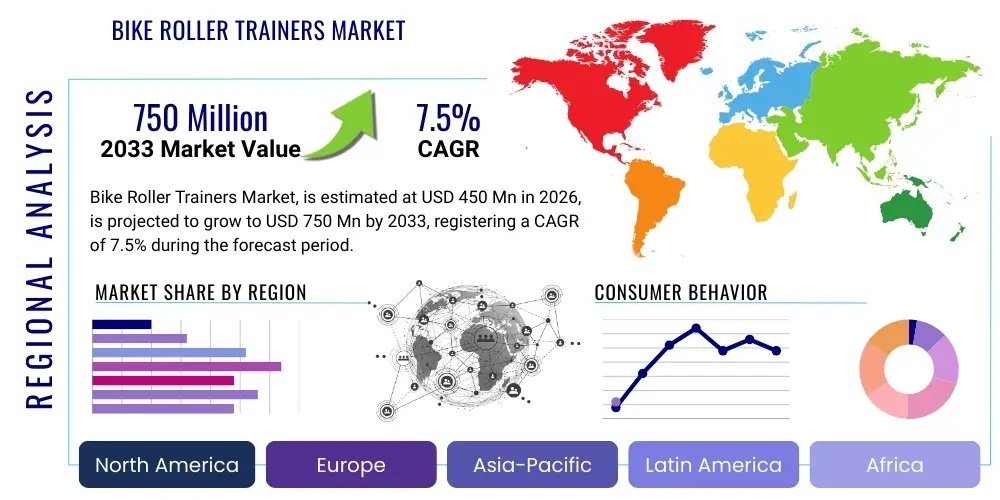

Bike Roller Trainers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435513 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Bike Roller Trainers Market Size

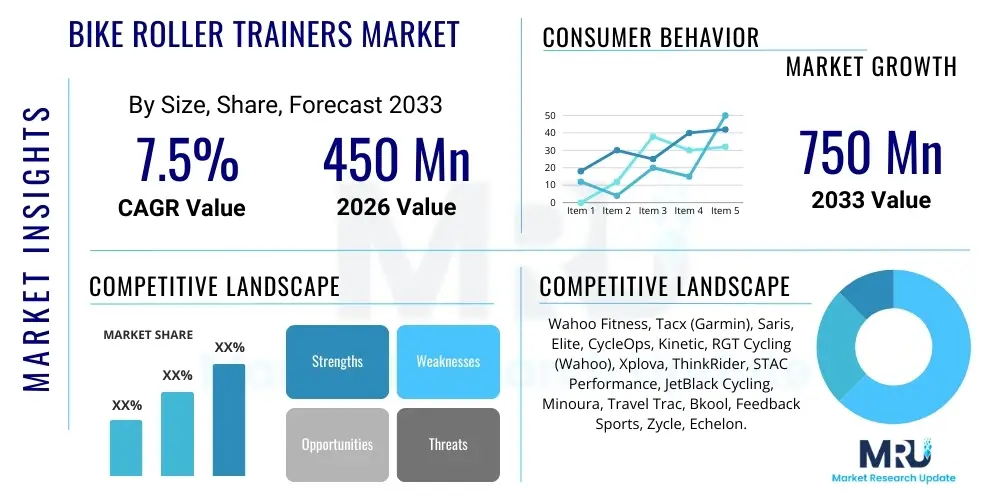

The Bike Roller Trainers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 750 Million by the end of the forecast period in 2033. This robust expansion is primarily fueled by the accelerating integration of digital training platforms, such as Zwift and TrainerRoad, coupled with increasing consumer interest in accessible, year-round indoor fitness solutions. The shift towards smart trainers offering high levels of immersion and data accuracy is a key differentiator driving value growth.

Bike Roller Trainers Market introduction

The Bike Roller Trainers Market encompasses devices that allow cyclists to use their existing bicycles indoors for training, fitness, and simulation. These trainers range from basic wheel-on magnetic resistance units to sophisticated direct-drive smart trainers that integrate seamlessly with virtual training software. Modern bike roller trainers are indispensable tools for competitive cyclists maintaining performance during adverse weather, and for recreational riders seeking structured, data-driven workouts. The product category includes traditional rollers, magnetic trainers, fluid trainers, and the highly popular smart trainers, which offer adjustable resistance and connectivity via protocols like ANT+ and Bluetooth Low Energy (BLE).

Major applications of bike roller trainers span professional sports training, general health and wellness maintenance, and virtual competitive racing. The technological evolution has shifted the market focus from simple resistance provision to delivering highly realistic road feel, accurate power measurement, and interactive simulation capabilities. Benefits include convenience, safety (avoiding traffic and weather), precise control over training variables (like wattage and cadence), and access to global virtual cycling communities. The enhanced data feedback provided by smart trainers aids in optimizing training efficacy and tracking physiological improvements over time, appealing strongly to the performance-focused consumer segment.

Key driving factors propelling market growth include the rising prevalence of virtual cycling competitions, increased consumer expenditure on home fitness equipment following global health crises, and continuous advancements in trainer technology offering quieter operation and higher simulation accuracy. Furthermore, the strong partnership ecosystem between hardware manufacturers and virtual training platform providers (e.g., Wahoo, Saris, and Zwift) ensures ongoing innovation and an expanding user base. The focus on holistic well-being and preventive health measures globally also contributes to sustained demand for indoor cycling solutions that provide measurable fitness outcomes.

Bike Roller Trainers Market Executive Summary

The Bike Roller Trainers Market is poised for substantial growth, characterized by significant shifts towards high-end, smart, direct-drive trainers that dominate new installations due to superior performance characteristics and immersive digital integration. Business trends indicate aggressive mergers and acquisitions among peripheral technology providers and trainer manufacturers, aiming to secure proprietary technological advantages and control over the expanding virtual ecosystem. Companies are focusing heavily on enhancing software integration, focusing on metrics like real-time gradient simulation and highly accurate power measurement (within +/- 1%). The market environment is highly competitive, emphasizing product innovation, especially in reducing noise levels and improving portability while maintaining high power ceilings suitable for elite athletes.

Regionally, North America and Europe remain the principal revenue generators, driven by established cycling cultures, high disposable incomes, and early adoption of fitness technology. However, the Asia Pacific region, particularly countries like Japan and South Korea, is emerging as the fastest-growing market segment, attributed to increasing urbanization, limited outdoor cycling access, and a burgeoning affluent middle class adopting premium indoor fitness equipment. Regional market dynamics are further influenced by local infrastructure limitations, prompting consumers in densely populated areas to prioritize compact, high-performance home training setups over traditional gym memberships or outdoor riding.

Segment trends highlight the overwhelming dominance of the direct-drive smart trainer segment, which offers superior flywheel inertia, reduced tire wear, and unparalleled power accuracy compared to traditional wheel-on or basic roller setups. Connectivity and software features are no longer optional but standard requirements. The accessories segment, including specialized trainer mats, fans, and dedicated desks, is also experiencing robust growth as users strive to create more comfortable and realistic dedicated indoor cycling environments. Furthermore, subscription services linked to virtual platforms are becoming integral to the product offering, solidifying recurring revenue streams for the associated hardware providers and ensuring customer loyalty.

AI Impact Analysis on Bike Roller Trainers Market

Users frequently inquire about how Artificial Intelligence (AI) will fundamentally transform static indoor cycling workouts into dynamic, personalized training experiences, focusing heavily on adaptive difficulty, real-time coaching feedback, and performance prediction accuracy. Common concerns revolve around data privacy when feeding vast amounts of physiological and performance data into AI algorithms, and the expectation for AI to flawlessly integrate third-party data (sleep quality, nutrition) to optimize training load recommendations. There is high anticipation for AI to move beyond structured interval workouts to create truly bespoke, spontaneous training rides that mimic real-world variability while maximizing specific physiological adaptations based on individual recovery rates and goals. Consumers expect AI to democratize elite coaching insights, making them accessible through mass-market hardware and software subscriptions.

The integration of AI algorithms into bike roller trainers and associated training software is rapidly transforming the market from simple physical resistance units to sophisticated, intelligent coaching systems. AI is crucial in processing vast amounts of rider data—including power output, heart rate, cadence, and variability—to create adaptive training plans that automatically adjust the intensity of workouts in real-time. This level of personalization significantly enhances training efficacy, preventing plateaus and reducing the risk of overtraining, thereby improving user retention for subscription services linked to these trainers. Manufacturers are leveraging machine learning to predict optimal performance windows and suggest recovery protocols tailored specifically to the user's fatigue profile and historical performance data, moving beyond basic predefined workout libraries.

Furthermore, AI facilitates highly realistic and variable virtual environments. By analyzing global terrain data and wind resistance models, AI algorithms can dynamically control the trainer’s resistance unit to simulate environmental physics with unprecedented accuracy, providing an immersive experience far superior to standard resistance curves. This development is critical for virtual racing applications where real-time simulation parity is paramount. The adoption of AI also impacts predictive maintenance for the trainers themselves, using sensor data to anticipate mechanical failures or calibration drift, allowing manufacturers to offer proactive support and maintain equipment reliability, thereby enhancing the overall consumer lifecycle value.

- AI-driven Adaptive Resistance: Real-time adjustment of power targets based on user fatigue and performance metrics.

- Personalized Coaching Algorithms: Creation of bespoke training schedules optimizing recovery and physiological gains.

- Enhanced Virtual Environment Simulation: Using ML to model wind drag, drafting effects, and precise gradient changes.

- Predictive Performance Analytics: Forecasting fitness improvements (FTP) and managing training load imbalances.

- Optimized Trainer Calibration: Utilizing AI for automatic drift correction and ensuring sustained power accuracy.

- Integration of Biofeedback Data: Incorporating third-party data (sleep, HRV) to modify daily workout intensity recommendations.

DRO & Impact Forces Of Bike Roller Trainers Market

The Bike Roller Trainers Market is strongly influenced by technological innovation (Drivers), particularly the development of smart, connected devices that integrate seamlessly with immersive virtual cycling platforms. However, the high initial capital investment required for direct-drive smart trainers, often exceeding $1,000, acts as a significant Restraint, limiting widespread adoption to dedicated cyclists and high-income households. Opportunities arise from expanding the market through subscription models and lower-cost smart peripherals that bridge the gap between basic trainers and premium units. The primary Impact Forces include the growing digitalization of fitness, increasing global health awareness driving home exercise equipment purchases, and the continuous evolution of data-driven training methodologies demanding higher accuracy hardware.

Key drivers include the global proliferation of virtual cycling applications, such as Zwift and Wahoo RGT, which provide competitive, social, and structured training environments that elevate the utility and entertainment value of indoor cycling. The continuous reduction in operating noise levels of direct-drive systems has addressed a major historical deterrent, making these units more suitable for apartment living and shared household spaces. Moreover, the demand for precise and validated training data, particularly among amateur athletes who leverage power metrics for structured improvement, necessitates the adoption of sophisticated smart trainers, thereby sustaining the premium segment's growth trajectory. The commitment of leading cycling brands to continuous hardware refinement further accelerates the replacement cycle for older, non-smart units.

Restraints center predominantly on the high cost and the logistical complexity associated with storing and setting up trainers, especially in urban environments where space is limited. While direct-drive trainers are superior, their size and weight can be prohibitive for users requiring frequent portability or temporary setups. Another restraint is the intense computational and connectivity requirement needed for a seamless virtual cycling experience; poor internet bandwidth or outdated devices can lead to frustrating interruptions, detracting from the product’s perceived value. Furthermore, the market faces competition from low-cost, non-smart alternatives and established gym ecosystems offering spin classes, although the latter often lacks the personalized data accuracy provided by dedicated roller trainers.

Opportunities reside in diversifying product lines to capture the mid-range consumer, perhaps through smart bike peripherals that convert standard equipment affordably, or through entry-level direct-drive units offering core smart features at a competitive price point. The expansion into developing markets through localized marketing and distribution strategies presents a long-term growth avenue. Furthermore, integrating trainers into clinical rehabilitation programs, leveraging the controlled environment for personalized physical therapy and cardiac recovery, offers a significant non-traditional growth opportunity. The development of advanced haptic feedback systems and augmented reality integration promises to unlock the next level of immersive training, appealing to tech-savvy early adopters and competitive e-sports athletes.

Segmentation Analysis

The Bike Roller Trainers market is comprehensively segmented based on product type, connectivity technology, distribution channel, and end-user profile, allowing for targeted market strategies. Product segmentation clearly delineates the technological maturity and feature set, ranging from basic, cost-effective traditional rollers to technologically advanced, data-rich direct-drive smart trainers, which represent the highest growth and profitability segment. Analyzing these segments is critical for understanding current investment flows, which are heavily tilted towards smart connectivity and enhanced user experience through seamless integration with software ecosystems.

Connectivity segmentation is foundational to the market’s evolution, with ANT+ and Bluetooth LE defining the current standard for data transmission. This ensures interoperability across various head units, smart devices, and virtual platforms. End-user categorization separates competitive athletes, who demand the highest accuracy and road feel simulation, from general fitness enthusiasts, who prioritize ease of use, quiet operation, and motivational features. Distribution analysis distinguishes between high-touch, specialized cycling retailers (offering consultation and setup) and high-volume e-commerce platforms, which dominate sales due to global reach and competitive pricing, especially for established, well-reviewed models.

- By Product Type:

- Direct-Drive Smart Trainers (Dominant and highest growth segment)

- Wheel-on Smart Trainers (Entry-level smart segment)

- Fluid Trainers (Traditional, non-smart resistance)

- Magnetic Trainers (Basic, low-cost resistance)

- Traditional Rollers (Skill and balance focused)

- By Connectivity:

- ANT+ (Standard for power meters and head units)

- Bluetooth Low Energy (BLE) (Dominant for mobile device and app connectivity)

- By End-User:

- Competitive and Professional Cyclists

- Recreational and Fitness Enthusiasts

- By Distribution Channel:

- Specialty Cycling Stores (Brick-and-mortar)

- Online Retail (E-commerce platforms)

- Sporting Goods Retail Chains

Value Chain Analysis For Bike Roller Trainers Market

The value chain for the Bike Roller Trainers market begins with complex upstream activities involving the sourcing of specialized components, particularly high-precision sensors, powerful electronic resistance units (ERUs), and high-grade metal alloys for flywheels and chassis construction. Manufacturing requires expertise in electronics integration, precision machining, and software calibration to ensure power accuracy within stringent industry standards. Supplier relationships are critical, especially for microprocessors and wireless communication modules (ANT+/BLE), which are often proprietary or sourced from specialized global electronics manufacturers. The control over raw material costs, particularly steel and aluminum, significantly impacts the final product margin, placing upward pressure on pricing in response to global commodity fluctuations.

Downstream activities focus heavily on software development, ecosystem integration, and marketing channels. The trainers are often sold as part of a larger technological ecosystem, requiring continuous software updates and ensuring compatibility with emerging operating systems and virtual training platforms (the integration stage is critical). Distribution channels are bifurcated into specialized channels (high-end cycling stores offering expert installation and calibration services) and high-volume, global e-commerce channels (Amazon, dedicated manufacturer websites) which manage complex logistics due to the size and weight of direct-drive trainers. Aftermarket support, including warranty services and recalibration support, constitutes a significant portion of the value delivered downstream, influencing brand reputation and customer loyalty.

The distribution methodology employs both direct and indirect models. Direct sales via manufacturer websites facilitate higher margins and direct customer feedback, crucial for fast iteration in a technology-driven market. Indirect channels, through specialized third-party retailers, offer critical physical presence, allowing customers to experience the product before purchase and benefit from expert advice on compatibility and setup. Successful market penetration depends on strategically managing both channels—using indirect channels for market breadth and physical presence, while leveraging direct channels for controlling branding, maximizing profitability, and offering subscription bundles seamlessly integrated with the hardware purchase.

Bike Roller Trainers Market Potential Customers

The primary potential customers (End-Users/Buyers) for Bike Roller Trainers fall into two distinct but overlapping categories: the performance-driven competitive cyclist and the convenience-seeking fitness enthusiast. The competitive cyclist segment includes professional athletes, dedicated amateurs, and triathletes who require highly accurate, reliable equipment for structured, off-season, or adverse-weather training. These customers prioritize features such as high maximum wattage capacity, highly realistic road feel simulation, sub-1% power accuracy, and guaranteed compatibility with third-party professional training software like WKO5 or TrainingPeaks. Their purchasing decisions are often based on technical specifications and endorsements from elite cycling teams or verified online reviewers focused on data integrity.

The second major customer segment, fitness enthusiasts, seeks convenience, social interaction, and measurable health benefits from indoor exercise. This group often discovers trainers through popular virtual platforms like Zwift, motivated by the gamification and social elements of indoor riding. They prioritize ease of setup, quiet operation (crucial for home use), and a seamless, engaging interface, often opting for wheel-on smart trainers or mid-range direct-drive units that balance cost with essential smart features. These consumers are typically influenced by lifestyle blogs, accessible product reviews, and bundled offers that include subscription services, emphasizing the overall user experience rather than marginal gains in power accuracy.

A burgeoning third segment includes individuals undergoing physical therapy or medical rehabilitation who utilize the controlled environment of roller trainers for low-impact, structured exercise prescribed by specialists. This group requires reliable, stable platforms and often benefits from trainers with lower maximum resistance but high stability and ease of mounting. Educational institutions, such as university cycling teams and specialized fitness studios offering indoor cycling classes beyond traditional spin, also represent a growing institutional buyer base requiring durable, networked training equipment suitable for simultaneous multi-user operation and centralized data monitoring.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 750 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wahoo Fitness, Tacx (Garmin), Saris, Elite, CycleOps, Kinetic, RGT Cycling (Wahoo), Xplova, ThinkRider, STAC Performance, JetBlack Cycling, Minoura, Travel Trac, Bkool, Feedback Sports, Zycle, Echelon. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bike Roller Trainers Market Key Technology Landscape

The contemporary Bike Roller Trainers market is defined by several converging technologies, primarily revolving around smart functionality and realistic simulation. The core technology lies in the Electronic Resistance Unit (ERU), which utilizes electro-magnets or motor control to precisely adjust resistance based on signals received from virtual platforms or pre-programmed workouts. Direct-drive technology, which removes the rear wheel and connects the bike cassette directly to the trainer's flywheel, minimizes slip and tire wear, allowing for significantly higher power accuracy (typically +/- 1% to 2%) and better road feel simulation through controlled inertia. This focus on accuracy is paramount, as trainers effectively serve as high-precision, dedicated power meters, a requirement driven by the data-centric nature of modern cycling training.

Connectivity standards are fundamental, utilizing ANT+ and Bluetooth Low Energy (BLE) to transmit critical data (power, speed, cadence, and heart rate) simultaneously to multiple devices, including cycling computers, smartphones, and PCs running training software. Advanced trainers incorporate integrated strain gauge power meters, leveraging algorithms to compensate for temperature variation and internal component wear, ensuring sustained accuracy over long periods of use. Furthermore, proprietary flywheel and belt drive system designs are constantly refined to minimize acoustic emissions (noise levels), making contemporary trainers substantially quieter than their predecessors—a key factor for consumer satisfaction and market adoption in residential settings.

The emerging technological frontier includes the integration of advanced haptic feedback and motion simulation. Manufacturers are developing motion platforms (rockers) that allow the bike to move laterally, replicating the natural sway and movement experienced while riding outdoors, which engages core muscles and significantly enhances immersion. Future technologies are focusing on integrating edge computing capabilities within the trainers themselves to process complex AI algorithms locally, reducing reliance on constant high-speed internet connectivity for adaptive training adjustments, thereby improving response time and overall reliability during dynamic, real-time virtual rides. The adoption of USB-C or other high-speed interfaces is also becoming standard for power delivery and firmware updates, streamlining the user maintenance experience.

Regional Highlights

The global Bike Roller Trainers market exhibits distinct regional dynamics driven by varying cycling cultures, climate conditions, and consumer technology adoption rates. North America, encompassing the United States and Canada, represents a mature market characterized by high consumer spending on recreational sports and a strong emphasis on data-driven fitness. The region benefits from a large, dedicated population of road cyclists and triathletes, coupled with significant market presence from major virtual training platform developers. This strong ecosystem supports continuous upgrades to premium, direct-drive smart trainers. Marketing efforts in this region focus on performance gains, social competitiveness, and the seamless integration of trainers with existing smart home fitness devices, ensuring North America maintains its position as a primary revenue generator.

Europe, particularly the Western European nations such as Germany, the UK, the Netherlands, and France, is another dominant region, driven by deeply entrenched cycling heritage and challenging winter weather conditions that necessitate reliable indoor training solutions. The European market shows a high preference for quality, durability, and precise engineering, often favoring brands with a strong reputation for accurate power measurement and robust mechanical design. Regulatory standards regarding safety and electromagnetic compatibility also play a critical role in product design and acceptance here. Furthermore, government initiatives promoting health and cycling infrastructure indirectly fuel the demand for complementary indoor training solutions, ensuring year-round adherence to fitness goals.

Asia Pacific (APAC) is identified as the fastest-growing market, largely due to rapid urbanization leading to increased traffic and pollution, making outdoor cycling less appealing or practical in metropolitan areas like Shanghai, Tokyo, and Seoul. The high density of tech-savvy consumers and increasing disposable income accelerate the adoption of high-tech fitness gear. While historically the market preferred lower-cost, traditional trainers, the increasing penetration of virtual platforms and e-sports culture is rapidly shifting demand toward smart, high-accuracy direct-drive units. China and Japan are strategic focus areas for manufacturers, requiring tailored product specifications, such as compact footprints, to suit smaller urban living spaces.

- North America: Market leader, high smart trainer adoption, strong virtual platform ecosystem integration, focus on competitive training and data accuracy.

- Europe: Established cycling culture, high demand for quality and precision, strong market for premium, quiet direct-drive systems, seasonal training necessity.

- Asia Pacific (APAC): Fastest-growing region, driven by urbanization and increasing tech-savvy consumer base, emerging market for compact, smart training solutions.

- Latin America (LATAM): Developing market, price sensitivity, increasing interest among elite athletes, reliance on imports.

- Middle East and Africa (MEA): Niche but growing market, particularly in urban centers like the UAE and South Africa, driven by extreme weather conditions (heat), necessitating indoor alternatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bike Roller Trainers Market.- Wahoo Fitness

- Tacx (Garmin)

- Saris

- Elite

- CycleOps

- Kinetic

- RGT Cycling (Wahoo)

- Xplova

- ThinkRider

- STAC Performance

- JetBlack Cycling

- Minoura

- Travel Trac

- Bkool

- Feedback Sports

- Zycle

- Echelon

- Schwinn

- Sufferfest (Wahoo)

- Alpenheat

Frequently Asked Questions

Analyze common user questions about the Bike Roller Trainers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between direct-drive and wheel-on trainers?

Direct-drive trainers remove the bicycle’s rear wheel and connect the frame directly to the trainer’s cassette, offering superior power accuracy, quieter operation, and no tire wear. Wheel-on trainers keep the rear wheel on and use friction, resulting in lower accuracy, higher noise, and potential tire slip, but are generally more affordable and easier to set up initially.

How does smart trainer technology integrate with virtual cycling platforms?

Smart trainers use ANT+ or Bluetooth LE protocols to transmit real-time power, cadence, and speed data to virtual platforms (like Zwift). Crucially, the platform simultaneously sends resistance commands back to the trainer’s electronic resistance unit (ERU), automatically adjusting the effort needed to simulate virtual terrain gradients, making the ride highly immersive and interactive.

Is the high cost of premium direct-drive trainers justified for recreational cyclists?

For recreational cyclists prioritizing immersion, quiet operation, and highly structured, data-accurate training, the cost is justified. Premium smart trainers offer superior road feel, minimal maintenance (no tire changes), and power accuracy crucial for structured fitness gains. They enhance the overall user experience far beyond basic magnetic units, encouraging consistent use and providing accurate performance metrics.

What are the typical connectivity requirements for a seamless indoor cycling experience?

A seamless experience requires stable dual-band connectivity (ANT+ and BLE) on the trainer itself for device pairing. Furthermore, a stable, low-latency internet connection (preferably 10 Mbps or higher) is necessary for continuous communication with virtual world servers, minimizing lag and ensuring that resistance changes and multiplayer interactions are synchronized in real-time.

What is the expected lifespan and required maintenance for a modern bike roller trainer?

Modern direct-drive trainers are built with robust components, typically providing a lifespan exceeding 5 to 7 years with moderate use. Required maintenance is minimal, primarily involving periodic firmware updates (via companion apps), keeping the unit clean, and occasionally performing a spin-down calibration check using the manufacturer's software to ensure power accuracy remains consistent over time.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager