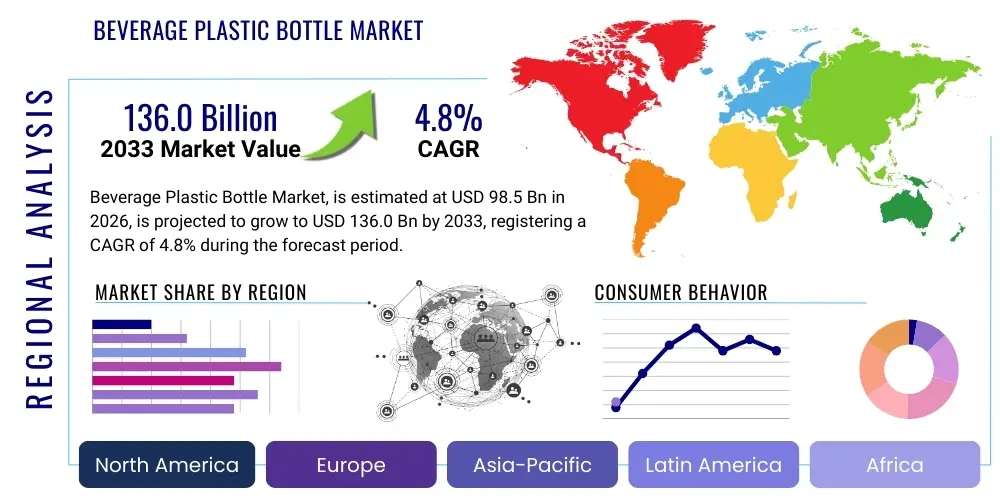

Beverage Plastic Bottle Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437036 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Beverage Plastic Bottle Market Size

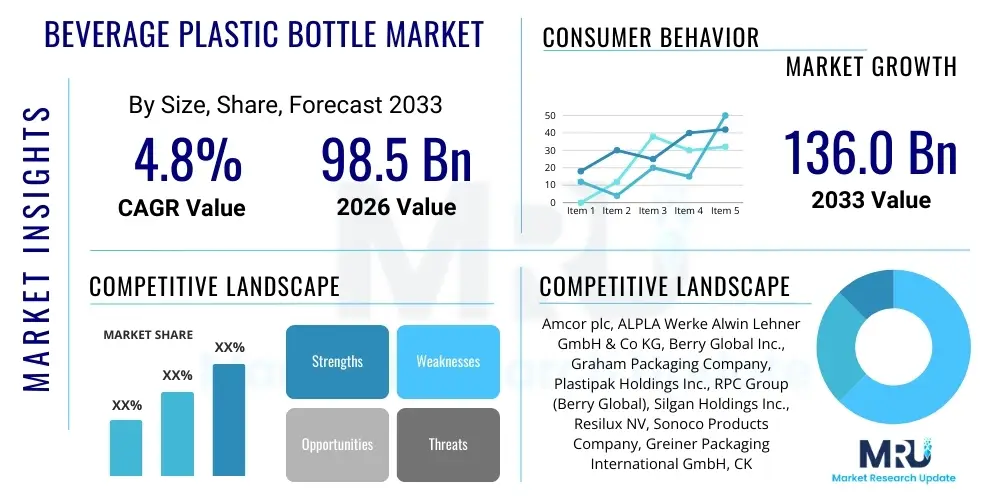

The Beverage Plastic Bottle Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 98.5 billion in 2026 and is projected to reach USD 136.0 billion by the end of the forecast period in 2033.

Beverage Plastic Bottle Market introduction

The Beverage Plastic Bottle Market encompasses the manufacturing, distribution, and sale of plastic containers used for packaging various liquid consumables, primarily driven by the lightweight, cost-effectiveness, and shatterproof nature of materials like Polyethylene Terephthalate (PET). These bottles are essential across the global beverage industry, offering superior barrier properties against moisture and gases, thereby extending product shelf life. The primary applications span packaged drinking water, carbonated soft drinks (CSD), juices, functional beverages, and dairy products. The inherent design flexibility allows manufacturers to produce bottles in diverse shapes and sizes, optimizing both aesthetic appeal and logistical efficiency.

A key benefit driving the adoption of plastic bottles is their high recyclability, particularly PET, which is the most widely utilized polymer in this sector. Modern production techniques focus heavily on reducing resin usage through lightweighting, while simultaneously enhancing the inclusion of post-consumer recycled (PCR) content to meet growing sustainability mandates and consumer preferences. The versatility of plastic packaging enables aseptic filling processes and hot-fill applications, catering to sensitive beverage types, ensuring microbial safety without compromising packaging integrity.

Major driving factors include the escalating global consumption of packaged drinking water, rapid urbanization, and increasing consumer reliance on convenient, on-the-go beverage options. Furthermore, emerging economies are experiencing significant growth in disposable incomes and a shift from traditional packaging (like glass or aluminum) to lightweight plastic due to distribution ease and lower production costs. However, regulatory pressures concerning single-use plastics and the advancement of chemical recycling technologies continue to reshape the market landscape, pushing innovation towards bio-based and fully circular packaging solutions.

Beverage Plastic Bottle Market Executive Summary

The Beverage Plastic Bottle Market is characterized by robust growth anchored by surging demand in the packaged water and functional beverage segments, offset partially by intense regulatory scrutiny regarding plastic waste. Business trends reveal a pronounced shift towards circular economy models, with major beverage producers committing to ambitious targets for incorporating 50% or more Post-Consumer Recycled (PCR) content by the end of the decade. This necessitates substantial investment in advanced recycling infrastructure, including depolymerization and purification technologies, to ensure sufficient food-grade PCR material supply. Furthermore, market competition is focusing less on price and more on sustainable design innovations, such as tethered caps and material reduction strategies (lightweighting), which reduce the overall carbon footprint of the packaging.

Regionally, Asia Pacific (APAC) remains the fastest-growing market, primarily due to the vast populations, accelerating urbanization, and underdeveloped tap water infrastructure leading to massive bottled water consumption, particularly in countries like China and India. North America and Europe, while mature markets, are leading the charge in sustainable innovation; European regulations, notably the Single-Use Plastics Directive, are compelling rapid market transformation towards higher recycling rates and mandatory PCR inclusion. The Middle East and Africa (MEA) are also emerging as critical growth pockets, driven by climate factors and infrastructural needs, though challenges related to waste management infrastructure persist.

Segment-wise, Polyethylene Terephthalate (PET) dominates the material type, given its clarity, barrier properties, and established recycling streams. Within application segments, bottled water continues to hold the largest market share, but the fastest growth is observed in the functional beverages and ready-to-drink (RTD) tea and coffee categories, which leverage specialized plastic formulations (e.g., multilayer barriers) to maintain product integrity. The capacity segment is seeing intensified competition in the 501–1000 ml range, reflecting the optimization of convenience and serving size for individual consumption.

AI Impact Analysis on Beverage Plastic Bottle Market

User inquiries frequently center on how AI can mitigate the environmental impact of plastic bottles, optimize complex supply chains, and enhance quality control in manufacturing. Key themes emerging from these questions involve the potential for AI-driven predictive maintenance to reduce downtime in high-speed bottling lines, the use of computer vision for advanced sorting in material recovery facilities (MRFs), and the application of machine learning (ML) to design lighter, yet structurally sound, packaging. Consumers and industry stakeholders are also keen on understanding how AI algorithms can forecast demand fluctuations more accurately, minimizing overproduction and subsequent waste. Furthermore, AI is expected to play a crucial role in validating and tracking the authenticity and source of PCR materials across the value chain, addressing concerns related to material provenance and circularity claims.

The incorporation of Artificial Intelligence is moving beyond basic automation and into core strategic areas, significantly enhancing operational efficiency and sustainability within the plastic bottle ecosystem. In manufacturing, AI algorithms analyze real-time sensor data from injection stretch blow molding machines, optimizing parameters like temperature, pressure, and cycle time to ensure perfect bottle consistency while achieving maximum lightweighting without compromising structural integrity or barrier performance. This precision minimizes material wastage during production runs and ensures compliance with stringent quality specifications required for beverage packaging.

On the distribution and recycling front, AI is transformative. Machine learning models process vast amounts of data related to logistics, route planning, and inventory management, substantially reducing transportation costs and associated carbon emissions. Crucially, in the recycling sector, advanced AI-powered optical sorters are now capable of distinguishing between different polymer types, colors, and even PCR content levels at speeds unachievable by traditional methods. This enhances the purity of sorted materials, making high-quality, food-grade PCR resins more readily available, directly addressing the key bottleneck in achieving bottle-to-bottle circularity goals demanded by regulatory bodies and brand owners.

- AI-Powered Predictive Maintenance: Reduces equipment downtime and operational costs in high-speed bottling lines.

- Computer Vision Systems: Enables high-speed, high-accuracy sorting of different plastics (PET, HDPE, PP) and colors in recycling facilities.

- Generative Design Optimization: Utilizes ML to simulate stress tests and optimize bottle design for maximal lightweighting and material reduction.

- Demand Forecasting: Improves supply chain resilience by accurately predicting market needs, reducing inventory waste and transportation footprints.

- Quality Control Assurance: Real-time defect detection during manufacturing, minimizing out-of-specification bottles that consume materials and energy.

- Circular Economy Tracing: Uses AI and blockchain integration to track and verify the source and quality of Post-Consumer Recycled (PCR) content.

DRO & Impact Forces Of Beverage Plastic Bottle Market

The dynamics of the Beverage Plastic Bottle Market are shaped by powerful opposing forces, summarized by the robust demand for convenience (Driver) versus intense global pressure to reduce plastic pollution (Restraint). Key drivers include the exponential growth in packaged water consumption and the favorable cost-to-performance ratio of PET over alternatives like glass. Opportunities arise from innovations in sustainable materials, specifically bio-based plastics and enhanced chemical recycling technologies that promise true circularity. The primary restraint is the increasingly hostile regulatory environment, particularly in Western nations and parts of Asia, imposing outright bans or high taxes on single-use plastics, coupled with volatile feedstock (crude oil/natural gas) prices. These forces combine to create a high-impact environment where technological breakthroughs in material science and recycling infrastructure investment will dictate future market leadership.

The impact forces driving the market include macroeconomic factors such as rising disposable incomes globally, which translate into higher consumption of value-added beverages (juices, fortified drinks), all requiring sophisticated packaging. Demographic shifts, including urbanization and smaller household sizes, also favor convenient, single-serve plastic packaging. Conversely, institutional forces, primarily governmental regulations and stringent brand owner commitments (often driven by NGO pressure), exert significant restraining pressure. The move towards Deposit Return Schemes (DRS) and mandatory minimum PCR content targets are transforming procurement strategies, forcing manufacturers to prioritize access to recycled feedstocks over virgin materials.

Furthermore, technological impact forces are constantly evolving the production landscape. Advances in barrier coating technologies (e.g., plasma coating) allow standard PET bottles to package oxygen-sensitive products, traditionally reserved for multilayer or glass containers, thereby expanding PET's application scope. Simultaneously, the public's perception of plastic, amplified by widespread media coverage of marine pollution, acts as a powerful external restraint, fueling demand for genuinely sustainable alternatives like refillable systems or aluminum cans, compelling the plastic bottle industry to accelerate its transition to circular models quickly and demonstrably.

Segmentation Analysis

The Beverage Plastic Bottle Market is highly diversified, segmented primarily based on material type, application, capacity, and color, reflecting the varying requirements of different beverage categories and consumer consumption patterns. Analyzing these segments provides critical insights into material preferences, regulatory compliance challenges, and growth opportunities. The market's stability is underpinned by the dominance of PET due to its superior clarity, strength, and widely accepted recyclability, making it the material of choice for clear beverages like water and CSDs. However, specialized segments require different polymers; for instance, High-Density Polyethylene (HDPE) is crucial for opaque dairy applications due to its excellent moisture barrier properties and chemical resistance. Understanding the interplay between these segments is vital for suppliers optimizing their product portfolio to align with global sustainability directives and consumer functional needs.

- By Type: Polyethylene Terephthalate (PET), High-Density Polyethylene (HDPE), Polypropylene (PP), Low-Density Polyethylene (LDPE), Polylactic Acid (PLA) and Others (e.g., PVC, PEN).

- By Application: Water (Packaged Drinking Water, Sparkling Water), Carbonated Soft Drinks (CSD), Juices & Smoothies, Dairy Beverages (Milk, Yogurt Drinks), Sports & Energy Drinks, Alcoholic Beverages (Ready-to-Drink cocktails, Beer).

- By Capacity: 0–500 ml (Single Serve), 501–1000 ml (Standard), Above 1000 ml (Family/Bulk Packs).

- By Color: Transparent/Clear, Colored (Blue, Green, Amber, Opaque).

Value Chain Analysis For Beverage Plastic Bottle Market

The value chain for the Beverage Plastic Bottle Market begins upstream with the petrochemical industry, supplying key raw materials such as Purified Terephthalic Acid (PTA) and Monoethylene Glycol (MEG) for PET production, or ethylene/propylene for polyolefin production (HDPE, PP). Suppliers of these feedstocks, often large chemical and oil companies, exert significant influence over raw material costs, which constitute a major component of the final bottle price. Midstream activities involve resin polymerization, followed by the actual bottle conversion process—either through integrated operations (major beverage companies producing their own bottles) or specialized contract packaging companies using techniques like injection molding and blow molding. The shift towards PCR adoption introduces a critical new upstream component: Material Recovery Facilities (MRFs) and specialized recyclers (mechanical and chemical), which supply the crucial secondary raw material.

Downstream analysis focuses on the distribution and end-user consumption. Beverage manufacturers (Coca-Cola, PepsiCo, Nestle, etc.) are the primary buyers, demanding extremely high quality and compliance with food safety standards. Distribution channels are varied, including direct sales from bottlers to large retail chains, wholesalers, and e-commerce platforms. The efficiency of the packaging supply chain is paramount, as bottle weight directly impacts logistics costs, favoring lightweight solutions. Bottlers often rely on specialized machinery providers for high-speed filling, capping, and labeling equipment, forming an essential auxiliary service segment.

The interplay between direct and indirect distribution channels is complex. Large, multinational beverage corporations often have long-term direct procurement contracts with major plastic packaging manufacturers like Amcor or ALPLA, ensuring stable supply and facilitating collaborative design efforts focused on sustainability goals. Indirect channels, involving third-party distributors and contract packagers, cater mainly to smaller regional brands or specialized product launches. The growing influence of Extended Producer Responsibility (EPR) schemes effectively extends the value chain to include post-consumer collection and recycling infrastructure management, holding producers accountable for the end-of-life management of their packaging.

Beverage Plastic Bottle Market Potential Customers

The primary consumers and buyers in the Beverage Plastic Bottle Market are large-scale bottling operations and beverage brand owners across multiple distinct product categories. These entities require robust, food-safe, and high-performance packaging solutions delivered reliably and consistently at scale. Customers prioritize factors such as barrier performance (crucial for CSDs and sensitive juices), thermal stability (for hot-fill products), compliance with global food contact regulations, and, increasingly, demonstrable progress on circularity metrics, demanding verifiable PCR content and easy-to-recycle designs. The purchasing decisions are often highly centralized and driven by global procurement strategies aimed at standardizing packaging formats across diverse geographies.

The largest customer segment is the packaged water industry, which requires massive volumes of lightweight, cost-effective PET bottles, often focusing on high-volume, low-margin operations where slight material reductions yield significant cost savings. The second major segment comprises the Carbonated Soft Drink (CSD) and flavored beverage manufacturers, which require packaging capable of withstanding internal pressure and maintaining CO2 retention over long shelf lives. These customers often demand specialized multi-layer bottles or highly engineered single-layer PET with enhanced barrier properties to protect flavor and carbonation.

Emerging and high-growth potential customers include manufacturers of functional beverages, nutritional supplements, and specialized dairy drinks. These products often have unique requirements, such as UV protection, aseptic filling capability, or specific opacity levels, driving demand for materials like HDPE or specialized PET formulations. Furthermore, the burgeoning demand for environmentally responsible packaging means that bottle manufacturers who can reliably supply high-quality, traceable 100% rPET (recycled PET) bottles have a significant competitive advantage and preferential status with major global brands aiming to meet sustainability commitments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 98.5 billion |

| Market Forecast in 2033 | USD 136.0 billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amcor plc, ALPLA Werke Alwin Lehner GmbH & Co KG, Berry Global Inc., Graham Packaging Company, Plastipak Holdings Inc., RPC Group (Berry Global), Silgan Holdings Inc., Resilux NV, Sonoco Products Company, Greiner Packaging International GmbH, CKS Packaging Inc., Alpha Packaging (Pretium), Apex Plastics, Constantia Flexibles GmbH, DAIWA CAN COMPANY, Krones AG, Sidel (Tetra Laval), Nampak Ltd., PET Power, KW Plastics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Beverage Plastic Bottle Market Key Technology Landscape

The technology landscape for the Beverage Plastic Bottle market is dominated by advancements in materials engineering, processing efficiency, and circular economy infrastructure. Injection stretch blow molding (ISBM) remains the foundational technology for high-volume PET production, but innovation is centered on optimizing preform design and mold precision to achieve extreme lightweighting without compromising the top-load strength required for efficient pallet stacking. Hot-fill technology, used for non-carbonated juices and teas requiring pasteurization, utilizes heat-set PET resins engineered to withstand temperatures up to 85°C, ensuring the bottle maintains its structure post-filling and cooling. These process innovations are critical for reducing material input and energy consumption per unit.

Barrier technology represents a significant area of research and development, particularly for sensitive beverages like craft beer, fortified juices, or long shelf-life CSDs. Technologies include passive barrier systems, such as multi-layer structures incorporating Nylon (PA) or Ethylene Vinyl Alcohol (EVOH) to restrict oxygen ingress, and active barrier systems, where oxygen scavengers are incorporated into the resin or cap lining to absorb residual oxygen. Plasma-enhanced chemical vapor deposition (PECVD) is gaining traction, depositing ultra-thin, amorphous carbon layers on the inner surface of the bottle, offering superior barrier performance while maintaining full recyclability, contrasting with some complex multi-layer solutions.

The most transformative technological shift lies in recycling and feedstock generation. Mechanical recycling processes are being enhanced with super-cleaning and decontamination technologies to produce food-grade rPET pellets that meet stringent regulatory standards (e.g., FDA and EFSA approval). Simultaneously, chemical recycling (depolymerization) technologies—including glycolysis, methanolysis, and pyrolysis—are maturing. These processes break down waste plastic into its original monomers, which can then be repolymerized into virgin-quality plastic. Chemical recycling is essential for handling complex or contaminated plastic waste that mechanical processes cannot manage, unlocking a truly infinite loop for beverage plastic bottles and securing a long-term supply of high-purity recycled content for brand owners.

Regional Highlights

Regional dynamics are critical drivers of the Beverage Plastic Bottle Market, reflecting diverse consumption habits, economic growth rates, and, most importantly, vastly different regulatory environments regarding plastic use and recycling.

- North America: Characterized by high consumer spending on convenience and functional beverages. The market is mature, with growth driven primarily by lightweighting innovations and the aggressive integration of PCR content, driven by commitments from major CPG (Consumer Packaged Goods) firms. California and other states are pioneering stringent PCR mandates, setting a trend for the rest of the continent. Significant investment is directed towards enhancing regional rPET supply chains to meet impending regulatory and voluntary demand.

- Europe: The global leader in regulatory enforcement and circular economy initiatives, exemplified by the EU Single-Use Plastics Directive, which mandates specific minimum PCR content in beverage bottles and the implementation of tethered caps. Growth is steady but highly constrained by environmental policies. The focus here is less on volume expansion and more on achieving bottle-to-bottle circularity and the widespread rollout of highly efficient Deposit Return Schemes (DRS).

- Asia Pacific (APAC): Represents the largest market share and the highest growth potential, fueled by massive population bases, rising disposable incomes, and critical need for safe packaged drinking water. Rapid urbanization in countries like India, China, and Indonesia drives volume expansion. While adoption of advanced recycling is uneven, countries like Japan and South Korea lead in recycling infrastructure and high-quality plastics recovery, while developing nations face substantial challenges in waste collection management.

- Latin America: Exhibits strong demand, particularly in Brazil and Mexico, for CSDs and bottled water. The market is price-sensitive, making lightweighting technology crucial. Regulatory frameworks are gradually strengthening, often influenced by European standards, focusing on collection rates and local recycling capacity building. Refillable plastic bottle systems remain culturally and economically significant in this region.

- Middle East and Africa (MEA): Growth is significant, particularly in bottled water due to arid climates and limited potable tap water access. The market infrastructure is rapidly developing, heavily reliant on imported resin and technology. Sustainability focus is emerging, often spearheaded by large international brand operators, but widespread waste management infrastructure development is still in nascent stages.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Beverage Plastic Bottle Market.- Amcor plc

- ALPLA Werke Alwin Lehner GmbH & Co KG

- Berry Global Inc.

- Graham Packaging Company

- Plastipak Holdings Inc.

- RPC Group (now part of Berry Global)

- Silgan Holdings Inc.

- Resilux NV

- Sonoco Products Company

- Greiner Packaging International GmbH

- CKS Packaging Inc.

- Alpha Packaging (Pretium Packaging)

- Apex Plastics

- Constantia Flexibles GmbH

- DAIWA CAN COMPANY

- Krones AG (KHS, Sidel, etc., machinery providers with captive packaging operations)

- Sidel (A member of Tetra Laval Group)

- Nampak Ltd.

- PET Power

- KW Plastics (Leading Recycler and Resin Supplier)

Frequently Asked Questions

Analyze common user questions about the Beverage Plastic Bottle market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of growth in the Beverage Plastic Bottle Market?

The central driver is the consistently escalating global consumption of packaged drinking water, especially in emerging economies and urbanized areas where access to reliable public tap water is limited or consumer preference favors bottled convenience. Additionally, the lightweight nature of PET reduces logistics costs significantly.

How are environmental regulations impacting the material composition of plastic bottles?

Environmental regulations, particularly in Europe and North America, are mandating a shift towards a circular economy by setting minimum thresholds for Post-Consumer Recycled (PCR) content in new bottles. This necessitates significant investment in advanced recycling technologies and favors single-material designs (like clear PET) that are easily recoverable.

Which plastic material dominates the beverage packaging market and why?

Polyethylene Terephthalate (PET) overwhelmingly dominates the market. This is due to its superior clarity, excellent barrier properties against carbonation loss, high tensile strength, and established, widespread recyclability infrastructure, making it the preferred choice for water and carbonated soft drinks (CSDs).

What role does chemical recycling play in the future of the market?

Chemical recycling (depolymerization) is crucial for the market's sustainability future, as it enables the conversion of contaminated or complex plastic waste into virgin-quality monomers. This process ensures a high-purity, food-grade recycled material supply (rPET) necessary for brand owners to meet their high PCR content targets, surpassing the limitations of mechanical recycling.

How is lightweighting technology affecting bottle design and performance?

Lightweighting involves reducing the total amount of polymer resin used per bottle, often achieved through sophisticated Injection Stretch Blow Molding (ISBM) optimization and material distribution analysis. While reducing material cost and carbon footprint, continuous technological refinement ensures the bottles maintain required structural integrity, barrier properties, and stability for high-speed filling lines.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager