Benchtop Hemoglobin Analyzer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434166 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Benchtop Hemoglobin Analyzer Market Size

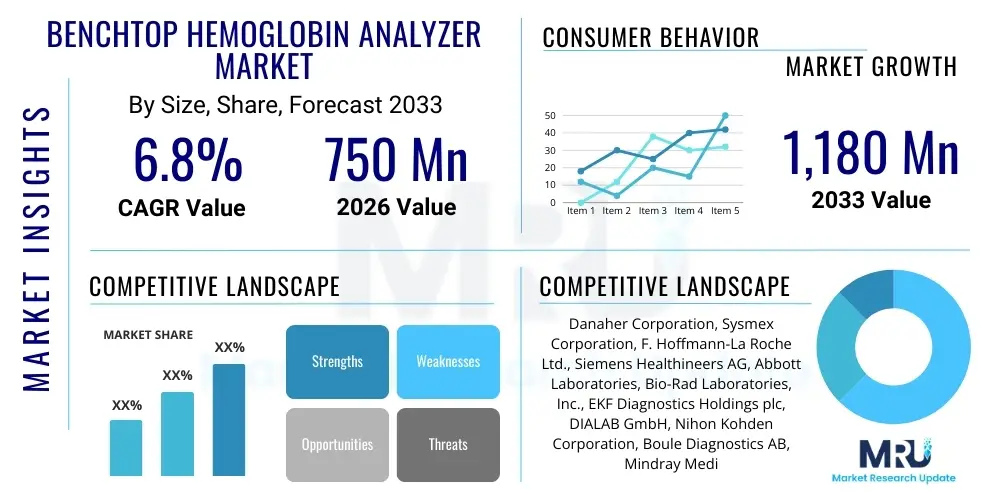

The Benchtop Hemoglobin Analyzer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 750 Million in 2026 and is projected to reach USD 1,180 Million by the end of the forecast period in 2033.

Benchtop Hemoglobin Analyzer Market introduction

Benchtop Hemoglobin Analyzers are sophisticated diagnostic instruments essential for measuring the concentration of hemoglobin in whole blood samples, providing critical insights into hematological conditions such as anemia, polycythemia, and other blood disorders. These systems typically utilize spectrophotometry, photometers, or advanced microfluidic technologies to deliver highly accurate and precise results rapidly. The product serves as the backbone for routine hematology testing in clinical laboratories and hospitals, offering reliability and high throughput necessary for large patient volumes. Major applications span routine health check-ups, preoperative assessment, monitoring of chronic diseases, and screening in blood donation centers, ensuring that blood products meet stringent safety and quality standards.

The primary benefits of utilizing modern benchtop analyzers include enhanced operational efficiency, reduced turnaround time (TAT), and minimization of manual errors compared to traditional methods. Furthermore, these advanced instruments often require smaller sample volumes and offer better calibration stability, which is crucial for achieving standardization across different testing environments. The increasing global prevalence of non-communicable diseases, particularly conditions linked to nutritional deficiencies and chronic inflammation that manifest as anemia, significantly drives the demand for reliable and accessible hemoglobin analysis tools. Product evolution is moving toward integrated systems that can analyze multiple parameters concurrently, further cementing their role as indispensable diagnostic tools in modern healthcare infrastructure.

Key driving factors propelling market expansion include substantial investments in healthcare infrastructure development, particularly in emerging economies, alongside technological innovations aimed at improving accuracy and connectivity. The shift towards preventive healthcare and early disease detection mandates the widespread availability of efficient diagnostic tools like benchtop hemoglobin analyzers. Moreover, the expanding geriatric population, which is inherently susceptible to various blood-related disorders, contributes substantially to the increasing procedural volume requiring hemoglobin assessment. Strict adherence to quality assurance and regulatory guidelines also favors the adoption of standardized, high-performance benchtop systems over less reliable manual or point-of-care alternatives in centralized laboratory settings.

Benchtop Hemoglobin Analyzer Market Executive Summary

The Benchtop Hemoglobin Analyzer Market is characterized by robust growth, fueled predominantly by technological convergence, demographic shifts, and sustained clinical necessity. Business trends indicate a strong focus on developing integrated platforms that offer greater automation, network connectivity, and enhanced data management capabilities, enabling seamless integration with Laboratory Information Systems (LIS). Key players are engaging in strategic collaborations and mergers to expand their geographical footprint, particularly targeting high-growth markets in Asia Pacific where undiagnosed hematological conditions remain prevalent. Furthermore, the push towards standardized, verifiable diagnostic results is driving the market toward analyzers certified under stringent international quality frameworks, elevating product complexity and reliability.

Regionally, North America and Europe maintain dominance, attributed to high healthcare expenditure, established diagnostic infrastructure, and early adoption of advanced analytical technologies. However, the Asia Pacific region is forecast to exhibit the highest Compound Annual Growth Rate (CAGR), driven by improving access to healthcare, rising awareness of blood disorders, and massive government initiatives to modernize public health systems. Latin America and the Middle East & Africa are emerging markets showing promising growth potential, contingent on increasing private sector investment in specialized diagnostic centers and rising patient awareness regarding hematological screening. Regulatory harmonization efforts across major economic blocs are simplifying global market entry for leading analyzer manufacturers, standardizing product specifications and performance metrics.

In terms of segment trends, analyzers based on advanced microfluidic technology are experiencing rapid uptake due to their ability to provide highly accurate results from minimal sample volumes, coupled with reduced reagent consumption and operational costs. The application segment sees hospitals and large diagnostic chains maintaining the largest market share, owing to their capacity for high-throughput testing and their central role in complex patient management pathways. Within end-users, public health laboratories are increasingly investing in benchtop models to support large-scale screening and epidemiological studies. The emphasis on user-friendly interfaces, minimized maintenance requirements, and reliable long-term performance continues to shape product development strategies across all market segments, ensuring operational continuity in demanding clinical settings.

AI Impact Analysis on Benchtop Hemoglobin Analyzer Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can enhance the diagnostic efficiency and data interpretation derived from benchtop hemoglobin analyzers. Common user questions revolve around AI’s role in quality control automation, predictive maintenance of instrumentation, early anomaly detection in test results, and improving the diagnostic specificity of complex blood smears or atypical hemoglobin profiles. There is a high expectation that AI integration will shift these analyzers from mere measurement tools to intelligent diagnostic assistants, offering automated flagging of critical results, personalized threshold adjustments based on patient history, and enhanced correlation of hemoglobin values with broader physiological parameters. Key user concerns include data privacy during cloud-based AI processing and ensuring the explainability (transparency) of AI-driven diagnostic suggestions to maintain clinician trust and regulatory compliance. The consensus is that AI will primarily optimize laboratory workflows and reduce the cognitive burden on technologists, moving towards truly autonomous analytical processes.

- AI-Powered Quality Control (QC) Automation: Utilizing ML algorithms to continuously monitor QC data, predicting failures, and automating calibration adjustments, thereby minimizing human intervention and ensuring sustained analytical precision.

- Predictive Maintenance: AI analyzes instrument performance metrics (temperature, motor cycles, sensor stability) in real-time to forecast potential component failure, scheduling preventative maintenance and drastically reducing unplanned downtime.

- Enhanced Data Interpretation: ML models analyze hemoglobin results in conjunction with other patient data (age, ethnicity, clinical symptoms) to provide probabilistic diagnostic suggestions, specifically aiding in the differential diagnosis of complex anemias.

- Workflow Optimization and Throughput Management: AI manages sample processing queues, optimizes reagent usage based on predicted test volumes, and routes results efficiently to the appropriate healthcare provider, maximizing laboratory efficiency.

- Improved Diagnostic Specificity: Advanced image analysis using AI assists in the automated recognition of specific red blood cell morphological changes linked to various hemoglobinopathies or thalassemias, enhancing diagnostic accuracy beyond standard numerical readings.

- Security and Compliance Monitoring: AI systems actively monitor data access and usage patterns to detect and mitigate security threats, ensuring compliance with stringent healthcare data protection regulations like HIPAA and GDPR.

DRO & Impact Forces Of Benchtop Hemoglobin Analyzer Market

The market for benchtop hemoglobin analyzers is propelled by several strong drivers, primarily the surging global prevalence of anemia and other hematological disorders, coupled with increasing investments in diagnostic infrastructure across developing nations. These drivers are amplified by technological advancements that result in more compact, accurate, and rapid testing systems. However, market expansion is moderated by significant restraints, particularly the high initial capital investment required for purchasing sophisticated benchtop systems and the continuous need for skilled personnel to operate and maintain them. Furthermore, the growing competition from highly accurate, lower-cost point-of-care (POC) devices poses a substitution threat in settings where laboratory quality is not the absolute priority. The synergistic effect of these forces shapes the market trajectory.

Opportunities for growth are abundant in geographical expansion into underserved rural areas through public-private partnerships and the development of cost-effective, semi-automated systems tailored for low-resource settings. Significant opportunity also lies in integrating advanced data management and connectivity features, aligning the analyzers with the broader trend of digital healthcare transformation and tele-diagnosis. The industry is focusing on opportunities related to personalized medicine, where rapid, accurate hemoglobin analysis is foundational for tailoring treatment protocols, especially in chronic disease management and oncology. Addressing the restraints through innovative financing models and developing automated calibration procedures represents a crucial area for future penetration.

The impact forces driving the market are substantial. Drivers such as the increasing global focus on preventive health screening and maternal and child health programs, where anemia screening is mandatory, exert a positive and powerful influence. Restraints, including complex and lengthy regulatory approval processes for new diagnostic technologies, slow down product introduction cycles and act as a strong impedance force. Opportunities related to miniaturization and enhanced multiplexing capabilities offer a future-shaping force, promising more comprehensive diagnostic panels from a single instrument. Overall, the powerful demand generated by global disease burden outweighs the restraining forces, resulting in a net positive impact leading to sustained market growth.

Segmentation Analysis

The Benchtop Hemoglobin Analyzer Market is systematically segmented based on Technology utilized for measurement, the various Applications where these devices are deployed, the specific End-Users procuring and operating the systems, and the underlying Portability requirements. This segmentation provides a granular view of market dynamics, allowing stakeholders to identify high-growth niches and tailor product development strategies to specific clinical needs. The technology segment is critical as it reflects the current state of analytical precision and speed, while application and end-user segmentation highlights the varying operational requirements and volume capacities demanded by different institutional environments, ranging from high-throughput centralized laboratories to specialized blood banks.

- By Technology: Photometry/Spectrophotometry, Electrochemical Analysis, Microfluidics, Other Technologies (e.g., Gasometry).

- By Application: Disease Diagnosis (Anemia, Diabetes Monitoring), Blood Banking & Transfusion Services, Nutritional Assessment and Monitoring, Research and Development.

- By End-User: Hospitals and Large Clinics, Diagnostic Laboratories (Centralized and Reference Labs), Blood Banks, Ambulatory Surgical Centers.

- By Portability: Benchtop Analyzers, Portable Analyzers (often included for comparison but focus remains on Benchtop).

Value Chain Analysis For Benchtop Hemoglobin Analyzer Market

The value chain for the Benchtop Hemoglobin Analyzer Market begins with the upstream segment, encompassing the sourcing and manufacturing of essential high-precision components. This includes optical sensors, microfluidic chips, sophisticated pumping systems, specialized reagents, and advanced electronic components necessary for data processing and display. Suppliers in this segment focus heavily on maintaining stringent quality control standards for optical clarity and chemical purity, as these factors directly dictate the analyzer’s accuracy and reliability. Innovation in the upstream phase is centered on developing proprietary reagents and integrating advanced materials that reduce sample preparation complexity and minimize measurement interference, thereby lowering per-test costs for the final product.

The core segment involves the design, assembly, and rigorous testing of the benchtop systems by major medical device manufacturers. This manufacturing phase requires significant investment in automated assembly lines and specialized cleanroom environments to ensure product longevity and compliance with ISO 13485 standards. Product differentiation in this stage often hinges on software capabilities, connectivity features, and the degree of automation achieved. Following manufacturing, the distribution channel plays a vital role. Direct distribution is preferred for major hospital systems and large reference laboratories, allowing manufacturers to maintain direct control over installation, training, and service agreements, thus preserving a premium customer experience.

Indirect distribution relies on regional distributors, medical equipment dealers, and specialized agents, particularly in fragmented or geographically challenging markets where local presence is critical for logistical support and market penetration. These indirect channels manage inventory, localized technical support, and regulatory documentation specific to their region. The downstream segment involves end-users—hospitals, diagnostic labs, and blood banks—who purchase and utilize the analyzers for patient care and screening. Success at this stage is measured by instrument uptime, operational cost-effectiveness, and the quality of post-sales service, including maintenance contracts and reagent supply logistics. Effective management of this chain ensures efficient delivery of high-quality diagnostic tools to the healthcare sector.

Benchtop Hemoglobin Analyzer Market Potential Customers

The primary potential customers and end-users of Benchtop Hemoglobin Analyzers are high-volume testing facilities that require accuracy, standardization, and integrated data capabilities for routine and complex hematology testing. These include major public and private hospitals, where centralized laboratories process thousands of samples daily across various clinical departments, from emergency medicine to internal medicine and surgery. The requirement for quick, reliable pre-operative screening and continuous monitoring of inpatients drives continuous demand from this sector. Diagnostic centers, including national reference laboratories and regional chains, represent another critical customer base, relying on benchtop systems to provide precise, certifiable results for referring physicians, often handling esoteric testing and quality assurance protocols for smaller clinics.

Blood banks and transfusion services are essential buyers, utilizing these analyzers extensively for pre-donation screening to ensure donor eligibility and confirm acceptable hemoglobin levels, minimizing risks associated with blood donation and ensuring the quality of the blood supply. These facilities prioritize high throughput and robust quality control features. Additionally, research institutions and academic medical centers constitute a specialized segment, purchasing analyzers for clinical trials, physiological research, and the development of new diagnostic markers. Their requirements often lean towards instruments capable of specialized assays or providing high levels of data granularity for analytical purposes.

Ambulatory surgical centers (ASCs) and specialized clinics focusing on chronic disease management, such as nephrology or oncology centers, are increasingly adopting benchtop models as part of their strategy to bring more diagnostic testing in-house, reducing reliance on external labs and speeding up patient management decisions. These customers seek mid-range benchtop systems that balance throughput with relatively easy operation and minimal maintenance footprint. The consistent demand from all these sectors is underpinned by continuous population growth, the expansion of healthcare access globally, and the mandatory requirement for accurate hemoglobin assessment in almost all aspects of clinical medicine.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 750 Million |

| Market Forecast in 2033 | USD 1,180 Million |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Danaher Corporation, Sysmex Corporation, F. Hoffmann-La Roche Ltd., Siemens Healthineers AG, Abbott Laboratories, Bio-Rad Laboratories, Inc., EKF Diagnostics Holdings plc, DIALAB GmbH, Nihon Kohden Corporation, Boule Diagnostics AB, Mindray Medical International Limited, Erba Mannheim, Convergent Technologies GmbH & Co. KG, HemoCue AB (a part of Danaher), HORIBA, Ltd., SFRI, Awareness Technology, Inc., Edan Instruments, Inc., Shenzhen Landwind Industry Co., Ltd., Shenzhen Mindray Bio-Medical Electronics Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Benchtop Hemoglobin Analyzer Market Key Technology Landscape

The technological landscape of the Benchtop Hemoglobin Analyzer Market is dominated by a few core methodologies, with ongoing innovation focused on miniaturization, enhanced throughput, and improved accuracy. Spectrophotometry, particularly the use of cyanmethemoglobin and azide methemoglobin methods, remains the foundational technology due to its reliability and standardization, often serving as the gold standard for laboratory verification. Modern benchtop instruments leveraging this principle employ sophisticated multi-wavelength optics and internal calibration mechanisms to compensate for turbidity and interference, ensuring highly reproducible results even in complex clinical samples. This technology is preferred for its robust performance in high-volume centralized laboratories requiring regulatory compliance.

A second crucial technology is based on advanced electrochemical analysis, which offers faster, reagent-less operation in some configurations, suitable for certain types of specialized benchtop devices. This method often focuses on measuring specific chemical properties related to hemoglobin concentration. However, the most disruptive advancements are centered around microfluidics. Microfluidic-based benchtop analyzers utilize lab-on-a-chip technology, enabling analysis with significantly smaller sample volumes (microliters) and dramatically reducing the time required for results. This integration of microfluidics allows for complex sample preparation and analysis to occur within a small, disposable cartridge, minimizing potential contamination and maximizing operational efficiency, making them highly desirable in modern diagnostic chains.

Furthermore, technology development is heavily focused on connectivity and automation. New generation benchtop analyzers feature bi-directional communication capabilities, allowing seamless integration with Laboratory Information Systems (LIS) and Hospital Information Systems (HIS), streamlining data flow and reducing manual transcription errors. Robotics and automated sample handlers are being incorporated into ultra-high-throughput systems, enabling 24/7 continuous operation with minimal human intervention. The future technology landscape emphasizes combining high-precision optical analysis with smart software algorithms, often powered by AI, to perform automated delta checks, flagging of abnormal results, and self-diagnosis of instrument malfunctions, creating intelligent diagnostic platforms.

Regional Highlights

- North America: North America, comprising the United States and Canada, holds the largest market share primarily due to extremely high healthcare spending, the presence of major key players, and robust reimbursement policies that facilitate the adoption of expensive, state-of-the-art diagnostic equipment. The region benefits from a well-established network of centralized reference laboratories and leading academic research institutions that frequently invest in the latest automated benchtop hemoglobin analyzer models. Regulatory frameworks, particularly from the FDA, though stringent, promote high quality and innovation. The high prevalence of chronic conditions requiring routine blood monitoring, such as diabetes and renal failure, ensures consistent demand for accurate and fast hemoglobin analysis. Innovation in cloud-based data management and telehealth integration further secures North America’s position as a market leader.

- Europe: The European market is the second-largest segment, driven by universal healthcare systems, a strong emphasis on preventative care, and unified standards (CE marking) that facilitate product mobility across the EU. Countries like Germany, the UK, and France are significant contributors, characterized by highly organized public and private diagnostic laboratory sectors. Growth is supported by government initiatives targeting early cancer detection and managing aging populations susceptible to hematological disorders. While economic austerity in some southern European nations occasionally dampens capital expenditure, the overall regional trend favors replacing older instruments with newer, more automated, and efficient benchtop models that reduce reagent waste and improve energy efficiency, aligning with European sustainability goals.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region during the forecast period. This rapid expansion is attributed to massive population bases in India and China, increasing healthcare awareness, and significant infrastructure investments led by both governmental and private entities. The rising middle class demands improved access to quality diagnostic services, shifting the market dynamics from low-cost solutions to high-quality benchtop analyzers. The high incidence of nutritional anemia, especially in South Asia, mandates widespread screening programs, driving procedural volume. Market strategies in APAC heavily involve local manufacturing partnerships and developing tailored products that meet localized regulatory requirements and cost constraints.

- Latin America (LATAM): The LATAM market is experiencing steady growth, driven primarily by expanding private healthcare facilities and medical tourism in countries such as Brazil and Mexico. The adoption of benchtop analyzers is increasing as laboratories seek to upgrade from basic manual methods to semi-automated and automated systems to improve testing accuracy and efficiency. Economic instability and fluctuating currency values remain persistent challenges, often influencing procurement decisions towards cost-effectiveness and favorable financing options. However, regional efforts to combat infectious diseases and improve maternal health screening provide a stable demand base for reliable hemoglobin analysis.

- Middle East and Africa (MEA): The MEA market growth is uneven but significant, concentrated mainly in the Gulf Cooperation Council (GCC) countries due to substantial governmental investment in modernizing healthcare infrastructure, especially high-tech diagnostic centers. High disposable income in key GCC nations allows for the rapid adoption of premium, fully automated benchtop systems. In contrast, the African segment faces challenges related to infrastructure limitations and funding constraints, yet opportunities are emerging through global health organizations and charitable foundations that sponsor diagnostic equipment for public health initiatives targeting widespread issues like malaria and nutritional deficiencies, making durable and semi-automated benchtop systems highly relevant.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Benchtop Hemoglobin Analyzer Market.- Danaher Corporation

- Sysmex Corporation

- F. Hoffmann-La Roche Ltd.

- Siemens Healthineers AG

- Abbott Laboratories

- Bio-Rad Laboratories, Inc.

- EKF Diagnostics Holdings plc

- DIALAB GmbH

- Nihon Kohden Corporation

- Boule Diagnostics AB

- Mindray Medical International Limited

- Erba Mannheim

- Convergent Technologies GmbH & Co. KG

- HemoCue AB (a part of Danaher)

- HORIBA, Ltd.

- SFRI

- Awareness Technology, Inc.

- Edan Instruments, Inc.

- Shenzhen Landwind Industry Co., Ltd.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Benchtop Hemoglobin Analyzer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What technological advancements are driving the accuracy of modern benchtop hemoglobin analyzers?

The primary drivers of accuracy include the integration of advanced microfluidic platforms, which reduce sample size and processing variability, and sophisticated multi-wavelength spectrophotometry that minimizes interference from lipemia and bilirubin. Furthermore, AI-driven calibration systems and internal quality control monitoring enhance result reliability and long-term analytical stability, crucial for clinical validity.

How does the cost-effectiveness of benchtop analyzers compare to point-of-care (POC) devices?

While POC devices have lower initial capital costs, benchtop analyzers offer superior cost-effectiveness in high-volume settings due to lower reagent costs per test, minimal labor requirements via automation, and enhanced standardization that reduces retesting rates. Benchtop systems also provide broader testing menus and better regulatory compliance, optimizing overall laboratory economics.

Which geographical region exhibits the fastest growth rate for the Benchtop Hemoglobin Analyzer Market?

The Asia Pacific (APAC) region is anticipated to exhibit the fastest Compound Annual Growth Rate (CAGR). This acceleration is driven by significant public and private investments in healthcare infrastructure, the expansion of diagnostic services to meet the needs of large, aging populations, and rising awareness regarding the diagnosis and management of widespread nutritional anemia.

What are the key regulatory hurdles influencing the adoption of new benchtop hemoglobin analyzers?

Key regulatory hurdles involve meeting stringent standards set by bodies like the FDA (in North America) and the European Medicines Agency (EMA), requiring extensive clinical validation and documentation of accuracy, precision, and stability. Furthermore, manufacturers must ensure compliance with evolving data privacy laws (such as GDPR) for connectivity features and maintain strict manufacturing quality standards (ISO 13485) to gain market approval.

In what ways is artificial intelligence (AI) expected to revolutionize benchtop hemoglobin analysis?

AI is set to revolutionize the field by automating sophisticated quality control checks, enabling predictive maintenance to minimize instrument downtime, and enhancing diagnostic support through the analysis of complex data patterns. AI integration facilitates faster, more reliable results while optimizing laboratory workflow and operational efficiency through intelligent scheduling and resource management.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager