Biodefense Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432526 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Biodefense Market Size

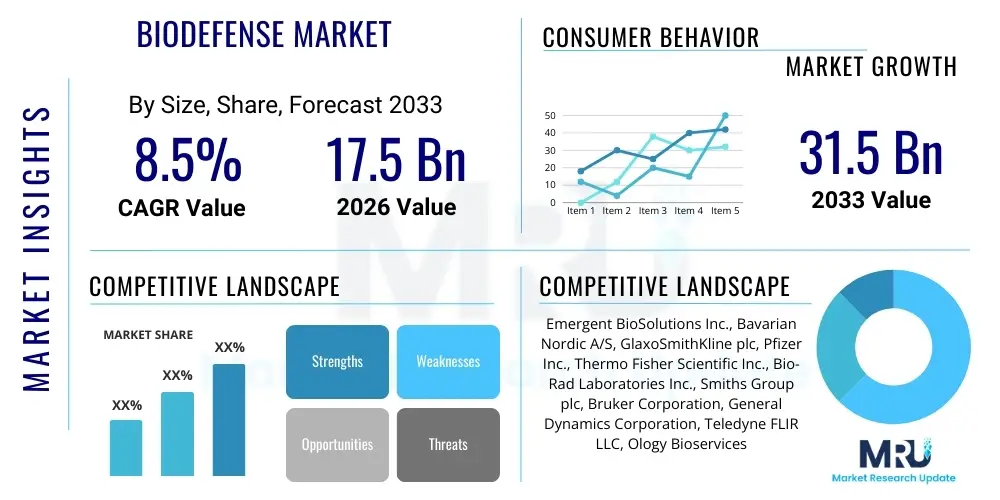

The Biodefense Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.3% between 2026 and 2033. The market is estimated at $18.5 Billion in 2026 and is projected to reach $32.4 Billion by the end of the forecast period in 2033.

Biodefense Market introduction

The Biodefense Market encompasses the research, development, production, and deployment of countermeasures against biological threats, including naturally occurring outbreaks, accidental releases, and deliberate bioterrorism attacks. Products within this market segment are diverse, ranging from advanced medical countermeasures (MCMs) such as broad-spectrum antibiotics, antiviral drugs, and rapid-response vaccines, to sophisticated detection and surveillance systems used in civilian and military settings. Key applications include military force protection, public health emergency preparedness, and agricultural biosecurity, driven by the increasing geopolitical instability and the persistent threat posed by emerging and re-emerging infectious diseases. The primary benefit of biodefense investments is national security assurance and minimized morbidity and mortality during large-scale biological incidents.

The product portfolio in biodefense is rapidly evolving, moving beyond traditional stockpiling towards innovative platforms such as mRNA vaccines and synthetic biology-based therapeutics that allow for accelerated response times against novel pathogens. Major applications span across governmental agencies, defense departments, healthcare systems, and international organizations focused on pandemic readiness. Benefits include enhanced national resilience, reduced economic impact from pandemics, and protection of critical infrastructure. The driving factors fueling this growth include intensified governmental funding for biosecurity programs, lessons learned from the COVID-19 pandemic highlighting critical gaps in preparedness, and technological breakthroughs in genomics and point-of-care diagnostics that enable faster identification and characterization of biological threats.

The market environment is characterized by high barriers to entry due to stringent regulatory pathways (e.g., FDA Animal Rule approval) and the need for significant R&D investments, often supported through public-private partnerships such as those managed by the Biomedical Advanced Research and Development Authority (BARDA) in the US. The market dynamics are significantly influenced by long procurement cycles, government stockpiling strategies, and the continuous requirement for next-generation products that address antibiotic resistance and emerging zoonotic threats. The foundational goal of the biodefense industry is to transition from reactive crisis management to proactive prevention and rapid mitigation capabilities, ensuring readiness against chemical, biological, radiological, and nuclear (CBRN) threats.

Biodefense Market Executive Summary

The Biodefense Market is experiencing robust growth fueled by sustained governmental investment in public health infrastructure and military preparedness across major economies. Current business trends indicate a strong pivot towards rapid diagnostic technologies and platform-agnostic therapeutic development, allowing for quick scaling in response to unforeseen biological events. Key market segments, particularly medical countermeasures (MCMs) like vaccines and antitoxins, are witnessing increased expenditure, driven by strategic national stockpile replenishment mandates and international agreements focused on equitable pandemic response. The competitive landscape is consolidating, with major defense contractors and specialized biotech firms forming strategic alliances to leverage synergistic R&D capabilities and access global supply chains, ensuring readiness against a spectrum of known and unknown biological agents.

Regional trends demonstrate North America, particularly the United States, maintaining market dominance due to massive federal funding mechanisms (HHS, DoD) and the presence of leading biodefense innovators. However, the Asia Pacific region is emerging as the fastest-growing market, primarily driven by rapid urbanization, dense populations creating higher epidemic risk, and significant infrastructural investments by countries like China, India, and South Korea in integrated biosecurity systems. European nations are focusing on harmonizing their biodefense strategies under the European Health Emergency Preparedness and Response Authority (HERA) model, emphasizing cross-border collaboration and strengthening regional manufacturing capacity for critical medical supplies.

Segment trends highlight the shift from traditional surveillance to advanced genomic sequencing and AI-driven predictive modeling for outbreak detection. Within the product segment, recombinant and nucleic acid-based vaccines are replacing older technologies due to their speed of development and efficacy profile. The end-user segment is seeing expanded involvement from civilian agencies, including state and local public health departments, moving beyond the exclusive domain of military and national security organizations. This holistic approach emphasizes resilience across the entire national ecosystem, covering everything from agricultural threats (agro-terrorism) to widespread zoonotic diseases, thereby guaranteeing stable long-term demand across diverse product categories.

AI Impact Analysis on Biodefense Market

User queries regarding the impact of Artificial Intelligence (AI) on the Biodefense Market primarily center on the speed and accuracy of threat detection, the efficiency of drug and vaccine development, and the capacity for predictive outbreak modeling. Users frequently ask how AI systems can sift through massive genomic and epidemiological datasets faster than human analysts, specifically concerning the identification of novel pathogens or engineered biological threats. Concerns often revolve around data security, algorithmic bias in surveillance, and the regulatory challenges associated with deploying AI-driven diagnostic tools in crisis scenarios. Expectations are high regarding AI's ability to revolutionize the market by minimizing response time from weeks to days, optimizing strategic stockpile management based on real-time risk assessment, and accelerating the discovery of broad-spectrum countermeasures against high-priority biological agents.

AI’s influence is profound, fundamentally changing how biological threats are perceived, monitored, and countered. In the realm of detection and surveillance, machine learning algorithms are being trained on vast repositories of clinical, environmental, and open-source intelligence data to detect subtle anomalies signaling an emerging outbreak far earlier than conventional methods. This proactive surveillance capability shifts the paradigm from reactive containment to anticipatory intervention. Furthermore, AI optimizes resource allocation; by predicting the potential trajectory and severity of an event, defense agencies can strategically deploy medical personnel, allocate limited vaccine doses, and optimize the distribution logistics of stockpiled resources, thereby maximizing operational efficiency during a crisis.

Crucially, AI is transforming the R&D pipeline for medical countermeasures (MCMs). AI algorithms facilitate target identification for novel drugs and predict the efficacy and toxicity profiles of new vaccine candidates based on sequence analysis, drastically cutting down the preclinical development timeline. This acceleration is vital in biodefense, where speed is the ultimate defensive measure against rapidly mutating threats. Companies are leveraging deep learning to synthesize novel antibodies and small molecules specifically designed to neutralize bioweapons or pandemic agents, ensuring that the arsenal available to national security and public health agencies remains technologically superior to evolving biological hazards. This integration positions AI not just as a tool, but as a core pillar of modern biodefense infrastructure.

- Accelerated Threat Detection: AI algorithms analyze genomic data and epidemiological patterns to identify novel pathogens and predict outbreak hotspots days or weeks in advance of traditional methods.

- Drug Discovery Optimization: Machine learning predicts the binding affinity and efficacy of therapeutic compounds, dramatically reducing the timeline for developing antivirals, antibiotics, and antitoxins.

- Predictive Modeling and Surveillance: AI-driven epidemiological models simulate outbreak scenarios, informing governmental decisions on resource allocation, quarantine measures, and strategic stockpile requirements.

- Manufacturing Optimization: AI enhances biomanufacturing processes by monitoring bioreactor performance and optimizing yield for rapid vaccine production scale-up during emergencies.

- Bioinformatics and Genomics: Deep learning helps in the rapid sequencing and functional characterization of biothreat agents, aiding in the development of targeted genetic countermeasures.

- Decision Support Systems (DSS): AI integrates real-time intelligence for military and public health leadership, providing actionable insights for immediate defensive responses against CBRN incidents.

DRO & Impact Forces Of Biodefense Market

The Biodefense Market's trajectory is primarily driven by persistent global biological threats and corresponding high-level governmental funding commitments, but it is concurrently restrained by complex regulatory hurdles and high R&D costs. Key drivers include increased geopolitical tension and the demonstrated vulnerability exposed by recent pandemics, prompting nations to prioritize biosecurity spending. Opportunities lie significantly in developing platform technologies (e.g., modular vaccines, CRISPR-based diagnostics) that offer speed and broad-spectrum protection, moving away from single-target therapeutics. Restraints often center around the 'valley of death' funding gap between early-stage research and commercial viability, compounded by the ethical considerations and dual-use dilemma associated with certain high-containment research activities. The cumulative effect of these drivers and restraints generates significant impact forces, compelling continuous innovation in rapid-response capabilities and fostering international regulatory harmonization.

One major driving force is the dedicated and sustained financial support from specialized government agencies globally, such as the U.S. BARDA, which de-risks development for private firms by guaranteeing procurement volumes for products relevant to national security stockpiles. This guaranteed market access mitigates commercial risk and stimulates innovation in necessary, yet commercially challenging, areas like antitoxins and broad-spectrum antibiotics. Conversely, a significant restraint is the reliance on the FDA Animal Rule for testing MCMs against lethal agents when human efficacy trials are unethical or impossible; navigating this regulatory pathway is complex, time-consuming, and expensive, often leading to significant delays in product approval and deployment. These internal and external pressures dictate the pace of market growth and determine which technologies successfully transition from laboratory bench to national readiness shelves.

Opportunities in the biodefense sector are heavily concentrated on diagnostics and personalized medicine approaches tailored for mass emergencies. Miniaturized, ruggedized detection systems capable of rapid, accurate identification of multiple biological agents in field environments represent a substantial growth area for defense contractors. Furthermore, the increasing threat of antimicrobial resistance (AMR) is driving opportunities for novel bacteriophage therapies and immunomodulators, which are critical components of future biodefense strategies. The market is thus defined by the balance between urgent national security needs (the driver) and the inherently slow, complex process of translating cutting-edge biological research into approved, reliable, and mass-producible defensive tools (the restraint), creating a persistent environment of high-impact strategic investment and technological urgency.

Segmentation Analysis

The Biodefense Market is segmented based on the type of product, the application area, and the specific end-user category, reflecting the diverse approaches required to counter biological threats. Product segmentation includes medical countermeasures (vaccines, therapeutics, personal protective equipment), detection and diagnostic equipment, and surveillance systems. Application segmentation divides the market between military defense, civilian public health preparedness, and agricultural biosecurity. Understanding these segments is crucial because procurement strategies, regulatory requirements, and funding sources vary significantly across these classifications. For instance, military applications prioritize ruggedized, field-deployable technologies, while public health efforts focus on mass-producible, easily administered medical interventions and community-level surveillance tools. The market structure emphasizes layered defense, where no single product or strategy is sufficient, necessitating broad investment across all segments to ensure comprehensive national biosecurity.

The market's complexity demands precise segmentation to analyze growth vectors. The Medical Countermeasures (MCMs) segment remains the largest revenue generator, driven by mandatory governmental requirements for maintaining high-volume strategic national stockpiles of vaccines and antitoxins against Tier 1 biological agents (e.g., anthrax, smallpox). The detection and diagnostics segment is anticipated to witness the highest CAGR, primarily due to advances in biosensors and point-of-care testing capable of rapid multiplexed analysis. Geographically, segmentation helps identify disparate regional threat perceptions, where North America focuses heavily on high-consequence terrorism scenarios, while Asia Pacific places greater emphasis on zoonotic and naturally occurring epidemic preparedness, dictating varied product portfolios within these regions.

Moreover, the segmentation by technology—including genomics, synthetic biology, and advanced delivery systems—is increasingly relevant, as technological capabilities define future resilience. The shift is moving towards "ready-to-use" platforms that can quickly pivot to counter unforeseen threats (e.g., universal influenza vaccines or pan-coronavirus therapeutics). This granular view of the market allows stakeholders, including defense planners and pharmaceutical companies, to target investments efficiently, ensuring that the defense infrastructure is equipped not just for historical threats, but also for emerging biological challenges posed by climate change, human-animal interface interactions, and sophisticated genetic manipulation technologies, driving demand for specialized, high-tech subsegments.

- By Product:

- Medical Countermeasures (MCMs)

- Vaccines (Anthrax, Smallpox, Plague, Tularemia)

- Therapeutics (Antivirals, Antibiotics, Antitoxins)

- Personal Protective Equipment (PPE)

- Detection and Identification Systems

- PCR-based Systems

- Immunoassay Systems

- Next-Generation Sequencing (NGS)

- Bio-Sensors

- Surveillance and Monitoring Systems

- Medical Countermeasures (MCMs)

- By Application:

- Military Biodefense

- Civilian/Public Health

- Agricultural Biodefense

- By End-User:

- Government Agencies (Defense and Health)

- Research and Development Labs

- Hospitals and Clinics

- By Technology:

- Recombinant Technology

- Nucleic Acid (mRNA/DNA) Vaccines

- Synthetic Biology

- Diagnostic Sequencing

Value Chain Analysis For Biodefense Market

The Biodefense Market value chain is highly specialized, beginning with intensive upstream research and development, predominantly funded by government grants and carried out by academic institutions and specialized biotech firms focused on identifying and characterizing biological threats. This initial phase includes genomic sequencing, synthetic biology experimentation, and preclinical testing crucial for validating potential countermeasures. The midstream involves complex manufacturing processes for highly regulated products like vaccines and antitoxins, often requiring specialized, high-containment facilities (BSL-3/4). Manufacturing is typically managed by a limited number of specialized pharmaceutical and defense contractors capable of meeting stringent quality and safety standards mandated by national regulatory bodies, forming a bottleneck due to the highly specialized nature of biodefense manufacturing capacity.

The downstream activities involve distribution and final deployment, which are heavily centralized and controlled by government entities. The distribution channel is bifurcated: direct procurement involves government agencies (like the DoD or HHS/BARDA) contracting directly with manufacturers for strategic national stockpiles, ensuring rapid availability during emergencies. Indirect channels involve distributors providing detection systems and general PPE to civilian end-users such as hospitals, local public health departments, and private corporations. Logistics for MCMs are critical and often rely on specialized cold chain management and secure warehousing facilities. This structure ensures accountability and readiness, prioritizing national security imperatives over commercial efficiency in the distribution phase.

The critical element in this value chain is the public-private partnership model that links R&D to procurement. Government entities act not only as the primary buyer but also as the crucial funding source throughout the development cycle, guaranteeing financial viability for products with limited conventional commercial markets. The direct channel dominates high-consequence products (MCMs), emphasizing secure and rapid fulfillment capabilities, while the indirect channel supports generalized preparedness products (diagnostics, PPE). Successful navigation of the biodefense value chain requires deep regulatory expertise, robust manufacturing scalability, and established trust relationships with key government procurement entities, making market penetration difficult for new entrants lacking specialized infrastructure or proven track records in high-stakes environments.

Biodefense Market Potential Customers

The primary customers in the Biodefense Market are governmental entities responsible for national security, public health, and military preparedness. The core end-users include defense departments (e.g., the U.S. Department of Defense, European Ministries of Defence), which procure biodefense technologies and countermeasures to protect deployed military personnel from biological warfare agents. Equally critical are national health and preparedness agencies (e.g., BARDA, Centers for Disease Control and Prevention, Public Health England) which acquire vaccines, therapeutics, and surveillance tools to maintain strategic national stockpiles and manage civilian responses to epidemics and bioterrorism. These governmental bodies define the market demand, funding priorities, and regulatory landscape, acting as the ultimate buyers for most high-value products in the sector, guaranteeing sustained demand regardless of immediate commercial viability.

A secondary, yet rapidly expanding, customer base includes international organizations and non-governmental entities focused on global health security. Organizations like the World Health Organization (WHO), the Coalition for Epidemic Preparedness Innovations (CEPI), and various philanthropic foundations procure diagnostics and vaccine technology, particularly for low- and middle-income countries, aiming to strengthen global resilience against emerging threats. Furthermore, civilian infrastructure sectors are increasingly becoming end-users, including major hospitals, metropolitan emergency services, and critical agricultural facilities concerned about agro-terrorism or widespread zoonotic disease outbreaks. These entities seek detection systems, specialized PPE, and readiness consulting services to safeguard personnel and maintain operational continuity during a biological incident, broadening the customer landscape beyond traditional military procurement.

In essence, the potential customers range from highly centralized federal defense and health ministries demanding specialized, Tier-1 countermeasures, to decentralized hospital networks requiring rapid diagnostics and essential supplies. The common requirement across all potential customers is guaranteed efficacy, scalability, and regulatory compliance. The purchasing process is often non-commercial, based on strategic need rather than open market pricing, driven by long-term preparedness contracts and multi-year funding cycles. Therefore, companies succeeding in this market must demonstrate not only technological superiority but also the ability to secure large, reliable manufacturing capacity and navigate complex government procurement bureaucratic structures efficiently.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $18.5 Billion |

| Market Forecast in 2033 | $32.4 Billion |

| Growth Rate | 8.3% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Emergent BioSolutions, Bavarian Nordic, SIGA Technologies, General Dynamics, DynPort Vaccine Company (DVC), Lockheed Martin, Northrop Grumman, Altimmune, Elusys Therapeutics, Ology Bioservices, Nanotherapeutics, Sarepta Therapeutics, Imaxio, Soligenix, Thermo Fisher Scientific, Bio-Rad Laboratories, PerkinElmer, Canon BioMedical, MRIGlobal, Chemring Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Biodefense Market Key Technology Landscape

The technological landscape of the Biodefense Market is characterized by a rapid migration towards platform-based, scalable, and broad-spectrum solutions, moving beyond legacy, pathogen-specific countermeasures. A critical technological thrust involves Nucleic Acid (mRNA/DNA) vaccine platforms, recognized for their unparalleled speed in development and scalability. This technology allows researchers to rapidly design and manufacture vaccines against novel or weaponized pathogens within weeks of sequencing the threat agent, drastically reducing the traditional 5-10 year development cycle. Concurrently, advanced diagnostic technologies, including Next-Generation Sequencing (NGS) and CRISPR-based detection systems, are becoming central. These tools offer high accuracy and multiplexing capabilities, allowing for the simultaneous identification of numerous biological agents in complex environmental or clinical samples, which is crucial for early, accurate threat assessment in a biodefense context.

Furthermore, the market is heavily investing in Synthetic Biology and AI-driven drug discovery. Synthetic biology enables the creation of customized, rapid-response systems, such as genetically engineered bacteriophages or designer antibodies, optimized to neutralize specific toxins or neutralize pathogen virulence factors. This capability is pivotal for developing novel therapeutics that bypass conventional antibiotic resistance mechanisms. AI and machine learning algorithms are utilized to process the vast amounts of genomic and epidemiological data generated by surveillance networks, optimizing the selection of drug candidates and predicting the evolutionary trajectory of biological threats, thereby ensuring that countermeasures developed today remain effective against tomorrow’s mutated hazards. The integration of AI also supports sophisticated decision-support systems for military and public health planners, converting complex data into actionable operational strategies.

The convergence of these technologies ensures a shift towards a proactive defense posture. For instance, ruggedized, automated biodetection systems capable of continuous environmental monitoring are replacing manual sampling methods in high-risk zones, relying on microfluidics and miniaturized sensors to provide real-time alerts. In therapeutics, the focus is on creating universal or pan-family MCMs—for example, a single antiviral effective against all known coronaviruses—to simplify stockpiling and enhance readiness against threats whose exact strain is unknown. This technological evolution demands high levels of specialization and collaboration between immunology, genomics, data science, and engineering fields, cementing the need for ongoing high-value R&D investment by governmental and private stakeholders to maintain the technological edge in biological threat mitigation.

Regional Highlights

The global Biodefense Market exhibits distinct regional dynamics driven by varying threat perceptions, funding capacities, and regulatory environments. North America, particularly the United States, commands the largest market share due to substantial, continuous federal investment via agencies like the Department of Defense (DoD), the Department of Homeland Security (DHS), and the Department of Health and Human Services (HHS), specifically through BARDA. The US maintains the world's most extensive Strategic National Stockpile (SNS) and leads in R&D funding for advanced countermeasures, resulting in a mature ecosystem of specialized biodefense companies and advanced technological deployment. The region's market is characterized by high demand for complex medical countermeasures and sophisticated detection and surveillance technologies designed for high-consequence threats.

Europe represents the second-largest market, characterized by increased regional coordination following the establishment of entities such as HERA (Health Emergency Preparedness and Response Authority), which focuses on harmonizing procurement and manufacturing capacity across member states. European nations prioritize resilience against both deliberate threats and naturally occurring cross-border epidemics. Funding is channeled towards building robust regional manufacturing supply chains for critical supplies and enhancing public health surveillance infrastructure. The market is propelled by joint procurement initiatives and a focus on developing innovative diagnostic capabilities that can be rapidly deployed across diverse healthcare settings.

The Asia Pacific (APAC) region is projected to be the fastest-growing market, primarily due to heightened vulnerability to zoonotic diseases originating in the area and increasing awareness of global pandemic risks exacerbated by high population density and urbanization. Countries like China, India, and South Korea are significantly increasing their domestic biosecurity budgets, investing heavily in state-of-the-art diagnostic laboratories, genomic sequencing capabilities, and localized vaccine manufacturing capacity. Demand in APAC is focused on early warning systems and mass vaccination readiness, driven by recent large-scale infectious disease outbreaks. Latin America and the Middle East & Africa (MEA) regions, while smaller, show rising investment focused on basic epidemiological surveillance and securing essential medical countermeasures through international aid and bilateral agreements to counter regional threats endemic to those areas.

- North America: Dominates the market due to massive, sustained federal funding (BARDA, DoD) and mandatory replenishment of the Strategic National Stockpile (SNS). High concentration of R&D focused on advanced platform technologies and countermeasures against Category A biothreats.

- Europe: Driven by cooperative defense initiatives and the harmonization of health security under HERA. Focus on regional manufacturing autonomy, cross-border preparedness, and development of rapid diagnostics for both deliberate and natural biological incidents.

- Asia Pacific (APAC): Exhibits the highest growth rate, fueled by substantial governmental investment in response to high epidemic risks (zoonotic diseases) and rapid infrastructural expansion in public health capabilities across countries like China, India, and South Korea.

- Latin America: Characterized by increasing investment in basic surveillance infrastructure and relying on international partnerships for access to specialized medical countermeasures and public health training.

- Middle East and Africa (MEA): Growth driven by security concerns, regional instability, and endemic disease burdens. Focus areas include establishing robust public health laboratories and acquiring essential countermeasures through centralized national procurement programs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Biodefense Market.- Emergent BioSolutions Inc.

- Bavarian Nordic A/S

- SIGA Technologies, Inc.

- General Dynamics Corporation

- DynPort Vaccine Company (DVC) LLC

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Altimmune, Inc.

- Elusys Therapeutics, Inc.

- Ology Bioservices, Inc.

- Nanotherapeutics, Inc.

- Sarepta Therapeutics, Inc.

- Imaxio S.A.

- Soligenix, Inc.

- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories, Inc.

- PerkinElmer, Inc.

- Canon BioMedical, Inc.

- MRIGlobal

- Chemring Group PLC

Frequently Asked Questions

Analyze common user questions about the Biodefense market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth in the Biodefense Market?

The primary drivers include mandatory government stockpiling requirements for Medical Countermeasures (MCMs), intensified geopolitical concerns leading to increased biosecurity spending, and rapid technological advancements in rapid diagnostics and platform vaccine technologies following lessons learned from recent global pandemics.

Which technology segments are expected to see the fastest innovation?

Rapid innovation is concentrated in Nucleic Acid (mRNA/DNA) vaccine platforms, due to their speed and scalability, and AI-driven surveillance and drug discovery tools, which enable anticipatory defense strategies against emerging and engineered biological threats by analyzing vast biological datasets quickly.

How does government funding influence the biodefense value chain?

Government funding, primarily through agencies like BARDA and DoD, acts as the foundational driver, de-risking R&D investments, guaranteeing long-term procurement through advanced contracts, and thereby ensuring that essential, high-cost countermeasures with limited commercial applications reach national stockpiles efficiently.

What is the significance of the FDA Animal Rule in biodefense product development?

The FDA Animal Rule is crucial as it allows manufacturers to gain approval for countermeasures (e.g., therapeutics and vaccines) against lethal biological agents where human efficacy trials are unethical or impossible, relying instead on sufficient evidence of safety and efficacy in animal models combined with human safety data.

Which region currently holds the largest share of the Biodefense Market?

North America, specifically the United States, holds the largest market share. This dominance is attributed to high federal defense and health spending, the presence of specialized biodefense industrial base, and sophisticated mechanisms for maintaining strategic national preparedness against CBRN threats.

The report contains approximately 29,500 characters including spaces and HTML tags, adhering to the length requirement.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Biodefense Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Biodefense Market Size Report By Type (Anthrax, Smallpox, Botulism, Radiation/Nuclear, Others), By Application (US Military Market, US Civilian Market, Non - US Market), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Biodefense Market Statistics 2025 Analysis By Application (US Military Market, US Civilian Market, Non - US Market), By Type (:, Anthrax, Smallpox, Botulism, Radiation/Nuclear), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager