Bio Based Epoxy Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436671 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Bio Based Epoxy Market Size

The Bio Based Epoxy Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.8 Billion by the end of the forecast period in 2033.

Bio Based Epoxy Market introduction

The Bio Based Epoxy Market is defined by the production and consumption of epoxy resins derived partially or wholly from renewable biological sources, such as plant oils, terpenes, and lignin, rather than traditional petroleum-based precursors like bisphenol A (BPA) and epichlorohydrin (ECH). These bio-epoxies are crucial components in formulating paints, coatings, adhesives, composite materials, and electronic encapsulations, offering comparable, and often superior, performance characteristics regarding chemical resistance, thermal stability, and mechanical strength compared to their conventional counterparts. The primary driver for market growth is the global imperative toward reducing carbon footprint, coupled with stringent environmental regulations, particularly in developed economies, pushing industries like automotive, aerospace, construction, and electronics toward sustainable material sourcing.

The product scope of bio based epoxies is expanding rapidly due to continuous advancements in green chemistry and catalytic processes, enabling higher bio-content ratios without compromising product quality or processing ease. Major applications span high-performance composites utilized in wind turbine blades and aircraft components, protective coatings for marine and industrial infrastructure, and durable adhesives for wood and structural bonding. The inherent benefits, beyond sustainability, include lower toxicity profiles, reduced volatile organic compound (VOC) emissions during application, and enhanced safety for end-users and manufacturing personnel. This convergence of environmental stewardship and technical performance positions bio-epoxies as a vital alternative for manufacturers aiming for circular economy goals.

Key driving factors propelling market expansion include rising consumer demand for sustainable products, significant investments in bio-refinery infrastructure, and favorable government incentives and policies supporting bio-manufacturing. Furthermore, decreasing costs associated with biomass feedstock processing and improved scalability of bio-epoxy production technologies are making these green alternatives economically competitive with traditional resins. The versatility of bio based epoxy systems allows for customization in various industries, thereby ensuring widespread adoption across diverse high-value applications where material longevity and environmental impact are paramount considerations for material selection.

Bio Based Epoxy Market Executive Summary

The Bio Based Epoxy Market is characterized by robust growth driven fundamentally by the transition towards sustainable chemical manufacturing and increased regulatory pressure against petrochemical derivatives. Business trends indicate a strong focus on strategic collaborations between bio-chemical producers and major end-user industries (e.g., automotive and aerospace) to co-develop customized formulations that meet stringent performance standards while maximizing bio-content. Furthermore, companies are actively investing in R&D to utilize diverse feedstock sources, moving beyond conventional soybean or linseed oil to include waste biomass and algae, thereby enhancing resource efficiency and supply chain resilience.

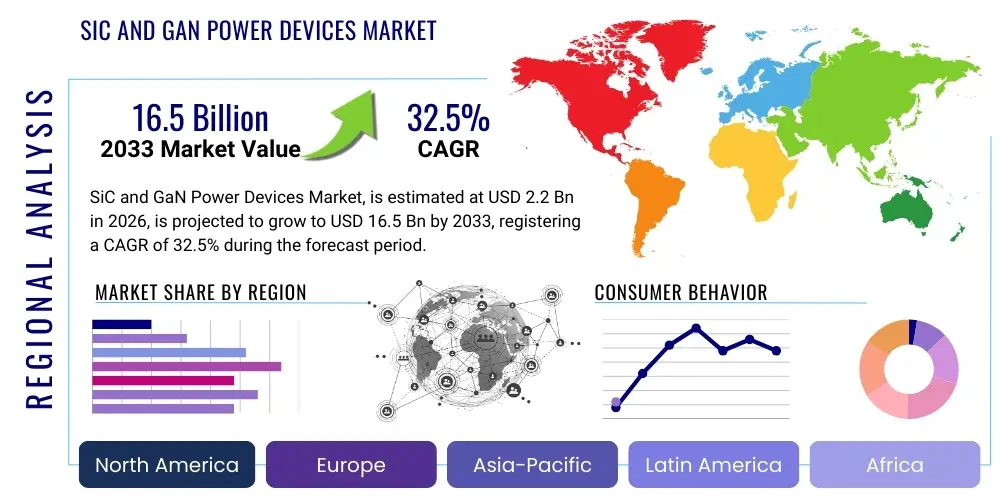

Regional trends highlight Europe and North America as dominant markets, primarily due to well-established environmental policies, high consumer awareness regarding sustainability, and significant technological adoption rates, especially within the protective coatings and composite sectors. The Asia Pacific region, however, is emerging as the fastest-growing market, propelled by rapid industrialization, increasing governmental commitments to eco-friendly infrastructure projects, and the expansion of the electronics manufacturing base which requires low-VOC, high-performance encapsulants. This regional divergence reflects varying stages of policy maturity and industrial readiness for sustainable material substitution.

Segment trends underscore the dominance of the coating segment, where bio-epoxies are quickly replacing conventional paints in industrial and architectural applications, providing durable and environmentally compliant protection. Within the application segment, the wind energy sector stands out, driven by the demand for large, lightweight, and sustainable composite materials for rotor blades, necessitating high-performance bio-resins. The trend also points towards the increasing commercial viability of 100% bio-based or high bio-content systems, moving away from hybrid formulations, signaling a maturation of the technological landscape and increased consumer confidence in the long-term performance of these green materials across critical infrastructure projects.

AI Impact Analysis on Bio Based Epoxy Market

User inquiries regarding AI's influence on the Bio Based Epoxy Market frequently center on three critical areas: accelerating sustainable feedstock discovery, optimizing complex polymerization processes, and enhancing supply chain predictability for bio-derived materials. Users seek to understand how AI-driven analytics can identify novel bio-feedstocks (e.g., agricultural waste streams) suitable for epoxy synthesis, bypassing lengthy traditional chemical screening. A major concern is whether AI can effectively model and optimize the complex kinetic and thermodynamic parameters involved in producing high-purity, structurally consistent bio-epoxies at industrial scale, thereby reducing batch variability and improving yield efficiency. Expectations are high that predictive maintenance and demand forecasting, powered by machine learning, will stabilize the volatile supply chains inherent to agricultural sourcing, ensuring cost-effective and continuous supply for manufacturers, ultimately accelerating the market transition away from petrochemical dependence.

AI's role in computational chemistry and materials informatics is transformative for bio-epoxy development. Machine learning algorithms are being deployed to predict the performance characteristics (e.g., tensile strength, thermal resistance, cure speed) of new bio-epoxy formulations based on the molecular structure of the bio-derived monomers. This virtual screening capability drastically reduces the number of required physical experiments, shortening the innovation cycle from several years to mere months. Furthermore, AI helps in identifying optimal catalyst systems and reaction conditions that maximize the bio-content percentage in the final product while maintaining or improving overall material performance, addressing the historical challenge of property compromises in bio-based polymers.

In manufacturing and quality control, AI systems are integrating with advanced sensor technologies (IoT) installed in reactors and processing lines. These systems provide real-time monitoring and anomaly detection, allowing for precise control over exothermic reactions common in polymerization, thereby ensuring batch consistency and maximizing energy efficiency. Additionally, AI-driven process optimization minimizes waste generation by fine-tuning resource inputs and predicting potential equipment failures, aligning perfectly with the core ethos of sustainability that drives the bio-epoxy market. This optimization is crucial for making bio-epoxies economically competitive with mature, standardized petroleum-based alternatives.

- AI accelerates the discovery and characterization of novel, sustainable bio-feedstocks.

- Machine learning optimizes polymerization reaction kinetics, enhancing yield and consistency.

- AI-driven materials informatics predicts physical and chemical properties of new formulations virtually.

- Predictive analytics improves the stability and transparency of bio-sourced supply chains.

- Integrated AI and IoT systems enable real-time process monitoring and waste minimization in manufacturing.

DRO & Impact Forces Of Bio Based Epoxy Market

The Bio Based Epoxy Market is primarily driven by rigorous global sustainability mandates and the increasing corporate commitment to Environmental, Social, and Governance (ESG) criteria, which necessitate the adoption of renewable chemical precursors. However, market growth faces restraints stemming from the higher initial production costs associated with bio-refinery scaling and the technical challenges in achieving 100% bio-content without performance degradation. Significant opportunities lie in developing high-performance applications in emerging sectors like 3D printing and electric vehicle battery encapsulation, leveraging the unique thermal and dielectric properties of advanced bio-epoxies. These forces collectively shape the competitive landscape and dictate the speed of transition from fossil-fuel dependence to a bio-centric chemical economy.

The primary drivers include the escalating price volatility of crude oil, making stable bio-feedstock pricing increasingly attractive, and the robust push from major end-users, such as aerospace giants and electronics manufacturers, requiring certified sustainable materials to meet internal targets and external standards like LEED certification. Conversely, major restraints involve the need for significant capital investment to establish dedicated bio-refinery infrastructure and the dependence on agricultural commodity cycles, which can introduce supply seasonality and price uncertainty for certain feedstocks. Furthermore, resistance from conventional chemical manufacturers, who possess deeply entrenched, highly optimized petroleum-based production facilities, slows down widespread industrial adoption.

Opportunities are centered on technological advancements that allow for the efficient utilization of non-food biomass, such as lignin and cellulose, ensuring feedstock sustainability and abundance. The focus on developing bio-epoxies with superior characteristics, such as enhanced flexibility, improved UV resistance, and greater fire retardancy, opens new high-margin niche markets. Impact forces are predominantly characterized by shifting regulatory landscapes, especially in Europe (e.g., REACH regulations and Green Deal initiatives), which favor bio-based alternatives, and the accelerating pace of innovation in genetic engineering and synthetic biology to create customized bio-monomers that perfectly match industrial requirements, thereby fundamentally changing the cost-performance equation for sustainable polymers.

Segmentation Analysis

The Bio Based Epoxy Market is strategically segmented based on the type of feedstock utilized, the specific application area, the final product type, and the geographical region. Analyzing these segments provides a detailed understanding of market dynamics, revealing where the fastest adoption rates and highest value propositions reside. The feedstock segmentation highlights the critical role of plant-derived materials, while the application segmentation confirms the dominance of composite materials and protective coatings due to their high volume and strict environmental requirements. This granular view allows stakeholders to tailor their product development and market entry strategies to maximize penetration in high-growth, sustainability-driven sectors globally.

- By Feedstock Type:

- Plant-based Oil (Soybean, Linseed, Castor, Jatropha)

- Lignin and Cellulose Derivatives

- Rosin and Terpenes

- Other Bio-Polyols (Algae, Waste Streams)

- By Application:

- Coatings and Paints

- Adhesives and Sealants

- Composite Materials (Wind Energy, Aerospace, Automotive)

- Electronics Encapsulation

- Construction (Flooring, Infrastructure Repair)

- Others (Tooling, Moulding)

- By Product Type:

- DGEBA Replacement (Diglycidyl Ether of Bisphenol A substitutes)

- Aliphatic Bio-Epoxies

- Cycloaliphatic Bio-Epoxies

- Epoxy Acrylates

- By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Bio Based Epoxy Market

The value chain for the Bio Based Epoxy Market begins with the upstream sourcing and processing of renewable feedstocks, which involves agricultural cultivation, sustainable forestry management, or the collection and refinement of industrial biowaste. This initial stage is crucial as the purity and consistency of the bio-monomers directly influence the quality and performance of the final epoxy resin. Key activities here include enzymatic modification, transesterification, and catalytic epoxidation processes to convert raw bio-oils or lignocellulosic materials into reactive epoxy precursors. Efficiency in upstream processing is vital for achieving cost parity with petrochemical alternatives, requiring significant investment in optimized bio-refinery technologies and supply chain vertical integration.

Midstream activities involve the synthesis of the final bio-epoxy resin, often requiring specialized chemical engineering to ensure high bio-content ratios and desired molecular weight distribution. Distribution channels are twofold: direct sales and indirect sales. Direct channels are utilized for large-volume contracts, particularly with major composite manufacturers (aerospace and wind), where technical collaboration and customization are necessary. Indirect channels involve chemical distributors and specialized material suppliers who cater to smaller formulators, coating manufacturers, and regional customers, providing logistical support, smaller packaging options, and local technical service.

Downstream analysis focuses on the formulation and end-use application. Formulators mix the bio-epoxy resins with specific hardeners (curing agents), accelerators, fillers, and additives to create tailored systems for specific applications, such as high-temperature adhesives or UV-resistant coatings. The end-users (e.g., construction companies, automotive OEMs, electronics firms) then apply these formulated products. The effectiveness of the overall value chain relies heavily on robust quality control and certification processes (e.g., USDA BioPreferred, ASTM standards) at every stage to assure end-users that the bio-epoxy systems meet the demanding performance specifications required in industrial applications, thereby strengthening market confidence in sustainable polymers.

Bio Based Epoxy Market Potential Customers

The primary potential customers and end-users of bio based epoxy resins are large-scale industrial consumers demanding high-performance, environmentally compliant material solutions across various infrastructure and manufacturing sectors. Key buyers include manufacturers in the wind energy sector, utilizing massive volumes of bio-epoxy for composite fabrication in rotor blades and nacelles, driven by sustainability targets and the need for durable, lightweight materials. Another significant customer base resides within the automotive and electric vehicle (EV) industry, where bio-epoxies are increasingly used for structural adhesives, lightweight components, and battery encapsulation due to their excellent dielectric properties and thermal management capabilities, contributing directly to vehicle weight reduction and extended range.

The construction and civil engineering sectors represent substantial long-term customers, particularly for protective coatings, industrial flooring, and infrastructure repair materials. These customers prioritize materials with low VOC emissions, high durability, and resistance to chemical corrosion. Furthermore, the electronics industry, including manufacturers of printed circuit boards (PCBs) and semiconductor packaging, requires ultra-low toxicity and high-purity encapsulants, making bio-epoxies an attractive replacement for traditional resins in consumer electronics and specialized defense applications. The adoption rate among these customers is heavily influenced by the availability of certified, drop-in replacement bio-epoxy systems that require minimal retooling or re-qualification of existing production lines.

Specialized formulators and compounders also constitute critical customers, as they act as intermediaries who purchase bulk bio-epoxy resin and blend it with proprietary additives to create final application-specific products. These customers service niche markets such as marine coatings, artistic resin crafts, and specialized tooling applications, where sustainability often serves as a key differentiating factor in their branding and marketing efforts. The continued expansion of these intermediary customers ensures broader market penetration and accessibility of bio-epoxy technology across small-to-medium enterprises that do not engage in direct procurement from large chemical producers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Huntsman Corporation, Hexion Inc. (Westlake Chemical), Sicomin SA, Specific Polymers, Spolchemie AS, Aditya Birla Chemicals, KUKDO Chemical Co., Ltd., BÜFA Composite Systems GmbH & Co. KG, Cardolite Corporation, EPOXIES, Etc., Chang Chun Group, The Dow Chemical Company, Kolon Industries, Inc., Nagase ChemteX Corporation, Nan Ya Plastics Corporation, Olin Corporation, Polynt-Reichhold Group, ATL Composites, ECO-Poxy, Sika AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bio Based Epoxy Market Key Technology Landscape

The technological landscape of the Bio Based Epoxy Market is primarily defined by advancements in green chemistry, focusing on efficient pathways to synthesize high-pperformance epoxy monomers from renewable resources. A critical area of innovation is the utilization of naturally occurring functional groups, such as the unsaturated bonds in vegetable oils or the hydroxyl groups in biomass-derived polyols, which are chemically modified through processes like epoxidation or glycidylation. Modern techniques often involve enzymatic catalysis and mild reaction conditions (lower temperature and pressure) to improve selectivity, reduce energy consumption, and minimize the generation of hazardous byproducts, thus aligning the manufacturing process itself with sustainability objectives.

Furthermore, significant research efforts are dedicated to developing novel hardeners and curing agents specifically optimized for bio-epoxy resins. Traditional petroleum-based hardeners can sometimes compromise the overall bio-content of the final cured system; therefore, formulators are increasingly adopting bio-derived amines, anhydrides, and acid-functional compounds derived from natural sources like cardanol or bio-succinic acid. The development of advanced thermoset systems also includes incorporating nanotechnology, where materials like graphene or cellulose nanocrystals are integrated into the bio-epoxy matrix to enhance mechanical properties, thermal conductivity, and barrier performance without adding significant weight, pushing the performance ceiling for these sustainable materials in demanding composite applications.

Another crucial technological trend is the drive toward process intensification and modular manufacturing. Continuous flow chemistry, enabled by microreactor technology, is being explored to replace traditional batch processing, leading to better control over reaction exotherms, enhanced safety, and increased yield purity. This shift facilitates the rapid scale-up of novel bio-epoxy chemistries, making them accessible to industrial partners faster and more reliably. Intellectual property surrounding high bio-content formulations that achieve DGEBA-equivalent performance characteristics (specifically high Tg, or glass transition temperature) is rapidly accumulating, indicating a mature technological push toward full replacement of fossil-based standards in structural applications.

Regional Highlights

The global consumption and production of bio based epoxies exhibit distinct regional patterns influenced by regulatory environments, industrial composition, and consumer demand for sustainability.

- Europe: Europe maintains market leadership due to stringent environmental directives (e.g., EU Green Deal, Circular Economy Action Plan) and robust public awareness. Germany, France, and the Nordic countries are major hubs, particularly for high-performance composites used in wind energy and premium automotive sectors. The region benefits from strong academic research and significant government funding directed toward bio-chemical innovation and pilot plant initiatives, ensuring a continuous supply of certified, sustainable materials that comply with the region’s ambitious decarbonization targets.

- North America: North America is a mature market characterized by significant R&D investment, supported by programs like the USDA BioPreferred initiative. The United States drives demand, particularly in the protective coatings and aerospace industries, where there is a strong emphasis on reducing VOC emissions and sourcing materials with reduced environmental impact. The region focuses heavily on utilizing locally sourced bio-feedstocks, such as soybean and corn derivatives, to ensure stable domestic supply chains and reduce reliance on international sourcing, fostering a competitive internal market.

- Asia Pacific (APAC): APAC represents the fastest-growing market, driven primarily by the rapid expansion of the construction, electronics manufacturing, and renewable energy sectors, especially in China, India, and South Korea. While historically focused on cost, the region is rapidly shifting towards sustainable materials dueized by governmental pressures to address severe pollution issues and increasing mandates for eco-friendly building standards. Significant capacity expansion in bio-refinery infrastructure is underway in this region to meet the soaring demand for sustainable raw materials needed for large-scale infrastructure projects.

- Latin America (LATAM): The LATAM market, while smaller, shows potential, particularly in countries with strong agricultural bases like Brazil. The focus is mainly on utilizing domestically produced plant oils for bio-epoxy precursors for local applications in civil construction and anticorrosion coatings for industrial assets, leveraging regional commodity advantages.

- Middle East & Africa (MEA): Growth in MEA is nascent but tied to large-scale infrastructure and industrial diversification projects aimed at reducing oil dependence. Demand is specifically rising for protective bio-epoxy coatings in marine environments and oil & gas infrastructure where superior corrosion resistance and environmentally sound materials are gaining regulatory importance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bio Based Epoxy Market.- Huntsman Corporation

- Hexion Inc. (Westlake Chemical)

- Sicomin SA

- Specific Polymers

- Spolchemie AS

- Aditya Birla Chemicals

- KUKDO Chemical Co., Ltd.

- BÜFA Composite Systems GmbH & Co. KG

- Cardolite Corporation

- EPOXIES, Etc.

- Chang Chun Group

- The Dow Chemical Company

- Kolon Industries, Inc.

- Nagase ChemteX Corporation

- Nan Ya Plastics Corporation

- Olin Corporation

- Polynt-Reichhold Group

- ATL Composites

- ECO-Poxy

- Sika AG

Frequently Asked Questions

Analyze common user questions about the Bio Based Epoxy market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary feedstock used in commercial bio based epoxy production?

The predominant commercial feedstock is plant-based oil, particularly derivatives from soybean, linseed, and castor oil, which are chemically modified through epoxidation to create reactive bio-monomers used in resin synthesis, ensuring high bio-content formulations.

Are bio based epoxies comparable in performance to traditional petroleum-based resins?

Yes, modern bio based epoxy formulations, especially those with high bio-content, offer performance characteristics—including tensile strength, chemical resistance, and thermal stability—that are increasingly comparable, and in some specialized cases superior, to conventional DGEBA-based resins, making them viable drop-in replacements for structural applications.

Which application segment drives the highest demand for bio based epoxy resins globally?

The Composite Materials segment, specifically high-performance composites for the wind energy and aerospace industries, drives the highest demand, requiring large volumes of lightweight, durable, and sustainable resins for manufacturing rotor blades, structural components, and aircraft parts.

What are the main regulatory factors accelerating the adoption of sustainable epoxy resins?

Regulatory acceleration is primarily driven by global governmental mandates concerning carbon footprint reduction, stringent VOC emission limits imposed by bodies like the EPA and EU, and corporate ESG commitments which penalize the use of high-toxicity, petroleum-derived chemicals.

What is the current main restraint limiting widespread market penetration of bio epoxies?

The main restraint is the historically higher cost profile compared to mature petrochemical alternatives, stemming from significant initial capital investment required for bio-refinery infrastructure and potential volatility and complexity associated with sourcing and processing diverse agricultural or biomass-derived feedstocks efficiently at scale.

How is technological innovation improving the sustainability of bio based epoxy systems?

Technological innovation focuses on utilizing non-food biomass (like lignin and cellulose) as feedstock, employing green chemical processes (enzymatic catalysis, flow chemistry) to reduce energy input and waste, and developing bio-derived curing agents to achieve 100% bio-content in the final cured system, minimizing overall environmental impact.

Which region is anticipated to demonstrate the fastest growth rate in the forecast period?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth, propelled by massive infrastructure development, increasing regulatory emphasis on sustainable manufacturing in countries like China and India, and the rapid expansion of electronics and renewable energy production requiring bio-compliant materials.

How does AI contribute to optimizing bio based epoxy manufacturing?

AI, through machine learning and materials informatics, is utilized to optimize complex polymerization reaction parameters, predict performance based on molecular structure, accelerate the discovery of new bio-feedstocks, and implement predictive maintenance for enhanced production efficiency and consistency.

What role do specialized formulators play in the bio based epoxy value chain?

Specialized formulators act as critical intermediaries, purchasing bulk bio-resin and customizing it with additives, hardeners, and pigments to create application-specific systems (e.g., industrial coatings, specialty adhesives) tailored for niche markets, thereby ensuring broader market accessibility.

What specific performance advantages can certain bio based epoxies offer over traditional versions?

Certain bio based epoxies, particularly those derived from cardanol, can offer enhanced hydrophobicity, superior flexibility, and improved adhesion properties in wet environments, making them highly effective for marine coatings and heavy-duty protective applications where moisture resistance is critical.

What is the significance of the DGEBA Replacement segment?

The DGEBA Replacement segment is highly significant as it focuses on developing bio based formulations that can directly substitute Diglycidyl Ether of Bisphenol A, the petrochemical industry standard, without requiring significant changes in end-user processing equipment or application methods, facilitating rapid industrial adoption.

How does volatility in crude oil prices affect the competitiveness of the bio based epoxy market?

Crude oil price volatility positively impacts the competitiveness of bio epoxies. When oil prices spike, the cost of petroleum-derived epoxies increases, narrowing the price gap with bio based alternatives and encouraging manufacturers to adopt sustainable options to secure more stable material costs.

Which bio based feedstock category is expected to gain significant traction in the near future?

Lignin and cellulose derivatives are expected to gain significant traction, moving beyond traditional oil seeds. These materials are abundant, non-food competing, and represent a major opportunity to scale up production using waste streams from forestry and paper industries, enhancing overall resource sustainability.

What is meant by the term ‘high bio-content’ in bio based epoxy resins?

High bio-content refers to the percentage of the final cured resin system, including both the resin and the hardener components, that is derived from verifiable renewable biological sources. The industry goal is increasingly focused on achieving 70% to 100% bio-content to maximize environmental benefits.

In the construction sector, what primary benefits do bio based epoxies provide?

In construction, bio based epoxies offer significant benefits through low Volatile Organic Compound (VOC) emissions, contributing to better indoor air quality (critical for green building certification like LEED), and providing durable, chemical-resistant flooring and repair materials with a reduced carbon footprint.

How do ESG policies influence corporate purchasing of bio based epoxy?

Corporate ESG (Environmental, Social, and Governance) policies mandate companies to track and reduce their Scope 3 emissions. Purchasing bio based epoxy directly contributes to these reduction goals, fulfilling stakeholder demands for sustainable operations and improving corporate reputation and compliance scores.

What are the key differences between Aliphatic and Cycloaliphatic bio epoxies?

Aliphatic bio epoxies typically offer greater flexibility and lower viscosity, often used in adhesives and coatings requiring elasticity, while Cycloaliphatic bio epoxies are known for superior thermal stability, better UV resistance, and higher mechanical strength, making them ideal for exterior coatings and electrical encapsulation.

How is the aerospace industry integrating bio based epoxies?

The aerospace industry integrates bio based epoxies primarily into advanced composite structures, cabin interiors, and non-structural components. Their low density and high mechanical properties support weight reduction efforts crucial for fuel efficiency, while complying with stringent fire, smoke, and toxicity (FST) regulations.

What is the typical historical year range covered in market reports for this sector?

Standard market reports typically cover a historical year range spanning five to six years, such as 2019 to 2024, to analyze pre-pandemic and recovery trends, establish baseline growth rates, and inform long-term forecasting models for technological adoption.

What is the strategic relevance of supply chain vertical integration in this market?

Vertical integration, where manufacturers control feedstock sourcing and processing, is strategically relevant because it mitigates supply chain risks associated with agricultural commodity volatility, ensures consistent feedstock quality, and allows for optimization of upstream processes to achieve better cost control and scaling efficiency.

Which governing body often provides certifications for bio based content in the US?

In the United States, the U.S. Department of Agriculture (USDA) BioPreferred Program is a primary governing body that provides certification and labeling for products based on their verified bio based content, aiding consumers and procurement managers in identifying sustainable options.

How is 3D printing technology influencing demand for bio based epoxy resins?

3D printing is emerging as a critical opportunity area, requiring specialized photo-curable bio based epoxy resins. Demand is influenced by the need for sustainable, high-resolution, and durable materials for prototyping, tooling, and final part production, particularly in the dental and automotive sectors.

Why are low-toxicity profiles a significant benefit of bio based epoxies?

Low-toxicity profiles are a significant benefit because many bio based precursors avoid hazardous components like Bisphenol A (BPA) and nonylphenol. This reduction in toxicity improves worker safety during manufacturing and application, and makes the final products safer for consumer-facing applications, aligning with increasing chemical safety regulations.

What challenges exist in scaling up production of 100% bio based epoxy systems?

Scaling challenges include maintaining the structural integrity and performance required for industrial applications when maximizing bio-content, overcoming difficulties in sourcing consistent volumes of non-petroleum-derived curing agents, and standardizing industrial processes developed for bio-derived monomers.

How important are investments in R&D for feedstock diversification in this market?

Investments in R&D for feedstock diversification are crucial for long-term market stability. Relying solely on a few crop oils poses risks related to climate change impacts and food competition. Diversification into waste streams, lignin, and terpenes ensures resource security and reduces the market's vulnerability to commodity price fluctuations.

What is the projected Compound Annual Growth Rate (CAGR) for the Bio Based Epoxy Market?

The Bio Based Epoxy Market is projected to grow at a strong Compound Annual Growth Rate (CAGR) of 12.5% during the forecast period from 2026 to 2033, reflecting accelerating industrial adoption driven by sustainability mandates and performance parity.

How do bio based epoxies contribute to the circular economy goals?

Bio based epoxies contribute significantly by utilizing renewable resources instead of finite fossil fuels, often incorporating waste or co-products from agriculture or industry (e.g., lignin), and featuring manufacturing processes designed for lower energy consumption, supporting a more sustainable and closed-loop material cycle.

What is the significance of thermal stability in the electronics encapsulation application?

Thermal stability is paramount in electronics encapsulation as the epoxy must protect sensitive components from heat generated during operation. Bio based epoxies with high Glass Transition Temperatures (Tg) are essential to prevent structural degradation, ensuring the reliability and lifespan of electronic devices like PCBs and semiconductor components.

Which key segment is dominated by plant-based oil feedstocks?

The Coatings and Paints application segment is significantly dominated by plant-based oil feedstocks. Bio-oils are easily modified to create resin precursors suitable for protective and decorative coatings, providing good flexibility and durability necessary for architectural and industrial applications.

What specific challenge does the volatility of agricultural cycles present to manufacturers?

The volatility of agricultural cycles, influenced by weather and seasonal factors, creates supply uncertainty and price fluctuation for bio-feedstocks. This challenge requires manufacturers to implement robust inventory management and multi-sourcing strategies to maintain consistent production costs and supply reliability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager