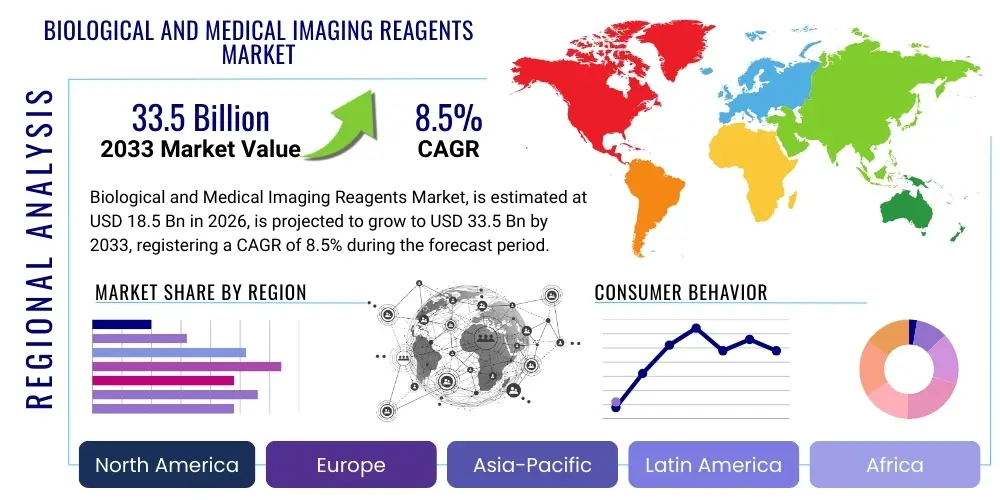

Biological and Medical Imaging Reagents Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435582 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Biological and Medical Imaging Reagents Market Size

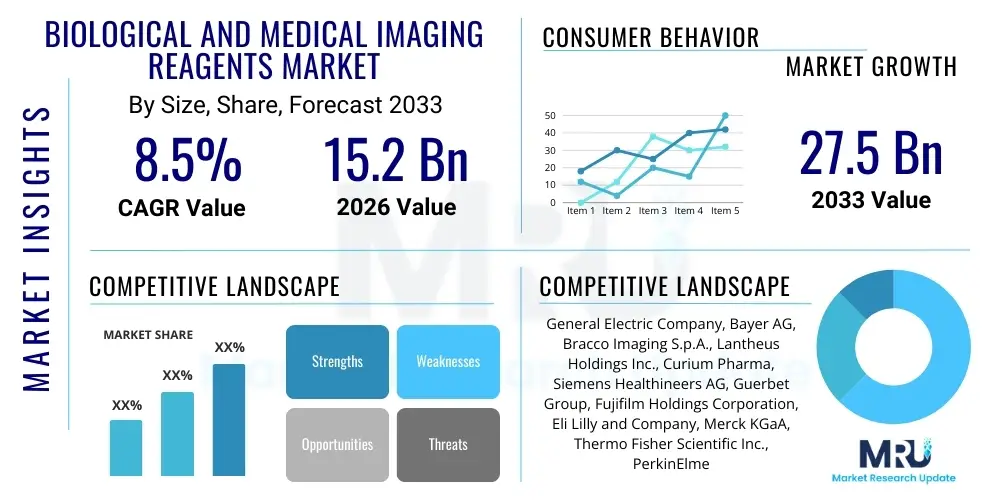

The Biological and Medical Imaging Reagents Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 15.2 Billion in 2026 and is projected to reach USD 27.5 Billion by the end of the forecast period in 2033.

Biological and Medical Imaging Reagents Market introduction

The Biological and Medical Imaging Reagents Market encompasses a diverse range of chemical compounds and biological agents critical for visualizing internal structures, physiological processes, and molecular targets within living organisms and biological samples. These reagents, which include contrast agents, radiotracers, fluorescent probes, and staining kits, are essential tools in clinical diagnostics, preclinical drug discovery, and fundamental biological research. The primary objective of these products is to enhance the contrast and specificity of imaging modalities such such as Magnetic Resonance Imaging (MRI), Positron Emission Tomography (PET), Computed Tomography (CT), ultrasound, and fluorescence microscopy, thereby enabling accurate disease detection, staging, and monitoring therapeutic efficacy. The increasing global prevalence of chronic diseases, particularly cardiovascular disorders and cancer, serves as a fundamental market driver, necessitating advanced and non-invasive diagnostic capabilities that these specialized reagents facilitate.

The market growth is intrinsically linked to advancements in molecular imaging technologies, which provide unprecedented insights into complex biological pathways at the cellular and subcellular level. Novel reagents are continuously being developed to target specific biomarkers associated with inflammation, tumor hypoxia, and neurological disorders. For instance, the development of targeted contrast agents allows for the specific accumulation of the visualization substance at the site of pathology, minimizing background noise and improving diagnostic sensitivity. Furthermore, the integration of multimodal imaging techniques, which utilize multiple types of reagents simultaneously, is gaining traction, providing comprehensive data sets for complex clinical scenarios. This pursuit of higher resolution, greater sensitivity, and improved safety profiles is fueling significant investment in research and development across the pharmaceutical and biotechnology sectors.

Major applications of these reagents span across oncology, cardiology, neurology, and immunology. In oncology, imaging reagents are indispensable for identifying primary tumors, detecting metastases, and assessing early responses to chemotherapy or immunotherapy. The benefits derived from the utilization of these specialized chemical and biological tools include improved patient outcomes through earlier and more precise diagnosis, reduction in the need for invasive procedures, and acceleration of the drug development lifecycle. Key driving factors include the aging global population, which correlates with a higher incidence of age-related illnesses, rising healthcare expenditure in developing economies, and regulatory approvals for new, highly efficient imaging tracers and contrast media with favorable safety profiles, continually expanding the clinical utility of medical imaging.

Biological and Medical Imaging Reagents Market Executive Summary

The Biological and Medical Imaging Reagents Market is experiencing robust expansion, primarily driven by significant technological innovations in molecular imaging and increasing clinical demand for minimally invasive diagnostic procedures. Business trends indicate a strong focus on strategic mergers and acquisitions among key market players, aimed at consolidating intellectual property in specialized areas such as radioisotope production and targeted fluorescent probe development. Furthermore, pharmaceutical companies are increasingly collaborating with diagnostic imaging firms to co-develop companion diagnostics that rely heavily on novel imaging reagents, ensuring that drug efficacy and safety can be monitored effectively throughout clinical trials. The market is shifting towards personalized medicine, where imaging reagents are tailored to identify specific patient characteristics and disease subtypes, enhancing treatment effectiveness and reducing systemic toxicity. This commercial push towards specificity and precision dictates the research and development priorities for the next decade.

Regionally, North America maintains its dominance due to high healthcare spending, early adoption of advanced imaging technologies, and the presence of major pharmaceutical and biotechnology hubs. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), fueled by rapidly expanding healthcare infrastructure, increasing awareness regarding early disease diagnosis, and favorable government initiatives promoting foreign investment in medical technology. Countries like China, India, and Japan are investing heavily in establishing advanced research facilities and clinical imaging centers, dramatically increasing the demand for high-quality biological and medical imaging reagents. Regulatory harmonization efforts across major economic blocs are also streamlining the approval processes for novel reagents, contributing positively to market accessibility and growth across diverse geographies.

Segmentation trends highlight the increasing prominence of nuclear medicine reagents, particularly PET tracers, due to their superior sensitivity in functional and molecular imaging, especially in oncological applications. Within the reagent type segment, contrast agents remain dominant due to their widespread use in standard modalities like MRI and CT, although fluorescent probes are rapidly gaining ground, particularly in intraoperative surgical guidance and cellular biology research. End-user analysis reveals that hospitals and diagnostic centers constitute the largest segment, driven by the volume of clinical procedures performed. However, the academic and research institutes segment is crucial for driving innovation and adopting cutting-edge, experimental reagents for preclinical studies, suggesting continuous market evolution fueled by academic research output and subsequent commercialization.

AI Impact Analysis on Biological and Medical Imaging Reagents Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Biological and Medical Imaging Reagents Market frequently revolve around three core themes: enhancement of imaging data interpretation, acceleration of new reagent discovery and optimization, and efficiency improvements in clinical workflow. Users express significant interest in how AI algorithms, specifically deep learning models, can be trained on reagent-enhanced images to detect subtle patterns invisible to the human eye, thereby improving diagnostic accuracy and reducing inter-observer variability. Concerns often center on the validation and regulatory approval pathways for AI-assisted diagnostic tools that rely on specific reagents, and the potential for AI to displace conventional radiological review processes. The consensus expectation is that AI will act as a force multiplier, making existing reagents more effective and speeding up the identification of 'next-generation' targeting molecules with enhanced efficacy and lower toxicity profiles. This synthesis of chemical biology and computational power is fundamentally reshaping the development landscape.

AI's primary influence is expected in the optimization phase of reagent usage and image processing. By automating the quality control of contrast agent administration and standardizing image acquisition protocols, AI minimizes technical variability, ensuring that the diagnostic utility of the reagent is maximized. Furthermore, AI-driven quantitative analysis can extract precise metrics from molecular images, such as tracer uptake rates and distribution volumes, which are crucial for pharmacokinetics studies and personalized dosing strategies. This capability transforms the raw image data from a qualitative visual tool into a precise, quantitative biomarker, substantially increasing the value derived from the initial investment in the specialized imaging reagent. This shift necessitates reagent manufacturers to develop products compatible with AI-driven processing pipelines, prioritizing signal consistency and stability.

In research and development, AI is accelerating the discovery pipeline for novel imaging reagents. Machine learning algorithms can screen vast chemical libraries and predict the biological affinity and pharmacokinetic properties of potential targeting ligands, drastically reducing the time and cost associated with traditional wet-lab experimentation. Specifically for radiopharmaceuticals, AI can optimize radioisotope synthesis and purification protocols, addressing current supply chain bottlenecks and increasing the efficiency of high-value, short half-life tracers. This computational assistance allows researchers to focus on high-potential molecules, promising a faster introduction of highly specific, clinically relevant imaging agents, thereby reinforcing the overall market growth trajectory. The integration of AI tools, therefore, is not a displacement but an augmentation of the chemical and biological processes inherent in the market.

- AI enhances image quality control and standardizes reagent administration protocols.

- Deep learning models improve diagnostic accuracy by analyzing complex reagent-enhanced images.

- AI accelerates the discovery of novel imaging reagents and targeted contrast agents.

- Optimization of radioisotope synthesis and purification processes is achieved through machine learning.

- Quantitative analysis tools based on AI transform qualitative images into precise, measurable biomarkers.

- Personalized medicine benefits from AI-driven prediction of optimal reagent dosage and efficacy monitoring.

DRO & Impact Forces Of Biological and Medical Imaging Reagents Market

The Biological and Medical Imaging Reagents Market is shaped by powerful Drivers, constrained by certain Restraints, and presents significant Opportunities, all interacting within a complex ecosystem of Impact Forces. The primary drivers revolve around the escalating global burden of chronic diseases, particularly cancer and neurological disorders, which mandates highly specific and early diagnostic tools. The continuous stream of innovation in molecular imaging modalities (e.g., PET/MRI hybrid systems) necessitates the parallel development of compatible and enhanced reagents. Government funding for advanced biomedical research and the increasing emphasis on non-invasive diagnostics also propel market expansion. The synergistic interplay between technological readiness and clinical demand forms the core positive momentum for the market. This consistent demand ensures sustained investment in R&D, focusing on reagents with improved targeting mechanisms and favorable toxicity profiles.

However, the market faces several notable restraints. The high cost associated with the development, manufacturing, and regulatory approval of novel imaging reagents, especially complex radiopharmaceuticals, presents a significant barrier to entry and limits widespread adoption in cost-sensitive markets. Concerns related to the safety and side effects of certain contrast agents, such as gadolinium-based contrast agents (GBCAs) and their association with nephrogenic systemic fibrosis (NSF) or deposition in the brain, necessitate continuous material substitution and rigorous regulatory scrutiny, potentially slowing market deployment. Furthermore, the short half-life of many radioisotopes used in nuclear medicine creates logistical challenges related to manufacturing, transportation, and timely delivery to clinical sites, which significantly impacts the operational efficiency of suppliers.

Opportunities for future growth are significant, centered on the rise of theranostics—the combined diagnostic and therapeutic approach using a single agent. This emerging field requires novel dual-purpose reagents that can not only image a tumor but also deliver a therapeutic payload, promising substantial market differentiation. The expansion into untapped markets in developing regions, coupled with the shift towards fluorescence imaging reagents for surgical applications (image-guided surgery), offers new high-growth niches. Impact forces include intense competition driving down manufacturing costs for established generic reagents, while simultaneously encouraging high investment in proprietary, targeted agents. Regulatory pressures and evolving safety standards continuously act as moderating forces, ensuring product quality and patient safety remain paramount, thereby influencing the pace and direction of technological development within this dynamic healthcare segment.

Segmentation Analysis

The Biological and Medical Imaging Reagents Market is comprehensively segmented based on various critical parameters including reagent type, modality, application, end-user, and geography. Understanding these segmentations is vital for stakeholders to identify high-growth areas and strategic investment opportunities. The segmentation by reagent type—encompassing contrast agents, radiopharmaceuticals, optical imaging agents, and others—reflects the chemical diversity and functional specialization required across different imaging platforms. Contrast agents, used extensively in MRI and CT, currently hold the largest market share due to the widespread availability and utility of these modalities, while radiopharmaceuticals, central to nuclear medicine (PET and SPECT), are expected to demonstrate the fastest growth driven by advancements in cancer diagnostics and theranostics.

Segmentation by modality directly reflects the technological landscape, dividing the market into reagents specific for MRI, CT, PET, SPECT, Ultrasound, and Optical Imaging (Fluorescence and Bioluminescence). Each modality imposes unique requirements on the physical and chemical properties of the corresponding reagent; for instance, MRI reagents require high magnetic moment characteristics, while PET reagents depend on radioisotope emission properties. The increasing trend towards multimodal imaging, leveraging the strengths of different techniques (e.g., anatomical clarity from CT and functional data from PET), drives demand for compatible reagent combinations and synergistic product offerings that allow simultaneous visualization or sequential application across platforms, enhancing diagnostic yield.

The application segment emphasizes the clinical utility of the reagents, primarily divided into Oncology, Neurology, Cardiology, Gastrointestinal Disorders, and Others. Oncology remains the dominant application segment globally, consuming the majority of specialized tracers and contrast media for diagnosis, staging, and monitoring treatment response. The neurology segment, however, is witnessing accelerated growth due to increasing research into neurodegenerative diseases like Alzheimer's and Parkinson's, necessitating high-specificity molecular probes capable of crossing the blood-brain barrier. End-user segmentation reveals a significant reliance on hospitals and diagnostic imaging centers for volume, while the importance of Contract Research Organizations (CROs) and academic institutes is growing for clinical trials and early-stage research utilization of novel, experimental reagents, suggesting divergent distribution strategies are required to capture the full market potential.

- By Reagent Type:

- Contrast Agents (Gadolinium-based, Iodine-based, Barium sulfate)

- Radiopharmaceuticals (PET Tracers, SPECT Tracers)

- Optical Imaging Agents (Fluorescent Probes, Bioluminescent Probes)

- Targeted Molecular Probes

- By Modality:

- Magnetic Resonance Imaging (MRI)

- Computed Tomography (CT)

- Positron Emission Tomography (PET)

- Single-Photon Emission Computed Tomography (SPECT)

- Ultrasound

- Optical Imaging

- By Application:

- Oncology

- Cardiology

- Neurology

- Gastrointestinal Disorders

- Infectious Diseases

- Immunology

- By End User:

- Hospitals and Diagnostic Centers

- Academic and Research Institutes

- Pharmaceutical and Biotechnology Companies

- Contract Research Organizations (CROs)

- By Region:

- North America (U.S., Canada)

- Europe (Germany, U.K., France, Italy, Spain)

- Asia Pacific (China, Japan, India, South Korea)

- Latin America (Brazil, Mexico)

- Middle East & Africa (GCC Countries, South Africa)

Value Chain Analysis For Biological and Medical Imaging Reagents Market

The value chain for the Biological and Medical Imaging Reagents Market is complex, stretching from raw material sourcing and radioisotope generation (upstream) to clinical application and patient diagnosis (downstream). Upstream activities involve the highly regulated procurement and processing of fundamental chemical precursors, chelating agents, and stable isotopes. For nuclear medicine reagents, this stage includes the operation of specialized cyclotrons or nuclear reactors for radioisotope production (e.g., F-18, Tc-99m). Strict quality control and compliance are non-negotiable at this stage due to the critical medical nature of the products. Success in the upstream segment requires heavy capital investment in specialized manufacturing facilities and robust supply chain resilience, especially for materials with short decay periods, ensuring the high purity and safety standards demanded by regulatory bodies.

The core manufacturing and distribution stages involve synthesis, formulation, packaging, and logistics. Due to the diverse nature of reagents—ranging from shelf-stable MRI contrast agents to highly unstable, patient-specific PET tracers—the distribution channel requires flexibility and specialized handling. Direct distribution models are often employed for radiopharmaceuticals, where manufacturers or centralized radiopharmacies deliver the product directly to the clinical site on a just-in-time basis to minimize radioactive decay loss. Conversely, indirect distribution, leveraging distributors and wholesalers, is more common for high-volume, stable products like X-ray contrast media, allowing for wider market penetration and inventory management across diverse healthcare settings, including smaller clinics and regional hospitals, optimizing cost-efficiency.

Downstream activities focus on the final user application, encompassing hospitals, diagnostic centers, and research laboratories. This stage includes procedural protocols, image acquisition, interpretation, and utilization of the diagnostic information for patient management. The value chain is significantly impacted by the increasing sophistication of imaging equipment and the need for highly trained personnel to administer and interpret reagent-enhanced images effectively. Interaction between reagent manufacturers and imaging equipment providers is crucial for product compatibility and optimization. Ultimately, the entire value chain is driven by the final outcome: improved diagnostic accuracy and better clinical decision-making, emphasizing that quality and reliability throughout the chain directly translate into patient benefit and market reputation.

Biological and Medical Imaging Reagents Market Potential Customers

The primary consumers and end-users of Biological and Medical Imaging Reagents are diverse institutions operating within the healthcare, pharmaceutical, and research sectors, all sharing the need for high-resolution, specific visualization of biological processes. Hospitals and large specialized diagnostic imaging centers constitute the largest customer segment. These entities require a constant, high volume supply of standard contrast agents (for CT and MRI) and increasingly rely on specialized radiopharmaceuticals for complex procedures in oncology, neurology, and cardiology. Their purchasing decisions are driven by factors such as cost-effectiveness, regulatory compliance, reagent safety profile, and seamless integration with existing imaging equipment, making reliable supply logistics a critical determinant of supplier selection in this high-volume environment.

Pharmaceutical and biotechnology companies represent a fast-growing and high-value customer segment. These firms utilize imaging reagents extensively throughout the preclinical and clinical phases of drug development (Phase I-IV). Imaging reagents are indispensable for tracking drug uptake, measuring therapeutic efficacy in vivo, and understanding pharmacodynamics and biodistribution profiles. These customers often seek highly specialized, sometimes custom-synthesized, molecular probes for targeted imaging of specific biomarkers related to the disease being studied. Their demand is focused on cutting-edge, proprietary reagents that offer superior sensitivity and specificity, enabling faster, data-rich clinical trials and supporting regulatory submissions, highlighting a preference for innovation over sheer volume.

Academic and government research institutes, alongside Contract Research Organizations (CROs), form another significant customer base. Researchers utilize imaging reagents for fundamental biological studies, disease modeling, and early-stage technology validation. While their volume demand might be lower than hospitals, their requirements are highly specialized and often precede clinical adoption, acting as early indicators of future market trends. CROs, in particular, serve as intermediaries, procuring reagents on behalf of numerous pharmaceutical clients for outsourced clinical trial services, requiring a broad portfolio of agents and expertise in diverse imaging modalities. Serving these segments requires manufacturers to maintain strong research collaboration programs and offer flexible packaging and specialized technical support.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.2 Billion |

| Market Forecast in 2033 | USD 27.5 Billion |

| Growth Rate | Insert CAGR 8.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | General Electric Company, Bayer AG, Bracco Imaging S.p.A., Lantheus Holdings Inc., Curium Pharma, Siemens Healthineers AG, Guerbet Group, Fujifilm Holdings Corporation, Eli Lilly and Company, Merck KGaA, Thermo Fisher Scientific Inc., PerkinElmer Inc., Trivitron Healthcare, Jubilant Pharma Limited, Advanced Molecular Imaging LLC, Blue Earth Diagnostics, Spectrum Dynamics Medical, Mirion Technologies, Actinium Pharmaceuticals, Novartis AG (Advanced Accelerator Applications) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Biological and Medical Imaging Reagents Market Key Technology Landscape

The technological landscape of the Biological and Medical Imaging Reagents Market is characterized by intense focus on precision, sensitivity, and safety. A significant trend is the shift towards targeted molecular imaging, which requires reagents specifically designed to bind to disease-specific biomarkers, such as receptors overexpressed on cancer cells or amyloid plaques in neurological disorders. This involves advanced conjugation chemistry to link a diagnostic reporting molecule (e.g., a radioisotope or fluorescent dye) to a biologically active vector (e.g., a peptide or antibody fragment). For example, the development of F-18 labeled PSMA tracers for prostate cancer imaging represents a major technological leap, offering superior diagnostic accuracy compared to traditional methods. Furthermore, research into nanoparticle-based reagents is gaining momentum, offering enhanced payload capacity and tunable pharmacokinetics, addressing limitations inherent in small molecule tracers, and opening pathways for simultaneous imaging and drug delivery (theranostics).

In the field of Magnetic Resonance Imaging (MRI), technological innovation focuses on developing safer, metal-free alternatives to traditional gadolinium-based contrast agents (GBCAs), driven by concerns over metal deposition. Researchers are exploring novel paramagnetic complexes and macromolecular contrast agents that offer high relaxivity at lower concentrations and improved clearance profiles. Concurrently, the proliferation of multimodal imaging requires reagents compatible with two or more imaging techniques (e.g., fluorescence and ultrasound, or PET and MRI). This necessitates the use of complex, hybrid reagents that integrate multiple functional components, demanding sophisticated chemical synthesis and rigorous testing protocols to ensure stable performance across disparate physical environments and detection methods, maximizing the clinical information yielded during a single patient session.

The advancement of optical imaging reagents, particularly for use in image-guided surgery (IGS), constitutes a key technological thrust. Near-Infrared (NIR) fluorescent probes are preferred due to their deeper tissue penetration and reduced autofluorescence interference, allowing surgeons to visualize critical structures like lymph nodes or tumor margins in real-time. The technological hurdle involves creating fluorescent dyes that are highly bright, photostable, and rapidly metabolized or cleared by the body, ensuring minimal systemic toxicity while providing clear contrast during the surgical procedure. Overall, the key technologies employed leverage cutting-edge chemistry, molecular biology, and nuclear physics to create diagnostic tools that are increasingly precise, enabling functional and molecular insights rather than just anatomical visualization, directly correlating to improved diagnostic confidence and therapeutic outcomes.

Regional Highlights

- North America: This region dominates the global market, primarily due to the presence of technologically advanced healthcare infrastructure, high per capita healthcare spending, and favorable reimbursement policies for advanced diagnostic procedures. The U.S. is the largest contributor, characterized by early and widespread adoption of innovative imaging modalities like PET/MRI and a high volume of clinical trials utilizing novel molecular probes. The substantial investment in R&D by major pharmaceutical and diagnostic companies headquartered in the region further solidifies its leading position in both development and consumption.

- Europe: Europe is a mature market, driven by stringent quality standards and a strong focus on public health initiatives. Countries like Germany, France, and the UK are major consumers of both conventional contrast agents and radiopharmaceuticals. The European market is characterized by strong regulatory collaboration (e.g., the European Medicines Agency) which facilitates product approval, alongside a significant push towards theranostics, particularly in specialized oncology centers, positioning the region as a key area for high-value product uptake.

- Asia Pacific (APAC): APAC is anticipated to be the fastest-growing region during the forecast period. This accelerated growth is attributed to the rapid expansion and modernization of healthcare facilities in emerging economies like China and India, increasing disposable incomes, and the growing incidence of lifestyle-related diseases requiring advanced diagnostics. Government initiatives supporting medical infrastructure development and the increasing accessibility of advanced imaging techniques are driving substantial demand for both imported and domestically manufactured reagents.

- Latin America (LATAM): The LATAM market exhibits moderate growth, focused primarily on essential contrast media for standard CT and MRI procedures. Market expansion is constrained by inconsistent healthcare expenditure and price sensitivity, though countries like Brazil and Mexico are seeing increasing investment in specialized oncology and cardiology services, incrementally boosting demand for higher-cost, specialized molecular imaging reagents.

- Middle East & Africa (MEA): The MEA region is characterized by fragmented market development. Growth in the Middle East (GCC countries) is robust due to heavy government investment in world-class medical cities and high-end diagnostic technology adoption. Conversely, the African market remains nascent, focused mainly on basic diagnostic needs, with reagent adoption heavily reliant on international aid and regional public health spending.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Biological and Medical Imaging Reagents Market.- General Electric Company

- Bayer AG

- Bracco Imaging S.p.A.

- Lantheus Holdings Inc.

- Curium Pharma

- Siemens Healthineers AG

- Guerbet Group

- Fujifilm Holdings Corporation

- Eli Lilly and Company

- Merck KGaA

- Thermo Fisher Scientific Inc.

- PerkinElmer Inc.

- Trivitron Healthcare

- Jubilant Pharma Limited

- Advanced Molecular Imaging LLC

- Blue Earth Diagnostics (part of Curium)

- Spectrum Dynamics Medical

- Mirion Technologies

- Actinium Pharmaceuticals

- Novartis AG (Advanced Accelerator Applications)

Frequently Asked Questions

Analyze common user questions about the Biological and Medical Imaging Reagents market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Biological and Medical Imaging Reagents Market?

The primary factor driving market growth is the escalating global prevalence of chronic diseases, particularly cancer and cardiovascular disorders, which necessitate highly specific, non-invasive diagnostic tools. This demand is further amplified by technological innovations in molecular imaging and the shift toward early diagnosis and personalized medicine approaches.

How is the rise of theranostics impacting the demand for imaging reagents?

The emergence of theranostics—combining diagnosis and therapy using a single agent—is creating significant demand for novel dual-purpose reagents. These agents must effectively visualize a pathological target (diagnosis) while simultaneously delivering a therapeutic dose (therapy), representing a high-value, high-growth segment, particularly in nuclear medicine and oncology.

Which geographical region exhibits the fastest growth potential for these reagents?

The Asia Pacific (APAC) region is projected to register the fastest growth rate. This accelerated expansion is fueled by vast improvements in healthcare infrastructure, increasing government investment in medical technology, and growing public awareness regarding advanced diagnostic procedures in countries such as China and India, driving up the adoption of specialized reagents.

What are the main safety concerns associated with widely used contrast agents?

Safety concerns primarily revolve around gadolinium-based contrast agents (GBCAs), which, while generally safe, have been linked to potential side effects like Nephrogenic Systemic Fibrosis (NSF) in patients with severe renal impairment, and evidence of residual gadolinium deposition in brain tissue. This concern is driving research toward developing safer, non-metal or macrocyclic alternatives with improved safety profiles and better clearance mechanisms.

How is Artificial Intelligence (AI) influencing the reagent development pipeline?

AI significantly influences the pipeline by accelerating the discovery and optimization of new reagents. Machine learning algorithms are used to screen vast chemical libraries, predict the pharmacokinetic properties and biological targeting efficiency of potential compounds, and optimize complex manufacturing processes, such as radioisotope synthesis, thereby reducing R&D costs and time-to-market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager