Bicycle Brakes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432129 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Bicycle Brakes Market Size

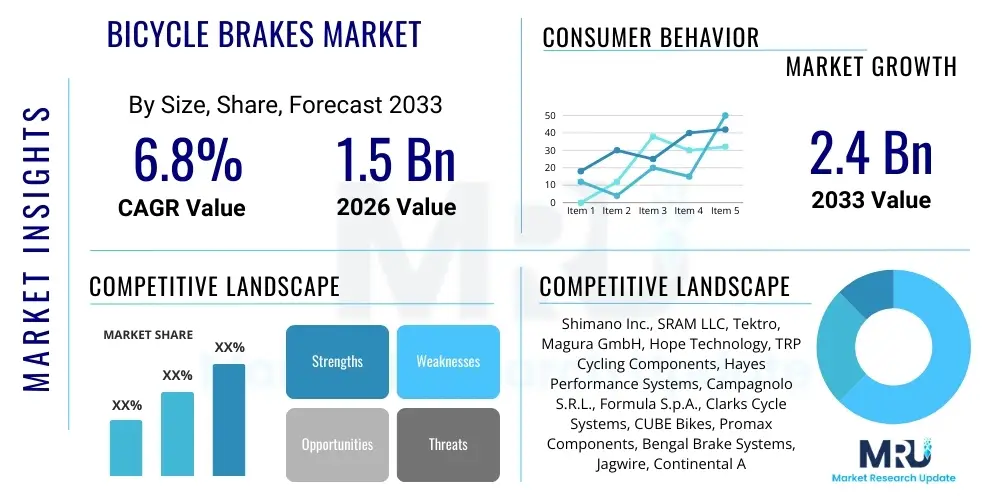

The Bicycle Brakes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.4 Billion by the end of the forecast period in 2033.

Bicycle Brakes Market introduction

The Bicycle Brakes Market encompasses all components and systems designed to slow down or stop bicycles, ranging from traditional rim brakes (caliper and V-brakes) to advanced hydraulic and mechanical disc brake systems. The primary product segments include disc brakes (hydraulic and mechanical), and rim brakes, further segmented by application in road cycling, mountain biking (MTB), urban/commuter bikes, and electric bicycles (e-bikes). These systems are crucial for rider safety and performance, especially as cycling speeds and bicycle weights (due to e-bike battery integration) increase. The shift towards disc brake adoption across all cycling disciplines, driven by superior stopping power, consistency in wet conditions, and reduced hand fatigue, stands as the most significant technological development shaping this market currently.

Major applications of modern braking systems extend beyond traditional recreational use; they are integral to competitive racing, professional delivery services utilizing cargo bikes, and the rapidly expanding urban micromobility sector. The key benefits of high-quality braking systems include enhanced modulation, shorter stopping distances, improved durability, and reduced maintenance frequency, particularly with sealed hydraulic systems. Driving factors for market growth include increasing governmental initiatives promoting cycling infrastructure, rising consumer awareness regarding bicycle safety, the proliferation of e-bikes which require higher braking force due to their increased speed and mass, and continuous technological advancements in brake rotor and pad materials that boost overall system efficiency and thermal management.

The global regulatory environment, particularly the introduction of stricter safety standards in regions like Europe and North America concerning e-bike components, further mandates the use of reliable and powerful braking mechanisms. Manufacturers are focusing heavily on integrating lightweight materials such as carbon fiber and advanced aluminum alloys, alongside developing semi-metallic and ceramic brake pads, to optimize performance characteristics while minimizing weight. Furthermore, the trend toward gravel biking and adventure cycling necessitates braking components capable of handling prolonged stress and extreme environmental conditions, pushing the envelope for durability and heat dissipation technologies within the scope of the Bicycle Brakes Market.

Bicycle Brakes Market Executive Summary

The Bicycle Brakes Market is characterized by a definitive trend towards hydraulic disc brake dominance, displacing traditional rim brakes across nearly all mid-to-high-end segments, including entry-level e-bikes and performance road bikes. Business trends highlight consolidation among key component suppliers who are investing heavily in automation and precision manufacturing to meet the high-tolerance requirements of hydraulic systems, particularly the caliper and master cylinder assemblies. There is a strong emphasis on OEM partnerships, driven by major bicycle assemblers requiring integrated groupset solutions that guarantee performance synergy and easier assembly processes. Supply chain resilience is a growing focus point, catalyzed by recent global disruptions, leading companies to diversify sourcing and increase regional manufacturing capabilities to ensure a steady supply of crucial components like brake fluids, tubing, and complex forged parts.

Regionally, Asia Pacific (APAC) stands as the fastest-growing market, fuelled by massive e-bike production and adoption in China and Southeast Asia, coupled with rising disposable incomes supporting premium bicycle purchases in countries like Japan and South Korea. Europe maintains its position as a mature but highly innovative market, driven by stringent European Union safety regulations (e.g., EN 15194 for e-bikes) and a robust consumer base demanding superior performance, especially in Germany and the Netherlands where cycling is deeply entrenched in daily commute life. North America shows significant growth, particularly in the aftermarket segment, propelled by the popularity of high-end mountain biking and gravel cycling, necessitating frequent upgrades to specialized braking components that handle extreme conditions and diverse terrain challenges.

Segment trends reveal that the Hydraulic Disc Brake segment will maintain the highest growth rate due to its intrinsic performance advantages and increasing cost-efficiency in mass production. Within the application segments, e-bikes are the primary revenue driver, requiring specialized rotors (often larger, 180mm minimum) and more robust calipers to manage higher kinetic energy. The OEM channel dominates market volume, but the Aftermarket segment remains critical for performance-focused innovations and margin growth, catering to enthusiasts who seek iterative improvements in brake feel, modulation, and weight reduction. Material science trends indicate an increased use of advanced composite materials for levers and bodies to reduce weight while maintaining strength and thermal stability across all major segments.

AI Impact Analysis on Bicycle Brakes Market

Common user questions regarding AI's impact on bicycle brakes revolve primarily around enhanced safety features, predictive maintenance capabilities, and optimized manufacturing processes. Users often inquire whether AI can lead to "smart braking systems" that automatically adjust pressure based on real-time road conditions, rider input analysis, and proximity sensors, effectively reducing accident risk, especially in high-speed or challenging terrains. Another key theme is the expectation that AI and machine learning (ML) will revolutionize quality control and design—specifically, optimizing brake component geometry for better heat dissipation or predicting fatigue life based on simulated usage data. There is also interest in AI-driven inventory management and personalized component selection for consumers, ensuring that the best brake system configuration is matched precisely to the cyclist’s specific riding style and environmental needs.

- AI-driven Predictive Maintenance: Algorithms analyze brake wear patterns (pad thickness, rotor heat stress) via integrated sensors, notifying riders or mechanics before critical failure, maximizing safety and component lifespan.

- Smart Braking Assistance: AI models process input from gyroscopes, accelerometers, and potentially proximity sensors on the bike to modulate braking force automatically during emergency stops or on slippery surfaces, preventing wheel lock-up and enhancing stability.

- Optimized Design and Simulation: Machine learning is utilized in Finite Element Analysis (FEA) to simulate thousands of brake rotor designs and material combinations, significantly accelerating the R&D cycle for improved thermal management and reduced weight.

- Enhanced Quality Control (QC): Computer vision systems and AI analyze production line output in real-time, detecting micro-defects in calipers, hoses, and master cylinders with precision far exceeding human capability, ensuring stricter component tolerance and reliability.

- Supply Chain Optimization: ML algorithms forecast demand for specific brake components (e.g., e-bike specific pads vs. road pads) based on seasonal trends and market shifts, optimizing inventory levels and reducing lead times for manufacturers and distributors.

DRO & Impact Forces Of Bicycle Brakes Market

The Bicycle Brakes Market is propelled by strong drivers such as the overwhelming global transition to electric bicycles (e-bikes), which require significantly higher braking performance due to increased speed and weight, thereby mandating disc brake adoption. Simultaneously, enhanced global focus on bicycling safety and the resultant enforcement of rigorous component quality standards act as continuous market drivers, pushing manufacturers toward premium, high-performance systems. Restraints predominantly involve the higher initial cost associated with hydraulic disc brake technology compared to traditional rim brakes, which can limit adoption in budget-sensitive developing markets and entry-level bicycle segments. Furthermore, the complexity of maintaining hydraulic systems requires specialized tools and technical expertise, posing a barrier to widespread adoption among amateur cyclists and repair shops in rural areas. Opportunities lie in the development of lightweight, integrated electronic braking systems compatible with smart cycling technology, and aggressive penetration into the rapidly growing cargo bike segment, which demands extreme stopping power and durability. The market is also poised to benefit from innovation in sustainable manufacturing processes and the use of eco-friendly brake fluid alternatives to address increasing environmental concerns. The impact forces are characterized by high substitution threat within the aftermarket (rim to disc brakes), moderate supplier power due to concentration among a few key groupset manufacturers, and growing buyer power driven by heightened consumer expectations regarding product quality and safety performance.

The market faces internal friction concerning the standardization of mounting formats (e.g., post mount vs. flat mount) and brake fluid types (mineral oil vs. DOT fluid), which creates complexity for consumers and inventory challenges for retailers. However, the overarching need for improved safety, especially given the density of urban cycling and the speeds attained by modern e-bikes, exerts significant positive pressure on technological advancement. The primary impact force accelerating growth is the regulatory environment in developed economies; for instance, European legislation necessitates certified braking performance for high-speed e-bikes (speed pedelecs), thereby guaranteeing demand for robust hydraulic systems. Another crucial driver is the increasing prominence of cycling as a leisure and fitness activity globally, raising the overall baseline demand for performance-oriented and reliable components, including advanced brake rotors engineered for superior heat management during long descents or heavy use.

The competitive landscape sees major groupset manufacturers dictating technology standards, exerting significant influence over both OEM and aftermarket segments, representing a critical impact force related to supplier power. Conversely, the rise of specialized, high-performance brake system manufacturers (often focused solely on MTB or high-end road components) introduces niche innovation and competitive pricing pressure. The enduring challenge remains the trade-off between cost and performance; while consumers demand the safety benefits of hydraulic disc brakes, manufacturers must continually work to reduce the production cost of these precision components without compromising on the tight tolerances required for reliable fluid dynamics and sealing capabilities. The market opportunity related to sustainable material usage, such as developing brake pads with reduced heavy metal content or biodegradable brake fluids, is becoming increasingly important as regulatory bodies focus on the full lifecycle environmental impact of cycling components.

Segmentation Analysis

The Bicycle Brakes Market is comprehensively segmented based on product type (disc brakes vs. rim brakes), operation mechanism (hydraulic vs. mechanical), distribution channel (OEM vs. Aftermarket), application (MTB, Road, E-Bikes), and material (Aluminum, Carbon Fiber, Steel). This detailed segmentation helps in precisely identifying high-growth pockets and understanding the differential demands across various cycling disciplines. Disc brakes, particularly the hydraulic variant, are the leading segment in terms of revenue growth, capitalizing on their proven superiority in all-weather conditions and providing exceptional stopping modulation, making them the standard choice for e-bikes and high-performance road and mountain bicycles.

The distinction between OEM and Aftermarket sales is crucial; the OEM segment, supplying manufacturers directly for bicycle assembly, accounts for the bulk of unit volume, reflecting the standardization of disc brakes on new mid-to-high-end bicycles. In contrast, the Aftermarket segment, consisting of upgrades and replacements sold through retail, drives innovation and demand for premium, often lightweight or specialized, components such as oversized rotors or heat-resistant ceramic brake pads sought by enthusiasts. Application-wise, the e-bike segment is projected to exhibit the highest CAGR, fundamentally restructuring the demand profile by requiring heavier-duty, highly durable braking systems capable of managing greater momentum and sustained deceleration, moving away from systems adequate only for traditional bicycles.

- By Product Type:

- Disc Brakes (Hydraulic Disc Brakes, Mechanical Disc Brakes)

- Rim Brakes (Caliper Brakes, V-Brakes/Cantilever Brakes)

- By Operation Mechanism:

- Hydraulic

- Mechanical

- By Application:

- Mountain Bikes (MTB)

- Road Bicycles

- Electric Bicycles (E-Bikes)

- Commuter/Urban Bicycles

- Gravel/Adventure Bikes

- By Distribution Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Bicycle Brakes Market

The value chain of the Bicycle Brakes Market begins with upstream activities focused on raw material procurement, encompassing high-grade aluminum and steel alloys for calipers and rotors, specialized rubber compounds for seals and hoses, and advanced friction materials for brake pads. Specialized component manufacturing, particularly precision machining of complex hydraulic components like master cylinders and pistons, requires high capital investment and technical expertise, often centralized among dominant Asian and European suppliers. These upstream activities are critical as the performance and reliability of the final brake system are highly dependent on the quality and tolerance of these foundational materials and precision parts, influencing everything from fluid dynamics stability to heat dissipation capability under extreme load.

Midstream activities involve the assembly of individual components into complete braking systems (lever/master cylinder, caliper, rotor, and hose kits) and integration into groupsets, typically carried out by major Tier 1 suppliers. This stage includes stringent quality control and proprietary processes, such as brake bleeding and pre-filling hydraulic lines, especially for OEM supply. Downstream analysis focuses on the distribution channels, which are bifurcated into Direct (OEM supply to bicycle assemblers) and Indirect (Aftermarket sales through distributors, wholesalers, and retail shops). The OEM channel dominates volume and is characterized by long-term contracts and just-in-time delivery schedules, while the Aftermarket channel, catering to consumer upgrades and maintenance, relies heavily on strong brand presence, technical support, and efficient logistics networks to deliver spare parts quickly, which often command higher margins.

The indirect distribution channel, particularly for aftermarket sales, requires significant investment in consumer education regarding compatibility (e.g., rotor standards, brake fluid types) and installation procedures, often through online tutorials and specialized retail personnel. Specialized bicycle retailers play a crucial role as they provide expert advice and installation services, particularly for complex hydraulic systems that require professional setup and tuning. Furthermore, the rise of e-commerce platforms has provided a new avenue for direct-to-consumer sales, allowing smaller, innovative brake manufacturers to bypass traditional distribution layers, although the logistical challenges of shipping components requiring precise handling remain a limiting factor, particularly concerning hazardous materials regulations for brake fluids.

Bicycle Brakes Market Potential Customers

The primary end-users and buyers in the Bicycle Brakes Market are multi-faceted, ranging from large-scale bicycle Original Equipment Manufacturers (OEMs) to individual high-performance cyclists and fleet operators managing bike-sharing schemes. OEMs, including giants like Trek, Specialized, Giant, and Merida, represent the highest volume buyers, making procurement decisions based on cost efficiency, component reliability, supply stability, and integration ease into new bike models. Their procurement strategies prioritize groupset compatibility and long-term supply agreements to ensure consistency across model years, thereby driving large volumes through direct sales channels, and setting the initial market standard for installed technologies, heavily favoring hydraulic disc brake systems for all premium and mid-range offerings.

Individual consumers constitute the core of the aftermarket segment, segmented broadly into professional cyclists, cycling enthusiasts (who prioritize weight reduction and incremental performance gains), and casual commuters (who seek reliability and minimal maintenance). Enthusiasts are crucial customers for the most advanced, often carbon-integrated or titanium brake components, driving demand for innovations such as larger heat-dissipating rotors and custom caliper designs. Furthermore, the rapidly expanding segment of e-bike owners forms a specific customer group requiring continuous replenishment of durable, high-friction brake pads and larger rotors due to the increased wear and tear resulting from the higher speeds and weight associated with electrically assisted riding.

Emerging customer groups include municipal and private fleet operators specializing in bike rentals, e-scooter share programs, and commercial cargo bike logistics. These customers prioritize durability, tamper resistance, and components requiring minimal downtime for maintenance. Fleet management procurement focuses on robust mechanical disc brakes or simplified hydraulic systems that offer consistent performance across diverse user skill levels and heavy daily usage cycles. The need for long operational life and easily serviceable parts dictates their buying behavior, often resulting in customized bulk orders with manufacturers, focusing on proven, heavy-duty components designed specifically to withstand the rigors of commercial and shared mobility environments, which are substantially harsher than typical recreational use.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shimano Inc., SRAM LLC, Tektro, Magura GmbH, Hope Technology, TRP Cycling Components, Hayes Performance Systems, Campagnolo S.R.L., Formula S.p.A., Clarks Cycle Systems, CUBE Bikes, Promax Components, Bengal Brake Systems, Jagwire, Continental AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bicycle Brakes Market Key Technology Landscape

The core technology landscape of the Bicycle Brakes Market is defined by the continual refinement of hydraulic disc brake systems, focusing on superior heat management and increased braking consistency. Key technological advancements include the development of multi-piston calipers (e.g., four-piston systems widely used in MTB and e-bikes) that distribute braking force more effectively and reduce pad wear. Furthermore, rotor technology has evolved significantly, utilizing advanced alloys and proprietary venting patterns to maximize surface area contact and facilitate rapid heat dissipation, crucial during long or steep descents where boiling brake fluid is a major failure risk. Integration of cooling fins directly onto brake pads and calipers, often incorporating ceramic pistons to minimize heat transfer into the hydraulic fluid, represents a critical area of innovation aimed at enhancing endurance and performance stability under sustained heavy use, especially relevant for the heavier and faster e-bike segment.

Another significant area of technological focus is the optimization of brake fluids and seals. Manufacturers are continuously improving the chemical stability and temperature resistance of mineral oils and DOT fluids to maintain optimal performance across a broader operational temperature range, minimizing the risk of performance fade. In parallel, advancements in brake lever ergonomics and reservoir design are focused on achieving a more precise and intuitive 'brake feel' for the rider, enabling better modulation and reducing rider fatigue over extended periods. Electronic integration is also emerging, where proprietary electronic shift/brake lever systems (common in high-end road cycling) communicate instantaneously, although fully autonomous or 'by-wire' electronic braking systems remain niche but represent the future potential, especially for advanced e-bikes and smart mobility applications requiring regenerative braking capabilities integrated into the overall drivetrain management system.

The materials technology segment is characterized by the application of lightweight materials such as forged aluminum, titanium, and carbon fiber composites in levers and caliper bodies to reduce overall bicycle weight while ensuring structural integrity and thermal resistance. Friction material science is highly competitive, with ongoing research into ceramic, semi-metallic, and organic pad compounds, each offering a specific balance between stopping power, noise generation, rotor wear, and heat resistance tailored to different riding conditions and price points. The adoption of flat mount standards (primarily in road and gravel biking) over traditional post mount standards is a recent trend simplifying frame and fork integration, contributing to cleaner aesthetic lines and enhanced rigidity, illustrating how component standardization and mounting technology continue to drive the evolution of the overall bicycle design landscape and component compatibility.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest market in terms of production volume, primarily driven by China, which is the global manufacturing hub for bicycles and e-bikes. The market here is characterized by high demand for entry-level and mid-range components, but also experiences explosive growth in the demand for robust, high-performance disc brakes due to the rapid proliferation of high-speed e-bikes for urban commuting. Growth is further sustained by governmental focus on reducing emissions and promoting electric mobility, ensuring continuous investment in bicycle infrastructure and associated safety components across key economies like India, Vietnam, and Indonesia.

- Europe: Europe is the leader in technological adoption and aftermarket revenue, propelled by stringent safety regulations and high consumer expectations for performance and quality, particularly in Germany, the Netherlands, and Scandinavia. The market benefits significantly from high e-bike penetration rates and the robust culture of competitive road and mountain biking. Hydraulic disc brakes are standard across almost all new bicycle segments, and manufacturers focus on lightweight, premium solutions compliant with European environmental standards and safety certification requirements, prioritizing advanced features like high thermal stability and enhanced modulation for diverse road conditions.

- North America: North America is defined by strong demand in the high-end aftermarket segment, driven by competitive cycling (MTB, road racing, and gravel biking). Consumers in this region often seek premium upgrade components offering maximum stopping power and minimal weight. The region showcases a distinct preference for proprietary hydraulic systems and specialized rotors. Urban centers also contribute significantly, as investment in shared mobility programs and commuter cycling increases, mandating durable, low-maintenance braking solutions for fleet operation, thereby guaranteeing stable demand for robust mechanical and hydraulic disc setups.

- Latin America (LATAM): The LATAM market is gradually transitioning from rim brakes to mechanical disc brakes, primarily influenced by affordability constraints and the prevalent use of bicycles for utilitarian purposes. Brazil and Mexico represent the largest markets, witnessing increasing adoption of mountain biking and commuter cycling. Growth is constrained by economic volatility but presents significant long-term opportunities as middle-class incomes rise and infrastructure improvements facilitate safer cycling, leading to incremental shifts towards cost-effective hydraulic brake solutions.

- Middle East and Africa (MEA): This region is the smallest but exhibits growth potential, especially in the urban centers of the UAE and South Africa, driven by leisure cycling and health awareness initiatives. The market for high-performance components is currently niche, serving expatriate communities and wealthy enthusiasts. Demand primarily centers on highly durable components capable of withstanding harsh, dusty, and high-temperature environments, making robust sealing and material resilience key purchasing criteria for all braking systems adopted in the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bicycle Brakes Market.- Shimano Inc.

- SRAM LLC

- Tektro (and TRP Cycling Components)

- Magura GmbH

- Hope Technology

- Hayes Performance Systems

- Campagnolo S.R.L.

- Formula S.p.A.

- Clarks Cycle Systems

- Promax Components

- Bengal Brake Systems

- Continental AG (for brake components and materials)

- Jagwire (focusing on cables and hoses)

- CUBE Bikes (major OEM consumer and integrator)

- ACID Components

- Tifosi Logistics (distribution focused)

- Nukeproof

- FSA (Full Speed Ahead)

- CST Corporation

Frequently Asked Questions

Analyze common user questions about the Bicycle Brakes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the market shift from rim brakes to hydraulic disc brakes?

The primary driver is the superior performance of hydraulic disc brakes, offering enhanced modulation, consistent stopping power in adverse weather (rain, mud), and reduced hand fatigue, crucial for high-performance cycling and mandatory for the heavier, faster electric bicycle (e-bike) segment due to safety regulations requiring higher kinetic energy management.

Which application segment holds the most promising growth potential in the bicycle brakes market?

The Electric Bicycles (E-Bikes) segment exhibits the highest growth potential. E-bikes fundamentally require robust braking systems due to increased weight and speed, translating into guaranteed high-volume demand for heavy-duty, multi-piston hydraulic disc brakes and specialized wear-resistant rotors and pads, essential for maintaining rider safety and compliance.

How are new technologies like AI influencing bicycle brake manufacturing and safety?

AI is primarily influencing the market through predictive maintenance (analyzing sensor data to forecast component failure), optimizing the design process (simulating complex thermal dissipation in rotors), and enhancing quality control during manufacturing. These advancements lead to safer, more durable, and lighter braking components while reducing production defects.

What are the main regional differences in bicycle brake adoption?

Europe leads in high-end hydraulic disc brake adoption driven by strict safety standards and high e-bike penetration. Asia Pacific leads in manufacturing volume and entry-level segment demand, while North America drives innovation in the performance-focused aftermarket segment, demanding specialized components for mountain and gravel cycling.

What are the major restraints affecting the growth of the hydraulic brake segment?

The major restraints include the high initial cost compared to mechanical systems, limiting adoption in budget-sensitive markets, and the complexity of maintenance, which requires specialized tools and expertise for bleeding and fluid replacement, posing a barrier to widespread adoption in basic service centers and among casual users.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager