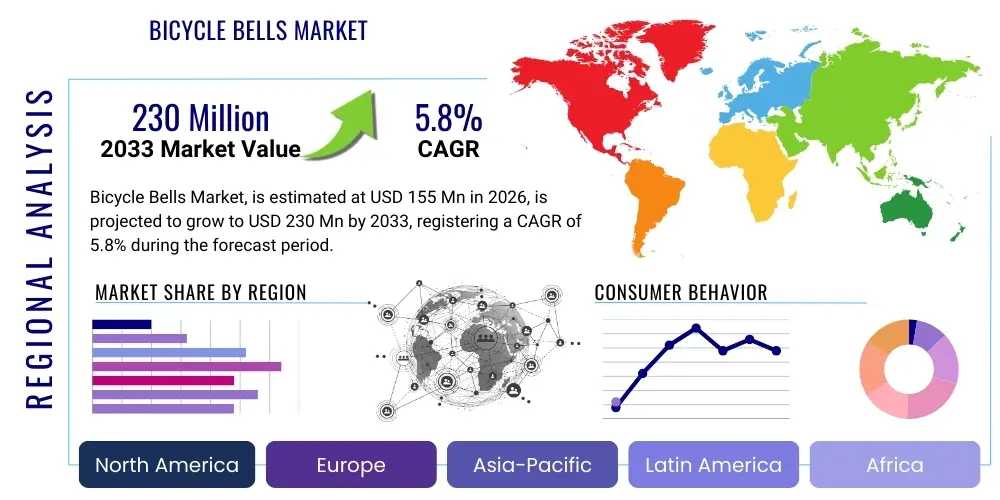

Bicycle Bells Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439004 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Bicycle Bells Market Size

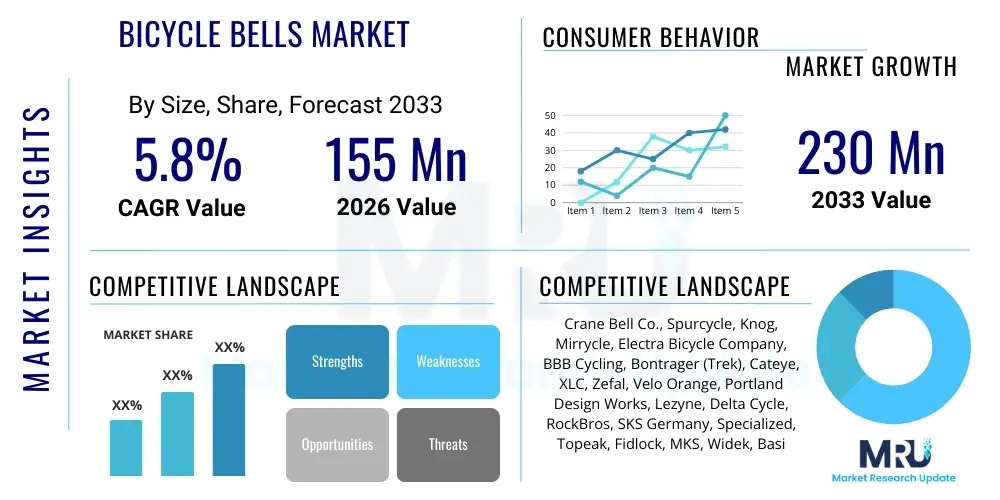

The Bicycle Bells Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $155 Million in 2026 and is projected to reach $230 Million by the end of the forecast period in 2033. This growth trajectory is primarily fueled by increasing global interest in cycling as a recreational activity and a sustainable mode of transport, coupled with stringent regulatory mandates concerning cyclist safety in urban environments worldwide. The steady increase in e-bike adoption also contributes significantly, as these vehicles necessitate reliable and compliant warning systems.

Bicycle Bells Market introduction

The Bicycle Bells Market encompasses the manufacturing, distribution, and sale of signaling devices designed to warn pedestrians and other road users of a cyclist’s presence. These products range from traditional mechanical dome bells to advanced electronic horns and integrated stealth solutions. The primary application of bicycle bells is enhancing road safety, making them a mandatory accessory in many developed regions. Key benefits include collision prevention, regulatory compliance, and improved urban mobility flow. The market is fundamentally driven by a global surge in cycling participation, government initiatives promoting bicycle infrastructure, and persistent consumer demand for aesthetic and high-performance safety accessories that integrate seamlessly with modern bicycle designs. Furthermore, technological advancements have led to innovations in materials and sound projection, continuously elevating product quality and functionality.

Bicycle Bells Market Executive Summary

The Bicycle Bells Market is characterized by stable demand driven by mandatory safety regulations and high consumer interest in cycling. Key business trends indicate a shift towards premium, minimalist, and aesthetically integrated bells, particularly those made from durable materials like brass and aluminum, favored by the enthusiast segment. Manufacturers are also focusing on silent mechanisms and corrosion resistance to improve product longevity. Regionally, Europe and North America dominate due to high cycling penetration rates and mature regulatory frameworks, while Asia Pacific exhibits the fastest growth, propelled by rapid urbanization and the proliferation of shared bicycle schemes, necessitating millions of reliable safety devices. Segment trends highlight the growing importance of the E-Bike segment, which requires louder and more robust signaling devices capable of cutting through traffic noise at higher speeds. Distribution channels are diversifying, with specialized cycling e-commerce platforms gaining significant market share over traditional bike shops, offering consumers a wider variety of niche and international brands.

AI Impact Analysis on Bicycle Bells Market

Users frequently inquire about the integration of smart technology and artificial intelligence into conventional cycling accessories. Common questions revolve around whether AI could enable proactive safety alerts, automatic volume adjustment based on ambient noise, or collision prediction features integrated into signaling systems. Users are concerned about the necessity of maintaining traditional mechanical bells versus adopting complex electronic systems that rely on battery power and software updates. The key expectations center on AI-driven systems providing context-aware signaling, meaning the bell or warning system would only activate or increase volume automatically when a pedestrian or vehicle is detected in close proximity, minimizing unnecessary noise pollution and maximizing safety effectiveness. The analysis indicates user demand for subtle, non-intrusive AI that enhances safety without over-complicating the simple mechanical nature of the bicycle bell.

- AI integration in smart bells for context-aware volume control based on ambient urban noise levels, ensuring optimal audibility.

- Use of machine learning algorithms to analyze cycling routes and suggest optimal bell sound profiles or signaling patterns for specific environments (e.g., park trails vs. busy intersections).

- Predictive maintenance alerts for electronic bell systems, notifying users when battery levels are critical or mechanical components require adjustment.

- Development of integrated safety systems utilizing AI-powered proximity sensors to trigger a warning chime automatically when collision risk is high, moving beyond manual operation.

- AI tools assisting manufacturers in optimizing acoustic design and material selection to achieve required decibel levels efficiently while minimizing material waste.

While the bicycle bell remains fundamentally a low-tech accessory, AI’s primary impact will be felt in adjacent smart cycling ecosystems. Manufacturers are exploring incorporating micro-AI elements into electronic horns, primarily for power management and adaptive sound output. This ensures that electronic bells maintain compliance with noise regulations while providing effective warnings when necessary, adapting sound frequencies to penetrate specific acoustic environments. The goal is to move beyond a simple on/off mechanism to a sophisticated system that analyzes environmental inputs (speed, ambient noise, traffic density) to modulate the warning signal autonomously.

However, the cost barrier associated with integrating complex AI hardware into a mass-market, inexpensive component remains a significant constraint. Therefore, AI application is expected to be concentrated in the premium and high-end E-bike accessory segments initially. This integration supports the broader trend of connected mobility, where all cycle components contribute data for safety enhancement. The future may see AI determining the most effective warning signal—a traditional bell sound, a high-frequency chirp, or a verbal warning—based on real-time data analysis of the impending hazard, ensuring maximum efficacy and minimal disturbance to non-involved parties.

DRO & Impact Forces Of Bicycle Bells Market

The Bicycle Bells Market is primarily driven by rigorous safety legislation making bells mandatory equipment, coupled with a booming global cycling culture, particularly in urban centers where cycling commutes are increasing. Restraints include the market saturation of basic models, price sensitivity among budget consumers, and the availability of alternative warning devices like whistles or verbal shouts, though these are often non-compliant. Opportunities lie in developing integrated electronic safety systems, advanced material bells offering superior acoustics, and targeting the rapidly growing e-bike sector with specialized, high-decibel products. Impact forces, such as government policy changes and fluctuating raw material costs (especially brass and aluminum), significantly influence market dynamics, particularly affecting pricing and market entry for new product innovations.

The principal driver is the regulatory environment. In numerous countries across Europe, North America, and parts of Asia, possessing a functional bicycle bell is a legal requirement for road use. Enforcement of these laws ensures a constant baseline demand for replacement and new installation units. Additionally, the proliferation of bike-sharing programs globally mandates that every shared bicycle is equipped with compliant safety features, creating substantial, recurring bulk orders for manufacturers. This legislative backing provides stability to the market that is less susceptible to discretionary consumer spending patterns. Furthermore, the societal shift towards sustainable and active transportation modes inherently boosts the demand for all cycling accessories, including bells.

Conversely, market growth is restrained by the low barriers to entry for basic product manufacturing, leading to intense price competition, particularly from generic Asian manufacturers flooding the market with low-cost plastic models. This commoditization pressures profit margins for established, quality-focused brands. Another restraint is the consumer preference among niche cycling groups, such as competitive road cyclists, who often view bells as unnecessary weight or aesthetic impediments and may illegally remove them or opt for extremely subtle, minimalist alternatives that offer lower functionality. Overcoming these restraints requires continuous innovation, focusing on superior acoustic performance and integrating bells seamlessly into the bicycle frame or handlebar design to appeal to performance-oriented users.

Significant opportunities exist in capitalizing on the premiumization trend. Consumers are increasingly willing to pay a premium for high-quality, durable, and uniquely designed brass or aluminum bells that function as aesthetic components rather than mere safety requirements. The integration of technology, such as electronic bells with rechargeable batteries and multiple sound modes, represents a high-growth segment, specifically for e-bikes which require louder, electronically generated sounds to overcome motor noise and high road speeds. Analyzing the impact forces reveals that global trade policies affecting the sourcing of metals and plastics directly influence manufacturing costs, while successful public health campaigns promoting cycling act as a major positive external force driving inherent market expansion.

Segmentation Analysis

The Bicycle Bells Market is highly diverse and segmented primarily based on product type, material composition, distribution channel, and application. Product segmentation separates the market into traditional mechanical bells, which remain the foundation of the industry, and modern electronic horns, which offer higher decibel outputs suitable for high-speed or noisy urban environments. Material analysis distinguishes between premium segments (brass, aluminum) offering superior acoustics and aesthetics, and volume segments (plastic, steel) focused on affordability and compliance. Understanding these segments is crucial for manufacturers to tailor their marketing and product development efforts toward specific consumer cohorts, ranging from daily commuters demanding reliability to recreational riders seeking design excellence.

- By Type:

- Traditional Dome Bells (Mechanical/Spring-loaded)

- Stealth/Minimalist Bells (Integrated, usually small diameter)

- Electronic Bells/Horns (Battery-powered, high decibel)

- Air Horns/Bulb Horns (Classic novelty or high-volume warning)

- By Material:

- Brass (Premium, resonant sound)

- Aluminum (Durable, mid-range)

- Steel (Standard, economical)

- Plastic/Polycarbonate (Lightweight, low-cost)

- By Distribution Channel:

- Online Retail (E-commerce platforms, brand websites)

- Offline Retail (Specialty Bicycle Stores, Department Stores, Mass Merchandisers)

- Original Equipment Manufacturers (OEM)

- By Application/End-User:

- Urban/Commuter Bicycles

- Mountain Bicycles (MTB)

- Road Bicycles (Focus on lightweight and stealth)

- E-Bikes (Need for louder signals)

- Kids Bicycles

The segment analysis highlights distinct price points and quality expectations across categories. Traditional dome bells, typically made of steel or aluminum, constitute the largest volume segment, driven largely by OEM integration on standard bicycles and mass-market replacement purchases. However, the brass segment, epitomized by premium brands, commands the highest average selling price (ASP), capitalizing on the desire for superior acoustics—often described as a deeper, more pleasant 'ring'—and craftsmanship longevity. The integration segment, where bells are built into the handlebars or stem, addresses the aesthetic concerns of high-performance cyclists, positioning functionality without visual clutter as a key differentiator.

Geographically, material preference varies significantly; for instance, European commuters often prefer high-quality brass or sophisticated aluminum designs that reflect the bicycle’s overall premium build, while developing Asian markets prioritize volume and affordability, boosting the demand for plastic and standard steel options. The rise of e-bikes globally presents a distinct segmentation challenge and opportunity: these users require bells that are rated higher in decibel output (often 100 dB or more) to effectively warn pedestrians when traveling at speeds up to 28 mph, leading to a specialized sub-segment dominated by electronic horns that can meet these safety standards efficiently. This ongoing diversification underscores the market's maturity and its responsiveness to regulatory shifts and evolving consumer demands.

Value Chain Analysis For Bicycle Bells Market

The value chain for the Bicycle Bells Market is relatively streamlined but involves complex interactions between raw material suppliers, specialized component manufacturers, assembly plants, and diverse distribution networks. Upstream activities are dominated by sourcing metals (brass, aluminum, steel) and high-grade plastics. Midstream involves precision stamping, casting, and acoustic tuning, which are crucial for achieving regulatory compliance regarding sound output and quality. Downstream activities focus heavily on efficient distribution, integrating both OEM sales (direct supply to bicycle assemblers) and aftermarket sales (via retail channels). The successful navigation of this chain depends on maintaining stable supply agreements for specialized acoustic metals and optimizing logistics for high-volume, low-cost goods.

Upstream analysis involves securing high-quality raw materials. For premium bells, the consistency and purity of brass alloys are paramount, as these properties directly influence the bell's resonance and tone. Manufacturers must maintain robust relationships with specialized metal foundries and plastic injection molding companies. Given that many bell components are small and require precision engineering (such as internal strikers and springs), reliability in component manufacturing is non-negotiable. A significant trend in the upstream market is the push towards sustainable and recycled materials, driven by European regulations and consumer preference for eco-friendly accessories, adding complexity to sourcing and material specification.

Downstream analysis highlights the critical role of distribution channels. OEM sales form a cornerstone, as leading bicycle brands integrate bells directly at the factory, securing guaranteed sales volumes. Aftermarket sales are handled through both direct (online brand stores) and indirect channels (third-party e-commerce giants and physical retailers). Specialty bicycle stores serve as critical influencers, promoting premium and technically advanced bells, while department stores and mass merchandisers handle high-volume, low-cost units. The globalization of e-commerce has significantly boosted indirect channels, allowing smaller, niche bell makers (like craft brass bell companies) to reach global audiences without massive physical distribution overhead, thereby flattening traditional retail hierarchies.

Bicycle Bells Market Potential Customers

The primary customers for bicycle bells are broadly categorized into Original Equipment Manufacturers (OEMs), who constitute the largest volume segment by integrating bells into new bicycle builds, and aftermarket consumers. Aftermarket consumers can be further segmented into daily commuters, who prioritize reliability and regulatory compliance; cycling enthusiasts, who demand aesthetic appeal and superior acoustic performance (often favoring premium brass or invisible designs); and E-bike riders, who specifically require high-decibel electronic signaling devices due to faster speeds and noisier operation. Institutional buyers, such as municipal bike-share schemes and rental companies, represent another significant, high-volume customer group requiring robust, tamper-resistant bells.

The OEM segment represents consistent demand driven by production volumes of new bicycles globally. These customers require suppliers who can meet strict quality standards, provide competitive bulk pricing, and maintain just-in-time delivery schedules. Manufacturers targeting the OEM market must offer a wide range of mounting solutions compatible with diverse bicycle designs and often need to comply with specific regional safety standards simultaneously. The negotiation power of large OEMs is substantial, forcing bell manufacturers to continuously optimize production efficiency and supply chain management to maintain profitability in high-volume contracts.

Retail consumers are becoming increasingly sophisticated. The modern commuter views the bicycle bell not just as a safety device but as a personal accessory. This demographic drives demand for personalized colors, unique finishes, and innovative mounting systems that integrate seamlessly with modern, minimalist bicycle aesthetics. The E-bike buyer, a rapidly growing customer base, specifically seeks out products that address the unique challenges of electric cycling. These customers often possess a higher disposable income and are less price-sensitive than the average user, preferring durability and technological sophistication over sheer cost savings, thereby boosting the high-end electronic bell sub-segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $155 Million |

| Market Forecast in 2033 | $230 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Crane Bell Co., Spurcycle, Knog, Mirrycle, Electra Bicycle Company, BBB Cycling, Bontrager (Trek), Cateye, XLC, Zefal, Velo Orange, Portland Design Works, Lezyne, Delta Cycle, RockBros, SKS Germany, Specialized, Topeak, Fidlock, MKS, Widek, Basil, Velo-Sound, Oi Bells, Palomar. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bicycle Bells Market Key Technology Landscape

The technology landscape in the Bicycle Bells Market, though seemingly simple, involves sophisticated material science and acoustic engineering. Key technologies focus on optimizing sound output (decibel levels and tone frequency) to meet safety requirements while ensuring product longevity and aesthetic integration. Modern advancements include the use of resonant metals like hardened brass alloys to produce rich, long-sustaining sounds, differentiating premium products. Furthermore, the development of internal mechanical mechanisms, such as frictionless strikers and magnetic activation systems, minimizes wear and improves the reliability of the traditional dome bell structure. For electronic bells, the technology involves highly efficient piezoelectric speakers, micro-batteries, and weatherproof housing materials to withstand harsh outdoor cycling conditions.

A significant technological focus is on miniaturization and stealth design. Brands are utilizing advanced manufacturing techniques, such as precision CNC machining and proprietary mounting systems, to create bells that wrap around the handlebar or integrate entirely into the bike’s components, minimizing visual clutter. This shift is crucial for attracting the performance road cycling demographic. In electronic systems, the integration of Bluetooth Low Energy (BLE) technology allows for linking the bell to smartphone apps, enabling features like sound customization, remote activation, or geo-fencing volume limitations to comply with local noise ordinances. The continued refinement of durable, lightweight, and corrosion-resistant materials, particularly in the activation mechanisms, is central to maintaining product quality across all price points.

Material innovation remains a core technological pillar. The acoustic performance of a bell is directly linked to the material composition, dome shape, and wall thickness. Engineers employ finite element analysis (FEA) to simulate sound waves and optimize material usage, ensuring the bell produces a pitch that cuts through urban noise effectively without sounding abrasive. For high-end electronic bells used on E-bikes, the technology extends to complex circuit boards designed for low power consumption and high output volume (often exceeding 110 dB). These systems must also incorporate robust ingress protection (IP ratings) against water and dust, confirming their functional reliability under all-weather commuting conditions, thereby justifying their higher price point and technological complexity over traditional mechanical alternatives.

Regional Highlights

- Europe: Europe is the dominant market for bicycle bells, driven by mature cycling infrastructure, high regulatory compliance rates, and strong consumer preference for cycling as a primary mode of transportation in countries like the Netherlands, Germany, and Denmark. Mandatory safety laws ensure consistent demand. The European market also leads in the adoption of premium and aesthetically integrated bell designs, favoring high-quality brass and minimalist aluminum products over low-cost plastic variants.

- North America: This region exhibits stable growth, fueled by increasing investment in urban cycling paths and the rapid expansion of bike-share programs in major metropolitan areas. While regulations vary by state and municipality, the overall trend toward improved cyclist safety drives demand. The US market is characterized by high demand for recreational cycling accessories, leading to a strong presence of both traditional decorative bells and modern electronic systems, particularly tailored for the expanding e-mountain biking segment.

- Asia Pacific (APAC): APAC is the fastest-growing region, primarily due to immense volume demand from emerging economies and the massive deployment of shared mobility services (bike sharing). China and India represent significant markets where affordability often dictates purchasing decisions, driving the bulk demand for standard, low-cost steel and plastic bells (OEM segment). However, developed APAC economies like Japan and Australia show increasing uptake of high-end, safety-focused electronic bells, reflecting rising disposable incomes and stricter enforcement of cycling laws.

- Latin America: This region presents emerging opportunities, linked to urbanization and government initiatives promoting cycling to alleviate traffic congestion in major cities like Bogotá and Mexico City. Market penetration is steadily increasing, though consumer focus remains primarily on basic, compliant, and durable low-cost models. The emphasis is less on aesthetic design and more on foundational safety and function.

- Middle East and Africa (MEA): The MEA market is currently nascent, with growth concentrated in urban centers adopting leisure cycling or limited commuter cycling. Demand is low relative to global figures but is growing, especially in the UAE and Saudi Arabia, driven by high-end consumer spending on leisure accessories and recreational infrastructure development. Safety compliance remains crucial for imports into this region.

The European market sets the global benchmark for quality and design innovation in the bicycle bells sector. Regulatory bodies like the European Committee for Standardization (CEN) often influence product specifications, pushing manufacturers to ensure acoustic consistency and durability. The strong cycling culture, combined with high environmental consciousness, means European consumers are highly receptive to products made from sustainably sourced or recycled materials. This dynamic fosters a highly competitive environment focused on technical superiority and aesthetic integration, moving the market away from simple novelty items towards sophisticated safety engineering solutions.

In contrast, the APAC market's growth is fundamentally volumetric. The scale of bicycle manufacturing and consumer base in countries like China means that even small per-unit sales translate into massive overall market volumes. Manufacturers operating here must focus on extreme cost efficiency, streamlined manufacturing processes, and compliance with local, often divergent, standards. While the overall ASP is lower than in the West, the sheer demand provides lucrative opportunities for bulk suppliers. Furthermore, the rapid adoption of high-speed scooters and E-mobility solutions in major Asian cities is driving a sharp, localized demand spike for specialized, high-intensity electronic horns capable of providing effective warnings in densely populated, noisy environments.

North America sits between the aesthetic demands of Europe and the volume dynamics of APAC. The US market, in particular, demonstrates dual consumption patterns: a demand for high-performance, subtle safety gear favored by affluent recreational cyclists, and a substantial requirement for basic, compliant bells integrated into city and children's bikes. The key regional differentiator in North America is the strong brand loyalty enjoyed by established bicycle accessory companies, necessitating heavy investment in marketing and retail partnerships to secure shelf space and consumer trust. The regional market outlook remains positive, underpinned by continuous infrastructure development and the mainstreaming of cycling as a health and wellness activity across diverse demographics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bicycle Bells Market.- Crane Bell Co.

- Spurcycle

- Knog

- Mirrycle

- Electra Bicycle Company

- BBB Cycling

- Bontrager (Trek)

- Cateye

- XLC

- Zefal

- Velo Orange

- Portland Design Works

- Lezyne

- Delta Cycle

- RockBros

- SKS Germany

- Specialized

- Topeak

- Fidlock

- MKS

- Widek

- Basil

- Velo-Sound

- Oi Bells

- Palomar

Frequently Asked Questions

Analyze common user questions about the Bicycle Bells market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key drivers for the growth of the Bicycle Bells Market?

The market is primarily driven by mandatory government safety regulations requiring bells on all bicycles, coupled with the rapid global increase in cycling participation, particularly in dense urban environments, necessitating reliable collision avoidance devices for cyclists and pedestrians.

How does the rise of E-bikes impact the demand for bicycle bells?

E-bikes significantly boost demand for specialized, high-decibel electronic horns. Because E-bikes travel faster and generate internal motor noise, standard mechanical bells are often inadequate. This shift drives growth in the premium electronic safety accessory segment.

Which materials are most popular in the premium bicycle bell segment?

Premium segments favor high-quality brass and precision-machined aluminum. Brass is highly valued for its superior acoustic resonance and rich, long-sustaining tone, while aluminum provides durability, lighter weight, and flexibility for minimalist, aesthetic designs.

What role does aesthetic integration play in modern bicycle bell design?

Aesthetic integration is crucial for attracting performance and enthusiast segments. Modern designs prioritize stealth, miniaturization, and seamless mounting—often integrating the bell discretely into handlebars or stems—to minimize visual impact while maintaining full functionality and regulatory compliance.

Is there a technological shift toward smart or electronic bells?

Yes, while mechanical bells dominate volume, there is a clear shift towards electronic systems, especially for high-speed E-bikes. These systems incorporate weatherproofing, rechargeable batteries, and high-output speakers to provide context-aware, effective warning signals exceeding the capabilities of traditional mechanical devices.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager