Beryllium oxide powders Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433247 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Beryllium oxide powders Market Size

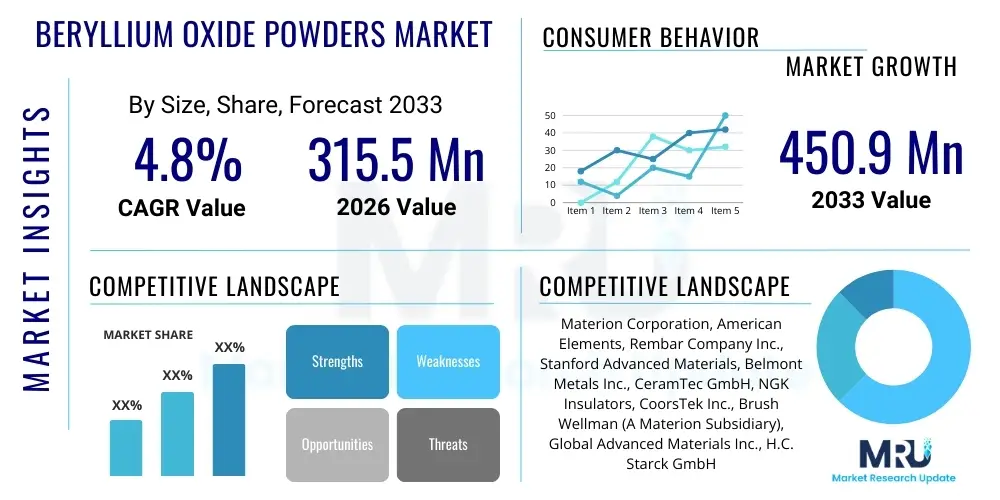

The Beryllium oxide powders Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 315.5 Million in 2026 and is projected to reach USD 450.9 Million by the end of the forecast period in 2033.

Beryllium oxide powders Market introduction

Beryllium oxide (BeO), often referred to as beryllia, is a highly specialized ceramic material known primarily for its unique combination of exceptionally high thermal conductivity—surpassing most non-metals and approaching metals like aluminum—and excellent electrical insulation properties. The powder form of Beryllium oxide serves as the foundational material for manufacturing high-performance ceramic components, crucibles, electronic substrates, heat sinks, and structural elements utilized in demanding industrial and technological environments. This dual characteristic makes it indispensable in applications requiring efficient heat dissipation from electronic devices without compromising electrical integrity, particularly within high-power density systems, radar equipment, and sophisticated medical devices.

Major applications driving the demand for Beryllium oxide powders include the advanced electronics sector, where miniaturization and increased power output necessitate superior thermal management solutions, and the aerospace and defense industries, which rely on its stability under extreme temperature fluctuations and radiation resistance for specialized components like gyro platforms and missile guidance systems. The material's ability to maintain structural integrity and dielectric strength across a broad temperature spectrum, coupled with its relatively low density, positions it favorably against alternative materials such as alumina (Al2O3) or aluminum nitride (AlN) in niche, performance-critical markets. Furthermore, its role as a neutron moderator and reflector in nuclear reactors constitutes another significant, albeit highly regulated, end-use application.

The primary driving factors for the growth of the Beryllium oxide powders market stem from the rapid proliferation of 5G infrastructure, the continuous advancement of high-power semiconductor devices (especially GaN and SiC technologies), and escalating defense modernization programs globally. Increased investment in satellite communication technologies and electric vehicle (EV) power electronics further fuels demand for BeO ceramics due to their proven reliability in thermal management under high current loads. However, stringent regulatory oversight concerning the toxicity associated with beryllium handling remains a persistent challenge that necessitates sophisticated manufacturing protocols and controlled environments, influencing market dynamics and production costs.

Beryllium oxide powders Market Executive Summary

The global Beryllium oxide powders market is characterized by moderate growth, primarily driven by critical performance requirements in high-reliability applications across the electronics and defense sectors. Current business trends indicate a strong focus on developing finer particle sizes and higher purity grades of BeO powder to improve the sintering density and thermal performance of resultant ceramic components, catering specifically to advanced semiconductor packaging and microelectronics. Key regional trends show the Asia Pacific (APAC) region, led by China, South Korea, and Japan, emerging as the dominant consumption center due to its extensive electronics manufacturing base and growing presence in 5G deployment and electric vehicle production. Segment trends highlight that the 99.8% purity segment commands a significant market share owing to the stringent requirements of high-frequency and high-power electronic devices, while the electronic substrates and heat sinks application segment remains the largest volume consumer, reflecting the overarching need for superior thermal dissipation across modern computing and communication infrastructure.

AI Impact Analysis on Beryllium oxide powders Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Beryllium oxide powders market typically revolve around the speed and efficiency gains in materials discovery, optimization of manufacturing processes, and the escalating demand generated by AI-driven infrastructure. Key themes include whether AI can accelerate the synthesis of higher-purity powders, how predictive maintenance systems powered by machine learning might reduce waste in ceramic fabrication, and critically, how the explosive growth in high-performance computing (HPC) and data centers—the backbone of AI—will translate into increased demand for Beryllium oxide-based thermal management solutions. Users are concerned about supply chain robustness if AI deployment causes sudden spikes in demand and expect AI to assist in mitigating the material’s toxicity risk through improved monitoring and control systems in production facilities.

- AI algorithms facilitate predictive modeling for optimizing sintering parameters, leading to higher component yield and reduced energy consumption in BeO ceramic manufacturing.

- Machine learning is utilized in quality control systems to analyze microscopic structures of BeO powder, ensuring consistent particle size distribution and purity levels essential for high-end applications.

- Increased global deployment of AI infrastructure, particularly large language models (LLMs) and advanced deep learning systems, necessitates massive, high-density data centers requiring superior thermal management materials like BeO ceramics.

- AI-driven materials informatics accelerates the discovery and testing of composite materials utilizing BeO, potentially leading to novel, lower-cost, or less regulated alternatives, thus influencing long-term market strategy.

- Automation and robotic handling systems, often managed by AI, enhance safety protocols in BeO powder processing, addressing historical concerns related to beryllium toxicity and dust inhalation.

- AI enhances demand forecasting accuracy for Beryllium oxide, enabling manufacturers to manage complex regulatory inventory and ensure timely supply for critical defense and aerospace orders.

DRO & Impact Forces Of Beryllium oxide powders Market

The Beryllium oxide powders market is significantly influenced by a complex interplay of high-performance demands (Drivers) and strict health and environmental constraints (Restraints), balanced by technological advancements (Opportunities). The main drivers are the relentless pursuit of higher power density in electronics, demanding materials with unparalleled thermal conductivity, particularly in 5G telecommunications, radar, and satellite systems. Conversely, the market faces severe restraints due to the inherent toxicity of beryllium, necessitating high capital expenditure for safe handling, disposal, and compliance with stringent environmental regulations, which limits the number of market entrants and increases operational complexity for existing players. Opportunities lie primarily in developing advanced composite materials that utilize Beryllium oxide properties while potentially mitigating toxicity risks, or exploring novel synthesis techniques that reduce overall production costs, thereby broadening application beyond highly specialized niches. These forces dictate the market's moderate, yet highly strategic, growth trajectory.

Drivers

The primary driver for the Beryllium oxide powders market is the escalating requirement for efficient thermal management across high-power electronics and communication systems. Modern semiconductor devices, especially those based on wide bandgap materials like Gallium Nitride (GaN) and Silicon Carbide (SiC), operate at higher power densities and temperatures, necessitating substrates and heat sinks that can rapidly dissipate heat while maintaining excellent electrical isolation. BeO’s combination of high thermal conductivity (up to 300 W/(mK)) and high dielectric strength makes it superior to traditional materials like alumina for these critical applications, ensuring device longevity and performance stability in harsh operating conditions.

A second major driver is the substantial investment in military, aerospace, and defense applications. Beryllium oxide components are crucial in specialized defense electronics such as high-frequency radar systems, electronic warfare (EW) modules, and advanced guidance systems, where performance under extreme operational stress (high G-forces, rapid temperature cycling, and radiation exposure) is non-negotiable. Government spending on modernization programs, particularly in North America and Asia, sustains a high demand for high-purity, defense-grade Beryllium oxide ceramics. The expansion of commercial space exploration and satellite broadband deployment further contributes to this growth, as BeO components are integral to reliable satellite transponders and power amplifiers.

- Escalating demand for high-performance thermal management in 5G and 6G infrastructure.

- Increased power density and operating temperatures in advanced semiconductor devices (GaN, SiC).

- Growing adoption in aerospace, defense, and high-reliability military radar systems.

- Requirements for nuclear reactor components utilizing BeO as a neutron moderator/reflector.

Restraints

The most significant restraint on the market is the toxicity associated with Beryllium oxide, particularly during the powder handling and processing stages. Inhaling beryllium dust can lead to Chronic Beryllium Disease (CBD), a severe and often fatal lung condition. Consequently, manufacturers must adhere to extremely strict Occupational Safety and Health Administration (OSHA) regulations and similar global standards, which translates into high infrastructural costs for closed-loop processing systems, advanced ventilation, and comprehensive employee monitoring. These compliance hurdles not only increase the cost of production but also deter new investment and restrict geographic market expansion.

Another restraint is the competition posed by alternative materials, primarily Aluminum Nitride (AlN) and specialized composites. While Beryllium oxide often offers superior thermal properties, AlN is less toxic, easier to handle, and generally more cost-effective for medium-to-high power applications. As manufacturers continuously improve the quality and thermal performance of AlN and other ceramic matrix composites (CMCs), they pose a viable threat, particularly in price-sensitive or non-defense-critical commercial markets. Furthermore, the limited global supply chain and high barrier to entry due to specialized manufacturing requirements keep the price of Beryllium oxide powder consistently high, restricting its use to niche, high-value applications where cost is secondary to performance.

- Toxicity concerns associated with beryllium dust leading to high regulatory compliance costs (OSHA, EPA).

- High cost of raw material refinement and specialized manufacturing processes.

- Competition from non-toxic alternatives such as Aluminum Nitride (AlN) and specialized composites.

- Limited global manufacturing base and dependence on specific primary ore sources.

Opportunities

Significant market opportunities exist in the development of Beryllium oxide composite materials that leverage BeO's thermal benefits while minimizing the concentration or handling risk of pure BeO powder. Research into BeO/polymer composites or BeO-reinforced metal matrix composites (MMCs) aims to create thermally efficient yet safer material solutions for consumer electronics and automotive power modules. If these composites can achieve a balance of performance and safety, the application scope could expand substantially beyond traditional military and high-end industrial uses into the rapidly growing electric vehicle (EV) battery management systems market, which requires robust, high-temperature, and efficient thermal dissipation.

Furthermore, technological advancements in powder synthesis, such as sol-gel methods or advanced precipitation techniques, present opportunities to produce nano-sized Beryllium oxide powders with enhanced surface area and improved sintering capabilities. These ultra-fine powders can lead to ceramics with lower porosity and superior mechanical strength, opening doors for use in micro-electromechanical systems (MEMS) and advanced medical imaging equipment where precision and compactness are paramount. Strategic partnerships between established BeO manufacturers and next-generation electronics fabricators are also key to integrating BeO solutions early in the design cycle for emerging technologies, securing long-term demand growth.

- Growing adoption in Electric Vehicle (EV) power modules and battery thermal management systems.

- Development of BeO-containing composite materials to mitigate handling risks and expand commercial applications.

- Technological advancements in nano-powder synthesis leading to superior ceramic density and performance.

- Expansion of commercial space technology and satellite communication requiring high-reliability BeO components.

Impact Forces Analysis

The impact forces within the Beryllium oxide powders market are exceptionally high due to regulatory stringency and the irreplaceable nature of the product's performance in specific critical applications. Regulatory impact is severe; any changes in permissible exposure limits (PELs) or disposal requirements directly translate to operational cost fluctuations and potential supply disruptions. This force acts as a barrier to entry, consolidating market power among a few well-established players capable of maintaining compliance. Simultaneously, the technological performance force is equally strong. In mission-critical defense and high-power radio frequency (RF) applications, substituting BeO often leads to unacceptable compromises in thermal management or reliability, meaning that end-users are relatively inelastic to moderate price increases, prioritizing material performance over cost.

This dynamic creates a market paradox: high regulatory restraint limits growth potential and maintains high operational costs, yet indispensable application performance requirements ensure sustained demand regardless of price. The threat of substitutes, while present (AlN), remains moderate because AlN has not yet achieved parity with BeO in the highest thermal conductivity ranges or radiation resistance profiles required by the most demanding sectors. Therefore, strategic investment is focused not on volume growth but on maintaining technological superiority and regulatory adherence, ensuring the market remains specialized, high-value, and concentrated among a limited group of suppliers globally.

- Regulatory Compliance (High Impact): Strict environmental and health regulations severely influence manufacturing costs and geographical market entry.

- Technological Performance Demand (High Impact): Unique thermal and dielectric properties create non-substitutable demand in critical defense and high-frequency electronics.

- Supply Chain Concentration (Moderate to High Impact): Few qualified producers and high barriers to entry stabilize pricing but pose risks in supply continuity.

- Substitution Threat (Moderate Impact): Alternatives like AlN are improving but have not fully replaced BeO in ultra-high-performance niches.

Segmentation Analysis

The Beryllium oxide powders market is comprehensively segmented primarily based on Purity Level, Application, and Form. Purity level is the most critical determinant of end-use, with Ultra-High Purity (99.8% and above) materials dominating the high-value segments, as minor impurities can significantly compromise thermal conductivity and dielectric properties in sensitive electronics and nuclear components. Segmentation by Application highlights the crucial role of BeO in the electronics and telecommunication sectors, driven by thermal management needs for high-power devices, followed by aerospace/defense and medical imaging equipment. Furthermore, segmentation by Form distinguishes between the raw powder feedstock and the intermediate ceramic forms (like pressed blanks or sintered ceramics), reflecting different stages of the value chain.

Understanding these segments is vital for strategic market positioning. Manufacturers often specialize in specific purity grades (e.g., dedicated nuclear or electronic grade), leveraging proprietary processing techniques to achieve precise particle size distribution and chemical uniformity. The fastest-growing segment is anticipated to be the electronics and communication application sector, buoyed by the global rollout of 5G/6G networks and increasing demand for robust electric vehicle components that require superior heat transfer capabilities under harsh operating conditions. Regional analysis further reveals that segment demand profiles vary significantly; for instance, North America and Europe show proportionally higher demand in defense applications, while APAC leads in commercial electronics consumption.

- By Purity Level:

- 99.5% Purity (Industrial Grade)

- 99.8% Purity (Electronic Grade)

- 99.9% and Above (Ultra-High Purity/Nuclear Grade)

- By Application:

- Electronic Substrates and Heat Sinks

- Aerospace and Defense (Radar, Guidance Systems)

- Medical Devices (Imaging Equipment, Lasers)

- Nuclear Technology (Neutron Moderation/Reflectors)

- High-Temperature Crucibles and Furnaces

- Automotive Power Electronics (EV/HEV)

- By Form:

- Beryllium Oxide Powder (Raw Material)

- Beryllium Oxide Ceramic Shapes (Sintered Products)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Beryllium oxide powders Market

The value chain for Beryllium oxide powders is short but highly intensive, starting with the complex and geographically concentrated mining and extraction of beryllium ores (such as bertrandite and beryl). The upstream segment involves chemical processing of these ores into high-purity beryllium hydroxide or sulfate, which then serves as the precursor for Beryllium oxide powder production. This refinement stage is technically challenging and capital-intensive due to the need for closed-loop systems to manage beryllium toxicity and achieve the requisite high purity levels (often >99.8%). A limited number of specialized primary producers dominate this crucial upstream segment, controlling the global supply dynamics and pricing structure of the powder feedstock.

The midstream process involves the powder manufacturers who refine the precursor materials through calcination and specialized grinding/milling techniques to achieve the desired particle size distribution and morphological characteristics necessary for subsequent ceramic fabrication. Distribution channels are typically direct or utilize highly specialized, certified distributors due to the restricted nature of the material. Direct distribution is prevalent for large defense and electronic component manufacturers, ensuring stringent quality control and secure logistics. Indirect channels involve authorized material handlers who service smaller industrial users or research institutions, maintaining compliance with all international shipping and handling regulations. The complexity of handling and regulatory hurdles significantly restricts open market trade, favoring established, robust supply agreements.

The downstream segment involves ceramic fabricators and end-use manufacturers. Ceramic fabricators utilize the BeO powder for sintering custom shapes, such as complex electronic substrates, vacuum tube insulators, or thermal heat sinks, using highly specialized processes like hot pressing or tape casting. These sintered components are then integrated by the final end-users in electronics (e.g., power amplifiers, RF switches), aerospace (e.g., radar modules), and nuclear facilities. Given the material’s strategic nature, vertical integration among the primary material suppliers and ceramic fabricators is common, aiming to control quality and secure supply from the raw material stage through to the finished, high-performance ceramic component.

Beryllium oxide powders Market Potential Customers

Potential customers for Beryllium oxide powders are concentrated within sectors where high thermal performance and electrical isolation are non-negotiable requirements, and where the associated high costs and regulatory complexities of BeO are justified by performance gains. The primary buyers are large multinational manufacturers of high-power semiconductor devices and integrated circuits, particularly those focused on RF power amplifiers, microwave components, and advanced radar systems used in both commercial communications (5G/6G) and defense applications. These customers purchase high-purity BeO powder or pre-sintered substrates for integration into their device packaging solutions, ensuring efficient heat rejection for optimal operation.

A second major customer group includes aerospace and defense prime contractors and their certified subcontractors who require BeO ceramics for military radar, electronic warfare systems, missile guidance components, and space-based communication payloads. These buyers demand materials that meet MIL-SPEC standards and have documented resistance to radiation and extreme mechanical stress. Additionally, the nuclear power and research sectors purchase ultra-high purity Beryllium oxide for use as moderator or reflector materials in experimental and operational reactors. Smaller, specialized buyers include medical device manufacturers focusing on high-precision imaging equipment (e.g., MRI, Linear Accelerators) and specialized industrial furnace makers requiring high-temperature, chemically inert crucibles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 315.5 Million |

| Market Forecast in 2033 | USD 450.9 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Materion Corporation, American Elements, Rembar Company Inc., Stanford Advanced Materials, Belmont Metals Inc., CeramTec GmbH, NGK Insulators, CoorsTek Inc., Brush Wellman (A Materion Subsidiary), Global Advanced Materials Inc., H.C. Starck GmbH, Ube Industries, Shin-Etsu Chemical Co., Ltd., Sumitomo Metal Mining Co., Ltd., JFE Holdings Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Beryllium oxide powders Market Key Technology Landscape

The technology landscape for the Beryllium oxide powders market is defined by sophisticated chemical processing and advanced ceramic fabrication techniques, aimed at achieving ultra-high purity and precisely controlled powder characteristics. A core technology is the chemical precipitation and calcination process used to convert beryllium salts into BeO powder. Critical advances focus on techniques like hydrothermal synthesis and sol-gel processing, which allow for the precise control of particle size, morphology, and surface area. Achieving nanosized powders (typically less than 100 nm) is paramount, as smaller, more uniform particles lead to lower sintering temperatures and final ceramic components with superior mechanical strength and improved thermal properties, crucial for microelectronic applications.

In the subsequent ceramic manufacturing phase, technologies such as pressure-assisted sintering (e.g., Hot Isostatic Pressing - HIP) and specialized tape casting methods are essential. Pressure-assisted techniques enable the production of highly dense, non-porous ceramic bodies, which are critical for achieving maximum thermal conductivity and minimizing dielectric losses at high frequencies. Furthermore, the development of sophisticated thin-film metallization techniques compatible with BeO substrates is a key technological area, allowing manufacturers to integrate complex electronic circuits directly onto the high-performance ceramic substrate. Innovation is also focused on enhanced closed-loop automation and containment technologies to safely handle the toxic powder, ensuring zero-emission production environments and compliance with evolving health standards.

Current research efforts are exploring solid-state reaction methods and microwave sintering as means to reduce the energy footprint and processing time for BeO ceramic production, potentially lowering overall manufacturing costs without compromising performance. Additionally, computational materials science and simulation tools are increasingly utilized to model the behavior of BeO powder during compaction and sintering, optimizing the final product microstructure before expensive physical trials are conducted. The confluence of ultra-clean synthesis, advanced consolidation techniques, and stringent safety automation dictates the technological edge in this highly specialized material market, securing the material's role in demanding next-generation electronics and defense systems.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for Beryllium oxide powders, primarily driven by its dominance in global electronics manufacturing, robust investment in 5G and telecommunication infrastructure, and a burgeoning automotive electronics sector (EV/HEV). Countries like China, South Korea, and Japan house extensive semiconductor packaging facilities and are key consumers of BeO substrates for RF power devices. The region's increasing defense modernization efforts, particularly in major economies, further contribute to steady, high-purity BeO demand.

- North America: North America holds a substantial market share, characterized by high-value, low-volume consumption, heavily influenced by the aerospace, defense, and military sectors. The region’s demand is concentrated among prime defense contractors and specialized nuclear facilities, where performance standards are exceptionally stringent. Regulatory environments are mature and strictly enforced (OSHA, EPA), driving continuous investment in sophisticated handling and processing technologies among local manufacturers like Materion Corporation.

- Europe: The European market demonstrates steady demand, supported by its advanced industrial base, particularly in specialized medical equipment, automotive electronics (especially Germany), and niche telecommunications applications. Demand is highly focused on high-purity electronic-grade BeO. Strict EU environmental and safety regulations enforce high production costs, encouraging procurement from certified, high-standard manufacturers, both local and international.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions represent emerging markets for BeO powders. Demand in MEA is primarily driven by defense-related procurement and limited oil & gas processing equipment requiring specialized heat resistance. LATAM demand is nascent, focused mainly on imports for commercial electronics repair and maintenance, with minimal local production capability or high-power electronics manufacturing presence.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Beryllium oxide powders Market.- Materion Corporation

- American Elements

- Rembar Company Inc.

- Stanford Advanced Materials

- Belmont Metals Inc.

- CeramTec GmbH

- NGK Insulators, Co., Ltd.

- CoorsTek Inc.

- Global Advanced Materials Inc.

- H.C. Starck GmbH

- Ube Industries

- Shin-Etsu Chemical Co., Ltd.

- Sumitomo Metal Mining Co., Ltd.

- JFE Holdings Inc.

- Heraeus Group

- Morgan Advanced Materials

- Trex Enterprises Corporation

- C-Mac International, LLC

- E.W. Bowman Inc.

- Honeywell International Inc. (Niche applications)

Frequently Asked Questions

Analyze common user questions about the Beryllium oxide powders market and generate a concise list of summarized FAQs reflecting key topics and concerns.What makes Beryllium oxide unique for high-power electronics?

Beryllium oxide (BeO) is uniquely valuable because it combines extremely high thermal conductivity (approaching that of metals) with excellent electrical insulation properties (high dielectric strength). This combination is essential for efficiently dissipating heat from high-power semiconductor devices, such as those used in 5G base stations and radar systems, without causing electrical short circuits or failures.

What are the main regulatory challenges facing the BeO market?

The primary regulatory challenge stems from the toxicity of beryllium powder, which necessitates strict adherence to occupational safety standards (like OSHA’s permissible exposure limits). Manufacturers must invest heavily in closed-loop handling systems, air filtration, and employee monitoring, leading to increased operational complexity and high barriers to market entry globally.

How does Aluminum Nitride (AlN) compare to Beryllium oxide?

Aluminum Nitride (AlN) is the main substitute, offering lower toxicity and lower cost than BeO. While AlN’s thermal conductivity is high, Beryllium oxide generally outperforms it, particularly in the ultra-high frequency and ultra-high power density niches where marginal performance gains are critical. AlN is often preferred in consumer and non-military industrial applications due to its safety profile.

Which application segment drives the highest demand for Beryllium oxide powders?

The Electronic Substrates and Heat Sinks segment drives the highest commercial demand. This includes high-reliability components for defense radar, commercial RF power amplifiers, and specialized modules in telecommunications infrastructure, all requiring BeO's superior thermal management capabilities to ensure operational stability.

Is the Beryllium oxide powder market expected to shift geographically?

Yes, while North America and Europe remain key for high-end defense consumption, the market is structurally shifting towards the Asia Pacific (APAC) region. This shift is driven by APAC's rapid growth in semiconductor manufacturing, 5G deployment, and mass production of electric vehicle power electronics, all demanding reliable thermal ceramics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager