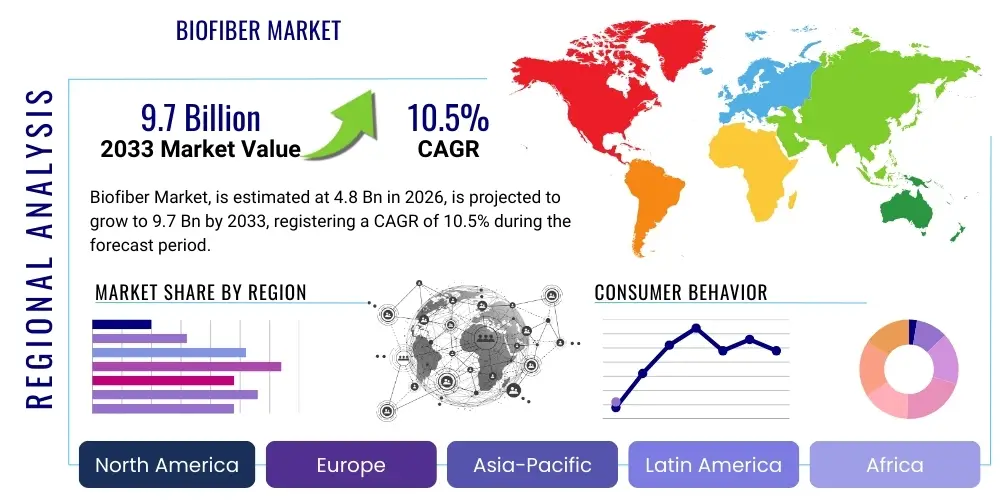

Biofiber Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440169 | Date : Jan, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Biofiber Market Size

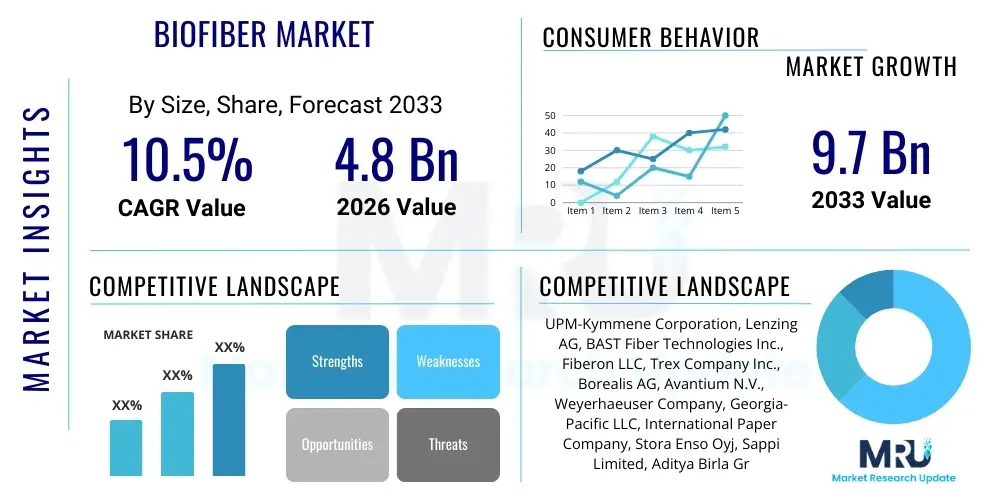

The Biofiber Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 9.7 Billion by the end of the forecast period in 2033. This robust growth trajectory is underpinned by increasing global awareness regarding environmental sustainability, stringent regulatory frameworks promoting bio-based materials, and significant advancements in material science enabling enhanced performance and broader applications of biofibers across various industries. The market expansion reflects a crucial shift from traditional synthetic materials towards more eco-friendly and renewable alternatives, driven by both consumer demand and corporate sustainability initiatives.

The consistent rise in demand for lightweight, high-performance, and sustainable materials in sectors such as automotive, construction, and packaging is a primary catalyst for this market's expansion. Biofibers offer a compelling combination of properties including renewability, biodegradability, low density, and favorable strength-to-weight ratios, making them increasingly attractive as substitutes for conventional materials like glass fibers and carbon fibers. Furthermore, the development of innovative processing techniques and surface treatments for biofibers is overcoming historical limitations, thereby broadening their industrial applicability and driving market adoption. Investments in research and development aimed at improving mechanical properties, moisture resistance, and processing compatibility are pivotal to maintaining this growth momentum.

Geographically, the market growth is anticipated to be particularly strong in regions with proactive environmental policies and a mature manufacturing base seeking to transition to greener supply chains. Emerging economies are also expected to contribute significantly, driven by rapid industrialization and growing middle-class populations with increasing purchasing power and environmental consciousness. The diversification of biofiber sources, from traditional wood pulp to agricultural residues and waste streams, further enhances market resilience and supply chain stability, ensuring a sustainable future for the industry. This global trend towards sustainable material consumption is firmly positioning the biofiber market for sustained expansion over the coming years.

Biofiber Market introduction

The Biofiber Market encompasses the production, distribution, and application of natural fibers derived from renewable biological resources, serving as sustainable alternatives to synthetic or conventional materials. These fibers are gaining prominence across diverse sectors due to their inherent ecological benefits, including biodegradability, low carbon footprint, and renewability. Key applications span biocomposites, textiles, paper and pulp, and various specialty products, driven by their compelling performance characteristics and environmental advantages. The market's growth is predominantly propelled by a confluence of stringent environmental regulations, escalating consumer demand for sustainable products, and continuous technological advancements in material processing.

Biofibers are typically categorized by their source, encompassing plant-based fibers like cotton, flax, hemp, jute, kenaf, and wood fibers, as well as animal-based fibers such as wool and silk, and regenerated cellulosic fibers like viscose and lyocell. Each type possesses unique properties, making them suitable for specific applications. For instance, flax and hemp fibers are increasingly utilized in automotive interior composites due to their high specific stiffness and strength, while cotton remains dominant in the textile industry for its comfort and versatility. Wood fibers are foundational for paper and packaging, and recent innovations are expanding their use into structural applications and advanced materials. The versatility and renewability of these fibers position them as critical components in the transition towards a circular economy, offering solutions that reduce reliance on finite fossil resources and mitigate environmental pollution associated with their production and disposal.

The benefits of biofibers extend beyond their environmental credentials, offering practical advantages such as lightweighting for automotive and aerospace industries, improved thermal and acoustic insulation in construction, and enhanced breathability in textiles. Furthermore, the agricultural cultivation of many biofiber sources provides economic benefits to rural communities and contributes to carbon sequestration, aligning with global sustainability goals. Despite facing challenges related to processing consistency, moisture sensitivity, and cost competitiveness with established synthetic alternatives, ongoing research and development efforts are systematically addressing these limitations. Innovations in surface modification, additive manufacturing compatibility, and advanced composite formulations are continuously expanding the functional capabilities and market penetration of biofibers, solidifying their role as a cornerstone of future sustainable material development.

Biofiber Market Executive Summary

The Biofiber Market is undergoing transformative growth, primarily fueled by a global impetus towards sustainability and circular economy principles. Business trends indicate a strong shift towards strategic partnerships and collaborations across the value chain, uniting agricultural producers, fiber processors, material scientists, and end-use manufacturers to accelerate innovation and market adoption. Regional trends show robust expansion in North America and Europe, driven by stringent environmental regulations and a mature R&D infrastructure, while Asia Pacific emerges as a high-growth region owing to rapid industrialization and increasing environmental awareness. Segment trends highlight the dominant role of biocomposites in automotive and construction, alongside significant advancements in sustainable textiles and packaging, all poised for substantial expansion as technological barriers are overcome and cost-effectiveness improves.

In terms of business trends, there is an observable increase in mergers and acquisitions aimed at consolidating market position and expanding technological capabilities. Companies are investing heavily in establishing closed-loop systems for biofiber production and recycling, enhancing resource efficiency and reducing waste. Furthermore, brand owners are increasingly integrating biofiber-based materials into their product portfolios not only to meet regulatory requirements but also to appeal to a growing segment of environmentally conscious consumers. This push for green products is fostering innovation in biofiber processing, leading to the development of higher-performance and more versatile materials that can compete effectively with conventional options. The focus on life cycle assessments (LCAs) is also becoming standard practice, allowing manufacturers to transparently communicate the environmental benefits of their biofiber products.

Regionally, Europe stands out with its ambitious sustainability targets and significant research funding for bio-based materials, driving widespread adoption in automotive and packaging sectors. North America is experiencing growth due to strong demand from the construction industry for sustainable insulation and structural materials, coupled with a growing interest in natural fiber composites for consumer goods. The Asia Pacific region, particularly countries like China and India, is witnessing rapid growth spurred by expanding manufacturing bases, increasing per capita income, and governmental initiatives promoting sustainable development. This region offers both significant production capacity for natural fibers and a vast consumer market, creating fertile ground for market expansion. Each region presents unique opportunities and challenges, shaping the global biofiber landscape with distinct patterns of innovation and adoption across various end-use industries.

AI Impact Analysis on Biofiber Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) within the biofiber market holds immense potential to revolutionize various stages of the value chain, from raw material sourcing and processing to product development and market forecasting. Users are increasingly curious about how AI can enhance the efficiency, sustainability, and quality of biofiber production, optimize supply chains, and accelerate the discovery of novel material properties. Key concerns often revolve around the initial investment costs, data privacy, and the need for specialized expertise to implement AI solutions effectively. However, the overarching expectation is that AI will be a critical enabler for overcoming current limitations and unlocking new growth avenues for the industry, leading to more sustainable and cost-effective biofiber-based products.

AI's influence is anticipated to be particularly profound in areas such as predictive analytics for crop yield optimization, quality control through automated inspection systems, and the design of novel biofiber composites with tailored properties. For instance, AI algorithms can analyze vast datasets of agricultural parameters—soil conditions, weather patterns, and plant genetics—to predict optimal harvesting times and cultivation methods, thereby maximizing fiber yield and quality while minimizing resource input. In processing, AI-powered vision systems can detect defects in fiber batches with unparalleled accuracy, ensuring consistent product quality and reducing waste. This level of precision and predictive capability is challenging to achieve through traditional methods and represents a significant leap forward in operational efficiency and sustainability within the biofiber industry.

Moreover, AI and ML are poised to accelerate material innovation by rapidly simulating and predicting the performance of new biofiber blends and composites. This drastically reduces the time and cost associated with physical prototyping and testing, allowing researchers to quickly identify promising formulations for specific applications. Supply chain management can also be optimized through AI, enabling real-time tracking of materials, demand forecasting, and inventory optimization, which enhances efficiency and resilience. As the biofiber market seeks to scale up and become more competitive, AI's ability to drive intelligent decision-making, automate complex tasks, and uncover hidden patterns in data will be indispensable for achieving sustainable growth and maintaining a competitive edge.

- Enhanced raw material cultivation and yield prediction through AI-driven agricultural analytics.

- Automated quality control and defect detection in fiber processing using machine vision and deep learning.

- Accelerated discovery and design of novel biofiber composites with AI-powered material simulations.

- Optimized supply chain logistics, inventory management, and demand forecasting with predictive AI models.

- Reduction in waste and energy consumption through AI-driven process optimization and predictive maintenance.

- Personalized product development and customization based on consumer preferences analyzed by AI.

- Improved market trend analysis and competitive intelligence through AI-driven data analytics.

DRO & Impact Forces Of Biofiber Market

The Biofiber Market is significantly shaped by a dynamic interplay of drivers, restraints, and opportunities, collectively forming the impact forces that dictate its growth trajectory. Key drivers include the escalating demand for sustainable and eco-friendly materials across industries, stringent environmental regulations pushing for reduced carbon footprints, and technological advancements enhancing biofiber performance. However, the market faces restraints such as the relatively higher cost of production for certain biofibers, inconsistency in fiber quality, and susceptibility to moisture absorption. Opportunities abound in the development of novel applications, market penetration in emerging economies, and continuous innovation in processing technologies to overcome existing limitations. These forces collectively influence investment decisions, research directions, and overall market dynamics.

Drivers: The growing global imperative for sustainability is arguably the strongest driver for the biofiber market. Consumers and industries alike are increasingly prioritizing products with a lower environmental impact, favoring renewable and biodegradable materials over synthetic ones. This shift is reinforced by governmental policies and regulations, such as bans on single-use plastics and mandates for bio-based content in various products, particularly in regions like the European Union and North America. Furthermore, the inherent benefits of biofibers, including their lightweight properties, good insulation characteristics, and relatively high strength-to-weight ratio, are making them attractive for performance-driven applications in sectors like automotive and construction, where weight reduction and energy efficiency are critical. Continuous advancements in fiber modification techniques and composite formulations are also expanding their functional capabilities, further fueling adoption.

Restraints: Despite the strong tailwinds, the biofiber market encounters several significant restraints. One primary challenge is the cost competitiveness, as some biofibers and their composites can be more expensive to produce than established synthetic alternatives, largely due to complexities in harvesting, processing, and refining to achieve consistent industrial-grade quality. Variability in natural fiber properties, influenced by cultivation conditions, harvesting methods, and post-harvest treatments, poses a challenge for standardization and predictability in manufacturing. The inherent hydrophilic nature of many plant fibers leads to moisture absorption, which can degrade mechanical properties and limit their use in certain humid environments. Additionally, the scalability of some advanced biofiber production technologies is still a hurdle, impacting their widespread availability and cost-effectiveness for large-volume applications. Overcoming these technical and economic barriers is crucial for broader market penetration.

Opportunities: The biofiber market is ripe with opportunities that promise to accelerate its growth and diversification. One major area is the expansion into new and high-value applications, such as aerospace interiors, medical devices, and advanced filtration systems, where the unique properties of biofibers can offer distinct advantages. The development of advanced bio-based resins and matrices that are fully compatible with natural fibers can unlock the potential for truly sustainable, fully biodegradable composites. Furthermore, the immense potential in emerging economies, driven by rapid industrialization, growing environmental awareness, and supportive government policies, presents significant untapped markets. Continuous investment in research and development, particularly in areas like nanotechnology for surface modification, genetic engineering for enhanced fiber properties, and novel processing techniques such as additive manufacturing, will be instrumental in creating next-generation biofiber materials that overcome current limitations and offer superior performance.

Segmentation Analysis

The Biofiber Market is meticulously segmented to provide a granular understanding of its diverse components and dynamics. This segmentation typically relies on various criteria, including source, type, application, and end-use industry, allowing for a comprehensive analysis of market trends, opportunities, and challenges across different niches. Understanding these segments is crucial for stakeholders to identify key growth areas, tailor product development strategies, and optimize market entry approaches. The inherent variability in biofiber properties necessitates a detailed segmentation to cater to the specific demands of various industrial applications.

By analyzing the market through these segments, it becomes evident how different biofiber types are uniquely positioned to address specific market needs. For instance, while wood fibers dominate the pulp and paper industry, non-wood fibers like flax and hemp are gaining traction in biocomposites for automotive and construction due to their superior specific strength. Similarly, the end-use industry segmentation reveals the significant impact of sustainability initiatives in automotive for lightweighting and construction for insulation, driving demand for specialized biofiber solutions. The intricate interdependencies between these segments highlight the market's complexity and the potential for cross-segment innovation, where advancements in one area can significantly influence others.

Further granularity in segmentation aids in precise market sizing and forecasting, enabling companies to allocate resources effectively and identify underserved markets. The evolving regulatory landscape and shifting consumer preferences continuously influence the relative growth of these segments. For example, increasing demand for sustainable packaging is boosting the segment for biofibers in packaging applications, while the push for electric vehicles is amplifying the demand for lightweight biocomposites. This multi-dimensional segmentation analysis provides a robust framework for navigating the rapidly expanding and diversifying biofiber market, offering critical insights for strategic decision-making and competitive positioning.

- By Source:

- Plant Fibers (Wood, Non-Wood: Cotton, Flax, Hemp, Jute, Kenaf, Ramie, Sisal, Abaca)

- Animal Fibers (Wool, Silk, Hair)

- Regenerated Cellulosic Fibers (Viscose, Lyocell, Modal, Cuprammonium Rayon)

- By Type:

- Wood Fiber (Softwood Pulp, Hardwood Pulp)

- Non-Wood Fiber (Agricultural Residues, Bast Fibers, Leaf Fibers, Seed Fibers)

- Recycled Fibers

- By Application:

- Biocomposites (Automotive Components, Construction Materials, Consumer Goods)

- Textiles (Apparel, Home Furnishings, Industrial Textiles)

- Paper & Pulp Products (Packaging, Printing & Writing Paper, Tissue)

- Filtration (Air Filters, Water Filters)

- Insulation Materials (Thermal, Acoustic)

- Medical & Hygiene Products

- Geotextiles

- By End-Use Industry:

- Automotive

- Construction

- Packaging

- Textile & Apparel

- Consumer Goods

- Aerospace

- Marine

- Sports & Leisure

Value Chain Analysis For Biofiber Market

The value chain for the Biofiber Market is a complex network spanning raw material sourcing, processing, manufacturing, distribution, and end-use, with each stage adding value and influencing the final product's cost and sustainability profile. Upstream analysis focuses on agricultural cultivation or forestry, where raw biological materials are grown and harvested. Midstream activities involve the extraction, purification, and modification of fibers, converting them into industrial-grade materials. Downstream operations encompass the manufacturing of final products, such as composites, textiles, or paper, using these biofibers. Efficient coordination across these stages, including effective distribution channels, is paramount for optimizing costs, ensuring consistent quality, and promoting market adoption of biofiber-based products.

Upstream Analysis: This segment involves the cultivation and harvesting of renewable biological resources, which serve as the primary source for biofibers. For plant fibers, this includes forestry for wood pulp, and agriculture for crops like cotton, flax, hemp, jute, and kenaf. Animal fiber production involves animal husbandry. Key considerations at this stage include sustainable land management practices, crop rotation, water usage, and pest control, all of which impact the environmental footprint and cost of the raw material. Innovations in agricultural biotechnology and precision farming are crucial for maximizing fiber yield, improving fiber quality, and reducing resource consumption. Ensuring a stable and sustainable supply of raw materials is fundamental to the entire value chain, directly influencing the scalability and long-term viability of the biofiber market. Establishing strong relationships with farmers and forestry companies, often through contractual agreements, helps secure consistent supply.

Downstream Analysis: This segment focuses on the transformation of processed biofibers into finished or semi-finished products that reach the end-users. It includes manufacturing processes like compounding for biocomposites, spinning and weaving for textiles, and pulping and papermaking for paper products. Further processing can involve molding, extrusion, or additive manufacturing to create complex parts for automotive, construction, or consumer goods. The integration of biofibers into existing manufacturing lines often requires specialized machinery and processing techniques, particularly to address issues like fiber dispersion, resin compatibility, and moisture management. Collaborations between biofiber producers and product manufacturers are critical for developing application-specific materials and optimizing manufacturing efficiency. The success of the downstream segment relies heavily on market demand, product innovation, and the ability to demonstrate performance and cost-effectiveness to end-users.

Distribution Channel: The distribution of biofiber products involves a network that connects manufacturers to their end-use markets. This can include direct sales channels, where manufacturers sell directly to large industrial clients (e.g., automotive OEMs or construction companies), and indirect channels, which involve intermediaries like distributors, wholesalers, and retailers. The choice of distribution channel depends on the product type, target market, and geographic reach. For raw or semi-processed biofibers, bulk sales to material compounders or textile mills are common. For finished products, a more complex network involving regional distributors and retail outlets may be employed. Effective logistics, warehousing, and inventory management are crucial to ensure timely delivery and maintain product quality. The growing emphasis on sustainable supply chains also influences distribution, with a preference for local sourcing and optimized transportation to minimize environmental impact. The development of specialized distribution networks tailored for bio-based materials is a key factor in expanding market access.

Biofiber Market Potential Customers

The Biofiber Market serves a broad and diverse range of potential customers across numerous industries, all seeking sustainable and high-performance material solutions. These customers, primarily business-to-business (B2B) entities, include manufacturers in sectors such as automotive, construction, packaging, textile, and consumer goods, along with specialized industries like aerospace and marine. Their purchasing decisions are increasingly driven by a combination of factors: stringent environmental regulations, growing consumer demand for eco-friendly products, and the inherent performance advantages that biofibers offer, such as lightweighting, improved insulation, and aesthetic appeal. Understanding the specific needs and challenges of these end-user segments is crucial for biofiber suppliers to develop tailored products and market strategies.

In the automotive industry, major car manufacturers and their tier-1 suppliers represent significant potential customers for biofibers. They utilize biofiber composites for interior components like door panels, headliners, and seatbacks, driven by the need for lightweighting to improve fuel efficiency or extend electric vehicle range, and to meet sustainability targets. The construction sector, including builders, insulation manufacturers, and material suppliers, seeks biofiber-based solutions for thermal and acoustic insulation, structural panels, and interior finishes, aiming to enhance building energy efficiency and reduce environmental impact. Packaging companies, from food and beverage to consumer electronics, are transitioning towards biofiber packaging to meet consumer demand for sustainable alternatives and comply with plastic reduction mandates.

The textile and apparel industry comprises designers, brands, and fabric manufacturers who are increasingly integrating natural and regenerated cellulosic fibers into their collections, driven by both fashion trends and sustainability commitments. Beyond these major sectors, specialized manufacturers in consumer goods (e.g., furniture, sporting goods), aerospace (e.g., cabin interiors), and marine (e.g., boat components) also represent growing customer segments. These industries value biofibers for their specific performance attributes, such as durability, unique aesthetics, or reduced weight, alongside their environmental benefits. As biofiber technology continues to advance, the range of applications and, consequently, the base of potential customers, is expected to expand significantly, making it imperative for biofiber suppliers to remain agile and innovative in their product offerings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 9.7 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | UPM-Kymmene Corporation, Lenzing AG, BAST Fiber Technologies Inc., Fiberon LLC, Trex Company Inc., Borealis AG, Avantium N.V., Weyerhaeuser Company, Georgia-Pacific LLC, International Paper Company, Stora Enso Oyj, Sappi Limited, Aditya Birla Group, Grasim Industries Limited, Tembec Inc. (Rayonier Advanced Materials), Ahlstrom-Munksjö Oyj, Mitsubishi Chemical Corporation, FuturaGene Ltd., Procotex Corporation SA, Texol SpA |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Biofiber Market Key Technology Landscape

The technological landscape of the Biofiber Market is rapidly evolving, driven by the imperative to enhance fiber performance, improve processing efficiency, and reduce production costs to compete effectively with synthetic alternatives. Key technologies span the entire value chain, from advanced agricultural techniques for optimizing fiber yield and quality to sophisticated material science for developing high-performance biofiber composites and textiles. Innovations in fiber extraction, modification, and integration into various matrices are critical for unlocking new applications and expanding market penetration. This dynamic environment fosters continuous research and development, leading to breakthroughs that address historical limitations such as moisture sensitivity and variability in natural fiber properties.

One pivotal area of technological advancement lies in the processing and modification of raw biofibers. This includes enzymatic treatments, chemical modifications, and physical treatments like steam explosion or fibrillation, all aimed at improving fiber surface properties, enhancing adhesion to polymer matrices, and increasing mechanical strength and thermal stability. Nanofibrillated cellulose (NFC) and cellulose nanocrystals (CNC) represent a significant frontier, leveraging nanotechnology to create high-strength, lightweight materials with unique barrier properties for applications in packaging, composites, and electronics. These nanocellulose materials offer exceptional stiffness and strength, opening avenues for advanced biomaterials with performance characteristics comparable to, or even exceeding, traditional synthetic counterparts.

Furthermore, significant technological progress is observed in the development of bio-based resins and bioplastics that are fully compatible with biofibers, enabling the creation of truly biodegradable and compostable composites. Additive manufacturing (3D printing) technologies are also being adapted to process biofiber-reinforced materials, allowing for the fabrication of complex geometries and customized components with reduced material waste. In the textile sector, innovations in spinning and weaving technologies are producing biofiber fabrics with enhanced comfort, durability, and functional properties. The integration of digital technologies, including AI and IoT, for process monitoring, quality control, and predictive maintenance is further optimizing production efficiency and consistency across the biofiber manufacturing landscape, propelling the market towards greater sustainability and economic viability.

Regional Highlights

- North America: The North American biofiber market is characterized by robust growth, primarily driven by increasing environmental awareness, stringent regulations promoting sustainable building materials, and strong demand from the automotive and construction industries. The region benefits from significant investments in R&D and a well-established manufacturing infrastructure capable of integrating biofiber technologies.

- Europe: Europe stands as a frontrunner in the biofiber market, propelled by ambitious sustainability targets, comprehensive circular economy initiatives, and substantial government support for bio-based industries. The automotive, packaging, and construction sectors are key adopters, benefiting from advanced research in natural fiber composites and a strong consumer preference for eco-friendly products.

- Asia Pacific (APAC): The APAC region is poised for the fastest growth in the biofiber market, attributed to rapid industrialization, growing populations, increasing disposable incomes, and an escalating focus on environmental protection across countries like China, India, and Japan. This region offers both vast raw material availability and a burgeoning market for sustainable products across diverse applications.

- Latin America: The Latin American biofiber market is emerging, driven by abundant natural resources (e.g., vast forestry, agricultural residues) and a growing awareness of sustainable practices. While still in nascent stages compared to developed regions, increasing foreign investments and regional initiatives focusing on bio-based economy development are creating significant opportunities for market expansion.

- Middle East and Africa (MEA): The MEA region presents unique opportunities, particularly in countries diversifying away from oil-based economies and investing in sustainable infrastructure and manufacturing. With diverse agricultural landscapes and growing consumer environmental consciousness, the market for biofibers, especially in packaging and construction, is expected to gradually expand, supported by strategic partnerships and technological transfers.

The North American market for biofibers is experiencing substantial expansion, largely due to a convergence of factors including stringent environmental regulations, growing corporate sustainability commitments, and increasing consumer demand for green products. The automotive industry in the U.S. and Canada, for instance, is actively incorporating natural fiber composites into vehicle interiors to reduce weight, improve fuel efficiency, and meet carbon emission targets. Similarly, the construction sector is adopting biofiber insulation and building materials to enhance energy efficiency and qualify for green building certifications. Investment in research and development, particularly in sustainable agriculture and advanced material science, further supports market growth by enhancing the performance and cost-effectiveness of biofibers, making them more competitive against traditional materials. This robust innovation ecosystem and strong regulatory push cement North America's position as a significant and growing market for biofibers.

Europe continues to lead the global biofiber market, showcasing a proactive approach to sustainability and circular economy models. The European Union's comprehensive policies, such as the EU Green Deal and directives on single-use plastics, create a highly favorable regulatory environment for bio-based materials. Countries like Germany, France, and the Nordic nations are at the forefront of adopting biofibers in diverse applications, ranging from high-performance automotive parts to sustainable packaging solutions and bio-based textiles. Strong collaborative networks between academic institutions, research organizations, and industrial players facilitate continuous innovation in fiber processing, composite manufacturing, and product design. This collaborative spirit, combined with a mature market that values environmental responsibility, ensures Europe's sustained leadership in the global biofiber industry, setting benchmarks for sustainable material development and adoption worldwide.

The Asia Pacific region represents a critical growth engine for the biofiber market, driven by rapid economic development, increasing urbanization, and a burgeoning middle class. While historically focused on conventional materials, countries such as China, India, and Southeast Asian nations are increasingly prioritizing environmental sustainability due to rising pollution concerns and governmental initiatives. This shift is fueling demand for biofibers in packaging, textiles, and construction, where large-scale manufacturing capabilities can efficiently integrate bio-based solutions. The abundant availability of agricultural residues and forestry resources in the region also provides a strong foundation for domestic biofiber production, reducing reliance on imports. As environmental awareness grows and regulatory frameworks evolve, the APAC market is expected to witness exponential growth, positioning it as a key player in the future of the global biofiber market and offering immense opportunities for both local and international companies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Biofiber Market.- UPM-Kymmene Corporation

- Lenzing AG

- BAST Fiber Technologies Inc.

- Fiberon LLC

- Trex Company Inc.

- Borealis AG

- Avantium N.V.

- Weyerhaeuser Company

- Georgia-Pacific LLC

- International Paper Company

- Stora Enso Oyj

- Sappi Limited

- Aditya Birla Group

- Grasim Industries Limited

- Tembec Inc. (Rayonier Advanced Materials)

- Ahlstrom-Munksjö Oyj

- Mitsubishi Chemical Corporation

- FuturaGene Ltd.

- Procotex Corporation SA

- Texol SpA

Frequently Asked Questions

What are biofibers and why are they important?

Biofibers are natural fibers derived from renewable biological resources, such as plants (e.g., flax, hemp, wood) or animals (e.g., wool). They are crucial for sustainability due to their biodegradability, renewability, lower carbon footprint, and potential to replace synthetic materials in various applications, contributing to a circular economy.

Which industries are the primary consumers of biofibers?

The primary consumers of biofibers are industries such as automotive (for lightweight composites), construction (for insulation and structural elements), packaging (for sustainable alternatives to plastics), and textiles (for eco-friendly apparel and home furnishings). Consumer goods and aerospace also represent growing end-use sectors.

What are the main advantages of using biofiber composites over traditional materials?

Biofiber composites offer several advantages, including reduced weight, improved environmental impact (lower energy consumption, biodegradability), good specific strength and stiffness, enhanced acoustic and thermal insulation properties, and aesthetic appeal. They also reduce reliance on finite fossil resources.

What are the key challenges facing the biofiber market?

The key challenges include achieving cost competitiveness with synthetic materials, ensuring consistent fiber quality due to natural variability, addressing moisture sensitivity in certain applications, and scaling up production technologies efficiently. Ongoing research aims to mitigate these limitations through advanced processing and modification techniques.

How is AI impacting the biofiber market?

AI is transforming the biofiber market by optimizing raw material cultivation, enhancing quality control through automated inspection, accelerating material discovery and design for novel composites, and streamlining supply chain management. AI helps in achieving greater efficiency, sustainability, and predictive capabilities across the value chain.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager