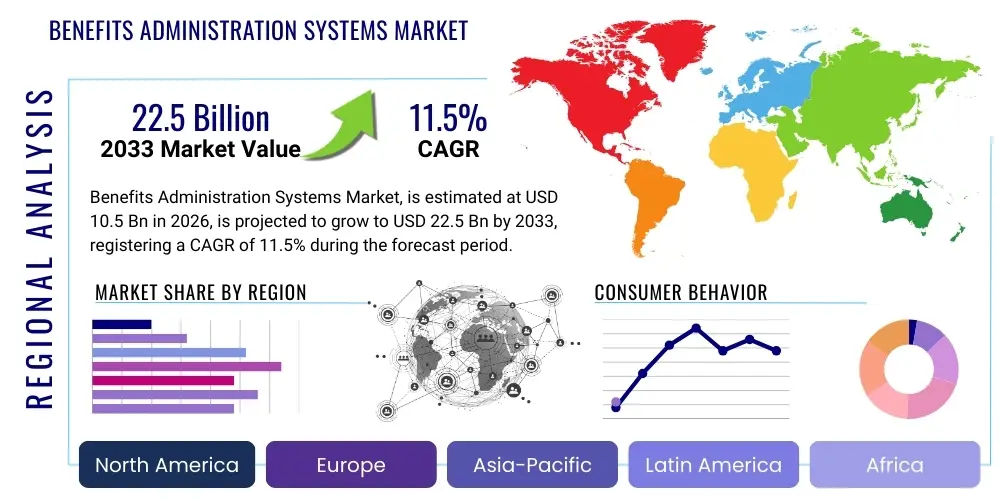

Benefits Administration Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437988 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Benefits Administration Systems Market Size

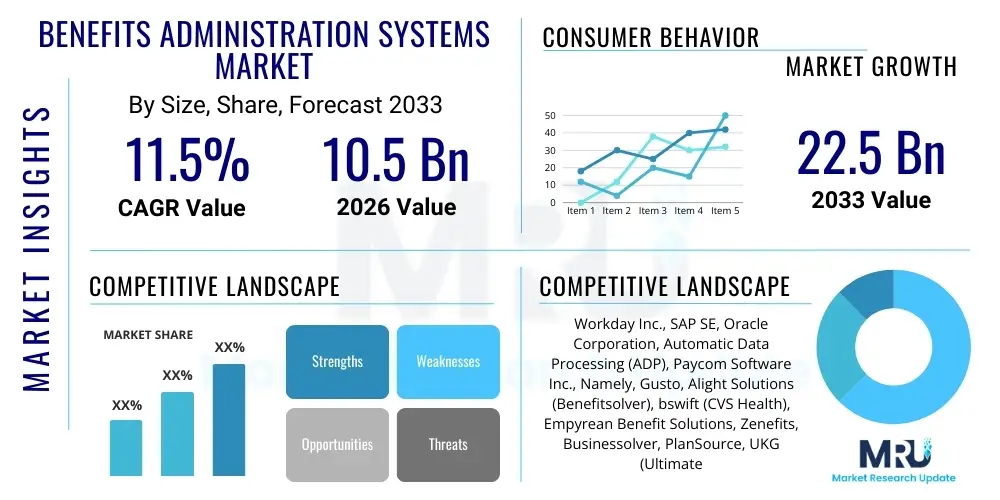

The Benefits Administration Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $10.5 Billion USD in 2026 and is projected to reach $22.5 Billion USD by the end of the forecast period in 2033. This substantial expansion is primarily driven by the increasing complexity of employee benefits packages, stringent regulatory requirements such as the Affordable Care Act (ACA) in the US, and the global shift towards cloud-based Human Capital Management (HCM) solutions that integrate benefits management functionalities seamlessly with core HR processes. The need for enhanced employee engagement and self-service capabilities further accelerates market adoption across various enterprise sizes.

Benefits Administration Systems Market introduction

The Benefits Administration Systems Market encompasses software and service solutions designed to streamline, automate, and manage complex employee benefits programs offered by organizations. These systems handle various functions, including enrollment, eligibility tracking, compliance management, premium reconciliation, communication, and reporting across diverse benefit offerings such as health insurance, retirement plans, wellness programs, and voluntary benefits. The core product description involves highly configurable platforms, often cloud-native, that offer self-service portals for employees and centralized administrative dashboards for HR personnel, significantly reducing manual errors and administrative burdens. Major applications span across large enterprises managing geographically dispersed workforces with diverse benefit requirements and Small and Medium-sized Enterprises (SMEs) seeking cost-effective, scalable solutions to remain competitive in talent acquisition and retention.

A primary benefit of adopting these sophisticated systems is the significant improvement in operational efficiency and regulatory adherence. By automating complex calculations and mandated reporting, organizations mitigate risks associated with non-compliance, particularly in jurisdictions with frequently changing labor and healthcare laws. Furthermore, modern benefits administration platforms enhance the employee experience by providing intuitive access to personalized benefit information and facilitating easy, real-time enrollment changes, which translates directly into higher employee satisfaction and better utilization of offered benefits. Driving factors for market growth include the increasing globalization of businesses, necessitating systems capable of managing multi-country benefit schemes, and the growing complexity of healthcare costs, which mandates robust analytical tools for strategic benefits planning.

The convergence of HR technology (HR Tech) platforms and benefits administration specialized providers is fundamentally reshaping the competitive landscape. Organizations are increasingly demanding unified solutions that combine payroll, core HR, and benefits functionality into a single system of record, favoring integrated platforms over siloed point solutions. This demand for integration, coupled with technological advancements like mobile optimization and artificial intelligence, fuels innovation in the market, driving vendors to offer hyper-personalized benefit recommendations and simplified user interfaces. The expansion into voluntary benefits—such as pet insurance, financial wellness, and legal services—further necessitates dynamic administration systems capable of handling a broad spectrum of non-traditional offerings efficiently.

Benefits Administration Systems Market Executive Summary

The Benefits Administration Systems Market is characterized by robust business trends emphasizing digital transformation, cloud migration, and heightened focus on employee experience (EX). Key business trends include the shift from traditional, rigid plan designs to flexible, personalized benefits marketplaces (or "cafeteria" plans), demanding highly configurable software architecture. Regional trends indicate North America maintaining market leadership due to stringent regulatory environments (e.g., ACA, HIPAA) and high technology adoption rates, while the Asia Pacific (APAC) region is demonstrating the fastest growth propelled by rapid economic digitalization and increasing awareness of employee benefits as a talent retention tool in rapidly industrializing economies. Segmentation trends highlight the dominance of cloud-based deployment models due to their scalability, lower upfront costs, and faster deployment cycles, alongside significant growth in the services component, encompassing consulting, implementation, and outsourcing of benefits administration functions, particularly among SMEs seeking specialized expertise without expanding internal HR staff.

The competitive dynamics are defined by intense rivalry between major enterprise resource planning (ERP) vendors offering integrated HCM suites (e.g., Workday, Oracle, SAP) and specialized Benefits Administration System (BAS) providers (e.g., Alight, Businessolver). A critical element summarized in the market’s trajectory is the pervasive influence of M&A activity, where larger players acquire niche providers to integrate specialized capabilities, such as advanced compliance tools or specific regional expertise, thereby expanding their market footprint and enhancing product portfolios. This consolidation pressure drives innovation, forcing vendors to invest heavily in user interface (UI) design and back-end integration capabilities to secure market share. Furthermore, the increasing complexity of workforce demographics, including the rise of gig economy workers and contract employees, mandates systems capable of administering non-traditional benefit structures, adding a layer of strategic importance to flexible system architecture.

In essence, the market’s growth hinges on regulatory catalysts and technological innovation. Organizations view benefits administration systems not merely as cost centers but as strategic tools for managing total rewards, enhancing compliance posture, and ultimately driving organizational performance through improved talent engagement. The executive summary points toward continued strong demand, particularly for systems that can leverage data analytics to optimize benefit plan utilization and cost containment, ensuring that investments in employee well-being are both effective and financially sustainable. The evolution towards real-time data synchronization and predictive analytics remains a cornerstone of future market development across all geographic and industry segments.

AI Impact Analysis on Benefits Administration Systems Market

User inquiries regarding the integration of Artificial Intelligence (AI) in Benefits Administration Systems center heavily on efficiency gains, personalization capabilities, and regulatory assurance. Common questions revolve around: "How can AI automate complex benefits enrollment and eligibility checks?", "What is the role of machine learning in personalizing benefit recommendations for individual employees?", and "Can AI-driven compliance monitoring truly keep pace with fast-changing labor laws?" The overriding key themes summarized are the expectation that AI will dramatically reduce manual administrative burdens, offer hyper-personalized decision support to employees (acting as a virtual benefits counselor), and significantly improve the speed and accuracy of compliance monitoring and risk detection. Users anticipate that AI will transition benefits administration from a reactive, transactional function to a proactive, strategic component of Human Resources, shifting HR staff focus from data entry to strategic planning and employee relations.

- AI-Driven Personalization: Utilizing machine learning algorithms to analyze employee demographics, utilization history, and declared preferences to recommend optimal benefit packages, maximizing perceived value and employee satisfaction.

- Automated Eligibility Verification: Applying AI models to process complex eligibility rules across diverse employee populations (full-time, part-time, contractors) in real-time, drastically reducing enrollment errors and verification time.

- Regulatory Compliance Monitoring: Employing Natural Language Processing (NLP) and machine learning to continuously monitor changes in state, federal, and international labor laws, automatically updating system configurations and flagging potential compliance risks (e.g., ACA reporting anomalies).

- Enhanced Employee Support (Chatbots/Virtual Assistants): Implementing AI-powered conversational interfaces (chatbots) to handle high-volume, routine employee queries regarding plan details, coverage, and claims status 24/7, improving accessibility and reducing HR workload.

- Fraud Detection and Risk Mitigation: Using predictive analytics to identify unusual claims patterns or enrollment discrepancies that might indicate fraudulent activity, strengthening plan integrity and reducing unnecessary financial losses.

- Predictive Modeling for Cost Management: Applying AI to forecast future healthcare costs and plan utilization based on historical data, enabling HR and finance teams to design more cost-effective benefit structures during open enrollment cycles.

- Streamlined Enrollment Experience: Employing AI to pre-fill enrollment forms with relevant data, minimizing manual input required from the employee and accelerating the annual enrollment process.

- Optimization of Voluntary Benefits: Leveraging AI to match specific voluntary benefit offerings (e.g., student loan repayment, specific wellness incentives) to segmented employee populations based on sophisticated demographic and behavioral analysis.

DRO & Impact Forces Of Benefits Administration Systems Market

The market is predominantly driven by regulatory complexity and the strategic necessity of talent management, while restraints include high initial implementation costs and integration challenges with legacy HRIS platforms. Opportunities are vast, centered on the expansion into emerging markets and the increasing demand for specialized, niche benefits management solutions, particularly those utilizing advanced AI/ML capabilities. The combined impact forces suggest a moderate to high pressure on organizations to adopt modern systems. Specifically, the regulatory environment acts as a strong driver, compelling mandatory upgrades, while the imperative to compete for top talent necessitates superior employee experience tools provided by modern benefits platforms. The impact of technological evolution (e.g., cloud and AI) significantly amplifies the opportunity landscape, pushing traditional vendors to innovate rapidly or risk obsolescence, thereby strengthening the competitive pressure across the ecosystem.

Key drivers include the global push for digitalization in HR functions, which mandates the integration of benefits into centralized data platforms; the ever-increasing complexity of benefit plan offerings, moving beyond standard health and retirement to include diverse wellness and financial literacy programs; and the critical need for robust data security and privacy compliance, particularly under regulations like GDPR and CCPA, which sophisticated systems are better equipped to handle. These drivers are fundamentally reshaping procurement decisions, favoring vendors that offer end-to-end security frameworks and verifiable compliance adherence. Furthermore, the shift towards defined contribution models in retirement and increasing employee responsibility in selecting benefits necessitates intuitive, educational interfaces, a capability that modern BAS platforms specialize in delivering.

Restraints primarily revolve around the significant capital expenditure required for full-scale system implementation, especially for large, established organizations tethered to deeply customized on-premise solutions that resist easy integration or migration. Data migration challenges—transferring sensitive employee data and historical benefits records accurately—also pose substantial roadblocks and risks. Opportunities are most pronounced in the expansion of managed services and outsourcing, where smaller enterprises can leverage specialized vendor expertise without significant internal investment. Moreover, the opportunity exists to develop vertical-specific benefits administration systems, tailored precisely to the unique compliance and benefits requirements of sectors like public sector unions, specialized manufacturing, or high-tech startups, allowing vendors to capture niche value at a premium. The overarching impact forces strongly favor cloud-native, agile solutions that can adapt quickly to both regulatory changes and evolving employee expectations, accelerating the obsolescence of legacy systems across all market segments.

Segmentation Analysis

The Benefits Administration Systems Market is analyzed through multiple dimensions, including Component (Software and Services), Deployment Model (Cloud-Based and On-Premise), Enterprise Size (Small and Medium-sized Enterprises and Large Enterprises), and Application (various industries). The segmentation provides granular insights into specific user needs and adoption patterns. The dominance of the Services segment is often observed, driven by the complexity of plan design, the continuous need for regulatory updates, and the preference among organizations to outsource non-core administrative functions to specialized third-party administrators (TPAs) or full-service HR technology providers. Cloud-based solutions maintain the highest growth trajectory due to lower total cost of ownership (TCO) and rapid deployment advantages, making them particularly attractive to the high-growth SME segment.

- By Component:

- Software (Core BAS Platforms, Enrollment Modules, Compliance Tools)

- Services (Consulting, Implementation, Outsourcing/Managed Services, Maintenance & Support)

- By Deployment Model:

- Cloud-Based (SaaS)

- On-Premise

- By Enterprise Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By Application/End-Use Industry:

- Healthcare and Life Sciences

- Banking, Financial Services, and Insurance (BFSI)

- Information Technology (IT) and Telecommunications

- Manufacturing and Retail

- Government and Public Sector

- Others (Education, Non-profit)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Benefits Administration Systems Market

The value chain for Benefits Administration Systems begins with Upstream activities centered on core technology development and data provision. This includes software developers creating highly configurable enrollment engines, integration APIs, and compliance databases. Key upstream suppliers are infrastructure providers (cloud services like AWS, Azure) and specialized data vendors supplying regulatory updates or actuarial data necessary for plan pricing and risk assessment. Successful upstream players prioritize scalability, security certifications (e.g., SOC 1/2), and flexible architecture allowing for rapid integration with diverse third-party HR ecosystems. Strategic partnerships at this stage focus on securing best-in-class encryption and data warehousing solutions essential for handling sensitive Protected Health Information (PHI) and Personally Identifiable Information (PII).

Midstream activities involve the core processing and platform delivery. This stage is dominated by Benefits Administration Systems vendors who integrate the software components, manage hosting (especially for cloud models), and provide comprehensive support services, including implementation, customization, and ongoing maintenance. Distribution channels are varied, encompassing Direct sales models, where large enterprise vendors engage directly with multinational corporations, and Indirect channels, which rely heavily on specialized brokers, consultants, and outsourcing firms (TPAs). These indirect channels are particularly crucial for reaching the SME segment, which often relies on benefit brokers for plan selection and administrative oversight. The effectiveness of the midstream relies heavily on the quality of implementation and the ease of integration with existing client systems (payroll, time and attendance).

Downstream activities focus on the final delivery of value to the End-User (the employer and the employee). This includes ongoing administrative services, premium reconciliation with carriers, mandated regulatory reporting (e.g., Form 1095-C in the US), and employee support services (call centers, self-service portals). Downstream analysis confirms that the primary beneficiaries are HR departments seeking efficiency and employees demanding transparent, accessible benefit information. The success of the downstream stage is measured by employee satisfaction scores, reduction in administrative overhead, and minimized compliance risks. The strongest value proposition is achieved when the system seamlessly connects the employer, the employee, the benefit broker, and the various insurance carriers, ensuring data fidelity and operational synchronization across the entire benefits ecosystem.

Benefits Administration Systems Market Potential Customers

The potential customers for Benefits Administration Systems span across all sectors and enterprise sizes, fundamentally comprising any organization employing a structured workforce and offering formalized employee benefits. End-users, or buyers of the product, are primarily Chief Human Resources Officers (CHROs), Vice Presidents of Benefits, and dedicated HRIS/HR Technology managers responsible for technology procurement and workforce planning. While Large Enterprises constitute the bulk of the market value due to their complex, multi-national benefit portfolios and high transactional volume, the highest growth potential resides within Small and Medium-sized Enterprises (SMEs). SMEs, motivated by the desire to offer competitive benefits without the infrastructure burden, increasingly seek outsourced solutions and scalable, user-friendly, cloud-based platforms.

Industries facing high regulatory scrutiny or dealing with a diverse employee base are prime targets. This includes the Healthcare sector, which manages intricate union agreements and specific medical professional benefits; the Banking, Financial Services, and Insurance (BFSI) sector, requiring robust security and compliance standards; and the Government/Public Sector, which often handles complex pension and retirement schemes. For large multinational corporations, the potential customer requirement centers on global capabilities—a single system capable of handling multiple currencies, regulatory frameworks, and language requirements across various geographic locations. Conversely, potential customers in the IT and Technology sector prioritize flexible, modern systems that can integrate rapidly with emerging HR technologies and offer highly customizable, non-traditional benefits tailored to a younger, tech-savvy workforce.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $10.5 Billion USD |

| Market Forecast in 2033 | $22.5 Billion USD |

| Growth Rate | CAGR 11.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Workday Inc., SAP SE, Oracle Corporation, Automatic Data Processing (ADP), Paycom Software Inc., Namely, Gusto, Alight Solutions (Benefitsolver), bswift (CVS Health), Empyrean Benefit Solutions, Zenefits, Businessolver, PlanSource, UKG (Ultimate Kronos Group), isolved, Darwin (Thomsons Online Benefits), Corestream, Benefitfocus. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Benefits Administration Systems Market Key Technology Landscape

The technology landscape of the Benefits Administration Systems market is predominantly defined by the migration to Software as a Service (SaaS) architecture, leveraging multi-tenant cloud environments for scalability and continuous deployment of updates. Core technological reliance is placed on robust Application Programming Interfaces (APIs) that facilitate seamless, real-time data exchange between the benefits platform, payroll systems, and hundreds of insurance carriers and third-party administrators (TPAs). Modern systems prioritize security, utilizing advanced encryption standards (e.g., TLS 1.3, AES-256) and adhering to critical compliance frameworks such as HIPAA and ISO 27001. User experience (UX) design, specifically mobile responsiveness and intuitive interfaces, is a key technological differentiator, ensuring high employee adoption rates and reducing the need for administrative assistance.

Artificial Intelligence (AI) and Machine Learning (ML) are rapidly transitioning from niche features to foundational technological components. AI is employed in intelligent automation for routine tasks, such as initial data verification and claim processing, minimizing human intervention. ML algorithms are crucial for sophisticated data analysis, including predictive modeling for identifying potential high-risk employees or forecasting healthcare cost trends based on historical enrollment and utilization data. Furthermore, the technology architecture is increasingly incorporating blockchain principles for enhanced data integrity and secure, verifiable identity management, particularly in complex, multi-party benefits transactions. The convergence with broader HCM suites mandates strong integration middleware and unified data repositories (e.g., data lakes) capable of supporting cross-functional reporting.

The rise of microservices architecture is enabling vendors to deploy updates and new features rapidly, allowing for quicker adaptation to evolving regulatory mandates and benefit offerings without requiring full system overhauls. This modular approach supports the growing trend of "benefits marketplaces," where employees can select from a wide array of core and voluntary benefits offered by numerous providers, managed through a single platform interface. Moreover, technologies focused on data visualization and advanced analytics—such as dynamic dashboards and ad-hoc reporting tools—are essential for HR leaders to make strategic, data-driven decisions about benefits strategy and cost management. The continuous need for integration with legacy systems means that vendors must maintain robust integration capabilities, often relying on middleware solutions or flexible ETL (Extract, Transform, Load) processes to ensure data fidelity during system transitions and ongoing operations.

Regional Highlights

The Benefits Administration Systems Market demonstrates distinct adoption patterns influenced by regional regulatory environments, technological maturity, and workforce characteristics. North America (NA) currently dominates the global market share, largely attributed to the highly complex and employer-sponsored healthcare system in the United States, which necessitates sophisticated, compliance-heavy BAS platforms (driven by legislation like the Affordable Care Act and ERISA). High labor costs and a strong focus on employee retention also drive early adoption of advanced, integrated HR technologies. Canada, while less complex than the US, maintains steady demand for efficient benefits systems tailored to provincial regulations and group insurance models. The NA region is the primary incubator for innovation, particularly in AI-driven personalization and comprehensive compliance tooling.

Europe represents the second-largest market, characterized by diverse national labor laws and privacy regulations (GDPR). The market here is fragmented, requiring vendors to offer highly localized, multi-language, multi-currency solutions. Adoption is strong in Western European countries (UK, Germany, France) driven by large multinational corporations seeking centralized benefits management across their European operations. However, the prevalence of state-sponsored healthcare in many European nations often shifts the focus of BAS platforms from managing core health insurance enrollment to administering supplementary benefits, pensions, and wellness programs. The emphasis in Europe is on strict data governance and flexible solutions that can harmonize benefit structures across various collective bargaining agreements.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid expansion is fueled by increasing foreign direct investment, the rapid growth of large domestic companies, and the digitalization push across developing economies like India, China, and Southeast Asia. As these regions formalize and standardize employee benefits to attract global talent, the demand for scalable, cloud-based BAS solutions escalates dramatically. While initial market penetration may focus on basic enrollment and compliance, the long-term trend involves adopting sophisticated systems similar to those in North America, particularly as regional regulations around data privacy and labor standards mature. Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets, where growth is currently concentrated in BFSI and IT sectors, driven by multinational company operations and the need for standardized global reporting.

- North America (Dominant Market): High regulatory complexity (ACA, ERISA), advanced technology adoption, strong competitive pressure to offer complex benefits, and high demand for AI-driven automation in compliance and enrollment.

- Europe (Mature and Regulatory Focused): Driven by GDPR compliance, demand for highly localized solutions, focus on integrated pension and supplementary benefits management, strong presence of third-party administrators (TPAs).

- Asia Pacific (Fastest Growing): Rapid industrialization, increasing awareness of employee benefits, strong push toward cloud-based deployment, high adoption rates among burgeoning domestic IT and manufacturing firms.

- Latin America (Emerging Potential): Increasing formalization of labor laws, growing investment in HR technology by large regional conglomerates, demand for mobile-friendly interfaces due to high mobile penetration.

- Middle East and Africa (MEA - Niche Growth): Driven by governmental initiatives towards private sector growth, requirements for sophisticated systems in high-growth sectors (Energy, Finance), and needs for managing expat benefits packages.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Benefits Administration Systems Market.- Workday Inc.

- SAP SE

- Oracle Corporation

- Automatic Data Processing (ADP)

- Paycom Software Inc.

- Namely

- Gusto

- Alight Solutions (Benefitsolver)

- bswift (CVS Health)

- Empyrean Benefit Solutions

- Zenefits

- Businessolver

- PlanSource

- UKG (Ultimate Kronos Group)

- isolved

- Darwin (Thomsons Online Benefits)

- Corestream

- Benefitfocus

- Aon Hewitt

- Mercer (Marsh McLennan)

Frequently Asked Questions

Analyze common user questions about the Benefits Administration Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of migrating benefits administration from on-premise solutions to the cloud (SaaS)?

The primary benefit of cloud migration is enhanced scalability, lower Total Cost of Ownership (TCO) by eliminating infrastructure maintenance, and guaranteed access to continuous regulatory updates and new features, ensuring persistent compliance and technological relevance without major capital expenditure.

How are Benefits Administration Systems ensuring data security and compliance with major regulations like HIPAA and GDPR?

Modern Benefits Administration Systems utilize advanced security protocols, including multi-factor authentication, end-to-end encryption for data in transit and at rest, regular security audits, and strict access controls, maintaining documented compliance certifications (e.g., SOC 2, ISO 27001) critical for handling sensitive health and personal information.

What role does Artificial Intelligence play in optimizing employee benefits selection and cost management?

AI, specifically machine learning, analyzes employee utilization data and demographics to provide personalized benefit recommendations (guiding employees to optimal plans) and assists HR teams by forecasting future healthcare utilization and associated costs, thereby enabling proactive cost containment strategies and plan design optimization.

Which segment—SMEs or Large Enterprises—is driving the highest growth rate in the Benefits Administration Systems Market?

While Large Enterprises account for the largest market share in terms of revenue, Small and Medium-sized Enterprises (SMEs) are driving the highest proportional growth rate, fueled by the availability of affordable, feature-rich cloud solutions and the necessity to offer competitive, automated benefits to attract and retain talent.

What are the typical integration challenges faced when implementing a new Benefits Administration System?

Key integration challenges include synchronizing data accuracy between the new BAS and existing legacy HRIS/payroll systems, establishing robust and error-free API connections with multiple external benefit carriers, and successfully migrating historical employee and benefits enrollment data without loss or corruption, often requiring specialized consulting services.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager