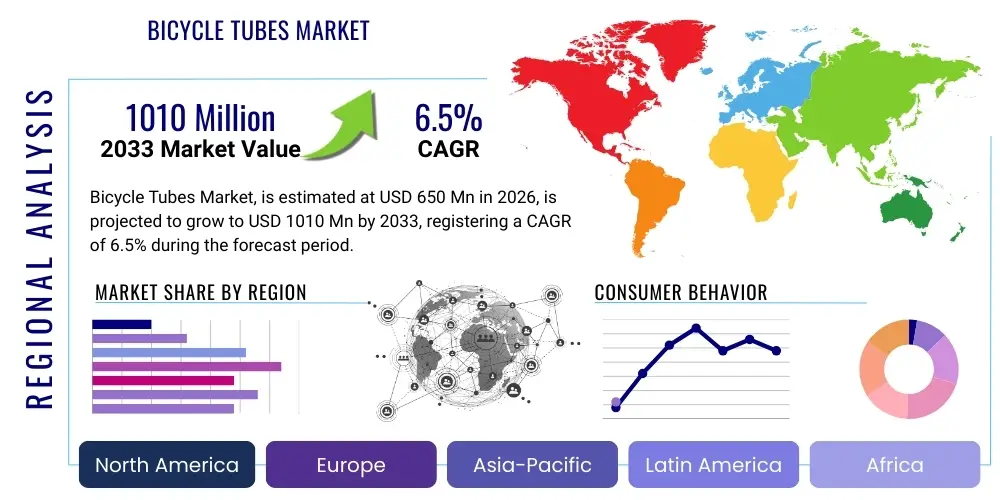

Bicycle Tubes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437692 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Bicycle Tubes Market Size

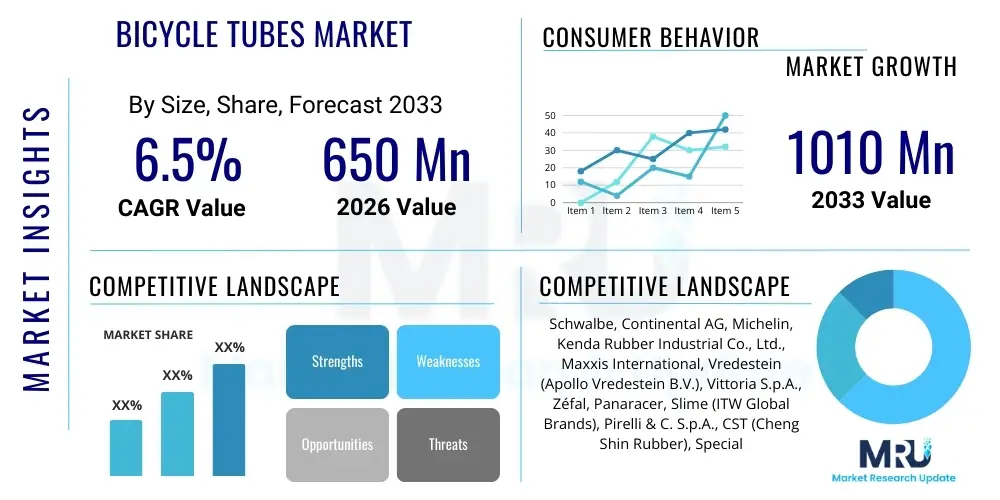

The Bicycle Tubes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 650 million in 2026 and is projected to reach USD 1010 million by the end of the forecast period in 2033. This consistent growth trajectory is primarily attributed to the global resurgence in cycling for recreation, fitness, and commuter purposes, coupled with the exponential adoption of electric bikes (e-bikes) which place higher demands on tire components, including tubes.

Bicycle Tubes Market introduction

The Bicycle Tubes Market encompasses the production, distribution, and sale of inner tubes used within pneumatic bicycle tires. These tubes, typically manufactured from materials such as butyl rubber, latex, or specialized thermoplastics (TPU), are essential components designed to maintain internal air pressure, providing cushioning, traction, and structural integrity for the bicycle wheel system. The performance characteristics of a bicycle tube, including weight, puncture resistance, and air retention capacity, directly influence the rider experience, making material science and manufacturing precision critical competitive factors in this domain.

Major applications of bicycle tubes span across various cycling disciplines, including road cycling, mountain biking (MTB), touring, commuting, and leisure riding. The product caters to the vast aftermarket segment, where replacement due to punctures or wear is necessary, as well as the Original Equipment Manufacturer (OEM) segment, supplying components for new bicycle assembly lines. Key benefits derived from bicycle tubes include ease of maintenance, affordability compared to complex tubeless setups, and reliable performance across standard riding conditions, ensuring they remain a fundamental element of the entry-level and mid-range bicycle segments globally.

Driving factors propelling this market forward include increased governmental investment in cycling infrastructure, rising consumer awareness regarding health and environmental benefits associated with cycling, and the significant technological advancements in tube materials offering lighter weight and improved puncture protection. Furthermore, the persistent growth in emerging economies, leading to higher purchasing power and increased mobility demands, solidifies the foundational demand for reliable and cost-effective bicycle components like inner tubes. Manufacturers are constantly innovating to counter the threat posed by tubeless systems by introducing ultra-lightweight and highly durable tube alternatives.

Bicycle Tubes Market Executive Summary

The Bicycle Tubes Market is characterized by steady expansion driven by resilient consumer interest in cycling activities worldwide. Current business trends indicate a strong focus on material innovation, particularly the rising adoption of thermoplastic polyurethane (TPU) tubes, which offer superior weight reduction and compactness compared to traditional butyl rubber. This technological shift, coupled with intense competition in the aftermarket segment, necessitates streamlined supply chains and robust omnichannel distribution strategies for market players to maintain relevance and gain market share. Furthermore, the integration of advanced manufacturing techniques, leveraging automation, is crucial for optimizing production costs amidst volatile raw material price fluctuations.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive production capacities in countries like China and Taiwan, coupled with explosive demand generated by large commuter populations and the emerging e-bike manufacturing hubs in Southeast Asia. Europe and North America remain critical markets, predominantly driven by high-value performance cycling, sport participation, and sustainable urban mobility initiatives. These developed markets prioritize premium, high-performance materials and quick access to specialized products, leading to higher average selling prices (ASPs) for advanced tubes.

Segment trends reveal that while butyl rubber maintains dominance due to its cost-effectiveness and excellent air retention, the TPU tube segment is expected to register the highest CAGR, primarily appealing to performance-oriented cyclists and high-end OEM bike manufacturers. The Aftermarket segment accounts for the largest revenue share, reflecting the continuous need for replacements and repairs globally. Strategic alliances between tube manufacturers and large bicycle component distributors are defining the competitive landscape, aiming to capture the expanding consumer base seeking reliable and readily available puncture-protection solutions.

AI Impact Analysis on Bicycle Tubes Market

Common user questions regarding AI's impact on the Bicycle Tubes Market often revolve around optimizing inventory management, enhancing quality control during manufacturing, and predicting consumer demand shifts, particularly in relation to competing technologies like tubeless systems. Users frequently inquire about how AI-driven predictive maintenance models can reduce puncture rates by analyzing usage patterns and material stress points, or whether AI can optimize rubber compound formulations for specific performance characteristics (e.g., maximizing air retention while minimizing weight). The core theme is leveraging AI to improve efficiency, reduce waste in production, and refine product development cycles in response to rapidly evolving cycling technologies and consumer preferences. While the physical tube product itself is low-tech, its production and supply chain are ripe for AI-driven transformation, ensuring manufacturers can meet market demands with precision and reduced lead times, especially considering the complexity of global logistics.

- AI-driven optimization of rubber compounding processes, leading to improved material consistency and reduced manufacturing defects.

- Predictive maintenance analytics applied to cycling patterns, forecasting required stock levels and regional demand surges for replacement tubes.

- Enhanced quality control systems utilizing computer vision and machine learning for rapid defect detection in high-volume production lines.

- Optimization of global supply chain and logistics routes, minimizing transportation costs and improving delivery speed for both OEM and aftermarket channels.

- AI models assisting in demand forecasting by correlating weather patterns, sporting event schedules, and e-bike sales data with tube requirements.

- Development of customized, performance-specific tube designs through AI-based simulation and stress testing, reducing physical prototyping requirements.

DRO & Impact Forces Of Bicycle Tubes Market

The dynamics of the Bicycle Tubes Market are dictated by a balanced interplay of propelling forces (Drivers), mitigating factors (Restraints), and future growth areas (Opportunities), all channeled through specific Impact Forces that shape industry structure and competition. The major driver is the persistent global trend toward healthier lifestyles and sustainable transportation, which consistently boosts bicycle utilization across all demographics. Concurrently, the proliferation of electric bicycles (e-bikes), which require durable, high-pressure tubes to support increased weight and speed, significantly contributes to steady demand, particularly in developed urban areas where micro-mobility is prioritized. These drivers create a foundational demand floor for the product.

Conversely, the primary restraint challenging market expansion is the accelerated adoption of tubeless tire technology, especially in the high-performance segments like competitive road cycling and mountain biking. Tubeless setups, offering superior puncture resistance and lower rolling resistance, often displace traditional tubes, forcing manufacturers to innovate in niche areas such as ultra-lightweight and emergency tubes. Additionally, the reliance on petrochemical derivatives, mainly butyl rubber, exposes the industry to volatile raw material pricing and stringent environmental regulations concerning synthetic rubber production, putting pressure on profit margins and necessitating exploration into alternative, bio-based materials.

Opportunities for market growth lie predominantly in the development and commercialization of advanced materials, such as TPU, which offers a significant performance upgrade (lighter weight, smaller packed size) addressing the performance gap with tubeless systems. Furthermore, the untapped potential in emerging markets, characterized by millions of conventional bicycles requiring frequent tube replacements, represents a massive and sustained aftermarket opportunity. Strategic focus on puncture-proof technologies built directly into the tubes and expansion into digital distribution channels are key strategic imperatives for capitalizing on these growth vectors, mitigating risks associated with competing tire technologies, and optimizing the market's response to environmental concerns.

Segmentation Analysis

The Bicycle Tubes Market is segmented based on material type, application, and distribution channel, providing a comprehensive understanding of diverse consumer preferences and industrial requirements. The material segmentation differentiates products based on core performance characteristics, with butyl rubber serving as the dominant, cost-effective standard, while latex and TPU cater to premium, performance-focused cycling segments demanding lightweight components and improved ride quality. Analyzing these segments helps stakeholders understand material trends and investment requirements for next-generation tube manufacturing technologies.

Segmentation by application highlights the distinct needs of different cycling disciplines. Mountain bike tubes require enhanced durability and thicker construction to withstand harsh terrain, whereas road bike tubes prioritize low weight and high-pressure capability. The hybrid/commuter segment demands a balance of reliability and affordability. Understanding these variances allows manufacturers to tailor product specifications, pricing, and marketing efforts accurately, ensuring product relevance across the diverse landscape of global cycling activities.

The market structure is heavily influenced by the distribution channel, split between Original Equipment Manufacturer (OEM) sales, which involves bulk supply to bike assembly plants, and the high-margin Aftermarket segment, covering retail sales through specialized bike shops, mass merchandisers, and, increasingly, e-commerce platforms. The aftermarket drives innovation in packaging and retail strategy, whereas OEM contracts require scale, cost efficiency, and rigorous quality assurance standards. This multi-layered segmentation is crucial for developing targeted marketing campaigns and optimizing supply chain logistics.

- By Material:

- Butyl Rubber

- Latex

- Thermoplastic Polyurethane (TPU)

- Others (e.g., composite materials)

- By Application:

- Road Bicycles

- Mountain Bicycles (MTB)

- Hybrid/Commuter Bicycles

- BMX and Specialty Bicycles

- By Distribution Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Retail, E-commerce, Repair Shops)

Value Chain Analysis For Bicycle Tubes Market

The value chain for the Bicycle Tubes Market begins with the upstream activities centered around the procurement of essential raw materials, primarily synthetic rubbers (like butyl rubber) and specialized polymers (like TPU), along with chemical additives required for compounding and vulcanization. Key upstream suppliers include major petrochemical companies and chemical manufacturers, who determine the material cost base and quality parameters. The efficiency of upstream logistics is paramount, as volatility in global oil and polymer markets directly impacts the final production costs of bicycle tubes, demanding sophisticated inventory and hedging strategies by manufacturers.

Midstream activities involve the core manufacturing processes: compounding, extrusion, joint welding, valve insertion, and quality testing. Tube manufacturers, ranging from large-scale global component suppliers to niche, specialized producers of high-performance latex or TPU tubes, add significant value through precision engineering and scale. This stage is crucial for ensuring product attributes such as air retention, puncture resistance, and weight meet the stringent standards required by different cycling applications. The implementation of lean manufacturing and automation technologies in this stage is a crucial competitive differentiator for high-volume producers, particularly those located in Asia.

Downstream analysis focuses on distribution channels, which are bifurcated into direct sales to OEM assemblers and indirect sales to the aftermarket. The direct channel requires long-term contracts and just-in-time delivery capabilities, while the aftermarket relies on a complex network involving international distributors, national wholesalers, local bicycle shops, and rapidly growing e-commerce platforms. E-commerce platforms, representing an increasingly vital indirect channel, streamline the process, offer global reach, and necessitate robust digital marketing and logistics capabilities to cater to the immediate replacement needs of end-users worldwide. Successful market players excel in optimizing this final mile of distribution, ensuring their product is readily available when a cyclist needs a replacement.

Bicycle Tubes Market Potential Customers

The potential customer base for the Bicycle Tubes Market is exceptionally broad, spanning multiple segments of the global cycling community, from manufacturers requiring components for new bicycles to individual riders needing essential replacements. The primary end-users, or buyers, can be categorized into institutional customers, mainly bicycle Original Equipment Manufacturers (OEMs) globally, who purchase tubes in massive volumes for the assembly of new bikes across all price points. These customers prioritize consistency, low cost per unit, and dependable supply reliability, often leading to large, long-term contractual agreements that stabilize production volumes for tube manufacturers.

The largest and most frequent purchasing group is the individual cyclist, representing the vital aftermarket segment. These end-users span casual commuters, fitness enthusiasts, professional athletes, and touring cyclists. Their purchase triggers are typically reactive (a puncture) or proactive (upgrading to a lighter or more durable tube, such as replacing a standard butyl tube with a TPU variant for weight savings). This segment drives innovation in retail packaging, point-of-sale visibility, and brand loyalty, demanding accessible distribution networks, including local bike shops (LBS) for expert advice and immediate fulfillment, and extensive online options for convenience and competitive pricing.

Further potential customers include fleet operators and rental services (especially those managing municipal bike-sharing schemes and e-bike rental fleets), institutional buyers such as police departments or park services utilizing bicycles, and independent bicycle repair shops. These customers require bulk purchasing options and tubes designed for enhanced durability and longevity to minimize maintenance downtime. Catering to this diverse audience necessitates a comprehensive product portfolio, offering tubes optimized for affordability and robustness for commuter/utility use, and high-performance, lightweight options for the competitive and enthusiast market segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 million |

| Market Forecast in 2033 | USD 1010 million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schwalbe, Continental AG, Michelin, Kenda Rubber Industrial Co., Ltd., Maxxis International, Vredestein (Apollo Vredestein B.V.), Vittoria S.p.A., Zéfal, Panaracer, Slime (ITW Global Brands), Pirelli & C. S.p.A., CST (Cheng Shin Rubber), Specialized Bicycle Components, Topeak Inc., Rema TipTop, Tannus, Tubolito, RideNow, TPU Tube Co. Ltd., B’Twin (Decathlon) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bicycle Tubes Market Key Technology Landscape

The key technology landscape in the Bicycle Tubes Market is primarily centered around material science innovation aimed at enhancing core attributes like weight reduction, puncture resilience, and air retention, directly competing with the advancements seen in tubeless tire systems. While traditional butyl rubber remains a fundamental technology due to its cost-effectiveness and excellent air impermeability, significant R&D efforts are focused on refining compounding and vulcanization techniques to produce thinner, lighter tubes without compromising strength. New manufacturing processes incorporate specialized internal sealants that are pre-applied during production, offering self-sealing capabilities upon minor punctures, thus bridging the gap toward tubeless advantages for the convenience-focused rider.

The most disruptive technological shift involves the development and mass production of Thermoplastic Polyurethane (TPU) tubes. TPU technology offers tubes that are significantly lighter (up to 60-70% lighter than standard butyl), highly compact, and environmentally friendlier due to easier recyclability. This material requires specialized high-frequency welding processes rather than traditional vulcanization, necessitating investment in advanced machinery. Furthermore, these tubes are often marketed with high visibility or performance color options, appealing directly to the enthusiast segment. The adoption of TPU is rapidly transforming the high-end aftermarket, providing cyclists with a performance upgrade previously restricted to only professional components.

Beyond materials, the manufacturing process itself employs advanced automation and quality control technologies. High-precision extrusion systems ensure uniform wall thickness, critical for balanced performance and preventing weak spots. Laser-based dimensional checking and automated pressure testing are standard practices to guarantee component reliability before tubes enter the complex global distribution network. Furthermore, advancements in valve technology, including lighter, more robust valve stems and specialized core designs for high-pressure applications, complement the tube material improvements, ensuring the overall reliability and performance of the pneumatic system.

Regional Highlights

Regional dynamics heavily influence the Bicycle Tubes Market, reflecting varying levels of cycling infrastructure maturity, economic development, and consumer adoption rates of competing tire technologies.

- Asia Pacific (APAC): This region is the undisputed powerhouse of the global bicycle tubes market, dominating both supply and demand. Driven by countries like China, India, and Southeast Asian nations, APAC hosts the largest manufacturing base for bicycle components (OEM supply) and possesses massive consumer populations relying on bicycles for daily commuting, resulting in substantial aftermarket demand for affordable butyl tubes. The rapid adoption of e-bikes in countries such as China and Japan further sustains high-volume requirements.

- Europe: Characterized by high cycling participation rates, particularly in countries like Germany, the Netherlands, and Scandinavia, Europe is a highly mature market. Demand here is segmented: high-volume commuter tubes are balanced against strong demand for premium, lightweight latex and TPU tubes driven by the sophisticated sports and leisure cycling segments. Strict environmental regulations also accelerate the adoption of sustainable and recyclable material innovations within the region.

- North America: The market here is driven by recreational and fitness cycling, with significant expenditure on high-performance road and mountain biking equipment. While tubeless technology is highly popular among advanced riders, the vast base of casual and entry-level riders ensures consistent aftermarket demand for reliable butyl tubes. The market is also receptive to advanced sealing solutions and puncture-resistant technologies designed for durability and ease of repair.

- Latin America: This region exhibits strong growth potential, driven by urbanization and economic development, leading to increased bicycle usage for basic transportation. The market is price-sensitive, making durable, cost-effective butyl tubes the preferred product. Investment in local assembly and distribution networks is critical for capturing this expanding consumer base.

- Middle East and Africa (MEA): While currently a smaller market share contributor, the MEA region is experiencing gradual growth fueled by increased infrastructure projects and growing awareness of cycling's health benefits. Demand is focused on utility and commuter bicycles, necessitating robust and heat-resistant tube constructions suitable for varied and often challenging environmental conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bicycle Tubes Market.- Schwalbe (Ralf Bohle GmbH)

- Continental AG

- Michelin

- Kenda Rubber Industrial Co., Ltd.

- Maxxis International (Cheng Shin Rubber Ind. Co. Ltd.)

- Vredestein (Apollo Vredestein B.V.)

- Vittoria S.p.A.

- Zéfal

- Panaracer (Panasonic Corporation)

- Slime (ITW Global Brands)

- Pirelli & C. S.p.A.

- CST (Cheng Shin Rubber)

- Specialized Bicycle Components

- Topeak Inc.

- Rema TipTop

- Tannus (Tannus Co. Ltd.)

- Tubolito

- RideNow

- TPU Tube Co. Ltd.

- B’Twin (Decathlon)

Frequently Asked Questions

Analyze common user questions about the Bicycle Tubes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Bicycle Tubes Market?

The primary factor driving market growth is the global surge in recreational and commuter cycling, further amplified by the exponential adoption of electric bicycles (e-bikes). E-bikes, due to their increased weight and speed, place higher demands on tire components, consistently fueling the need for reliable replacement and OEM tubes worldwide.

How is the adoption of tubeless technology impacting the demand for traditional bicycle tubes?

Tubeless technology acts as a significant restraint, primarily impacting the high-performance segments (professional road and mountain biking). However, tubeless setups require more complex maintenance and higher initial costs. Traditional tubes maintain dominance in the vast entry-level, commuter, and aftermarket segments due to their affordability, simplicity, and ease of roadside repair.

What are TPU bicycle tubes, and why are they gaining popularity?

TPU (Thermoplastic Polyurethane) bicycle tubes are modern alternatives to traditional butyl rubber tubes. They are gaining popularity rapidly, especially among performance cyclists, because they are significantly lighter (offering weight savings of 60-70%), highly compact when folded, and exhibit low rolling resistance. This material innovation directly addresses the weight concerns often associated with traditional inner tubes.

Which region holds the largest market share in the Bicycle Tubes Market, and why?

The Asia Pacific (APAC) region holds the largest market share. This dominance is due to two critical factors: APAC countries, particularly China and Taiwan, house the world's largest bicycle component manufacturing base (OEM supply), and they also have the largest consumer base utilizing bicycles for daily essential commuting, driving immense volume demand in the aftermarket.

What are the key technological advancements shaping the future of bicycle tubes?

Key technological advancements are centered on material science, specifically the shift towards TPU and sustainable, recyclable polymers to improve weight and eco-friendliness. Furthermore, integrated self-sealing technologies and advanced manufacturing processes, including AI-enhanced quality control, are being adopted to increase puncture resistance and reliability across all tube types.

Are butyl rubber tubes expected to be phased out by newer materials like TPU?

Butyl rubber tubes are highly unlikely to be completely phased out in the foreseeable future. While TPU tubes capture the high-performance niche, butyl tubes remain indispensable for the high-volume, cost-sensitive OEM and general aftermarket segments due to their superior air retention, proven reliability, and substantially lower manufacturing cost, making them the default choice for commuter and entry-level bicycles globally.

How does the volatile price of raw materials affect the profitability of tube manufacturers?

The profitability of tube manufacturers is highly sensitive to the volatile prices of petrochemical-derived raw materials, particularly synthetic butyl rubber. Fluctuations in crude oil and associated polymer markets directly impact input costs. Manufacturers often manage this through forward purchasing contracts, process efficiencies, or by passing increased costs onto the aftermarket segment, leading to variable profit margins and strategic material substitution when viable.

What is the primary difference in requirements between road bike tubes and mountain bike tubes?

Road bike tubes generally prioritize low weight and the ability to handle extremely high pressures (up to 120 psi or more), often utilizing lighter materials like latex or thin butyl. Conversely, mountain bike tubes prioritize thickness and durability to withstand lower pressures and resist pinch flats and punctures caused by sharp objects and rugged terrain, typically requiring heavier, reinforced butyl rubber construction.

What role does the aftermarket segment play in the overall Bicycle Tubes Market revenue?

The aftermarket segment, consisting of replacement sales through retail and e-commerce, accounts for the largest share of the Bicycle Tubes Market revenue. Tubes are consumable items requiring frequent replacement due to punctures or wear. This consistent demand ensures the aftermarket’s continuous volume and revenue contribution, often driving higher profit margins compared to bulk OEM sales.

Are there any sustainable or eco-friendly trends emerging in bicycle tube production?

Yes, sustainability is a growing focus. Trends include the development of highly recyclable materials like TPU, the incorporation of recycled butyl content into new tubes, and the use of natural rubber blends where feasible. European manufacturers are particularly active in developing production processes that minimize waste and maximize the longevity and end-of-life recyclability of their products to meet consumer demand for greener cycling components.

How important are distribution channels, such as e-commerce, for tube sales?

E-commerce platforms have become critically important, especially for the aftermarket segment. They offer cyclists immediate access to a wide variety of specialized tubes (e.g., specific valve lengths, TPU materials) and are essential for meeting sudden, localized demand spikes due to puncture events. Efficient digital logistics and competitive pricing through online channels define modern competitive distribution strategies.

What criteria do bicycle OEMs use when selecting a tube supplier?

Bicycle Original Equipment Manufacturers (OEMs) primarily select tube suppliers based on four key criteria: Consistency of quality (minimal defect rates), large-scale production capacity, competitive pricing (low cost per unit), and the ability to provide reliable, just-in-time delivery to assembly lines. Long-term reliability and adherence to strict specifications are non-negotiable requirements for OEM contracts.

What is the significance of the latex tube segment in the market?

Latex tubes occupy a high-performance niche, favored by competitive road cyclists due to their extremely low rolling resistance and supple ride quality, which is attributed to their high elasticity. Despite being expensive, difficult to install, and having poor air retention compared to butyl, their performance advantages make them a staple in professional and enthusiast racing circuits, driving premium pricing in this specialized segment.

How does AI technology benefit the manufacturing process of bicycle tubes?

AI technology benefits tube manufacturing by optimizing complex processes. This includes machine learning algorithms used for predictive quality control, where computer vision systems detect microscopic defects during extrusion and welding. AI also optimizes material mixing and compounding ratios, ensuring consistent material strength and air retention properties while minimizing material waste and production variance across large batches.

What market opportunities are available for manufacturers specializing in niche tube products?

Opportunities for niche specialists lie in high-margin segments, such as ultra-lightweight TPU tubes, specialized self-sealing tubes, or tubes designed specifically for highly unusual tire sizes (e.g., fat bikes, cargo bikes). Innovation in integrated smart technology (e.g., pressure sensors) also provides avenues for niche manufacturers to command premium prices by offering superior performance and specialized solutions that standard manufacturers often overlook.

How is the growth of micro-mobility (e-scooters, e-bikes) influencing tube demand?

The rapid growth of e-bikes and other micro-mobility vehicles significantly boosts tube demand. E-bikes are heavier, leading to higher stress on tires and tubes, and often require thicker, more robust tubes designed for sustained durability and load-bearing capacity. This segment represents a high-growth, stable revenue source for tube manufacturers, especially in urban areas.

What impact do government initiatives supporting cycling infrastructure have on the market?

Government initiatives supporting cycling infrastructure (e.g., dedicated bike lanes, rental schemes) significantly expand the user base and increase cycling frequency, leading directly to higher consumption of tubes. Improved infrastructure makes cycling safer and more appealing for commuting, accelerating both initial bicycle sales (OEM demand) and ongoing replacement purchases (aftermarket demand).

Why is high-precision extrusion technology critical for tube quality?

High-precision extrusion technology is critical because it ensures uniform wall thickness across the entire circumference and length of the tube. Non-uniformity leads to weak spots, inconsistent air retention, and a higher risk of premature failure or blowouts under pressure, making precise manufacturing a core determinant of product reliability and brand reputation.

What are the typical lifespan and replacement cycles for standard bicycle tubes?

The typical replacement cycle for bicycle tubes is highly variable, largely dependent on riding environment and frequency. For commuter bikes, tubes are often replaced reactively following a puncture, which can occur every few months. However, tubes should ideally be proactively replaced every 2-3 years, even without punctures, as the rubber material slowly degrades and loses elasticity, compromising air retention and structural integrity over time.

How do manufacturers ensure their tubes are resistant to pinch flats?

Manufacturers combat pinch flats (snake bites) primarily through design and material use. They often specify thicker, heavier gauge butyl rubber for mountain and commuter tubes, and advise riders to maintain tires at the correct pressure. Some manufacturers also offer specialized tube shapes or integrated liners near the rim interface to provide extra material protection against impact-induced punctures.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager