Bicycle Hubs Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432392 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Bicycle Hubs Market Size

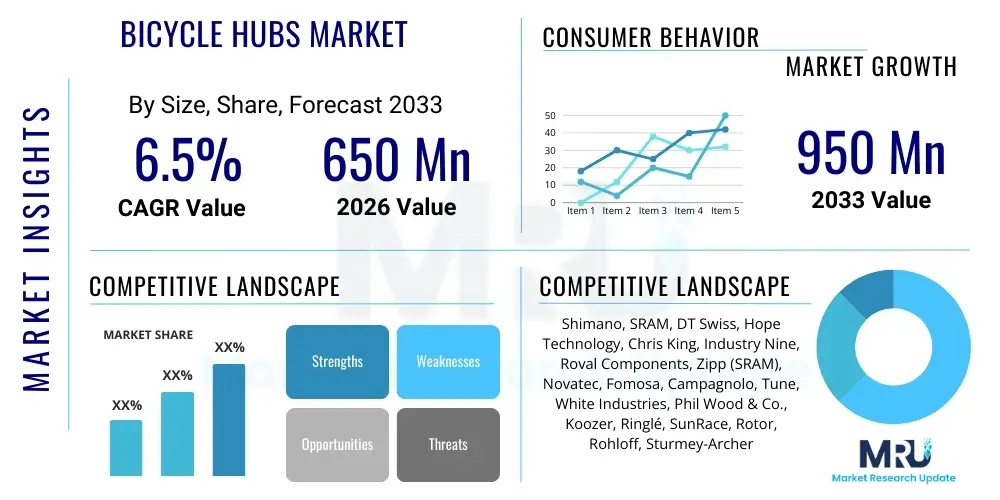

The Bicycle Hubs Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 950 Million by the end of the forecast period in 2033. This consistent expansion is predominantly fueled by the global surge in cycling as a recreational activity, a sustainable mode of transport, and an increasing penetration of high-performance and electric bicycles (e-bikes) globally, all of which require sophisticated, reliable, and durable hub assemblies to manage varying load conditions and performance expectations.

Bicycle Hubs Market introduction

The Bicycle Hubs Market encompasses the production and distribution of specialized components centered within the bicycle wheel, serving as the rotational axis and mounting point for spokes and disc brakes. These critical components house the bearings that allow the wheel to spin freely around the axle and often incorporate the freehub mechanism necessary for coasting on rear wheels. Product offerings span a wide range, from standard cup-and-cone bearing hubs utilized in mass-market commuter bikes to highly engineered sealed cartridge bearing hubs made from lightweight alloys or carbon fiber for high-end racing and mountain bikes. Major applications are broadly categorized into mountain biking (MTB), road cycling, urban commuting, and increasingly, the electric bicycle segment, which imposes unique design demands due to higher speeds and sustained torque output. The primary benefits of advanced hubs include reduced rolling resistance, enhanced durability against environmental factors like mud and water, and improved overall wheel stiffness and reliability, which are crucial for rider safety and performance.

Key driving factors supporting the market expansion include global government initiatives promoting cycling infrastructure and usage, the escalating popularity of off-road cycling disciplines such as gravel and enduro, and the ongoing technological evolution focusing on lighter, stronger, and more efficient hub designs. Furthermore, the growing aftermarket demand from cycling enthusiasts seeking performance upgrades and component customization significantly contributes to market dynamism. The transition towards standardized yet technically complex features like thru-axles and Boost spacing standards also dictates manufacturing requirements and provides opportunities for specialized hub producers. As cycling moves from a niche activity to a mainstream mode of transportation and leisure, the demand for hubs that offer specific performance attributes—such as quick engagement for MTB or aerodynamic profiles for road racing—continues to diversify, maintaining a robust growth trajectory for the sector.

Bicycle Hubs Market Executive Summary

The Bicycle Hubs Market is characterized by a significant transition towards premiumization, driven by sustained business trends favoring sealed bearing technology and advanced material utilization, moving away from traditional loose bearing systems due to superior performance characteristics and reduced maintenance requirements. Regional trends highlight Asia Pacific (APAC) as the dominant manufacturing and volume market, supported by large-scale bicycle production in countries like China and Taiwan. Conversely, North America and Europe are key drivers for technological innovation and high-margin product consumption, particularly in the performance segments associated with mountain biking and high-end road cycling, where component reliability under extreme stress is paramount. Segment trends show a clear dominance of disc brake compatible hubs over rim brake models, reflecting the widespread industry adoption of disc braking systems across nearly all bicycle categories. Furthermore, the e-bike segment is experiencing the fastest growth rate, specifically demanding heavier-duty, integrated hub motor solutions or reinforced traditional hubs capable of handling electric assist loads, creating distinct product development streams focused on longevity and torque resistance.

Overall, market competition is intense, centered around key factors such as weight reduction, engagement speed (for freehubs), and bearing quality, establishing a competitive environment where strategic partnerships with major bicycle OEMs are crucial for securing long-term volume sales. The aftermarket segment remains vital for specialized brands, allowing them to showcase innovative designs and proprietary technologies directly to cycling enthusiasts who seek customization and performance enhancements. Geopolitical factors affecting global supply chains, specifically concerning the sourcing of high-grade aluminum, steel, and carbon fiber prepregs, represent critical operational risks that manufacturers are actively mitigating through diversification and vertical integration efforts. The synthesis of these dynamics points toward a future market structure defined by high technological differentiation, strong regional disparities in demand profile, and an increasingly sophisticated consumer base prioritizing durability and performance features tailored to specific cycling disciplines.

AI Impact Analysis on Bicycle Hubs Market

Analysis of common user questions regarding AI's influence on the Bicycle Hubs Market reveals significant user interest centered on four main themes: predictive maintenance for component longevity, optimization of manufacturing processes, integration of smart features within the hub itself, and enhanced supply chain efficiency for specialized parts. Users frequently inquire if AI algorithms could analyze riding data (speed, torque, distance) to predict bearing failure or freehub wear, thereby extending the lifespan of expensive components. Furthermore, questions arise concerning how AI-driven simulations and generative design tools might revolutionize hub structure, minimizing weight while maximizing strength and stiffness—a perpetual challenge in component engineering. The underlying concern revolves around whether AI adoption will lead to a significant increase in the complexity and cost of hub units, potentially pricing out mass-market consumers, or conversely, whether improved manufacturing efficiency will result in broader accessibility of high-performance features.

The most immediate and practical impact of Artificial Intelligence resides in the operational segments of the market, specifically within advanced manufacturing and logistics. AI is being deployed in automated quality control systems, utilizing computer vision to detect minute flaws in bearing races and hub shells with precision far exceeding manual inspection, thereby enhancing product reliability and reducing waste. In the supply chain, machine learning models optimize inventory management for critical raw materials like aerospace-grade aluminum and high-precision steel balls for bearings, predicting demand fluctuations based on seasonal cycling trends and economic indicators, ensuring a smoother flow of specialized components. While fully integrated "smart hubs" (featuring embedded sensors for data collection) are still nascent, AI provides the analytical backbone for processing sensor data from associated drivetrain components, informing riders and mechanics about optimal service intervals and component performance profiles. This shift represents a transition from purely mechanical components to connected, data-generating elements of the bicycle ecosystem.

- AI optimizes material usage in manufacturing, reducing waste of expensive alloys.

- Machine learning enhances quality control, automatically identifying microscopic defects in bearing surfaces.

- Predictive maintenance algorithms, fueled by AI, project component lifespan based on user cycling data.

- Generative design tools, driven by AI, create lighter and structurally stronger hub shell geometries.

- AI improves supply chain resilience by forecasting demand for specialized bearings and freehub components.

DRO & Impact Forces Of Bicycle Hubs Market

The Bicycle Hubs Market dynamics are governed by a complex interplay of internal and external forces summarized by key Drivers, Restraints, and Opportunities. The primary drivers include the accelerated global growth of the electric bicycle market, which mandates durable, high-load-bearing hubs, and the sustained popularity of premium cycling segments (MTB and gravel) requiring components with rapid engagement and robust sealing mechanisms. Simultaneously, the market faces significant restraints, notably the high upfront cost associated with precision-engineered, sealed bearing, and internally geared hubs, which limits mass-market adoption. Furthermore, the rapid proliferation of proprietary standards (e.g., axle spacing, freehub driver body variations like HG, XD, and Micro Spline) creates inventory complexities for retailers and compatibility confusion for consumers. These restraining factors necessitate significant research and development investment to remain competitive in a fragmented technical landscape. Opportunities are plentiful, centered around the integration of IoT technology for performance monitoring and the adoption of advanced, lightweight materials like proprietary carbon composites for high-performance hub shells, targeting weight reduction without compromising structural integrity.

The impact forces within this market are predominantly qualitative, driven by consumer perception of quality and the critical performance role hubs play in the overall cycling experience. Durability and maintenance requirements are major decision factors; riders are increasingly willing to pay a premium for hubs that offer extended service intervals and superior protection against environmental ingress. The shift towards disc brakes across all cycling genres has necessitated a fundamental redesign of hub structures to manage asymmetric braking forces, establishing disc brake compatibility as a near-universal requirement, thus exerting a powerful technological force on product development. Moreover, sustainable manufacturing practices and the use of recyclable materials are emerging as significant, albeit slower, impact forces, particularly in environmentally conscious European markets, influencing brand reputation and sourcing strategies. Ultimately, the rapid rate of technological standardization changes (e.g., the obsolescence of quick-release skewers in favor of thru-axles) forces manufacturers to frequently update their product lines, channeling investment into retooling and design validation, thereby keeping the competitive pressure consistently high across all tiers of the market.

Segmentation Analysis

The Bicycle Hubs Market is extensively segmented based on several critical criteria, allowing manufacturers to target specific cycling disciplines and price points effectively. Key segmentation dimensions include product type (front hub, rear hub, and internal gear hub), bearing type (cup-and-cone versus sealed cartridge bearings), material (aluminum alloy, steel, carbon fiber), and application (road, mountain, urban/commuter, and e-bike). The dominance of the rear hub segment is clear due to the incorporation of complex freehub mechanisms or motor integration in e-bikes, driving higher average selling prices compared to simpler front hubs. The continuous shift towards sealed cartridge bearings represents a foundational segmentation trend, as these units offer superior longevity, higher load capacity, and simplified maintenance, distinguishing premium offerings from entry-level products. Furthermore, the segmentation by application is crucial, as the demands for a robust, quick-engaging mountain bike hub are vastly different from the lightweight, aerodynamic requirements of a road racing hub.

Understanding these segments is vital for strategic market positioning. For instance, the material segmentation directly correlates with performance characteristics and cost; while most high-volume hubs use aluminum alloy, the niche, high-performance segment relies heavily on carbon fiber shells and aerospace-grade titanium freehub bodies to minimize rotational mass. Geographically, segmentation by region reflects distinct consumer preferences; for example, North American markets heavily prioritize lightweight performance hubs, whereas Asian markets drive high volume for durable, cost-effective commuter hubs. The fastest evolving segment remains the e-bike application, which requires specialized heavy-duty aluminum alloys and robust steel axles to withstand continuous high-torque stresses, leading to dedicated R&D efforts focused on heat dissipation and power transfer efficiency within these specific component lines. This detailed market breakdown allows for precise forecasting and targeted technological development.

- By Product Type:

- Front Hubs

- Rear Hubs (including Freehubs)

- Internal Gear Hubs (IGH)

- By Bearing Type:

- Sealed Cartridge Bearings

- Cup-and-Cone Bearings

- By Material:

- Aluminum Alloy

- Steel

- Carbon Fiber Composites

- By Brake Type:

- Disc Brake Compatible Hubs

- Rim Brake Compatible Hubs

- By Application:

- Mountain Biking (MTB)

- Road Cycling

- Commuter/Urban Bicycles

- Electric Bicycles (E-bikes)

- By Sales Channel:

- OEM (Original Equipment Manufacturers)

- Aftermarket

Value Chain Analysis For Bicycle Hubs Market

The value chain for the Bicycle Hubs Market begins with upstream activities focused on sourcing specialized, high-grade raw materials, primarily aerospace-grade aluminum alloys (6061 and 7075 series), high-precision steel for axles and freehub components, and sealed cartridge bearings, which are often sourced from specialist bearing manufacturers (e.g., SKF, Enduro). The integration of complex computer numerical control (CNC) machining and precision forging processes transforms these materials into high-tolerance hub shells and internal components. Manufacturing is often concentrated in high-tech industrial clusters in Asia Pacific, capitalizing on scale and precision engineering expertise. Midstream activities involve the assembly and quality control processes, where bearing installation, axle insertion, and freehub engagement mechanism assembly occur, requiring specialized clean-room environments for premium products to ensure optimal performance and longevity.

Downstream activities center on distribution channels, which are bifurcated into Original Equipment Manufacturers (OEMs) and the aftermarket. The OEM channel involves large-volume sales directly to major bicycle brands (e.g., Specialized, Trek, Giant) for integration into complete bikes. This channel demands competitive pricing, stringent quality standards, and consistent delivery schedules. The aftermarket channel, conversely, relies on distribution networks feeding specialized bicycle retailers, online platforms, and individual mechanics, focusing on high-margin, performance-oriented components sought by enthusiasts for upgrades and custom builds. Direct-to-consumer (DTC) models are increasingly utilized by boutique hub manufacturers, offering customization and direct engagement with the end-user. The success of the downstream segment heavily relies on efficient inventory management, minimizing lead times for specialized configurations (e.g., specific spoke counts, axle standards), and maintaining strong relationships with influential mechanics and specialized dealers who often recommend specific brands based on reliability and serviceability.

The distribution network complexity is amplified by the technical variety of hubs required globally. Indirect sales, handled through regional distributors and wholesalers, ensure broad market penetration, especially for mass-market and mid-range components. Direct sales, though less common for high volume, are critical for maintaining control over brand image and supporting high-end OEMs with just-in-time (JIT) delivery systems. The quality of the bearing systems and the reputation of the freehub engagement mechanism are paramount value-add points recognized throughout the entire chain. Ensuring the integrity and traceability of these precision components from material procurement to final retail sale is essential for maintaining brand trust, especially given the crucial safety and performance role a hub plays in cycling.

Bicycle Hubs Market Potential Customers

The primary customers for the Bicycle Hubs Market are diversified across institutional buyers, professional entities, and individual consumers. The largest volume segment consists of Original Equipment Manufacturers (OEMs), which include global giants and regional bicycle producers spanning road, MTB, and e-bike categories. These OEMs are highly influential, demanding specialized product specifications, scalability in production, and stringent compliance with safety and environmental standards, often dictating the adoption rate of new technologies like specific axle dimensions or proprietary freehub standards. Securing long-term supply contracts with major OEMs is a significant objective for large-scale hub manufacturers, as this guarantees substantial, predictable revenue streams and establishes market presence through factory integration on reputable bicycle models.

Another crucial customer segment involves independent bicycle builders and custom frame shops, who require flexibility, low-volume specialization, and access to premium or aesthetically unique hub designs. These small-scale customers often drive demand for specialized spoke counts, custom anodization colors, and high-end materials like titanium or carbon fiber, focusing on customization and top-tier performance characteristics. Finally, the broad category of cycling enthusiasts and individual consumers represents the vital aftermarket segment. These buyers, typically focused on performance upgrades or replacement parts, are highly informed and driven by factors such as brand reputation (e.g., quick engagement points, reduced weight, superior sealing), professional reviews, and ease of maintenance. This group often invests heavily in sealed bearing, high-engagement hubs to enhance their riding experience, particularly within the competitive mountain biking and gravel cycling communities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 950 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shimano, SRAM, DT Swiss, Hope Technology, Chris King, Industry Nine, Roval Components, Zipp (SRAM), Novatec, Fomosa, Campagnolo, Tune, White Industries, Phil Wood & Co., Koozer, Ringlé, SunRace, Rotor, Rohloff, Sturmey-Archer |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bicycle Hubs Market Key Technology Landscape

The Bicycle Hubs Market is defined by continuous technological advancement focused on optimizing rotational efficiency, durability, and compatibility with evolving bicycle standards. A foundational technology driving the premium segment is the widespread adoption of sealed cartridge bearings, which encapsulate the ball bearings, races, and lubricant into a single, high-tolerance unit. This provides superior protection against water, dust, and grime compared to traditional cup-and-cone systems, significantly extending service intervals and enhancing reliability under severe riding conditions, particularly relevant for mountain biking and gravel disciplines. Manufacturers are competing fiercely on bearing quality, utilizing ceramic bearings or high-grade stainless steel bearings (e.g., ABEC 5 or higher) to minimize rolling resistance. Simultaneously, the freehub mechanism, critical for rear hubs, has seen innovation focused on increasing the points of engagement (POE), enabling faster power transfer when the rider begins pedaling. High-end hubs now feature 70+ engagement points through complex ratcheting or pawl systems (e.g., DT Swiss Star Ratchet or Industry Nine’s Hydra drive), appealing directly to performance-focused riders.

Furthermore, structural and dimensional technologies have radically changed the hub landscape. The transition from traditional quick-release skewers to thru-axles (12mm and 15mm diameters) provides enhanced stiffness and security, which is paramount for bikes equipped with disc brakes, as the forces generated during braking are significantly higher and asymmetric. The standardization of "Boost Spacing" (110mm front, 148mm rear) in mountain bikes has driven a new generation of wider hub flanges, improving the spoke bracing angle for a stiffer and more robust wheel build, directly addressing the demands of aggressive off-road riding. Material science also plays a crucial role; while aluminum remains standard, the use of proprietary carbon fiber composites for hub shells is a growing niche, offering extreme weight reduction necessary for elite racing applications. Internal Gear Hubs (IGH), such as those produced by Rohloff and Shimano, represent a mature but continually refined technology that encapsulates the entire gear system within the hub shell, offering low maintenance and wide gear ranges, particularly popular in urban and touring markets.

The integration requirements for modern disc brakes dictate specific hub designs. Center lock and 6-bolt mounting standards dominate the market, requiring high-precision machining to ensure proper rotor alignment and braking performance. E-bike hubs introduce additional complexity; they must accommodate either reinforced freehub systems for external drivetrains or, in the case of direct-drive or geared motor systems, incorporate the entire motor and battery connection apparatus directly into the hub shell. These e-bike applications demand specialized thermal management technologies and robust materials capable of dissipating heat generated under sustained high torque loads, representing a distinct and technologically intensive development path within the broader market segment. Ongoing research focuses on incorporating sensor technology into hubs for real-time monitoring of wheel speed, rotational integrity, and eventually, proactive maintenance alerts utilizing embedded micro-electronics.

Regional Highlights

- Asia Pacific (APAC) Market Dominance: APAC remains the undisputed global hub for bicycle hub manufacturing, driven by massive production capabilities in Taiwan, China, and Southeast Asia. This region controls the majority of the supply chain, producing both high-volume, cost-effective hubs for commuter bicycles and sophisticated, high-precision components (particularly in Taiwan) for premium global brands. The growing middle class and increasing urbanization in countries like India and China are simultaneously fueling strong domestic demand for basic and mid-range cycling equipment. Manufacturers in this region benefit from economies of scale and expertise in complex CNC machining, establishing APAC as the foundational source for both OEM and aftermarket components worldwide.

- North American Performance Focus: The North American market is characterized by a high demand for premium, performance-oriented hubs, particularly within the specialized disciplines of mountain biking (MTB), gravel racing, and high-end road cycling. Consumers in this region prioritize technical specifications such as high points of engagement (POE), weight optimization through lightweight alloys and carbon fiber, and proprietary sealing technologies for extreme weather protection. The aftermarket segment is robust, with significant consumer spending directed toward component upgrades. Innovation often originates here, driven by strong competitive cycling cultures and consumer willingness to invest in technologies like ceramic bearings and customized anodization options, favoring specialty brands known for rapid engagement mechanisms.

- European E-bike and Urban Segment Growth: Europe represents a technologically advanced market driven by stringent environmental policies favoring cycling and the widespread adoption of e-bikes. This region is a major consumer of durable, high-load-capacity hubs suitable for daily commuting and touring. The prominence of e-bikes has accelerated demand for reinforced traditional hubs and specialized Internal Gear Hubs (IGH), which offer low maintenance and robustness, ideal for urban use. Additionally, European consumers often place a high value on components sourced through ethical and sustainable manufacturing processes. Western Europe, particularly Germany and the Netherlands, shows strong demand for high-quality, long-lasting components capable of withstanding year-round weather conditions, reinforcing the market for superior sealed bearing systems.

- Latin America, Middle East, and Africa (MEA) Emerging Markets: These regions represent emerging opportunities characterized by infrastructural challenges and growing adoption of cycling for basic transportation and entry-level sport. Demand is predominantly focused on cost-effectiveness and robustness, favoring durable aluminum hubs with simplified maintenance requirements, often utilizing cup-and-cone bearing systems due to lower unit cost. Market penetration is steadily increasing, fueled by improving road infrastructure and governmental initiatives to promote cycling, suggesting future growth potential as disposable incomes rise and the market shifts towards mid-range and performance-oriented products over the forecast period.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bicycle Hubs Market.- Shimano

- SRAM

- DT Swiss

- Hope Technology

- Chris King

- Industry Nine

- Roval Components

- Zipp (SRAM)

- Novatec

- Fomosa

- Campagnolo

- Tune

- White Industries

- Phil Wood & Co.

- Koozer

- Ringlé

- SunRace

- Rotor

- Rohloff

- Sturmey-Archer

Frequently Asked Questions

Analyze common user questions about the Bicycle Hubs market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between sealed cartridge and cup-and-cone bicycle hubs?

Sealed cartridge hubs use pre-assembled, self-contained bearing units offering superior protection against contamination and requiring less maintenance, ideal for performance and harsh conditions. Cup-and-cone hubs use loose ball bearings that require regular adjustment and greasing but are often cheaper and more easily serviced with standard tools.

Why are high engagement points important in modern bicycle freehubs?

High engagement points (POE) on a freehub reduce the degree of rotation needed before the drivetrain engages, minimizing 'slop.' This is crucial for disciplines like mountain biking and technical climbing, where instantaneous power transfer is required when starting to pedal out of a coasting state, improving bike control and efficiency.

How is the rise of e-bikes affecting the demand for bicycle hubs?

E-bikes demand significantly more robust and durable hubs due to higher sustained torque and loads. This trend drives demand toward heavy-duty sealed bearing hubs, reinforced axles, and sometimes integrated motor hubs, increasing the overall average selling price and shifting manufacturing focus toward component longevity.

What is "Boost Spacing" and why is it now common in mountain bike hubs?

Boost Spacing refers to wider hub standards (110mm front, 148mm rear) that spread the hub flanges further apart. This increases the bracing angle of the spokes, resulting in a stiffer, stronger wheel assembly, essential for the demanding conditions and large wheel sizes (29-inch) prevalent in modern mountain biking.

Which geographic region leads the technological innovation in premium bicycle hubs?

While Asia Pacific leads manufacturing volume, technological innovation, particularly concerning high-engagement mechanisms, proprietary sealing, and lightweight materials like carbon fiber, is primarily driven by companies and strong market demand originating from North America and parts of Europe.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager