Bicycle Mudguard Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435933 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Bicycle Mudguard Market Size

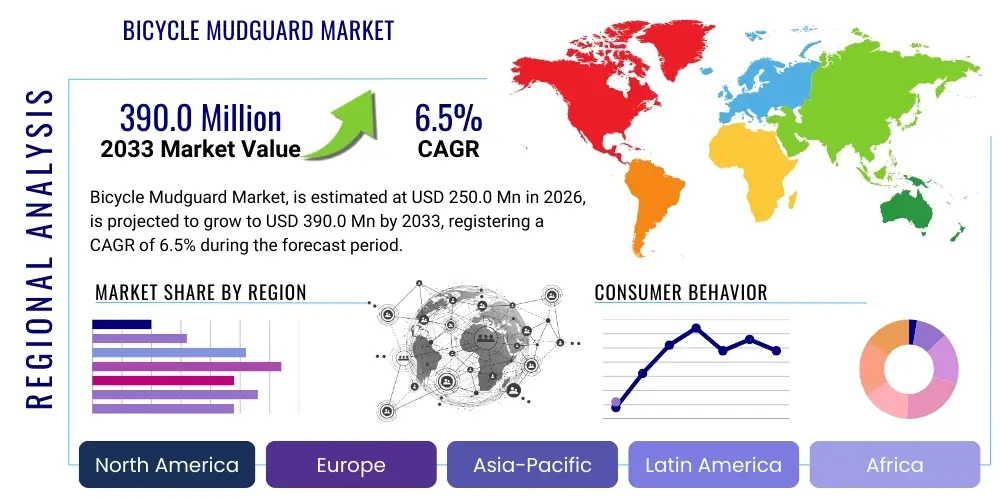

The Bicycle Mudguard Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 250.0 million in 2026 and is projected to reach USD 390.0 million by the end of the forecast period in 2033. This consistent growth trajectory is primarily underpinned by the increasing global emphasis on sustainable urban mobility, coupled with the burgeoning popularity of cycling as a fitness and recreational activity, particularly in developed and rapidly urbanizing economies. The resilience of the aftermarket segment, driven by replacement cycles and the customization needs of cyclists, further stabilizes the valuation.

The market expansion is characterized by continuous innovation in material science, focusing on producing lightweight, durable, and aesthetically integrated mudguard systems. Manufacturers are increasingly utilizing advanced polymers, composite materials, and quick-release mounting mechanisms to cater to diverse bicycle types, including road, mountain, and, most significantly, electric bikes (e-bikes). The rising adoption of e-bikes, which are often used year-round for commuting, necessitates reliable weather protection components, driving demand for premium, full-coverage mudguards.

Bicycle Mudguard Market introduction

The Bicycle Mudguard Market encompasses the manufacturing, distribution, and sale of devices designed to deflect water, mud, and road debris thrown up by bicycle wheels, thereby protecting the rider, drivetrain components, and following cyclists. Historically simple, the product has evolved into a sophisticated accessory that integrates seamlessly with frame geometry and suspension systems. Modern mudguards are categorized based on coverage (full-coverage, clip-on/temporary, and specialized fenders) and material composition, including injection-molded plastics, aluminum alloys, and carbon fiber composites. The primary applications span across commuter cycling, recreational touring, competitive off-road cycling (MTB), and professional road racing, where protection from adverse weather conditions is crucial for performance and comfort. The market growth is intricately linked to the overall health of the global bicycle industry and governmental investment in cycling infrastructure.

The core benefits derived from high-quality mudguards include enhanced rider comfort and hygiene, substantial protection of critical moving parts (such as bottom brackets, chains, and derailleur systems) from abrasive contaminants, thus extending component lifespan and reducing maintenance frequency. Furthermore, in urban settings, they contribute to the safe co-existence of cyclists and pedestrians by minimizing spray. Major driving factors for market proliferation include increasing environmental consciousness spurring bicycle adoption, favorable government policies promoting cycling through subsidies and infrastructure development (e.g., dedicated bike lanes), and the continuous technological advancements leading to superior product durability and ease of installation. The robust growth in the gravel and adventure cycling segments, requiring specific, heavy-duty fender solutions, also provides significant market momentum.

Crucially, the aesthetic integration of mudguards has become a key differentiator, moving from purely functional add-ons to design elements. High-end bicycle manufacturers are increasingly specifying pre-installed, custom-fit mudguards that match the bicycle's design language, further boosting the Original Equipment Manufacturer (OEM) segment. Simultaneously, the aftermarket thrives on customization, allowing cyclists to select components based on specific riding conditions (e.g., seasonal changes or trail types) and personal style preferences, reinforcing the market’s dynamism across both utility and luxury segments.

Bicycle Mudguard Market Executive Summary

The Bicycle Mudguard Market is currently experiencing robust momentum, predominantly fueled by evolving global business trends centered on sustainability and the expansion of the e-mobility sector. Key business trends indicate a strong shift towards lightweight, recycled, and recyclable material usage, aligning with circular economy principles favored by consumers and regulators in Western markets. Supply chain resilience, following the disruptions of recent years, has driven diversification, with manufacturing capabilities expanding beyond traditional Asian hubs into Eastern Europe and North America to facilitate quicker response times for customized and premium offerings. Furthermore, digital sales channels, particularly direct-to-consumer (D2C) models, are increasingly critical, allowing specialized mudguard brands to capture higher margins and establish direct customer feedback loops essential for rapid product iteration.

From a regional perspective, Europe remains the dominant market, characterized by high rates of bicycle commuting, stringent safety regulations concerning road spray, and a mature cycling culture that prioritizes accessory quality. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, propelled by the massive uptake of utility bicycles and e-bikes in countries like China, India, and Southeast Asia, driven by urbanization and improved middle-class spending power. North America is characterized by high demand in the specialized segments—mountain biking and gravel cycling—driving innovation in flexible and quick-detach fender systems. Regional success hinges on localization of product design, ensuring compatibility with locally popular bicycle frame architectures and addressing regional weather patterns, such as monsoon seasons in parts of APAC or heavy snowfall in Nordic countries.

Segmentation analysis reveals that the Material segment sees Thermoplastic Polymers (e.g., polypropylene and polycarbonate) maintaining dominance due to cost-effectiveness and versatility, but composite materials (carbon fiber and advanced glass-filled nylon) are gaining share in the premium sector due to superior weight-to-strength ratios. By Application, the Commuter/Hybrid bike segment leads volume sales, whereas the Mountain Bike (MTB) segment is the primary driver of innovation in geometry and attachment technology (such as inverted fork guards). Distributionally, the Aftermarket segment holds sway, offering vast customization, though the OEM segment is expanding significantly due to the increasing factory integration of high-quality fender systems, particularly on high-value touring and e-commuter models. Trends also point to the integration of features like reflective strips and mounting points for lighting systems within the mudguard structure to enhance safety.

AI Impact Analysis on Bicycle Mudguard Market

User queries regarding the impact of Artificial Intelligence (AI) on the Bicycle Mudguard Market primarily revolve around three strategic areas: how AI can optimize manufacturing efficiency, how it influences personalized product design, and its role in predicting future market demand and supply chain risks. Users are keen to understand if AI can democratize access to customized bicycle accessories by streamlining design processes previously reliant on extensive human CAD work. Concerns often center on the practical application of complex AI algorithms in a relatively low-cost, high-volume manufacturing sector like plastic injection molding, and whether the investment in AI-driven automation justifies the resulting efficiency gains for a product with generally low margins. Expectations are high regarding AI's ability to minimize material waste through predictive quality control and dynamic nesting in composite layups.

AI’s influence is subtle but pervasive, primarily impacting behind-the-scenes operations rather than the end-user interaction with the product itself. In design, Generative AI is being leveraged to explore thousands of potential aerodynamic profiles and structural geometries that maximize rigidity while minimizing material usage, ensuring optimal performance across different bicycle tire sizes and suspension travel characteristics. Furthermore, AI-powered predictive analytics are essential for optimizing inventory management. By analyzing real-time weather data, regional cycling event schedules, and historical sales trends, sophisticated systems can forecast demand spikes for specific types of mudguards (e.g., full fenders before winter or temporary clip-ons before summer recreational riding) with unprecedented accuracy, thereby reducing warehousing costs and mitigating the risk of stockouts.

In the manufacturing phase, AI facilitates advanced automation and quality inspection. Computer vision systems equipped with AI algorithms perform rapid, non-destructive testing on injection-molded parts, identifying minute defects, warping, or dimensional inaccuracies far faster and more reliably than traditional human inspection methods. This precision leads to higher yield rates and superior product consistency. Over time, the data collected by these AI systems can feedback directly into the molding process, adjusting temperatures, pressure, and cooling cycles dynamically (closed-loop manufacturing), further refining the production of lightweight, complex geometries characteristic of modern integrated mudguard designs.

- Generative Design for Aerodynamics: AI algorithms explore optimal mudguard shapes, balancing coverage area, weight, and aerodynamic drag, resulting in functionally superior, streamlined designs that integrate better with modern bicycle aesthetics.

- Predictive Demand Forecasting: AI analyzes geographical weather patterns, seasonal commuting trends, and e-commerce search data to accurately predict regional demand for different fender types, optimizing production scheduling and reducing inventory risk.

- Manufacturing Quality Control: AI-driven computer vision systems conduct real-time inspection of injection-molded and composite parts, ensuring precise dimensional accuracy and identifying microscopic flaws, significantly increasing yield rates and product reliability.

- Supply Chain Optimization: Machine learning models process global logistics data, factoring in raw material price volatility (especially polymers and metals) and shipping constraints to recommend the most cost-effective and resilient sourcing and distribution pathways.

- Personalized Accessory Recommendations: AI enhances e-commerce platforms by analyzing user bike type, riding environment, and previous purchase history to recommend perfectly compatible and necessary mudguard systems, boosting conversion rates and customer satisfaction.

- Additive Manufacturing Optimization: AI determines the ideal parameters (e.g., layer thickness, infill density) for 3D printed mudguard prototypes and custom components, accelerating product development cycles and minimizing material consumption during rapid prototyping.

DRO & Impact Forces Of Bicycle Mudguard Market

The Bicycle Mudguard Market is shaped by a critical interplay of Drivers, Restraints, and Opportunities, collectively influenced by competitive and environmental Impact Forces. Key drivers include the accelerated global shift towards cycling for daily commuting and recreation, significantly bolstered by public health initiatives and environmental concerns that favor non-motorized transport. The rapid expansion of the e-bike sector globally is a powerful multiplier, as e-bike users often ride longer distances and require year-round protection, demanding robust and integrated fender solutions. Opportunities are concentrated in material innovation—specifically, developing durable, recycled plastics and composites—and capitalizing on the growing demand for highly specialized accessories catering to niche markets like gravel cycling and fat biking, which require unique, often oversized fender geometry and robust attachment methods.

However, the market faces significant restraints. The primary challenge remains the perception among many casual cyclists, especially in markets where cycling culture is less mature, that mudguards are an optional, non-essential accessory, leading to price sensitivity and reluctance to invest in premium products. Furthermore, compatibility issues present a continuous technical constraint; the proliferation of non-standard frame designs, varying tire widths, and the complexity of integrating fenders with modern disc brake systems and suspension linkages require manufacturers to offer extensive and often confusing fitment options. Counterfeit products and low-quality imports, particularly in the aftermarket segment, also exert downward pressure on average selling prices and erode brand value for legitimate manufacturers.

Impact forces are dominated by competitive intensity driven by both established cycling accessory giants and agile, highly specialized niche manufacturers focusing solely on fender solutions. Technological forces necessitate continuous investment in quick-release mechanisms and aesthetic integration to meet consumer demands for simplicity and style. Regulatory forces, while generally supportive of cycling, sometimes impose standards on component materials (e.g., chemical restrictions in the EU) that influence manufacturing costs. Overall, the market's trajectory is positive, leveraging the robust macroeconomic trend toward sustainable transport, but success requires navigating the complexity of customization and maintaining a competitive edge against low-cost alternatives through demonstrable quality and innovative fitting systems.

Segmentation Analysis

The Bicycle Mudguard Market is meticulously segmented across key dimensions including Material, Product Type, Application, and Distribution Channel, allowing market players to precisely target specific consumer needs and cycling disciplines. This granular segmentation reflects the diverse requirements of the global cycling community, ranging from the performance-focused demands of mountain bikers to the durability and full coverage needs of urban commuters. Understanding these segments is vital for strategic pricing and product development, especially as consumers increasingly seek specialized accessories tailored to their specific bicycle type and riding environment. The trend toward integration mandates that product types are often cross-referenced with application, meaning commuter fenders must handle heavy load bearing, while MTB fenders prioritize rapid detachment and flexibility.

Material composition segmentation highlights the trade-off between cost, weight, and durability, where affordable thermoplastic polymers dominate the volume market due to their ease of molding and resilience, while premium sectors utilize lightweight aluminum, steel, or carbon fiber for superior stiffness and longevity. Application segmentation clearly delineates demand: the Commuter/Hybrid category demands full-wrap fenders for maximum protection, whereas the Mountain Bike (MTB) segment requires highly specialized, small, flexible splash guards near the fork crown and downtube. Product type segmentation distinguishes between permanent, full-coverage fenders (often bolted directly to frame eyelets, common on touring and city bikes) and temporary, clip-on or quick-release fenders favored by road cyclists and those who only use protection in adverse weather, demanding flexibility and minimal aesthetic intrusion.

Distribution Channel analysis reveals the crucial role of the Aftermarket, which holds the largest share, facilitating rider customization and replacements via specialized cycling retail stores (Independent Bicycle Dealers or IBDs) and high-volume e-commerce platforms. However, the OEM segment is gaining prominence, particularly with the proliferation of integrated solutions for high-end e-bikes and commuter bicycles, where manufacturers recognize the value of pre-fitting reliable, high-quality fenders directly at the factory. The growth of omnichannel retail strategies is critical, linking the technical expertise provided by IBDs with the convenience and competitive pricing of online platforms, optimizing customer access to technical advice and product availability across all segments.

- By Material:

- Thermoplastic Polymers (Polypropylene, Polycarbonate, PVC)

- Metal Alloys (Aluminum, Stainless Steel)

- Composites (Carbon Fiber, Glass-Filled Nylon)

- Rubber and Elastomers

- By Product Type:

- Full-Coverage Fenders (Permanent Mount)

- Clip-On/Quick-Release Fenders (Temporary)

- Ass Savers and Minimalist Guards

- Specialized Guards (e.g., Down Tube Guards, Fork Guards)

- By Application:

- Mountain Bikes (MTB)

- Road Bikes

- Commuter and Hybrid Bikes

- Touring and Gravel Bikes

- Electric Bikes (E-Bikes)

- By Distribution Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (AM)

- Independent Bicycle Dealers (IBD)

- E-commerce Platforms

- Mass Merchandise Retailers

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Bicycle Mudguard Market

The Value Chain for the Bicycle Mudguard Market begins with upstream activities focused on raw material procurement, primarily sourcing large quantities of engineering plastics (polycarbonate, ABS, nylon) and aluminum or specialized composite prepregs. This stage is highly sensitive to global petrochemical pricing and metal commodity cycles. Key considerations upstream include establishing long-term contracts with material suppliers who can ensure the quality, purity, and, increasingly, the certified recycled content of polymers used in sustainable product lines. Efficiency in material conversion is crucial, requiring advanced molding technologies and minimal waste generation, as materials constitute a significant portion of the final product cost, especially for high-volume thermoplastic models.

The manufacturing stage involves conversion processes such as injection molding, thermoforming, extrusion, or precision metal stamping, followed by secondary operations like finishing, painting, or the integration of reflective materials. This phase requires significant capital investment in tooling and automation to maintain consistency and rapid production scaling. Downstream activities involve managing a complex distribution network characterized by both direct and indirect channels. Direct channels include sales to bicycle OEMs for factory installation (a growing, high-volume, but lower-margin segment) and direct-to-consumer (D2C) sales through brand websites, offering maximum margin control and direct customer relationship management. The reliance on indirect distribution remains paramount, utilizing global distributors, regional wholesalers, and thousands of Independent Bicycle Dealers (IBDs) who offer expert installation and product advice.

The indirect channel, particularly the role of the IBD, is vital for premium products and complex installations, ensuring correct fitment across the vast range of bicycle frame geometries and wheel sizes. Logistics optimization, particularly for bulky yet relatively low-value items like mudguards, is critical to maintaining profitability across international markets. Effective channel management requires manufacturers to balance the need for widespread physical availability (through distributors and retailers) with the efficiency and data capture capabilities offered by their own digital platforms. The overall value chain success hinges on maintaining quality control throughout, managing logistics costs effectively, and fostering strong partnerships with both material suppliers upstream and the specialized bicycle retail community downstream.

Bicycle Mudguard Market Potential Customers

The Bicycle Mudguard Market targets a diverse array of end-users whose purchasing decisions are dictated by their cycling discipline, frequency of use, and local climate. The most significant segment of potential customers comprises Urban Commuters and Hybrid Cyclists. These individuals rely on their bicycles for daily transport, making reliable, full-coverage weather protection essential for maintaining professional appearance and reducing component wear during frequent, year-round use. This segment prioritizes durability, ease of maintenance, and maximum coverage, driving demand for securely mounted, wide-profile thermoplastic or metal fenders that integrate well with lighting and rack systems.

A second major customer segment includes Enthusiast and Performance Cyclists, specifically Road Riders, Mountain Bikers (MTB), and Gravel Riders. For this group, the priorities shift to lightweight construction, quick removal, and compatibility with specific, aggressive geometries. MTB riders require specialized, flexible splash guards to protect sensitive suspension seals and optics, while gravel and touring cyclists demand robust, lightweight fenders capable of handling large tire volumes and challenging off-road conditions. Their buying decisions are less price-sensitive and more focused on performance metrics, material science, and brand reputation for innovation and quality fitment.

Finally, the rapidly expanding E-Bike Users constitute a crucial and distinct customer base. E-bikes, due to their higher average speeds and increased use as primary transportation replacements, inherently require heavy-duty, often wider, and structurally rigid fenders that can withstand the vibrations and forces associated with motorized cycling. E-bike fenders are frequently mandated by OEM standards to be integrated into the frame structure for enhanced stability and safety, positioning e-bike manufacturers as critical OEM buyers. Furthermore, general recreational cyclists and families using bikes for leisure trips represent the volume-driven, entry-level segment, where ease of installation and cost-effectiveness (typically achieved through clip-on plastic solutions) are the primary purchasing criteria.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 250.0 Million |

| Market Forecast in 2033 | USD 390.0 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SKS Germany, Topeak, Zéfal, Velo Orange, Portland Design Works, Bontrager, Crud Products, Ass Savers, RockShox, R&S Speedshop, Curana, Specialized Bicycle Components, Flinger, BBB Cycling, Riesel Design, Mucky Nutz, Polisport, Axiom Gear, XLC Components, Trelock |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bicycle Mudguard Market Key Technology Landscape

The technological landscape of the Bicycle Mudguard Market is characterized by material science advancements and innovative mounting system development, aiming to solve the long-standing issues of weight, durability, and fitting complexity. The transition from basic stamped metal or simple plastic guards to highly engineered composite structures is a major technological trend. Manufacturers are increasingly utilizing injection-molded, high-grade polymers such as glass-filled nylon and polycarbonate, which offer exceptional impact resistance and flexural strength while maintaining extremely low weight profiles. Furthermore, the integration of advanced polymers with anti-static properties minimizes the adhesion of debris, contributing to cleaner cycling. The pursuit of sustainable manufacturing drives the adoption of technologies capable of processing post-consumer recycled (PCR) plastics without sacrificing structural integrity or surface finish.

A second critical technology focus is the development of universal and rapid attachment mechanisms. Traditional bolted systems are labor-intensive and require specialized frame eyelets, limiting their use. Modern innovations include tool-less, quick-release strapping systems (utilizing robust Hook-and-loop fasteners or proprietary rubber straps) and magnetic attachments, enabling cyclists to add or remove mudguards quickly based on weather conditions. This rapid transition capability is particularly valued by performance cyclists. For integrated OEM systems, the technological challenge lies in creating hidden or semi-hidden bracketry that mounts directly to brake calipers or suspension components, maintaining a clean aesthetic while ensuring vibration damping and structural rigidity at high speeds.

Future technological advancements are trending toward smart integration and material intelligence. This includes the development of flexible polymer composites that automatically adjust shape based on external temperature or aerodynamic forces, although this remains nascent. More immediately relevant is the integration of peripheral technologies, such as embedded, low-profile reflective strips and channels designed specifically to accommodate internal wiring for dynamo-powered lighting systems. Moreover, technology enabling standardized fitment indexing, where manufacturers use precise digital mapping of frame components to guarantee compatibility across various bike models, simplifies the complex decision process for consumers in the highly fragmented aftermarket.

Regional Highlights

The regional dynamics of the Bicycle Mudguard Market reflect distinct cycling cultures, infrastructural maturity, and regulatory environments, influencing both demand volume and product sophistication across major geographical areas.

- Europe: This region holds the largest market share due to its entrenched cycling culture, particularly in countries like Germany, the Netherlands, and Scandinavia, where cycling is a primary mode of transportation year-round. Regulatory frameworks, such as those governing road safety and requiring splash guards for commercial utility bicycles, drive consistent demand for high-quality, full-coverage, integrated fender systems. The premium segment is highly active here, focusing on sophisticated, lightweight designs compatible with high-end commuter and touring e-bikes.

- North America (NA): Characterized by a strong emphasis on recreational and performance cycling, the NA market shows high demand for specialized, quick-release fenders catering to Mountain Biking (MTB) and the rapidly growing Gravel Cycling sector. While daily commuting is increasing, particularly in major metro areas, the bulk of sales is driven by aftermarket customization, where durability and technological features (such as optimized mud shedding design) outweigh initial cost considerations. The high concentration of specialized accessory brands drives innovation in fitment technology.

- Asia Pacific (APAC): Expected to exhibit the fastest growth, APAC is driven by massive volume sales of utility and entry-level electric bicycles in densely populated countries such as China, India, and Vietnam. The primary drivers are urbanization and affordability. Demand is focused on cost-effective, durable plastic guards for basic utility use. However, the premium segment is emerging, especially in developed markets like Japan and Australia, where high disposable income supports the purchase of high-performance and integrated e-bike accessories.

- Latin America (LATAM): This market is primarily price-sensitive, focusing on essential, low-cost plastic mudguards distributed through mass market channels. Growth potential is significant due to expanding urban centers and increasing traffic congestion, positioning cycling as a viable alternative, though adoption depends heavily on improving cycling infrastructure and addressing security concerns.

- Middle East and Africa (MEA): Currently the smallest market, demand is sporadic and localized, often linked to leisure cycling activities or specific utility use in urban areas. Sales are generally concentrated in high-income Gulf Cooperation Council (GCC) countries, focusing on niche, specialized accessories for performance cycling. The market is slowly evolving with increased government focus on recreational infrastructure development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bicycle Mudguard Market.- SKS Germany

- Zéfal

- Topeak

- Bontrager (Trek Bicycle Corporation)

- Specialized Bicycle Components

- Portland Design Works (PDW)

- Crud Products

- Ass Savers

- Riese & Müller GmbH (Integrated Solutions)

- Mucky Nutz

- Polisport Plásticos S.A.

- BBB Cycling

- Velo Orange

- Curana

- Axiom Gear

- XLC Components

- Flinger

- R&S Speedshop

- Trelock GmbH

- Syncros (Scott Sports SA)

Frequently Asked Questions

Analyze common user questions about the Bicycle Mudguard market and generate a concise list of summarized FAQs reflecting key topics and concerns.What materials are most commonly used in manufacturing high-performance bicycle mudguards?

High-performance mudguards primarily utilize advanced thermoplastic polymers such as polycarbonate and specialized glass-filled nylon due to their superior combination of low weight, high flexibility, and excellent impact resistance. Premium solutions for competitive cycling sometimes incorporate carbon fiber composites for ultimate stiffness and minimal mass.

How is the growth of the E-Bike segment influencing the demand for specific mudguard features?

The E-Bike segment is driving demand for wider, more structurally robust, and permanently integrated mudguards. Features such as increased rigidity to handle higher speeds and integrated channels for internal lighting wires are critical, moving the market toward factory-fitted (OEM) solutions that offer full coverage and long-term durability.

What is the primary difference between OEM and Aftermarket sales channels for mudguards?

OEM (Original Equipment Manufacturer) sales involve supplying mudguards directly to bicycle assemblers for pre-installation on new bikes, focusing on volume and compatibility. Aftermarket sales cater to individual cyclists for upgrades, replacements, or customization, offering a wider variety of specialized designs and fitment options, often at higher retail margins.

What technological advancements are simplifying the installation and removal of modern mudguards?

Key technological advancements include tool-less, quick-release mounting systems, often employing robust rubber straps, proprietary clip mechanisms, or strong magnetic attachments. These innovations address consumer demand for effortless seasonal removal and rapid switching between dry-weather and wet-weather setups, especially for road and mountain bikes without traditional mounting points.

Which geographical region dominates the Bicycle Mudguard Market in terms of revenue?

Europe currently dominates the Bicycle Mudguard Market in terms of revenue. This leadership is sustained by high rates of year-round bicycle commuting, extensive cycling infrastructure, a mature consumer base that values accessory quality, and supportive government regulations promoting cycling as a primary mode of transport.

How does sustainable manufacturing affect the material composition of modern fenders?

Sustainable manufacturing is pushing companies to adopt Post-Consumer Recycled (PCR) plastics and bio-based polymers. This transition requires technological processes that can maintain the necessary structural integrity and impact resistance using recycled feedstock, appealing to environmentally conscious consumers in mature markets.

What specific challenges do gravel and adventure cyclists pose to mudguard manufacturers?

Gravel and adventure cyclists require fenders that accommodate unusually large tire volumes (up to 50mm or wider) and complex suspension or dropper post cabling. Manufacturers must develop highly adjustable, lightweight, and durable systems that resist abrasion from coarse debris without fouling tight clearances.

How is digital integration transforming the purchasing experience in the mudguard aftermarket?

Digital platforms utilize advanced product configurators and compatibility tools, often leveraging AI, to guide customers in selecting the correct mudguard size and attachment mechanism for their specific bike model. This reduces return rates and enhances customer satisfaction by overcoming the complexity of frame and tire size variations.

What role does aesthetic design play in the competitiveness of the mudguard market?

Aesthetic design has moved from an afterthought to a core competitive factor. Consumers, especially in premium segments, demand fenders that are visually integrated, minimizing bulk and complexity. Sleek, matte finishes, color-matched components, and minimalist profiles are increasingly preferred over bulky, utilitarian designs.

Are there notable trends regarding integrated lighting systems within mudguards?

Yes, a key trend is the integration of light-compatible features. Modern fenders often include specialized channels or mounting points for rear lights and reflective elements. High-end systems may feature internal routing for dynamo-powered wires, creating a clean, permanent safety solution for commuters.

Why is the restraing factor of "compatibility complexity" so significant in this market?

Compatibility complexity arises from the lack of universal standards across the rapidly evolving bicycle industry. Variables include disc brake caliper placement, thru-axle designs, internal frame routing, tire width variations, and the absence of traditional eyelets on many modern performance frames, necessitating highly specific and expensive tooling for various mounting kits.

What impact does material thickness have on mudguard performance and manufacturing?

Material thickness is a direct determinant of weight, rigidity, and cost. High-performance fenders utilize thinner, more technologically advanced materials (like advanced polycarbonate) to maintain rigidity at low weight, while mass-market products rely on slightly thicker, cheaper polymers to achieve necessary durability and structural stability.

How do global events, such as the COVID-19 pandemic, affect mudguard demand?

The pandemic significantly boosted mudguard demand initially by accelerating the overall cycling boom (particularly commuter and leisure cycling). This led to temporary supply chain constraints, driving innovation in rapid production techniques and highlighting the need for localized manufacturing capabilities.

In value chain analysis, what is the major risk factor in the upstream segment?

The major risk factor upstream is volatility in raw material pricing, particularly petroleum-derived polymers. Since polymers constitute a high proportion of the final product cost, especially in high-volume markets, sudden price spikes or supply shortages can severely compress manufacturing margins.

What is the role of Independent Bicycle Dealers (IBDs) in the distribution of premium mudguards?

IBDs are crucial for premium mudguards as they provide essential technical expertise. Their staff can ensure precise and complex installations, guarantee correct fitment for non-standard bikes, and offer personalized recommendations that online channels struggle to replicate, thereby reinforcing the value proposition of high-end brands.

How do manufacturers ensure adequate spray coverage across different tire sizes and frame geometries?

Manufacturers rely on extensive computational fluid dynamics (CFD) modeling during the design phase to simulate spray patterns across varying wheel circumferences and speeds. This ensures the fender’s radius, width, and mounting angle provide optimal deflection for the designated tire size range without interfering with moving parts.

What defines a "minimalist" or "ass saver" type of mudguard, and who is the target user?

Minimalist guards are extremely lightweight, small, and often foldable plastic sheets designed to protect only the rider's immediate rear. They target road cyclists and weight-conscious MTB riders who prioritize minimal aesthetic impact and ease of storage, using them only in truly unavoidable wet conditions.

Is there a noticeable trend in the market toward recycled content for mudguards?

Yes, there is a strong and increasing trend toward using recycled materials, particularly certified Post-Consumer Recycled (PCR) plastics. This is driven by consumer demand in Western Europe and North America for sustainable cycling accessories, which brands leverage for marketing differentiation.

What is the strategic advantage of manufacturers utilizing a Direct-to-Consumer (D2C) sales model?

The D2C model grants manufacturers higher control over pricing, captures better profit margins, and facilitates immediate, direct feedback from end-users. This data accelerates product iteration and allows brands to build closer relationships with their consumer base, especially for specialized or customized products.

How do mountain bike mudguards differ structurally from road bike fenders?

MTB mudguards are generally shorter, wider, and made from highly flexible, resilient materials to absorb impacts and resist breaking during off-road use. They prioritize protection for suspension forks and downtubes, whereas road bike fenders are longer, narrower, and focus on clean, aerodynamic integration with tighter tire clearances.

What role does quality assurance play in mitigating risks from low-cost competitors?

Rigorous quality assurance, focusing on material strength, UV resistance, and the durability of attachment mechanisms, allows established brands to differentiate themselves. Demonstrating superior longevity and fitment complexity helps justify the higher price point compared to generic, poorly fitting, low-cost alternatives.

In the context of the supply chain, why is localization becoming increasingly important?

Localization, or establishing manufacturing closer to primary consumption markets (e.g., in Europe for European sales), reduces international shipping costs, minimizes lead times, increases supply chain flexibility against geopolitical risk, and allows for faster customization to regional specifications and frame designs.

What specific demands does gravel cycling place on fender geometry?

Gravel cycling requires fenders that combine the robustness of MTB guards with the coverage of commuter fenders. They must manage large clearances for knobby, wide tires (often 650b or 700c) and provide adequate mud shedding capability without clogging, usually achieved through slightly wider and stiffer profiles than traditional road fenders.

How are government regulations impacting the demand for mudguards in urban settings?

In several European cities, regulations promoting commuter cycling often include standards regarding visibility and splash reduction, indirectly boosting demand for fenders that are either mandated or strongly encouraged for safe public cycling, ensuring protection for both the rider and pedestrians.

What is the current CAGR projection for the Bicycle Mudguard Market between 2026 and 2033?

The Bicycle Mudguard Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between the forecast years of 2026 and 2033, reflecting steady adoption rates driven primarily by the e-bike sector and increasing urban mobility.

How does the use of computer vision technology impact the manufacturing process?

Computer vision, powered by AI, enables rapid, highly accurate automated inspection of finished mudguard components for structural integrity, dimensional tolerances, and surface finish. This technology significantly reduces manufacturing defects, ensuring product consistency and quality at high throughput rates.

What are the key characteristics of a full-coverage mudguard system?

A full-coverage system is characterized by fenders that extend significantly past the apex of the wheel, often wrapping close to 180 degrees, providing maximum protection for the rider, the bicycle drivetrain, and those cycling behind. They are typically secured permanently using multiple frame eyelets.

Why are aluminum alloys still used, despite the prevalence of plastics and composites?

Aluminum alloys are utilized for their superior rigidity and clean, classic aesthetic, especially in high-end touring and commuter bikes. They offer maximum durability and structural stability, often necessary for fenders supporting additional components like reflector brackets or heavy-duty mountings.

What are the primary challenges when designing a mudguard for a fully suspended mountain bike?

Designing for full-suspension bikes involves managing the dynamic movement of the wheels relative to the frame. Fenders must be mounted to the moving parts (like the fork crown or seat stays) and must maintain clearance through the full range of suspension travel without fouling the tires or suspension linkages.

How does the aftermarket address the need for extreme customization among cyclists?

The aftermarket provides extensive options based on material, color, coverage, and attachment method. Specialized brands focus on highly niche solutions, such as asymmetrical fenders or modular systems, allowing riders to build a tailored protection setup precisely matching their bike geometry and local weather requirements.

What is the expected market valuation of the Bicycle Mudguard Market by 2033?

Based on current growth projections and market trends, the Bicycle Mudguard Market is expected to reach an estimated valuation of USD 390.0 million by the end of the forecast period in 2033.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager