Bicycle Shock Absorber Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432827 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Bicycle Shock Absorber Market Size

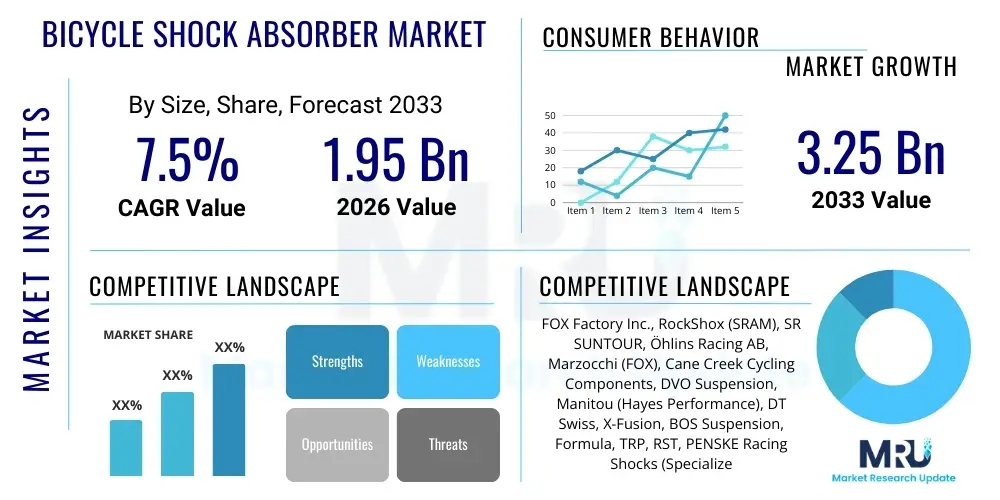

The Bicycle Shock Absorber Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $1.95 Billion USD in 2026 and is projected to reach $3.25 Billion USD by the end of the forecast period in 2033.

Bicycle Shock Absorber Market introduction

The Bicycle Shock Absorber Market encompasses the design, manufacturing, and distribution of suspension components primarily used in high-performance mountain bikes, e-bikes, and increasingly, specialized gravel and endurance road bicycles. These components, which include front forks and rear shock units (dampers), are crucial for enhancing rider comfort, improving traction, and maximizing control over varied terrain. The core function involves absorbing and dissipating kinetic energy generated by impacts, converting it into heat, and managing wheel movement to ensure consistent contact with the ground. Market growth is intrinsically linked to the rising popularity of recreational cycling, professional cycling events, and the surging adoption of electric bicycles globally, which demand sophisticated suspension systems to handle higher speeds and increased weight loads.

Product sophistication ranges from basic coil-sprung forks found on entry-level models to highly advanced air-sprung systems featuring intricate hydraulic damping circuits, remote lockouts, and electronic adjustments, catering to competitive cross-country (XC), enduro, and downhill segments. Major applications are concentrated in off-road disciplines, where the performance of the shock absorber directly dictates safety and speed. Key benefits derived from these systems include reduced rider fatigue, enhanced stability during aggressive maneuvering, and superior modulation of forces, translating into a smoother, more efficient riding experience.

Driving factors fueling this market include substantial technological advancements in material science, particularly the use of lightweight alloys and carbon fiber composites to reduce unsprung mass, and the continuous innovation in damping technologies such as specialized valving and magnetic fluids. Furthermore, the stringent safety requirements for high-speed e-bikes are compelling manufacturers to adopt premium, durable suspension solutions. The globalization of cycling culture and the expansion of dedicated biking trails and parks also contribute significantly to sustained market momentum.

Bicycle Shock Absorber Market Executive Summary

The Bicycle Shock Absorber Market is characterized by robust growth, driven primarily by the escalating demand for premium full-suspension mountain bikes and the rapid proliferation of e-bikes, which necessitate heavy-duty, reliable suspension components. Business trends indicate a strong focus on integration, with major component manufacturers offering complete suspension ecosystems, often incorporating electronic sensor technology for real-time damping adjustments. Companies are heavily investing in lightweight materials and miniaturization of hydraulic mechanisms to maintain performance while adhering to weight constraints, critical for competitive racing and consumer appeal. The Aftermarket segment remains vital, fueled by enthusiasts seeking performance upgrades and customization options for their existing bicycles.

Regionally, Asia Pacific (APAC) stands out as the largest market, driven by its expansive manufacturing base for both bicycles and components (particularly Taiwan and China) and the burgeoning middle-class consumer base adopting recreational cycling. North America and Europe, however, lead in terms of technological adoption and demand for high-end products, supported by well-established cycling communities and high per capita spending on sports equipment. Regional trends show a significant push towards sustainable manufacturing processes and locally sourced materials, particularly in the European Union, influencing supply chain strategies.

Segment trends highlight the dominance of the Air Spring segment due to its tunability, adjustability, and inherent weight advantage over traditional coil springs, making it favored across XC and trail riding categories. The E-Bike Application segment is exhibiting the fastest growth trajectory, demanding specialized forks and rear shocks designed to withstand continuous torque and increased static weight, pushing performance boundaries beyond traditional cycling requirements. Furthermore, segmentation by distribution channel shows OEMs capitalizing on the growth through mandatory inclusion of high-quality suspension on mid-to-high-end bicycle models, securing consistent, large-volume sales.

AI Impact Analysis on Bicycle Shock Absorber Market

Common user questions regarding AI's influence in the Bicycle Shock Absorber Market center on themes such as automated setup, predictive maintenance scheduling, and real-time performance optimization based on terrain analysis. Users are keen to understand how AI algorithms can personalize damping settings instantly (Adaptive Suspension), moving beyond manual clicker adjustments, and how sensor data can preemptively warn of component failure (e.g., seal degradation or oil viscosity changes). The synthesis of these inquiries reveals an expectation for AI to transform bicycle suspension from a passive component into an intelligent, adaptive system that significantly reduces setup complexity and maximizes performance efficiency for riders across all skill levels.

- AI-driven Adaptive Damping Systems: Utilizing machine learning algorithms to analyze sensor data (speed, acceleration, suspension travel, braking force) and instantly adjust compression and rebound characteristics (valve actuation) for optimal performance across changing terrain.

- Generative Design and Topology Optimization: AI tools speeding up the R&D process by exploring thousands of design iterations for shock body geometry, reducing weight while maximizing structural integrity and heat dissipation efficiency.

- Predictive Maintenance: Analyzing telemetry data from embedded sensors to predict seal wear, oil contamination levels, or internal component fatigue, allowing riders and service centers to schedule maintenance proactively, minimizing downtime and catastrophic failure.

- Personalized Tuning Recommendations: AI platforms guiding riders through initial setup (sag, air pressure) based on weight, riding style, and specific bike geometry, ensuring optimal baseline performance without requiring extensive technical knowledge.

- Quality Control and Manufacturing Optimization: Implementing AI vision systems in manufacturing lines to detect micro-defects in shafts, seals, and castings, ensuring higher component precision and reducing warranty claims.

DRO & Impact Forces Of Bicycle Shock Absorber Market

The Bicycle Shock Absorber Market is propelled by significant technological drivers, countered by cost-related restraints, yet possesses substantial opportunities tied to evolving cycling disciplines and market penetration. The primary drivers include the exponential growth in the e-bike segment, which requires specialized, durable suspension units, and the continuous innovation in fluid dynamics and materials science leading to lighter and more sophisticated products. Restraints often revolve around the high initial cost of premium, electronically adjustable suspension systems, which limits adoption in emerging markets and entry-level bicycle categories. Opportunities arise through the expansion of gravel biking, demanding lightweight micro-suspension systems, and the implementation of rental and sharing schemes requiring robust, maintenance-free components. These dynamics create a powerful market structure where the pursuit of performance heavily influences demand, counterbalanced by economic viability and accessibility.

Drivers: The increasing consumer interest in high-performance off-road cycling (mountain biking, enduro racing) necessitates superior control and comfort, directly boosting demand for advanced suspension components. Furthermore, regulatory requirements mandating higher quality components for faster Class 3 e-bikes and urban cargo bikes contribute strongly to market expansion. The continuous cycle of professional racing innovation filtering down to consumer-level products ensures sustained technological development and replacement demand among enthusiasts. This driver is amplified by global investment in cycling infrastructure, making off-road cycling more accessible.

Restraints: Significant restraints include the complex service and maintenance requirements for highly sophisticated hydraulic systems, which require specialized tools and trained technicians, leading to higher ownership costs. Counterfeit products, particularly in Asian markets, pose a threat to legitimate manufacturers, impacting pricing and brand reputation. Additionally, economic volatility, particularly affecting discretionary spending on expensive sporting goods, can temporarily dampen demand for high-end bicycle upgrades and new luxury bikes.

Opportunities: Key opportunities lie in the development of semi-integrated and fully electronic suspension systems that offer automated, seamless adjustments, appealing to a broader consumer base seeking ease of use. Expanding market share in developing economies through the introduction of robust, low-maintenance coil-based or simplified air systems presents a viable growth path. Furthermore, strategic partnerships between suspension manufacturers and large e-bike drivetrain producers (e.g., Bosch, Shimano) to co-develop integrated platforms offers a significant competitive advantage and market opportunity.

Impact Forces: The market impact is currently moderate-to-high, driven intensely by technological push from leading manufacturers. The high level of technological differentiation between premium brands (e.g., FOX, RockShox) acts as a significant entry barrier for new competitors. Buyer power is moderate; while brand loyalty is strong among enthusiasts, the increasing availability of quality mid-range products from Taiwanese and European manufacturers provides buyers with alternative options. Supplier power is high for specialized components like proprietary seals and damping fluids, but moderate for general materials like aluminum and titanium. Threat of substitutes is low, as fundamental suspension requirements cannot be bypassed for demanding applications like mountain biking, ensuring the continued necessity of dedicated shock absorbers.

Segmentation Analysis

The Bicycle Shock Absorber Market segmentation provides granular insights into key product characteristics, material composition, end-user applications, and distribution channels, enabling targeted strategic planning. The market is primarily divided by the damping mechanism (Air vs. Coil) and the position of the shock (Front Fork vs. Rear Shock), reflecting critical design differences affecting performance and weight. Analysis of the application segments reveals the dominance of Mountain Biking, yet the fastest growth is observed within the E-Bike segment due to rising average bike weights and performance expectations. Understanding these segments is vital for allocating R&D resources toward specific technological needs, such as developing heavier-duty seals for e-bike shocks or extremely lightweight carbon-integrated forks for competitive XC racing.

Segmentation by material composition shows a shift towards lightweight, high-strength alloys and carbon components, driven by performance demands, particularly in competitive segments. Distribution channels are highly polarized, with Original Equipment Manufacturers (OEMs) dominating the volume share through large supply contracts with bicycle assemblers, while the Aftermarket thrives on specialized upgrades and replacement parts, often through online retail and dedicated bicycle repair shops. Geographic segmentation underscores the concentration of manufacturing and high-volume demand in APAC, contrasted with the premium pricing and innovation leadership demonstrated in North American and European markets.

- By Product Type:

- Front Forks (Suspension Forks)

- Rear Shocks (Dampers)

- By Mechanism:

- Air Spring (High adjustability, lightweight, dominant in XC/Trail)

- Coil Spring (Linear feel, high durability, dominant in Downhill/Enduro)

- Hydraulic/Oil Damping Systems (Standalone components)

- By Application/Bike Type:

- Mountain Biking (XC, Trail, Enduro, Downhill)

- E-Bikes (E-MTB, E-Cargo, E-Trekking)

- Road and Hybrid Bicycles (Micro-suspension, minor travel systems)

- By Material:

- Aluminum Alloys

- Carbon Fiber Composites

- Steel/Chromoly

- Titanium

- By Distribution Channel:

- Original Equipment Manufacturers (OEM)

- Aftermarket (Retail Stores, Online E-commerce, Service Centers)

Value Chain Analysis For Bicycle Shock Absorber Market

The Bicycle Shock Absorber value chain is complex, starting with highly specialized raw material sourcing and culminating in global distribution through dual channels: direct supply to OEMs and retail sales in the aftermarket. Upstream analysis focuses on the sourcing of high-grade aerospace aluminum, specialized steel alloys for coil springs, proprietary damping fluids, and high-precision sealing systems, which are often procured from niche chemical and metallurgy suppliers. Manufacturing involves sophisticated machining, casting, and assembly processes, requiring high precision and rigorous quality control to ensure component durability and safety under extreme loads. Core manufacturing is concentrated in Asia Pacific due to established supply networks and competitive production costs.

The midstream of the value chain involves brand-specific assembly, testing, tuning, and integration of electronic components for advanced models. Research and Development plays a critical role here, focusing on proprietary damping valve designs (e.g., specialized shim stacks or electronically controlled valving) that differentiate top-tier manufacturers. Logistics are managed globally, requiring efficient inventory management to meet the just-in-time demands of large bicycle manufacturers (OEMs) during peak production cycles.

Downstream analysis reveals the two primary distribution routes: Direct-to-OEM, which accounts for the majority of unit volumes and involves direct contracts with global bicycle brands (e.g., Specialized, Trek, Giant); and the Aftermarket, which involves wholesale distribution to specialized cycling retailers, online e-commerce platforms, and professional service centers. Direct distribution is crucial for controlling branding and ensuring correct installation by bicycle assembly lines, while indirect distribution via the aftermarket focuses on consumer awareness, technical support, and the provision of replacement or upgrade kits. The aftermarket channel also services the professional racing community, which acts as a key promotional and testing environment.

Bicycle Shock Absorber Market Potential Customers

Potential customers for the Bicycle Shock Absorber Market are broadly categorized into three distinct groups: Original Equipment Manufacturers (OEMs), High-Performance Cycling Enthusiasts and Racers, and Everyday Commuters/E-Bike Users. OEMs, including global bicycle brands like Trek, Giant, and Specialized, constitute the largest volume customer base, purchasing thousands of units annually for integration into their mid-to-high-end bicycle lineups. Their purchasing decisions are driven by cost efficiency, reliability, brand reputation (co-branding value), and volume scalability. These customers demand consistent supply chain performance and components that integrate seamlessly with frame designs.

The second key customer segment, Enthusiasts and Racers, are the primary consumers in the high-margin aftermarket. These buyers seek the latest technological advancements, such as electronic lockout systems, specialized coatings (e.g., Kashima, Black Gold), and custom tuning options to maximize performance for specific disciplines (e.g., downhill or cross-country). This group is highly knowledgeable, brand-loyal to specific component makers (e.g., FOX, RockShox, Öhlins), and driven by the pursuit of marginal gains in performance and personalized setup. They rely heavily on independent bike shops and online specialist retailers for advice and purchase.

The third and fastest-growing customer group comprises E-Bike Manufacturers and Everyday Riders utilizing e-bikes for commuting or touring. These customers require extremely durable, reliable, and often heavier-duty suspension components capable of handling continuous use, increased weight, and higher average speeds. Their purchasing criteria prioritize longevity, low maintenance, and compliance with safety standards. This segment is less focused on marginal weight savings and more concerned with robust construction and minimal service intervals, driving demand for simpler, high-load coil and air systems tailored for e-bike specifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.95 Billion USD |

| Market Forecast in 2033 | $3.25 Billion USD |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | FOX Factory Inc., RockShox (SRAM), SR SUNTOUR, Öhlins Racing AB, Marzocchi (FOX), Cane Creek Cycling Components, DVO Suspension, Manitou (Hayes Performance), DT Swiss, X-Fusion, BOS Suspension, Formula, TRP, RST, PENSKE Racing Shocks (Specialized Applications) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bicycle Shock Absorber Market Key Technology Landscape

The technological landscape of the Bicycle Shock Absorber Market is characterized by intense innovation focused on optimizing damping performance, reducing friction, and integrating electronic control systems. A pivotal development is the refinement of air spring technology, allowing for multiple positive and negative air chambers to achieve highly customized spring curves that mimic the linear feel of coil shocks while retaining the weight advantage of air. Furthermore, manufacturers are focusing heavily on reducing stiction and friction through advanced low-friction coatings (e.g., proprietary anodizing processes and polymer bushings) on stanchions and seals, which significantly improves small-bump sensitivity and overall shock responsiveness. The integration of sensors and electronic systems, such as magnetic fluid damping and computerized lockout mechanisms, represents a growing trend, offering real-time, instantaneous adjustment capabilities.

Another critical area of development is the standardization and sophistication of hydraulic damping circuits. Modern shocks utilize complex internal valving (shim stacks) to separately manage low-speed and high-speed compression and rebound damping. This allows riders or automated electronic systems to precisely control wheel movement across varied impact types, from small trail chatter to large drop impacts, maximizing both comfort and bottom-out resistance. The trend towards sealed, cartridge-based damping units also simplifies maintenance and increases reliability, offering consistent performance over longer service intervals, which is particularly attractive to the burgeoning e-bike market segment.

The material science domain contributes significantly to technological progress, with continuous advancements in the use of lightweight carbon fiber structures for fork crowns and steerers to minimize weight without compromising stiffness. For high-wear internal components, specialized materials resistant to heat fade and cavitation are employed to maintain consistent damping performance during prolonged, aggressive use. The future technological direction is firmly rooted in connectivity, where suspension systems communicate with drivetrains and telemetry systems (e.g., ANT+, Bluetooth) to provide comprehensive performance data and facilitate automated adjustments based on rider input and environmental factors, ensuring maximum efficiency and customization.

Regional Highlights

Geographically, the Bicycle Shock Absorber Market exhibits distinct consumption patterns and manufacturing concentrations across major regions. Asia Pacific (APAC) dominates the market in terms of production volume and is a significant consumer market, largely driven by the presence of major component suppliers (Taiwan) and high-volume bicycle manufacturing facilities (China). APAC's growth is fueled by increasing disposable incomes and the mass adoption of cycling, particularly in urban environments and for entry-to-mid-level e-mobility solutions. The region acts as the global supply hub, influencing pricing and accessibility worldwide.

North America holds a leading position in terms of technological innovation and market value, driven by a highly engaged and affluent consumer base specializing in high-performance mountain biking. Demand here centers on premium, technologically advanced suspension systems (e.g., electronic damping control, lightweight carbon components). The strong culture of competitive cycling and the presence of leading suspension brand headquarters (e.g., FOX Factory) ensure continuous investment in R&D and rapid adoption of new products.

Europe represents a mature and highly profitable market characterized by strong environmental regulations favoring cycling and massive governmental investment in cycling infrastructure, particularly for e-bikes and trekking bicycles. European consumers demand robust components that align with strict quality and safety standards. Germany and the UK are key markets for both mountain biking and advanced e-bike suspension, driving demand for specialized OEM solutions designed for European trekking and cargo bike applications. Latin America and MEA are emerging markets, currently focused on entry-to-mid-range components, but showing increasing potential as cycling tourism and recreational activities gain traction.

- Asia Pacific (APAC): Dominates manufacturing volume; significant consumer growth fueled by recreational cycling and urbanization; key supply chain hub (Taiwan, China).

- North America: Leader in market value and technology adoption; strong demand for high-end, electronic suspension systems in the competitive mountain biking segment.

- Europe: Mature market with high regulatory standards; rapid growth in specialized e-bike suspension components; focus on durability and sustainability in manufacturing.

- Latin America (LATAM): Emerging market focused on entry-level and reliable coil suspension systems; potential growth tied to infrastructure development.

- Middle East & Africa (MEA): Niche market with growing interest in high-end leisure cycling; limited localized manufacturing capacity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bicycle Shock Absorber Market.- FOX Factory Inc.

- RockShox (A brand of SRAM LLC)

- SR SUNTOUR Inc.

- Öhlins Racing AB (A division of Tenneco)

- Marzocchi (Owned by FOX Factory Inc.)

- Cane Creek Cycling Components

- DVO Suspension

- Manitou (A brand of Hayes Performance Systems)

- DT Swiss AG

- X-Fusion Shox

- BOS Suspension

- Formula S.p.A.

- TRP (Tektro Racing Products)

- RST (Rapid Suspension Technology)

- Noleen J6

- PUSH Industries, Inc.

- Specialized Bicycle Components (In-house suspension R&D)

- Continental AG (Focus on elastomer/micro-suspension interfaces)

- PENSKE Racing Shocks (Niche high-performance customization)

Frequently Asked Questions

Analyze common user questions about the Bicycle Shock Absorber market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift from coil spring to air spring suspension in bicycles?

The shift is primarily driven by the superior tunability, adjustability, and significant weight savings offered by modern air spring technology. Air shocks allow riders to easily adjust the spring rate for different weights and riding styles without physically changing hardware, making them dominant in XC and Trail categories where lightweight performance is critical.

How does the rapid growth of the E-Bike segment affect shock absorber design and demand?

E-bikes, due to their increased weight and higher operational speeds, require heavier-duty suspension components with enhanced structural rigidity, more robust internal components, and specialized damping curves to manage sustained high-frequency input and prevent premature wear, substantially boosting demand for specialized, durable units.

What is the role of electronic control systems in modern bicycle suspension?

Electronic control systems (e.g., Live Valve, Flight Attendant) use integrated sensors to read terrain and rider input in real-time, instantly adjusting compression and rebound settings. This maximizes efficiency by stiffening the suspension for climbing or sprinting and opening it immediately for impacts, optimizing performance without manual intervention (Adaptive Suspension).

Which geographic region leads in terms of high-end suspension technology adoption?

North America and Western Europe lead in the adoption of premium, high-end suspension technology, driven by strong competitive cycling markets, high consumer disposable income, and the presence of major R&D centers for global suspension brands.

What key factors determine a suspension component's position in the OEM versus Aftermarket segment?

OEM sales are driven by volume, price point, and integration capabilities for mass-produced bikes. Aftermarket sales are driven by performance upgrades, brand preference, specialized tuning options, and consumer demand for the latest technological features not available on their stock bicycle.

The Bicycle Shock Absorber Market continues its trajectory of innovation, driven by competitive demands and the evolving landscape of cycling, ensuring sustained technological complexity and robust growth across key global regions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager