Bicycle Tubeless Tire Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435094 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Bicycle Tubeless Tire Market Size

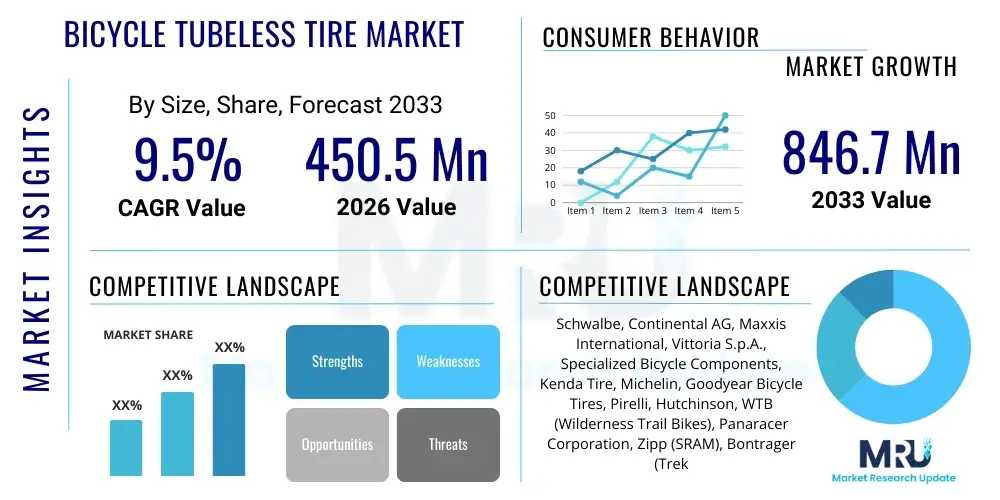

The Bicycle Tubeless Tire Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 846.7 Million by the end of the forecast period in 2033.

Bicycle Tubeless Tire Market introduction

The Bicycle Tubeless Tire Market encompasses the manufacturing, distribution, and sales of specialized tires designed to operate without an inner tube, relying instead on a sealed rim system and liquid sealant to maintain air pressure and provide immediate puncture repair capabilities. These tires are fundamentally constructed with a specialized bead designed to lock tightly into a tubeless-ready rim, creating an airtight seal. The primary product differentiation lies in the composition of the rubber compounds, casing structure (e.g., thread count per inch or TPI), and compatibility with various sealant types and rim widths. This technology has revolutionized cycling across multiple disciplines, particularly in mountain biking, gravel riding, and high-performance road racing, by offering superior performance metrics compared to traditional clincher systems.

Major applications of bicycle tubeless tires span professional racing circuits, recreational cycling, and commuting. In performance environments, particularly in mountain biking (MTB) and cyclocross, tubeless setups allow riders to use lower tire pressures, significantly improving traction, comfort, and control over rugged terrain without the risk of pinch flats, which are common in traditional tube setups. The intrinsic benefits driving market adoption include enhanced puncture resistance due to the sealant self-sealing minor holes, reduced rolling resistance leading to faster speeds and greater efficiency, and a substantial decrease in the likelihood of catastrophic air loss, thereby improving rider safety and reducing maintenance downtime.

Driving factors propelling this market growth are the increasing global participation in cycling for both sport and leisure, particularly the explosive popularity of gravel biking which necessitates durable, low-pressure tire solutions. Furthermore, continuous innovations in tire and rim manufacturing, leading to easier setup and better air retention characteristics, have minimized the historically steep learning curve associated with tubeless systems. Original Equipment Manufacturers (OEMs) are increasingly specifying tubeless-ready wheelsets and tires on mid-to-high-end bicycles, normalizing the technology and expanding the consumer base. The demand for lightweight components that enhance overall bicycle performance while maintaining robustness against common trail hazards continues to solidify the market trajectory.

Bicycle Tubeless Tire Market Executive Summary

The Bicycle Tubeless Tire Market is experiencing robust expansion driven primarily by shifting consumer preferences towards high-performance, maintenance-reducing cycling components across North America and Europe. Key business trends include aggressive investment in advanced sealant formulations and specialized casing technologies, allowing manufacturers to cater to the specific demands of road, MTB, and gravel segments with tailored products offering optimal pressure ranges and durability. The market is consolidating around major tire and bicycle component manufacturers who are leveraging vertical integration to offer complete tubeless systems (rims, tires, and sealants), simplifying the adoption process for end-users. Strategic partnerships between tire producers and emerging bicycle brands are crucial for securing OEM fitment, defining industry standards, and ensuring sustainable market penetration in fast-growing sectors like electric bicycles (E-bikes), which benefit significantly from the reliability and load-bearing capabilities of tubeless tires.

Regionally, Asia Pacific (APAC) is emerging as the fastest-growing market, fuelled by increased disposable income, government initiatives promoting cycling infrastructure, and the region’s status as a dominant manufacturing hub for mid-to-high-end bicycles and components. North America and Europe maintain dominance in terms of market value due to strong cycling cultures, high adoption rates of premium cycling technology, and a well-established aftermarket demand for performance upgrades. Segment trends indicate that the Mountain Bike (MTB) application segment holds the largest market share, driven by the inherent need for puncture protection and low-pressure stability in off-road environments. However, the Gravel/Cyclocross segment is projected to exhibit the highest CAGR, reflecting the meteoric rise of mixed-surface cycling that demands the unique balance of speed and resilience offered by tubeless technology.

Furthermore, the Aftermarket sales channel accounts for the majority of current revenue, as enthusiasts frequently upgrade their existing setups to tubeless for performance enhancement and weight savings. However, the OEM channel is rapidly increasing its contribution as tubeless systems become standard on new bicycle models, particularly in the premium and mid-range segments. The industry is focused on overcoming restraints such as the perceived complexity of initial setup and the messy nature of sealants, through user-friendly rim designs, specialized inflation tools, and more advanced sealant compositions that remain effective over longer periods. Overall, the market trajectory is strongly positive, underpinned by technological maturity and sustained consumer demand for improved riding dynamics and reduced roadside interruptions.

AI Impact Analysis on Bicycle Tubeless Tire Market

Common user questions regarding AI's impact on the Bicycle Tubeless Tire Market often center on how artificial intelligence can optimize manufacturing precision, personalize product design, and improve logistics within the highly competitive component sector. Key themes include the use of machine learning (ML) to analyze material stress points and predict failure in tire casings, optimizing rubber compound formulations for specific environmental conditions (temperature, humidity, surface type), and enhancing quality control during the curing process. Users are concerned about whether AI integration will lead to increased customization options, such as on-demand tire treads or personalized pressure recommendations based on real-time rider data (weight, terrain, speed) collected via smart sensors. Expectations are high that AI could reduce the R&D cycle time for new tubeless standards and improve supply chain efficiency, ensuring faster delivery of specialized components and sealants to global distributors and repair shops.

- AI-driven optimization of rubber compound mixing and curing parameters to ensure consistency and maximize durability.

- Machine learning algorithms applied to Finite Element Analysis (FEA) to predict tire deformation and wear patterns under diverse loads and terrains, accelerating R&D of new casing designs.

- Implementation of sophisticated quality control systems using computer vision and AI for flaw detection in bead seating and sidewall integrity during production, minimizing failure rates.

- Predictive maintenance analytics for manufacturing equipment, reducing downtime and maintaining consistent production quality for highly technical tubeless beads.

- Personalized tire pressure recommendation systems integrated with cycling computers (using AI to process rider weight, bike weight, and real-time terrain data) to optimize tubeless performance.

- Enhanced supply chain management using AI to forecast regional demand spikes for specific tubeless sizes (e.g., 700c vs. 29er) and sealant replenishment.

DRO & Impact Forces Of Bicycle Tubeless Tire Market

The dynamics of the Bicycle Tubeless Tire Market are influenced by a powerful combination of drivers, restraints, and opportunities that collectively define the industry's growth trajectory and competitive landscape. The central driver is the demonstrated performance advantage of tubeless systems, specifically superior traction and the elimination of pinch flats, which are critical benefits for both competitive athletes and serious enthusiasts. This is coupled with the growing public awareness regarding the long-term cost-effectiveness and weight savings associated with converting to tubeless setups. However, market expansion is restrained by the perceived initial complexity and necessity for specific tools (e.g., high-volume pumps or air compressors) for the initial setup, which can deter entry-level consumers. Furthermore, the reliance on chemical sealants, which require periodic replenishment, introduces a recurring maintenance requirement that some users view as inconvenient.

Opportunities abound in developing next-generation tubeless technologies, including biodegradable sealants that address environmental concerns and advanced rim-tire interface designs that simplify the installation process (the 'mess-free' tubeless concept). The integration of tubeless systems into the rapidly expanding E-bike segment presents a significant opportunity, as E-bikes require robust tires capable of handling higher speeds, heavier loads, and improved reliability—all areas where tubeless technology excels. The impact forces acting on this market include intense competition driving down manufacturing costs and increasing the feature set (lighter weight, better puncture resistance) across all price points. Technological innovation, particularly in materials science leading to better air retention properties without excessive weight penalty, acts as a pivotal force reshaping consumer choices.

Overall, the market is characterized by strong positive momentum generated by performance benefits, tempered by logistical and installation hurdles. The strategic focus for industry players is mitigating these restraints through consumer education and product simplification while aggressively pursuing opportunities in high-growth niches like gravel and E-bike segments. The collective impact forces ensure continuous refinement of both the physical tire product and the accompanying sealant and rim technology, ensuring that the tubeless standard rapidly becomes the norm rather than an upgrade option across the entire spectrum of cycling disciplines.

Segmentation Analysis

The Bicycle Tubeless Tire Market is comprehensively segmented based on Type, Application, Sales Channel, and Material, reflecting the diverse requirements and technological variations inherent in the cycling component industry. Analyzing these segments provides strategic insights into the most lucrative growth avenues and prevailing consumer demands. By Type, the distinction primarily exists between standard tubeless-ready tires, which utilize an airtight seal and sealant with a specialized bead, and potentially less common, higher-pressure specific tubular tubeless applications, although the 'Tubeless Ready' clincher format dominates mainstream adoption due to its versatility and ease of use. This segmentation is crucial for manufacturers tailoring their product portfolios to specific performance benchmarks such as air retention characteristics and maximum pressure capabilities.

The Application segmentation is the most critical driver of volume and revenue, clearly distinguishing between the high-impact demands of Mountain Biking (MTB), the high-speed requirements of Road Cycling, and the balanced resilience needed for the rapidly growing Gravel/Cyclocross category. Each application necessitates unique tire widths, tread patterns, casing reinforcement, and rubber compound hardness, leading to distinct product lines and marketing strategies. Furthermore, the split between OEM and Aftermarket sales channels dictates distribution strategies and pricing structures, with OEM focusing on bulk supply and long-term contracts, while the Aftermarket segment targets brand loyalty, technological upgrades, and premium margins for replacement and performance-enhancing products.

The segmentation based on Material, primarily focusing on advanced rubber compounds and reinforcement fabrics (like nylon or Kevlar), highlights the innovation front in material science aimed at improving puncture protection without compromising flexibility or weight. Understanding these segments allows companies to optimize their R&D investments, ensuring they meet the varied performance demands—from the robust, low-pressure requirements of downhill MTB tires to the lightweight, high-TPI (Threads Per Inch) constructions favored by road racers seeking minimized rolling resistance. This detailed segmentation analysis is fundamental to developing effective market entry and expansion strategies across the global cycling ecosystem.

- Type:

- Tubeless Ready Clincher Tires

- Tubeless Tubular Tires (Less prevalent)

- Application:

- Mountain Biking (MTB)

- Road Cycling

- Gravel/Cyclocross

- Commuting/Urban Cycling

- Sales Channel:

- Original Equipment Manufacturers (OEM)

- Aftermarket (Retail/Online)

- Material:

- Synthetic Rubber Compounds (Butyl, Isoprene)

- Natural Rubber Blends

- Casing Materials (Nylon, Polyester, Aramid Fibers)

Value Chain Analysis For Bicycle Tubeless Tire Market

The value chain for the Bicycle Tubeless Tire Market begins with upstream activities involving the sourcing and refinement of specialized raw materials, predominantly natural and synthetic rubbers, carbon black, silica, and various polymer fabrics used for casing construction (e.g., nylon or cotton threads for TPI). This upstream phase is highly capital-intensive and relies on petrochemical and chemical industries to supply high-quality, performance-grade elastomers. Key success factors at this stage include managing commodity price volatility and ensuring sustainable sourcing practices. Tire manufacturers often invest heavily in proprietary compound formulations to achieve desired characteristics such as low rolling resistance, optimal grip, and long-term wear resistance, creating significant barriers to entry for new competitors lacking material science expertise. The production phase involves complex processes like calendering, extrusion, and highly precise curing to form the tire, especially the crucial tubeless bead geometry.

Downstream activities focus on distribution and reaching the end-consumer. Distribution channels are bifurcated into Original Equipment Manufacturer (OEM) supply, where tires are sold directly to bicycle assembly plants globally, and the Aftermarket channel. The OEM channel demands significant scale, stringent quality control, and competitive pricing, often involving global logistics to support major manufacturing hubs in Asia. The Aftermarket, conversely, relies on a complex network involving wholesale distributors, independent bicycle dealers (IBDs), large sporting goods retailers, and increasingly, direct-to-consumer (D2C) e-commerce platforms. The success of downstream activities hinges on effective inventory management, localized marketing efforts, and strong relationships with IBDs who provide essential technical advice and installation services to consumers transitioning to tubeless systems.

Direct and indirect distribution channels play contrasting roles. Direct sales are primarily concentrated in the OEM segment and the D2C model utilized by a few major brands to capture higher margins and control brand experience. Indirect distribution, dominated by wholesalers and IBDs, remains critical in the Aftermarket, especially for tubeless tires due to the requirement for expert advice on sealant compatibility, rim tape application, and specialized installation techniques. Distributors also manage the complex logistics of various tire sizes, widths, and tread patterns required for the global market. Furthermore, the value chain integrates sealant manufacturers and specialized valve suppliers, often operating in parallel, whose products are essential components of the final tubeless system solution, demanding cooperative marketing and R&D efforts across the entire ecosystem.

Bicycle Tubeless Tire Market Potential Customers

The potential customer base for the Bicycle Tubeless Tire Market is broad yet distinctly segmented based on their cycling discipline, performance requirements, and willingness to invest in maintenance and premium technology. The primary customer groups are high-performance cyclists, including professional and competitive racers across Mountain Biking, Road Cycling, and Gravel racing, who prioritize reduced rolling resistance, precise handling at low pressures, and the guaranteed puncture protection offered by sealant technology. These buyers are typically highly knowledgeable about component specifications (e.g., TPI count, durometer ratings) and frequently upgrade their equipment, making them the core audience for premium, high-margin tubeless products and replacement sealants.

A second crucial segment includes serious recreational riders and enthusiasts who participate in long-distance events or regularly tackle challenging terrain. For this group, the primary driver is reliability and convenience—the ability to avoid common pinch flats and self-seal minor punctures means fewer roadside stops and greater enjoyment. This segment is highly influenced by peer recommendations, cycling forums, and the advice of local bike shops, focusing on durable, easy-to-install tubeless systems that offer a significant upgrade over standard tubes without demanding continuous technical attention. This middle segment represents high-volume potential, especially as the cost of tubeless entry decreases and ease of setup improves.

Emerging and future customers include new bicycle buyers, particularly those purchasing mid-to-high-end E-bikes, gravel bikes, and entry-level road bikes where OEMs are standardizing tubeless setups. E-bike riders, in particular, are potential high-volume consumers because the increased weight and motor torque of E-bikes place greater stress on tires, making the reliability and load-bearing capacity of tubeless systems extremely valuable. Lastly, fleet operators, such as bike rental services and professional cycling teams, represent a specialized B2B customer segment focused on maximizing operational uptime and minimizing repair costs, viewing tubeless technology as a crucial investment in fleet reliability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 846.7 Million |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schwalbe, Continental AG, Maxxis International, Vittoria S.p.A., Specialized Bicycle Components, Kenda Tire, Michelin, Goodyear Bicycle Tires, Pirelli, Hutchinson, WTB (Wilderness Trail Bikes), Panaracer Corporation, Zipp (SRAM), Bontrager (Trek Bicycle Corporation), IRC Tire (Inoue Rubber Co. Ltd.), DT Swiss, Challenge Tires, Stans NoTubes, Joe's No Flats, Rema Tip Top. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bicycle Tubeless Tire Market Key Technology Landscape

The technological landscape of the Bicycle Tubeless Tire Market is primarily defined by advancements across three critical areas: tire bead and rim interface standardization, fluid sealant chemistry, and casing construction methodologies. The adoption of ETRTO (European Tire and Rim Technical Organisation) standards for tubeless compatibility, such as "Tubeless Ready" and "Tubeless UST," has significantly reduced issues related to tire retention and air loss. However, manufacturers are continually pushing proprietary bead designs and specific rim tape formulations to improve the ease of installation, addressing a major consumer pain point. Innovations in rim design, such as hookless rims, demand corresponding advancements in tire bead technology to ensure secure retention under high-stress conditions and varying pressures, driving co-development efforts between tire and wheel manufacturers.

Sealant technology represents a highly competitive and rapidly evolving segment. Traditional latex-based sealants are being augmented by advanced synthetic and fibrous compositions that offer longer effective lifespans, greater efficacy against large cuts, and reduced tendency to coagulate prematurely inside the tire. Key R&D focus areas include developing environmentally friendly, biodegradable sealant formulas and integrating micro-particles (such as fine rubber granules or fibrous materials) within the liquid matrix to enhance the sealing capability for complex, irregularly shaped punctures. Furthermore, some high-end sealants are engineered to maintain performance across a wider temperature range, optimizing performance in both cold weather and extreme heat, conditions which typically degrade sealant effectiveness.

Casing technology revolves around optimizing the balance between weight, puncture protection, and flexibility (low rolling resistance). High TPI (Threads Per Inch) casings (e.g., 120 TPI or higher) are favored for road and high-performance applications due to their supple ride quality and minimized energy loss, while lower TPI count casings are often reinforced with specialized belts (e.g., woven Aramid fibers or bead-to-bead protection) to maximize durability and cut resistance necessary for aggressive MTB and gravel use. Multi-compound rubber technologies, where different durometers of rubber are used for the central tread (for wear life) and the side knobs (for grip), further enhance performance specificity. These technological refinements collectively ensure that tubeless tires continue to offer compelling performance advantages over traditional systems, cementing their market dominance.

Regional Highlights

- North America: Dominant Market Value and Early Adoption

North America currently holds a substantial share of the global Bicycle Tubeless Tire Market value, primarily driven by a robust cycling culture, high discretionary consumer spending on premium cycling components, and the widespread popularity of high-end mountain biking and gravel cycling. The region is characterized by a high rate of aftermarket upgrades, where performance-focused consumers readily adopt the latest tubeless technologies to gain competitive edge or enhance their off-road experience. The market benefits significantly from the presence of major industry influencers and large cycling events that aggressively promote new tubeless standards. Key drivers include the extensive network of dedicated trails and roads suitable for various cycling disciplines, necessitating the durability and performance benefits offered by tubeless setups.

The United States, in particular, serves as a hub for both consumer demand and technological dissemination, with major brands headquartered or heavily invested in the region. OEM adoption is strong, especially in the mid-to-high-end segments of mountain bikes and gravel bikes produced for the North American market. The continuous push towards lighter weight components and superior puncture resistance in the rugged terrain common across the Rocky Mountains and the Pacific Northwest sustains demand for premium tubeless tires and sophisticated sealant solutions. The market here is highly competitive, emphasizing quick product cycles and effective digital marketing strategies targeting the technically savvy consumer base.

Regulatory factors, while minimal in terms of specific tire mandates, favor cycling infrastructure development, which indirectly supports market growth. Furthermore, the strong influence of local bicycle retailers (IBDs) in educating consumers about the setup and maintenance of tubeless systems is crucial for sustained market penetration. The trend toward personalized riding experiences and data-driven performance improvements further solidifies North America’s leading position in adopting cutting-edge tubeless technology, maintaining high average selling prices for advanced tubeless systems, and acting as a key indicator for global product launches and market acceptance.

- Europe: High Market Maturity and Focus on Road and Gravel Segments

Europe is another cornerstone of the global tubeless tire market, demonstrating high maturity and deep penetration, particularly in Western European nations like Germany, the UK, Italy, and the Netherlands, where cycling is both a major sport and a principal mode of transportation. While historically strong in road cycling (which has been slower to adopt tubeless technology than MTB), the European market is now rapidly embracing tubeless setups across all disciplines, driven by professional racing teams demonstrating the performance gains, such as reduced rolling resistance and improved cornering stability offered by tubeless road tires. Gravel biking has seen explosive growth across the continent, becoming a significant revenue generator for tubeless manufacturers.

The European market is highly influenced by sustainability trends, leading to strong demand for environmentally friendlier products, including latex-free and biodegradable tubeless sealants. Manufacturers operating in this region are prioritizing adherence to REACH regulations and are often at the forefront of developing sustainable material science solutions. OEM adoption is robust, particularly for trekking, urban, and E-bike models, where the enhanced reliability of tubeless tires is critical for commuters and tourists. The stringent quality expectations of European consumers necessitate high manufacturing standards, particularly concerning long-term air retention and sealant compatibility.

Continental market dynamics show Germany leading in technical innovation and manufacturing presence, while countries like the UK and France drive high aftermarket sales volumes due to extensive racing and leisure cycling communities. Government support for cycling infrastructure and E-bike subsidies further stimulate demand for reliable components. The competitive landscape in Europe is fierce, with both global giants and highly specialized, local European tire manufacturers vying for market share by focusing on application-specific products, such as tires optimized for wet conditions or specific regional terrains (e.g., paved roads versus Alpine trails). This regional focus ensures a highly specialized and technologically advanced product offering.

- Asia Pacific (APAC): Fastest Growing Market Driven by Manufacturing and E-bike Adoption

The Asia Pacific region represents the fastest-growing market globally for bicycle components, including tubeless tires. This growth is multi-faceted: APAC serves as the world's primary manufacturing hub for bicycles (especially Taiwan, China, and Vietnam), generating massive demand through the OEM channel. Simultaneously, rising disposable incomes in countries like China, India, and Southeast Asian nations are fostering a burgeoning middle class that is increasingly adopting cycling for fitness and recreation, driving significant aftermarket growth.

The massive scale of E-bike production in China is a defining factor in regional tubeless demand. E-bikes benefit immensely from the robustness of tubeless tires, mitigating the risks associated with carrying greater weight and achieving higher sustained speeds. Governments across the region are investing in urban cycling infrastructure to combat congestion and pollution, further supporting market expansion. However, consumer education remains a crucial factor, as many riders are transitioning from basic, low-maintenance setups to more technical tubeless systems, requiring significant input from distributors and retailers regarding proper installation and upkeep.

Technological transfer and localization of manufacturing processes are accelerating the availability of high-quality tubeless products at competitive price points within APAC. While the OEM market dominates volume, the aftermarket is rapidly expanding, particularly in specialized segments like MTB in regions with rugged terrain, such as parts of India and the Philippines. The potential for long-term growth is enormous, contingent on continued consumer confidence in the reliability and simplicity of tubeless setups, positioning APAC as the strategic focal point for future capacity expansion and revenue growth for global tire manufacturers.

- Latin America (LATAM) & Middle East and Africa (MEA): Emerging Markets with Niche Growth

Latin America presents an emerging market with significant growth pockets, primarily centered around competitive cycling and high-end mountain biking in countries like Brazil, Colombia, and Chile. The rugged, often challenging terrain found across the Andes and diverse climates make puncture resistance and tire durability paramount, naturally favoring tubeless technology. Market growth here is primarily driven by imported high-end bikes and components, with pricing sensitive to fluctuating exchange rates and import tariffs. While the overall market size is smaller than North America or Europe, the enthusiasm for cycling, particularly MTB racing, ensures steady demand for premium tubeless solutions.

The Middle East and Africa (MEA) region is characterized by highly disparate market maturity. In the GCC countries (UAE, Saudi Arabia), high per capita income fuels demand for luxury and high-performance bicycles and components, including tubeless tires, often used in desert endurance cycling and structured racing events. Africa, conversely, sees growth focused on utility cycling and emerging leisure markets. In both regions, the harsh environmental conditions (extreme heat, abrasive sand, or sharp terrain) amplify the need for reliable puncture protection, making the fundamental value proposition of tubeless systems highly compelling. Logistics and distribution networks are critical challenges, often necessitating reliance on centralized distribution hubs and specialized retailer relationships to reach end-consumers effectively.

Both LATAM and MEA markets are poised for accelerated growth as local economies mature and cycling participation broadens beyond the niche enthusiast level. Investment in local assembly and distribution infrastructure will be key to unlocking mass-market adoption. Manufacturers must focus on offering products that balance high durability against local price constraints, potentially leading to the growth of mid-range, highly resilient tubeless tire lines designed specifically to withstand harsh regional cycling environments prevalent in both South American mountainous regions and the arid Middle Eastern trails. These regions represent significant untapped potential, offering diversification benefits for global market players.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bicycle Tubeless Tire Market.- Schwalbe (Ralf Bohle GmbH)

- Continental AG

- Maxxis International (Cheng Shin Rubber Ind. Co. Ltd.)

- Vittoria S.p.A.

- Specialized Bicycle Components

- Kenda Tire

- Michelin

- Goodyear Bicycle Tires

- Pirelli

- Hutchinson

- WTB (Wilderness Trail Bikes)

- Panaracer Corporation

- Zipp (SRAM Corporation)

- Bontrager (Trek Bicycle Corporation)

- IRC Tire (Inoue Rubber Co. Ltd.)

- DT Swiss

- Challenge Tires

- Stans NoTubes (Sealant & Components)

- Joe's No Flats (Sealant & Components)

- Rema Tip Top

Frequently Asked Questions

Analyze common user questions about the Bicycle Tubeless Tire market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of tubeless bicycle tires over traditional tires?

The primary advantage is superior puncture protection, as liquid sealant inside the tire immediately seals minor punctures, virtually eliminating flat tires. Additionally, tubeless systems allow for running lower air pressure, which dramatically increases traction, comfort, and control, especially beneficial for off-road cycling disciplines.

How frequently must tubeless tire sealant be replenished or replaced?

Tubeless sealant typically needs replenishment every two to six months, depending on the sealant brand, volume used, and the environmental conditions (heat and humidity accelerate sealant drying). Riders must periodically check the sealant volume by shaking the wheel or using specialized dipsticks to ensure optimal puncture resistance.

Is the initial setup of bicycle tubeless tires difficult for an average cyclist?

While historically challenging, the initial setup has become significantly easier due to advancements in ETRTO standards, improved tire bead designs, and the use of tubeless-specific pumps or compressors. However, it still requires more technical attention than a standard tube change, particularly ensuring the rim tape is perfectly sealed and the tire beads are correctly seated.

Which cycling discipline exhibits the highest rate of tubeless tire adoption?

Mountain Biking (MTB) exhibits the highest rate of tubeless tire adoption. The low pressures achievable with tubeless setups are essential for maximizing off-road grip and preventing pinch flats, which are extremely common when riding aggressively on rough or rocky trails with inner tubes.

Are tubeless tires generally more expensive than standard clincher tires?

Yes, tubeless-ready tires often have a higher initial purchase price due to specialized bead construction and casing materials required for air retention. However, the long-term cost-benefit is realized through reduced frequency of replacement (due to fewer catastrophic flats) and enhanced performance leading to a more efficient and reliable riding experience.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager