Bicycle Headbar Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439985 | Date : Jan, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Bicycle Headbar Market Size

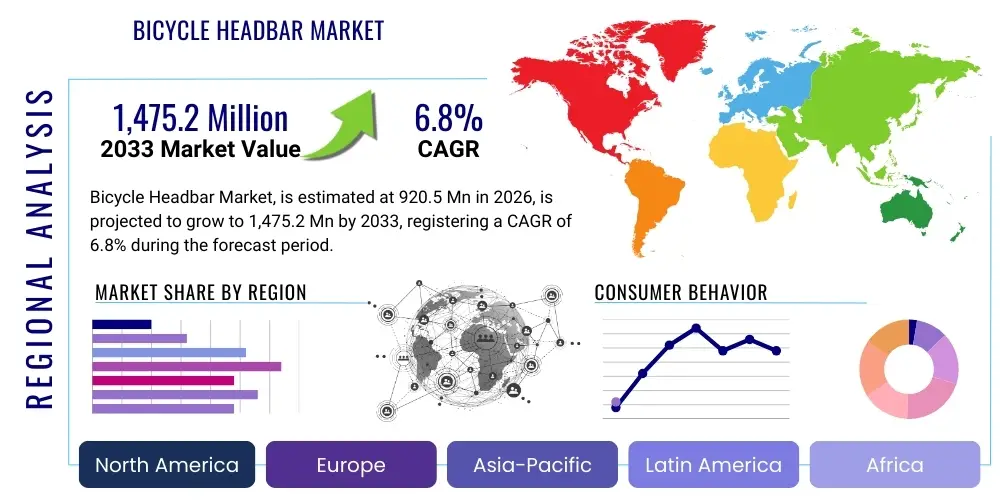

The Bicycle Headbar Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 920.5 Million in 2026 and is projected to reach USD 1,475.2 Million by the end of the forecast period in 2033.

Bicycle Headbar Market introduction

The bicycle headbar, often referred to as a stem, is a critical component that connects the handlebars to the steerer tube of the bicycle's fork, playing a pivotal role in steering, control, and rider ergonomics. It is a fundamental interface that transmits rider input to the front wheel, directly influencing handling characteristics and comfort. Modern headbars are engineered from a variety of materials including aluminum alloys, carbon fiber, steel, and titanium, each offering distinct advantages in terms of weight, strength, stiffness, and vibration damping. Their design and material choice are crucial for optimizing a bicycle's performance across different cycling disciplines, from high-performance road racing and aggressive mountain biking to urban commuting and gravel adventures.

Major applications of bicycle headbars span the entire spectrum of cycling, encompassing mountain bikes, road bikes, gravel bikes, e-bikes, and urban/commuter bicycles. In mountain biking, robust and short headbars are often preferred for aggressive trail riding, providing quick steering response and stability over technical terrain. For road cycling, longer and lighter headbars contribute to an aerodynamic and stretched-out riding position, enhancing speed and efficiency. The burgeoning e-bike segment also demands specialized headbars capable of handling potentially higher loads and integrating routing for electronic components, reflecting a broader trend towards system integration and advanced functionality across all bike types.

The market benefits significantly from several driving factors, including the increasing global participation in cycling for recreation, fitness, and sustainable transportation. The rapid expansion of the e-bike market, driven by technological advancements and shifting consumer preferences, is creating new demand for durable and integrated headbar solutions. Furthermore, a growing emphasis on rider comfort, performance optimization, and personalized bike fit fuels innovation in headbar design and material science. These factors collectively contribute to a dynamic market landscape, characterized by continuous product development aimed at improving rider experience and expanding the capabilities of modern bicycles.

Bicycle Headbar Market Executive Summary

The Bicycle Headbar Market is experiencing robust growth, primarily fueled by the global resurgence in cycling activities, the accelerating adoption of electric bicycles, and a persistent demand for high-performance and customized cycling components. Business trends indicate a strong focus on lightweight materials, aerodynamic designs, and enhanced integration capabilities to accommodate modern bicycle technologies such as internal cable routing and electronic shifting systems. Manufacturers are increasingly investing in research and development to produce headbars that offer superior strength-to-weight ratios, improved vibration absorption, and more precise steering responses, catering to both the original equipment manufacturer (OEM) segment and the rapidly expanding aftermarket for upgrades and personalization. Strategic partnerships between headbar manufacturers and bicycle brands are also becoming more prevalent, aimed at co-developing integrated solutions that offer seamless aesthetics and optimized functionality, further driving market innovation and penetration.

Regional trends reveal varying dynamics across major geographical markets. North America and Europe continue to dominate the premium segment, driven by a strong cycling culture, high disposable incomes, and a significant presence of specialized cycling brands and enthusiasts. These regions exhibit high demand for advanced carbon fiber and high-end aluminum headbars, often featuring sophisticated designs for competitive cycling and gravel riding. The Asia Pacific region, particularly China, India, and Southeast Asian countries, represents a high-growth market, propelled by increasing urbanization, rising health consciousness, and a burgeoning middle class opting for bicycles as a primary mode of transport or for leisure. This region is witnessing a surge in demand for both entry-level and mid-range headbars, alongside a growing appetite for e-bikes which consequently boosts the market for compatible components. Latin America and the Middle East & Africa regions are also showing promising growth, albeit from a smaller base, as cycling infrastructure improves and consumer awareness about cycling benefits increases.

Segmentation trends highlight a shift towards specialized headbar types tailored for specific cycling disciplines and user preferences. The demand for headbars optimized for mountain bikes, which prioritize robustness and control, and road bikes, which focus on aerodynamics and stiffness, remains strong. However, there is a notable rise in the gravel bike segment, which demands a versatile balance of durability, vibration damping, and ergonomic flexibility. The e-bike segment is emerging as a significant growth driver, requiring headbars that can accommodate higher torque, increased weight, and often integrate battery or display components. Material-wise, while aluminum remains the workhorse for its cost-effectiveness and reliability, carbon fiber continues to gain traction in the high-performance and premium segments due to its unparalleled weight savings and tunable stiffness characteristics. The aftermarket segment is thriving, driven by cyclists seeking performance upgrades, aesthetic customization, and ergonomic adjustments, underscoring the importance of diverse product offerings.

AI Impact Analysis on Bicycle Headbar Market

The impact of Artificial intelligence on the Bicycle Headbar Market, while not immediately obvious at the physical component level, is increasingly a topic of interest for users, particularly concerning design optimization, manufacturing efficiency, and integrated smart features within the broader bicycle ecosystem. Common user questions revolve around how AI can contribute to lighter yet stronger headbar designs, enable more precise manufacturing processes, or facilitate personalized ergonomics. Cyclists are curious about AI's potential role in analyzing ride data to recommend optimal headbar dimensions or materials for individual riders, thereby enhancing performance and comfort. There's also an expectation regarding AI's influence on predictive maintenance for components, including headbars, and its eventual integration into smart bikes to adjust settings dynamically. The key themes encompass optimization, personalization, and intelligent integration, reflecting users' desire for more advanced, data-driven solutions in cycling components.

- AI-driven generative design can optimize headbar geometries for maximum strength-to-weight ratios, producing innovative shapes unachievable through traditional design methods.

- Predictive analytics powered by AI can enhance quality control in manufacturing, identifying potential material flaws or production anomalies before they lead to product failures.

- AI algorithms can analyze vast datasets of rider biomechanics and performance metrics to recommend personalized headbar length, angle, and material choices for optimal fit and efficiency.

- Integration of AI in smart bicycles could enable headbars to house sensors that collect real-time data on rider posture, steering input, and vibration, providing feedback for adaptive adjustments or training.

- Supply chain optimization through AI can improve raw material procurement, inventory management, and distribution logistics for headbar components, reducing costs and lead times.

- AI-enabled simulation tools allow for virtual testing of headbar designs under various stress conditions, accelerating product development cycles and reducing physical prototyping costs.

- Enhanced customer service: AI-powered chatbots and recommendation engines can guide customers through complex choices for headbars, ensuring better product matching based on individual needs and bike specifications.

DRO & Impact Forces Of Bicycle Headbar Market

The Bicycle Headbar Market is significantly influenced by a dynamic interplay of drivers, restraints, and opportunities that shape its growth trajectory and competitive landscape. Key drivers include the escalating global enthusiasm for cycling, whether for sport, leisure, or sustainable commuting, which inherently boosts demand for bicycles and their components. The rapid proliferation of electric bicycles (e-bikes) further amplifies this demand, as e-bikes often require robust and sometimes specialized headbars to manage increased speeds, weight, and integrated electronic systems. Moreover, the continuous pursuit of performance enhancement and customization among cyclists drives innovation, pushing manufacturers to develop lighter, stronger, and more aerodynamically efficient headbars. The growing awareness of health and environmental benefits associated with cycling also contributes to a larger rider base, consequently increasing the total addressable market for headbars.

Despite these strong growth drivers, the market faces several significant restraints. Volatility in the prices of raw materials such as aluminum, carbon fiber, and titanium directly impacts manufacturing costs and profit margins. Supply chain disruptions, exacerbated by global events like pandemics or geopolitical tensions, can lead to material shortages and production delays, hindering market growth. Intense competition among a multitude of established brands and new entrants often results in price pressures, particularly in the mid-range and entry-level segments. Furthermore, the inherent need for standardization in component dimensions (e.g., handlebar and steerer clamp diameters) can sometimes limit radical innovation, as new designs must maintain compatibility with existing bicycle architectures. The prevalence of counterfeit products, especially in emerging markets, also poses a challenge, diluting brand value and impacting legitimate sales.

Opportunities for growth in the Bicycle Headbar Market are substantial and diverse. The ongoing advancements in material science offer immense potential for integrating even lighter and stronger composites, such as advanced carbon fiber weaves or novel aluminum alloys, leading to superior product performance. The trend towards smart component integration, possibly incorporating sensors for ride data or connectivity features, presents an avenue for product differentiation and added value. Developing ergonomic designs that cater to an increasingly diverse rider population, including varying body types and riding styles, can unlock new market segments. Furthermore, expanding into emerging markets in Asia Pacific, Latin America, and Africa, where cycling infrastructure is improving and disposable incomes are rising, offers significant untapped growth potential. Strategic partnerships with e-bike manufacturers and leveraging direct-to-consumer online sales channels are also crucial for capturing future market share and adapting to evolving consumer purchasing behaviors.

Segmentation Analysis

The Bicycle Headbar Market is comprehensively segmented to provide granular insights into product preferences, material choices, application-specific demands, and distribution channels. This segmentation allows for a detailed understanding of market dynamics, enabling manufacturers and retailers to tailor their strategies to specific consumer needs and capitalize on emerging trends. The market is primarily dissected based on the material used for construction, which significantly impacts weight, strength, and cost; the specific type of headbar relating to steering mechanism; key dimensions like handlebar and steerer clamp diameters crucial for compatibility; the application or type of bicycle it is designed for; and the sales channel through which it reaches the end consumer.

- By Material:

- Carbon Fiber: Favored for high-performance road and mountain bikes due to its exceptional strength-to-weight ratio and vibration damping properties.

- Aluminum Alloy: The most common material, offering a balance of strength, durability, and cost-effectiveness for a wide range of bicycles.

- Steel: Primarily used in classic or custom bike builds, known for its compliance and durability, though heavier.

- Titanium: A premium material offering an excellent strength-to-weight ratio, superior corrosion resistance, and vibration absorption, often used in high-end or bespoke applications.

- By Headbar Type:

- Threadless: The dominant type in modern bicycles, offering a secure and adjustable connection between the fork steerer and handlebars.

- Threaded: Predominantly found on older or entry-level bicycles, connecting handlebars to a quill stem inserted into the fork steerer.

- By Handlebar Clamp Diameter:

- 25.4mm: Common on older mountain bikes and some commuter bikes.

- 31.8mm: The industry standard for most modern road and mountain bikes, offering increased stiffness.

- 35mm: Gaining popularity in aggressive mountain biking for enhanced stiffness and control.

- By Steerer Clamp Diameter:

- 1-1/8 inch: The most widespread standard for modern bicycle forks.

- 1.5 inch: Found on some mountain bikes and e-bikes, particularly for increased front-end stiffness and strength.

- By Application:

- Mountain Bikes: Requiring robust, often shorter headbars for responsive steering and durability.

- Road Bikes: Focused on lightweight, aerodynamic designs for speed and efficiency.

- Gravel Bikes: Balancing durability and vibration absorption for mixed-terrain riding.

- E-Bikes: Demanding strength and sometimes integrated routing for electronic components.

- Urban/Commuter Bikes: Prioritizing comfort, durability, and sometimes adjustability.

- BMX Bikes: Specialized for extreme strength and compact geometry.

- By Sales Channel:

- OEM (Original Equipment Manufacturer): Headbars supplied directly to bicycle manufacturers for factory assembly.

- Aftermarket: Products sold to consumers through retail stores, online platforms, and specialized bike shops for upgrades or replacements.

Value Chain Analysis For Bicycle Headbar Market

The value chain for the Bicycle Headbar Market is a multi-tiered process encompassing raw material sourcing, manufacturing, assembly, distribution, and end-user engagement. Upstream analysis begins with the procurement of essential raw materials such as various grades of aluminum alloys, pre-impregnated carbon fiber sheets, steel tubing, and titanium billets from specialized suppliers. These raw material providers form the foundational layer of the value chain, heavily influencing the cost, quality, and performance characteristics of the final headbar product. Key considerations at this stage include material purity, consistency, and adherence to specific metallurgical or composite specifications. Relationships with reliable and cost-effective suppliers are critical for maintaining competitive pricing and ensuring uninterrupted production schedules for headbar manufacturers. Research and development activities, including material science advancements and design innovations, are also integral to this upstream segment, influencing future product capabilities and market differentiation.

Midstream activities involve the actual manufacturing and assembly of the headbars. This phase includes processes such as forging, CNC machining, welding (for metal components), and carbon layup and molding (for composite components). Precision engineering and rigorous quality control are paramount to ensure that headbars meet stringent safety standards, specified dimensions, and performance benchmarks. Manufacturers often specialize in specific materials or production techniques, leveraging proprietary technologies to gain an edge. After manufacturing, headbars may undergo finishing processes like anodization, painting, or polishing, followed by packaging. The efficiency of these manufacturing processes, including automation levels and waste reduction efforts, directly impacts production costs and market competitiveness. Innovation in manufacturing techniques, such as additive manufacturing for complex geometries or advanced robotics for consistent quality, continues to shape this segment.

Downstream analysis focuses on how headbars reach the end consumer. This involves a dual distribution channel: Original Equipment Manufacturer (OEM) and Aftermarket. In the OEM channel, headbars are sold directly to bicycle manufacturers for integration into complete bikes. This requires strong business-to-business relationships, reliable supply, and often co-development agreements to meet specific bicycle brand requirements. The aftermarket channel serves consumers directly through a network of distributors, independent bicycle retailers (IBDs), and a rapidly growing direct-to-consumer (DTC) online sales model. Indirect distribution through third-party wholesalers and retailers provides broad market access, while direct online sales offer higher margins and closer customer engagement for brands. Marketing and branding efforts, after-sales support, and warranty services are crucial in the downstream segment to build brand loyalty and drive repeat purchases. The overall effectiveness of the value chain hinges on seamless coordination and efficient information flow between all these interconnected stages.

Bicycle Headbar Market Potential Customers

The Bicycle Headbar Market caters to a diverse range of potential customers, broadly categorized into two primary segments: Original Equipment Manufacturers (OEMs) and End-Users in the aftermarket. OEMs represent major bicycle brands globally, ranging from mass-market producers to high-end boutique manufacturers, who procure headbars in bulk for integration into their complete bicycle assemblies. These manufacturers seek reliable, high-quality, and cost-effective headbars that align with their brand's design philosophy, performance specifications, and target price points. The relationships with OEM customers are often long-term, characterized by technical collaboration, bulk purchasing agreements, and stringent quality control requirements. The growth of the OEM segment is directly tied to the overall bicycle production volumes, including the booming e-bike market and the increasing demand for various bicycle types globally, influencing both the design and material choices for headbars.

The aftermarket segment encompasses individual cyclists who purchase headbars for upgrades, replacements, or custom bike builds. This segment is highly fragmented but significant, driven by riders' desire for performance enhancement, personalized ergonomics, aesthetic customization, and routine maintenance. Within this segment, there are several sub-categories of end-users. Performance-oriented cyclists, including road racers, mountain bikers, and triathletes, seek lightweight, stiff, and aerodynamically optimized headbars to gain a competitive edge or improve their riding experience. These customers are often willing to invest in premium carbon fiber or high-grade aluminum options. Commuters and recreational riders, on the other hand, prioritize durability, comfort, and sometimes adjustability, opting for reliable aluminum headbars that offer a good balance of function and value. The customization trend further empowers enthusiasts to select headbars that match their aesthetic preferences and precise bike fit requirements.

Furthermore, specialized segments within the aftermarket include bike mechanics and professional bike fitters who often recommend specific headbars to their clients based on biomechanical analysis and riding style. They serve as influential intermediaries, guiding end-users towards appropriate choices. Online retailers and brick-and-mortar bike shops are key distribution channels for reaching these aftermarket customers, offering a wide array of brands, sizes, and materials. The rise of direct-to-consumer (DTC) models has also created a direct line between headbar manufacturers and end-users, fostering brand loyalty and enabling direct feedback. Ultimately, understanding the varied needs and purchasing motivations of both OEM clients and diverse aftermarket end-users is crucial for success in the Bicycle Headbar Market, dictating product development, marketing strategies, and distribution networks to effectively serve this broad customer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 920.5 Million |

| Market Forecast in 2033 | USD 1,475.2 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shimano, SRAM, FSA (Full Speed Ahead), Ritchey, Thomson, ENVE Composites, Zipp, PRO (by Shimano), Easton, Syncros, Specialized, Bontrager (by Trek), Cannondale, Giant, Lapierre, Merida, Cube, Canyon, Cervelo, Look Cycle |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bicycle Headbar Market Key Technology Landscape

The Bicycle Headbar Market is continually evolving, driven by advancements in materials science, manufacturing processes, and design philosophies aimed at enhancing performance, durability, and rider comfort. A critical technological aspect is the widespread adoption of Computer Numerical Control (CNC) machining for aluminum and titanium headbars. This technology allows for extremely precise shaping and removal of material, creating complex internal and external geometries that optimize strength-to-weight ratios while reducing stress concentrations. CNC machining facilitates the production of lightweight designs with intricate aesthetic details and ensures consistent quality across large production batches. Furthermore, hydroforming technology for aluminum allows manufacturers to create lightweight and stiff headbars with unique shapes by forming tubes with high-pressure fluid, pushing the boundaries of traditional metal shaping and contributing to superior ergonomic and aerodynamic profiles.

In the high-performance segment, carbon fiber composite technology is paramount. Advanced carbon fiber headbars utilize sophisticated layup schedules, where multiple layers of carbon fiber fabric are strategically oriented and bonded with resin to achieve specific stiffness, compliance, and strength characteristics. This allows engineers to "tune" the headbar's ride feel, providing rigidity where needed for power transfer and compliance in other areas for vibration damping. Techniques like monocoque construction, where the headbar is molded as a single, seamless piece, minimize weak points and further optimize weight. Ongoing research in resin systems and fiber types, including aerospace-grade carbon, continues to push the limits of what is possible in terms of lightness and resilience, directly impacting the top-tier segment of the market and inspiring trickle-down technologies to more accessible price points.

Beyond materials and manufacturing, integrated design technologies are gaining traction, particularly with the rise of internal cable routing and electronic shifting systems. Many modern headbars are designed with specific channels and ports for clean integration of brake hoses, shift cables, and e-bike wires, enhancing aerodynamics and aesthetics. This requires advanced CAD/CAM software for precise engineering and collaboration between headbar manufacturers and bicycle frame designers to ensure seamless compatibility. Furthermore, the development of adjustable headbar systems, though less common in high-performance segments, utilizes innovative clamping and angle-adjustment mechanisms to provide greater ergonomic flexibility for a broader range of riders. Smart manufacturing techniques, including robotic automation and advanced metrology, are also playing a crucial role in improving production efficiency, reducing waste, and ensuring the consistent quality of bicycle headbars across all technological tiers.

Regional Highlights

- North America: A mature market with high demand for premium and performance-oriented headbars, driven by a strong cycling culture, competitive racing, and a growing gravel bike segment. Significant adoption of e-bikes is also a key growth factor. The region benefits from a high disposable income and a robust aftermarket for upgrades and customization.

- Europe: Leading the global bicycle market, particularly in e-bike adoption and urban cycling infrastructure. European countries like Germany, Netherlands, and France show strong demand for both durable commuter headbars and high-performance components for road and mountain biking. Strict safety standards and an emphasis on sustainable transportation further drive innovation and market growth.

- Asia Pacific (APAC): The fastest-growing region, fueled by rising disposable incomes, increasing health consciousness, and urbanization in countries such as China, India, and Southeast Asia. This region is a major manufacturing hub and also a rapidly expanding consumer market for both entry-level and mid-range bicycles, including e-bikes, driving significant demand for headbars.

- Latin America: An emerging market with growing cycling participation, especially in urban centers as a mode of transportation and for recreation. Economic development and improving cycling infrastructure are gradually increasing the demand for quality headbars, though price sensitivity remains a key consideration for consumers.

- Middle East and Africa (MEA): A developing market for bicycle headbars, with growth driven by increasing health awareness, government initiatives promoting cycling, and emerging tourism. The market for high-end components is limited to niche segments, while demand for robust and affordable headbars for utility and leisure cycling is expanding.

- Germany: A powerhouse in European cycling, characterized by high e-bike penetration and a strong preference for quality and engineering excellence in bicycle components, including headbars. Strong domestic manufacturing and innovative brands contribute significantly to the market.

- United Kingdom: Features a vibrant cycling community with diverse preferences, from competitive road and mountain biking to active urban commuting. The aftermarket for headbar upgrades is particularly strong, reflecting a culture of customization and performance optimization among cyclists.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bicycle Headbar Market.- Shimano

- SRAM

- FSA (Full Speed Ahead)

- Ritchey

- Thomson

- ENVE Composites

- Zipp

- PRO (by Shimano)

- Easton

- Syncros

- Specialized

- Bontrager (by Trek)

- Cannondale

- Giant

- Lapierre

- Merida

- Cube

- Canyon

- Look Cycle

- Race Face

Frequently Asked Questions

Analyze common user questions about the Bicycle Headbar market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a bicycle headbar and why is it so crucial for riding performance?

The bicycle headbar, or stem, connects the handlebars to the bike's fork steerer tube, enabling steering control and transmitting rider input to the front wheel. Its length, angle, and stiffness significantly impact a bicycle's handling characteristics, steering responsiveness, and the rider's ergonomic position, directly influencing comfort, efficiency, and overall performance.

What are the main types of materials used to manufacture bicycle headbars, and what are their respective benefits?

Bicycle headbars are predominantly made from aluminum alloy, carbon fiber, steel, and titanium. Aluminum offers a cost-effective balance of strength and durability. Carbon fiber provides exceptional strength-to-weight ratios and vibration damping for high-performance applications. Steel is valued for its compliance and classic aesthetic, while titanium offers superior corrosion resistance, high strength, and excellent vibration absorption at a premium price point.

How do advancements in e-bike technology influence the demand and design trends for bicycle headbars?

The rapid growth of the e-bike market drives demand for more robust and often heavier-duty headbars capable of handling increased bike weight, higher speeds, and greater torque. Design trends include stronger clamping mechanisms, integrated routing for electronic cables and displays, and enhanced durability to ensure reliable performance under the specific stresses of electric assistance, requiring specialized material and construction techniques.

What factors should a cyclist consider when choosing the right headbar for their specific bicycle and riding style?

Key factors include headbar length and angle for optimal bike fit and ergonomics, material choice for desired weight and stiffness (e.g., carbon for performance, aluminum for durability), handlebar and steerer clamp diameters for compatibility with existing components, and the specific application (e.g., shorter and stronger for mountain biking, longer and lighter for road cycling) to match riding style and performance goals.

What are the key opportunities for innovation and growth within the Bicycle Headbar Market?

Significant opportunities lie in the integration of advanced lightweight materials, such as next-generation carbon composites, and the development of smart headbars with integrated sensors for data collection and performance analysis. Further growth can be achieved through ergonomic designs catering to diverse rider demographics, expansion into emerging cycling markets, and the optimization of supply chains to enhance manufacturing efficiency and reduce lead times.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager