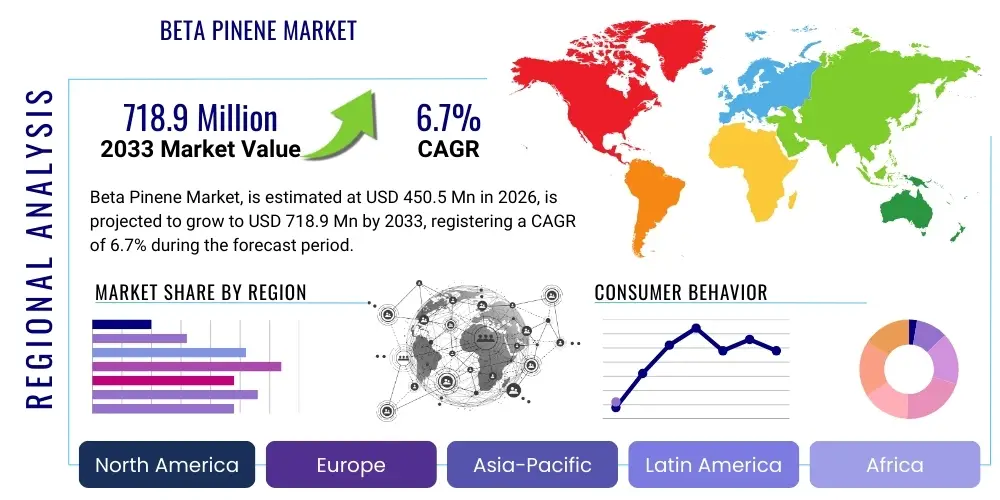

Beta Pinene Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438800 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Beta Pinene Market Size

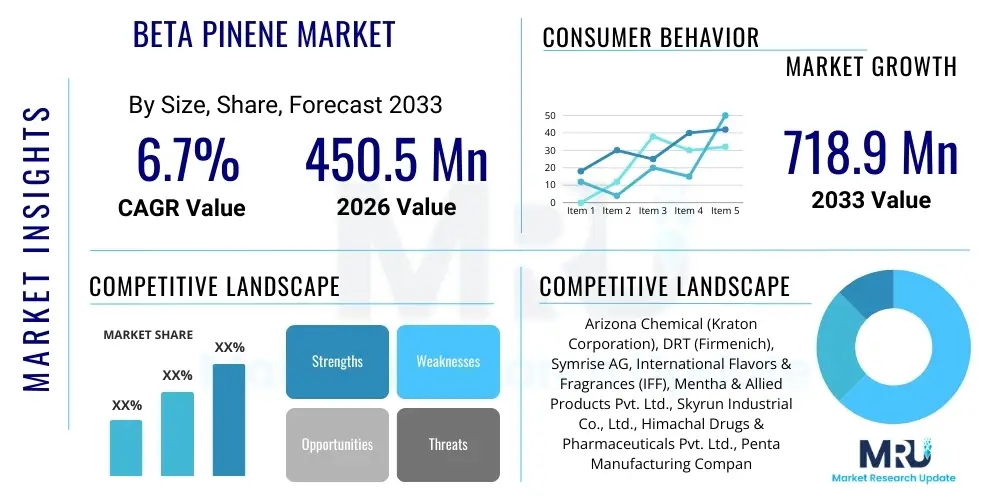

The Beta Pinene Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 718.9 Million by the end of the forecast period in 2033.

Beta Pinene Market introduction

Beta Pinene, a bicyclic monoterpene and an isomer of Alpha-Pinene, is naturally derived primarily from the essential oil of various coniferous trees, notably pine. It is a vital intermediate compound known for its strong woody-pine aroma, making it highly valuable in the flavor and fragrance industry. Chemically, it is used extensively as a precursor for synthesizing complex terpene chemicals, including myrcene, which is critical in manufacturing various synthetic aroma chemicals and vitamins. The market is fundamentally driven by the robust demand from sectors such as cosmetics, household cleaning products, and specialty chemicals, where its versatile chemical properties enable a wide range of end-use applications.

The core applications of Beta Pinene extend beyond simple scent additives. Its polymerization capabilities are leveraged in the production of polyterpene resins, which serve as tackifiers in adhesives, sealants, and coatings, providing enhanced binding strength and stability. Furthermore, Beta Pinene is increasingly utilized in the pharmaceutical sector, exploring its potential antimicrobial and anti-inflammatory properties, although its dominant market share remains anchored in flavor and fragrance formulations. The ongoing shift toward natural and bio-based ingredients across industries further bolsters the adoption of naturally sourced Beta Pinene, pushing manufacturers to optimize extraction and purification processes.

Key driving factors influencing market expansion include the burgeoning demand for high-quality, long-lasting fragrances in developing economies, coupled with regulatory support for bio-based chemicals in regions like Europe and North America. Manufacturers are also focusing on improving the yield and purity of Beta Pinene through advanced fractional distillation and chromatographic techniques, ensuring that the supply meets the stringent quality requirements of high-end cosmetic and food applications. However, the market faces constraints related to the volatility of raw material sourcing, primarily crude sulfate turpentine (CST), which ties market stability closely to the global pulp and paper industry cycles.

Beta Pinene Market Executive Summary

The Beta Pinene market exhibits robust growth, primarily fueled by sustained demand from the downstream flavor and fragrance (F&F) industry, where it acts as a foundational building block for numerous synthetic aroma compounds. Current business trends indicate a critical focus on supply chain resilience, particularly concerning the sourcing of crude sulfate turpentine (CST), a major byproduct of the pulp industry. Major market players are investing heavily in vertical integration and strategic long-term procurement contracts to mitigate price volatility and ensure a stable supply of high-purity Beta Pinene. Furthermore, the development of high-performance polyterpene resins, used increasingly in sustainable packaging and automotive adhesives, is creating lucrative opportunities for market diversification beyond traditional F&F applications, positioning the market for steady, above-average chemical industry growth.

Regional dynamics highlight the Asia Pacific (APAC) region as the fastest-growing market, driven by rapid industrialization, expanding domestic consumption of personal care products, and increasing manufacturing capacity in China and India for derivative chemicals like myrcene. Europe and North America, while mature, remain dominant in terms of consumption value, largely due to stringent quality standards and high demand for premium natural ingredients in cosmetics and fine fragrances. Regulatory trends in these Western regions, particularly those promoting bio-solvents and sustainable chemicals, are encouraging innovation in production methods and the adoption of high-purity Beta Pinene grades, impacting global trade flows and regional production emphasis.

Segmentation analysis underscores the dominance of the Flavor & Fragrance segment by application, reflecting Beta Pinene's essential role in synthesizing compounds that mimic floral, citrus, and woody notes. However, the Polyterpene Resins segment is expected to show the highest proportional growth, stimulated by increasing applications in construction, road marking paints, and advanced adhesive formulations requiring enhanced thermal stability and tackiness. In terms of grade, the High Purity (>95%) Beta Pinene grade is gaining traction over Technical Grade due to elevated regulatory requirements in food contact and cosmetic applications, driving technology adoption focused on advanced fractional distillation for increased purity and minimized trace impurities.

AI Impact Analysis on Beta Pinene Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Beta Pinene market primarily revolve around three areas: how AI can optimize volatile raw material sourcing (CST pricing), its role in enhancing the efficiency and purity of complex chemical separation processes, and its potential in accelerating the discovery of novel fragrance molecules derived from Beta Pinene precursors. Users are concerned about mitigating the dependency on fluctuating turpentine supply through predictive analytics and automating quality control to meet stringent international standards for cosmetic and food-grade products. They expect AI tools to reduce operational costs associated with fractional distillation and chromatographic purification, ultimately leading to more competitive pricing and consistent supply in the global market.

AI's immediate impact is most noticeable in operational optimization. Machine learning algorithms are being deployed to analyze vast datasets pertaining to pulp mill operations, historical CST pricing, and seasonal turpentine yield variations. This predictive maintenance and supply chain forecasting allows Beta Pinene manufacturers to make highly informed purchasing decisions, hedging against short-term price spikes and ensuring the continuous flow of feedstock. Furthermore, AI-driven process control systems are being integrated into distillation columns, adjusting parameters (temperature, pressure, flow rate) in real-time to maximize Beta Pinene yield and purity while minimizing energy consumption, offering a significant competitive advantage to early adopters.

Looking forward, AI is set to revolutionize R&D and product formulation. In the flavor and fragrance industry, deep learning models are analyzing complex olfactive profiles to predict the precise combination of Beta Pinene derivatives required to achieve specific desired scents, drastically reducing the time and resources traditionally spent on trial-and-error chemical synthesis. This accelerated molecular design capability aids in developing high-value, unique aroma compounds derived from Beta Pinene, enabling manufacturers to quickly respond to niche market trends and consumer preferences for natural-mimicking fragrances and functional ingredients, thereby increasing the intrinsic value of the core chemical intermediate.

- AI optimizes raw material procurement by predicting Crude Sulfate Turpentine (CST) price fluctuations.

- Machine learning enhances fractional distillation efficiency, increasing Beta Pinene purity and yield.

- Predictive modeling minimizes energy consumption in complex separation processes, lowering operational expenditure.

- AI-driven automated quality control systems ensure compliance with stringent pharmaceutical and cosmetic grade standards.

- Deep learning algorithms accelerate the discovery and formulation of novel aroma chemicals derived from Beta Pinene.

- Supply chain visibility is improved through real-time data analysis, reducing lead times and stockouts.

- Robotics integrated with AI monitors process variables, leading to safer and more consistent production environments.

DRO & Impact Forces Of Beta Pinene Market

The Beta Pinene market is fundamentally influenced by dynamic drivers centered around expanding end-use applications in high-growth consumer sectors, offset by inherent structural restraints tied to resource dependency and chemical manufacturing complexity. The primary driver is the escalating global demand for bio-based, natural-source fragrances and flavor enhancers, positioning Beta Pinene as a preferred raw material over fully synthetic alternatives due to consumer perception and regulatory support. This demand is further amplified by the versatility of Beta Pinene in synthesizing critical intermediates such as myrcene, which is essential for manufacturing vitamins (like Vitamin A and E) and specialty polymers. However, the market faces a significant restraint in the form of raw material price volatility, as Beta Pinene production relies heavily on crude sulfate turpentine, a co-product whose supply and price are governed by the cyclical performance and operational output of the global pulp and paper industry, creating supply risk.

Opportunities for market expansion are largely concentrated in the adoption of Beta Pinene derivatives in next-generation sustainable technologies. The shift toward bio-solvents, non-toxic cleaning agents, and high-performance, eco-friendly adhesive systems presents a substantial avenue for market penetration outside the traditional flavor and fragrance core. Advancements in biotechnology, specifically the potential for microbial fermentation routes to produce pinene, could eventually mitigate dependency on forest-derived sources, offering a long-term opportunity for more stable, scalable, and environmentally controlled production. This technological potential attracts considerable investment aimed at decarbonizing the chemical feedstock supply chain.

The impact forces currently acting on the market underscore a continuous push-pull between innovation and cost structure. High impact drivers, such as increasing urbanization leading to greater consumption of packaged goods and luxury fragrances, apply constant upward pressure on demand. Conversely, environmental regulations concerning volatile organic compounds (VOCs) and sustainable sourcing practices act as high impact restraints, necessitating capital expenditure for emission control and certification, thereby raising operational barriers for smaller manufacturers. The medium-term impact forces revolve around technological substitution risk, where alternative bio-based or synthetic terpenes could erode Beta Pinene’s market share if cost efficiencies are not maintained, requiring persistent R&D to uphold its functional superiority and cost-effectiveness in diverse applications.

Segmentation Analysis

The Beta Pinene market segmentation provides a comprehensive view of consumption patterns, purity requirements, and end-user uptake across various industries. Segmentation by Application reveals the overwhelming importance of the Flavor & Fragrance sector, followed closely by the Polyterpene Resins and Specialized Chemical Synthesis segments. Segmentation by Grade highlights the evolving demand for High Purity Beta Pinene necessary for stringent applications in cosmetics and pharmaceuticals, contrasting with the Technical Grade utilized primarily in industrial coatings and lower-cost adhesives. Understanding these segments is crucial for manufacturers to tailor production capacity and purity levels to meet specific industry needs and optimize pricing strategies based on value-in-use.

- By Application: Flavor & Fragrance, Polyterpene Resins, Adhesives & Sealants, Chemical Intermediates (Myrcene, Linalool Synthesis), Pharmaceutical, Others (Bio-solvents, Coatings).

- By Grade: High Purity Grade (>95%), Technical Grade (80-95%).

- By Source: Natural (Wood & Gum Turpentine Oil), Synthetic/Biotech Derived (Emerging).

- By Region: North America, Europe, Asia Pacific (APAC), Latin America, Middle East & Africa (MEA).

Value Chain Analysis For Beta Pinene Market

The Beta Pinene value chain is complex, starting with the upstream sourcing of crude sulfate turpentine (CST) or wood turpentine, primarily sourced from the pulp and paper industry or pine tree tapping operations, respectively. Upstream analysis focuses heavily on the operational efficiency of pulp mills, as CST availability directly dictates the cost of raw material for terpene manufacturers. Key processes involve initial separation and collection of the crude oil, followed by bulk transport to specialized distillation facilities. Price volatility in this phase represents the largest risk factor in the entire value chain, requiring sophisticated risk management and long-term supply agreements between pulp producers and terpene refiners.

Midstream activities involve highly specialized processing, typically fractional distillation and sophisticated purification techniques, to separate Beta Pinene from other terpene isomers (like Alpha-Pinene, Limonene) and impurities, achieving the required high purity standards for cosmetic and food applications. Manufacturers in this stage, such as large global chemical companies, focus on proprietary distillation column designs and process optimization to reduce energy consumption and maximize yield. Distribution channels are varied: direct sales are common for large-volume industrial end-users (like polyterpene resin producers), while indirect channels utilizing specialized chemical distributors are prevalent for smaller F&F houses and regional formulators who require smaller batch sizes and specialized technical support.

Downstream analysis centers on the diverse end-user applications. Major buyers include Flavor & Fragrance companies, who use Beta Pinene to synthesize derivatives like myrcene, which is then used in perfumes, soaps, and detergents. Another significant downstream segment is the adhesive and sealant industry, which uses polyterpene resins derived from Beta Pinene for improved tackiness in tapes, labels, and construction mastics. The efficiency of the distribution network—ensuring timely delivery while maintaining product stability—is crucial in this downstream phase, especially considering global logistics challenges and varying regional regulatory requirements for chemical transport and storage.

Beta Pinene Market Potential Customers

Potential customers for Beta Pinene span several diverse industrial sectors, with the primary end-users being manufacturers of specialized chemicals and formulators in the consumer goods space. The largest consumer base comprises companies in the Flavor & Fragrance industry, including major global fragrance houses and specialty chemical producers who utilize Beta Pinene as a vital precursor to manufacture high-value aroma chemicals (e.g., myrcene, which is subsequently converted into linalool, citral, and other scent components). These customers prioritize high purity and consistent supply, as any impurity can significantly alter the final sensory profile of their formulated products, demanding rigorous quality assurance from their suppliers.

Another rapidly growing customer segment includes manufacturers of adhesives, sealants, and coating materials. These buyers rely on Beta Pinene to synthesize high-performance polyterpene resins, which are essential tackifiers used in sensitive applications such as medical tapes, food packaging adhesives, and automotive assembly glues. These industrial customers focus heavily on functional performance criteria, including thermal stability, cohesive strength, and compatibility with other polymers in their formulations. Emerging customer groups include green chemistry companies and producers of bio-solvents seeking non-toxic, sustainable alternatives derived from natural sources, leveraging Beta Pinene's favorable environmental profile compared to petrochemical solvents.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 718.9 Million |

| Growth Rate | 6.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Arizona Chemical (Kraton Corporation), DRT (Firmenich), Symrise AG, International Flavors & Fragrances (IFF), Mentha & Allied Products Pvt. Ltd., Skyrun Industrial Co., Ltd., Himachal Drugs & Pharmaceuticals Pvt. Ltd., Penta Manufacturing Company, Socer Brasil, Good Scents Company, Dalian Hanhua Chemical Co., Ltd., Jiangxi Jishui County Xinghua Natural Spice Oil Co., Ltd., Renessenz LLC, Agan Aroma and Fine Chemicals Ltd., VNLAB, Millennium Specialty Chemicals Inc., Fufeng Group, Guangzhou Xuerong Chemical Co., Ltd., Xiamen Bestlink Chemical Co., Ltd., Pine Chemical Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Beta Pinene Market Key Technology Landscape

The core technology underpinning the commercial production of Beta Pinene is fractional distillation, a highly energy-intensive process requiring sophisticated column design and precise temperature control to separate Beta Pinene from its structurally similar isomers, particularly Alpha-Pinene, found within crude sulfate turpentine (CST). Continuous improvements in this area focus on using high-efficiency packing materials (such as structured packing) to increase separation resolution and throughput, thereby improving product purity while simultaneously reducing the energy footprint of the refining operation. This technological evolution is critical, as end-user requirements, especially in the fine fragrance and pharmaceutical sectors, increasingly demand purity levels exceeding 95%, pushing manufacturers to adopt multi-stage or vacuum distillation setups.

Beyond distillation, advanced purification techniques, including preparative chromatography and proprietary chemical washing methods, are employed to remove non-terpene impurities and trace contaminants that affect the stability and sensory profile of the final product. Recent technological advancements are centered on catalysis and reaction engineering, exploring more efficient and selective ways to convert lower-value terpenes into Beta Pinene, or to directly synthesize key derivatives like Myrcene from Beta Pinene with higher yield and fewer byproducts. Automation, leveraging Industrial Internet of Things (IIoT) sensors and AI-driven control systems, is becoming standard practice to ensure tight control over these complex chemical reactions and separation parameters, minimizing batch-to-batch variation.

An emerging technological landscape focuses on sustainable, non-forest-dependent production methods, notably microbial fermentation. Research efforts are underway to engineer specific yeast strains or microorganisms to biosynthesize pinene isomers directly from renewable feedstocks, such as sugar or cellulosic biomass, offering a potential long-term solution to the volatility associated with CST sourcing. While currently in the research and pilot phase, successful commercialization of bio-based pinene would represent a disruptive technology, fundamentally altering the upstream value chain, decoupling Beta Pinene supply from the dynamics of the global pulp and paper industry, and significantly reducing environmental impact through reliance on renewable carbon sources and more controlled manufacturing processes.

Regional Highlights

The regional consumption and production landscape of the Beta Pinene market reflects a bifurcated structure, characterized by high-value consumption in mature economies (North America and Europe) and robust production and rapidly expanding consumer bases in emerging regions (Asia Pacific). North America and Europe, with their established F&F and advanced chemical industries, dictate global quality standards and consume high-purity grades for premium cosmetic products and specialized industrial applications. However, production capacity is increasingly shifting toward regions with favorable access to raw materials and lower operational costs.

Asia Pacific (APAC) stands out as the engine of future growth. Countries like China and India are not only major producers of turpentine derivatives but are also witnessing unprecedented growth in their domestic markets for personal care, adhesives, and coatings, driven by rising disposable incomes and rapid urbanization. This region is rapidly expanding its distillation and processing capabilities to meet both internal demand and export requirements, often competing aggressively on price while gradually improving product purity to meet international benchmarks. Regulatory liberalization and investment incentives further stimulate market expansion within key APAC manufacturing hubs.

Latin America and the Middle East & Africa (MEA) represent smaller but strategically important markets. Latin America, particularly Brazil, is a significant source of raw materials (turpentine) and hosts substantial processing facilities, positioning it as a key supplier in the global trade network. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, shows increasing consumption driven by local development of consumer goods manufacturing and infrastructure projects requiring high-performance polyterpene resins in construction and coatings applications, indicating strong demand potential over the forecast period.

- Asia Pacific (APAC): Dominates manufacturing capacity and exhibits the highest growth rate due to expanding F&F, coatings, and adhesives sectors in China and India.

- Europe: High-value consumption driven by stringent quality standards in the fine fragrance and premium cosmetic markets; focus on bio-based solvent utilization.

- North America: Mature market characterized by advanced research in terpene-based specialty chemicals and stable demand from the adhesive and sealants industry.

- Latin America: Important region for raw material sourcing (turpentine) and a growing center for basic chemical refining, particularly Brazil.

- Middle East & Africa (MEA): Emerging market with increasing infrastructural development driving demand for polyterpene resins and coatings.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Beta Pinene Market.- Arizona Chemical (Kraton Corporation)

- DRT (Firmenich)

- Symrise AG

- International Flavors & Fragrances (IFF)

- Mentha & Allied Products Pvt. Ltd.

- Skyrun Industrial Co., Ltd.

- Himachal Drugs & Pharmaceuticals Pvt. Ltd.

- Penta Manufacturing Company

- Socer Brasil

- Good Scents Company

- Dalian Hanhua Chemical Co., Ltd.

- Jiangxi Jishui County Xinghua Natural Spice Oil Co., Ltd.

- Renessenz LLC

- Agan Aroma and Fine Chemicals Ltd.

- VNLAB

- Millennium Specialty Chemicals Inc.

- Fufeng Group

- Guangzhou Xuerong Chemical Co., Ltd.

- Xiamen Bestlink Chemical Co., Ltd.

- Pine Chemical Group

Frequently Asked Questions

Analyze common user questions about the Beta Pinene market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Beta Pinene primarily used for?

Beta Pinene is primarily used as a foundational chemical intermediate in the Flavor and Fragrance (F&F) industry, serving as a precursor for the synthesis of high-value aroma chemicals such as myrcene, which is then converted into compounds like linalool and citral. It is also extensively used in the production of polyterpene resins for adhesives and coatings due to its tackifying properties.

How does the volatility of crude sulfate turpentine (CST) impact the Beta Pinene market?

CST, a byproduct of the pulp and paper industry, is the main raw material for natural Beta Pinene production. Fluctuations in CST supply and pricing, often tied to cyclical performance in the pulp industry, directly result in cost volatility for Beta Pinene manufacturers, creating supply chain risk and affecting global pricing stability. Manufacturers rely on strategic sourcing and long-term contracts to mitigate this dependency.

Which grade of Beta Pinene is experiencing the highest demand growth?

High Purity Grade Beta Pinene (typically >95%) is experiencing strong demand growth. This is driven by increasing regulatory scrutiny and consumer preference for highly purified ingredients in premium consumer sectors, specifically fine fragrances, cosmetics, and specialized food contact adhesives, which require minimal trace impurities to ensure product stability and safety.

Is there an environmental benefit to using Beta Pinene over other chemical alternatives?

Yes, Beta Pinene is naturally derived from renewable forest resources (turpentine), positioning it favorably as a bio-based chemical. This natural sourcing supports the trend toward sustainable chemistry and offers an environmentally friendlier profile compared to certain petrochemical-derived solvents and polymers, leading to its growing adoption in green solvents and eco-friendly adhesive systems.

What role does the Asia Pacific region play in the global Beta Pinene market?

The Asia Pacific region, particularly China and India, is the leading global manufacturing hub for Beta Pinene and its derivatives. It is characterized by rapidly expanding domestic consumption in personal care and industrial sectors, making it the fastest-growing market in terms of volume and increasingly important in terms of global supply capacity and export volume.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Beta Pinene Market Size Report By Type (Purity 95%, Purity 95%), By Application (Fragrance Ingredient, Terpene Resin, Pharmaceutical Intermediate, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Beta Pinene Market Statistics 2025 Analysis By Application (Fragrance Ingredient, Terpene Resin, Pharmaceutical Intermediate), By Type (?95%, ?95%), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager