Bicycle Pannier Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438399 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Bicycle Pannier Market Size

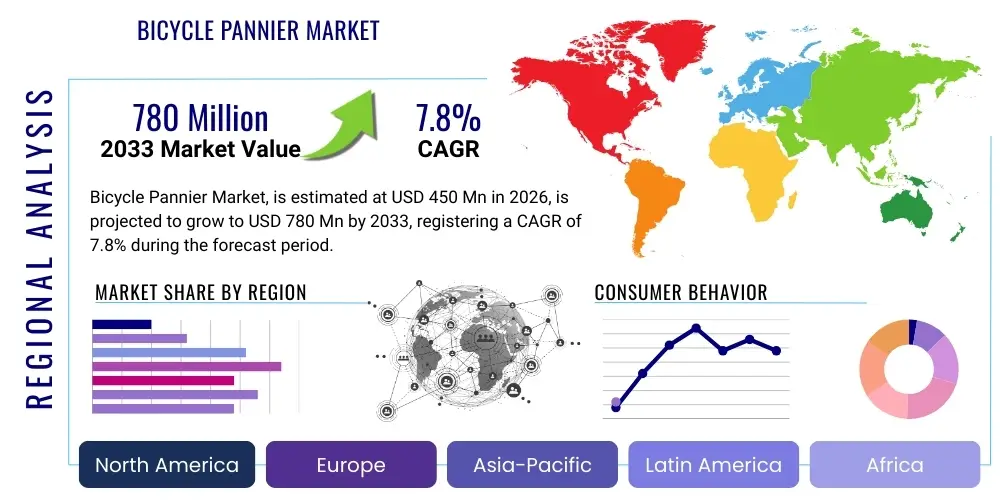

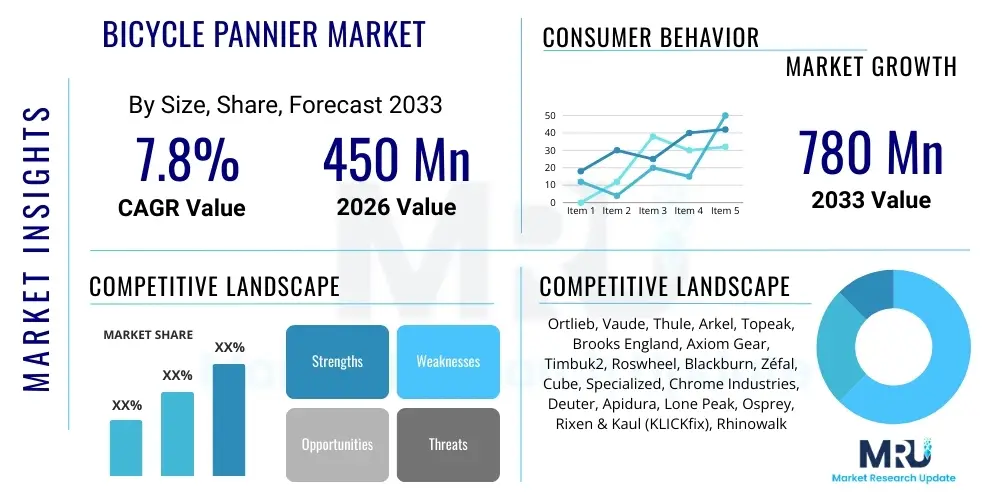

The Bicycle Pannier Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 780 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the global shift towards sustainable and active transportation, alongside the increasing popularity of bicycle touring and bikepacking activities.

Bicycle Pannier Market introduction

The Bicycle Pannier Market encompasses the manufacturing, distribution, and sale of specialized bags designed to be mounted on bicycles, primarily used for carrying luggage, groceries, or equipment. These products are essential components for cyclists engaged in commuting, long-distance touring, or recreational cycling where carrying capacity is necessary. Modern panniers are characterized by durable construction, high-level waterproofing, and innovative mounting mechanisms, providing stability and security during various cycling conditions. The core market demand stems from urbanization trends, rising fuel prices encouraging cycling adoption, and significant consumer interest in health and wellness activities that incorporate outdoor exercise.

Product descriptions typically highlight features such as material composition, which often includes high-performance synthetic fabrics like nylon or polyester, often coated with TPU or PVC for superior weather resistance. Key applications span daily commuting, where panniers replace traditional backpacks, minimizing strain on the rider, to specialized applications in bikepacking, where lightweight and rugged designs are preferred for unsupported travel. Major benefits include enhanced load stability, increased carrying capacity, improved rider comfort by shifting weight off the body, and the ability to safely transport electronics and essential gear in adverse weather conditions.

The market is currently being driven by several macro factors, including governmental initiatives promoting cycling infrastructure development in urban centers globally, the sustained growth of the e-bike segment which inherently supports heavier loads and longer commutes, and heightened environmental consciousness among consumers leading to greater investment in eco-friendly and reusable cycling gear. These factors collectively contribute to a robust demand outlook, pushing manufacturers to innovate in terms of lightweight materials and modular design systems.

Bicycle Pannier Market Executive Summary

The Bicycle Pannier Market exhibits strong growth momentum, underpinned by favorable global business trends centered on sustainability and the expansion of the cycling leisure segment. Business trends show manufacturers focusing on modular design systems and integrated electronic features, such as compatibility with smart bike lighting or integrated charging ports, appealing to the tech-savvy urban commuter. Furthermore, strategic partnerships between pannier manufacturers and e-commerce platforms are accelerating market penetration in regions with high online retail adoption. Investments in automating material cutting and welding processes are helping companies manage escalating demand while maintaining high quality standards, particularly concerning waterproofing.

Regionally, Europe remains the dominant market, driven by established cycling cultures in countries like Germany and the Netherlands and significant governmental investment in touring routes and urban bike paths. However, the Asia Pacific region is demonstrating the highest growth trajectory, fueled by rapid urbanization, increasing disposable incomes, and the adoption of cycling as a primary mode of affordable and efficient transportation in densely populated cities. North America shows stable growth, strongly influenced by the booming recreational and adventure cycling (bikepacking) sectors, which demand specialized, high-capacity, and extremely durable panniers.

Segmentation trends indicate a pronounced shift towards premium, waterproof materials (TPU/PVC-coated fabrics) across all application segments, reflecting consumer willingness to pay more for reliability and longevity. The Commuting segment dominates volume sales, favoring versatile, quick-release systems, while the Touring/Bikepacking segment drives innovation in ultra-lightweight and repairable designs. The most dynamic growth sub-segment is currently observed in single-rear panniers, which are preferred by daily commuters requiring just enough space for professional or grocery items, balancing capacity with bike maneuverability.

AI Impact Analysis on Bicycle Pannier Market

User queries regarding AI's impact on the Bicycle Pannier Market often center on manufacturing efficiency, inventory management, and personalized consumer engagement. Key themes include how AI can optimize supply chains to match fluctuating seasonal demand (especially for touring products), the potential for AI-driven material quality testing, and the use of machine learning algorithms for designing more aerodynamic or ergonomic pannier shapes. Consumers are particularly interested in whether AI can assist in creating personalized product recommendations based on individual riding styles, typical weather conditions, and bicycle geometry, thus ensuring the highest compatibility and functional satisfaction. There is also a latent interest in AI-enhanced anti-theft mechanisms integrated into smart pannier systems.

While the product itself remains largely mechanical, AI primarily influences the back-end operations and the consumer interface. In manufacturing, AI-powered predictive maintenance minimizes downtime on highly specialized equipment, such as ultrasonic welding machines used for creating seamless, waterproof seals. Furthermore, AI analytics are crucial for forecasting demand for specific colors, sizes, and mounting systems across different regional markets, allowing manufacturers to reduce inventory waste and accelerate product cycles. This optimization of inventory flow is paramount, particularly for premium brands utilizing specialized, often imported, raw materials.

On the consumer front, Generative AI tools are starting to assist in rapid prototyping and visualization, allowing companies to iterate quickly on design concepts, responding faster to market feedback on ergonomics and aesthetics. Moreover, data collected from cycling apps and sensors can be processed by machine learning models to provide highly accurate recommendations for the ideal pannier volume and mounting solution required for a cyclist's planned route or typical load profile, enhancing the overall customer journey and potentially increasing conversion rates.

- AI-driven Predictive Demand Forecasting: Optimizes inventory levels for seasonal touring and daily commuting products.

- Manufacturing Process Optimization: Use of machine learning in quality control for seamless waterproofing and material integrity testing.

- Personalized Product Recommendation Engines: AI algorithms suggest ideal pannier type (volume, material, mounting) based on user riding data and bike model.

- Supply Chain Resilience: AI models predict logistic bottlenecks and optimize routing for global distribution of raw materials and finished goods.

- Generative Design Assistance: Accelerates the prototyping of new ergonomic and aerodynamic pannier geometries.

DRO & Impact Forces Of Bicycle Pannier Market

The Bicycle Pannier Market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities, which collectively form the impact forces shaping its trajectory. The primary driver is the pervasive trend of eco-friendly and active commuting globally, spurred by rising environmental concerns and government subsidies for cycling infrastructure. Restraints mainly revolve around the premium pricing of high-quality, waterproof panniers, which can deter price-sensitive consumers, and the increasing market competition from low-cost, less durable alternatives. Opportunities are plentiful, centered on integrating smart features (such as solar charging panels or integrated GPS trackers), expanding product lines tailored specifically for the rapidly growing e-bike segment, and capitalizing on the global enthusiasm for long-distance bikepacking and adventure travel.

These forces create a complex market environment. The strong driver of urbanization and sustainable transport heavily pushes demand upwards, particularly in developed economies. However, the high initial cost barrier acts as a counter-force, requiring manufacturers to continuously prove the long-term value and durability of their products through extended warranties and superior material performance. The impact of external forces, such as fluctuating raw material costs (e.g., specialized plastics, high-denier fabrics), further necessitates efficient manufacturing processes and flexible pricing strategies to maintain profitability.

Crucially, the opportunity to innovate in the mounting technology and material science space exerts a significant positive impact. For instance, developing lighter, stronger, and more sustainable (recycled or bio-based) materials allows companies to address both the premium pricing restraint and the environmental driver simultaneously. Furthermore, the rising adoption of e-bikes, which typically travel faster and carry heavier loads, demands specialized, robust panniers with enhanced locking mechanisms, opening up a high-value niche market that requires specific product development and strategic focus.

Segmentation Analysis

The Bicycle Pannier Market is fundamentally segmented based on Material, Type, Mounting Type, and Application, providing a structured view of consumer preferences and market needs. This granular segmentation allows manufacturers to target specific end-user groups, ranging from the daily city commuter requiring basic functionality and waterproofing to the professional cycle tourist demanding extreme durability, modularity, and lightweight construction. The structure of demand is heavily skewed towards the Application segment, which dictates the necessary material and type configurations, with commuting representing the largest volume and touring representing the highest average selling price.

The segmentation by Material highlights the contrast between traditional, aesthetically pleasing materials like leather, popular in urban heritage brands, and high-performance technical fabrics like PVC and TPU, which dominate the performance and utility sectors due to their superior water resistance and ease of cleaning. Segmentation by Type differentiates between single panniers, favored for light commuting and balance on the bike, and double sets (or pairs), which are essential for multi-day touring where maximum carrying capacity is paramount. The nuances within these segments reveal shifting consumer priorities towards sustainability and integrated technological features across all product categories.

- By Material

- Waterproof Fabric (PVC, TPU, Waxed Canvas)

- Leather (Premium Urban Commuting)

- Others (Recycled Materials, Specialty Composites)

- By Type

- Single Panniers (Rear or Front)

- Double Pannier Sets (Pairs)

- By Mounting Type

- Rack-Mounted (Quick-Release Systems, Hook and Bungee)

- Handlebar-Mounted Bags

- Seat Post/Frame Bags (Bikepacking Style)

- By Application

- Commuting and Utility (Daily Use, Groceries)

- Touring and Bikepacking (Long-Distance Travel, Expedition)

- Recreation and Leisure

- By Distribution Channel

- Online Retail (E-commerce Platforms, Brand Websites)

- Offline Retail (Specialty Bike Stores, Sporting Goods Stores)

Value Chain Analysis For Bicycle Pannier Market

The value chain for the Bicycle Pannier Market begins with upstream activities involving the sourcing of highly specialized raw materials. This includes high-denier nylon and polyester fabrics, thermoplastic polyurethane (TPU) and polyvinyl chloride (PVC) coatings for waterproofing, specialized metal components (aluminum/steel) for mounting hardware, and high-performance zippers and buckles. The crucial upstream challenge is maintaining a steady supply of high-quality, specialized waterproof materials, as the performance of the final product is directly tied to the material integrity, especially the welding and coating quality. Manufacturers often need strong relationships with chemical and textile producers to ensure compliance with strict environmental standards.

The midstream phase involves manufacturing, which is highly specialized, particularly for premium waterproof products requiring radio-frequency (RF) welding or heat-sealing processes rather than traditional stitching to ensure complete seam integrity. Key activities include material cutting, welding, assembly of internal compartments, and the integration of proprietary mounting systems. Efficiency in manufacturing, especially reducing material waste and optimizing the welding process, is a primary determinant of cost competitiveness. Quality control at this stage is intensive, focusing on load-bearing capacity and sustained water resistance under pressure.

Downstream analysis focuses on distribution channels, which are bifurcated into direct and indirect routes. Direct distribution often involves sales through brand-owned websites, allowing manufacturers greater control over pricing and customer feedback, especially prevalent for premium, high-engagement brands like Ortlieb or Thule. Indirect distribution relies heavily on specialty bicycle retailers (LBS), large sporting goods stores, and major e-commerce platforms (Amazon, dedicated cycling retailers). Specialty bike stores remain vital as they provide expert advice on fitting and compatibility with different bicycle models, a necessary service for complex rack-mounted systems. The growth of global e-commerce has significantly expanded market reach, allowing smaller niche bikepacking brands to access international consumers efficiently. Efficient logistics and warehousing are critical downstream activities due to the relatively bulky nature of the finished goods.

Bicycle Pannier Market Potential Customers

The primary potential customers in the Bicycle Pannier Market can be categorized into three distinct end-user segments: Urban Commuters, Cycle Tourists/Bikepackers, and Recreational Riders. Urban Commuters represent the largest volume buyer group, characterized by a need for quick-release functionality, moderate capacity (often single panniers), high visibility features, and absolute waterproofing for protecting professional items like laptops and documents. Their purchasing decision is heavily influenced by convenience, aesthetics that fit a city environment, and durability that withstands daily wear and tear.

Cycle Tourists and Bikepackers constitute the highest average value customer segment. These buyers require multiple panniers (front and rear sets) with maximum load capacity, superior ruggedness, extreme resilience to abrasion, and modular attachment systems for multi-week or multi-month expeditions. Their purchasing criteria prioritize reliability, ease of field repair, weight-to-strength ratio, and proven performance under harsh conditions. This segment is less price-sensitive and highly loyal to specialized, high-performance brands that offer guaranteed waterproof systems.

The Recreational Rider segment includes casual users who might need panniers for shopping, short weekend trips, or carrying gear for light outdoor activities. This group is typically more price-sensitive and opts for entry-level to mid-range products. Their purchasing decisions often focus on versatility and ease of storage when not in use. Retail strategies aimed at this group often highlight value-for-money, simple installation, and adequate, though not necessarily extreme, weather protection. The growing adoption of e-bikes is blurring the line between the Commuter and Recreational segments, as e-bike riders often carry heavier loads over longer recreational distances.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 780 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ortlieb, Vaude, Thule, Arkel, Topeak, Brooks England, Axiom Gear, Timbuk2, Roswheel, Blackburn, Zéfal, Cube, Specialized, Chrome Industries, Deuter, Apidura, Lone Peak, Osprey, Rixen & Kaul (KLICKfix), Rhinowalk |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bicycle Pannier Market Key Technology Landscape

The technology landscape within the Bicycle Pannier Market is defined primarily by advancements in material science, seamless construction methods, and sophisticated mounting hardware. The shift from traditional stitched canvas to advanced synthetic fabrics like high-denier nylon and polyester coated with Thermoplastic Polyurethane (TPU) or Polyvinyl Chloride (PVC) is the most significant material evolution. TPU is increasingly favored over PVC due to its lighter weight, flexibility, and superior resistance to environmental degradation, alongside being viewed as a more environmentally benign option. The core technological advantage lies in the use of high-frequency or ultrasonic welding techniques to create completely seamless, watertight connections, eliminating the vulnerability inherent in needle stitching.

Innovation in mounting technology is crucial for user experience and product reliability. Proprietary quick-release systems, such as those employing self-locking mechanisms and adjustable hooks, have replaced older, less secure bungee cords and straps. Leading manufacturers invest heavily in hardware designed for one-hand operation, adjustable rail spacing to fit various rack diameters, and integrated anti-theft locking features. The goal is to provide maximum load stability, preventing pannier detachment even over rough terrain, while ensuring rapid removal for portability when dismounted. Furthermore, specific material treatments are being developed to enhance UV resistance and anti-abrasion properties, extending the operational lifespan of the products, which is a key value proposition for high-end touring gear.

Emerging technologies include the integration of 'smart' features, though still nascent. This includes the incorporation of solar panels on the exterior surface of panniers to charge small electronics (phones, lights) during touring. Reflective materials and high-visibility color choices are also becoming standard, enhancing cyclist safety, particularly for urban commuters. The bikepacking segment is driving demand for new composite materials and frame-specific designs that maximize the available triangular space within the bike frame, demanding highly engineered, non-traditional mounting points that utilize straps and buckles rather than rigid rack systems, necessitating ongoing innovation in material flexibility and attachment security.

Regional Highlights

Regional dynamics play a significant role in shaping the demand for bicycle panniers, reflecting differences in cycling culture, infrastructure investment, and economic development. Europe, encompassing major economies such as Germany, the Netherlands, and Scandinavia, dominates the market share. This dominance is attributed to a highly established cycling infrastructure, strong governmental support for sustainable transport, and a deep-rooted culture of both utilitarian commuting and long-distance cycle tourism. Demand in Europe is high for robust, completely waterproof panniers featuring secure locking mechanisms, driven by high population density and reliance on cycling for daily activities. Furthermore, European consumers often prioritize sustainable manufacturing practices and transparency in the supply chain, influencing brand selection.

North America (US and Canada) represents a substantial and rapidly expanding market, characterized by two primary growth drivers: high-end leisure cycling and the booming bikepacking trend. While commuter cycling is significant in major metropolitan areas, the substantial increase in outdoor recreation spending has fueled demand for specialized, lightweight, and highly durable panniers suitable for rugged off-road touring. Manufacturers targeting North America focus on maximizing volume capacity and offering specialized frame bags and saddle packs that cater specifically to the non-rack mounting requirements of mountain bikes and gravel bikes. The US market also exhibits a strong preference for brands that emphasize a lifetime guarantee and extreme durability.

The Asia Pacific (APAC) region is projected to register the fastest growth rate over the forecast period. This accelerated expansion is driven by massive urbanization, the necessity for cost-effective transportation in populous cities like Shanghai, Delhi, and Jakarta, and rising disposable incomes allowing consumers to transition from basic baskets to more durable storage solutions. Government efforts in countries like China to reduce vehicle emissions and traffic congestion through cycling promotion are acting as significant catalysts. The APAC market shows a strong demand for value-for-money products, but there is also a rapidly emerging premium segment driven by expatriates and a growing middle class adopting Western-style touring and high-quality recreational cycling. Latin America and the Middle East and Africa (MEA) currently hold smaller market shares but offer long-term growth potential as urban cycling initiatives and tourism infrastructure gradually develop.

- Europe: Dominant market, driven by entrenched cycling culture, extensive infrastructure, and high consumer spending on durable, sustainable, waterproof products. Key countries include Germany, Netherlands, and the UK.

- North America: High-growth area fueled by recreational cycling, e-bike adoption, and the substantial popularity of the bikepacking and adventure touring segments, demanding highly specialized and rugged gear.

- Asia Pacific (APAC): Fastest growing region, propelled by rapid urbanization, increasing use of cycling for utility and commuting, and governmental focus on improving city air quality and reducing traffic congestion.

- Latin America (LATAM): Emerging market potential linked to urban development and investment in public transportation alternatives, favoring entry-level and mid-range durable panniers.

- Middle East and Africa (MEA): Growth primarily concentrated in tourism hotspots and cities implementing new cycling lanes, requiring robust products resilient to high temperatures and abrasive conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bicycle Pannier Market.- Ortlieb

- Vaude

- Thule

- Arkel

- Topeak

- Brooks England

- Axiom Gear

- Timbuk2

- Roswheel

- Blackburn

- Zéfal

- Cube

- Specialized

- Chrome Industries

- Deuter

- Apidura

- Lone Peak

- Osprey

- Rixen & Kaul (KLICKfix)

- Rhinowalk

Frequently Asked Questions

Analyze common user questions about the Bicycle Pannier market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Bicycle Pannier Market?

The market growth is primarily driven by the global shift towards sustainable urban mobility, substantial governmental investment in cycling infrastructure (bike lanes and touring routes), and the accelerating popularity of cycle touring, bikepacking, and recreational e-biking, all of which necessitate increased carrying capacity and load stability for cyclists.

Which material type currently dominates the Bicycle Pannier Market, and why?

Waterproof synthetic fabrics, specifically those coated with Thermoplastic Polyurethane (TPU) or Polyvinyl Chloride (PVC), dominate the market. This is due to their superior performance characteristics, including lightweight structure, extreme water resistance achieved through welding technology, and high durability necessary for daily commuting and expedition cycling.

How does the segmentation by application influence product design and pricing strategies?

The Commuting application segment demands quick-release features, moderate capacity, and mid-range pricing, focusing on convenience. In contrast, the Touring/Bikepacking segment requires maximum durability, multi-point modularity, large volume, and extreme reliability, leading to a significantly higher price point and specialized design features like field repair capability and complex attachment systems.

What technological innovations are currently impacting the mounting systems of bicycle panniers?

Key technological innovations involve proprietary quick-release mechanisms that are adjustable and self-locking, enabling secure, single-handed attachment and removal. Additionally, specialized hardware is being developed for non-rack mounting (frame, saddle, handlebar bags) to cater to the lightweight demands of the growing bikepacking niche.

Why is the Asia Pacific region expected to exhibit the fastest growth in the pannier market?

The Asia Pacific region's accelerated growth is attributed to rapid urbanization, the widespread need for affordable and efficient commuter transportation in dense metropolitan areas, and rising disposable incomes which facilitate the purchase of higher-quality cycling accessories over traditional, non-specialized carrying methods.

What is the significance of the shift from stitched seams to welded seams in modern pannier construction?

The use of high-frequency or ultrasonic welding (heat-sealing) technology creates completely seamless, watertight connections in panniers. This eliminates the microscopic holes created by traditional stitching, offering 100% reliable waterproofing, which is critical for protecting electronics and essential gear during inclement weather, thereby raising the overall quality standard of premium products.

How do e-bikes specifically affect the demand and design requirements for bicycle panniers?

E-bikes typically allow riders to carry heavier loads and travel at higher speeds or for longer durations. This increases the demand for panniers with enhanced stability, reinforced mounting hardware capable of handling greater weight and vibration, and larger volume capacities to accommodate extended commuting or touring needs, driving innovation in robust attachment systems.

What role does sustainability play in consumer purchasing decisions within this market?

Sustainability is increasingly vital, particularly in European markets. Consumers prioritize brands that utilize recycled fabrics, employ PVC-free coatings (favoring TPU), and demonstrate transparency in their manufacturing processes. This preference drives manufacturers to invest in eco-friendly material alternatives and implement circular economy initiatives in their product lifecycle.

What are the primary challenges in the upstream segment of the Bicycle Pannier value chain?

The key challenges upstream involve securing a consistent supply of specialized, high-performance waterproof fabrics and managing the volatility in pricing of oil-derived plastic components necessary for coatings (TPU/PVC). Quality control of these raw materials is critical, as any defect compromises the final product's fundamental promise of waterproofing and durability.

How does AI contribute to optimizing the supply chain for pannier manufacturers?

AI-powered analytics and machine learning are utilized to create highly accurate predictive demand forecasts based on seasonal cycling trends, regional weather patterns, and promotional activities. This allows manufacturers to optimize inventory levels, reducing excess stock and ensuring raw materials are ordered precisely when needed, thereby increasing efficiency and reducing waste across the global distribution network.

Why do specialty bike stores remain a crucial distribution channel despite the growth of e-commerce?

Specialty bike stores (LBS) are essential because they provide crucial expert consultation on product compatibility, especially for complex rack-mounted systems. Their staff can ensure the pannier’s mounting hardware correctly fits the specific geometry and rack type of the customer's bicycle, a necessary service that mitigates consumer frustration and returns, especially for high-end systems.

What separates panniers designed for bikepacking from traditional touring panniers?

Bikepacking panniers emphasize minimal weight and use non-rack mounting systems (frame bags, saddle bags, handlebar rolls) to distribute weight centrally, improving off-road maneuverability. Traditional touring panniers, in contrast, rely on large, rigid rack-mounted designs optimized for maximum volume and stability on paved or maintained touring surfaces.

Which geographical region holds the highest growth potential for expansion in the premium pannier segment?

North America and Europe hold the highest growth potential for the premium segment. This is driven by high consumer spending power, strong engagement in specialized sports (like adventure cycling), and a willingness to invest in top-tier gear that offers reliability, innovative technology, and multi-year warranties for demanding outdoor use.

What is the primary restraint related to pricing in the Bicycle Pannier Market?

The primary restraint is the premium pricing associated with high-quality, fully waterproof panniers utilizing advanced materials (TPU, welded seams) and complex proprietary mounting systems. This high initial cost can deter price-sensitive consumers who may opt for cheaper, non-specialized alternatives like standard backpacks or lower-quality imported luggage.

How are aesthetic and design trends changing in the urban commuting segment?

Urban commuting panniers are moving towards more discreet, office-friendly aesthetics. They often feature clean lines, muted colors, and integrated laptop sleeves, with quick-release mechanisms that can be concealed when the bag is carried off the bike, bridging the gap between functional cycling gear and stylish city bags.

What type of load testing or quality control is essential for ensuring product reliability?

Essential quality control includes rigorous waterproofing testing (often simulating extended downpours), prolonged abrasion resistance tests for the exterior materials, and static and dynamic load testing of the mounting hardware to ensure it can withstand specified maximum weights and repeated road vibrations without structural failure or detachment.

Beyond carrying capacity, what benefits do panniers offer over traditional cycling backpacks?

Panniers significantly improve rider comfort and performance by shifting the load weight off the cyclist's back, reducing fatigue, improving ventilation, and lowering the bike's center of gravity for better handling. They also typically offer superior volume and protection from the elements compared to most cycling-specific backpacks.

How do manufacturers cater to the rising demand for panniers compatible with different rack sizes and types?

Manufacturers utilize highly adjustable mounting hardware featuring interchangeable inserts and adjustable rail spacing. Proprietary systems like Rixen & Kaul’s KLICKfix offer standardized interfaces that can adapt seamlessly to different rack diameters (e.g., 8mm to 16mm) commonly found across various bicycle brands and models, ensuring broad product compatibility.

What are 'smart features' currently being explored for integration into bicycle panniers?

Smart features currently under exploration include small integrated solar panels for device charging, embedded GPS trackers for anti-theft and recovery, internal LED lighting for improved visibility when accessing contents in the dark, and potentially integration with proximity sensors to alert riders of vehicles approaching from behind.

What is the competitive advantage of using recycled or bio-based materials in pannier manufacturing?

The competitive advantage lies in meeting growing consumer demand for sustainable products, enhancing brand reputation as environmentally conscious, and potentially gaining regulatory favor in markets with strict environmental standards. Using recycled materials also appeals strongly to the eco-aware demographic prevalent in high-value segments like touring and commuting.

Why is material science considered the key technology influencing the future of the pannier market?

Material science is key because ongoing innovations focus on developing fabrics that are simultaneously lighter, stronger, and more sustainable. Future market success depends on creating materials that offer extreme tensile strength and abrasion resistance at reduced weight, enhancing performance for high-end touring cyclists while reducing the environmental footprint.

What impact does the growth of bicycle tourism have on the manufacturing specifications of panniers?

The growth of bicycle tourism dictates a need for panniers with maximized capacity, exceptional longevity (warranties often exceeding five years), and modular designs allowing cyclists to configure carrying capacity based on trip length and load type. Manufacturers must ensure hardware is exceptionally durable and reliable for remote, unsupported travel.

How does the market differentiate between PVC-coated and TPU-coated waterproof fabrics?

PVC (Polyvinyl Chloride) is historically common, durable, and cost-effective but heavier and less environmentally desirable. TPU (Thermoplastic Polyurethane) is gaining market share because it offers comparable waterproofing and abrasion resistance, is generally lighter, remains flexible in cold temperatures, and is viewed as a more environmentally friendly plasticizer alternative.

What is the significance of visibility features (reflective strips, bright colors) in the commuter segment?

Visibility features are critical safety elements in the commuter segment. Integrated reflective strips, often running along seams or entire panels, significantly increase a cyclist’s profile in low-light conditions, reducing the risk of accidents in urban environments where heavy traffic and frequent stops are common.

How do inventory management challenges differ between touring panniers and commuting panniers?

Touring panniers, often high-ticket items, face challenges related to seasonal demand peaks (spring/summer) and require precise forecasting for specialized materials. Commuting panniers face year-round demand but require higher volume inventory turnover and constant assessment of aesthetic trends (colors, finishes) to match fast-changing urban consumer tastes.

What role do third-party accessory standards (like KLICKfix or Racktime) play in the competitive landscape?

These third-party standards provide universal compatibility across multiple bike brands and rack manufacturers. Using them reduces the barrier to entry for smaller pannier brands and offers greater consumer confidence regarding easy integration, ensuring that the pannier system will fit various bike setups efficiently.

What are the typical concerns of end-users regarding pannier security and anti-theft mechanisms?

End-users are concerned about quick-release systems that may be too easy to detach or steal when the bike is parked. Manufacturers address this by integrating specific locking mechanisms (often requiring a key or special tool) directly into the mounting hardware, preventing casual theft when the rider steps away from the bicycle briefly.

What is the expected long-term impact of rising fuel prices on the bicycle pannier market?

Rising fuel prices are expected to have a sustained positive impact, compelling more people in urban and suburban areas to adopt cycling, including e-biking, as a cost-effective alternative for daily commuting and utility trips, thereby increasing the essential need for reliable carrying solutions like panniers.

How does the average selling price (ASP) of panniers vary between different regions globally?

The ASP is generally highest in Western Europe and North America, where consumers purchase premium, fully featured, branded pannier sets for touring. The ASP tends to be lower in Asia Pacific and Latin America, driven by high demand for entry-to-mid-level utility panniers where price sensitivity is higher, although the premium segment is rapidly expanding in key APAC cities.

What financial metrics are crucial for manufacturers operating in the midstream segment of the value chain?

Crucial financial metrics include return on invested capital (ROIC) for specialized welding equipment, gross margin percentage (highly sensitive to raw material costs), material utilization rate (reducing waste in specialized fabric cutting), and inventory turnover rate, particularly for high-volume commuter products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager