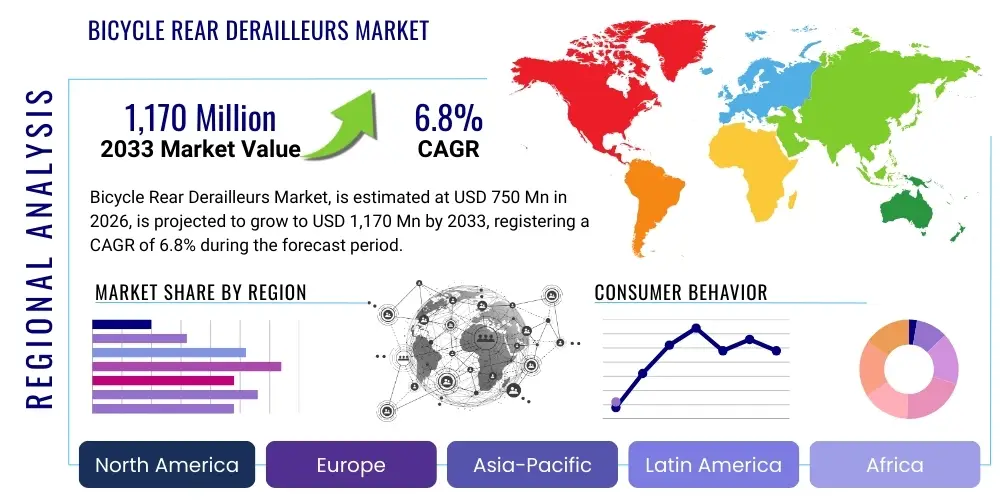

Bicycle Rear Derailleurs Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437923 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Bicycle Rear Derailleurs Market Size

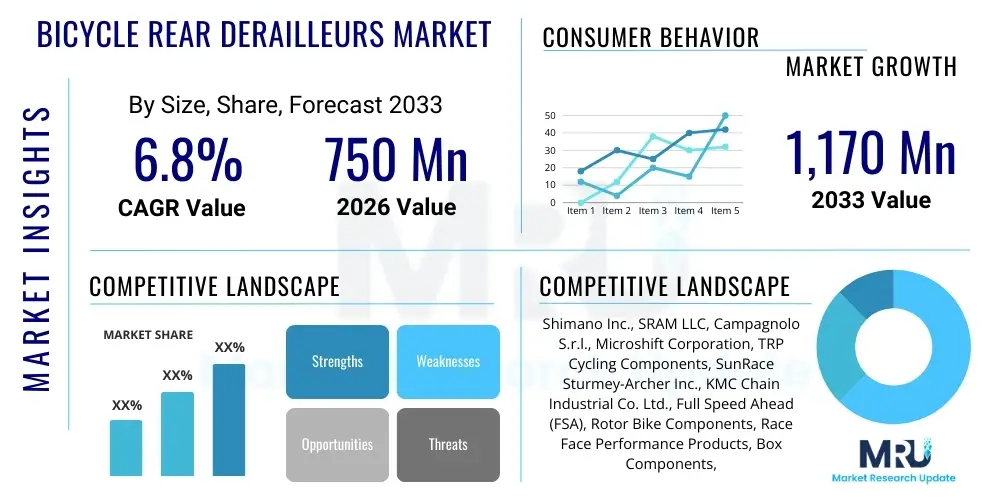

The Bicycle Rear Derailleurs Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 750 million in 2026 and is projected to reach USD 1,170 million by the end of the forecast period in 2033.

Bicycle Rear Derailleurs Market introduction

The Bicycle Rear Derailleurs Market encompasses the manufacturing, distribution, and sales of components crucial for gear shifting on bicycles. Rear derailleurs are intricate mechanical or electronic assemblies responsible for moving the drive chain across the sprockets of the rear cassette, enabling cyclists to maintain an optimal pedaling cadence across varying terrain and speeds. This market is intrinsically linked to the global cycling industry's health, including the demand for recreational, competitive, commuting, and electric bicycles (e-bikes). Technological advancements, particularly the widespread adoption of electronic shifting systems (Di2, AXS), and the increasing preference for 1x drivetrain configurations, are defining the current market landscape. The core product provides enhanced shifting precision, efficiency, and durability, directly impacting the cycling experience.

Major applications of rear derailleurs span across distinct bicycle categories, notably road cycling, mountain biking (MTB), and gravel cycling, each demanding specialized derailleur designs optimized for specific performance characteristics. Road derailleurs prioritize low weight and aerodynamic efficiency, while MTB derailleurs are built for extreme durability, large cassette capacity, and effective chain retention, often featuring clutch mechanisms to minimize chain slap. The benefits derived from high-quality rear derailleurs include faster, more reliable gear changes, reduced maintenance requirements, and improved power transfer efficiency. These factors are critical for professional athletes and serious enthusiasts, driving demand for premium products, particularly those integrating advanced materials like carbon fiber and precision CNC machining.

Driving factors propelling this market include the sustained global rise in cycling participation, fueled by environmental consciousness, health trends, and governmental investments in cycling infrastructure. Furthermore, continuous innovation by leading manufacturers focused on electronic shifting, which offers instantaneous and highly customizable performance, significantly boosts market value. The increasing penetration of e-bikes, which often require robust and high-torque-resistant drivetrain components, represents a substantial growth area. However, market dynamics are sensitive to raw material costs, supply chain disruptions, and the stringent demands for compatibility across diverse component manufacturers, necessitating continuous adaptation in product development and market positioning strategies.

Bicycle Rear Derailleurs Market Executive Summary

The Bicycle Rear Derailleurs Market is experiencing dynamic shifts, driven primarily by technological convergence and evolving consumer preferences toward specialized cycling segments. Business trends highlight intense competition centered on proprietary electronic shifting technologies (EST), which command premium pricing and increased adoption in mid-to-high-end bicycle builds. Manufacturers are increasingly focusing on vertical integration and stringent component compatibility standards to secure market share, especially in the rapidly expanding e-bike sector where durability and seamless integration are paramount. The market structure is dominated by a few key global players who invest heavily in R&D to optimize shifting speed, noise reduction, and long-term reliability. Furthermore, the rising adoption of direct-to-consumer (DTC) models by bicycle brands influences component purchasing decisions, favoring suppliers offering stable inventory and modular systems.

Regionally, Asia Pacific (APAC) stands out as the primary manufacturing hub and a rapidly growing consumer market, fueled by increasing disposable incomes and large-scale government promotion of cycling, particularly in China and India. Europe and North America remain critical markets, characterized by high Average Selling Prices (ASP) due to strong demand for performance-oriented and electronic derailleur systems used in road racing and high-end mountain biking. Regional trends also reflect varying levels of adoption concerning sustainability; European markets show a higher propensity for durable, repairable components suitable for commuter and touring applications, while North American consumers often prioritize the latest, lightweight performance enhancements, driving segment trends.

Segment trends demonstrate a clear bifurcation: the mechanical segment, while stabilizing, continues to cater to entry-level and budget-conscious segments, offering robust functionality at a lower cost. Conversely, the electronic shifting segment is witnessing exponential growth due to its superior performance attributes, offering precise, effortless shifting that significantly improves the riding experience, crucial for both competitive cyclists and aging populations seeking ease of use. Within the application segment, Mountain Biking (MTB) drives innovation in clutch mechanisms and capacity for massive cassettes (e.g., 10-52T), whereas Road Cycling focuses on speed and weight reduction. The component material segmentation shows a gradual shift toward lightweight composites and specialized alloys in premium offerings, balancing strength, weight, and corrosion resistance for diverse operating conditions.

AI Impact Analysis on Bicycle Rear Derailleurs Market

User questions regarding AI's influence on the Bicycle Rear Derailleurs Market frequently revolve around predictive maintenance capabilities, optimization of manufacturing processes, and the development of 'smart' shifting algorithms. Users are keen to understand if AI can predict component failure based on usage data, how advanced robotics and AI vision systems are impacting the precision machining of complex derailleur parts, and whether AI-driven analytics can dynamically adjust shifting performance based on real-time rider input (power output, cadence) and environmental factors (gradient, weather). The collective expectation is that AI will enhance product quality, streamline supply chains, and, crucially, enable next-generation 'intelligent' electronic shifting systems that move beyond pre-programmed mapping to truly adaptive performance.

- AI-driven predictive maintenance modeling utilizing sensor data from electronic derailleurs to forecast component wear and recommend service intervals.

- Optimization of CNC machining paths and quality control through AI vision systems, ensuring near-perfect tolerances for derailleur cages and linkage components.

- Development of adaptive electronic shifting algorithms that use machine learning to customize gear selection based on terrain, fatigue, heart rate, and stored rider preference profiles.

- Enhanced supply chain management and inventory forecasting by leveraging AI analytics to predict global bicycle assembly demand and component consumption rates.

- AI integration into research and development (R&D) for topological optimization of derailleur designs, maximizing strength-to-weight ratios using computational generative design.

- Augmented reality (AR) tools powered by AI for faster and more accurate assembly, setup, and troubleshooting of complex electronic shifting systems in professional workshops and retail settings.

DRO & Impact Forces Of Bicycle Rear Derailleurs Market

The Bicycle Rear Derailleurs Market is shaped by a confluence of accelerating demand (Drivers), inherent technological hurdles (Restraints), vast untapped applications (Opportunities), and the competitive environment (Impact Forces). The global push towards micro-mobility and health consciousness serves as a primary driver, dramatically increasing the installed base of bicycles worldwide. However, the high capital cost associated with electronic shifting technology and the ongoing complexity of achieving universal cross-brand compatibility restrain faster mass adoption. Opportunities lie predominantly in integrating derailleurs with smart biking platforms and penetrating the high-volume replacement part segment driven by the aggressive wear characteristics in off-road and e-bike applications. These dynamics necessitate rapid innovation cycles and careful strategic positioning against both established competitors and emerging component manufacturers, defining the market's trajectory.

Drivers: The dominant driver remains the increasing global participation in competitive and recreational cycling, underpinned by strong consumer willingness to invest in performance-enhancing components. Specifically, the proliferation of e-bikes mandates the use of highly durable, specialized derailleurs capable of handling higher torque inputs and increased chain tension, spurring R&D. Furthermore, the continuous improvement in electronic shifting systems, offering unparalleled precision, personalization, and ease of use over traditional mechanical systems, significantly stimulates replacement and upgrade cycles. Government policies favoring cycling infrastructure development also contribute by making bicycling a more viable and safer commuting option globally, thereby expanding the overall market size for components.

Restraints: The market faces significant restraints, chiefly related to manufacturing precision and cost. The rear derailleur is one of the most mechanically complex components on a bicycle, requiring extremely high tolerance engineering, which elevates production costs, particularly for electronic systems. Moreover, the current lack of complete interoperability and standardization between the proprietary systems of major manufacturers (e.g., Shimano, SRAM) creates hurdles for aftermarket customization and inventory management for distributors and retailers. Economic fluctuations and potential tariffs on imported goods, especially those sourced from the APAC manufacturing hub, also pose risks by impacting consumer pricing and supply chain stability, potentially delaying mass-market penetration.

Opportunities: Substantial opportunities exist in several key areas. The burgeoning gravel cycling segment demands new derailleur designs that blend the large cassette capacity and chain retention features of mountain bike systems with the lighter weight and closer gear spacing of road systems. The massive global fleet of mechanical derailleurs represents a significant opportunity for upgrading to electronic systems as prices decline, driven by technology maturation. Furthermore, the integration of derailleurs with smart bicycle computer systems for automated, efficiency-optimized shifting, leveraging sensor data and connectivity, offers a path toward premium product differentiation. Finally, focusing on sustainable manufacturing practices and developing more durable, easily repairable components could capture a growing consumer segment prioritizing longevity and environmental responsibility.

Impact Forces: The competitive impact forces are intense, driven primarily by technological leapfrogging between the dominant players. Patent protection and the control over proprietary electronic communication protocols act as strong entry barriers for new competitors. The ongoing shift from 2x (two chainrings) to 1x (single chainring) drivetrains profoundly impacts derailleur design, increasing the required cassette capacity and necessitating specialized narrow-wide chain retention features, forcing companies to rapidly retool their product lines. Buyer power is moderately high in the OEM segment, where bulk purchasing dictates pricing, while supplier power is moderate but concentrated among specialized component and material providers. Substitutes, primarily internal geared hubs (IGHs), pose a minor, growing threat, particularly in the urban and e-bike segments where low maintenance is prioritized over competitive performance. The introduction of smaller, innovative players often focuses on niche customization or unique material usage, forcing the large incumbents to continuously monitor these disruptive pressures.

Segmentation Analysis

The Bicycle Rear Derailleurs Market is comprehensively segmented based on technology, application, component material, and distribution channel, providing critical insights into consumer preferences and market maturity across different cycling disciplines. Technological segmentation distinguishes between mechanical and electronic shifting systems, the latter being the fastest-growing due to performance advantages. Application segmentation is crucial, differentiating between road, mountain, and gravel/e-bike usage, as each requires specialized designs in terms of cage length, capacity, and durability features. Material segmentation reflects the cost and performance matrix, ranging from basic aluminum alloys to advanced carbon fiber composites and titanium components used in premium performance segments, dictating the overall price point and weight characteristics of the final product.

Analysis by distribution channel further delineates the market structure, identifying the relative importance of OEM supply versus the aftermarket retail sales. The OEM channel, supplying manufacturers like Giant, Trek, and Specialized, represents the largest volume segment, driven by fixed contracts and high volume. Conversely, the aftermarket, consisting of independent bicycle dealers (IBDs), online retailers, and specialty sporting goods stores, drives premium sales, upgrades, and replacement parts, often at higher margins. Understanding these segmented dynamics is essential for market participants to tailor their R&D investments, manufacturing scale, and marketing strategies to target high-growth niches effectively.

The ongoing trend toward consolidation and specialization within these segments is noticeable. For instance, the e-bike specific segmentation is demanding components rated for extremely high mileage and continuous shifting under load, leading to the development of dedicated, robust product lines. Similarly, the 1x drivetrain architecture, pervasive in MTB and gravel, necessitates derailleurs with specific pivot kinematics (like Shimano’s Shadow RD+) and enhanced clutch tension management to ensure optimal chain retention across a wide gear range, influencing the competitive landscape within the application segment profoundly.

- By Technology:

- Mechanical Shifting Systems

- Electronic Shifting Systems (Wired/Wireless)

- By Application:

- Mountain Biking (MTB)

- Road Cycling

- Gravel/Cyclocross

- Commuter/Urban Biking

- E-Bikes (Specific High-Torque Derailleurs)

- By Material:

- Aluminum Alloy

- Carbon Fiber Composites

- Steel and Titanium Alloys

- By Distribution Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (AM)

Value Chain Analysis For Bicycle Rear Derailleurs Market

The value chain for the Bicycle Rear Derailleurs Market is characterized by highly specialized manufacturing and a concentrated distribution network, reflecting the precision engineering required for these components. The upstream segment is dominated by raw material suppliers providing specialized aluminum alloys, advanced polymers, and carbon fiber prepregs, along with semiconductor and sensor manufacturers crucial for electronic shifting systems. High barriers to entry exist in the manufacturing stage due to the stringent requirements for multi-axis CNC machining, forging, and specialized coating processes (e.g., anodizing, ceramic coatings) necessary to ensure durability and minimal friction. Key manufacturers, primarily located in East Asia, often manage the entire assembly and rigorous testing process internally, integrating mechanical and electronic sub-components.

The distribution channel is predominantly dual-structured: the OEM channel and the aftermarket. Direct sales (OEM) involve large-volume, contract-based transactions where derailleur manufacturers supply directly to global bicycle brands for new bike assembly. This channel requires efficient logistical management and compliance with strict production schedules. The indirect channel (Aftermarket) relies on a global network of specialized distributors, wholesalers, and importers who then supply Independent Bicycle Dealers (IBDs) and large online retailers. The quality of sales and service at the IBD level is critical, as specialized knowledge is required for installing, tuning, and maintaining complex derailleur systems, particularly electronic ones.

The downstream analysis focuses on the end-users: recreational cyclists, professional athletes, and commuters. Consumer demand is heavily influenced by brand loyalty, technological reviews, and compatibility with existing drivetrain components. Service and warranty provision, facilitated primarily through IBDs, represent a crucial final stage of the value chain, ensuring long-term customer satisfaction and brand reputation. Manufacturers are increasingly utilizing digital platforms and specialized diagnostic tools to support their dealer networks, thus tightening the connection between production and end-user support, optimizing the overall efficiency and effectiveness of the component lifecycle management.

Bicycle Rear Derailleurs Market Potential Customers

The potential customers for the Bicycle Rear Derailleurs Market span a broad spectrum, categorized primarily by their purchasing needs (OEM vs. Aftermarket) and cycling discipline. Original Equipment Manufacturers (OEMs), including major bicycle producers like Trek, Specialized, Giant, and smaller boutique brands, constitute the largest volume customers, demanding consistent supply, competitive pricing, and cutting-edge components for integration into their new model years. These buyers prioritize reliability and large-scale manufacturing capacity. Aftermarket customers are segmented into Independent Bicycle Dealers (IBDs) who purchase inventory for replacement, repair, and upgrade sales, and direct consumers who buy online for personal customization or immediate maintenance needs.

Within the end-user base, the key buyers are high-performance enthusiasts, competitive racers, and serious commuters. High-performance buyers (road and MTB) are focused on purchasing premium electronic shifting systems, prioritizing low weight, instant responsiveness, and advanced features like programmable shifting modes. Commuters and casual riders form the volume segment, typically opting for durable, reliable mechanical derailleurs that offer a good balance of cost and functionality. The fastest-growing customer segment comprises E-bike manufacturers and owners, who require specialized, robust, and often heavier-duty derailleurs designed specifically to withstand the unique stresses associated with electric motor assistance, demanding higher fatigue resistance and shifting longevity.

Furthermore, specialized segments such as gravel cyclists are increasingly important, driving demand for specific derailleur capabilities like expanded cassette range capacity and enhanced clutch mechanisms for chain retention over rough terrain. Retailers and distributors act as crucial intermediaries, requiring comprehensive product ranges, timely logistics, and robust training support from manufacturers to effectively service the diverse demands of the end-user base. Targeting these different customer groups requires tailored product specifications—from mass-market mechanical units for entry-level OEMs to bespoke, carbon-intensive electronic units for high-end racing bike builders.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 750 Million |

| Market Forecast in 2033 | USD 1,170 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shimano Inc., SRAM LLC, Campagnolo S.r.l., Microshift Corporation, TRP Cycling Components, SunRace Sturmey-Archer Inc., KMC Chain Industrial Co. Ltd., Full Speed Ahead (FSA), Rotor Bike Components, Race Face Performance Products, Box Components, L-TWOO Components, S-Ride Technology Co., Ltd., Sensah Components, TISO Components. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bicycle Rear Derailleurs Market Key Technology Landscape

The technological landscape of the Bicycle Rear Derailleurs Market is highly competitive and centered on optimizing the efficiency, speed, and durability of the shifting mechanism. The two dominant technology pillars are mechanical indexing systems and electronic shifting systems. Mechanical systems rely on precisely engineered cable pull ratios (e.g., 1:1, 2:1) to actuate the derailleur movement, emphasizing robust construction and reliable indexing stability, which are critical for longevity and lower maintenance costs. Recent mechanical innovations focus on enhancing parallelogram rigidity, utilizing sealed bearing pulleys, and incorporating clutch mechanisms to manage chain tension effectively, especially crucial for 1x systems used in demanding off-road environments. The precision required in manufacturing the pivot points and springs is paramount to ensuring consistent shift performance across the cassette.

Electronic shifting technology (EST) represents the cutting edge of the market, utilizing small electric servo motors controlled by proprietary microprocessors to execute instantaneous and precise gear changes. Key technological advancements here include fully wireless communication protocols (e.g., SRAM AXS) which simplify installation and reduce cable maintenance, rechargeable lithium-ion battery integration, and the implementation of automatic trim functions that constantly adjust the derailleur position to prevent chain rub. Furthermore, EST allows for deep customization of shifting logic, multi-shift capabilities, and seamless integration with other components like front chainrings and dropper posts. The performance gap between EST and mechanical systems continues to widen, justifying the higher premium for electronic components in competitive and high-end recreational cycling.

Beyond the core shifting mechanism, material science plays a significant role in technology adoption. The use of carbon fiber for the derailleur cage and linkage arms reduces overall weight while maintaining stiffness, enhancing responsiveness. Ceramic bearing pulley wheels minimize drivetrain friction, offering marginal but critical performance gains for professional use. Innovation is also focused on improving the resilience of derailleurs against impacts, particularly in mountain biking, leading to protected designs (e.g., Shimano Shadow RD+) where the derailleur geometry is optimized to tuck closer to the bike frame, reducing vulnerability. Compatibility standards, although often proprietary, continue to evolve to maximize the range of cassette sizes and chain lines that a single derailleur unit can handle, catering directly to the increasing trend towards wider gear ranges for diverse terrain.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global manufacturing of bicycle components, including rear derailleurs, driven by the presence of key production hubs in Taiwan, mainland China, and Japan (home to industry giants like Shimano). The region is characterized by economies of scale, leading to highly competitive pricing for mass-market components. Crucially, APAC is also rapidly emerging as a massive consumption market, particularly in urban areas and for high-end sporting goods, fueled by rising middle-class disposable income and increasing government initiatives promoting cycling as a sustainable transport option. China and Southeast Asia are major consumers of mid-range mechanical systems and increasingly adopt e-bike components.

- Europe: Europe represents a mature market with high demand for premium and electronic shifting systems, driven by strong road cycling culture (e.g., Italy, France) and extensive government support for commuter cycling (e.g., Netherlands, Germany). The continent has one of the highest Average Selling Prices (ASP) for rear derailleurs due to the prevalence of high-end leisure cyclists and competitive athletes. Furthermore, environmental regulations and a focus on sustainable transport contribute significantly to the high penetration rate of e-bikes, which necessitates specialized, heavy-duty derailleur models optimized for motor assistance.

- North America (NA): North America is a critical innovation adoption market, particularly in the Mountain Biking (MTB) and gravel segments. Consumers here are generally early adopters of cutting-edge, high-cost components such as fully wireless electronic shifting and specialized 1x drivetrains designed for extreme terrain. Demand is strong for durable, resilient components that can withstand aggressive off-road use. The market size is heavily influenced by the seasonal nature of outdoor sports, but year-round professional and enthusiast demand ensures a stable, high-value segment.

- Latin America (LATAM): LATAM is characterized by a high demand for robust, affordable mechanical systems, largely serving commuter and utility cycling needs. Price sensitivity is higher in this region, leading to preference for reliable, easy-to-maintain components over the latest electronic innovations, except in specific high-growth urban centers like Brazil and Mexico, where professional cycling communities drive limited demand for premium components. Market growth is closely tied to improving economic stability and infrastructure investment.

- Middle East and Africa (MEA): This region is currently a nascent market for specialized rear derailleurs, with demand concentrated in fitness and competitive cycling hubs, particularly within the Gulf Cooperation Council (GCC) states. Utility cycling is less prevalent than in other regions. Growth is anticipated, spurred by government efforts to promote sports and wellness, leading to investment in infrastructure and the subsequent import of performance-oriented bicycles and components, primarily from European and Asian manufacturers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bicycle Rear Derailleurs Market.- Shimano Inc.

- SRAM LLC

- Campagnolo S.r.l.

- Microshift Corporation

- TRP Cycling Components

- SunRace Sturmey-Archer Inc.

- KMC Chain Industrial Co. Ltd.

- Full Speed Ahead (FSA)

- Rotor Bike Components

- Race Face Performance Products

- Box Components

- L-TWOO Components

- S-Ride Technology Co., Ltd.

- Sensah Components

- TISO Components

- Nidec Corporation (via motor and electronic components)

- Rohloff AG (Indirect competitor via IGH technology)

- Jagwire (Component supplier/Aftermarket)

- Token Products

- Xiamen Speedone Composite Material Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Bicycle Rear Derailleurs market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the electronic rear derailleur segment?

The primary factor is the superior performance offered by electronic systems, characterized by instantaneous, precise, and customizable shifting accuracy, which significantly enhances the overall riding experience for high-end cyclists and simplifies operation for e-bike users.

How do 1x drivetrains impact the design requirements for rear derailleurs?

The shift to 1x systems necessitates rear derailleurs with much larger cassette capacity (up to 52 teeth), longer cages, and crucially, integrated clutch mechanisms to maintain extremely high chain tension and retention, preventing dropped chains over rough terrain.

Which geographical region holds the largest market share for rear derailleur manufacturing?

Asia Pacific (APAC), specifically Taiwan and Mainland China, holds the largest share of manufacturing volume due to established supply chains, high-volume production capabilities, and the location of major component producers like Shimano and SRAM’s primary facilities in the region.

What are the main drawbacks of adopting electronic shifting systems (EST) compared to mechanical systems?

The main drawbacks include the significantly higher initial cost, the requirement for battery maintenance and recharging, and the proprietary nature of communication protocols, which limits cross-compatibility between different component brands.

How is AI expected to revolutionize the future functionality of bicycle derailleurs?

AI is anticipated to enable predictive maintenance by analyzing component wear data and facilitating the development of truly adaptive shifting algorithms that automatically optimize gear selection based on real-time sensor inputs, rider performance, and terrain characteristics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager