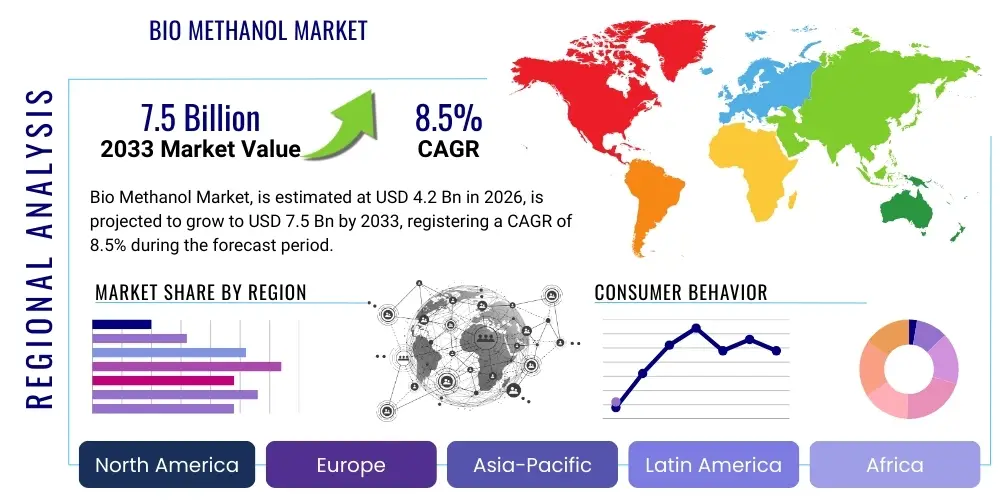

Bio Methanol Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436063 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Bio Methanol Market Size

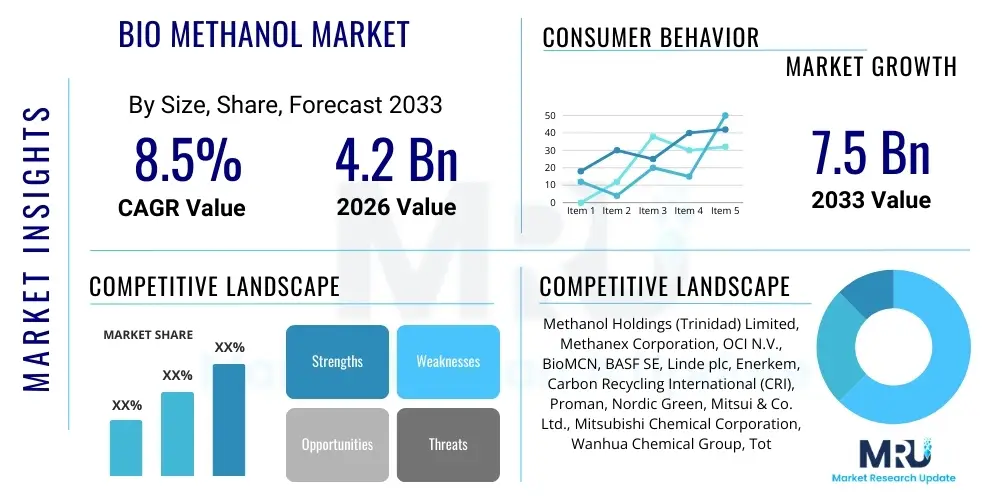

The Bio Methanol Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 4.2 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033.

Bio Methanol Market introduction

The Bio Methanol Market encompasses the production, distribution, and consumption of methanol derived from renewable biological sources, primarily biomass, agricultural waste, municipal solid waste, and forestry residues, rather than fossil fuels. This renewable chemical intermediate plays a crucial role in the global transition towards a low-carbon economy, offering a sustainable alternative to conventional petrochemical-based methanol. Bio methanol, chemically identical to conventional methanol, serves as a versatile building block for numerous chemical derivatives, including formaldehyde, acetic acid, and various fuels, aligning it with stringent environmental mandates being enforced across developed economies. Its inherent ability to significantly reduce greenhouse gas (GHG) emissions across the value chain positions it as a key commodity in green chemical synthesis and as a viable marine fuel.

Bio methanol, often referred to as green methanol, is fundamentally produced using thermochemical processes such as gasification and subsequent synthesis, or through advanced biological routes like anaerobic digestion followed by purification. The versatility of the product allows for its application in diverse sectors, acting as a crucial feedstock for producing renewable gasoline blends (MTBE), biodiesel (through transesterification), and dimethyl ether (DME), a clean-burning fuel and aerosol propellant. Major applications span from energy generation and maritime shipping to the manufacturing of plastics and polymers, where sustainability credentials are increasingly scrutinized by both regulators and consumers. Furthermore, the chemical’s relatively low cost compared to other bio-based platform chemicals makes it an attractive investment for scaling sustainable production across industrial hubs globally, particularly in regions with abundant biomass resources.

The core benefits driving market adoption include its significant carbon reduction potential—achieving near net-zero emissions when sourced sustainably—and its compatibility with existing infrastructure for storage and transportation, particularly in the shipping industry which is aggressively seeking decarbonization solutions. Key driving factors include escalating global pressure for cleaner fuels, supportive governmental policies favoring renewable chemical production, and corporate sustainability targets mandated by large multinational chemical and energy conglomerates. These drivers collectively establish a robust foundation for market expansion, moving bio methanol from a niche product into a mainstream commodity essential for achieving global climate objectives.

Bio Methanol Market Executive Summary

The Bio Methanol Market is characterized by robust growth underpinned by significant business investments aimed at scaling production facilities, particularly those utilizing innovative gasification technologies for diverse feedstock streams like agricultural residue and non-recyclable waste. Key business trends indicate a strong move toward long-term off-take agreements and strategic joint ventures between established chemical producers, technology providers, and renewable energy developers to secure consistent, high-quality biomass supply and mitigate feedstock price volatility. Furthermore, there is an increasing vertical integration observed among major players who are consolidating their control over the entire supply chain, from feedstock preparation and conversion to distribution channels, optimizing operational efficiencies and strengthening market resilience against geopolitical or supply disruptions. Financial incentives, such as production tax credits and carbon pricing mechanisms, further enhance the economic viability of green methanol projects, attracting substantial private equity and institutional capital focused on sustainable infrastructure.

Regionally, the market exhibits divergent growth trajectories, with Europe and North America leading in regulatory support and demand for sustainable chemicals, primarily driven by stringent mandates like the EU Renewable Energy Directive (RED II) and various state-level low-carbon fuel standards (LCFS) in the US. The European maritime sector's rapid adoption of methanol as a bunker fuel is a critical regional trend, positioning Northern European ports as major demand centers. Asia Pacific, while currently smaller in market share due to higher reliance on cost-competitive conventional methanol, is anticipated to emerge as the fastest-growing region, fueled by massive industrial expansion, increasing air quality concerns in countries like China and India, and national strategies focused on energy independence and circular economy principles. Investment in new production capacity in Southeast Asia, leveraging abundant palm oil and forestry residues, highlights the region's long-term potential.

Segment trends reveal that the application segment is shifting dynamically, with the fuel blending and marine fuel sectors demonstrating exponential demand growth, rapidly overtaking traditional chemical intermediate uses such as formaldehyde and acetic acid production. Technology-wise, the gasification route remains dominant for large-scale production, but advanced biological pathways, particularly those utilizing novel microorganisms for efficient conversion of waste gases or low-cost feedstocks, are gaining traction due to their ability to achieve higher carbon efficiency. Feedstock segmentation shows a diversification away from dedicated energy crops towards waste-to-methanol pathways, utilizing municipal solid waste (MSW) and industrial residues, driven by the dual goals of resource recovery and maximizing the sustainability profile of the resulting bio methanol product, thereby aligning with circular economy models promoted globally.

AI Impact Analysis on Bio Methanol Market

Common user inquiries concerning the influence of Artificial Intelligence (AI) on the Bio Methanol Market predominantly revolve around optimizing production yield, enhancing feedstock logistics, and predicting market price volatility. Users frequently ask how AI can improve the efficiency of complex thermochemical conversion processes, specifically querying AI's role in real-time monitoring and adaptive control of gasification reactors to maintain optimal operating parameters under varying feedstock quality. A major concern is the scalability and cost-effectiveness of integrating AI systems into existing legacy infrastructure. Users also seek information on AI-driven solutions for managing the highly heterogeneous nature of biomass feedstocks, including sorting, pre-treatment optimization, and forecasting supply chain bottlenecks. The core expectation is that AI will be the primary technological leverage point for driving down the Levelized Cost of Methanol (LCOM) for bio-based routes, making it economically competitive with fossil fuel derivatives without relying heavily on subsidies.

AI plays a transformative role by enabling precision engineering and predictive maintenance within bio methanol production facilities. Through sophisticated sensor networks and machine learning algorithms, operators can analyze vast amounts of data—including temperature, pressure, chemical composition, and flow rates—in real-time. This capability allows for continuous process adjustments, preventing operational drift, minimizing downtime due to equipment failure, and maximizing the overall conversion efficiency of biomass to syngas and subsequently to methanol. Furthermore, AI models are critical in optimizing energy consumption across the plant, balancing the exothermic and endothermic steps involved in the conversion process, which is essential for reducing the embedded carbon intensity of the final product and enhancing sustainability metrics.

In the crucial area of supply chain management, AI algorithms address the inherent complexity of sourcing, storing, and transporting bulky and often seasonally available biomass. Predictive analytics are deployed to forecast feedstock availability, optimize inventory levels to buffer against supply shocks, and determine the most cost-effective transportation routes, minimizing logistical carbon footprint and overheads. Additionally, AI-enhanced market analysis tools provide precise forecasting of demand shifts in key application segments, such as marine fuel blending requirements, allowing producers to adjust production volumes and optimize pricing strategies based on anticipated market needs and global regulatory changes. This strategic intelligence derived from AI is instrumental in minimizing financial risk and securing long-term profitability in a volatile commodity market.

- AI optimizes reactor performance and maximizes conversion yield by using machine learning for real-time parametric adjustments.

- Predictive maintenance schedules are generated by AI, reducing unplanned downtime and lowering operational expenditure (OPEX).

- Feedstock logistics and scheduling are enhanced through AI-driven algorithms that forecast biomass availability and optimize inventory management.

- Advanced process control systems leverage AI to manage variability in biomass composition, ensuring consistent syngas quality.

- Market forecasting and price volatility prediction models assist in strategic off-take agreements and hedging strategies.

- AI aids in optimizing utility and energy consumption within the plant, significantly reducing the operational carbon footprint.

DRO & Impact Forces Of Bio Methanol Market

The Bio Methanol market is fundamentally shaped by powerful drivers related to global decarbonization efforts, while simultaneously navigating significant restraints concerning feedstock security and capital intensity. The core driver is the escalating global regulatory framework mandating the reduction of carbon emissions, particularly in hard-to-abate sectors like maritime shipping, which increasingly views methanol as a critical transitional fuel. This regulatory pull, coupled with strong corporate commitments to environmental, social, and governance (ESG) criteria, has created a reliable demand signal for green chemicals. Opportunities primarily lie in the rapid development of waste-to-methanol conversion technologies, which provide dual benefits of addressing waste disposal issues while producing a high-value commodity, and the potential expansion into emerging high-growth markets like sustainable aviation fuels (SAF) through methanol-to-jet synthesis routes. The overall impact forces are strongly weighted towards growth, driven by technological maturity and supportive policy environments, although substantial upfront capital investment remains a critical hurdle for widespread deployment.

Key drivers include the global push for lower carbon intensity fuels, mandatory blending requirements in transportation fuels, and significant governmental incentives such as carbon credits and grants for bio-based chemical infrastructure development, particularly in North America and Europe. The increasing number of methanol-powered ships ordered by major shipping lines validates the long-term demand for bio methanol as bunker fuel. Conversely, primary restraints involve the competitive pressure from low-cost conventional methanol, which limits price premiums for the bio-based alternative, and the inherent logistical challenges associated with sourcing and processing diverse and often geographically dispersed biomass feedstocks. Furthermore, the construction of bio methanol plants necessitates exceptionally large initial capital outlays (CAPEX) compared to comparable fossil-fuel facilities, introducing financing risks that often require government backing or sophisticated project finance structures to overcome.

The primary opportunities stem from leveraging novel, non-food-competing feedstocks, such as industrial CO2 emissions combined with green hydrogen (e-methanol synthesis), or leveraging municipal solid waste (MSW) streams, minimizing competition with agricultural land use. Market participants are increasingly exploring opportunities in decentralized, modular production units that can be sited closer to biomass collection points, reducing transportation costs and improving efficiency. The impact forces show that while the short-term market growth is heavily dependent on regulatory mandates, the long-term sustainability and competitiveness of bio methanol hinges on successful technological innovation that drastically lowers production costs and ensures feedstock reliability. The positive impact of global climate policy greatly outweighs the current logistical and financial constraints, pushing the market into a steep growth trajectory post-2026 as initial large-scale projects become operational.

Segmentation Analysis

The Bio Methanol Market is segmented based on critical parameters including Feedstock Type, Technology utilized for conversion, and the final Application sector, each reflecting distinct supply chain dynamics and demand characteristics. Understanding these segments is crucial for strategic market entry and investment planning, as the optimal technology and feedstock choice are highly dependent on regional biomass availability and the target application’s sustainability requirements. The segmentation highlights the market's evolution from a niche chemical supplier focused on basic derivatives to a major contributor to the global fuel decarbonization effort. The rapid expansion of the marine fuel segment is reshaping the competitive landscape, emphasizing the need for robust, large-scale production facilities capable of meeting high volume, intermittent demand. Geographical variations in regulatory frameworks further dictate the profitability and viability of each segment, with stricter sustainability standards in developed economies favoring advanced feedstock utilization.

- By Feedstock:

- Biomass (Forestry Residues, Agricultural Waste)

- Municipal Solid Waste (MSW)

- Black Liquor

- Industrial and Process Gases (Syngas, Biogas)

- By Technology:

- Gasification and Synthesis

- Biological Conversion (Fermentation)

- E-Methanol (Power-to-Methanol)

- By Application:

- Formaldehyde

- Acetic Acid

- MTBE/TAME (Fuel Blending)

- Dimethyl Ether (DME)

- Marine Fuel

- Other Chemicals (Silicones, Methacrylates)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Bio Methanol Market

The Bio Methanol value chain is complex, starting with the upstream sourcing and preparation of diverse biomass feedstocks, which is highly localized and often involves intricate logistical networks to collect and preprocess materials like agricultural residues or forestry waste. Upstream analysis focuses intensely on secure and sustainable feedstock procurement, ensuring traceability to meet certification standards (such as ISCC Plus) required by end-users. Key activities include densification, drying, and chipping of biomass to create a standardized input suitable for gasification or digestion, processes that significantly impact the overall production cost and energy intensity of the final methanol. Efficiency and consistency in this upstream phase are paramount, as feedstock quality variability directly affects the stability and performance of the synthesis reactors.

The core midstream process involves the conversion technology—predominantly large-scale gasification, where biomass is converted into syngas (a mixture of hydrogen and carbon monoxide) followed by catalytic synthesis and purification of the raw methanol. Downstream analysis focuses on the distribution, storage, and final utilization of the bio methanol. Since methanol is a hazardous chemical, specialized infrastructure for transportation via pipeline, rail, or sea tanker is necessary. The distribution channel is bifurcated into direct sales to large industrial consumers (e.g., chemical manufacturers and marine fuel providers) who require bulk delivery via terminals, and indirect sales through specialized chemical distributors and traders who serve smaller manufacturers and regional fuel blenders. Direct sales channels are preferred for high-volume, long-term contracts, particularly in the rapidly growing marine bunker fuel segment.

The effectiveness of the value chain is increasingly judged by its ability to maintain low carbon intensity (CI) from cradle to gate, necessitating rigorous monitoring of energy inputs and emissions at every stage. Collaboration between technology licensors, engineering, procurement, and construction (EPC) firms, and feedstock suppliers is critical to ensure seamless project execution and operational scalability. The adoption of digital tracking systems and block-chain technology is emerging as a means to enhance transparency in the feedstock supply chain and verify sustainability claims, thereby enhancing market value and customer trust. Optimization efforts across the chain are continuously focused on reducing handling costs and minimizing fugitive emissions associated with storage and transportation.

Bio Methanol Market Potential Customers

The primary end-users and potential customers of bio methanol span across four major industrial verticals: the chemical manufacturing sector, the global transportation industry (particularly maritime and road fuel blending), the energy generation sector, and the emerging field of advanced materials synthesis. Chemical manufacturers constitute a foundational customer base, using bio methanol as a green feedstock to produce essential building blocks like formaldehyde (for resins, adhesives, and construction materials), acetic acid (for solvents and vinyl acetate monomer), and various chemical derivatives. These customers are driven by corporate mandates to reduce Scope 3 emissions and meet demand for bio-based content in their final products, often requiring certified, high-purity methanol delivered under long-term procurement agreements to ensure supply stability.

The most rapidly expanding customer segment is the maritime shipping industry. Major global shipping lines and charterers are heavily investing in dual-fuel engines compatible with methanol to comply with the International Maritime Organization (IMO) carbon intensity targets and other regional environmental regulations. These customers require bulk supply at strategic global bunkering ports and value reliability, consistent quality, and verifiable low-carbon credentials above minor price fluctuations. The fuel blending sector, which uses bio methanol to produce MTBE and other gasoline additives, continues to be a stable customer base, particularly in regions with established low-carbon fuel standards that mandate renewable content percentages in transportation fuels. This segment focuses on volume and adherence to fuel specification standards.

Beyond these established industrial consumers, emerging customers include firms specializing in synthetic biology and sustainable materials. Companies producing high-performance polymers, specialized resins, and biodegradable plastics are increasingly seeking bio methanol as a renewable solvent or intermediate. Furthermore, utility companies and independent power producers exploring options for clean power generation utilizing methanol fuel cells or blending methanol into natural gas streams represent a burgeoning customer segment. The key buying criterion across all these diverse customer groups is the demonstrable reduction in carbon footprint that bio methanol provides relative to fossil-derived alternatives, supported by robust sustainability certifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Methanol Holdings (Trinidad) Limited, Methanex Corporation, OCI N.V., BioMCN, BASF SE, Linde plc, Enerkem, Carbon Recycling International (CRI), Proman, Nordic Green, Mitsui & Co. Ltd., Mitsubishi Chemical Corporation, Wanhua Chemical Group, TotalEnergies, Equinor ASA, GIDARA Energy, WasteFuel, Repsol, Synhelion, Johnson Matthey |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bio Methanol Market Key Technology Landscape

The Bio Methanol Market relies heavily on several mature and emerging technologies designed to convert diverse renewable feedstocks into high-purity methanol efficiently. The dominant commercial technology remains biomass gasification coupled with conventional catalytic methanol synthesis. This route involves heating solid biomass in a controlled, oxygen-starved environment to produce syngas, which is then refined and passed over copper-zinc-aluminum catalysts to synthesize methanol. Continuous technological improvements in gasifier design, such as fluidizing bed reactors, are enhancing the ability to handle heterogeneous feedstocks like municipal solid waste (MSW) and agricultural residues, improving the overall carbon conversion efficiency and operational stability. Technological advancements are focused on maximizing the yield of hydrogen and carbon monoxide in the syngas, while minimizing the production of impurities like tar, which can poison the downstream catalysts and necessitate costly clean-up processes.

Beyond thermal processes, the landscape is increasingly shaped by biological and electrochemical conversion pathways. Biological conversion technologies, utilizing anaerobic digestion or specialized microorganisms (e.g., bacteria or yeast), convert organic waste or residual gases directly into methanol or an intermediate alcohol which is then purified. This approach is generally favored for smaller, decentralized facilities or for specific low-quality feedstocks where thermal processing is uneconomical. The most disruptive emerging technology, however, is Power-to-Methanol (PtM), or E-Methanol synthesis. This process captures unavoidable or industrial CO2 emissions and combines them with green hydrogen (produced via electrolysis powered by renewable electricity) to synthesize methanol. E-Methanol offers the potential for virtually zero-emission methanol production and is highly scalable in regions with abundant renewable power, though the current capital and operational costs associated with large-scale electrolyzer deployment and green hydrogen production remain significant technological challenges that are actively being addressed through ongoing R&D and pilot projects.

Furthermore, technology providers are focusing on catalyst innovation to improve selectivity and longevity, reducing the operating temperature and pressure requirements for the synthesis reaction, thereby lowering overall energy consumption. Process integration is another crucial technological trend, where waste heat from the methanol synthesis unit is recovered and reused in the gasification or pre-treatment stages, dramatically improving the thermal efficiency of the entire plant. Technology licensing, engineering expertise, and proprietary catalyst formulations are core competitive assets, with leading firms continuously filing patents to protect advancements in feed flexibility, tar reduction, and overall system integration capabilities. The market’s future is intrinsically linked to the successful industrialization and cost reduction of the e-methanol route, driven by declining renewable energy costs and policy support for carbon capture and utilization (CCU).

Regional Highlights

- Europe: Europe stands as the regulatory frontrunner, driven by the ambitious targets set under the European Green Deal and the Renewable Energy Directive (RED II). The region exhibits the highest penetration of bio methanol in the marine fuel segment, supported by key infrastructure development in North Sea ports and substantial investments in waste-to-methanol projects, particularly in Nordic countries and the Netherlands. Strong policy support and high consumer willingness to pay a premium for certified sustainable products anchor regional growth.

- North America: North America is characterized by large-scale production potential, primarily leveraging vast quantities of forestry residues and agricultural biomass, especially in the US and Canada. Growth is highly influenced by state-level policies like California's Low Carbon Fuel Standard (LCFS), which provides significant financial incentives for low-CI fuels, stimulating investment in gasification and synthesis facilities geared towards transportation fuel markets.

- Asia Pacific (APAC): APAC represents the future high-growth engine, driven by massive industrial expansion, rapidly increasing energy demand, and government initiatives in China and India focused on reducing reliance on coal and improving air quality. While current production is limited, the region boasts abundant feedstock resources (e.g., rice husks, palm residues) and a rapidly developing chemical manufacturing base, positioning it for accelerated adoption of bio methanol as a chemical intermediate and a pathway to cleaner industrial production.

- Latin America (LATAM): LATAM's market relevance is rooted in its extensive agricultural sector, particularly sugarcane bagasse and other crop residues in Brazil, which are ideal feedstocks for bio-based chemicals. The region is focused on developing domestic supply chains and utilizing bio methanol primarily for fuel blending purposes, capitalizing on existing ethanol infrastructure and expertise in bio-based commodity production.

- Middle East and Africa (MEA): This region is characterized by high potential for e-methanol production, leveraging vast solar resources in the Middle East to produce cost-effective green hydrogen, which is then combined with captured CO2. Major petrochemical producers in the Gulf Cooperation Council (GCC) are strategically positioning themselves to become global exporters of low-carbon methanol, transitioning their fossil fuel economies towards sustainable chemical exports.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bio Methanol Market.- Methanol Holdings (Trinidad) Limited

- Methanex Corporation

- OCI N.V.

- BioMCN

- BASF SE

- Linde plc

- Enerkem

- Carbon Recycling International (CRI)

- Proman

- Nordic Green

- Mitsui & Co. Ltd.

- Mitsubishi Chemical Corporation

- Wanhua Chemical Group

- TotalEnergies

- Equinor ASA

- GIDARA Energy

- WasteFuel

- Repsol

- Synhelion

- Johnson Matthey

- Woodside Energy Group Ltd.

- Axens SA

- BP p.l.c.

Frequently Asked Questions

Analyze common user questions about the Bio Methanol market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between bio methanol and conventional methanol?

The primary difference is the source feedstock. Conventional methanol is derived from fossil fuels (natural gas or coal), while bio methanol, or green methanol, is produced from renewable biological materials such as biomass, agricultural residues, or municipal solid waste. Both products are chemically identical but bio methanol offers a significantly lower carbon footprint.

Which application segment drives the highest demand for bio methanol currently?

While chemical synthesis (formaldehyde, acetic acid) has been the traditional anchor, the marine fuel segment is now the most powerful growth driver. Global shipping mandates and vessel fleet conversions to dual-fuel engines are creating massive, sustained demand for bio methanol as a low-emission bunker fuel.

What are the main technological challenges limiting the large-scale production of bio methanol?

The main challenges involve managing feedstock variability, which complicates the gasification process, and overcoming the high initial capital expenditure (CAPEX) required for setting up large-scale, dedicated bio methanol production facilities compared to established fossil fuel plants.

How do government regulations influence the market profitability of bio methanol?

Government regulations, such as the EU Renewable Energy Directive (RED II) and Low Carbon Fuel Standards (LCFS), are critical profitability drivers. They mandate renewable content usage and provide financial mechanisms, including carbon credits and subsidies, which enhance the cost competitiveness and market viability of the bio-based product.

What is E-Methanol and how does it relate to the Bio Methanol Market?

E-Methanol (Power-to-Methanol) is synthesized by combining captured industrial CO2 with green hydrogen, bypassing biomass entirely. Although technically distinct from biomass-derived bio methanol, it is often grouped with it as a crucial pathway for producing ultra-low-carbon, certified renewable methanol required to meet stringent future decarbonization targets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Bio Methanol Market Size Report By Type (By-Product Sourced, Waste Sourced), By Application (MTBE, DME, Gasoline Blending, Bio-diesel, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Bio Methanol Market Statistics 2025 Analysis By Application (MTBE, DME, Gasoline Blending, Bio-diesel), By Type (By-Product Sourced, Waste Sourced), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Bio Methanol Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (By-Product Sourced, Waste Sourced), By Application (MTBE, DME, Gasoline Blending, Bio-diesel, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager