Biodegradable Packaging Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433273 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Biodegradable Packaging Market Size

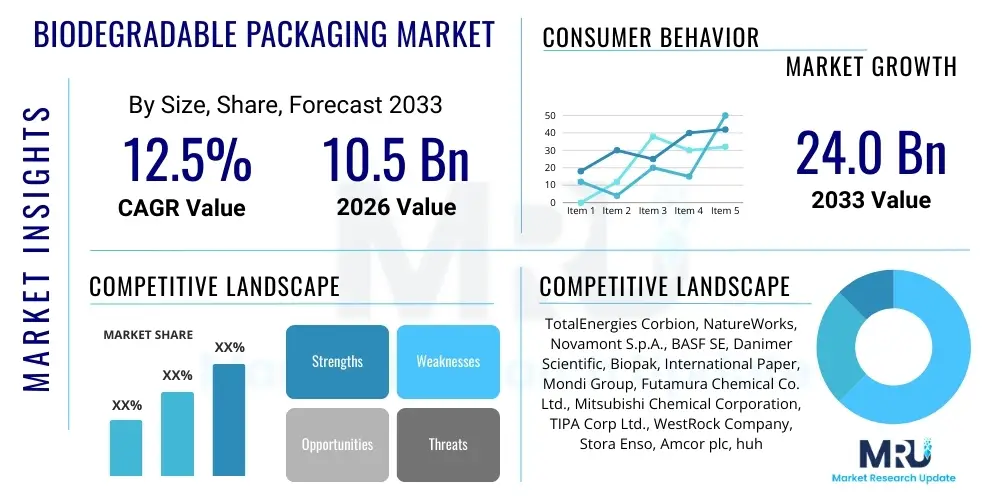

The Biodegradable Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at $10.5 Billion in 2026 and is projected to reach $24.0 Billion by the end of the forecast period in 2033.

This robust expansion is fundamentally driven by the escalating global regulatory pressure aimed at phasing out single-use plastics and the pronounced shift in consumer preference towards sustainable consumption patterns. Governments worldwide, particularly in the European Union and specific regions in Asia Pacific, are implementing strict environmental mandates, including extended producer responsibility (EPR) schemes and direct bans on non-recyclable materials. This regulatory push incentivizes major fast-moving consumer goods (FMCG) companies, food service providers, and pharmaceutical firms to aggressively transition their packaging portfolios to certified biodegradable or compostable alternatives, thereby cementing the market's trajectory.

Furthermore, technological advancements in biopolymer synthesis, particularly in materials derived from renewable resources such as polylactic acid (PLA), starch blends, and polyhydroxyalkanoates (PHAs), are enhancing the performance characteristics and cost-competitiveness of biodegradable packaging solutions. As production scales increase and innovation addresses former limitations concerning barrier properties and shelf life, biodegradable packaging is becoming a viable substitute for conventional petroleum-based plastics across high-volume applications like flexible packaging, rigid containers, and molded fiber products. The convergence of favorable economics, improved material performance, and undeniable environmental necessity underpins the substantial forecasted market valuation.

Biodegradable Packaging Market introduction

The Biodegradable Packaging Market encompasses packaging solutions designed to decompose naturally into non-toxic components, such as biomass, water, and carbon dioxide, through biological action, typically within designated composting environments or specific natural settings. These materials are primarily derived from renewable sources, including starch, cellulose, agricultural byproducts, and various bioplastics like PLA and PHA, addressing the critical global challenge of plastic waste accumulation. Major applications span across the food and beverage industry, where they are used for fresh produce containers, disposable tableware, and flexible food wrappers, and extend into industrial and consumer goods sectors for primary and secondary packaging, including protective cushioning and retail bags. The paramount benefit of adopting biodegradable packaging lies in mitigating landfill reliance and reducing greenhouse gas emissions associated with plastic production and incineration, while simultaneously appealing to the environmentally conscious consumer base.

The inherent limitations of municipal recycling infrastructure globally often render traditional plastics environmentally inefficient, positioning biodegradable alternatives as an essential component of the emerging circular economy framework. Key driving factors accelerating market adoption include widespread corporate sustainability commitments, often articulated through ambitious net-zero waste goals, and the increasing investment in specialized industrial composting facilities, which are essential for processing materials like PLA effectively. Moreover, the enhanced visibility of ocean plastic pollution and microplastic contamination has significantly raised public awareness, compelling brands to adopt transparently sustainable packaging strategies to maintain brand equity and consumer trust.

The market is defined by continuous material innovation aimed at improving critical functionalities such as oxygen and moisture barrier properties, which are crucial for maintaining the quality and extending the shelf life of packaged goods, especially food items. The development of advanced biopolymer blends and hybrid materials that balance performance, cost, and biodegradability profiles is central to market evolution. Furthermore, the standardization of labeling and certification (e.g., relating to home compostability versus industrial compostability) is crucial for clarity, driving confidence among both businesses and end-users in the environmental claims of these advanced packaging products.

Biodegradable Packaging Market Executive Summary

The Biodegradable Packaging Market is experiencing rapid structural transformation, largely defined by the convergence of stringent environmental regulation and aggressive corporate sustainability mandates, resulting in a forecasted CAGR of 12.5% through 2033. Business trends indicate a powerful strategic pivot by major multinational corporations toward implementing portfolio-wide sustainable packaging goals, driving massive investments in R&D for next-generation biopolymers and molded fiber technologies. The primary focus of technological innovation is reducing production costs and enhancing functional properties to achieve parity with traditional fossil fuel-based packaging, thus ensuring scalability and economic viability across high-volume sectors like e-commerce and fast food service.

Regionally, Europe leads the adoption curve, fueled by the ambitious European Green Deal and specific directives targeting single-use plastics, creating a mature market environment characterized by established composting infrastructure and high consumer awareness. The Asia Pacific (APAC) region, however, is poised for the fastest growth, propelled by rapid industrialization, growing regulatory action in major economies like China and India concerning plastic waste, and the surging demand from the burgeoning urban middle-class population seeking premium, eco-friendly products. North America follows a steady growth trajectory, influenced by patchwork state-level regulations and robust commitment from large retailers and food service chains.

Segmentation trends reveal that flexible biodegradable packaging, particularly bags, pouches, and wraps derived from bioplastics like PLA and starch blends, holds the largest market share due to its ubiquitous application in food and retail sectors. However, the rigid packaging segment, including molded fiber containers and biodegradable bottles, is projected to exhibit the highest growth rate, driven by innovations catering to beverage and cosmetics packaging needs. The primary end-use segments—food and beverage and consumer goods—remain the dominant drivers, with significant penetration also observed in medical and pharmaceutical packaging where sterility and sustainability are becoming crucial dual requirements.

AI Impact Analysis on Biodegradable Packaging Market

Users frequently inquire about how Artificial Intelligence (AI) can streamline the complex processes involved in material selection, supply chain optimization, and end-of-life management for biodegradable packaging. Key concerns center on AI’s ability to differentiate biodegradable materials from traditional plastics during sorting processes, which is a major logistical hurdle for effective composting and recycling programs. Users also express expectations regarding AI-driven predictive modeling for material properties, aiming to accelerate the discovery of novel, high-performance biopolymers and optimize their large-scale synthesis, thereby reducing research timelines and material costs. Furthermore, there is strong interest in how AI can enhance transparency and traceability within the sustainable packaging supply chain, ensuring compliance with complex global certifications and combating greenwashing by providing verifiable data on material origins and decomposition pathways.

- AI-Powered Material Informatics: Accelerating the discovery, characterization, and simulation of new biopolymer structures, optimizing properties like barrier capacity and tensile strength.

- Waste Stream Recognition: Implementing Computer Vision and machine learning models in material recovery facilities (MRFs) to accurately identify and separate certified biodegradable packaging from non-compostable materials, improving diversion rates.

- Supply Chain Optimization: Utilizing AI for demand forecasting and optimizing inventory management of raw, renewable feedstocks (e.g., sugar cane, corn starch), stabilizing supply chains against agricultural variability.

- Process Manufacturing Efficiency: Employing predictive maintenance and process control AI in bioplastic extrusion and molding to minimize production waste and improve energy efficiency.

- Consumer Engagement and Traceability: Developing AI-backed applications that scan packaging to provide consumers with precise, localized instructions on disposal (e.g., compost vs. trash), verified by blockchain-integrated data on the packaging's origin and certification.

DRO & Impact Forces Of Biodegradable Packaging Market

The market dynamics of biodegradable packaging are governed by a powerful interplay of regulatory enforcement (Drivers), infrastructure deficiencies (Restraints), and material science breakthroughs (Opportunities), all contributing to substantial impact forces reshaping global commerce. The primary drivers revolve around mandatory sustainability targets set by governmental bodies and consumer pressure for visible environmental stewardship, forcing immediate corporate action across consumer-facing industries. However, the lack of standardized global composting infrastructure and the higher cost of production for biopolymers currently restrain widespread adoption, limiting immediate scaling. Opportunities arise through advanced fermentation technology and vertical integration strategies that promise cost reduction and performance enhancements. These combined forces exert a strong, positive cumulative impact on market growth, fundamentally changing the landscape of material preference and investment focus toward sustainable, end-of-life conscious solutions.

Drivers: Intensifying global regulations against single-use plastics, exemplified by EU directives and various national bans, serve as the foremost driver, compelling industry compliance and rapid innovation. Simultaneously, amplified consumer awareness regarding climate change and plastic pollution translates directly into purchasing decisions, rewarding brands that visibly commit to eco-friendly packaging. Furthermore, major corporations are setting ambitious, non-negotiable sustainability targets—such as achieving 100% recyclable, reusable, or compostable packaging by specific deadlines—which generate reliable, large-volume demand for biodegradable alternatives, thereby attracting necessary investment into manufacturing capacity and technological refinement.

Restraints: The most significant restraint is the inherent cost disparity between petroleum-based plastics and bioplastics, primarily due to the complex extraction and polymerization processes, and the relatively smaller scale of biopolymer production. A critical infrastructural challenge is the limited global network of industrial composting facilities; many regions lack the specific high-heat, controlled environments necessary for the effective decomposition of commonly used bioplastics like PLA, often leading to these materials being incorrectly sent to landfills, which undermines their environmental advantage and confuses consumers. Additionally, maintaining sufficient barrier properties (e.g., against moisture and oxygen) in certain biopolymers for sensitive applications like long-shelf-life food products remains a technical challenge that limits their immediate replacement capacity in high-performance sectors.

Opportunities: Significant market opportunities exist in the development and commercialization of polyhydroxyalkanoates (PHAs), which offer superior barrier properties and, crucially, exhibit biodegradability in marine environments, addressing critical oceanic plastic pollution concerns. The utilization of waste streams and agricultural residues as feedstock for biopolymer production presents a twofold opportunity: reducing raw material costs and enhancing the circularity of the production cycle. Furthermore, expanding into high-value, niche applications such as flexible pharmaceutical packaging, personal care rigid containers, and sustainable protective shipping materials, where brands are willing to absorb higher costs for premium, certified sustainable solutions, offers excellent avenues for specialized market penetration and growth.

Impact Forces: The impact forces driving the biodegradable packaging market are profoundly strong and systemic, fueled by legislative mandates that make non-compliance increasingly expensive and risky. The shift toward a mandatory circular economy model, where producers bear increasing responsibility for the end-of-life management of their products (Extended Producer Responsibility - EPR), acts as a powerful economic lever. This regulatory pressure, combined with the undeniable public relations value of demonstrably sustainable products, creates an environment where failure to adopt biodegradable or circular materials results in both financial penalties and irreparable brand damage. This cumulative pressure accelerates R&D investment, leading to rapid scaling and eventual cost reductions, establishing sustainable packaging as a baseline operational requirement rather than a niche advantage.

- Drivers: Stringent environmental regulations; Favorable consumer perception and demand; Corporate sustainability commitments (Net-Zero goals); High price volatility of crude oil affecting conventional plastics.

- Restraints: Higher production cost of biopolymers; Limited industrial composting infrastructure; Technical limitations in achieving high-barrier properties; Potential contamination risks in conventional recycling streams.

- Opportunities: Advancements in PHA and PHB bioplastics; Utilization of agricultural and food waste as feedstock; Expansion into e-commerce protective packaging; Development of home compostable certified solutions.

- Impact Forces: Strong regulatory push accelerating market adoption; High level of capital investment into material science; Shifting procurement policies favoring sustainable sourcing; Increased consumer willingness to pay a premium for eco-friendly goods.

Segmentation Analysis

The Biodegradable Packaging Market is comprehensively segmented based on material type, product type, end-use industry, and geography, reflecting the diverse application landscape and material science complexities inherent in the sector. The material segmentation delineates the market based on the chemical composition of the biopolymer or substrate, distinguishing between bioplastics (like PLA, PHA, PBAT, starch blends) and cellulose-based options (such as molded fiber and paper-based materials). Product segmentation captures the physical form, focusing on the differences between flexible packaging (pouches, wraps) and rigid packaging (bottles, containers). Analyzing these segments allows stakeholders to pinpoint high-growth areas and understand the specific technological needs and infrastructural requirements associated with different biodegradable solutions.

The end-use industry segmentation provides crucial insight into demand drivers, with the food and beverage sector dominating consumption, largely due to its massive scale and immediate need for compostable solutions for single-use items and fresh produce. The segmentation analysis highlights the strategic importance of aligning material choice with end-of-life management capability; for instance, materials designed for industrial composting are necessary for food service waste, while marine biodegradable options are emerging for specialized agricultural or fishing applications. This granular analysis is vital for companies planning capacity expansion, product portfolio diversification, and strategic market entry based on specific material performance criteria.

- By Material:

- Bioplastics (PLA, PHA, Starch Blends, Cellulose Films, PBAT)

- Molded Fiber (Sugarcane Bagasse, Bamboo, Recycled Paper)

- Paper/Cardboard (with biodegradable coatings)

- By Product Type:

- Flexible Biodegradable Packaging (Bags, Pouches, Wraps, Films)

- Rigid Biodegradable Packaging (Clamshells, Bottles, Containers, Trays)

- By Application/End-Use Industry:

- Food and Beverage (Fresh Produce, Ready-to-Eat Meals, Dairy)

- Pharmaceuticals and Medical Devices

- Consumer Goods (Cosmetics, Personal Care, Detergents)

- Industrial and Institutional Packaging

Value Chain Analysis For Biodegradable Packaging Market

The value chain for biodegradable packaging begins significantly upstream with the sourcing and processing of renewable feedstocks, which typically include agricultural raw materials such as corn, sugarcane, potatoes, or specific wood pulp. This phase involves extensive cultivation and biochemical conversion processes, particularly fermentation, to generate precursor monomers for bioplastics like PLA or PHA. Upstream analysis focuses heavily on supply security, the optimization of feedstock conversion efficiency, and adherence to sustainable farming practices to ensure the packaging material truly minimizes its overall environmental footprint. The stability and ethical sourcing of these renewable resources are critical determinants of the final product's cost and sustainability credentials, demanding robust supplier relationship management and traceability systems.

The midstream phase involves the polymerization, compounding, and conversion of these raw biopolymers into usable packaging formats—namely, flexible films, rigid containers via injection molding or thermoforming, and molded fiber products. This manufacturing stage requires specialized machinery and expertise to handle the unique rheological and thermal properties of bioplastics compared to conventional polymers. Distribution channels, both direct and indirect, then facilitate the movement of finished packaging materials. Direct channels often involve large-scale contracts between major biopolymer producers and global FMCG brands, ensuring customized solutions and high-volume delivery. Indirect channels utilize distributors and packaging converters to supply smaller or regional end-users, requiring robust logistics to maintain material integrity.

Downstream analysis centers on the end-use and, critically, the end-of-life management of the packaging. Effective decomposition relies heavily on the presence and accessibility of appropriate infrastructure, either industrial composting or, for select materials, home composting or natural biodegradation. A functioning value chain requires seamless collaboration among material producers, packaging converters, brand owners, and waste management operators. Failure in the downstream disposal mechanism—such as insufficient composting facilities or consumer confusion—can undermine the entire value proposition of biodegradable packaging. Therefore, investment in educational initiatives and standardized labeling is an integral part of optimizing the downstream value realization.

Biodegradable Packaging Market Potential Customers

Potential customers, or end-users/buyers, of biodegradable packaging solutions are overwhelmingly concentrated in sectors characterized by high turnover, single-use applications, and direct consumer interaction, placing immense brand pressure on sustainability. The largest customer segment is the Food and Beverage (F&B) industry, particularly Quick Service Restaurants (QSRs), packaged food manufacturers, and fresh produce suppliers, who urgently require alternatives to plastic cutlery, coffee cups, meal trays, and produce wraps to comply with waste regulations and meet consumer demands for compostable disposal. These buyers seek solutions that offer high hygiene standards, adequate moisture/gas barriers, and cost-effective scaling.

Another rapidly expanding customer base includes the E-commerce and Retail sectors. With the massive growth in parcel volume, there is a substantial demand for biodegradable protective packaging, mailing bags, cushioning materials (e.g., biodegradable foam peanuts or molded fiber inserts), and secondary packaging that reduces the environmental impact of shipping. These customers prioritize materials that are lightweight, durable during transit, and clearly recognized as sustainable by the recipient. Pharmaceutical and Cosmetic companies also represent high-value potential customers, requiring specialized biodegradable materials for blister packs, pill bottles, and tubes where product safety, material purity, and precise decomposition profiles are non-negotiable considerations for compliance and luxury branding.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $10.5 Billion |

| Market Forecast in 2033 | $24.0 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TotalEnergies Corbion, NatureWorks, Novamont S.p.A., BASF SE, Danimer Scientific, Biopak, International Paper, Mondi Group, Futamura Chemical Co. Ltd., Mitsubishi Chemical Corporation, TIPA Corp Ltd., WestRock Company, Stora Enso, Amcor plc, huhtamaki, Smurfit Kappa, BioPak, Cardia Bioplastics, PTT Global Chemical Public Company Limited, Eastman Chemical Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Biodegradable Packaging Market Key Technology Landscape

The technology landscape of the Biodegradable Packaging Market is dynamic and primarily focused on enhancing material performance, reducing conversion costs, and improving the decomposition profile of biopolymers. A core technological area is the advancement in fermentation and polymerization processes for bioplastics, particularly for Polylactic Acid (PLA) and Polyhydroxyalkanoates (PHAs). PLA production has matured significantly, utilizing technologies that convert agricultural sugars into lactic acid monomers, which are then polymerized. Current innovations are focused on creating high-heat PLA (e.g., via stereocomplexation or blending with nucleating agents) to expand its use into hot-fill and microwaveable food applications, overcoming its natural heat sensitivity.

PHA technology, while currently more expensive, represents a critical area of future investment because of its superior barrier properties and unique ability to biodegrade in various natural environments, including soil and marine water. Technological advancements here involve utilizing bacterial fermentation driven by low-cost feedstocks, such as municipal solid waste or wastewater sludge, thereby enhancing sustainability and reducing input costs. Furthermore, blending technologies are essential, combining bioplastics with natural fibers or specific additives (e.g., starch or cellulose) to fine-tune flexibility, strength, and compostability rates, optimizing the final packaging material for specific end-use requirements while managing overall material expense.

Beyond bioplastics, technology related to molded fiber packaging is rapidly evolving. Innovations in pulp molding, including advanced pressing and drying techniques, are allowing for the creation of smoother, more complex geometric shapes with greater structural integrity, making molded fiber a viable alternative to plastic containers in premium food service and electronics protective packaging. Finally, the development of functional, water-based, and compostable barrier coatings for paper and cardboard is a crucial area. These coatings replace conventional polyethylene or fluorochemical barriers, allowing paper packaging to maintain moisture resistance while remaining fully compostable or recyclable, a major technological breakthrough for liquid and semi-liquid food packaging applications.

Regional Highlights

- Europe: Market Dominance Driven by Strict Legislation

- Asia Pacific (APAC): Fastest Growth Due to Regulatory Catch-Up and Consumer Affluence

- North America: Innovation and Corporate Mandate Driven Expansion

- Latin America (LATAM) and Middle East & Africa (MEA): Emerging Markets with Untapped Potential

Europe currently represents the most mature and dominant market for biodegradable packaging, a leadership position cemented by the European Green Deal and the Single-Use Plastics Directive (SUPD), which aggressively targets non-recyclable items. The market here is characterized by high levels of consumer environmental consciousness and well-developed industrial composting infrastructure, particularly in countries like Germany, Italy, and the Benelux nations. The regulatory environment compels businesses to internalize the environmental cost of packaging, directly driving demand for certified compostable alternatives in food service, beverage containers, and flexible packaging. The key focus in Europe remains optimizing collection schemes and standardizing definitions for biodegradability to ensure that these materials truly deliver their environmental promise.

Furthermore, European companies are leaders in biopolymer R&D and production, fostering a competitive ecosystem that pushes material science forward, particularly in sustainable sourcing and advanced blending techniques. The emphasis on the circular economy model means that packaging solutions must not only be biodegradable but also preferably derived from sustainably managed resources. This high degree of regulation and commitment creates reliable, long-term market pull, encouraging large-scale capital investment in new manufacturing facilities and ensuring a stable growth trajectory across the region.

Key countries driving growth include the UK, which is implementing its own plastic tax and EPR schemes, and Italy, which has robust regulations favoring compostable materials. The focus is shifting beyond primary packaging to secondary and tertiary packaging, with major retailers setting regional mandates that exceed EU minimum requirements.

The Asia Pacific region is projected to register the highest growth rate globally, primarily driven by rapid urbanization, substantial economic growth leading to higher consumer spending power, and increasing government recognition of the devastating impact of plastic waste, especially on coastal and marine environments. While infrastructure remains heterogeneous, large economies like China, India, and South Korea are implementing or planning extensive nationwide bans on single-use plastics and investing heavily in waste management infrastructure improvements. China’s extensive solid waste policies and commitment to addressing air and water pollution provide a massive, rapidly emerging market opportunity.

The F&B sector, coupled with the booming e-commerce market in Southeast Asia, necessitates a tremendous volume of packaging, much of which is rapidly shifting to paper-based and starch-based biodegradable solutions to comply with new municipal regulations. Localized production of bioplastics is also increasing, driven by the availability of low-cost agricultural feedstocks such as cassava, rice, and sugarcane residues, which enhances local self-sufficiency and improves the cost-competitiveness of biodegradable alternatives against imports. However, the region faces challenges related to consumer education and the need for massive capital investment to build adequate industrial composting capacity to support the required decomposition cycle.

India is a critical growth market, spurred by national plastic reduction goals and entrepreneurial local companies focused on innovative, often low-cost, biopolymer solutions derived from local waste streams. Japan and South Korea lead in technological adoption and consumer awareness within the region, exhibiting mature demand for premium, certified sustainable packaging in retail and cosmetics segments.

North America’s biodegradable packaging market is characterized by a mix of strong corporate commitments and fragmented regulatory action, with growth primarily fueled by voluntary mandates from large retailers, food service chains, and technology companies aiming to meet their own internal sustainability goals. While the United States lacks a unified federal plastic policy, state-level regulations in California, New York, and Washington are significant drivers, enforcing composting mandates and bans that require businesses to adopt biodegradable and compostable solutions, particularly in the QSR and prepared food segments.

The market benefits from high levels of technological innovation, particularly in advanced bioplastics like PHA, led by US-based start-ups and established chemical manufacturers focusing on bio-based feedstock sources. However, the commercial scaling of these materials is often challenged by the limited availability and accessibility of industrial composting facilities outside of major metropolitan areas, leading to consumer confusion and skepticism about the efficacy of these materials. Canada, with its federal commitment to plastic reduction and robust municipal composting programs in provinces like British Columbia and Ontario, serves as a more consistent regional adopter.

Key growth sectors include e-commerce packaging, where major players are demanding recyclable and compostable protective materials, and the high-end consumer goods sector, where brands leverage biodegradable packaging as a key differentiator. The future trajectory depends heavily on continued large-scale private investment in composting infrastructure to close the loop on bioplastic waste management.

Latin America presents an emerging market with significant opportunities, driven by rising environmental awareness and the implementation of plastic reduction laws in major economies like Brazil, Chile, and Mexico. The region benefits from abundant agricultural resources that can serve as sustainable feedstock for biopolymer production, offering potential cost advantages. However, market adoption is currently hindered by economic volatility and underdeveloped waste management infrastructure, requiring focused efforts on pilot projects and infrastructure build-out to support market growth. Brazil, with its large agricultural base and strong export orientation, is a key regional player focusing on sugarcane-derived bioplastics.

The Middle East and Africa (MEA) market is still nascent but poised for substantial acceleration, particularly in the Gulf Cooperation Council (GCC) countries, driven by ambitious diversification and sustainability visions (e.g., Saudi Vision 2030). These countries are making significant, large-scale investments in smart cities and green initiatives, creating demand for premium sustainable packaging in the hospitality and high-end retail sectors. In Africa, localized solutions, often utilizing starch-based or paper-based materials, are emerging to address local plastic waste issues, driven by regulatory bans in countries like Kenya and Rwanda. The primary challenge across MEA is establishing reliable supply chains and achieving economies of scale for domestic bioplastic production.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Biodegradable Packaging Market.- TotalEnergies Corbion

- NatureWorks

- Novamont S.p.A.

- BASF SE

- Danimer Scientific

- Biopak

- International Paper

- Mondi Group

- Futamura Chemical Co. Ltd.

- Mitsubishi Chemical Corporation

- TIPA Corp Ltd.

- WestRock Company

- Stora Enso

- Amcor plc

- huhtamaki

- Smurfit Kappa

- BioPak

- Cardia Bioplastics

- PTT Global Chemical Public Company Limited

- Eastman Chemical Company

Frequently Asked Questions

Analyze common user questions about the Biodegradable Packaging market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between compostable and biodegradable packaging?

Biodegradable packaging breaks down naturally, but the timeline and resulting components are not always defined, potentially leaving toxic residues. Compostable packaging is a subset of biodegradable materials that break down entirely into non-toxic components (humus, water, CO2) within a specific timeframe (usually 90–180 days) under controlled, specific conditions (industrial or home composting), requiring certification like ASTM D6400 or EN 13432 for verification.

Why is the cost of biodegradable packaging typically higher than conventional plastic?

The higher cost stems primarily from smaller economies of scale in biopolymer production compared to mature petroleum plastics, complex and specialized processing technologies (fermentation, polymerization), and the relatively high cost of sustainably sourced renewable agricultural feedstocks. Furthermore, substantial R&D investments needed to achieve performance parity with conventional polymers contribute significantly to the current price premium.

Is Polylactic Acid (PLA) the most widely used material in the biodegradable packaging market?

Yes, PLA is currently the most widely adopted bioplastic due to its versatility, favorable production economics, and clarity, making it suitable for rigid and flexible applications. However, it requires industrial composting facilities to decompose effectively. Newer materials like PHAs are gaining traction due to their enhanced barrier properties and ability to biodegrade more readily in diverse natural environments.

How significant is the role of infrastructure in the success of biodegradable packaging adoption?

Infrastructure is critically significant. The market's success is directly dependent on robust, accessible industrial composting facilities. Without adequate infrastructure, biodegradable materials often end up in landfills or contaminate conventional plastic recycling streams, negating their environmental benefit and undermining consumer trust in their sustainability claims. Investment in appropriate waste management is essential for realizing the full potential of these materials.

Which end-use industry drives the largest demand for biodegradable packaging solutions globally?

The Food and Beverage (F&B) sector is the dominant driver of demand for biodegradable packaging. This is due to the high volume of single-use items (e.g., disposable cutlery, trays, cups, and food wraps) required for quick service restaurants, retail packaged meals, and fresh produce, combined with the stringent regulatory focus on reducing plastic waste originating from this sector.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager