Bilanciai Group, Hardy Process Solutions, Sartorius AG, C.I.S.N. Weighing Systems, Tecweigh, Thermo Fisher Scientific, Endress+Hauser, Pesa-Check International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Belt Weigher Market Key Technology Landscape

The contemporary Belt Weigher Market is defined by a landscape of increasingly digitized and interconnected technologies aimed at overcoming the inherent challenges of dynamic weighing, notably reducing sensitivity to mechanical variables and improving long-term accuracy without constant manual intervention. A primary technological shift involves the transition from traditional analog load cells to Digital Load Cells. Digital load cells incorporate microprocessors to convert analog weight signals directly into a digital format at the point of measurement. This conversion significantly improves signal-to-noise ratio, provides enhanced immunity to electrical interference and temperature fluctuations, and facilitates superior diagnostics, allowing the system to monitor the health and performance of individual cells in real-time. This digital foundation is essential for supporting advanced features like continuous internal self-checking and complex, multi-variable compensation algorithms necessary for high-accuracy applications.

Another dominant technological trend is the pervasive integration of Industrial Internet of Things (IIoT) and cloud computing capabilities. Modern belt weighers are equipped with network communication protocols (e.g., MQTT, OPC UA) allowing them to transmit real-time data on throughput, component health, and calibration status directly to centralized SCADA systems, remote monitoring centers, and cloud platforms. This connectivity facilitates predictive maintenance models, remote diagnostics, and the ability to leverage big data analytics and machine learning (AI) for process optimization and autonomous calibration adjustments. IIoT integration is particularly valuable in remote mining or quarrying operations where physical access for maintenance can be costly and time-consuming, enabling centralized technical teams to manage and optimize a large fleet of geographically dispersed weighing systems from a single location.

Furthermore, advancements in Non-Contact Measurement Technologies are exploring new methods to minimize or eliminate the mechanical dependency of conventional weigh bridges. While still nascent for high-accuracy custody transfer, technologies such as nuclear density measurement (gamma ray sources) or sophisticated ultrasonic and laser profiling combined with speed measurement offer alternatives for abrasive or extremely challenging materials where physical contact components suffer rapid wear. Concurrently, software innovations, specifically the refinement of advanced filtering techniques and adaptive calibration routines, are crucial. These software solutions utilize complex algorithms to filter out dynamic noise caused by conveyor components (like idler run-out or belt splices) and automatically adjust for subtle changes in belt characteristics, significantly stabilizing the measurement output and reducing the reliance on costly physical test weight procedures for recalibration.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for belt weighers, primarily driven by massive government and private sector investments in infrastructure development, including ports, railways, and urban development projects across China, India, and Southeast Asian nations. The region's robust mining and heavy manufacturing sectors necessitate high volumes of material handling, driving demand for both standard process control belt scales and advanced multi-idler systems for major commodity export terminals. Local manufacturing capabilities are expanding rapidly, leading to highly competitive pricing, though there is a concurrent high demand for premium international brands known for superior accuracy and reliability in custody transfer applications.

- North America: This region is characterized by a mature market with a high adoption rate of technologically advanced, high-precision equipment. Demand is fueled by the need for regulatory compliance (NTEP certification) in trade applications and the sustained focus on industrial automation and digitalization (Industry 4.0). Key segments include precision weighing in aggregates, advanced food processing, and the modernization of older infrastructure, leading to a strong demand for IIoT-enabled digital load cells and AI-integrated diagnostic systems that minimize calibration downtime. Companies here emphasize TCO reduction through predictive maintenance tools.

- Europe: The European market is highly regulated, particularly concerning accuracy for commercial transactions, governed by the Measurement Instruments Directive (MID). This leads to a strong preference for multi-idler systems and certified weigh feeders known for their metrological reliability. Market growth is stable, driven by the replacement cycle of existing equipment, strict environmental mandates requiring precise material input and output tracking (e.g., waste management and power plant emissions monitoring), and significant R&D activity focused on improving component durability and integration into complex European process control standards.

- Latin America (LATAM): LATAM is a critical market due to its abundant natural resources and extensive mining operations (Brazil, Chile, Peru). Demand is heavily correlated with global commodity prices. While budget constraints sometimes favor lower-cost solutions, the necessity for accurate stock reconciliation and mine-to-port logistics drives significant investment in robust, heavy-duty belt weighers capable of withstanding extreme throughput rates and harsh environments. The region increasingly seeks remote monitoring solutions due to the geographical isolation of many operational sites.

- Middle East and Africa (MEA): Growth in MEA is concentrated in Gulf Cooperation Council (GCC) nations undertaking large-scale construction projects and in South Africa and West Africa, which have extensive mining and port facilities. The market is highly sensitive to major project timelines. Customers in this region prioritize equipment robustness against high temperatures, dust, and sand, favoring established brands that can guarantee reliable after-sales support and calibration services in challenging logistical environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Belt Weigher Market.- Mettler Toledo

- Schenck Process

- FLSmidth

- Siemens AG

- Precia Molen

- Thayer Scale

- Yamato Scale

- Avery Weigh-Tronix

- Rice Lake Weighing Systems

- Ashworth Bros Inc.

- Conveyor Components Company

- Saimo Electric Co.

- Bilanciai Group

- Hardy Process Solutions

- Sartorius AG

- C.I.S.N. Weighing Systems

- Tecweigh

- Thermo Fisher Scientific

- Endress+Hauser

- Pesa-Check International

Frequently Asked Questions

Analyze common user questions about the Belt Weigher market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Single Idler and Multi Idler belt weighers?

The primary difference lies in measurement accuracy and cost. Single Idler scales use one set of load cells and are economical, suitable for inventory monitoring (1-2% accuracy). Multi Idler scales use multiple load cell sets distributed over several idlers, providing a higher degree of linearity correction and stability (0.1% - 0.5% accuracy), which is essential for custody transfer and high-value blending applications.

How does AI technology improve the operational efficiency of belt weighers?

AI improves efficiency by facilitating predictive maintenance and autonomous calibration. Machine learning analyzes sensor data to detect subtle component degradation (load cell failure, speed sensor drift) before it causes downtime. It also dynamically adjusts calibration factors in real-time to compensate for external variables like temperature or belt tension, minimizing the need for expensive, manual test weight calibration routines and ensuring sustained metrological accuracy.

Which industry segment accounts for the largest demand in the Belt Weigher Market?

The Mining and Metallurgy sector currently represents the largest demand segment. This is due to the enormous volumes of material extracted and processed globally, requiring continuous, dynamic quantification for stockpile management, production monitoring, and ensuring accurate loadout for transport and commerce, driving the need for robust, high-throughput belt weighing solutions.

What are the main factors contributing to measurement errors in belt weighing systems?

Key measurement errors often arise from non-product related factors, including variations in belt tension and stiffness, inconsistent belt speed, misalignment of the weigh bridge, material build-up on the idlers, and environmental changes (temperature or high vibration). Minimizing these requires sophisticated multi-idler designs, digital filtering integrators, and rigorous periodic calibration procedures.

Why is IIoT integration crucial for the future growth of the Belt Weigher Market?

IIoT integration allows for seamless connectivity between the weigher and enterprise systems (SCADA, ERP), facilitating remote monitoring, centralized data aggregation, and rapid diagnostics. This connectivity enables operators to track key performance indicators (KPIs), implement predictive maintenance, and reduce labor costs associated with manual data collection and on-site troubleshooting, thus significantly lowering the total cost of ownership (TCO) and boosting overall operational uptime.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Belt Weigher Market Size Report By Type (Single-Idler, Two-Idler, Three-Idler, Four-Idler, Multi-Idler), By Application (Power (including coal), Cement, Steel, Aggregate, Mining, Pulp & paper, Food, Chemical, Water/ waste water), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Belt Weigher Market Statistics 2025 Analysis By Application (Power (including coal), Cement, Steel, Aggregate, Mining, Pulp & Paper, Food, Chemical, Water/ Waste Water), By Type (Single-Idler, Two-Idler, Three-Idler, Four-Idler, Multi-Idler), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Belt Weigher Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Single-Idle, Two-Idler, Three-Idler, Four-Idler, Multi-Idler), By Application (Coal Industry, Power Station, Steel Plants, Cement Plants, Port, Chemical), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager