Bioinks Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435085 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Bioinks Market Size

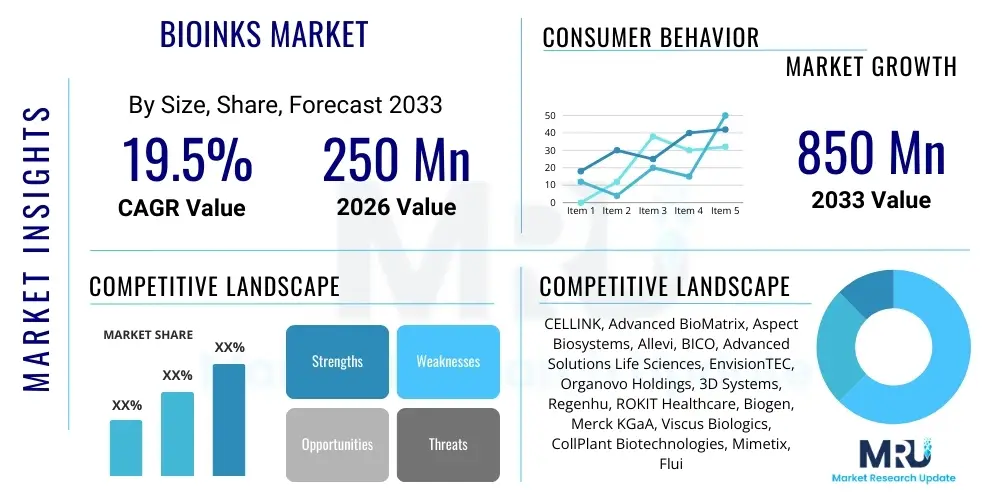

The Bioinks Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 19.5% between 2026 and 2033. The market is estimated at $250 Million in 2026 and is projected to reach $850 Million by the end of the forecast period in 2033.

Bioinks Market introduction

The Bioinks Market encompasses specialized biomaterials formulated for use in bioprinting technologies, serving as the foundational building blocks for creating functional 3D tissue constructs and organ models. Bioinks are typically composed of biocompatible polymers, hydrogels, and living cells, engineered to mimic the physicochemical properties of the native extracellular matrix (ECM). These materials are crucial because they provide the necessary mechanical support, biochemical cues, and physiological environment required for cell viability, proliferation, and differentiation during and after the bioprinting process. The quality and composition of bioinks directly determine the resolution, structural integrity, and biological function of the printed construct, positioning them at the forefront of regenerative medicine and pharmaceutical research. Key applications span across complex fields such as tissue engineering, where they are used to fabricate skin, cartilage, and even vascular structures, and drug development, where high-fidelity models enable superior preclinical testing and toxicity screening.

Product descriptions of bioinks are highly diverse, ranging from natural polymers like collagen, gelatin, alginate, and hyaluronic acid, known for their inherent biocompatibility and bioactivity, to synthetic polymers such as polyethylene glycol (PEG) and polycaprolactone (PCL), valued for their tunable mechanical properties and precise control over degradation rates. Hybrid bioinks, combining the best attributes of both natural and synthetic components, are gaining traction, offering enhanced printability, structural fidelity, and long-term biological function. The development cycle for new bioinks focuses intensely on optimizing rheological properties—specifically viscosity and shear-thinning behavior—to ensure smooth extrusion through fine nozzles without damaging encapsulated cells, a critical parameter for maintaining high cell viability post-printing. Furthermore, the crosslinking mechanism (photopolymerization, ionic crosslinking, or thermal gelation) is a defining feature, impacting both the ease of use during the printing process and the stability of the final construct.

The principal benefits driving market expansion include the ability to fabricate patient-specific tissues, significantly accelerating the adoption of personalized medicine approaches. Bioinks facilitate the creation of complex, multi-cellular architectures that more accurately replicate human physiology compared to traditional 2D cell cultures, thereby improving the predictive power of in vitro models for drug efficacy and toxicology studies. Major driving factors include substantial government and private funding in regenerative medicine and 3D bioprinting research, rapid advancements in bioprinter hardware capabilities (such as higher resolution and multi-material printing), and the growing ethical imperative to reduce reliance on animal testing. The confluence of these technological advancements and clinical demands solidifies the strategic importance of high-performance bioinks in the future biomedical landscape.

Bioinks Market Executive Summary

The global Bioinks Market is undergoing robust expansion, driven primarily by technological convergence in materials science, biology, and advanced manufacturing. Key business trends indicate a strong move towards hybrid and custom bioink formulations designed for specific bioprinting modalities, such as extrusion, inkjet, and laser-assisted bioprinting. Major industry players are focusing on strategic collaborations with academic institutions and specialized biotech firms to accelerate R&D and commercialize next-generation bioinks that offer improved mechanical strength and bioactivity suitable for complex organ printing. Furthermore, the competitive landscape is shifting towards integrating sophisticated software solutions with bioink products to provide standardized printing protocols, addressing a major restraint related to reproducibility and quality control across different research settings. Investment in automated bioink production systems is also a prominent trend aimed at scaling up manufacturing processes for clinical and industrial applications.

Regional trends highlight North America and Europe as dominant forces, primarily due to well-established research infrastructures, high levels of funding for regenerative medicine, and the presence of numerous key market players and pioneering bioprinting companies. The United States, in particular, leads in adopting advanced bioprinting techniques for drug discovery applications. Asia Pacific (APAC) is emerging as the fastest-growing region, propelled by increasing healthcare expenditure, supportive governmental initiatives in biotechnology development, and a rising focus on medical tourism and stem cell research in countries like China, South Korea, and Japan. Latin America and the Middle East & Africa (MEA) currently represent nascent markets, but they are expected to experience gradual growth supported by expanding research collaborations and efforts to modernize local healthcare systems, particularly in large economies seeking self-sufficiency in high-tech medical device manufacturing and personalized therapies.

Segmentation trends reveal that natural polymer-based bioinks (such as gelatin and alginate) currently hold a substantial market share due to their proven biocompatibility and ease of processing, though synthetic bioinks are rapidly gaining ground due to their superior structural tunability and consistency. The application segment is dominated by tissue engineering, encompassing the creation of functional replacements for bone, cartilage, and vascular tissues, representing the largest revenue generator. However, the drug screening and toxicology testing segment is projected to exhibit the highest Compound Annual Growth Rate (CAGR) as pharmaceutical companies increasingly rely on 3D bioprinted models to enhance the speed and accuracy of preclinical drug development pipelines. End-user analysis underscores academic and research institutions as the primary consumers, although the impending commercialization of clinical bioprinting products is expected to significantly boost demand from hospitals and biotechnology firms within the forecast period.

AI Impact Analysis on Bioinks Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Bioinks Market commonly revolve around themes such as accelerated material discovery, optimization of printing parameters, standardization challenges, and the potential for AI to design novel, previously unattainable bioink formulations. Key concerns include the necessity for extensive, standardized datasets to train effective AI models, the computational complexity associated with modeling multi-component biological systems, and the validation of AI-designed materials for biocompatibility and clinical safety. Users are highly expectant that AI will revolutionize the customization of bioinks, allowing for fine-tuning of rheology, mechanical strength, and degradation kinetics specifically for individual patients or complex tissue architectures. The consensus is that AI will transform bioink R&D from a largely empirical process into a highly predictive and rapid design cycle, fundamentally changing how new materials are discovered, validated, and manufactured for bioprinting applications.

The integration of machine learning and deep learning algorithms allows researchers to analyze vast datasets relating material properties (chemical composition, molecular weight, crosslinking density) to resulting printability and cellular response. This predictive modeling capability significantly cuts down the time and cost associated with iterative laboratory experimentation. For instance, AI algorithms can efficiently screen thousands of potential polymer combinations and predict their suitability as bioinks, optimizing variables like viscosity and gelation time necessary for specific bioprinter hardware. This shift towards data-driven material selection ensures higher quality, consistency, and reproducibility, which are critical hurdles in scaling bioprinting technologies for clinical use. Furthermore, AI facilitates the personalization of bioinks by integrating patient-specific data, such as medical imaging and cell characteristics, to design bespoke formulations that maximize tissue integration and functional outcome.

The deployment of AI in controlling the bioprinting process itself is equally impactful. Real-time monitoring systems enhanced by computer vision and machine learning can adjust printing parameters dynamically (e.g., nozzle speed, pressure, temperature) to compensate for minor variations in bioink batches or environmental conditions, ensuring the structural integrity of the printed construct. This precise process control, managed by intelligent algorithms, is paramount for achieving regulatory compliance and moving bioprinted constructs from the laboratory bench to the commercial clinical setting. Overall, AI is viewed not merely as an efficiency tool but as a transformative engine enabling the creation of advanced, multi-functional bioinks and complex tissue structures that were previously technologically infeasible, thereby accelerating the timeline for achieving viable bioprinted organs and complex drug models.

- AI-driven optimization of bioink rheology and printability parameters.

- Machine learning for accelerated discovery and screening of novel, multi-component bioink formulations.

- Predictive modeling of cellular response and long-term tissue function based on material composition.

- Real-time quality control and dynamic process adjustment during bioprinting using AI-powered monitoring.

- Enhanced data standardization and reproducibility across different bioink manufacturing batches.

- Development of patient-specific bioink formulations integrated with medical data.

DRO & Impact Forces Of Bioinks Market

The Bioinks Market dynamics are heavily influenced by a multifaceted set of Drivers, Restraints, and Opportunities (DRO), which collectively dictate the direction and pace of market evolution. Key drivers include the exponential growth in demand for personalized medicine and patient-specific implants, which necessitate bioprinting solutions and, consequently, high-fidelity bioinks capable of encapsulating and supporting complex cellular structures. The continuous technological breakthroughs in 3D bioprinting hardware—offering increased resolution, faster printing speeds, and the capacity for multi-material printing—directly fuel the need for advanced, specialized bioink materials. Furthermore, substantial public and private investments globally focused on regenerative medicine, organ transplantation alternatives, and developing complex human-on-a-chip models are significant market accelerators, creating a sustainable funding environment for bioink research and commercialization efforts. These driving forces solidify the market's trajectory towards becoming a cornerstone technology in future healthcare solutions.

However, the market faces considerable restraints that temper rapid widespread adoption. The foremost constraint is the prohibitive cost associated with both high-quality, clinical-grade bioinks and the complex bioprinting equipment required for their utilization, making the technology often inaccessible to smaller research laboratories or developing economies. A critical technical challenge remains the lack of standardized protocols for bioink formulation, characterization, and quality assurance, leading to significant variability in experimental results and hindering regulatory approval processes. Moreover, achieving the perfect balance of printability, mechanical integrity, and long-term biological functionality remains a material science hurdle, as many current bioinks lack the strength and stability required for viable, load-bearing clinical implants. Addressing these standardization and cost issues is essential for unlocking the full commercial potential of the bioinks sector.

Opportunities for market players are substantial, particularly in the realm of advanced material science and application diversification. The growing focus on developing functional organ-on-a-chip and human-on-a-chip platforms for drug testing presents a lucrative niche for specialized, high-throughput bioinks optimized for microfluidic systems. The integration of nanotechnology into bioink formulations to enhance conductivity, mechanical properties, or drug-delivery capabilities offers a significant competitive edge. Furthermore, the transition of bioprinting from research tools to clinical products, such as bio-printed skin substitutes or cartilage repair patches, will open massive commercial avenues. Successfully overcoming regulatory challenges through robust standardization and generating compelling clinical evidence will be the primary impact forces propelling market leaders forward, ensuring that the innovation cycle continues to meet stringent clinical requirements and capitalize on the shift towards synthetic biology integration.

Segmentation Analysis

The Bioinks Market is comprehensively segmented based on material type, application, and end-user, reflecting the diverse requirements and technological approaches utilized within the bioprinting ecosystem. Material segmentation distinguishes between natural polymers, which are biologically intuitive but often mechanically weak; synthetic polymers, which offer superior tunability and mechanical strength but require careful modification for biocompatibility; and hybrid bioinks, representing the cutting-edge of material science by combining the best attributes of both classes to optimize printability and long-term tissue function. Application segmentation reveals the immediate utility of bioinks in critical fields ranging from foundational tissue repair to advanced pharmaceutical modeling, while end-user segmentation highlights the current research-heavy dominance transitioning toward clinical commercialization.

Analyzing these segments provides strategic insights into investment priorities. For instance, the demand for synthetic and hybrid bioinks is accelerating due to the need for mechanically robust constructs suitable for complex tissues like bone and muscle, indicating strong future growth potential in these sub-segments. Conversely, the high adoption rate of natural bioinks in drug screening underscores their immediate utility for non-load-bearing, high-throughput applications where cellular viability and biochemical signaling are paramount. Understanding these nuanced preferences allows manufacturers to tailor product development and marketing efforts towards the most receptive and high-growth sectors, ensuring alignment with the rapidly evolving demands of regenerative medicine researchers and pharmaceutical scientists globally.

The inherent versatility and necessary specialization of bioinks mandate this detailed segmentation approach. Each bioprinting technique (e.g., extrusion, droplet-based, light-based) requires specific rheological properties, meaning manufacturers must offer a broad portfolio. The market's success hinges on providing tailored materials that maintain high cell viability while achieving the required structural complexity and mechanical properties for the target application, be it developing complex vasculature models or fabricating therapeutic tissue patches ready for in vivo implantation. This high degree of customization inherent in the product ensures ongoing segmentation growth and specialization within the materials offering.

- By Material Type:

- Natural Bioinks (Alginate, Gelatin, Collagen, Fibrin, Hyaluronic Acid)

- Synthetic Bioinks (PLA, PEG, PCL, Pluronic)

- Hybrid Bioinks

- By Application:

- Tissue Engineering (Skin, Bone, Cartilage, Vascular, Cardiac)

- Drug Screening and Toxicology Testing

- Regenerative Medicine

- Cosmetics

- Food and Environmental Testing

- By End-User:

- Academic and Research Institutes

- Pharmaceutical and Biotechnology Companies

- Hospitals and Diagnostic Centers

- By Bioprinting Technology:

- Extrusion-Based Bioprinting

- Inkjet-Based Bioprinting

- Laser-Assisted Bioprinting

Value Chain Analysis For Bioinks Market

The Bioinks Market value chain is complex, starting with the sourcing and purification of high-purity raw materials, extending through specialized manufacturing and formulation, and concluding with highly specific distribution channels reaching research facilities and clinical end-users. Upstream analysis focuses on the acquisition of high-grade polymers, natural matrix components (like collagen or alginate), and specialized cell culture reagents. Raw material procurement demands stringent quality control to ensure batch-to-batch consistency and high biological purity, as contaminants can severely compromise cell viability and experimental reproducibility. Suppliers in this phase are often specialized chemical or biological material providers, emphasizing quality metrics such as sterility, low endotoxin levels, and defined molecular characteristics. Efficiency in the upstream phase is critical, as the purity of initial components directly influences the final bioink product's performance and market acceptance.

The central phase involves the manufacturing and formulation of the bioink itself, where materials science expertise is paramount. This includes optimizing the material's rheological properties (viscosity, yield stress) for specific bioprinting technologies, incorporating necessary crosslinking agents (photoinitiators, ionic buffers), and packaging the product in sterile, ready-to-use formats. This stage also includes the rigorous testing of printability, cell compatibility, and mechanical properties. Downstream analysis focuses on reaching the end-user. Distribution channels are highly specialized, often relying on direct sales teams for customized technical support and cold-chain logistics due to the temperature-sensitive nature of many bioink formulations. Indirect channels include specialized life science distributors and e-commerce platforms catering specifically to the research community, providing global reach while maintaining compliance with biological material handling regulations.

The interaction between manufacturers and end-users in the value chain is typically characterized by high technical consultation, as the application of bioinks often requires expert guidance on optimal printer settings and scaffold design. Direct distribution is favored by leading companies to maintain tight control over product quality, supply chain integrity, and to capture valuable feedback for continuous product iteration. Furthermore, the role of regulatory bodies impacts the entire chain, from defining purity standards for raw materials to approving the final bioprinted constructs for clinical trials, thereby adding several layers of complexity and specialized oversight not typically seen in standard chemical manufacturing. This integrated technical and regulatory involvement defines the competitive dynamics of the bioinks value chain.

Bioinks Market Potential Customers

The primary customer base for the Bioinks Market consists of institutions and organizations heavily invested in advanced biological research, drug discovery, and regenerative medicine development. Leading potential customers include academic research institutions and university laboratories worldwide, which utilize bioinks extensively for fundamental studies in cell biology, tissue morphogenesis, and scaffold design. These institutions drive demand for novel, experimental bioink formulations and require flexibility in material choices to support diverse research projects, making them high-volume consumers of research-grade materials. The demand here is often cyclical, aligning with major grant funding cycles, focusing on proof-of-concept studies and the initial validation of bioprinted tissues for various applications including cardiac, neural, and musculoskeletal systems.

Pharmaceutical and biotechnology companies represent the fastest-growing segment of potential customers. These corporate end-users leverage bioinks to create sophisticated 3D models (such as organ-on-a-chip and tumoroids) that mimic human disease states more accurately than traditional 2D assays. This enhances the predictability and efficiency of drug efficacy testing, toxicology screening, and personalized drug development, significantly reducing time and costs in preclinical trials. Their requirements are stringent, demanding high batch consistency, scalable production capability, and bioinks optimized for automation and high-throughput screening methodologies. Furthermore, biotechnology firms specializing in cell therapy and engineered tissues are crucial customers, seeking clinical-grade bioinks for therapeutic product development aiming for eventual human implantation.

Hospitals and diagnostic centers, particularly those associated with advanced clinical research and personalized medicine initiatives, are emerging as significant potential buyers. As bioprinting technologies mature and move toward point-of-care manufacturing (e.g., printing skin grafts directly at the burn unit), the demand for certified, clinical-grade bioinks designed for immediate therapeutic use will surge. Other niche potential customers include cosmetics companies using 3D bioprinted skin models for safety testing, and food technology startups exploring bioprinted meat alternatives, demonstrating the expanding, cross-industry applicability of bioink technology beyond traditional medical applications. The continuous evolution of clinical trial data regarding bioprinted implants will heavily influence the purchasing decisions and requirements of the hospital segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $250 Million |

| Market Forecast in 2033 | $850 Million |

| Growth Rate | 19.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CELLINK, Advanced BioMatrix, Aspect Biosystems, Allevi, BICO, Advanced Solutions Life Sciences, EnvisionTEC, Organovo Holdings, 3D Systems, Regenhu, ROKIT Healthcare, Biogen, Merck KGaA, Viscus Biologics, CollPlant Biotechnologies, Mimetix, FluidForm, Bio-Rad Laboratories, Sartorius AG, Nano3D Biosciences |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bioinks Market Key Technology Landscape

The technological landscape of the Bioinks Market is dynamically shaped by the evolution of bioprinting techniques and advancements in polymer and material science, focusing on achieving precise control over cellular microenvironments. Extrusion-based bioprinting remains the dominant technology, requiring bioinks with high viscosity and shear-thinning properties to allow smooth deposition while maintaining structural integrity upon contact with the substrate. Inkjet-based bioprinting, conversely, demands low-viscosity, non-clogging formulations capable of high-resolution droplet formation, often limiting the concentration of encapsulated cells. Laser-assisted bioprinting (LAB) represents a high-resolution, yet complex, method that requires bioinks to form thin sacrificial layers or specialized absorbing materials for precise energy transfer, pushing the boundaries of material engineering for ultra-fine feature printing and multi-cell patterning.

A crucial technological focus is on the mechanism of crosslinking, which determines how the printed bioink solidifies to form a stable scaffold. Photopolymerizable bioinks, utilizing photoinitiators activated by UV or visible light (such as methacrylated gelatin, or GelMA), are increasingly popular due to their rapid gelation time and spatial control, which is essential for maintaining cell viability during printing. Ionic crosslinking, frequently used with alginate, provides a gentler alternative but often results in lower mechanical strength. The industry is rapidly adopting technologies to functionalize bioinks, incorporating specific biomolecules, growth factors, and nanomaterials directly into the polymer matrix. This functionalization aims to improve cell-material interaction, guide cellular differentiation, and enhance vascularization potential within the printed construct, moving beyond simple structural support to active biological signaling.

The integration of advanced characterization techniques, such as rheometers and high-speed microscopy, is paramount for quality control in bioink manufacturing, ensuring that batches meet stringent specifications for viscosity, yield stress, and elasticity before commercial use. Furthermore, the development of multi-material and gradient bioinks, which allow for the printing of heterogeneous tissues that better mimic complex native structures (like bone-cartilage interfaces), represents a significant technological leap. These cutting-edge material combinations, often coupled with sophisticated multi-nozzle or multi-head bioprinters, drive the commercial value proposition by enabling the creation of intricate, multi-layered constructs necessary for developing fully functional organ models and advanced therapeutic solutions, thereby expanding the entire market's potential applications.

Regional Highlights

- North America: North America, particularly the United States, holds the largest market share in the global Bioinks Market, primarily driven by substantial government and private sector investment in regenerative medicine and biomedical research. The region benefits from a robust ecosystem of leading biotechnology firms, academic research centers, and sophisticated regulatory frameworks that facilitate clinical trials and commercialization of advanced therapeutic products. High healthcare expenditure, coupled with an early adoption rate of 3D bioprinting technology in pharmaceutical R&D for drug screening, solidifies the region's dominance. Innovation in hybrid and synthetic bioink development, focused on achieving mechanically superior constructs suitable for complex tissue engineering, is concentrated heavily within this region. The large presence of key opinion leaders and major market players ensures continuous technological advancement and market penetration.

- Europe: Europe represents the second-largest market, characterized by strong funding for science and innovation through initiatives like Horizon Europe, particularly in countries such as Germany, the UK, and Switzerland. European researchers are highly active in biomaterials science, focusing on regulatory challenges and the standardization of bioinks for potential clinical use, often emphasizing natural polymer derivations and smart bioinks. The regulatory landscape, though complex, is proactively addressing the introduction of bioprinted medical devices, fostering an environment where small and medium-sized enterprises (SMEs) can thrive by specializing in niche bioink formulations for niche applications like personalized drug toxicology studies and orthopedic implants. Collaboration between clinical institutions and technology developers is a defining feature of the European market dynamic.

- Asia Pacific (APAC): The APAC region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid growth is attributed to increasing healthcare investments, expanding biotechnology research capabilities in China, Japan, and South Korea, and supportive governmental policies aimed at developing domestic high-tech industries. China, in particular, is emerging as a critical growth engine, investing heavily in bioprinting infrastructure and material science to compete globally. The market in APAC is driven by the urgent need for accessible tissue engineering solutions and a rapidly expanding patient pool requiring advanced medical interventions, leading to significant demand for cost-effective and scalable bioink manufacturing solutions. South Korea and Japan are leaders in applying bioinks to stem cell research and regenerative aesthetics.

- Latin America (LATAM) and Middle East & Africa (MEA): LATAM and MEA currently possess smaller market shares but are expected to exhibit steady growth, largely spurred by international collaborations, improving healthcare infrastructure, and initial technology transfer agreements. In LATAM, countries like Brazil are seeing increasing academic interest and localized research funding for bioprinting applications. In the MEA region, particularly in high-income Gulf countries, investments are focused on establishing specialized medical research hubs and centers of excellence, driving preliminary demand for high-end bioink materials and advanced bioprinting equipment for localized drug discovery and personalized treatment programs. Growth here is dependent on regulatory maturity and sustained government commitment to advanced biomedical technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bioinks Market.- CELLINK

- Advanced BioMatrix

- Aspect Biosystems

- Allevi

- BICO

- Advanced Solutions Life Sciences

- EnvisionTEC

- Organovo Holdings

- 3D Systems

- Regenhu

- ROKIT Healthcare

- Biogen

- Merck KGaA

- Viscus Biologics

- CollPlant Biotechnologies

- Mimetix

- FluidForm

- Bio-Rad Laboratories

- Sartorius AG

- Nano3D Biosciences

Frequently Asked Questions

Analyze common user questions about the Bioinks market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary types of materials used in bioinks?

The primary types include natural polymers like collagen, gelatin, alginate, and hyaluronic acid, known for their biocompatibility; synthetic polymers such as PEG and PCL, valued for their mechanical tunability; and hybrid bioinks, which combine the strengths of both natural and synthetic components to optimize printability and biological function for complex tissue engineering applications.

How does the rheology of a bioink influence its effectiveness in bioprinting?

Bioink rheology, specifically its viscosity and shear-thinning behavior, is critical because it dictates printability. For successful bioprinting, the bioink must flow smoothly through the nozzle under pressure (low viscosity during extrusion) but rapidly solidify or gel post-deposition (high viscosity at rest) to maintain the desired structural fidelity and protect encapsulated cells from excessive shear stress damage.

Which application segment holds the largest potential for bioink market revenue?

Tissue Engineering currently holds the largest revenue potential, driven by extensive research and development focused on fabricating functional substitutes for various tissues, including bone, cartilage, and vascular structures. However, the Drug Screening and Toxicology Testing segment is projected to show the highest CAGR due to rapid pharmaceutical adoption of 3D bioprinted models for preclinical testing.

What major challenges impede the commercialization of bioinks for clinical use?

Major challenges include the lack of industry-wide standardization regarding bioink formulation and testing protocols, the high cost of clinical-grade materials, and the persistent difficulty in developing bioinks that offer the necessary mechanical robustness and long-term in vivo stability required for load-bearing clinical implants or complex organ fabrication.

How is Artificial Intelligence (AI) transforming the development of new bioinks?

AI transforms bioink development by enabling accelerated material discovery, using machine learning to analyze correlations between chemical composition and biological performance, thereby predicting optimal formulations. AI also optimizes bioprinting parameters in real-time and aids in standardizing manufacturing processes, significantly enhancing the speed and reproducibility of bioink production.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager