Beta Carotene Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432678 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Beta Carotene Powder Market Size

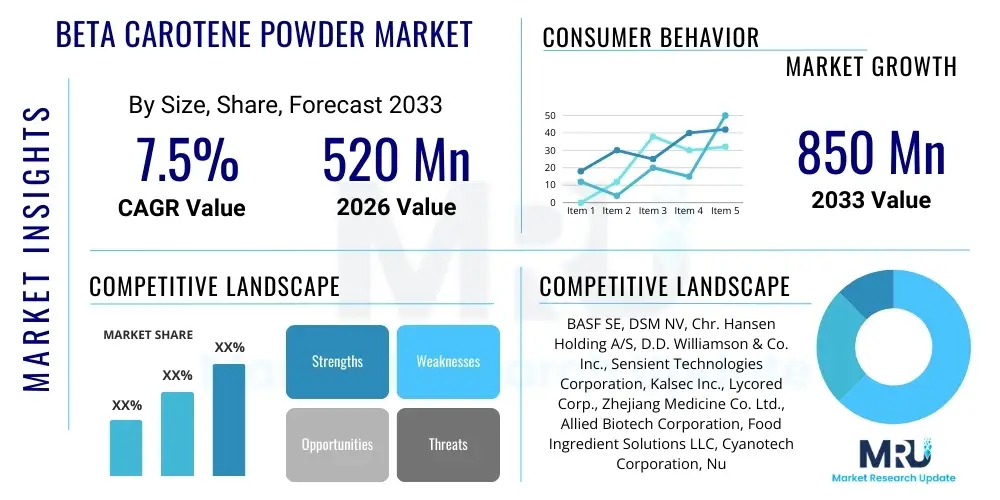

The Beta Carotene Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 520 Million in 2026 and is projected to reach USD 850 Million by the end of the forecast period in 2033.

Beta Carotene Powder Market introduction

Beta Carotene Powder is a naturally occurring pigment found primarily in plants and fruits, serving as a critical precursor to Vitamin A (retinol) within the human body. As a strong antioxidant and colorant, its powder form is highly valued for its stability, ease of incorporation, and versatility across various industrial applications, particularly in the food and beverage, dietary supplement, and cosmetics sectors. The market scope encompasses products derived from both natural sources (like carrots, palm oil, or fermentation) and synthetic processes, differentiated by concentration levels and specific application suitability.

Major applications driving the demand include its use as a natural food coloring agent to impart hues ranging from yellow to deep orange, replacing synthetic azo dyes in processed foods, confectionery, and baked goods, driven by burgeoning consumer preference for clean-label ingredients. Furthermore, its crucial role in nutritional enhancement, supporting eye health, immune function, and acting as a photoprotective agent, solidifies its position within the burgeoning nutraceutical and functional food segments globally. This dual functionality—as both a vibrant colorant and a vital nutrient—positions Beta Carotene Powder as an indispensable ingredient in modern product formulation, contributing significantly to market expansion.

The primary benefits driving market expansion include its proven health benefits as a pro-vitamin A source and its efficacy as a safe, natural alternative to artificial coloring. Driving factors involve stringent regulatory frameworks in developed economies favoring natural additives, coupled with heightened consumer awareness regarding synthetic food additives' potential adverse effects. The increasing incidence of Vitamin A deficiency in developing regions also mandates its widespread use in fortified foods, further accelerating its adoption in the global health and wellness landscape.

Beta Carotene Powder Market Executive Summary

The global Beta Carotene Powder market is characterized by robust business trends focusing on innovation in delivery systems, particularly microencapsulation technologies, to enhance stability and bioavailability, thereby expanding its application scope in demanding matrices like beverages and baked goods. Business strategies are heavily oriented towards securing sustainable and scalable natural sources, moving away from purely synthetic production, often through advanced fermentation of microorganisms like Blakeslea trispora. Furthermore, strategic mergers, acquisitions, and partnerships aimed at strengthening supply chain resilience and expanding geographical presence, especially in rapidly industrializing economies, define the competitive landscape.

Regional trends indicate that North America and Europe maintain dominance, driven by mature regulatory environments and high consumer purchasing power focused on functional and naturally colored products. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market, propelled by rapid urbanization, changing dietary habits, and increasing per capita expenditure on health supplements and packaged foods in countries like China and India. This shift is stimulating localized production capacity investments and focusing on regulatory compliance harmonization to facilitate international trade of Beta Carotene Powder products across diverse end-use markets.

Segment trends highlight the significant growth of naturally sourced Beta Carotene, overshadowing synthetic variants due to clean-label demands. The dietary supplements application segment exhibits the highest growth rate, fueled by an aging population and proactive health management practices. Within the food sector, the use of powdered formulations for coloring beverages and dairy alternatives is experiencing substantial uptick, demanding high-purity, standardized grades. The powder form remains the preferred format due to its superior shelf-life, ease of handling, and precise dosing capabilities compared to liquid or oil suspensions, reinforcing its market lead.

AI Impact Analysis on Beta Carotene Powder Market

User inquiries regarding AI's influence predominantly center on three main themes: how Artificial Intelligence can optimize the expensive and complex production processes, particularly in fermentation (yield optimization and bioprocess control); how AI-driven predictive analytics can manage the volatile global supply chain and raw material costs (e.g., carrot sourcing, algae cultivation); and the potential for AI algorithms to personalize nutritional product formulations incorporating Beta Carotene, thereby accelerating product development and consumer targeting. Users are keen to understand if AI can democratize access to high-quality, stable carotenoids while ensuring rapid detection of contaminants or adulteration in the supply chain.

The application of AI is poised to revolutionize the cultivation and extraction phases of Beta Carotene. Machine learning models can analyze vast datasets from bioreactors, including temperature, pH, light exposure, and nutrient concentration, to predict optimal growth conditions for carotene-producing microorganisms or algae, significantly boosting fermentation yields and reducing batch inconsistencies. This precision fermentation approach minimizes waste, reduces energy consumption, and provides the necessary scalability required to meet the surging global demand for natural colorants and supplements, directly impacting overall operational efficiency and cost of goods sold (COGS).

Furthermore, AI-driven bioinformatics and cheminformatics are accelerating R&D efforts related to improving the stability and bioavailability of the powdered product. Algorithms are being used to simulate molecular interactions and design highly effective microencapsulation matrices, which protect Beta Carotene from degradation factors like light, heat, and oxygen during processing and storage. On the market front, AI assists in analyzing consumer preference data and regulatory changes in real-time, allowing manufacturers to quickly adapt product formulations, packaging, and marketing strategies for specific regional demographics, ensuring that product efficacy and consumer appeal are maximized.

- AI optimizes bioprocess control, boosting fermentation yields (e.g., Blakeslea trispora) by up to 15%.

- Predictive analytics enhance raw material sourcing and inventory management, mitigating price volatility.

- Machine Learning accelerates R&D for novel, stable microencapsulation techniques, improving shelf stability.

- Computer vision systems ensure quality control and rapid detection of contamination in production lines.

- AI analyzes personalized nutrition data to recommend customized Beta Carotene supplement dosages.

- Generative AI assists in formulating clean-label products compliant with regional food safety regulations.

DRO & Impact Forces Of Beta Carotene Powder Market

The dynamics of the Beta Carotene Powder market are profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively shaping the competitive landscape and strategic direction. The primary driving force is the global shift toward natural ingredients, spurred by increasing consumer distrust of artificial coloring agents and the growing recognition of Beta Carotene's functional health benefits, particularly its role in vision health and antioxidant capacity. This demand places intense pressure on manufacturers to scale up sustainable, naturally derived production, often through costly technological upgrades like advanced microbial fermentation.

Significant restraints include the high production cost associated with natural extraction and fermentation methods compared to synthetic alternatives, leading to price sensitivity, particularly in cost-competitive food coloring applications. Furthermore, the inherent instability of Beta Carotene, which is highly susceptible to degradation from light, heat, and oxygen, necessitates expensive stabilization technologies (e.g., spray drying and microencapsulation), increasing final product cost and complexity. Regulatory hurdles, particularly regarding novel food ingredient approvals and inconsistent global standards for natural claims, also impede streamlined market entry and expansion.

Opportunities for growth are concentrated in untapped functional food and beverage segments, such as fortified plant-based dairy alternatives and specialized sports nutrition products, leveraging Beta Carotene’s dual role as a nutrient and colorant. Technological advancements in genetic engineering and synthetic biology offer avenues to develop novel strains of microorganisms with superior carotene production capabilities and enhanced stability profiles, potentially reducing production costs and increasing yield consistency. Additionally, expansion into emerging markets in APAC and Latin America, where demand for basic nutritional fortification is escalating, presents lucrative long-term growth prospects, contingent upon effective distribution network development.

Segmentation Analysis

The Beta Carotene Powder market is systematically segmented based on source, application, and form, providing detailed insights into consumption patterns and growth pockets. Segmentation by source delineates between synthetic and natural variants, with the natural segment (derived from algae like Dunaliella salina, fermentation, or plant extracts) commanding increasing market share due to the prevailing clean-label movement. The application segmentation highlights key end-use industries, including Food & Beverages, Dietary Supplements, Cosmetics, and Animal Feed, each exhibiting unique requirements for concentration, purity, and stability.

The Dietary Supplements segment represents the fastest-growing application area, driven by global demographics emphasizing preventative healthcare and the proven efficacy of Beta Carotene as a Vitamin A precursor. Within the Food & Beverage industry, the powder form is predominantly used in dry mixes, bakery goods, and confectionery, where water dispersibility and color stability are crucial formulation criteria. Regional consumer preferences significantly influence the uptake of specific segments; for instance, European markets prioritize the natural source segment highly, whereas nutritional fortification remains a primary driver in many developing economies.

Furthermore, segmentation by form distinguishes Beta Carotene in its crystalline powder form versus various microencapsulated powders, emphasizing technical differentiation. Microencapsulated products offer superior stability and enhanced dissolution characteristics, making them suitable for complex formulations like clear beverages and moisture-sensitive functional ingredients, thereby fetching premium pricing. Understanding these segmented demands allows manufacturers to tailor their product offerings, optimizing production scale and focusing R&D efforts on areas promising maximum return on investment (ROI).

- Source:

- Natural (Algae, Fungi/Fermentation, Plant Extracts)

- Synthetic

- Application:

- Food & Beverages (Confectionery, Bakery, Dairy, Beverages, Processed Foods)

- Dietary Supplements & Nutraceuticals

- Cosmetics & Personal Care

- Animal Feed

- Form:

- Powder (Crystalline)

- Beadlets/Microencapsulated Powder

- End-Use Industry:

- Pharmaceutical

- Food Processing

- Cosmetics Manufacturing

- Nutraceutical Formulation

Value Chain Analysis For Beta Carotene Powder Market

The value chain for Beta Carotene Powder is extensive and complex, beginning with upstream activities focused on securing raw materials, encompassing the cultivation or harvesting of natural sources (e.g., carrots, palm oil, or specialized algae like Dunaliella salina) or the procurement of petrochemical feedstocks for synthetic production. For natural variants, this stage includes optimizing cultivation conditions (light, temperature, nutrients) to maximize carotene content, requiring specialized biotechnology expertise and often significant initial capital investment in controlled environments or large-scale fermentation facilities. Efficiency in the upstream phase directly impacts the sustainability and overall cost structure of the final powdered product.

Midstream processing involves critical steps such as extraction, purification, concentration, and conversion into the final powder format. Extraction methods, whether solvent-based or supercritical fluid extraction, must be highly efficient and meet strict purity standards, especially for food and pharmaceutical grades. Downstream activities are dominated by specialized formulation processes, particularly microencapsulation and spray drying, which are essential for stabilizing the sensitive carotene molecules. These technical steps are crucial for ensuring the product’s shelf stability, controlled release, and bioavailability when incorporated into diverse end products.

Distribution channels are multifaceted, employing both direct and indirect routes. Direct sales are common for high-volume transactions with major pharmaceutical and large multinational food manufacturers, allowing for customized technical support and supply chain integration. Indirect channels involve utilizing specialized ingredient distributors and agents who possess localized knowledge and provide smaller batches to regional formulators, cosmetic producers, and private label supplement companies. The choice of channel is determined by geographical reach, regulatory requirements of the target market, and the need for just-in-time inventory management, with the distribution network adding considerable value through logistics, handling, and quality assurance.

Beta Carotene Powder Market Potential Customers

The primary end-users and buyers of Beta Carotene Powder are the formulators and manufacturers within the Food & Beverage industry, utilizing the powder predominantly as a clean-label natural colorant and, secondarily, for nutritional fortification. This customer segment includes multinational confectionery companies requiring vibrant, stable orange and yellow hues; major beverage producers using encapsulated powder for clear drink applications; and bakery manufacturers integrating it into cereal bars and specialized breads. Their purchasing decisions are heavily influenced by regulatory compliance (e.g., EU color regulations), color stability under various processing conditions, and the cost-in-use relative to synthetic alternatives.

Another major customer segment consists of Dietary Supplement and Nutraceutical manufacturers. These buyers value Beta Carotene Powder for its high concentration of pro-Vitamin A activity and antioxidant properties. They incorporate it into multivitamin formulations, vision health supplements, immune boosters, and prenatal vitamins. For this segment, the critical purchasing criteria are purity (pharmaceutical grade preferred), bioavailability data, and the availability of clinical research supporting health claims. They often require highly stable beadlet formulations to ensure potency is maintained throughout the product’s shelf life.

The third substantial group includes Cosmetics and Personal Care manufacturers, using Beta Carotene for its coloring properties in sun protection products, lotions, and makeup, as well as its functional benefits as a skin-conditioning agent and antioxidant. Lastly, the Animal Feed industry represents a specialized buyer segment, using the powder to enhance the pigmentation of poultry (egg yolks and broiler skin) and aquatic species, thereby improving the perceived quality and marketability of animal products. The demand from these diverse end-users necessitates a broad portfolio of Beta Carotene grades with varying concentration, particle size, and stabilization techniques.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 520 Million |

| Market Forecast in 2033 | USD 850 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, DSM NV, Chr. Hansen Holding A/S, D.D. Williamson & Co. Inc., Sensient Technologies Corporation, Kalsec Inc., Lycored Corp., Zhejiang Medicine Co. Ltd., Allied Biotech Corporation, Food Ingredient Solutions LLC, Cyanotech Corporation, Nutriblend Foods Inc., Bio Extract, Novus International Inc., V.P. Labs, Nature's Bounty Co., Carotech Sdn Bhd, Indena S.p.A., ExcelVite Sdn Bhd, Fenchem |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Beta Carotene Powder Market Key Technology Landscape

The core technological landscape of the Beta Carotene Powder market is dominated by advancements aimed at maximizing purity, increasing yield from natural sources, and critically, enhancing molecular stability. Microbial fermentation technology, specifically utilizing strains like Blakeslea trispora or controlled cultivation of algae like Dunaliella salina, represents a major technical focus. Advances in strain selection, optimization of bioreactor conditions (e.g., photobioreactors), and continuous fermentation processes are key areas of innovation, allowing for scalable, consistent, and higher-yield production of natural Beta Carotene compared to traditional plant extraction, thus addressing sustainability and cost constraints.

A crucial technological area is the stabilization and formulation of the final powdered product. Beta Carotene’s high sensitivity to environmental factors necessitates sophisticated stabilization techniques, with microencapsulation being the industry standard. Technologies such as spray drying, fluidized bed coating, and complex coacervation are employed to create beadlets or microcapsules, where the carotene is physically protected within a matrix of starches, proteins, or carbohydrates. This protective barrier significantly improves shelf life, protects the active ingredient during high-heat processing (like baking), and facilitates better water dispersibility, making it suitable for a wider range of food and beverage applications.

Furthermore, extraction efficiency remains a vital area, especially for plant-based sources. Supercritical Fluid Extraction (SFE) using CO2 is gaining traction over traditional organic solvent extraction. SFE offers a cleaner, solvent-free method, producing high-purity Beta Carotene extracts that meet stringent regulatory requirements for food safety and clean labeling. Alongside this, advances in analytical techniques, including High-Performance Liquid Chromatography (HPLC) and Mass Spectrometry, are crucial for quality assurance, ensuring product standardization, verifying isomer composition (all-trans vs. cis isomers), and detecting potential adulterants or impurities.

Regional Highlights

Regional dynamics are critical to understanding the consumption and production patterns of Beta Carotene Powder, reflecting varying regulatory environments, consumer preferences, and manufacturing capacities across the globe. North America, comprising the United States and Canada, holds a substantial market share, driven primarily by its mature dietary supplement industry and a well-established consumer base highly invested in preventative healthcare and functional foods. Strict FDA regulations encourage transparency and high-quality standards, favoring stable, often microencapsulated, natural Beta Carotene products. The region is a key hub for innovation in formulation and product development, especially in the sports nutrition and clean-label food sectors.

Europe represents another dominant region, characterized by strong regulatory emphasis on natural food colorants (e.g., the phasing out of certain synthetic azo dyes) and stringent Novel Food approvals. Germany, the UK, and France are major contributors, driving demand for fermentation-derived Beta Carotene to meet the high clean-label and non-GMO expectations of consumers. The market here is highly competitive, focusing on traceability and certified organic sourcing, making it a premium market for specialized, high-purity powders used in pharmaceuticals and sophisticated nutraceuticals.

The Asia Pacific (APAC) region is projected to register the highest growth rate during the forecast period. This rapid expansion is fueled by increasing disposable incomes, rapid urbanization, and a dramatic rise in the processed food and packaged goods sectors in populous nations like China, India, and Southeast Asian countries. Government initiatives to combat Vitamin A deficiency through food fortification programs, combined with the increasing awareness of cosmetic and dietary supplements, are powerful market accelerators. APAC is also emerging as a major production base, leveraging lower operational costs and expanding fermentation capabilities, although quality control and intellectual property protection remain strategic challenges.

- North America: Dominant market for dietary supplements; characterized by high consumer awareness regarding natural ingredients and high demand for specialized, stable formulations.

- Europe: Driven by strict clean-label regulations and consumer preference for natural food coloring agents; focus on traceable, organic, and fermentation-derived sources.

- Asia Pacific (APAC): Fastest-growing region, spurred by population growth, urbanization, food fortification programs, and expanding domestic manufacturing capabilities in China and India.

- Latin America (LATAM): Emerging market demonstrating significant potential, particularly in Brazil and Mexico, due to increasing Western dietary influence and rising health consciousness.

- Middle East and Africa (MEA): Primarily a consumption market reliant on imports; growth driven by food processing industrialization and nutritional deficiency mitigation efforts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Beta Carotene Powder Market.- BASF SE

- DSM NV

- Chr. Hansen Holding A/S

- D.D. Williamson & Co. Inc.

- Sensient Technologies Corporation

- Kalsec Inc.

- Lycored Corp.

- Zhejiang Medicine Co. Ltd.

- Allied Biotech Corporation

- Food Ingredient Solutions LLC

- Cyanotech Corporation

- Nutriblend Foods Inc.

- Bio Extract

- Novus International Inc.

- V.P. Labs

- Nature's Bounty Co.

- Carotech Sdn Bhd

- Indena S.p.A.

- ExcelVite Sdn Bhd

- Fenchem

Frequently Asked Questions

Analyze common user questions about the Beta Carotene Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between synthetic and natural Beta Carotene Powder?

Synthetic Beta Carotene is chemically manufactured, often yielding a high proportion of the all-trans isomer, providing cost efficiency and consistency. Natural Beta Carotene is derived from sources like algae (Dunaliella salina) or fermentation, is preferred for clean-label products, and often contains a complex mixture of cis and trans isomers, which may offer enhanced bioavailability and antioxidant capacity.

How do manufacturers ensure the stability of Beta Carotene Powder?

Stability is primarily ensured through advanced microencapsulation technologies, such as spray drying or beadlet formation. This process surrounds the sensitive carotene molecules with a protective matrix (usually starch or gelatin), shielding them from light, oxygen, moisture, and high temperatures encountered during food processing and storage, thereby extending the product's shelf life.

Which application segment drives the highest demand for Beta Carotene Powder?

The Dietary Supplements and Nutraceuticals segment currently drives the highest growth and premium demand for high-purity Beta Carotene Powder, utilizing its status as a critical precursor to Vitamin A and a powerful antioxidant for eye health and immune support formulations. The Food & Beverages sector follows closely, leveraging its natural coloring properties.

What key regulations affect the global trade of Beta Carotene Powder?

Global trade is heavily influenced by regional bodies like the FDA in North America and the EFSA in Europe, which set standards for acceptable daily intake (ADI), purity specifications, and permissible applications in food coloring. Specifically, the definition and classification of natural versus synthetic sources, along with Novel Food approvals for new microbial sources, are critical regulatory hurdles.

What are the primary challenges restricting the market growth of natural Beta Carotene?

The main challenges are the high production costs and complexity associated with scaling up sustainable natural extraction or fermentation processes, which results in a higher price point compared to synthetic alternatives. Furthermore, managing the inherent instability of the compound and ensuring consistent supply chain quality pose technical difficulties that require substantial investment in stabilizing technologies.

The market analysis concludes that strategic investment in advanced bioprocessing and encapsulation techniques will be paramount for competitive differentiation, allowing key players to capitalize on the sustained consumer shift towards natural, functional ingredients globally. The convergence of health consciousness, clean labeling, and technological advancements in stability enhancement solidifies the long-term positive outlook for the Beta Carotene Powder market across all major regions and application segments.

Future growth trajectories are heavily reliant on addressing the scalability constraints of natural sourcing, particularly utilizing precision fermentation technologies to achieve cost parity with synthetic products while maintaining the clean-label appeal. Furthermore, the integration of supply chain transparency tools, often enabled by blockchain and AI, will become standard practice to meet increasing consumer demand for verifiable ingredient origins and sustainability credentials. The adoption rate of microencapsulated beadlets in the developing APAC functional food market will serve as a critical indicator for overall market performance over the forecast period.

The industry must continue to navigate complex regulatory landscapes that increasingly favor natural food colors but simultaneously demand robust scientific substantiation for all health claims related to pro-Vitamin A and antioxidant activity. Companies that strategically invest in clinical trials and robust quality control systems will gain a significant competitive edge, especially when targeting high-value pharmaceutical and sophisticated nutraceutical customers who require the highest standards of purity and efficacy assurance. This proactive approach to both technical excellence and regulatory compliance is essential for sustained market leadership in the dynamic Beta Carotene sector.

The demand for Beta Carotene is intrinsically linked to global demographic trends, specifically the aging population necessitating eye health supplements, and the growing middle class in emerging economies seeking nutritional fortification in staple foods. Manufacturers must diversify their source materials—moving beyond reliance solely on traditional plant extracts—to leverage scalable technologies like algae cultivation and microbial synthesis. This diversification not only ensures supply resilience but also addresses the unique formulation needs of various customers, ranging from high-dose therapeutic applications to low-concentration coloring requirements in processed snacks, ensuring market accessibility across all tiers of the food and nutrition value chain.

Technological refinement in particle engineering is anticipated to drive innovation in the coming years. Developing nanocarriers or liposomal delivery systems, rather than conventional microcapsules, could further enhance the bioavailability and targeted delivery of Beta Carotene, opening up new therapeutic applications in pharmaceuticals and specialized medical foods. These high-tech formulations, while currently expensive, represent the future direction of the market, focusing on maximizing the physiological effect of the nutrient at lower inclusion rates, thereby potentially offsetting some of the high costs associated with premium natural sourcing.

In conclusion, while the market faces challenges related to sourcing cost and product instability, the overriding drivers—consumer demand for natural ingredients, regulatory impetus away from synthetic colors, and the undeniable nutritional importance of Vitamin A precursors—ensure a steady and robust growth trajectory. Success in this market demands a dual focus on upstream efficiency through biotechnology and downstream product protection through advanced material science, coupled with agile adaptation to regional dietary and regulatory shifts, particularly the burgeoning opportunities presented by the APAC consumer base.

The strategic imperative for market participants is centered on vertical integration and securing intellectual property rights related to high-yield microbial strains and patented stabilization techniques. Companies controlling both the source material production (e.g., owned algal farms or fermentation facilities) and the final powder formulation process can achieve superior cost control and quality assurance, offering a significant advantage over competitors reliant on fragmented third-party suppliers. This control over the entire value chain is crucial for maintaining competitive pricing while adhering to the stringent clean-label requirements demanded by modern consumers and major food manufacturers alike.

Furthermore, the market's reliance on Beta Carotene as a versatile compound means that economic fluctuations in adjacent industries—such as the price of palm oil (a potential source) or the overall health and wellness spending climate—can influence market stability. Effective risk management, including long-term supply contracts and hedging strategies against commodity price volatility, is becoming increasingly relevant for large-scale producers. The continuous evolution of food processing technologies also requires suppliers to perpetually upgrade their product specifications, ensuring their powdered forms remain compatible with new high-shear mixing, extrusion, and sterilization techniques used by their end-user customers.

Finally, the growing environmental and ethical sourcing concerns necessitate investments in sustainable practices. Buyers are increasingly auditing suppliers not just for quality but also for environmental impact, particularly concerning water usage, waste disposal from fermentation processes, and energy consumption in controlled cultivation. Achieving third-party sustainability certifications and demonstrating commitment to reducing carbon footprints will soon transition from being a competitive advantage to a fundamental prerequisite for securing major contracts in the Beta Carotene Powder market, particularly within European and North American supply chains.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager