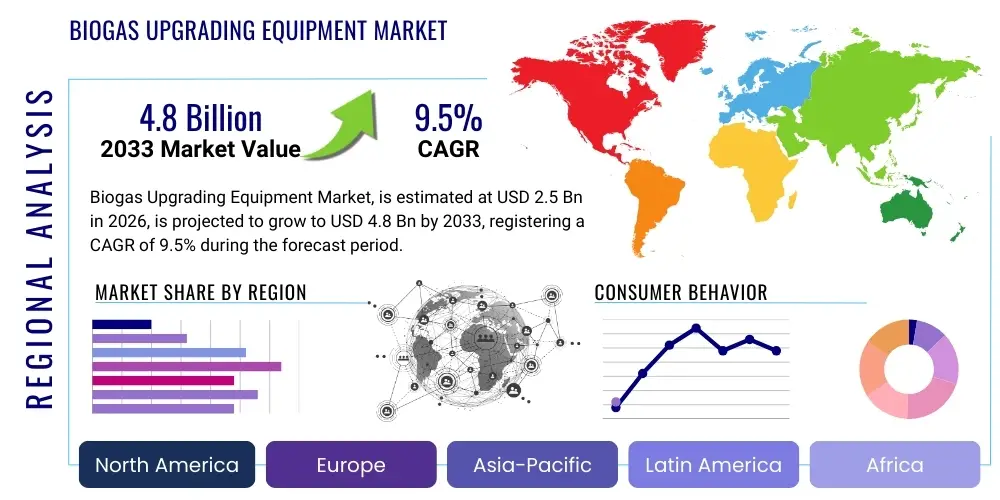

Biogas Upgrading Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439111 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Biogas Upgrading Equipment Market Size

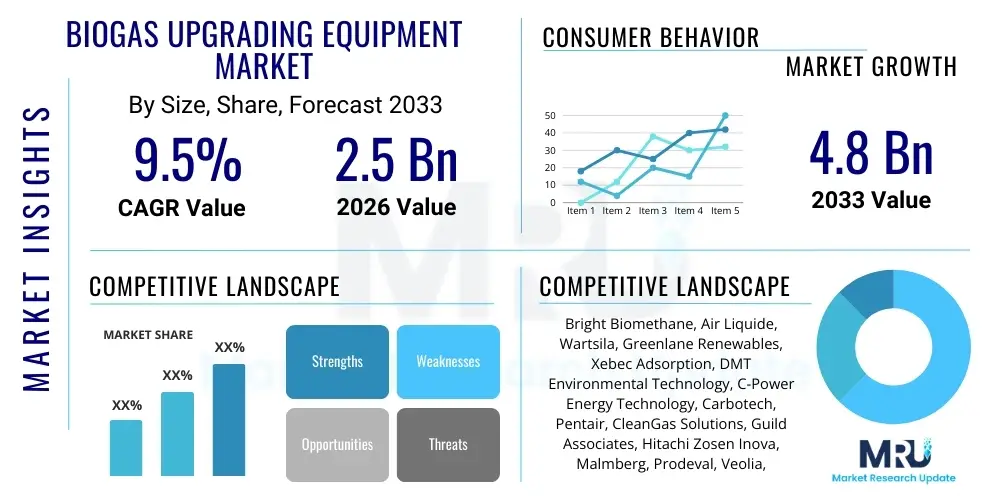

The Biogas Upgrading Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $2.5 Billion in 2026 and is projected to reach $4.8 Billion by the end of the forecast period in 2033.

Biogas Upgrading Equipment Market introduction

The Biogas Upgrading Equipment Market encompasses the technologies and systems required to purify raw biogas—typically produced from anaerobic digestion of organic materials—into high-quality biomethane, also known as Renewable Natural Gas (RNG). Raw biogas contains significant impurities, primarily carbon dioxide (CO2) and hydrogen sulfide (H2S), alongside trace elements like siloxanes and volatile organic compounds (VOCs). Biogas upgrading equipment removes these contaminants to achieve gas quality standards compatible with injection into natural gas grids, use as vehicle fuel (bio-CNG/bio-LNG), or high-efficiency power generation. The resultant biomethane possesses a methane concentration typically exceeding 97%, making it functionally interchangeable with fossil natural gas.

Major applications driving the demand for upgrading equipment include transportation fuel production, where biomethane offers a sustainable, low-carbon alternative for heavy-duty vehicles; grid injection, which allows producers to sell biomethane into established utility infrastructure; and decentralized power and heat generation systems utilizing high-purity gas. The increasing regulatory emphasis on decarbonization, coupled with governmental incentives such as feed-in tariffs and renewable energy mandates, is fundamentally driving the adoption of these specialized upgrading technologies. Furthermore, technological advancements in membrane separation and pressure swing adsorption (PSA) have reduced operational costs and improved the efficiency of the upgrading process, accelerating market penetration across diverse geographical regions.

Biogas Upgrading Equipment Market Executive Summary

The global Biogas Upgrading Equipment Market is experiencing robust expansion driven by stringent climate policies and the accelerating shift towards circular economy models, emphasizing waste-to-energy pathways. Business trends indicate a strong move toward integrated systems that combine biogas production (anaerobic digestion) with highly efficient upgrading technologies, facilitating the rapid commercialization of Renewable Natural Gas (RNG). Key players are focusing on modular and containerized solutions to reduce installation time and increase scalability for smaller and decentralized waste management facilities, enhancing flexibility across various feedstocks, including agricultural residues and municipal solid waste. Strategic mergers, acquisitions, and partnerships aimed at integrating complementary purification and separation technologies are prevalent, allowing companies to offer full-scope solutions from raw biogas conditioning to biomethane liquefaction or compression.

Regionally, Europe maintains market dominance due to early adoption of renewable energy directives and robust gas grid injection infrastructure, particularly in Germany, France, and the Nordics. North America, especially the United States, is emerging as the fastest-growing market, largely fueled by federal and state-level incentives like the Renewable Fuel Standard (RFS) and Low Carbon Fuel Standard (LCFS), making biomethane production economically attractive for landfill operators and large-scale agricultural operations. Segment trends highlight the growing preference for advanced separation methods like membrane separation and Pressure Swing Adsorption (PSA) over traditional water scrubbing, attributed to their higher methane recovery rates, lower energy consumption, and reduced environmental impact related to wastewater discharge. The transportation fuel application segment is forecast to demonstrate the highest growth trajectory, reflecting the global commitment to decarbonizing the logistics and heavy-duty transport sectors.

AI Impact Analysis on Biogas Upgrading Equipment Market

Users frequently inquire about how Artificial Intelligence (AI) can optimize the operational performance, energy efficiency, and predictive maintenance of complex biogas upgrading systems. Primary concerns center on using AI for dynamic control of upgrading units in response to varying raw biogas quality and flow rates, which are inherently volatile based on feedstock composition and digestion stability. Expectations are high regarding AI’s ability to minimize parasitic energy load—a significant operational cost—by precisely modulating parameters such as pressure, temperature, solvent flow, or membrane throughput. Furthermore, users seek AI-driven tools for real-time fault detection and enhanced safety monitoring, especially concerning trace contaminants that can damage equipment or compromise biomethane quality standards for grid injection. The consensus theme is that AI adoption is essential for moving the upgrading process from reactive control to proactive, self-optimizing operation, thereby maximizing profitability and asset lifespan.

- AI algorithms enable real-time analysis of inlet biogas composition, dynamically adjusting upgrading parameters (e.g., solvent regeneration cycles, PSA switching times) to maintain optimal methane purity and recovery efficiency.

- Predictive maintenance schedules are generated using machine learning models analyzing vibration data, pressure fluctuations, and temperature profiles, significantly reducing unexpected downtime and maintenance costs.

- AI optimizes energy consumption (parasitic load) by predicting required operational power based on forecasted biogas flow rates and seasonal temperature variations, leading to substantial reductions in overall operating expenses.

- Enhanced safety and regulatory compliance monitoring are achieved through AI flagging anomalous trace contaminant levels (e.g., siloxanes, H2S) faster than conventional control systems, preventing equipment corrosion or grid quality violations.

- Digital twins, powered by AI, allow operators to simulate operational changes and feedstock variations virtually before implementing them on the physical plant, optimizing design and operational strategies.

DRO & Impact Forces Of Biogas Upgrading Equipment Market

The Biogas Upgrading Equipment Market is strongly influenced by three primary forces: stringent governmental regulations (Driver), high initial capital expenditure (Restraint), and the emergence of innovative methanation technologies (Opportunity). The overarching Impact Force is the global mandate for decarbonization and the urgent need to utilize organic waste streams, compelling industries and municipalities to invest in RNG infrastructure. Specifically, the implementation of carbon taxes and supportive incentive schemes like tax credits or renewable portfolio standards drastically improve the economic feasibility of upgrading projects, providing a substantial market stimulus. Conversely, the high upfront cost associated with sophisticated separation systems (e.g., cryogenic or advanced membrane units) and the requirement for highly skilled technical personnel act as critical inhibitors, particularly for small-scale decentralized projects. The opportunity landscape is expanding rapidly through advancements in biological methanation and novel hybrid systems that offer lower operating costs and higher flexibility, positioning the market for sustained, technology-driven growth.

Segmentation Analysis

The Biogas Upgrading Equipment Market is comprehensively segmented based on the core Technology deployed for purification, the Source of the raw biogas feedstock, and the ultimate Application of the resulting high-purity biomethane. This multi-dimensional segmentation allows for a detailed analysis of market dynamics, revealing varying growth patterns across different technological approaches and end-user demands. The choice of upgrading technology is often dictated by the size of the project, the required purity level, and the specific composition and consistency of the inlet biogas, leading to intense competition and innovation within the technology segment.

From a technological standpoint, the market is broadly categorized into methods based on physiochemical separation, such as Pressure Swing Adsorption (PSA) and chemical absorption, and physical separation methods like membrane filtration and water scrubbing. The evolution within this segment is shifting towards highly efficient, less energy-intensive technologies that minimize methane slip and maximize recovery rates. The segmentation by Source (e.g., agricultural, municipal, industrial) highlights the diversification of raw material streams being processed, indicating market maturity beyond traditional wastewater treatment plants. Finally, the Application segmentation demonstrates a crucial pivot from localized heat and power towards global transportation fuel and utility grid monetization, which requires the highest levels of gas quality assurance and reliable operational performance.

- By Technology:

- Water Scrubbing

- Pressure Swing Adsorption (PSA)

- Membrane Separation

- Chemical Absorption (Amine Scrubbing)

- Cryogenic Separation

- Biological Methanation

- By Source:

- Agricultural Waste (Manure, Crop Residues)

- Municipal Solid Waste (Landfills, Wastewater Treatment Plants)

- Industrial Waste (Food Processing, Breweries)

- By Application:

- Transportation Fuel (Bio-CNG, Bio-LNG)

- Grid Injection

- Power Generation (CHP)

Value Chain Analysis For Biogas Upgrading Equipment Market

The value chain for the Biogas Upgrading Equipment Market is complex, beginning upstream with component manufacturers and specialized engineering firms and extending downstream through system integrators, project developers, and ultimately, the end-users (operators). Upstream analysis focuses on the suppliers of critical components such as specialized membranes, adsorbent materials (zeolites, activated carbon), high-pressure compressors, and gas analyzers. Innovation at this stage, particularly in membrane selectivity and adsorbent material lifespan, directly impacts the efficiency and cost-effectiveness of the entire upgrading system. Engineering, Procurement, and Construction (EPC) firms play a central role, integrating these components into functional, customized upgrading plants tailored to specific feedstock and required biomethane standards.

The midstream involves system integration and distribution channels. Equipment manufacturers act as direct distributors for large, complex projects, or they utilize value-added resellers and regional agents for market penetration into smaller, decentralized installations. Direct distribution ensures high technical competency during installation and commissioning, which is crucial given the complexity of the equipment. Indirect channels, involving engineering consultants and local construction partners, are utilized to extend geographical reach, often providing supplementary services such as financing advice and regulatory compliance assistance. This middle layer ensures that the sophisticated technology is appropriately sited, configured, and implemented according to regional technical standards and grid codes.

Downstream analysis focuses on the end-users and the monetization of the upgraded biomethane. End-users, including utilities, fleet operators, and independent power producers, drive demand based on the economic viability of RNG programs. The successful operation and profitability of upgrading equipment rely heavily on reliable after-sales service, including maintenance, spare parts supply, and remote monitoring capabilities provided by the original equipment manufacturers (OEMs). The distribution channels for the final product—the biomethane—typically involve pipeline injection or the establishment of dedicated fueling stations, tying the upgrading equipment value chain directly into the larger energy infrastructure ecosystem. The efficiency and reliability maintained throughout the value chain are paramount for securing long-term contracts for biomethane supply.

Biogas Upgrading Equipment Market Potential Customers

The primary consumers and end-users of Biogas Upgrading Equipment are diverse entities committed to sustainable waste management and renewable energy production. These customers can be broadly categorized into municipal authorities, which manage large volumes of sewage sludge and municipal solid waste via wastewater treatment plants (WWTPs) and landfills; agricultural operations, specifically large-scale farms and cooperatives that process animal manure and crop residues through anaerobic digesters; and industrial facilities, particularly those in the food and beverage, chemical, and paper sectors, generating organic-rich process wastewater.

Municipal customers are driven by regulatory obligations to reduce landfill gas emissions and seek cost-effective methods to generate energy from waste. For them, upgrading equipment transforms a disposal challenge into a revenue stream, either through electricity generation or, increasingly, through grid injection. Agricultural customers utilize upgrading systems to monetize surplus manure, addressing environmental concerns related to nutrient runoff while producing clean fuel. Industrial customers often deploy these systems to achieve energy independence and comply with corporate sustainability targets, leveraging waste heat and renewable gas for internal process requirements or selling excess biomethane back to the grid. Each customer segment requires bespoke solutions tailored to their specific feedstock variability and ultimate energy utilization strategy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.5 Billion |

| Market Forecast in 2033 | $4.8 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bright Biomethane, Air Liquide, Wartsila, Greenlane Renewables, Xebec Adsorption, DMT Environmental Technology, C-Power Energy Technology, Carbotech, Pentair, CleanGas Solutions, Guild Associates, Hitachi Zosen Inova, Malmberg, Prodeval, Veolia, Linde Engineering, EnviTec Biogas, Bio-CNG, AB Energy, SEPURAN. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Biogas Upgrading Equipment Market Key Technology Landscape

The technological landscape of biogas upgrading is characterized by several established methods and rapidly emerging innovations, all focused on efficiently separating CO2 from methane (CH4) while removing trace contaminants. The core challenge lies in achieving high methane recovery (minimizing methane slip) with low specific energy consumption (SEC). Established technologies like Water Scrubbing remain relevant for simpler, lower-capacity plants, utilizing water solubility differences, though they are often penalized for high water usage and potential methane losses. Pressure Swing Adsorption (PSA) utilizes specialized solid adsorbents that selectively capture CO2 and other impurities under pressure, offering high purity levels but potentially higher energy demands for vacuum regeneration cycles, making it highly dependent on the quality and lifespan of the adsorbent material.

Membrane Separation is rapidly gaining market share due to its modular design, low energy requirements, and absence of chemical usage. This technology employs polymer membranes that selectively permeate CO2, allowing high-purity methane to pass through. Continuous innovation is focused on developing next-generation membranes with improved selectivity and resistance to trace contaminants like siloxanes and H2S, which can foul the membrane surface. Hybrid systems are also becoming prominent, combining, for instance, membrane separation with cryogenic chilling to achieve ultra-high purity (>99% CH4), necessary for high-value applications like Liquefied Biomethane (LBM) used in maritime or long-haul transport.

The emerging field of Biological Methanation presents a disruptive technology that converts CO2 and externally sourced renewable hydrogen (H2) directly into methane using specialized microorganisms. This process not only purifies the biogas but also significantly increases the overall biomethane yield, effectively converting the waste CO2 into valuable product gas. While still nascent and requiring robust scaling solutions, biological methanation offers the potential to link biogas production directly with Power-to-Gas (P2G) concepts, utilizing surplus renewable electricity to generate hydrogen and synthesize high-grade RNG, positioning it as a key technology for future energy system integration and deep decarbonization efforts.

Regional Highlights

- Europe: Europe is the established leader in the Biogas Upgrading Equipment Market, driven by the ambitious goals set by the Renewable Energy Directive (RED II) and extensive natural gas pipeline infrastructure conducive to grid injection. Countries such as Germany, Sweden, France, and the Netherlands have well-developed biomethane markets supported by high feed-in tariffs and favorable legislative frameworks promoting anaerobic digestion and RNG usage. The regional focus is shifting towards maximizing the utilization of agricultural residues and reducing greenhouse gas emissions from manure management, leading to high demand for advanced, efficient upgrading technologies like PSA and membranes to meet strict gas quality specifications for transnational grid access.

- North America (NA): North America, particularly the United States, represents the fastest-growing market segment, primarily propelled by federal programs such as the Renewable Fuel Standard (RFS) and California’s Low Carbon Fuel Standard (LCFS). These incentives create substantial economic value for RNG derived from landfills, dairies, and wastewater treatment plants. The focus in this region is on large-scale upgrading projects, especially those producing Bio-CNG/LNG for heavy-duty trucking fleets. The market sees intense activity among equipment manufacturers providing robust, scalable solutions that can handle the often high variability in landfill gas composition while adhering to rigorous standards for vehicle fuel quality.

- Asia Pacific (APAC): The APAC region, led by China and India, is poised for significant future growth, spurred by rapid industrialization, increasing energy demand, and mounting challenges associated with urban solid waste management. While the current market size is smaller than Europe, government initiatives aimed at promoting decentralized waste treatment and rural energy access are stimulating demand. Market penetration is currently dominated by less complex, cost-effective technologies like water scrubbing, but there is a growing interest in adopting advanced membrane and PSA systems as regulatory standards for gas purity begin to tighten and project sizes increase, aiming to utilize upgraded gas for cooking and local power generation.

- Latin America, Middle East, and Africa (LAMEA): These regions present nascent but high-potential markets. Latin America, particularly Brazil and Argentina, is focusing on utilizing agricultural and agro-industrial residues, with nascent regulatory frameworks beginning to support RNG production. The Middle East and Africa are starting to explore biogas utilization as part of diversification away from fossil fuels and addressing significant municipal waste challenges. Growth here is dependent on stable political support, securing international project financing, and deploying modular, easily deployable upgrading units suitable for varied infrastructure conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Biogas Upgrading Equipment Market.- Bright Biomethane

- Air Liquide

- Wartsila

- Greenlane Renewables

- Xebec Adsorption

- DMT Environmental Technology

- C-Power Energy Technology

- Carbotech

- Pentair

- CleanGas Solutions

- Guild Associates

- Hitachi Zosen Inova

- Malmberg

- Prodeval

- Veolia

- Linde Engineering

- EnviTec Biogas

- Bio-CNG

- AB Energy

- SEPURAN

Frequently Asked Questions

Analyze common user questions about the Biogas Upgrading Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most energy-efficient technology for biogas upgrading?

Membrane separation and advanced Pressure Swing Adsorption (PSA) are generally considered the most energy-efficient technologies for biogas upgrading, especially when implemented in optimized, multi-stage configurations. Membrane systems consume minimal external energy, primarily for compression, while minimizing heat input, leading to low specific energy consumption (SEC) per cubic meter of biomethane produced.

How does the quality of the raw biogas feedstock affect the upgrading process?

Feedstock quality significantly influences the upgrading process, primarily impacting the concentration of methane, CO2, and harmful trace contaminants like H2S and siloxanes. High levels of contaminants require more intensive pretreatment steps (e.g., desulfurization, activated carbon filtration), increasing operational costs and potentially shortening the lifespan of upgrading components, such as membranes or adsorbents.

What is Renewable Natural Gas (RNG) and how is it related to biogas upgrading?

Renewable Natural Gas (RNG) is pipeline-quality biomethane produced by upgrading raw biogas. Biogas upgrading equipment removes impurities like CO2 to ensure the methane purity meets stringent specifications (typically >97% CH4) required for injection into the existing natural gas grid or use as transportation fuel, making RNG functionally identical to fossil natural gas.

Which regulatory incentives are major drivers for the Biogas Upgrading Market in North America?

The primary regulatory incentives driving the North American market are the U.S. Renewable Fuel Standard (RFS), which generates tradable Renewable Identification Numbers (RINs), and the California Low Carbon Fuel Standard (LCFS). These programs assign high carbon intensity credits to RNG projects, significantly enhancing project economics and return on investment.

What role does methane slip reduction play in the economic viability of upgrading equipment?

Methane slip—the unintentional loss of methane into the CO2 exhaust stream—directly impacts the economic viability of a plant. High methane recovery rates (ideally >99%) are critical because methane is the primary value product; minimizing slip ensures maximum yield and minimizes greenhouse gas emissions associated with the upgrading process, aligning with environmental compliance and maximizing revenue generation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager