Benzocyclobutene (BCB) Resin Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431801 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Benzocyclobutene (BCB) Resin Market Size

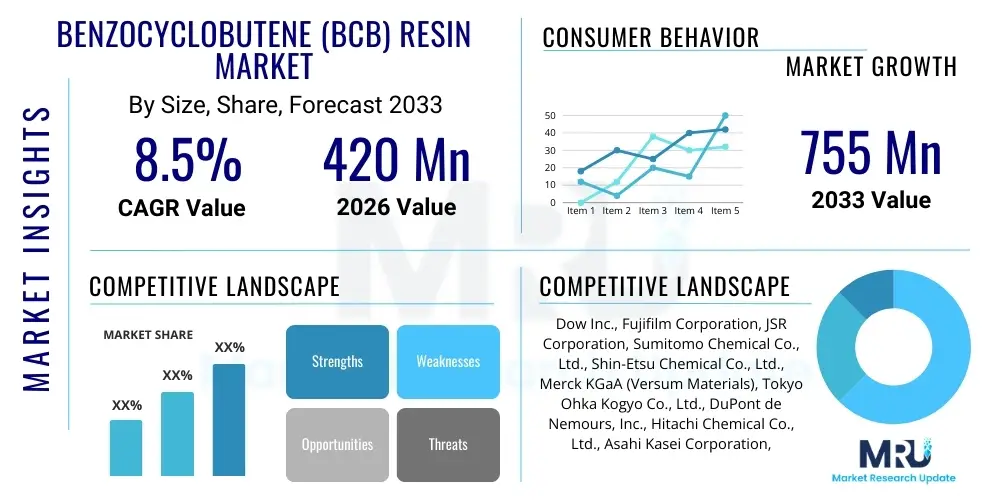

The Benzocyclobutene (BCB) Resin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 420 million in 2026 and is projected to reach USD 755 million by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by the increasing demand for high-performance dielectric materials across advanced microelectronics, particularly in the semiconductor and advanced packaging sectors where superior thermal stability and low dielectric constant are critical performance differentiators.

Benzocyclobutene (BCB) Resin Market introduction

The Benzocyclobutene (BCB) Resin Market encompasses specialized thermosetting polymer materials utilized extensively in high-reliability electronic applications due to their exceptional thermal stability, low moisture absorption, and excellent planarization capabilities. BCB resins, derived from proprietary cyclic monomers, function primarily as spin-on or laminated dielectric layers and passivation coatings in the fabrication of integrated circuits (ICs), microelectromechanical systems (MEMS), and wafer-level packaging (WLP). These resins are critical enablers for next-generation semiconductor manufacturing processes, offering superior performance compared to traditional polyimide and epoxy materials in high-frequency environments. The major applications driving market expansion include 3D integrated circuits (3D-ICs), advanced fan-out wafer level packaging (Fo-WLP), high-density interconnect (HDI) substrates, and the production of flexible electronics. Key market benefits include outstanding electrical properties, such as a low dielectric constant (k) and low dissipation factor (Df), which minimize signal loss and cross-talk at high frequencies. The market is primarily driven by the relentless miniaturization of electronic devices, the proliferation of 5G and 6G technologies demanding higher data transmission speeds, and the burgeoning adoption of sophisticated packaging techniques essential for AI hardware and high-performance computing (HPC) systems.

Benzocyclobutene (BCB) Resin Market Executive Summary

The Benzocyclobutene (BCB) Resin Market is poised for accelerated growth, reflecting dominant business trends centered around the global expansion of advanced semiconductor manufacturing capabilities, particularly in Asia Pacific. Business trends show a strategic shift toward capacity expansion and vertical integration among leading material suppliers to secure stable BCB resin supply, crucial for major foundries. The rising complexity of heterogeneous integration and 3D stacking technologies necessitates materials like BCB with ultra-low cure temperatures and excellent mechanical properties, driving intense R&D investment focused on developing novel photo-definable BCB variants that streamline fabrication processes. Regionally, Asia Pacific maintains its undisputed leadership, propelled by massive investments in semiconductor fabrication plants (fabs) in China, Taiwan, and South Korea, which are rapidly deploying advanced packaging technologies where BCB is indispensable. North America and Europe also demonstrate healthy growth, focused mainly on high-end R&D, defense, and specialized automotive electronics requiring extreme reliability. Segment trends indicate a strong preference for liquid spin-on formulations due to their ease of application and superior gap-filling capability in complex 3D structures. Furthermore, the burgeoning demand for temporary bonding materials in wafer thinning and the application of BCB in bio-compatible medical sensors represent significant, albeit specialized, growth pockets that contribute to overall market resilience and expansion.

AI Impact Analysis on Benzocyclobutene (BCB) Resin Market

User inquiries regarding AI's influence on the BCB resin market frequently center on two main themes: first, how AI-driven demand for specialized high-performance computing (HPC) hardware accelerates the need for advanced packaging materials; and second, how AI tools themselves can optimize the material science and manufacturing processes associated with BCB resins. Users are concerned with supply chain resilience under sudden surge demand catalyzed by AI hardware booms (e.g., massive GPU clusters) and seek clarification on whether current BCB formulations meet the stringent thermal management and electrical requirements of next-generation AI processors operating at higher power densities. Furthermore, there is significant interest in how machine learning can be applied to predict the performance characteristics (e.g., dielectric constant drift over temperature) of new BCB formulations, drastically reducing traditional R&D cycles. The consensus among analyzed questions suggests that AI is both a massive consumer driver and a transformative optimization tool for the BCB market, demanding quicker development cycles and higher volume manufacturing capacity.

The core of AI’s impact is felt directly through the architecture of advanced logic chips. AI accelerators and specialized neuromorphic processors rely heavily on 2.5D and 3D integration techniques—such as Chip-on-Wafer (CoW) and Hybrid Bonding—where BCB acts as the essential dielectric and stress buffer layer between stacked dies or adjacent chips on an interposer. The unprecedented computational loads generated by generative AI and large language models (LLMs) require packaging solutions that can efficiently handle extreme thermal loads while minimizing signal latency. BCB's low dielectric loss characteristics make it uniquely suited to maintain signal integrity in the high-frequency environments characteristic of AI data centers and edge processing units, cementing its status as a critical enabling material for future computing infrastructure.

Furthermore, AI and machine learning (ML) are increasingly being integrated into the material synthesis and quality control phases of BCB resin production. ML algorithms are utilized to analyze vast datasets relating to raw material purity, polymerization reaction conditions, and final film properties, allowing manufacturers to predict and mitigate defects far more efficiently than traditional statistical process control (SPC) methods. This application of AI ensures tighter process windows, leading to higher yield rates and improved consistency of the final BCB film, which is vital for sophisticated multi-layer structures in advanced packaging. The efficiency gains delivered by AI in manufacturing optimization directly address concerns about scaling production to meet the volatile, yet exponential, demand from the AI hardware industry.

- AI drives exponential demand for 2.5D/3D ICs, increasing BCB use in interposers and stacking architectures.

- Generative AI hardware requires BCB for superior thermal management and signal integrity in high-power density chips.

- Machine learning optimizes BCB synthesis, predicting performance (low-k value) based on monomer ratios, accelerating R&D timelines.

- Predictive maintenance using AI in fabrication minimizes material waste and downtime related to BCB dispensing and curing processes.

- AI modeling is used to simulate mechanical stress relief provided by BCB films in heterogeneous integration, ensuring long-term device reliability.

DRO & Impact Forces Of Benzocyclobutene (BCB) Resin Market

The BCB Resin Market dynamics are shaped by a powerful confluence of drivers, constraints, and opportunities, underpinned by fundamental impact forces emanating from technological evolution and global geopolitical shifts. The primary driver is the pervasive trend of semiconductor miniaturization and the subsequent shift towards advanced packaging techniques, necessitated by the limits of Moore’s Law; BCB’s intrinsic properties, especially its low k-value and excellent planarization, make it superior to competing polymers for high-density interconnects. Counterbalancing this growth are restraints, mainly the high cost associated with proprietary BCB monomer synthesis and the complex manufacturing process involved in applying and curing the resin, requiring specialized high-capital equipment. Opportunities abound in niche areas such as flexible electronics, bio-integrated sensors, and the burgeoning photonics industry, where BCB’s optical transparency and chemical inertness open new application verticals.

Key impact forces include the exponential growth in data consumption and the rapid global deployment of 5G and future 6G networks, which necessitate components with minimal signal loss, directly favoring BCB usage in high-frequency modules and antennas. Furthermore, geopolitical tensions and supply chain risks related to essential precursor chemicals pose a significant external force, driving strategic localized material production and increasing the focus on material substitution alternatives if supply becomes unstable. The high entry barrier, dictated by intellectual property protection surrounding BCB technology, acts as an internal consolidating force, ensuring that only a few specialized chemical companies dominate the supply landscape, thereby controlling market pricing and technological evolution.

The market faces structural restraints related to technological maturity and competition from established materials like certain advanced polyimides and epoxy formulations, which, while offering inferior electrical performance, often present lower production costs and established supply chains. However, the expanding opportunity in automotive electronics—specifically in ADAS (Advanced Driver-Assistance Systems) and in-car infotainment requiring robust, thermally stable components—provides a long-term demand catalyst. The ability of BCB resins to withstand harsh operating conditions and temperature cycling inherent to automotive environments ensures sustained penetration into this high-reliability sector, mitigating some of the restraints associated with the high initial investment required by end-users for processing equipment.

- Drivers: Demand for advanced packaging (2.5D/3D ICs), proliferation of 5G/6G communication infrastructure, and requirements for high thermal stability in HPC and AI accelerators.

- Restraints: High synthesis cost of specialized BCB monomers, complex processing requirements (curing temperature/atmosphere), and intellectual property constraints limiting competition.

- Opportunities: Expansion into flexible electronics, bio-medical sensors (implantable devices), optical interconnects, and high-reliability automotive components (ADAS).

- Impact Forces: Rapid technological obsolescence in semiconductors, geopolitical shifts affecting supply chain localization, and stringent regulatory standards in aerospace and medical applications.

Segmentation Analysis

The Benzocyclobutene (BCB) Resin Market is meticulously segmented based on formulation type, application method, and end-use industry, reflecting the diverse and highly specialized requirements of the microelectronics sector. Segmentation by formulation, distinguishing between liquid spin-on and film/sheet forms, is critical as it dictates the suitability for specific fabrication steps, with liquid forms dominating in complex 3D structures requiring excellent planarization. Application-based segmentation highlights critical uses such as Wafer Level Packaging (WLP), High-Density Interconnects (HDI), and R&D activities, demonstrating where the highest value BCB formulations are utilized. Furthermore, end-use segmentation categorizes demand from sectors like Telecommunications (5G infrastructure), Consumer Electronics, Automotive, and Aerospace/Defense, providing a granular view of market consumption patterns and growth pockets driven by distinct performance specifications.

- By Formulation Type:

- Liquid Spin-on Resin (Dominant segment due to superior planarization for 3D stacking)

- Film/Sheet Resin (Used primarily for specific substrate buildup layers)

- By Application:

- Wafer Level Packaging (WLP)

- High-Density Interconnects (HDI)

- Passivation Layers

- Dielectric Interlayers (in 2.5D/3D ICs)

- Temporary Bonding/Debonding Agents

- By End-Use Industry:

- Semiconductors & Microelectronics

- Telecommunications (5G/6G components)

- Automotive Electronics (ADAS, Power Modules)

- Aerospace and Defense

- Medical Devices and Sensors

- Consumer Electronics

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Benzocyclobutene (BCB) Resin Market

The BCB resin value chain is characterized by high technological specialization, starting with the complex synthesis of proprietary precursors. Upstream activities are dominated by specialized chemical synthesis houses that produce high-purity monomers, requiring intense R&D and strict intellectual property control. This synthesis stage is capital-intensive and involves complex organometallic or photochemical processes to yield the necessary cycloolefin precursors. The specialized nature of these raw materials creates significant supply bottlenecks and high procurement costs, directly impacting the final resin price. Manufacturers must ensure ultra-high purity, as minute contaminants can severely compromise the electrical performance of the finished semiconductor device.

Midstream processing involves the transformation of these monomers into usable BCB formulations, either liquid spin-on solutions or dry films, incorporating solvents, photo-initiators, and other proprietary additives. This critical formulation step determines key performance metrics such as viscosity, curing temperature, dielectric constant, and photo-definability. Quality assurance testing during this stage—focusing on thermal properties (Tg, Td) and electrical loss—is rigorous. Downstream, the distribution channel is highly specialized. Due to the high value and technical nature of BCB resins, direct distribution to major Integrated Device Manufacturers (IDMs) and foundries is common, facilitating immediate technical support and product customization. Indirect distribution involves highly technical chemical distributors capable of managing sensitive, high-ppurity materials and providing localized technical application expertise to smaller fabricators.

The value derived from BCB resides heavily in its unique ability to enable advanced heterogeneous integration schemes that are otherwise impossible with conventional polymers. The strong link between the material supplier and the semiconductor fabricator means that the value chain is highly integrated and collaborative, especially regarding new product introductions (NPIs) for emerging process nodes. The increasing adoption of Wafer-Level Packaging and 3D stacking techniques ensures that the value accrued at the end-use application stage—in terms of improved device performance, smaller form factors, and reduced power consumption—justifies the high cost and complexity inherent in the upstream material synthesis and formulation processes.

Benzocyclobutene (BCB) Resin Market Potential Customers

The primary customers for Benzocyclobutene (BCB) resin are entities involved in high-end microfabrication and advanced electronic packaging where thermal stability, low dielectric constant, and excellent planarization are non-negotiable requirements. These include major semiconductor foundries (like TSMC, Samsung, and GlobalFoundries), Integrated Device Manufacturers (IDMs) that handle both design and fabrication (such as Intel and major memory producers), and Outsourced Semiconductor Assembly and Test (OSAT) companies specializing in advanced packaging services (like ASE and Amkor). These buyers utilize BCB resins to manufacture interposers for 2.5D architectures, form insulating layers in multi-chip modules (MCMs), and create stress-absorbing layers in fan-out wafer level packaging (Fo-WLP).

Beyond the core semiconductor industry, significant demand originates from specialized manufacturers in aerospace and defense, who require materials capable of operating reliably under extreme thermal cycles and radiation exposure, often utilizing BCB for robust protective coatings on sensitive electronic warfare components and sensors. Furthermore, leading producers of high-frequency communication modules, particularly for 5G/6G base stations and military radar systems, represent high-value potential customers. A growing niche includes manufacturers of advanced medical devices, specifically implantable sensors and bio-compatible electronics, where the low toxicity and chemical inertness of BCB are crucial. These end-users prioritize material reliability and certification over cost, making them lucrative targets for high-purity BCB suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 420 million |

| Market Forecast in 2033 | USD 755 million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dow Inc., Fujifilm Corporation, JSR Corporation, Sumitomo Chemical Co., Ltd., Shin-Etsu Chemical Co., Ltd., Merck KGaA (Versum Materials), Tokyo Ohka Kogyo Co., Ltd., DuPont de Nemours, Inc., Hitachi Chemical Co., Ltd., Asahi Kasei Corporation, Kolon Industries, Showa Denko K.K., Toray Industries, Inc., Brewer Science, Solvay S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Benzocyclobutene (BCB) Resin Market Key Technology Landscape

The technological landscape surrounding the Benzocyclobutene (BCB) resin market is defined by innovation aimed at enhancing processability, optimizing dielectric performance, and integrating BCB into increasingly complex 3D structures. A core technology is the development of photo-definable BCB (Photo-BCB) formulations. Unlike standard BCB resins that require traditional lithography and plasma etching steps, Photo-BCB can be directly patterned using UV exposure, significantly reducing the number of processing steps, lowering manufacturing costs, and improving yield rates, particularly in fan-out wafer level packaging (Fo-WLP). This technology is crucial for achieving the extremely fine pitch and high aspect ratios required in next-generation high-density interconnect applications. Ongoing research focuses on improving the photosensitivity and resolution of these materials without compromising the inherent low-k and thermal stability advantages of BCB polymers.

Another significant technological advancement involves the development of low-stress BCB variants and specialized formulations for temporary bonding applications. In 3D integration, differential thermal expansion between stacked dies or substrates can induce significant stress, leading to device failure. Low-stress BCB acts as a buffer layer to mitigate these mechanical stresses. Furthermore, temporary bonding BCB materials are essential for supporting ultrathin wafers during back-end-of-line (BEOL) processing, offering high thermal resistance during subsequent steps and clean, residue-free debonding after processing. The optimization of debonding mechanisms, ranging from thermal release to laser ablation, remains a key R&D focus. The pursuit of even lower dielectric constants (ultra-low k) for frequencies exceeding 100 GHz necessitates the incorporation of porosity control techniques and specialized oligomers, pushing the material science frontier to meet future communication standards.

Furthermore, the integration of BCB resins with complementary technologies, such as advanced deposition techniques like Chemical Vapor Deposition (CVD) and Atomic Layer Deposition (ALD), is expanding the application space. While BCB is typically spin-coated, hybrid processing schemes are being explored to create highly conformal and multi-layered dielectric stacks with finely tuned electrical properties. Research into self-assembly and directed assembly techniques leveraging BCB is emerging as manufacturers seek methods to create highly ordered nanoscale features, potentially overcoming the resolution limitations of traditional lithography in mass production. Sustainability is also becoming a technological focus, driving efforts to develop solvent-free or low-VOC (Volatile Organic Compound) BCB formulations, aligning the market with stricter environmental regulations and worker safety standards across advanced manufacturing hubs.

- Photo-Definable BCB (Photo-BCB): Enables direct patterning, reducing processing steps and cost in WLP and HDI applications.

- Low-Stress BCB Formulations: Critical for mitigating mechanical stress and thermal mismatch in high-stack 3D ICs and heterogeneous integration.

- Temporary Bonding BCB: High thermal resistance materials used for supporting ultra-thin wafers during back-end processing, designed for clean release.

- Ultra-Low-k BCB Variants: Utilizing controlled porosity or novel chemistry to achieve dielectric constants below 2.5 for extremely high-frequency components (6G).

- Hybrid Processing Integration: Combination of spin-coating BCB with CVD/ALD for complex, highly conformal dielectric stacks.

Regional Highlights

The Asia Pacific (APAC) region dominates the Benzocyclobutene (BCB) Resin Market, accounting for the largest share in both consumption and production capacity. This supremacy is directly attributable to the region's overwhelming concentration of global semiconductor fabrication facilities, wafer foundries, and advanced packaging houses, particularly in countries like Taiwan, South Korea, China, and Japan. Massive governmental and private sector investments in building state-of-the-art fabs and pushing advanced packaging limits (2.5D interposers and 3D stacking) make APAC the core demand center. The rapid rollout of 5G infrastructure and the massive scale of consumer electronics manufacturing further cement APAC's leading position, driving high-volume consumption of BCB resins for dielectric layers and passivation coatings.

North America holds a significant position in the BCB market, characterized less by high-volume manufacturing and more by high-value, specialized applications. The demand here is concentrated among R&D centers, major aerospace and defense contractors, and leading-edge semiconductor design firms involved in high-performance computing (HPC) and military electronics. The focus is often on highly specialized, customized BCB formulations that meet stringent military specifications (Mil-Specs) and unique requirements for complex silicon photonics and quantum computing hardware. While fabrication volumes are lower than in APAC, the intellectual property and technology innovation driven by US-based companies significantly influence global material specifications and development trends.

Europe represents a mature market with stable, moderate growth, primarily driven by its established automotive electronics sector and specialized industrial and medical device manufacturing. European demand for BCB is fueled by the need for extremely reliable components in ADAS, power management modules, and precision medical implants, where BCB's thermal robustness is essential for long-term operational integrity. Countries like Germany and the Netherlands, with strong industrial automation and high-end automotive manufacturing bases, are key consumers. Europe is also a significant center for high-frequency telecommunication research, requiring BCB for prototype development in advanced microwave and millimeter-wave applications, ensuring steady, albeit targeted, growth.

- Asia Pacific (APAC): Market leader due to concentration of semiconductor manufacturing (Taiwan, South Korea, China) and massive investment in advanced packaging (WLP, 2.5D/3D).

- North America: High-value market focused on R&D, aerospace/defense, HPC, and specialized military electronics requiring Mil-Spec BCB formulations.

- Europe: Stable market driven by robust automotive electronics (ADAS), industrial automation, and specialized medical device manufacturing, prioritizing long-term reliability.

- Latin America & MEA: Emerging markets with nascent demand, mainly concentrated in localized assembly operations and telecommunication infrastructure build-out (e.g., localized 5G deployment).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Benzocyclobutene (BCB) Resin Market.- Dow Inc.

- Fujifilm Corporation

- JSR Corporation

- Sumitomo Chemical Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Merck KGaA (Versum Materials)

- Tokyo Ohka Kogyo Co., Ltd.

- DuPont de Nemours, Inc.

- Hitachi Chemical Co., Ltd.

- Asahi Kasei Corporation

- Kolon Industries

- Showa Denko K.K.

- Toray Industries, Inc.

- Brewer Science

- Solvay S.A.

- Micron Technology, Inc. (as a major end-user and specification setter)

- Taiwan Semiconductor Manufacturing Company (TSMC) (influencer in material standards)

- Samsung SDI Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Benzocyclobutene (BCB) Resin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Benzocyclobutene (BCB) resin primarily used for in electronics?

BCB resin is primarily used as a high-performance, low-dielectric constant (low-k) interlayer dielectric and passivation material in advanced semiconductor packaging, notably in Wafer Level Packaging (WLP) and 2.5D/3D Integrated Circuits (ICs). Its exceptional thermal stability and planarization capabilities are essential for minimizing signal delay in high-frequency applications.

Why is BCB preferred over traditional polyimide materials in high-frequency applications?

BCB is favored because it possesses a significantly lower dielectric constant (k) and dissipation factor (Df) compared to polyimides, minimizing electrical signal loss and cross-talk, especially critical for high-speed data transmission required in 5G and high-performance computing (HPC) environments.

How do Photo-definable BCB resins simplify the manufacturing process?

Photo-BCB resins can be directly patterned using standard photolithography techniques, eliminating the need for separate plasma etching steps. This simplification reduces the total number of processing steps, lowers manufacturing cost, and improves yield in the fabrication of fine-pitch interconnect structures.

Which geographical region dominates the consumption of BCB resins?

The Asia Pacific (APAC) region dominates BCB resin consumption, driven by the concentration of major semiconductor foundries and advanced packaging facilities in Taiwan, South Korea, and China, which are the leading adopters of BCB-enabled 2.5D and 3D stacking technologies.

What are the main market restraints impacting BCB adoption?

The primary restraints include the high initial cost associated with the proprietary chemical synthesis of BCB monomers and the requirement for specialized, high-capital equipment necessary for the precise spin-coating and curing processes utilized by BCB resins in semiconductor fabrication.

What role does BCB play in 3D integration technology?

In 3D integration, BCB functions as a crucial stress buffer layer, insulating stacked dies (interlayer dielectric) while mitigating mechanical stress caused by the coefficient of thermal expansion (CTE) mismatch between different materials, thus enhancing device reliability and longevity.

Are there environmentally friendly BCB alternatives or formulations?

Market R&D is increasingly focused on developing low-Volatile Organic Compound (low-VOC) and potentially solvent-free BCB formulations. While the fundamental chemistry remains complex, manufacturers are adapting formulations to meet increasingly stringent global environmental and occupational safety standards, aiming for greener processing solutions.

How is the automotive industry driving demand for BCB resin?

The automotive industry, particularly through Advanced Driver-Assistance Systems (ADAS) and electric vehicle power modules, demands highly reliable electronic components that can withstand extreme temperature cycling. BCB's superior thermal stability and moisture resistance make it ideal for these demanding, mission-critical applications.

What is the difference between BCB and silicon dioxide (SiO2) in dielectric applications?

While SiO2 is a common dielectric, BCB is an organic polymer typically used in back-end-of-line (BEOL) processes. BCB offers a significantly lower dielectric constant (k), better planarization capability, and superior mechanical flexibility compared to inorganic SiO2, making it suitable for high-frequency flexible electronics and stress-sensitive packaging.

What recent technological breakthrough is set to impact the BCB market most significantly?

The rapid advancement of temporary bonding BCB materials is highly significant. These materials enable ultra-thin wafer handling—critical for 3D stacking—by providing a robust, yet temporary, mechanical support during processing, ensuring high yields for next-generation memory and logic stacking.

Can BCB be used in flexible electronic devices?

Yes, BCB is highly suitable for flexible electronics due to its excellent mechanical flexibility, low moisture uptake, and robust thermal properties, enabling its use in flexible display substrates and bendable integrated circuits that require high-reliability dielectric insulation.

What is the typical curing temperature range for BCB resins?

BCB resins typically cure at relatively high temperatures, often ranging from 250°C to 350°C, usually performed under an inert atmosphere (nitrogen) to prevent oxidation and ensure optimal film properties. This high thermal threshold contributes to its final robust stability.

How does the increasing adoption of AI hardware influence BCB demand?

AI hardware relies heavily on specialized high-performance chips integrated using 2.5D interposers and 3D stacking, necessitating BCB as the core dielectric material to manage heat dissipation and maintain signal integrity at the high operating frequencies and power densities characteristic of AI accelerators.

Who are the main end-users for BCB film/sheet products?

BCB film/sheet products are primarily utilized by manufacturers of high-density printed circuit boards (PCBs) and specialized substrates, where they serve as robust, pre-formed dielectric layers for lamination, ensuring consistent layer thickness and high insulation integrity.

What competitive materials challenge BCB resins in the market?

BCB faces competition primarily from advanced polyimides (PIs), liquid crystal polymers (LCPs), and certain epoxy-based formulations. While competitors might offer cost advantages, BCB generally maintains a performance edge in areas requiring the lowest k-value and superior thermal stability above 250°C.

How does intellectual property affect market competition?

The BCB market is highly consolidated due to strong intellectual property protection surrounding the monomer synthesis and polymerization processes. This high entry barrier limits the number of key players, allowing dominant suppliers to maintain premium pricing and control over specialized formulations.

What is the significance of the low moisture absorption of BCB resins?

Low moisture absorption is critical because water ingress significantly increases the dielectric constant and leads to device performance degradation, particularly in humid operating environments. BCB's hydrophobic nature ensures long-term electrical stability and reliability for packaged devices.

Are BCB resins used in optical applications?

Yes, due to their excellent optical transparency in the near-infrared spectrum and high thermal stability, BCB resins are increasingly being explored and utilized as optical waveguides and cladding materials in silicon photonics and integrated optical interconnects.

What are the primary factors driving supply chain risk in the BCB market?

Supply chain risk is driven by the limited global sources for specialized precursor chemicals required for BCB monomer synthesis. Geopolitical tensions or unexpected disruptions at specialized chemical synthesis plants can severely impact the supply of high-purity BCB resin to the semiconductor industry.

How are R&D efforts focused regarding BCB resin performance?

Current R&D is heavily focused on achieving ultra-low dielectric constants (k < 2.5) for next-generation wireless communications, improving the resolution and lithographic performance of photo-BCB, and developing better adhesion promoters for integration with diverse substrate materials.

What impact does the trend of heterogeneous integration have on BCB demand?

Heterogeneous integration—combining different chiplets onto a single package—massively increases BCB demand. BCB is the preferred material for the interposer's dielectric layers and redistribution layers (RDLs) due to its reliability in managing the electrical connections and thermal dissipation between dissimilar components.

Is BCB resin used for permanent or temporary bonding?

BCB is used for both permanent bonding, primarily as an insulating dielectric layer, and increasingly for temporary bonding applications where a thermally stable adhesive is required to hold ultra-thin wafers during processing before a clean debonding step.

Which sector demands the highest quality and reliability standards for BCB?

The aerospace, defense, and specialized medical device sectors demand the absolute highest quality and reliability standards for BCB, requiring stringent certification processes to ensure the material can withstand extreme operational conditions, temperature fluctuations, and long service lifetimes.

How does the planarization capability of BCB affect manufacturing yield?

BCB's excellent planarization capability allows it to create a smooth, flat surface over uneven topography introduced by underlying circuit layers. This is crucial for subsequent photolithography steps, ensuring uniform exposure and reducing defects, thereby maximizing manufacturing yield in multi-layer processes.

What is the expected long-term growth driver for the BCB market beyond 5G?

The expected long-term growth driver is the foundational shift towards high-bandwidth, low-latency 6G communication technologies and the ongoing need for extreme miniaturization in medical and Internet of Things (IoT) devices, all of which require ultra-low-k, thermally stable dielectric materials like BCB.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager