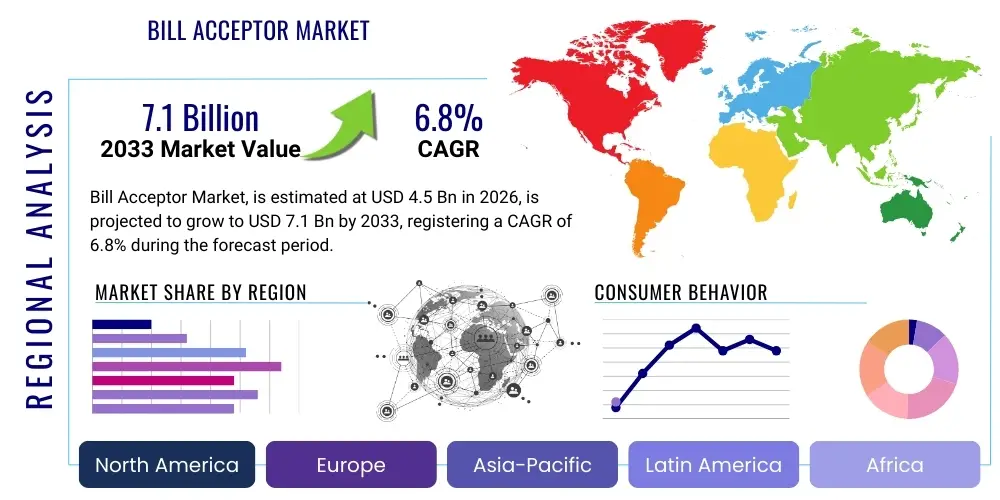

Bill Acceptor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434967 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Bill Acceptor Market Size

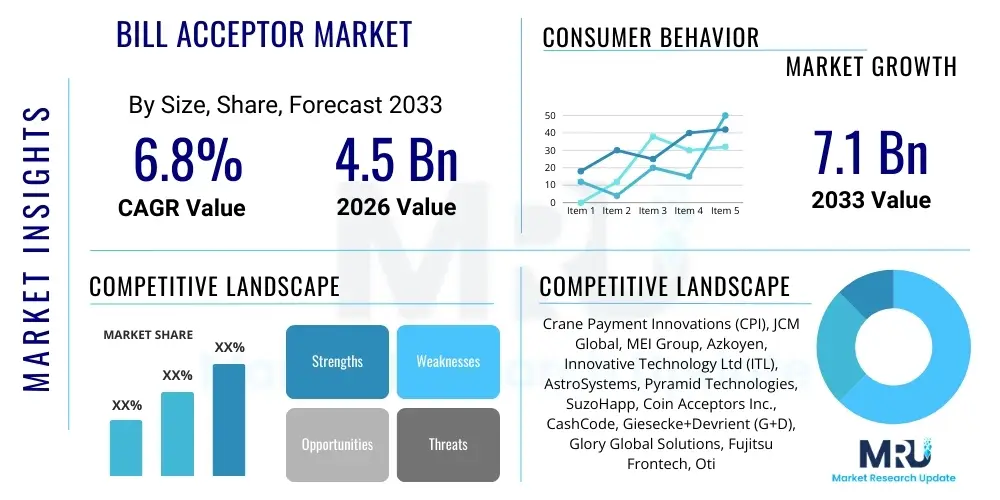

The Bill Acceptor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.1 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily underpinned by the accelerating adoption of cashless payment solutions alongside the persistent need for secure and reliable cash handling in automated retail, gaming, and public transit sectors. While digital transformation is prevalent, cash remains a critical transactional medium globally, especially in emerging economies and for lower-value transactions, necessitating advanced bill acceptor technologies to ensure operational efficiency and mitigate counterfeiting risks.

Bill Acceptor Market introduction

The Bill Acceptor Market encompasses devices designed to validate, accept, and stack paper currency automatically in various automated transaction environments. These sophisticated electromechanical products, often referred to as banknote validators or currency readers, serve as the crucial interface for cash payments in unmanned systems. Key products range from basic stackers for vending applications to advanced bill recyclers capable of dispensing change. Major applications span high-volume segments such as gaming and amusement machines, automated retail vending units, self-service kiosks (including ticketing and information portals), and comprehensive parking management systems. The primary benefit derived from these devices is enhanced operational security through advanced anti-counterfeiting technology, coupled with improved user convenience and reduced labor costs associated with manual cash collection and reconciliation.

Market growth is significantly driven by the continuous expansion of the global self-service economy, particularly in developing regions where cash liquidity remains high. Furthermore, stringent regulatory requirements mandating higher acceptance rates and reduced fraud exposure compel operators to upgrade to newer, more reliable bill acceptor models equipped with multi-sensor validation capabilities. The constant evolution of global currency designs necessitates adaptable and remotely upgradable hardware, sustaining demand for modern, smart bill acceptor systems that can handle diverse denominations and security features efficiently. The integration of advanced diagnostics and telematics further positions these devices as integral components of the interconnected self-service infrastructure.

The strategic importance of bill acceptors extends beyond simple transaction processing; they are vital instruments in maintaining the integrity of cash flows within high-traffic, unattended environments. Innovations focusing on modular design, enhanced resistance to environmental tampering, and faster transaction speeds are key areas of product development. As consumer expectations for instantaneous service rise, the performance and reliability of bill acceptors directly impact customer satisfaction and machine profitability, driving continuous investment in R&D aimed at maximizing uptime and minimizing fraudulent loss. The shift towards recycling technology, which reuses accepted bills for change dispensing, is also a powerful factor driving replacement cycles and overall market valuation.

Bill Acceptor Market Executive Summary

The global Bill Acceptor Market exhibits resilient growth, driven fundamentally by robust business trends across the automated retail and gaming sectors, despite the macro trend toward digitalization. Key business trends include the rising demand for closed-loop payment systems, increased adoption of bill recycling mechanisms to optimize operational floats, and a strong focus on IoT integration for real-time monitoring and predictive maintenance of cash handling devices. Regionally, the Asia Pacific (APAC) market is projected to demonstrate the fastest growth rate, fueled by massive deployment of self-service kiosks and vending machines in countries like China and India, coupled with high cash usage persistence. North America and Europe remain mature but vital markets, characterized by mandatory technology upgrades to comply with new currency standards and heightened security protocols.

Segment-wise, the Multi-Note Acceptor segment is dominating the market share due to its flexibility and applicability across diverse high-value environments, including casinos and automated teller machines (ATMs). Within applications, the Gaming and Amusement sector historically accounts for the largest revenue share, demanding exceptionally high acceptance security and transaction speed due to the high-stakes nature of the environment. However, the Kiosk segment, encompassing everything from transit ticketing to automated retail lockers, is expanding rapidly, representing a significant opportunity for growth and diversification. Trends also indicate a strong preference for validators that offer modular compatibility and remote software update capabilities, minimizing physical servicing costs and maximizing long-term device relevance.

Overall market dynamics suggest a future where bill acceptors are increasingly integrated with comprehensive payment platforms that accept both cash and cashless transactions, thereby future-proofing investment for operators. Competition is intensifying, focusing not only on hardware reliability but also on sophisticated software solutions for anti-counterfeiting, data reporting, and fleet management. Strategic alliances between hardware manufacturers and payment processors are becoming common to deliver holistic, end-to-end solutions. This strategic shift towards integrated technology packages is consolidating market players while simultaneously elevating the technological barrier to entry for new competitors.

AI Impact Analysis on Bill Acceptor Market

User inquiries regarding AI's influence on the Bill Acceptor Market primarily revolve around three core themes: enhanced fraud detection capabilities, predictive maintenance for maximizing uptime, and improved operational intelligence. Users seek clarity on how AI algorithms can move beyond traditional security pattern matching to identify sophisticated, evolving counterfeit methods and how machine learning can analyze sensor data for anticipatory component failure, minimizing costly service calls. Furthermore, there is considerable expectation that AI-driven data analysis will provide operators with granular insights into cash flow patterns, optimal replenishment schedules, and consumer behavior at the point of interaction, transforming bill acceptors from mere transaction devices into intelligent data collection nodes. The consensus expectation is that AI integration will significantly elevate security standards and dramatically improve the total cost of ownership (TCO) by reducing downtime.

- AI enhances banknote security by implementing deep learning models capable of identifying nuanced, high-fidelity counterfeit attempts that evade traditional optical and magnetic sensors.

- Predictive maintenance algorithms use operational telemetry data (temperature, motor cycles, acceptance speed) to forecast mechanical failures, allowing for scheduled, proactive servicing instead of reactive repairs.

- Optimized cash recycling strategies are deployed using AI to analyze transaction history and demand forecasting, ensuring appropriate denomination availability and minimizing excess cash storage requirements.

- AI-powered fraud pattern recognition allows for instant, network-wide updates on new counterfeiting techniques, providing a collective defense mechanism across deployed fleets.

- Advanced image processing algorithms, facilitated by machine learning, improve the speed and accuracy of banknote validation, especially for severely damaged or worn currency notes.

DRO & Impact Forces Of Bill Acceptor Market

The market for bill acceptors is subject to a complex interplay of Drivers, Restraints, and Opportunities (DRO) that collectively determine its growth trajectory and competitive landscape. The primary Driver is the continuous global deployment of self-service technologies across public and commercial sectors, coupled with the persistent need for secure cash handling in environments like gaming, where regulation is paramount. A significant Restraint, however, is the accelerating global shift towards digital and cashless payment methods, particularly in highly developed economies, which incrementally reduces the transaction volume handled by physical cash acceptors. The central Opportunity lies in the development and integration of "smart" bill acceptors that incorporate IoT connectivity, AI-driven diagnostics, and bill recycling capabilities, providing added value and justifying replacement cycles, even in digitally advanced markets.

Impact Forces are predominantly shaped by technological innovation and regulatory compliance. The demand for next-generation security features to combat increasingly sophisticated counterfeit operations exerts a powerful positive force, driving operators to invest in high-end validator units. Conversely, economic downturns or regulatory policies favoring specific non-cash payment systems (e.g., mandated use of contactless payments in transit) can act as a counter-force, potentially slowing down new installations or hardware upgrades. Furthermore, the operational cost and complexity associated with integrating and maintaining diverse payment peripherals (cash and cashless) influence purchasing decisions, favoring modular, unified systems.

The strategic deployment of bill acceptors is also heavily influenced by regional variations in cash usage habits. In regions where financial inclusion is low, or internet penetration is limited, the acceptance of cash remains indispensable, providing a foundational driver for market stability. Manufacturers that successfully navigate currency changes, offering firmware adaptability and multi-country compliance, are best positioned to capitalize on global expansion opportunities. The imperative to reduce operational expenditure through enhanced reliability and predictive maintenance, often enabled by integrated telemetry, further reinforces the strategic importance of advanced bill acceptor technology as a core component of the modern unattended retail ecosystem.

Segmentation Analysis

The Bill Acceptor Market is comprehensively segmented based on Type, Application, and Geography, providing granular insights into demand characteristics and technological preferences across various end-use environments. The Type segmentation distinguishes between single-note acceptors, which typically validate one bill at a time without change dispensing, and multi-note/recycler acceptors, which offer sophisticated cash management by storing and recycling multiple denominations for change delivery. Application segmentation reveals critical areas of demand, with gaming, vending, and kiosks dominating utilization, each imposing distinct requirements regarding speed, security, and durability. Geographical segmentation highlights disparities in market maturity and cash dependency, with rapid expansion noted in emerging economies contrasted with technology upgrade cycles driving sales in established regions like North America and Europe.

- By Type:

- Single-Note Acceptors (Stackers)

- Multi-Note Acceptors (Recyclers/Dispensers)

- By Application:

- Vending Machines (Snacks, Beverages, Retail Goods)

- Gaming and Amusement Machines (Slots, Arcades)

- Kiosks (Ticketing, Self-Checkout, Information)

- Parking Systems and Transit Ticketing

- Banking and Financial Services (ATMs, Cash Deposit Machines)

- By Technology:

- Standard Validators (Basic Sensor Technology)

- Advanced Multi-Sensor Validators (Magnetic, Optical, Inductive)

- Recycling and Dispensing Technology

- By Region:

- North America (U.S., Canada)

- Europe (Germany, UK, France, Italy, Spain)

- Asia Pacific (China, Japan, India, South Korea)

- Latin America (Brazil, Mexico)

- Middle East & Africa (MEA)

Value Chain Analysis For Bill Acceptor Market

The value chain of the Bill Acceptor Market begins with the upstream sourcing of highly specialized electronic components, including sophisticated optical sensors, magnetic readers, microprocessors, and high-precision mechanical components (motors, gears, stackers). Key upstream activities involve intensive R&D for anti-counterfeiting features and ensuring compliance with global currency standards. Manufacturers engage in complex assembly processes, integrating these components into robust, reliable units capable of operating reliably in harsh or unsupervised environments. Quality control and rigorous testing for high acceptance rates and low jam incidence are critical at this stage, dictating the ultimate performance and market acceptance of the final product.

Downstream analysis focuses on the distribution channels and end-user integration. Products are typically distributed through specialized Original Equipment Manufacturers (OEMs) who integrate bill acceptors into their final products (e.g., vending machine manufacturers, ATM providers, kiosk fabricators), or through direct sales channels to large fleet operators, particularly in the gaming sector. Service and maintenance providers, often working in partnership with the original manufacturers, form a crucial part of the downstream value chain, offering technical support, preventative maintenance, and critical firmware updates necessitated by new currency issues or enhanced security protocols. The complexity of software integration and mechanical reliability mandates strong, specialized technical support, distinguishing successful players.

Distribution channels for bill acceptors are generally structured as a mix of direct and indirect engagement. Direct sales dominate high-volume, specialized sectors like casino operations or major transit systems where customization and long-term service contracts are essential. Indirect channels rely heavily on distributors and value-added resellers (VARs) who provide local installation, technical expertise, and support to smaller vending operators or regional kiosk deployments. The effectiveness of the supply chain in managing global logistics, particularly for proprietary parts and swift delivery of replacement units, is a key determinant of competitive advantage, ensuring minimal downtime for cash-generating assets.

Bill Acceptor Market Potential Customers

The primary consumers and end-users of bill acceptors are organizations and businesses that operate unattended, cash-based transaction systems across public and commercial domains. This includes a diverse array of sectors, most prominently encompassing Gaming and Amusement operators, who require extremely high-security, high-speed validators for slot machines and arcade games, where revenue protection is paramount. Vending Machine Operators (VMOs) form a vast customer base, demanding reliable, cost-effective validators that can handle various environmental conditions and high transaction volumes associated with snack, beverage, and small retail product sales.

Another rapidly expanding segment of potential customers includes operators of Self-Service Kiosks, deployed across retail, transit, healthcare, and governmental agencies for automated tasks such as ticket dispensing, information services, or payment processing. These customers prioritize integration flexibility and the ability of the acceptor to handle multiple currency types and interface securely with complex back-end systems. Furthermore, entities involved in transportation, such as parking garage operators and public transit authorities, constitute significant buyers, relying on bill acceptors for fare collection and ticket vending machines, requiring robust, tamper-resistant units capable of enduring heavy public use.

Finally, the Financial Services sector, including banks and independent ATM deployers (IADs), represents the high-end spectrum of potential customers, requiring banknote acceptors and recyclers that adhere to stringent regulatory standards for cash handling (e.g., secure counting, fitness sorting, and vault specifications). These customers demand maximum reliability, advanced diagnostic capabilities, and robust internal audit trails. The need for continuous upgrades in all these segments—driven by security threats, new currency notes, or end-of-life replacement—ensures a sustained, high-volume demand stream for manufacturers offering technologically superior and compliant solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.1 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Crane Payment Innovations (CPI), JCM Global, MEI Group, Azkoyen, Innovative Technology Ltd (ITL), AstroSystems, Pyramid Technologies, SuzoHapp, Coin Acceptors Inc., CashCode, Giesecke+Devrient (G+D), Glory Global Solutions, Fujitsu Frontech, Oti, VNE Corporation, Custom America, Coinco, CIMA S.p.A., Hanco, SandenVendo. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bill Acceptor Market Key Technology Landscape

The current technology landscape in the Bill Acceptor Market is characterized by intense focus on multi-sensor validation and secure communications infrastructure. Modern bill acceptors rely on a combination of proprietary technologies, including advanced optical scanning (reading high-resolution images, watermarks, and security threads), magnetic sensing (verifying magnetic ink patterns), and dielectric sensors (measuring the paper composition and density) to establish banknote authenticity. This layered approach is essential to defeat modern counterfeiting methods, often requiring sophisticated signal processing and filtering. The competitive edge is often derived from the speed and accuracy of this validation stack, minimizing transaction delays and reducing the false rejection rate (FRR).

A major technological advancement driving market transformation is the proliferation of Bill Recycling technology. These systems not only validate and stack bills but also sort high-quality, fit banknotes into separate reservoirs for use as change dispensing. This reduces the requirement for manual intervention, cuts down on cash-in-transit costs, and dramatically improves machine uptime and efficiency, moving the market away from simple passive acceptors toward active cash management solutions. The integration of robust anti-fishing and anti-stringing mechanisms—physical and electronic defenses against tampering and vandalism—is another baseline technological requirement, especially for outdoor kiosk applications.

Furthermore, connectivity and IoT integration are reshaping the service model for bill acceptors. New devices are increasingly equipped with Ethernet or cellular modules, enabling remote diagnostics, real-time status reporting, and over-the-air (OTA) firmware updates. This capability allows operators to instantly update currency templates when new notes are introduced or security patches are deployed, mitigating the logistical challenges of physical site visits. The migration towards standardized communication protocols and enhanced data encryption protocols ensures secure data transmission and interoperability with centralized fleet management software, optimizing asset performance across geographically dispersed installations.

Regional Highlights

- Asia Pacific (APAC)

The APAC region is anticipated to be the fastest-growing market segment, primarily driven by rapid urbanization, significant investments in public transportation infrastructure, and the massive proliferation of unattended retail (vending and self-service kiosks), particularly in emerging economies like China, India, and Southeast Asian nations. Despite the concurrent growth of digital wallets, cash remains the dominant transactional medium for a large proportion of the population due to lower financial inclusion and high levels of underbanked citizens. Regulatory emphasis on modernizing transit ticketing and ensuring high security in burgeoning casino markets across the region further fuels the demand for advanced, multi-currency bill acceptors capable of high-volume processing. Local manufacturers are rapidly adopting global standards to compete effectively with established Western brands.

- North America

North America holds a significant market share, characterized by its mature gaming and financial services sectors. Demand is consistently high, driven largely by continuous technological replacement cycles rather than new deployment expansion. Strict regulatory mandates, especially within the casino industry, necessitate frequent upgrades to the latest security features and adherence to anti-money laundering (AML) protocols, ensuring a steady revenue stream for premium hardware providers. The region is also a pioneer in adopting bill recycling technology in vending and self-checkout systems to mitigate labor costs and enhance operational efficiency. The market is intensely competitive, focusing heavily on service contracts, predictive maintenance software integration, and maximum device reliability.

- Europe

The European market is marked by high diversity in currency denominations (Euro and various national currencies) and stringent compliance requirements, especially regarding the European Central Bank’s standards for banknote handling and security features. Growth is steady, propelled by the modernization of public transit systems and expansion of automated retail segments. A key trend is the strong preference for modular systems that can easily adapt to regional regulatory variances and accommodate future cashless payment integration. The deployment of bill acceptors in sophisticated Automated Teller Machines (ATMs) and cash deposit machines is robust, with an emphasis on high-throughput, high-security recycling devices that minimize logistical cash management overheads.

- Latin America (LATAM)

LATAM presents considerable growth opportunities, though stability can be affected by economic volatility and high inflation rates, which necessitate frequent currency updates. The core demand stems from the expanding penetration of vending, gaming, and transit services in urban centers across Brazil and Mexico. The market is highly price-sensitive, often favoring robust, durable validators over premium, complex models, although security requirements remain crucial due to high local rates of counterfeiting. Localized manufacturing and service capabilities are highly valued, reducing dependence on global supply chains and improving response times for maintenance and currency recalibration.

- Middle East and Africa (MEA)

The MEA region is developing, with growth concentrated in high-capital areas such as the GCC (Gulf Cooperation Council) nations, focusing on large-scale infrastructure projects including smart cities, airport transit systems, and integrated leisure complexes (casinos where permitted). Demand in this region is typically for high-end, secure units integrated into high-profile kiosks and ATMs. Africa, while offering potential due to high cash usage, faces challenges related to infrastructure reliability and diverse local currency standards. The demand is slowly evolving from basic validation towards more interconnected, remotely manageable systems as network infrastructure improves.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bill Acceptor Market.- Crane Payment Innovations (CPI)

- JCM Global

- Innovative Technology Ltd (ITL)

- SuzoHapp

- Azkoyen

- Pyramid Technologies

- Glory Global Solutions

- Giesecke+Devrient (G+D)

- Fujitsu Frontech

- Oti

- CashCode (A CPI Brand)

- Coin Acceptors Inc.

- MEI Group (Historical/Integrated into CPI)

- AstroSystems

- VNE Corporation

- Custom America

- Coinco

- CIMA S.p.A.

- Hanco

- SandenVendo

Frequently Asked Questions

Analyze common user questions about the Bill Acceptor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for Bill Acceptor recycling technology?

The primary factor driving demand for bill acceptor recycling technology is the imperative to reduce operational costs, specifically cash-in-transit expenses and labor associated with manual cash replenishment and collection. Recycling systems ensure the machine's float remains optimized by reusing accepted bills for change, maximizing uptime and machine profitability in high-volume, unattended environments.

How does the shift to cashless payments impact the Bill Acceptor Market?

While the overall shift to cashless payments acts as a restraint on market volume in highly developed regions, it simultaneously drives demand for higher-specification, integrated bill acceptors. Manufacturers must now produce "hybrid" payment solutions that securely manage both cash and digital transactions, justifying the cost of the cash handling module through enhanced reliability, high security, and IoT connectivity for operational oversight.

What are the key technological advancements utilized in modern banknote validation?

Modern banknote validation utilizes advanced multi-sensor fusion, combining high-resolution optical scanning (RGB and infrared), advanced magnetic pattern detection, and dielectric sensors to analyze paper composition. Crucially, these systems increasingly employ sophisticated algorithmic processing and machine learning to distinguish genuine currency from complex, evolving counterfeit notes with exceptional speed and accuracy.

Which application segment accounts for the highest revenue share in the Bill Acceptor Market?

The Gaming and Amusement application segment historically accounts for the highest revenue share due to the high-stakes nature and strict regulatory requirements associated with casino and slot machine operations. These environments demand the most secure, fastest-performing, and most reliable bill acceptors to minimize fraud exposure and ensure seamless patron experience, thus justifying investment in premium equipment.

What role does IoT play in the operational efficiency of deployed bill acceptors?

IoT integration allows bill acceptors to transmit real-time telemetry data regarding transaction volume, acceptance rates, internal diagnostics, and security alerts to centralized management platforms. This connectivity enables remote firmware updates, predictive maintenance scheduling, and optimized cash collection logistics, significantly reducing machine downtime and lowering the total cost of ownership (TCO) for fleet operators.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager