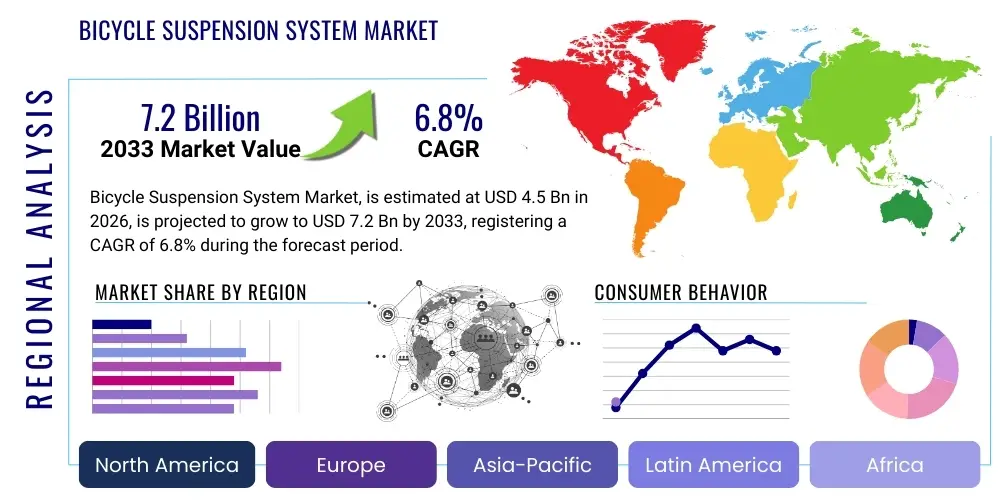

Bicycle Suspension System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436995 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Bicycle Suspension System Market Size

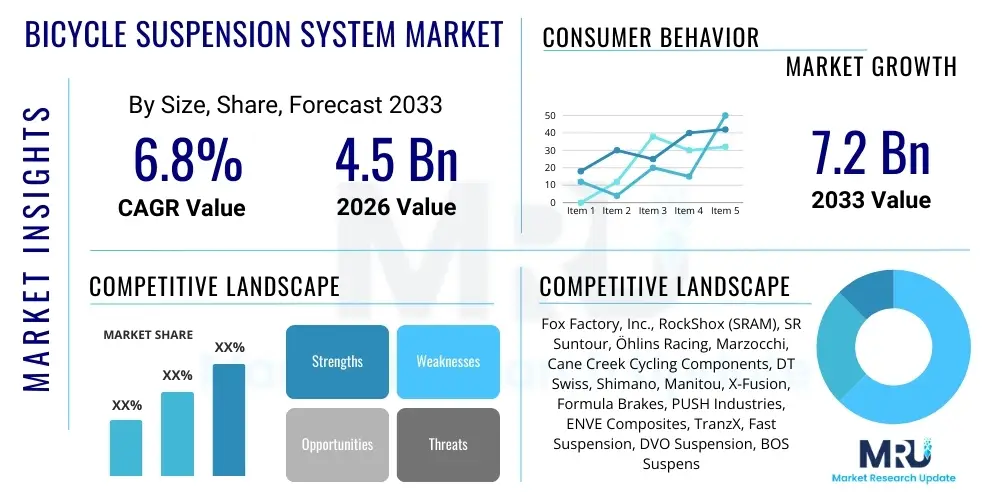

The Bicycle Suspension System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Bicycle Suspension System Market introduction

The Bicycle Suspension System Market encompasses the design, manufacturing, and distribution of components—primarily forks and rear shock absorbers—that allow bicycle wheels to move vertically relative to the frame when encountering obstacles. These systems are crucial for enhancing rider comfort, improving traction, and maintaining control, particularly in off-road disciplines like mountain biking and gravel riding. Product offerings range from basic coil spring mechanisms used in entry-level bikes to sophisticated air spring systems featuring electronic damping control and lightweight materials, catering to high-performance and competitive cycling segments. The continuous innovation in damping technologies and material science is a core aspect of this market.

Major applications of bicycle suspension systems are predominantly found in Mountain Bikes (MTB), covering cross-country (XC), trail, enduro, and downhill segments, where terrain demands robust shock absorption. However, the application scope is expanding significantly, with increasing adoption in performance E-bikes that require specialized, heavier-duty suspension to manage higher speeds and mass, as well as in the burgeoning gravel biking sector, where smaller travel suspension or specialized dampened components enhance long-distance comfort and capability. The market’s resilience is driven by the global enthusiasm for outdoor recreation and the sustained growth of the electric bicycle segment which standardizes the inclusion of advanced suspension.

The primary benefits derived from high-quality suspension systems include superior control at speed, reduced rider fatigue over long distances, and increased tire contact with the ground, leading to enhanced braking performance and cornering grip. Driving factors fueling market growth include the rise in global cycling participation, especially following recent increases in health consciousness and outdoor activity post-pandemic; substantial technological advancements such as adaptive electronic suspension and lighter carbon-fiber integrated components; and favorable government initiatives promoting cycling infrastructure and safety worldwide. These interconnected elements ensure sustained demand across both premium and mid-range bicycle segments.

Bicycle Suspension System Market Executive Summary

The Bicycle Suspension System Market is characterized by robust growth, driven primarily by the escalating demand for high-performance mountain bikes and the rapid proliferation of E-bikes globally. Business trends indicate a strong emphasis on research and development focusing on miniaturization, weight reduction, and the integration of smart electronics, enabling real-time adjustment of damping characteristics based on terrain input. Key industry players are increasingly consolidating their supply chains and forging strategic partnerships with major bicycle manufacturers (OEMs) to ensure their advanced suspension components are factory-installed on new premium models, thereby setting higher industry standards for performance and safety. Furthermore, the aftermarket segment remains vital, providing cyclists with opportunities to upgrade existing systems with advanced components featuring proprietary damping technologies.

Regional trends reveal that North America and Europe currently dominate the market, attributed to high disposable incomes, deeply established cycling cultures, and significant consumer investment in high-end sporting goods. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by improving economic conditions in countries like China and India, increased manufacturing activity, and the surging popularity of E-bikes for commuting and recreation. Emerging markets in Latin America and the Middle East & Africa are slowly adopting more advanced suspension systems as cycling infrastructure improves and awareness of specialized sports cycling increases. Government support for bicycle commuting further stimulates demand across all regions, particularly for urban E-bike suspension solutions.

Segment trends highlight the dominance of Fork Suspension systems in terms of revenue, although Rear Suspension (shock absorbers) is experiencing accelerated growth due to the rising market share of full-suspension mountain bikes across all price points. Technological segmentation shows that Air Suspension systems lead the market due to their lightweight nature and adjustability, making them preferred for competitive cross-country and trail riding. Conversely, Coil Suspension maintains a strong presence in downhill and enduro segments where maximum durability and consistent linear damping are prioritized. The Electric Bicycle application segment is emerging as the most dynamic segment, requiring specialized, often over-built, suspension components to handle the unique stresses associated with higher speeds and torque generated by electric motors, pushing manufacturers to develop purpose-built E-bike suspension models.

AI Impact Analysis on Bicycle Suspension System Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on bicycle suspension center around the viability and reliability of "smart" or "electronic" suspension systems, specifically addressing questions like: "How does AI improve suspension performance?", "Are electronic suspension systems durable and worth the cost?", and "Will predictive AI replace traditional manual setup?" Users are deeply interested in the capability of AI to analyze real-time data from various sensors (speed, G-force, wheel position, pedaling input) to instantly adjust compression and rebound damping without rider intervention. The key themes revolve around achieving optimal performance across diverse terrain, enhancing safety through automatic adjustments, and simplifying the previously complex task of suspension tuning. There is significant expectation that AI integration will democratize high-end suspension performance, making professional-level tuning accessible to average consumers, while concerns focus on system reliability, battery life, and the potentially prohibitive initial investment required for such sophisticated electronic components.

AI is fundamentally transforming the R&D and manufacturing processes within the suspension market. Machine learning algorithms are increasingly utilized during the design phase to simulate performance under extreme conditions, optimizing material usage and damper valve stacks for better heat dissipation and consistency before physical prototyping begins. This reduces development cycles and manufacturing costs while improving product quality and consistency. Furthermore, AI-driven quality control systems are being deployed on production lines, using computer vision and anomaly detection to identify minute defects in components like fork stanchions or shock bodies, ensuring higher precision and reliability of the final product, which is critical for high-pressure cycling environments.

From a consumer perspective, AI integration manifests most clearly in electronically controlled suspension systems (e.g., Fox Live Valve or RockShox Flight Attendant). These systems use complex algorithms fed by sensor arrays to determine the necessary suspension state—fully locked out, platform mode, or fully open—often milliseconds faster than a human could react. This real-time, predictive damping adjustment significantly enhances riding efficiency, especially in races, by eliminating unnecessary suspension movement during climbing or sprinting while instantly opening up for maximum shock absorption upon impact, thus offering a seamless and adaptive riding experience that maximizes both pedaling efficiency and control.

- AI enables real-time, predictive damping adjustment via electronic suspension systems, optimizing performance instantly across varied terrain.

- Machine learning algorithms accelerate R&D by simulating component stress and optimizing material structures, leading to lighter and more durable designs.

- AI-driven sensor data analytics personalize suspension tuning recommendations for individual riders based on weight, riding style, and local trail conditions.

- Predictive maintenance schedules are generated using AI monitoring of internal component wear, improving the lifespan and reliability of high-end suspension units.

- Manufacturing quality control is enhanced through AI computer vision systems detecting microscopic flaws in critical components, ensuring precision engineering.

- Generative design tools, powered by AI, are used to create novel, lightweight geometries for suspension linkages and crowns, maximizing stiffness-to-weight ratios.

DRO & Impact Forces Of Bicycle Suspension System Market

The Bicycle Suspension System Market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO). A primary driver is the global surge in outdoor recreational activities, specifically the explosive growth of mountain biking and the widespread adoption of E-bikes, which fundamentally rely on robust suspension systems to operate efficiently and safely. Technological innovation acts as another significant driver, with manufacturers continually introducing high-end electronic and smart suspension systems offering superior performance and user-friendliness. Restraints predominantly center on the high acquisition cost of premium, electronically controlled systems, which limits adoption in price-sensitive emerging markets, alongside persistent challenges posed by the manufacturing of counterfeit products that dilute brand value and introduce safety risks into the market. Opportunities are abundant, including the potential for expansion into the high-volume urban and cargo E-bike segments, and the increasing feasibility of integrating advanced, lightweight composites like carbon fiber into suspension components, reducing unsprung mass and enhancing handling dynamics.

Analyzing the impact forces reveals strong market momentum driven by continuous product differentiation and consumer willingness to invest in performance. The bargaining power of suppliers is moderate; while component sourcing (e.g., advanced seals, damping fluids, specialized alloys) is subject to global supply chain pressures, key suspension manufacturers maintain significant proprietary knowledge (patents on damping mechanisms), granting them pricing leverage. The bargaining power of buyers is high in the aftermarket segment due to numerous choices, but moderate in the OEM segment, where long-term contracts and the reputation of major suspension brands dictate procurement decisions by bicycle assembly companies. The threat of new entrants is relatively low due to the substantial capital investment required for R&D, patent barriers, and the necessity for deep material science expertise to compete effectively at the high-end.

The threat of substitutes is low to moderate. While rigid bikes or simple front-suspension (hardtail) configurations serve entry-level and road markets, they cannot substitute for full-suspension systems required for technical off-road riding, limiting the threat primarily to low-travel applications like gravel biking where compliant frames or seat post suspension might suffice. However, the intensity of competitive rivalry is extremely high, dominated by a few global powerhouses (Fox, RockShox) that invest heavily in aggressive marketing, sponsorship of professional athletes, and rapid iteration of product lines. This intense rivalry ensures continuous technological advancement and often leads to price wars in the mid-range segment, ultimately benefiting the consumer through higher performance standards and faster adoption of new features.

Segmentation Analysis

The Bicycle Suspension System Market is systematically segmented based on Type, Technology, Application, and Distribution Channel, reflecting the diverse requirements across the cycling industry. This granular analysis is essential for identifying specific growth pockets and understanding the differential demands placed on suspension components across various riding disciplines, from competitive downhill racing to casual urban commuting. The inherent technical differences between front and rear suspension components necessitate separate evaluation, as do the fundamental engineering distinctions between air and coil spring systems. Furthermore, the segmentation by application highlights the shift in focus towards specialized components designed for the heavier, faster E-bike category, distinguishing their needs from traditional mountain biking components.

Segmentation by Distribution Channel—OEM (Original Equipment Manufacturer) versus Aftermarket—is crucial for market strategists. The OEM segment is volume-driven, relying on large contracts with bicycle assemblers and often prioritizing cost efficiency and integration compatibility. Conversely, the Aftermarket segment, while lower in volume, is characterized by high-margin sales of premium, highly customizable, and often electronically-equipped upgrade components, targeting performance enthusiasts seeking marginal gains. The increasing complexity of modern suspension, requiring specialized tooling and setup knowledge, is driving market consolidation toward established repair centers and authorized distributors.

The intersection of technology and application drives market innovation. For instance, the high-end MTB segment overwhelmingly demands Air Suspension due to its light weight and tuning flexibility, while the E-MTB segment often requires robust Coil Suspension or specialized hybrid air/coil systems to manage the sustained high forces and increased weight of the battery and motor. Understanding these segmentation nuances allows manufacturers to tailor product development, marketing campaigns, and pricing strategies to maximize market penetration and capture specific, high-value consumer niches within the rapidly evolving cycling ecosystem.

- By Type:

- Fork Suspension (Front Suspension)

- Rear Suspension (Shock Absorbers)

- Integrated Suspension Systems

- By Technology:

- Air Suspension (Air Spring)

- Coil Suspension (Coil Spring)

- Electronic/Smart Suspension Systems

- By Application:

- Mountain Biking (XC, Trail, Enduro, Downhill)

- E-Bikes (E-MTB, E-Cargo, Urban E-bikes)

- Gravel and Hybrid Biking

- Others (Road Bikes with micro-suspension, Recumbents)

- By Distribution Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Retail Stores, Online Platforms, Specialized Service Centers)

Value Chain Analysis For Bicycle Suspension System Market

The value chain for the Bicycle Suspension System Market begins with Upstream Analysis, which focuses heavily on the procurement of high-quality raw materials, including specialized aerospace-grade aluminum alloys, high-strength steel for springs and shafts, precision machined plastics for seals and guides, and highly refined damping fluids. Key activities at this stage involve sourcing components with extremely tight tolerances and managing complex global supply logistics. Suppliers of specialized materials, particularly those providing proprietary coatings (like Kashima or DLC coatings for stanchions), hold significant power due to the performance critical nature of these materials. Strategic partnerships and long-term contracts with material providers are essential to ensure both quality and supply stability in this highly technical manufacturing segment.

The midstream stage centers on the Manufacturing and Assembly process, where core competencies lie in precision CNC machining, sophisticated surface treatments (anodization, coating), and the highly controlled assembly of intricate damping cartridges and air spring systems. This stage is characterized by high intellectual property barriers related to proprietary valving and damping technologies, which distinguish market leaders. Quality control (QC) is paramount, involving rigorous testing for fatigue, sealing integrity, and damping consistency across millions of cycles. Manufacturers often invest heavily in robotic assembly and AI-driven QC to maintain the necessary precision required for high-performance components that operate under extreme stress.

Downstream Analysis encompasses distribution and sales through two major channels: OEM and Aftermarket. The OEM channel involves direct sales to bicycle brands (Trek, Specialized, Giant), often dictating high-volume production runs and customized specifications. The Aftermarket channel utilizes specialized distributors, online retailers, and independent bicycle dealers (IBDs), where technical service and expert consultation are critical elements of the value proposition. Direct-to-Consumer (D2C) models are emerging, particularly for smaller, high-end component manufacturers, offering better margin control but requiring robust technical support infrastructure. Ultimately, end-user service—including tuning, repairs, and professional maintenance—forms the final, critical link, ensuring product longevity and customer satisfaction, often provided by specialized suspension service centers trained and certified by the manufacturers.

Bicycle Suspension System Market Potential Customers

The primary segment of potential customers for bicycle suspension systems includes Original Equipment Manufacturers (OEMs)—global bicycle assembly companies that integrate these components into their new models. These customers prioritize reliability, volume discounts, supply consistency, and compatibility with their frame geometries. Their procurement decisions are often influenced by professional racing endorsements and consumer brand recognition of the suspension supplier. The shift towards electrification means OEMs building E-MTBs and high-end commuter E-bikes are increasingly becoming crucial customers, demanding heavier-duty, E-bike specific suspension components that can handle greater loads and sustained high velocities.

The second major customer group is the direct consumer, comprising enthusiast mountain bikers, gravel riders, and performance cyclists who purchase components through the Aftermarket. These customers are driven by performance upgrades, seeking marginal gains, lighter weight, better tunability, and the latest electronic features. They are highly informed, often utilizing online forums, reviews, and specialized technical content to guide their purchasing decisions. Within this group, professional athletes and amateur racers represent a high-value niche, demanding the absolute highest performance and utilizing customizable, race-tuned suspension that requires frequent maintenance and servicing.

A burgeoning customer segment includes specialized commercial and municipal buyers, such as operators of bike rental fleets (especially E-bikes), adventure tour companies, and potentially military or law enforcement units utilizing specialized off-road bikes. These customers prioritize durability, low maintenance requirements, and robustness over ultimate performance gains, focusing on total cost of ownership (TCO) and system longevity in harsh environments. The increasing use of cargo bikes in urban logistics also represents a growing customer base needing specialized, heavy-load-rated front and sometimes rear suspension systems to protect delicate cargo and ensure rider control under heavy weights.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fox Factory, Inc., RockShox (SRAM), SR Suntour, Öhlins Racing, Marzocchi, Cane Creek Cycling Components, DT Swiss, Shimano, Manitou, X-Fusion, Formula Brakes, PUSH Industries, ENVE Composites, TranzX, Fast Suspension, DVO Suspension, BOS Suspension, EXT Racing Shox, Risse Racing Technology, E*thirteen. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bicycle Suspension System Market Key Technology Landscape

The technology landscape of the Bicycle Suspension System Market is defined by intense competition in damping control, material innovation, and electronic integration. Traditional hydraulic damping mechanisms continue to evolve, moving towards highly sensitive, velocity-dependent, and position-sensitive valving that allows for precise control over the full range of travel. Major manufacturers focus on proprietary damping fluid formulations and low-friction seals to ensure consistent performance and longevity. A key technical differentiator is the air spring design, with companies developing complex, multi-chamber systems (such as positive and negative air springs, and volume spacers) that allow riders to fine-tune the spring rate and progression curve to match their specific riding style and terrain requirements, moving far beyond basic single-chamber air systems.

The most disruptive technological advancement is the integration of electronic control systems, exemplified by products utilizing solenoids and processors to adjust damping in real-time. These Electronic Suspension Systems employ sophisticated algorithms (often leveraging AI/ML) that process data from accelerometers, gyroscopes, and pressure sensors multiple times per second. This enables instant transition between 'open' (maximum absorption) and 'locked out' (maximum efficiency) modes, offering a significant performance advantage, especially in competitive cycling where marginal efficiency gains are critical. While these systems require battery power, their increasing reliability and weight reduction are accelerating their adoption in high-end MTB and E-bike platforms.

Material science innovation is equally vital, focusing on reducing overall component weight while increasing stiffness and strength. The utilization of high-modulus carbon fiber for fork crowns, steerers, and suspension linkages is becoming standard in the premium segment, drastically reducing unsprung weight and improving handling responsiveness. Surface treatments like specialized, low-friction coatings (e.g., gold titanium nitride or various proprietary anodizations) applied to stanchions are critical for minimizing stick-slip friction, thus improving the small-bump sensitivity and overall plushness of the suspension. Furthermore, advancements in manufacturing precision, particularly in CNC machining and honing of damper bodies, ensure components maintain their designed performance characteristics even under continuous high thermal loads and extreme pressure fluctuations.

Regional Highlights

The Bicycle Suspension System Market demonstrates significant regional variation in terms of demand, adoption rates, and technological preference, predominantly segmented into North America, Europe, Asia Pacific (APAC), Latin America, and Middle East & Africa (MEA). North America and Europe represent the core revenue generators, characterized by mature markets with high consumer spending on recreational cycling, strong participation in competitive mountain biking, and a high penetration rate of premium, technologically advanced bicycles. European markets, in particular, benefit from robust cycling infrastructure, stringent safety regulations, and strong governmental promotion of cycling as a sustainable transport mode, fueling steady demand for both performance and reliable commuter suspension systems, especially for the high volume of premium E-bikes sold in countries like Germany and the Netherlands.

North America remains the epicenter for aggressive off-road cycling culture, driving intense demand for the latest innovations, including electronic suspension and lightweight carbon components. Consumers here are highly performance-oriented, leading to a vibrant Aftermarket sector focused on upgrades and custom tuning. The OEM market is also strong, dominated by large U.S. bicycle brands that standardize high-end suspension on their flagship models. In contrast, the Asia Pacific (APAC) region is forecasted to exhibit the fastest growth over the forecast period. This growth is attributable to rapid urbanization, rising disposable incomes in emerging economies (China, India), and a massive shift towards E-bike usage for commuting. While the APAC market currently leans towards cost-effective, durable suspension solutions, the increasing wealth and growing exposure to international competitive cycling are rapidly boosting demand for premium, full-suspension MTBs and specialized E-MTBs.

Latin America and the Middle East & Africa (MEA) currently hold smaller market shares but represent long-term growth opportunities. Latin America, particularly countries like Brazil and Colombia, possesses substantial terrain suitable for mountain biking, fostering a growing community of enthusiasts who are gradually upgrading from basic to mid-range suspension systems. Market penetration in MEA is highly concentrated around wealthy urban centers and tourist destinations that cater to adventure sports. Challenges in these regions include underdeveloped cycling infrastructure and economic volatility, but growing awareness of the benefits of quality suspension components for both safety and performance suggests a slow but steady trajectory towards greater market maturity. Manufacturers are increasingly recognizing the necessity of localizing marketing efforts and developing mid-tier product lines tailored to the budgetary constraints and specific riding environments of these developing regions.

- North America: Dominant market share due to established MTB culture, high consumer income, and strong adoption of electronic/smart suspension systems (Fox Live Valve, RockShox Flight Attendant). Significant aftermarket upgrade activity.

- Europe: High revenue contributor driven by the explosive growth of premium E-bikes (E-MTBs, E-Trekking), robust regulatory environment promoting cycling, and preference for highly reliable, sophisticated suspension components (e.g., Öhlins, DT Swiss).

- Asia Pacific (APAC): Fastest-growing region, fueled by massive E-bike adoption for commuting (China, Southeast Asia) and increasing consumer interest in high-performance mountain biking in countries like Japan and South Korea. Focus shifting from coil springs to air suspension systems.

- Latin America: Emerging market with growing potential, characterized by increasing demand for entry-to-mid-level suspension systems due to expanding cycling participation in countries with challenging natural terrain (Andean region).

- Middle East & Africa (MEA): Limited but growing presence concentrated in tourism-focused areas and urban centers, primarily driven by luxury sports equipment sales and infrastructure investment in specific high-income areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bicycle Suspension System Market.- Fox Factory, Inc.

- RockShox (SRAM Corporation)

- SR Suntour

- Öhlins Racing AB (Tenneco)

- Marzocchi (Fox Factory, Inc.)

- Cane Creek Cycling Components

- DT Swiss

- Shimano Inc. (Damping technologies)

- Manitou (Hayes Performance Systems)

- X-Fusion

- Formula Brakes

- PUSH Industries

- ENVE Composites

- TranzX

- Fast Suspension

- DVO Suspension

- BOS Suspension

- EXT Racing Shox

- Risse Racing Technology

- E*thirteen Components

Frequently Asked Questions

Analyze common user questions about the Bicycle Suspension System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Bicycle Suspension System Market?

The Bicycle Suspension System Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033, driven by increasing E-bike penetration and growth in performance cycling segments globally.

What are the primary technological differentiators in modern bicycle suspension?

Key technological differentiators include advanced electronic damping control systems (smart suspension), proprietary low-friction stanchion coatings, multi-chamber air spring designs for fine-tuning progression, and lightweight integration of carbon fiber components for improved stiffness and reduced weight.

Which application segment is contributing most significantly to market growth?

The Electric Bicycles (E-bikes) application segment is contributing most significantly to market growth, requiring specialized, heavy-duty suspension components to manage higher sustained speeds and increased bicycle mass, especially within the E-Mountain Biking (E-MTB) category.

How does AI impact the development of bicycle suspension systems?

AI significantly impacts suspension by enabling real-time, predictive damping adjustments in electronic systems and optimizing R&D through machine learning simulations, leading to faster product development, personalized tuning recommendations, and improved manufacturing precision.

Which geographical region is expected to show the highest growth in the forecast period?

The Asia Pacific (APAC) region is expected to show the highest growth rate, primarily attributed to the massive adoption of E-bikes for commuting and recreation, coupled with rapidly rising disposable incomes allowing for increased purchasing of high-performance sports equipment.

The Bicycle Suspension System Market report provides an in-depth analysis of the current market dynamics, technological advancements, and competitive landscape. The market trajectory is heavily influenced by consumer preference for performance and comfort, accelerated by the global shift towards electrified cycling. Strategic investments in electronic and adaptive suspension technologies will define market leadership over the forecast period, while supply chain resilience and cost management remain crucial for sustained profitability across both OEM and Aftermarket segments.

The transition toward sustainable and personalized mobility solutions worldwide reinforces the critical role of suspension systems in enhancing the user experience, particularly in urban environments where E-bikes and cargo bikes demand reliability under continuous heavy use. Future growth will hinge upon the successful integration of lighter materials, further miniaturization of electronic components, and the establishment of robust, accessible maintenance networks capable of supporting highly technical suspension systems globally. Manufacturers who successfully leverage AI for component optimization and customer experience will likely secure a dominant position in this competitive landscape.

The market faces ongoing pressure from raw material price volatility and the need for constant innovation to meet evolving safety standards and performance expectations from professional cyclists and demanding amateurs. Companies must focus on intellectual property protection concerning damping mechanisms, as proprietary technology forms the cornerstone of competitive advantage. Analyzing the specific regional demands, such as the need for durable, low-maintenance systems in emerging markets versus highly tunable, performance-focused systems in mature Western markets, is essential for crafting targeted product and distribution strategies. The overall outlook remains positive, driven by sustained global interest in cycling as a health, recreation, and transport activity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager