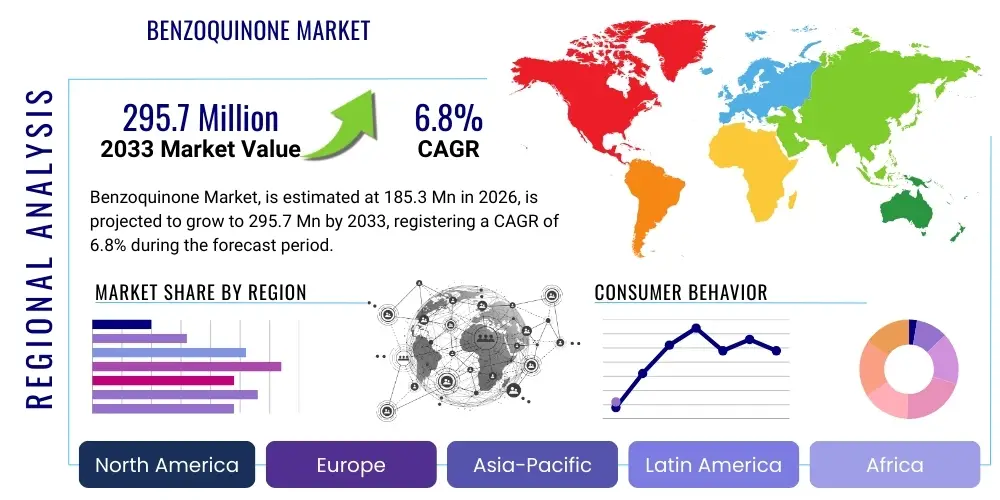

Benzoquinone Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440155 | Date : Jan, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Benzoquinone Market Size

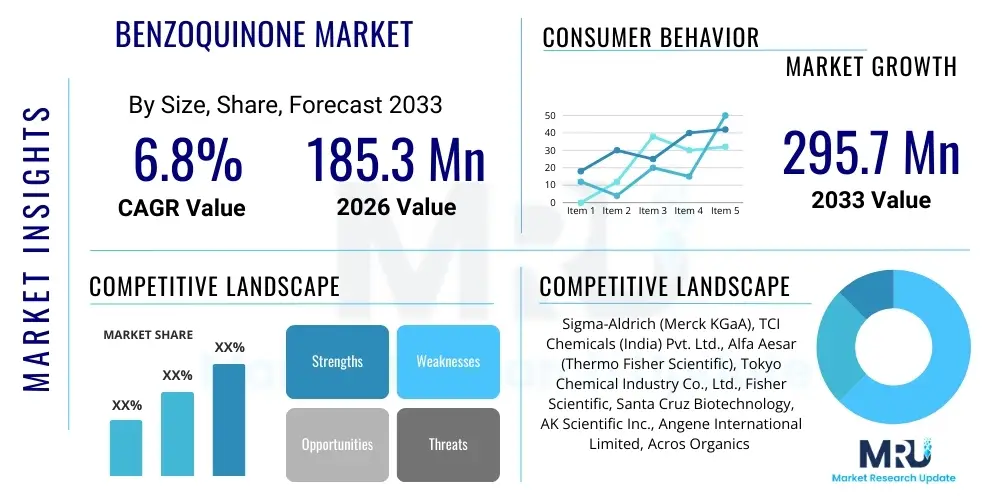

The Benzoquinone Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $185.3 Million in 2026 and is projected to reach $295.7 Million by the end of the forecast period in 2033.

Benzoquinone Market introduction

The Benzoquinone market is defined by the production, distribution, and application of a vital organic compound known for its strong oxidizing properties and versatile chemical reactivity. Benzoquinone, particularly para-benzoquinone (p-benzoquinone), is a fundamental building block in organic synthesis, playing a crucial role in the creation of a vast array of downstream products. Its market dynamics are intricately linked to the growth and innovation within several key industries, including pharmaceuticals, agrochemicals, dyes, and polymers. The compound's unique electron-accepting properties make it indispensable in various chemical processes, from serving as a dehydrogenating agent to acting as a polymerization inhibitor.

As a product, benzoquinone exists primarily as a crystalline solid, characterized by its distinctive pungent odor. Its chemical structure, featuring a six-membered carbon ring with two carbonyl groups, confers excellent reactivity, making it a valuable intermediate in complex synthetic pathways. The compound is predominantly manufactured through the oxidation of aromatic amines or phenols, with process optimization continuously sought to enhance purity, yield, and environmental sustainability. This chemical versatility translates into significant benefits across industries, offering solutions for intricate molecular design and efficient industrial production. Its ability to undergo facile reduction and re-oxidation cycles further expands its utility, particularly in redox-sensitive applications.

Major applications of benzoquinone span a wide spectrum. In the pharmaceutical sector, it is utilized as a key intermediate for synthesizing drugs, antibiotics, and vitamins, leveraging its electrophilic nature. The agrochemical industry relies on benzoquinone derivatives for producing fungicides, herbicides, and insecticides, contributing to crop protection and yield enhancement. Furthermore, it finds extensive use in the textile industry as a dye intermediate, contributing to vibrant and durable coloration. Its role as a polymerization inhibitor is critical in preventing premature polymerization of monomers like styrene, ensuring product stability during storage and transportation. The market is driven by increasing demand from these burgeoning end-use industries, coupled with ongoing research into new applications and more sustainable production methods, solidifying benzoquinone's position as a cornerstone chemical.

Benzoquinone Market Executive Summary

The Benzoquinone market is currently experiencing robust growth, propelled by sustained demand from critical end-use sectors and continuous advancements in chemical synthesis. Business trends indicate a strong focus on enhancing production efficiencies, exploring novel applications, and adhering to evolving environmental regulations. Companies are increasingly investing in research and development to discover greener synthesis routes and expand the utility of benzoquinone derivatives, aiming to capture new market niches and diversify product portfolios. Strategic partnerships and collaborations between manufacturers and end-users are also becoming prevalent, fostering innovation and ensuring a stable supply chain. The competitive landscape is characterized by both established chemical giants and specialized producers, all vying for market share through product differentiation and cost optimization.

Regional trends highlight Asia Pacific as the dominant and fastest-growing market, primarily due to the rapid industrialization, expanding chemical manufacturing base, and burgeoning pharmaceutical and agrochemical industries in countries like China and India. North America and Europe, while mature markets, continue to represent significant demand, driven by stringent quality standards, high-value specialty chemical production, and sustained R&D activities in drug discovery and advanced materials. Emerging economies in Latin America, the Middle East, and Africa are also showing promising growth potential, fueled by increasing agricultural output, developing healthcare infrastructure, and rising industrialization, creating new avenues for market expansion for benzoquinone and its derivatives.

Segmentation trends reveal that the p-Benzoquinone type holds the largest share due to its wider range of applications and established synthesis methods, though o-Benzoquinone is also gaining traction for specific niche uses. In terms of application, the pharmaceutical and agrochemical intermediates segments are expected to witness significant growth, driven by increasing global populations, rising healthcare expenditures, and the continuous need for improved crop yields. The segment for polymerization inhibitors also demonstrates stable demand, integral to the plastics and polymer industries. These trends collectively underscore a dynamic market characterized by innovation, regional shifts in manufacturing and consumption, and a constant drive towards greater sustainability and efficiency across the value chain.

AI Impact Analysis on Benzoquinone Market

The impact of Artificial intelligence (AI) on the Benzoquinone market is becoming a significant area of interest, reflecting a broader trend of technological integration within the chemical industry. Users frequently inquire about how AI can enhance the synthesis and production processes of complex chemical compounds like benzoquinone, seeking to understand its potential in optimizing reaction conditions, predicting yields, and improving material purity. Key concerns often revolve around the economic feasibility of implementing AI solutions, the necessary infrastructure and data requirements, and the skill sets needed to leverage these advanced technologies. There is also considerable expectation regarding AI's role in accelerating research and development, particularly in discovering new applications for benzoquinone and its derivatives, as well as in identifying more sustainable and environmentally friendly synthesis routes.

Furthermore, users are keen to explore AI's contribution to supply chain management and quality control within the Benzoquinone market. Questions often arise concerning AI's ability to forecast demand fluctuations more accurately, optimize inventory levels, and minimize waste throughout the production lifecycle. The precision and consistency offered by AI-powered analytical tools are expected to revolutionize quality assurance, ensuring that benzoquinone products meet stringent industry specifications. The overarching theme is a strong anticipation that AI will drive efficiency, reduce operational costs, and foster innovation, ultimately leading to a more competitive and resilient Benzoquinone market. This integration is seen as a strategic imperative for manufacturers to maintain a leading edge in a rapidly evolving global chemical landscape.

Overall, the key themes summarizing user expectations about AI's influence in this domain include process optimization, accelerated R&D, enhanced supply chain resilience, and superior quality control. Users anticipate that AI will facilitate predictive maintenance of equipment, thereby minimizing downtime and maximizing production output. The ability of AI to analyze vast datasets pertaining to chemical reactions and material properties is expected to unlock novel insights, leading to the development of advanced benzoquinone-based compounds with improved functionalities. This technological shift is poised to transform traditional manufacturing paradigms, introducing an era of smart chemistry characterized by data-driven decision-making and automated process execution, ensuring that the Benzoquinone market remains at the forefront of chemical innovation and efficiency.

- AI-driven optimization of reaction parameters for enhanced benzoquinone yield and purity.

- Predictive modeling for raw material sourcing and demand forecasting, improving supply chain efficiency.

- Automated quality control systems utilizing machine learning for real-time contaminant detection and product consistency.

- Accelerated discovery of novel benzoquinone derivatives and applications through AI-powered molecular design and simulation.

- Enhanced process safety and risk management by identifying potential hazards and optimizing operational protocols.

- Development of sustainable and greener synthesis routes for benzoquinone using AI to minimize waste and energy consumption.

- Intelligent inventory management and logistics optimization, reducing storage costs and ensuring timely delivery.

DRO & Impact Forces Of Benzoquinone Market

The Benzoquinone market is shaped by a complex interplay of various Drivers, Restraints, and Opportunities, collectively forming the impact forces that dictate its growth trajectory. Key drivers include the ever-expanding pharmaceutical industry, which utilizes benzoquinone as a crucial intermediate in the synthesis of a wide range of drugs, antibiotics, and vitamins. The robust growth in the agrochemical sector, driven by the global need for increased food production and crop protection, also significantly boosts demand for benzoquinone derivatives used in fungicides, herbicides, and insecticides. Furthermore, the versatile applications of benzoquinone as a polymerization inhibitor in the plastics and polymers industry, and as an oxidizing agent in various chemical processes, contribute substantially to its market expansion. Technological advancements leading to more efficient and cost-effective synthesis methods also act as a strong driver, making benzoquinone more accessible and competitive.

However, the market faces several significant restraints that could impede its growth. Volatility in raw material prices, particularly for phenol and aniline, which are primary precursors, can impact production costs and overall market stability. Stringent environmental regulations concerning the production and handling of certain chemicals, including some aspects of benzoquinone manufacturing, pose compliance challenges and can increase operational expenses for manufacturers. The availability of substitute chemicals or alternative synthetic pathways for specific applications can also limit market growth for benzoquinone. Additionally, potential health hazards associated with exposure to benzoquinone necessitate strict safety protocols, adding another layer of operational complexity and cost for producers, thereby acting as a restraint.

Despite these restraints, ample opportunities exist for market expansion and innovation. Emerging economies, particularly in Asia Pacific and Latin America, present vast untapped markets with burgeoning industrial bases and increasing demand across healthcare and agriculture sectors. Investment in research and development aimed at discovering new applications for benzoquinone, especially in advanced materials, electronics, and energy storage, could unlock significant growth potential. The growing global emphasis on green chemistry and sustainable manufacturing processes offers an opportunity for companies to develop environmentally friendly synthesis routes for benzoquinone, enhancing their market appeal and regulatory compliance. Furthermore, strategic collaborations and mergers can allow companies to consolidate resources, expand geographical reach, and leverage synergies, thereby strengthening their market position and mitigating some of the existing restraints, collectively defining the dynamic impact forces within this market.

Segmentation Analysis

The Benzoquinone market is comprehensively segmented to provide a detailed understanding of its diverse applications, product types, and end-use industries. This segmentation allows for precise market analysis, enabling stakeholders to identify key growth areas, understand competitive dynamics, and strategize effectively. The primary segmentation categorizes the market by type into p-Benzoquinone and o-Benzoquinone, reflecting their distinct chemical structures and reactivity profiles. Further crucial segmentation occurs by application, which details the specific uses of benzoquinone across various industries, highlighting its functional versatility. Finally, the market is also segmented by end-use industry, illustrating the ultimate consumers of benzoquinone, thereby providing a holistic view of its demand landscape and value chain integration.

- By Type:

- p-Benzoquinone

- o-Benzoquinone

- By Application:

- Pharmaceutical Intermediates

- Agrochemical Intermediates

- Dyes & Pigments

- Polymerization Inhibitors

- Oxidizing Agents

- Reagents in Organic Synthesis

- Other Applications (e.g., photography, analytical reagents)

- By End-Use Industry:

- Chemical Manufacturing

- Pharmaceuticals

- Agriculture

- Textile

- Paints & Coatings

- Plastics & Polymers

- Research & Development

Value Chain Analysis For Benzoquinone Market

The value chain for the Benzoquinone market begins with upstream activities, primarily involving the sourcing and production of key raw materials. The main precursors for benzoquinone synthesis are typically phenol and aniline, which are derived from petroleum refining processes. Therefore, the upstream segment heavily relies on the petrochemical industry for a stable and cost-effective supply. Other essential chemicals like oxidizing agents (e.g., manganese dioxide, hydrogen peroxide) and solvents are also critical inputs. Key players in this stage include large chemical manufacturers and petrochemical companies that produce these foundational compounds. Fluctuations in crude oil prices and the supply-demand dynamics of these raw materials significantly influence the manufacturing costs and profitability of benzoquinone producers, making robust supplier relationships and efficient procurement strategies vital.

Moving downstream, the value chain encompasses the manufacturing, purification, and distribution of benzoquinone to various end-user industries. After synthesis, the crude benzoquinone undergoes rigorous purification processes to meet specific industrial standards, such as purity levels required for pharmaceutical intermediates or specialized reagents. This stage often involves sophisticated chemical engineering processes and quality control measures. Once purified, benzoquinone is packaged and distributed through a complex network. The distribution channel can be direct, where large manufacturers sell directly to major industrial clients like pharmaceutical or agrochemical companies, or indirect, involving a network of distributors, wholesalers, and agents who cater to smaller businesses, research laboratories, and specialized niche markets. These intermediaries play a crucial role in market penetration and reaching a diverse customer base.

The direct distribution channel is typically favored for large-volume, long-term contracts with established industrial customers, ensuring consistent supply and strong client relationships. This approach allows manufacturers to maintain greater control over product quality and pricing, while also fostering closer collaboration for custom solutions. Conversely, the indirect distribution channel leverages the extensive reach and logistical expertise of third-party distributors to service fragmented markets and deliver smaller quantities more efficiently. These distributors often provide value-added services such as technical support, warehousing, and local inventory management, making the product accessible across a wider geographical area. The efficiency and reliability of both upstream raw material supply and downstream distribution channels are paramount for the overall competitiveness and sustainability of the Benzoquinone market, impacting lead times, customer satisfaction, and overall market responsiveness.

Benzoquinone Market Potential Customers

The potential customers for the Benzoquinone market are diverse and span across multiple high-value industries, primarily driven by the compound's multifaceted chemical properties. End-users typically include large-scale chemical manufacturers that utilize benzoquinone as a fundamental building block for synthesizing a wide array of specialized chemicals and intermediates. Pharmaceutical companies represent a significant customer base, relying on benzoquinone for the synthesis of complex drug molecules, antibiotics, and vitamins, where its precise reactivity and electrophilic nature are indispensable for creating active pharmaceutical ingredients (APIs) and their precursors. The stringent quality and purity requirements of this sector make it a premium segment for benzoquinone suppliers, demanding consistent product specifications and reliable supply.

Another major segment of buyers comes from the agrochemical industry, where benzoquinone derivatives are critical for formulating effective fungicides, herbicides, and insecticides. These products are essential for modern agriculture, enhancing crop yield, and protecting against pests and diseases, thus driving a steady demand for benzoquinone. The textile industry also serves as a key customer, employing benzoquinone intermediates in the production of various dyes and pigments to achieve vibrant and durable coloration in fabrics. Furthermore, the plastics and polymers sector utilizes benzoquinone as a polymerization inhibitor, preventing unwanted reactions during the storage and processing of monomers, thereby extending product shelf-life and maintaining material integrity, making polymer manufacturers consistent buyers of this compound.

Beyond these industrial giants, a significant number of potential customers exist within research and development institutions, universities, and specialized laboratories globally. These entities purchase benzoquinone for experimental purposes, novel compound synthesis, analytical chemistry applications, and academic research into new chemical processes and material science. Moreover, companies involved in manufacturing specialized reagents for organic synthesis, photography, and advanced materials also constitute important buyers, albeit often in smaller, highly specialized volumes. The broad applicability of benzoquinone across these varied sectors underscores its critical importance as a chemical intermediate, ensuring a robust and diversified customer base that is continually seeking high-quality and reliably supplied product.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185.3 Million |

| Market Forecast in 2033 | $295.7 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sigma-Aldrich (Merck KGaA), TCI Chemicals (India) Pvt. Ltd., Alfa Aesar (Thermo Fisher Scientific), Tokyo Chemical Industry Co., Ltd., Fisher Scientific, Santa Cruz Biotechnology, AK Scientific Inc., Angene International Limited, Acros Organics (Thermo Fisher Scientific), S. D. Fine-Chem Limited, Loba Chemie, Central Drug House (P) Ltd., Clearsynth Labs Pvt. Ltd., Otto Chemie Pvt. Ltd., VWR International, Avantor Inc., Lonza Group, Arkema S.A., BASF SE, Sumitomo Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Benzoquinone Market Key Technology Landscape

The key technology landscape of the Benzoquinone market is primarily characterized by the various synthesis methods employed for its production, coupled with advanced purification techniques and process optimization strategies designed to enhance efficiency and product quality. Historically, benzoquinone has been produced through the oxidation of phenol or aniline derivatives. Modern approaches focus on improving the selectivity and yield of these oxidation reactions, often utilizing more environmentally benign catalysts and greener solvents to reduce the ecological footprint. Innovations in catalysis, including the use of transition metal catalysts or enzymatic processes, are continuously being explored to make the synthesis more sustainable and less energy-intensive, aligning with global trends in green chemistry.

Beyond synthesis, the technological landscape encompasses sophisticated purification and isolation methods crucial for achieving the high purity levels required by downstream applications, especially in the pharmaceutical and specialty chemical sectors. Techniques such as recrystallization, distillation, and chromatography are routinely employed, with ongoing research into more advanced membrane separation technologies or supercritical fluid extraction to enhance purity while minimizing waste. Automation and continuous flow chemistry are also emerging as significant technological advancements, allowing for greater control over reaction conditions, improved safety, and higher throughput compared to traditional batch processes, thereby reducing production costs and increasing operational efficiency.

Furthermore, the integration of process analytical technology (PAT) plays a vital role in real-time monitoring and control of benzoquinone production processes. PAT tools, including spectroscopy (e.g., FTIR, UV-Vis), chromatography, and sensor technologies, enable manufacturers to monitor reaction kinetics, intermediate formation, and final product quality throughout the synthesis, ensuring consistent output and preventing deviations. Digitalization and the adoption of Industry 4.0 principles, such as AI and machine learning, are also beginning to influence the technology landscape by enabling predictive maintenance, optimizing production schedules, and simulating reaction pathways. These technological advancements collectively aim to drive down costs, improve safety, enhance environmental performance, and meet the increasingly stringent quality demands of the global Benzoquinone market, positioning it for continued innovation and growth.

Regional Highlights

- North America: A mature market characterized by robust research and development activities, particularly in pharmaceuticals and specialty chemicals. The region benefits from stringent quality standards and a strong emphasis on advanced manufacturing, driving demand for high-purity benzoquinone.

- Europe: Similar to North America, Europe is a significant market for specialty chemicals, with a strong focus on sustainable production and regulatory compliance. The presence of major pharmaceutical and agrochemical companies ensures a steady demand, coupled with innovation in green chemistry applications.

- Asia Pacific (APAC): The largest and fastest-growing market, propelled by rapid industrialization, expanding manufacturing capabilities, and burgeoning pharmaceutical and agrochemical industries in countries like China, India, and Japan. Increased investments in infrastructure and rising disposable incomes further fuel market expansion.

- Latin America: An emerging market exhibiting promising growth, driven by increasing agricultural activities and developing pharmaceutical sectors. Countries like Brazil and Mexico are key contributors, with rising industrial output and foreign investments creating new opportunities.

- Middle East and Africa (MEA): Another emerging region with growth potential, particularly due to investments in industrial diversification, expanding agricultural practices, and improvements in healthcare infrastructure. While smaller, the region is expected to witness steady growth over the forecast period.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Benzoquinone Market.- Sigma-Aldrich (Merck KGaA)

- TCI Chemicals (India) Pvt. Ltd.

- Alfa Aesar (Thermo Fisher Scientific)

- Tokyo Chemical Industry Co., Ltd.

- Fisher Scientific

- Santa Cruz Biotechnology

- AK Scientific Inc.

- Angene International Limited

- Acros Organics (Thermo Fisher Scientific)

- S. D. Fine-Chem Limited

- Loba Chemie

- Central Drug House (P) Ltd.

- Clearsynth Labs Pvt. Ltd.

- Otto Chemie Pvt. Ltd.

- VWR International

- Avantor Inc.

- Lonza Group

- Arkema S.A.

- BASF SE

- Sumitomo Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Benzoquinone market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Benzoquinone primarily used for?

Benzoquinone is primarily used as a versatile chemical intermediate in organic synthesis, crucial for producing pharmaceuticals, agrochemicals, dyes, and as a polymerization inhibitor in the plastics industry. Its strong oxidizing properties make it invaluable in various chemical reactions.

How is Benzoquinone manufactured?

Benzoquinone is typically manufactured through the oxidation of aromatic compounds such as phenol or aniline. Modern production methods often involve catalytic processes and strive for higher efficiency, purity, and environmental sustainability.

What are the key market drivers for Benzoquinone?

The key market drivers for Benzoquinone include the expanding pharmaceutical and agrochemical industries, growing demand for dyes and pigments, and its critical role as a polymerization inhibitor. Technological advancements in synthesis also contribute to market growth.

Which region dominates the Benzoquinone market?

The Asia Pacific region currently dominates the Benzoquinone market and is also the fastest-growing region, driven by rapid industrialization, a large chemical manufacturing base, and increasing demand from pharmaceutical and agrochemical sectors in countries like China and India.

What are the main challenges faced by the Benzoquinone market?

The main challenges include volatility in raw material prices, stringent environmental regulations governing chemical production, the availability of alternative chemicals, and the need for strict safety protocols due to potential health hazards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager