Betel Leaf Essential Oil Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433519 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Betel Leaf Essential Oil Market Size

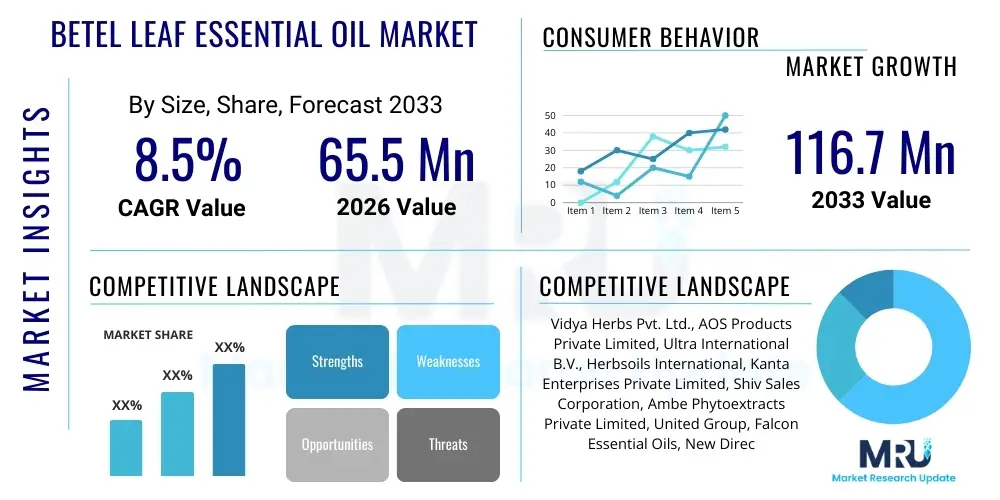

The Betel Leaf Essential Oil Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 65.5 Million in 2026 and is projected to reach USD 116.7 Million by the end of the forecast period in 2033.

Betel Leaf Essential Oil Market introduction

The Betel Leaf Essential Oil Market encompasses the extraction, processing, distribution, and consumption of oil derived from the leaves of the Piper betle L. plant. This essential oil is highly valued globally, particularly in the Asia-Pacific region, due to its rich chemical composition, which includes chavibetol, eugenol, and various terpenes, imparting significant antiseptic, antifungal, and antioxidant properties. The product description highlights its use across diverse sectors, migrating from traditional Ayurvedic and Unani medicine practices into modern cosmetic, pharmaceutical, and functional food applications. Major applications include oral hygiene products, topical pain relief formulations, and fragrance components in high-end personal care items. The intrinsic biological activity of the oil makes it a compelling natural alternative to synthetic ingredients, a trend strongly favored by modern consumer preferences toward organic and clean-label products. Key driving factors propelling market expansion include escalating awareness regarding natural therapeutic solutions, rising disposable incomes facilitating expenditure on premium personal care products, and increasing research validating its efficacy against common pathogens.

Betel Leaf Essential Oil Market Executive Summary

The Betel Leaf Essential Oil market trajectory is defined by robust business trends emphasizing sustainability and traceability in sourcing, responding to global demand for ethically produced natural ingredients. Regional trends show a dominant consumption and production concentration in Asia Pacific, particularly in India, Indonesia, and Thailand, which possess the necessary raw material cultivation infrastructure and deep cultural roots for its usage; however, North America and Europe exhibit the highest growth rates, driven by surging interest in ethnobotanicals and aromatherapy within wellness and cosmetic industries. Segment trends indicate that the pharmaceutical and cosmeceutical applications segment holds significant revenue share, utilizing the oil's antimicrobial and anti-inflammatory attributes in medical-grade and high-value skin care formulations. Furthermore, the rising adoption of standardized extraction techniques, such as supercritical fluid extraction (SFE), is improving product quality and yield, further stabilizing supply chains and enabling greater penetration into regulated Western markets. These dynamic trends collectively forecast a favorable outlook characterized by increased industrial integration and expanded product diversification beyond traditional uses.

AI Impact Analysis on Betel Leaf Essential Oil Market

Common user questions regarding AI's impact on the Betel Leaf Essential Oil Market frequently center on optimizing cultivation yields, enhancing essential oil extraction efficiency, and accelerating product development through predictive modeling of bioactive compounds. Users are concerned with how AI-driven precision agriculture can mitigate risks associated with climate variability affecting betel vine cultivation and how machine learning algorithms can analyze complex chromatograms to ensure consistent product purity and quality, a critical factor for premium essential oils. The synthesis of these concerns points toward the expectation that AI will primarily serve as a tool for supply chain resilience and scientific validation, moving the industry from traditional methods to data-driven operational excellence. AI integration is anticipated to drastically reduce processing waste, optimize resource allocation in distillation, and provide advanced insights into consumer preferences for formulation, thereby creating highly personalized and effective end-products in the cosmetics and nutraceutical sectors.

- AI optimizes betel vine cultivation through predictive analytics for irrigation, pest control, and nutrient management, improving crop yield consistency.

- Machine learning algorithms enhance extraction process parameters (temperature, pressure) in hydrodistillation and SFE, maximizing essential oil yield and specific compound concentration (e.g., chavibetol).

- Data analytics models track the complex global supply chain, ensuring traceability, validating ethical sourcing, and predicting geopolitical impacts on raw material availability.

- AI assists in formulating cosmetic and pharmaceutical products by predicting the synergistic effects of betel leaf oil with other ingredients, accelerating R&D cycles.

- Automated quality control systems utilize spectral analysis and AI image processing to ensure the purity and authenticity of essential oil batches, combating market adulteration.

DRO & Impact Forces Of Betel Leaf Essential Oil Market

The market dynamics for Betel Leaf Essential Oil are fundamentally shaped by a confluence of accelerating drivers (D) rooted in consumer preference for natural remedies, persistent restraints (R) related to supply chain instability and standardization challenges, and substantial opportunities (O) stemming from technological advancements and market diversification. The primary impact force driving demand is the validated efficacy of the oil's antimicrobial properties, translating into broad applications in therapeutic and preventive care products. Conversely, the market faces constraints due to the labor-intensive nature of betel vine harvesting and the regional specificity of high-quality raw material sourcing, which contribute to volatile pricing and inconsistent supply. Opportunities lie predominantly in capitalizing on the rapidly expanding aromatherapy and clinical nutraceutical fields, leveraging modern encapsulation technologies to stabilize the oil's volatile components and enhance its bioavailability for internal consumption, thereby opening new product categories and consumer demographics.

Segmentation Analysis

The comprehensive segmentation analysis of the Betel Leaf Essential Oil Market reveals a highly differentiated product landscape catering to specialized industrial requirements across various sectors. The primary segmentation dimensions include the Grade of Oil (Therapeutic Grade, Cosmetic Grade, Industrial Grade), the Application Method (Aromatherapy, Personal Care, Pharmaceuticals), and the Distribution Channel (Direct Sales, E-commerce, Retail). This structure allows market participants to tailor their offerings, addressing the specific purity requirements demanded by sensitive applications like pharmaceuticals versus the volume-driven needs of industrial fragrance and flavor manufacturers. The increasing consumer sophistication regarding essential oil quality drives significant value toward Therapeutic Grade oils, which command premium pricing due to stringent processing and validation standards, influencing overall market profitability.

- Grade:

- Therapeutic Grade (Pure, High-Purity)

- Cosmetic Grade

- Industrial Grade (Lower Purity, Diluted)

- Application:

- Pharmaceuticals & Nutraceuticals

- Cosmetics & Personal Care (Skin Care, Hair Care, Oral Care)

- Food & Beverages (Flavoring)

- Aromatherapy

- Agriculture (Bio-pesticides)

- Distribution Channel:

- Direct Sales (B2B, Contract Manufacturing)

- E-commerce (Online Retail)

- Specialty Retail Stores

- Supermarkets & Hypermarkets

Value Chain Analysis For Betel Leaf Essential Oil Market

The value chain for Betel Leaf Essential Oil begins with the upstream segment, involving the cultivation and harvesting of Piper betle L. leaves, primarily concentrated in tropical and subtropical regions of Asia. Upstream analysis focuses on efficient farming practices, including optimizing yield per hectare and ensuring sustainable harvesting techniques to maintain plant regeneration, which is critical since the quality and age of the leaves directly impact the resulting oil chemistry. Key challenges in this stage include seasonal variability and the fragmented nature of smallholder farming. Midstream activities involve the extraction and processing of the leaves into essential oil, utilizing hydrodistillation, steam distillation, or advanced methods like supercritical CO2 extraction. Standardization of extraction techniques to ensure consistent concentration of bioactive compounds, such as phenolic compounds like chavibetol, is the main value addition at this stage, dictating the oil's grade and market price.

The distribution channel subsequently handles the logistics, storage, and movement of the oil from processing units to end-users. This involves both direct and indirect channels. Direct sales dominate B2B transactions where large pharmaceutical or cosmetic manufacturers procure bulk quantities under contract, often requiring customized purity specifications and detailed compliance documentation. Indirect channels, including specialty retailers, e-commerce platforms, and distributors, cater primarily to the smaller businesses, aromatherapy practitioners, and individual consumers.

Downstream analysis encompasses the integration of the essential oil into final consumer products across various applications—from medicated mouthwashes and anti-acne formulations to flavoring agents in chewing tobacco alternatives. Value enhancement downstream involves strategic branding, clinical validation (especially for nutraceuticals), and innovative product delivery systems, such as microencapsulation, designed to preserve the oil's potency and extend shelf life. The effectiveness of the overall supply chain relies heavily on maintaining the integrity of the oil's volatile compounds from farm to final application, necessitating strict quality control protocols at every transitional point.

Betel Leaf Essential Oil Market Potential Customers

The potential customers and primary end-users of Betel Leaf Essential Oil are highly diversified, reflecting the oil’s versatile therapeutic profile. Pharmaceutical companies represent a significant buyer segment, leveraging the oil's proven antiseptic, anti-inflammatory, and analgesic properties for use in topical creams, oral preparations, and potentially, drug delivery systems targeting fungal or bacterial infections. These buyers require therapeutic-grade oil backed by extensive quality assurance documentation and regulatory compliance, particularly concerning heavy metal content and pesticide residues.

The cosmetics and personal care industry forms another crucial customer base, utilizing the essential oil in formulations designed for skin care (due to its antioxidant benefits), hair care (anti-dandruff and scalp conditioning), and most prominently, oral hygiene products such as specialized toothpaste and mouthwashes where its potent antimicrobial action against common oral pathogens is highly valued. These customers often seek cosmetic-grade oil, prioritizing consistent fragrance profiles and stable formulation compatibility over extreme therapeutic potency, provided it adheres to relevant safety standards (e.g., IFRA guidelines for fragrance components).

Furthermore, niche markets such as high-end aromatherapy practitioners, nutraceutical manufacturers focusing on digestive health supplements, and agricultural entities developing natural bio-pesticides constitute growing segments. Nutraceutical companies, in particular, are keen buyers as consumers increasingly turn towards natural sources for health maintenance, requiring encapsulated forms of the oil. The direct-to-consumer market, facilitated largely by e-commerce platforms, also represents a growing body of buyers seeking the oil for home remedies and DIY cosmetic formulations, underscoring the oil's broad appeal across industrial, institutional, and individual end-users.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 65.5 Million |

| Market Forecast in 2033 | USD 116.7 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Vidya Herbs Pvt. Ltd., AOS Products Private Limited, Ultra International B.V., Herbsoils International, Kanta Enterprises Private Limited, Shiv Sales Corporation, Ambe Phytoextracts Private Limited, United Group, Falcon Essential Oils, New Directions Aromatics, Aroma Depot, Green Fields Essential Oils, Kama Ayurveda, A.G. Industries, SDM Essential Oils, SVA Organics, Pothos Labs, Mother Herbs, Aromaaz International, Veda Oils |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Betel Leaf Essential Oil Market Key Technology Landscape

The technological landscape driving the Betel Leaf Essential Oil market is primarily focused on enhancing extraction efficiency, ensuring product quality consistency, and maximizing the concentration of targeted bioactive molecules. Traditionally, hydrodistillation and steam distillation were the standard methods; however, modern industrial practices increasingly favor advanced techniques. Supercritical Fluid Extraction (SFE), particularly using CO2, represents a pivotal technology. SFE is non-toxic, operates at lower temperatures, and allows for precise control over the extraction process, minimizing thermal degradation of sensitive compounds like chavibetol and producing a purer, solvent-free essential oil with superior organoleptic properties. This improvement in purity directly impacts the oil’s eligibility for high-value therapeutic and nutraceutical applications, providing manufacturers with a distinct competitive advantage over those relying on conventional methods.

Furthermore, advancements in analytical chemistry, specifically High-Performance Liquid Chromatography (HPLC) and Gas Chromatography-Mass Spectrometry (GC-MS), are fundamental for quality control. These technologies allow suppliers to provide detailed chemical profiles (chemotypes) of each batch, which is essential for regulated industries like pharmaceuticals that demand standardization and traceability. The integration of spectroscopic techniques, combined with AI-driven data analysis, enables real-time monitoring of raw material quality and process outputs, moving the industry towards predictive quality management rather than retrospective batch testing.

Finally, formulation technologies are playing a critical role in market expansion, especially those related to stability and bioavailability. Microencapsulation and nanoemulsion technologies are being employed to stabilize the volatile components of the oil, protecting them from oxidation and heat, thereby extending shelf life and facilitating its incorporation into water-based products, beverages, and oral supplements. This technological evolution not only improves product efficacy but also allows the Betel Leaf Essential Oil market to expand its reach into complex delivery systems previously inaccessible with traditional oil forms.

Regional Highlights

The market for Betel Leaf Essential Oil exhibits significant regional heterogeneity, largely determined by cultivation capacity, traditional usage, and regulatory frameworks governing natural ingredients in the health and cosmetics sectors.

- Asia Pacific (APAC): APAC remains the undisputed global production hub and the largest consumption market, led by countries such as India, Indonesia, and Thailand where betel vine cultivation is indigenous and its use is ingrained in traditional medicine (Ayurveda) and cultural practices. The region benefits from low raw material costs and established local processing infrastructure. However, the market in APAC is increasingly professionalizing, moving away from artisanal distillation towards large-scale industrial processing to meet international export standards.

- North America: North America is characterized by high growth potential and a high willingness to pay for premium natural wellness and personal care products. Demand is concentrated in the aromatherapy and specialized nutraceutical segments, driven by consumer interest in exotic and scientifically validated botanical ingredients. Regulatory compliance, particularly related to the FDA, mandates rigorous testing and documentation, influencing procurement strategies toward certified therapeutic-grade suppliers.

- Europe: Similar to North America, the European market shows robust growth fueled by the stringent EU Cosmetics Regulation (EC) 1223/2009 and a widespread consumer shift towards sustainable, plant-derived ingredients. Betel Leaf Essential Oil finds application in high-end cosmetic formulations and specific medical device applications. The market is highly sensitive to ingredient sourcing ethics and requires detailed traceability reports, encouraging investment in transparent and sustainable supply chains originating in Asia.

- Latin America (LATAM): The LATAM market is emerging, driven by internal demand for natural ingredients in pharmaceuticals and traditional herbal remedies, particularly in Brazil and Mexico. Economic development and rising middle-class disposable income are facilitating greater access to imported specialty essential oils, though local competition from other regional botanicals presents a moderate restraint.

- Middle East and Africa (MEA): Demand in MEA is primarily focused on personal hygiene, oral care, and traditional perfumery applications. Market growth is constrained by high import duties and reliance on established trade routes, although increasing governmental focus on diversifying healthcare away from synthetic products offers long-term growth opportunities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Betel Leaf Essential Oil Market.- Vidya Herbs Pvt. Ltd.

- AOS Products Private Limited

- Ultra International B.V.

- Herbsoils International

- Kanta Enterprises Private Limited

- Shiv Sales Corporation

- Ambe Phytoextracts Private Limited

- United Group

- Falcon Essential Oils

- New Directions Aromatics

- Aroma Depot

- Green Fields Essential Oils

- Kama Ayurveda

- A.G. Industries

- SDM Essential Oils

- SVA Organics

- Pothos Labs

- Mother Herbs

- Aromaaz International

- Veda Oils

Frequently Asked Questions

What are the primary therapeutic applications of Betel Leaf Essential Oil?

The oil is extensively used for its potent antimicrobial, antiseptic, and anti-inflammatory properties, making it valuable in oral care products (combating plaque and bad breath), topical pain relief gels, and dermatological treatments addressing fungal infections and acne. Its primary compound, chavibetol, contributes significantly to these bioactivities.

How does the quality grade of Betel Leaf Essential Oil affect its market price?

Therapeutic Grade oil, which undergoes stringent testing via GC-MS and utilizes advanced extraction methods like SFE to ensure high purity and optimal concentration of active compounds, commands the highest market price. Cosmetic and Industrial grades, which may be less pure or produced via conventional hydrodistillation, are priced lower.

Which extraction technology is gaining traction in the Betel Leaf Essential Oil Market?

Supercritical Fluid Extraction (SFE) using CO2 is gaining traction due to its ability to yield high-quality, solvent-free essential oil while preserving heat-sensitive volatile components. This method is preferred by manufacturers supplying pharmaceutical and high-end cosmetic industries that demand superior purity and consistency.

What are the major restraints hindering the growth of the Betel Leaf Essential Oil market?

Major restraints include the seasonality and vulnerability of betel vine cultivation to climate change, leading to inconsistent raw material supply and price volatility. Furthermore, the lack of standardized regulatory guidelines globally for botanical extracts presents challenges for market entry and scalability in heavily regulated regions.

Is Betel Leaf Essential Oil primarily used in traditional medicine or modern applications?

While historically rooted in traditional South Asian medicine (Ayurveda), the market growth is increasingly driven by modern industrial applications, particularly in functional cosmetics, advanced oral care products, and nutraceuticals, leveraging scientific validation of its potent antimicrobial properties to meet global consumer demand for natural ingredients.

The market for Betel Leaf Essential Oil is experiencing significant expansion, driven by the global pivot toward natural and plant-derived ingredients across the health and wellness spectrum. The intrinsic medicinal value of the oil, coupled with advancements in extraction technologies, positions it as a high-growth botanical commodity. The market’s future profitability relies heavily on overcoming supply chain bottlenecks and achieving global standardization of product quality. Producers must invest in sustainable sourcing practices and technological innovation, particularly SFE and AI-driven quality control, to meet the stringent demands of high-value segments like pharmaceuticals and premium cosmeceuticals. Asia Pacific will continue to dominate production, but the fastest revenue expansion will occur in North America and Europe, necessitating rigorous compliance with international safety and quality standards to fully capitalize on export opportunities.

Specific drivers include the increasing prevalence of dental hygiene awareness and the search for natural alternatives to synthetic antibiotics and antifungals. Betel leaf oil is proven effective against certain oral pathogens, making it a star ingredient in natural toothpaste and mouthwash formulations. This market shift is further supported by clinical research validating traditional uses, transforming anecdotal evidence into marketable, science-backed claims. Furthermore, the oil's unique, spicy, and peppery aromatic profile lends itself well to specialty fragrance applications, although its primary value remains rooted in its functional properties rather than purely aesthetic use. The complexity of the oil's chemical profile means that detailed chemotypic analysis is becoming standard practice, allowing formulators to select oil batches optimized for specific applications, thus increasing the overall perceived value of the product.

The challenges in the market are multifaceted, extending beyond mere supply volatility. Regulatory ambiguity across different global markets presents a significant hurdle. For instance, the oil might be classified as a food additive in one region, a cosmetic ingredient in another, and a pharmaceutical raw material elsewhere, requiring producers to navigate complex and costly compliance pathways. This lack of harmonization often discourages smaller producers from entering lucrative Western markets, concentrating high-value supply among a few large, integrated players who possess the financial and analytical capabilities to adhere to diverse international standards. Moreover, consumer education remains critical; differentiating high-purity therapeutic grade oil from diluted or adulterated products sold in the general market is essential for maintaining brand trust and premium pricing.

Opportunities for market players are substantial in developing novel delivery mechanisms. The oil’s highly volatile nature necessitates stabilization techniques. Encapsulation technology not only preserves the active components but also allows for controlled release, enhancing efficacy and opening doors for its use in advanced functional foods and internally consumed nutraceuticals targeting gut health. Furthermore, diversification into agricultural applications, particularly as a natural bio-pesticide and fungicide, represents an untapped growth avenue, capitalizing on global efforts to reduce chemical pesticide usage in crop protection. Research into synergistic effects with other botanicals to create enhanced formulations for anti-aging and anti-inflammatory treatment also represents a significant R&D opportunity that will define long-term market leadership.

The segmentation by Grade, particularly the Therapeutic Grade segment, is expected to witness the highest CAGR throughout the forecast period. This is attributable to increasing pharmaceutical R&D activities focused on isolating and standardizing high concentrations of bioactive compounds for clinical use. Pharmaceutical manufacturers are willing to pay a substantial premium for oils that guarantee a minimum threshold of key components, coupled with comprehensive safety profiles, including heavy metal and microbial testing certifications. This upward pressure on quality requirements simultaneously elevates the entry barrier for new producers while consolidating the position of established suppliers who can invest in rigorous quality infrastructure. As regulatory oversight tightens globally, the delineation between Therapeutic and Cosmetic grades becomes sharper, driving investment toward superior processing equipment.

Conversely, the Industrial Grade segment, characterized by lower purity and higher volume, continues to serve bulk applications, primarily in soaps, detergents, and inexpensive aroma products. While this segment offers consistent volume demand, margins are significantly lower. The transition toward sustainable and green chemistry principles, however, may eventually mandate higher purity standards even in industrial applications, particularly if environmental impact becomes a regulatory factor. This suggests a gradual convergence in quality standards across all grades over the long term, pushing all producers toward cleaner, technologically advanced extraction methods.

The Application segmentation underscores the dominance of the Cosmetics & Personal Care sector, mainly propelled by the oral hygiene sub-segment. The oil’s proven effectiveness against Porphyromonas gingivalis and Streptococcus mutans—key pathogens in gum disease and cavities—has positioned it as a flagship ingredient in premium natural oral care lines globally. As consumer awareness about the link between oral health and systemic well-being increases, demand for natural, potent oral care ingredients like betel leaf oil is projected to surge. This growth is particularly pronounced in developed economies where consumers are actively seeking preventative health solutions based on botanical extracts.

The Pharmaceuticals & Nutraceuticals segment, although smaller in volume compared to cosmetics, contributes significantly to market revenue due to the high unit price of pharmaceutical raw materials. Betel leaf essential oil and its isolated compounds are being researched for use in anti-diabetic, wound healing, and anti-cancer preparations, leveraging its antioxidant and anti-mutagenic activities. Success in obtaining regulatory approval for these uses would dramatically expand the market size. Nutraceutical manufacturers specifically focus on incorporating the oil into dietary supplements aimed at digestive support and anti-inflammatory response, aligning with the clean-label trend where consumers prefer natural ingredients over synthetic alternatives for daily health maintenance.

From a Distribution Channel perspective, Direct Sales (B2B) continues to be the most vital channel, facilitating large-volume contracts between processors and major industrial users. Stability and reliability are paramount in this channel, with pricing negotiated based on long-term supply agreements and stringent quality guarantees. However, E-commerce is rapidly emerging as the fastest-growing distribution channel, driven by the fragmentation of the end-user market (individual consumers, small aromatherapy businesses) and the ability of online platforms to reach global niche markets quickly and efficiently. The proliferation of specialized online essential oil retailers allows producers to manage inventory and branding more effectively, circumventing traditional retail markups and reaching consumers directly, offering detailed product information necessary for informed purchasing decisions in the natural health space.

Regional analysis indicates that Asia Pacific's long-term dominance is facing a fundamental shift towards optimization and technological enhancement. Countries like India are leveraging their advanced scientific research infrastructure to transition from traditional distillation to highly efficient, standardized extraction methods. Furthermore, regional efforts to establish certifications for organic and sustainable betel vine cultivation enhance the oil's attractiveness to premium export markets. This transition is essential for APAC producers to maintain competitive advantage against emerging substitutes and ensure compliance with the complex import requirements of Western nations, securing their long-term position as global supply leaders.

In North America, the market growth is significantly correlated with the popularity of lifestyle and preventative medicine. The oil is often marketed as an exotic botanical with ancient origins and scientifically verified benefits, appealing to the health-conscious demographic seeking alternatives to over-the-counter pharmaceuticals. Successful market penetration in North America requires robust marketing campaigns that emphasize scientific efficacy and traceability. Furthermore, collaborations between essential oil suppliers and established cosmetic formulators or pharmaceutical companies are common strategies used to accelerate product adoption and ensure regulatory compliance within the stringent US regulatory environment.

The European market, driven by powerful consumer advocacy for sustainability and clean-label products, demands that suppliers adhere not only to chemical purity standards but also to strict ethical and environmental sourcing guidelines. This focus on sustainability presents both a challenge and an opportunity. Suppliers who invest in fair-trade certification and ecologically responsible farming of betel vines can command a premium price and secure long-term contracts with major European cosmetic and wellness brands. The EU’s strong regulatory framework ensures that only high-quality, documented essential oils enter the supply chain, reinforcing the market’s focus on therapeutic and premium cosmetic grades of Betel Leaf Essential Oil.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager