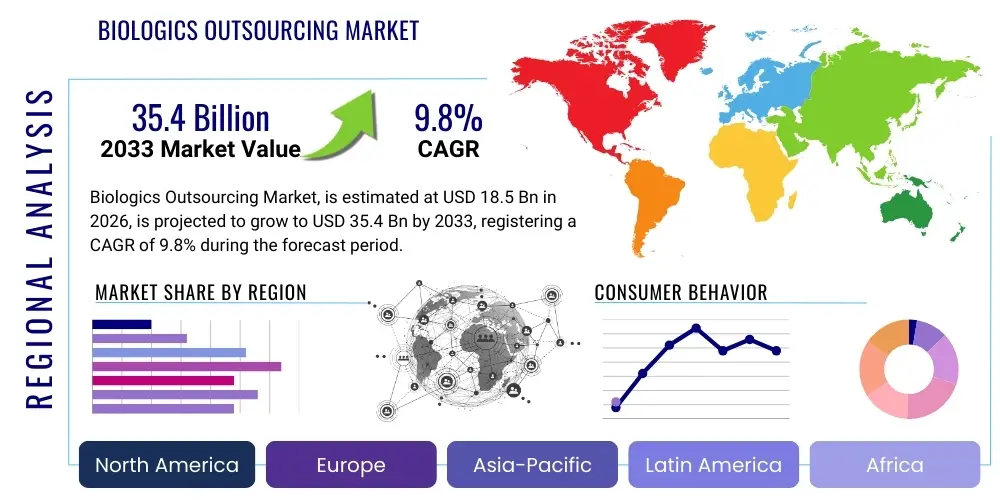

Biologics Outsourcing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437200 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Biologics Outsourcing Market Size

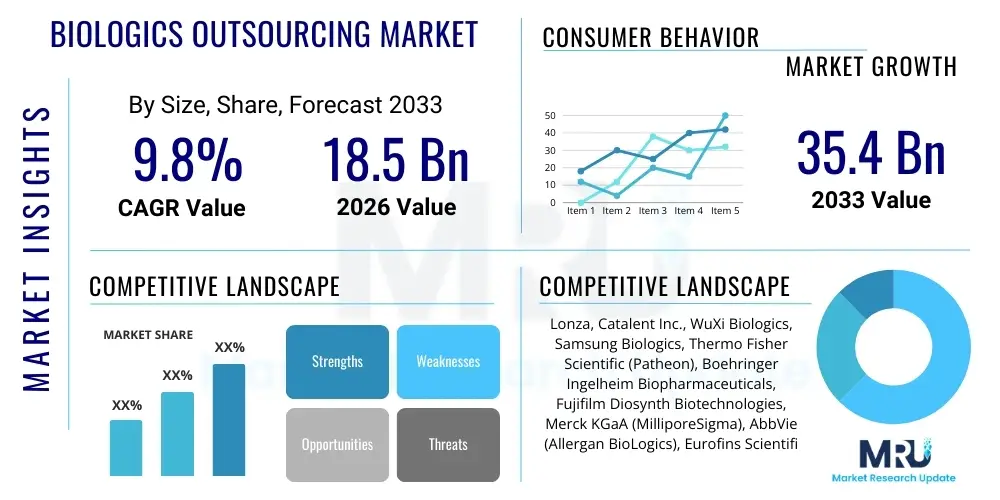

The Biologics Outsourcing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at $18.5 Billion in 2026 and is projected to reach $35.4 Billion by the end of the forecast period in 2033.

Biologics Outsourcing Market introduction

The Biologics Outsourcing Market encompasses the delegation of various stages of biologic drug development and manufacturing to specialized third-party organizations, primarily Contract Research Organizations (CROs) and Contract Development and Manufacturing Organizations (CDMOs). Biologics, including monoclonal antibodies, recombinant proteins, vaccines, and advanced therapies like cell and gene therapies, are inherently complex to develop and require specialized infrastructure, advanced technological expertise, and stringent regulatory compliance. Outsourcing allows pharmaceutical and biotechnology companies, particularly smaller entities and virtual companies, to mitigate high capital expenditures, accelerate time-to-market, and focus internal resources on core competencies such as target identification and commercialization strategy. This strategic reliance on external partners has become crucial due to increasing pipeline complexity and the global pressure to reduce development costs while maintaining quality.

The primary services outsourced range across the entire drug lifecycle, including early-stage discovery, preclinical development, clinical trial management, process optimization, and large-scale commercial manufacturing. The rising prevalence of chronic diseases, coupled with successful therapeutic outcomes achieved by biologic drugs, drives substantial investment in the sector. Furthermore, the expiration of patents for several blockbuster biologics necessitates robust and efficient manufacturing capabilities for biosimilars, a field heavily reliant on sophisticated CDMO expertise to navigate regulatory pathways and achieve cost-effective production at scale. The technical demands associated with handling sensitive biological materials, ensuring sterility, and managing complex cold chains further solidify the rationale for engaging specialized outsourcing providers.

Key applications of biologics outsourcing span oncology, immunology, infectious diseases, and regenerative medicine. The benefits derived from this model include enhanced operational flexibility, access to cutting-edge technologies (such as single-use systems and continuous bioprocessing), and expedited global regulatory submissions leveraging the established track record of experienced CROs and CDMOs. Major driving factors propelling market expansion include the significant surge in biologic drug approvals, the globalization of clinical trials, capacity constraints faced by innovator companies, and the rapid expansion of the cell and gene therapy sector, which requires highly specialized, bespoke manufacturing capabilities that few in-house facilities possess.

Biologics Outsourcing Market Executive Summary

The Biologics Outsourcing Market is experiencing profound structural transformation, driven by an accelerating shift towards complex, high-value modalities, particularly cell and gene therapies (CGTs) and messenger RNA (mRNA) technologies. Business trends indicate a strong move toward integrated, end-to-end service models, where CDMOs are no longer merely contract manufacturers but strategic partners offering comprehensive services from preclinical development through commercial launch, enhancing supply chain resiliency. Consolidation remains a key theme, with major players aggressively acquiring smaller, specialized CDMOs and CROs to quickly build capacity in niche areas such as viral vector production and sterile fill-finish operations. This vertical integration aims to streamline operations and provide seamless transition across development phases, directly addressing the industry need for accelerated timelines and simplified vendor management.

Regionally, North America maintains its dominance, primarily due to robust R&D investment, a highly mature biotech ecosystem, and a favorable regulatory environment fostering innovation, particularly in novel modalities. However, the Asia Pacific (APAC) region, led by China and India, is emerging as the fastest-growing market, driven by lower operational costs, substantial government initiatives supporting domestic biomanufacturing, and increasing clinical trial activity. European markets exhibit strong growth, characterized by significant investment in biosimilars manufacturing and a growing focus on decentralized manufacturing models to support personalized medicine initiatives. The trend highlights a shift in global capacity, with manufacturing capabilities expanding eastward while development and clinical strategy often remain centered in established Western hubs.

Segment trends underscore the criticality of the Manufacturing segment, particularly Biomanufacturing, which commands the largest market share due to the capital-intensive nature and scale required for commercial production. Within services, Process Development and Formulation are witnessing rapid growth, reflecting the challenges associated with optimizing complex biologics for stability and efficacy. By product type, monoclonal antibodies (mAbs) remain the foundational segment, but advanced therapies, including gene and cell therapies, represent the highest growth potential, necessitating significant technological investment in specialized, cGMP-compliant facilities capable of handling autologous and allogeneic materials. The market is increasingly competitive, forcing CDMOs to differentiate themselves through technological leadership, specialized regulatory expertise, and proven track records in delivering complex biological molecules.

AI Impact Analysis on Biologics Outsourcing Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Biologics Outsourcing Market predominantly center on three core themes: efficiency gains in biomanufacturing processes, the application of predictive analytics in clinical trials, and concerns about data security and intellectual property protection when utilizing third-party AI platforms. Users are keen to understand how AI can reduce the inherently high failure rates in early-stage development, specifically through optimizing upstream and downstream processing parameters and predicting stability issues before large-scale investment. There is significant interest in AI's role in accelerating therapeutic discovery, particularly in identifying novel antibody sequences or optimizing lead candidates, which directly impacts the services offered by CROs and CDMOs. The expectation is that AI integration will shift outsourcing dynamics, moving contracts away from purely transactional agreements toward knowledge-intensive partnerships focused on data utilization and advanced process modeling, ultimately demanding higher computational and data science capabilities from service providers.

The integration of AI tools within the outsourcing ecosystem promises to revolutionize various stages, from target identification and lead optimization to quality control and supply chain management. For CDMOs, AI facilitates the creation of digital twins for bioprocesses, allowing for real-time monitoring, anomaly detection, and autonomous control adjustment, dramatically improving batch consistency and yield. In the clinical realm, CROs utilize machine learning algorithms to optimize patient recruitment strategies, predict clinical trial endpoints, and accelerate data analysis, which reduces trial duration and associated costs. However, implementing these complex AI systems requires substantial initial investment in data infrastructure and specialized personnel, which smaller outsourcing providers often lack, leading to a competitive advantage for larger entities capable of leveraging these advanced tools and offering them as value-added services.

Furthermore, AI-driven predictive maintenance models are being deployed in biomanufacturing facilities to minimize downtime and ensure continuous operation, critical for sensitive biological production. The ability to harness vast datasets generated during process development—ranging from bioreactor parameters to high-throughput screening results—allows for sophisticated process optimization that traditional statistical methods cannot achieve. This evolution necessitates that outsourcing partners not only possess manufacturing capacity but also data management and bioinformatics expertise, fundamentally redefining the skill sets required in the biologics outsourcing sector. This comprehensive adoption of AI is expected to significantly enhance operational efficiency, increase product quality, and potentially compress the biological drug development lifecycle, reinforcing the strategic role of specialized outsourcing partners.

- AI accelerates target identification and lead molecule optimization, reducing preclinical timelines.

- Machine learning algorithms optimize bioprocessing parameters (e.g., cell culture conditions) in real-time, boosting yield and consistency.

- Predictive analytics enhance clinical trial design, patient stratification, and endpoint forecasting, accelerating trial completion.

- Digital twins and advanced modeling improve facility utilization and validate scale-up strategies before physical execution.

- AI-enabled quality control (QC) systems automate inspection and defect detection, ensuring stringent cGMP compliance.

- Improved supply chain visibility and risk prediction minimize cold chain failures and logistics delays.

- Data infrastructure requirements for AI necessitate specialized expertise in data governance and security offered by advanced CRO/CDMO partners.

DRO & Impact Forces Of Biologics Outsourcing Market

The dynamics of the Biologics Outsourcing Market are shaped by a strong combination of accelerating drivers, critical restraints, and transformative opportunities, which collectively constitute the impact forces guiding market trajectory. Key drivers include the exponential growth in the global biologics pipeline, particularly complex modalities like cell and gene therapies, which require highly specialized and capital-intensive manufacturing expertise that most biopharma companies cannot efficiently maintain in-house. Furthermore, the imperative to reduce internal operating costs and the approaching patent expiration of several blockbuster biologics fuel demand for high-quality, cost-effective manufacturing solutions provided by CDMOs, especially for biosimilar production. The regulatory complexity associated with global clinical trials also drives companies to leverage the expertise of established CROs to navigate diverse international requirements efficiently.

However, the market growth is moderately restrained by critical challenges, notably intellectual property (IP) protection concerns. Pharmaceutical companies often harbor reservations about sharing proprietary drug manufacturing processes and confidential clinical data with third-party vendors, necessitating robust confidentiality agreements and security protocols. Regulatory hurdles, especially the complexity involved in transferring production sites or scaling up processes while maintaining strict comparability and compliance (cGMP standards), also pose significant constraints. Moreover, the shortage of highly skilled technical personnel specialized in areas like viral vector manufacturing and complex cell line development limits the immediate capacity expansion potential of some outsourcing providers, creating bottlenecks in high-demand segments.

Significant opportunities abound, particularly in the emerging field of personalized medicine and advanced therapies, which demand highly flexible and geographically decentralized manufacturing capabilities. The adoption of innovative technologies, such as single-use bioprocessing systems and continuous manufacturing, offers CDMOs a chance to enhance efficiency, reduce turnaround times, and lower production costs, thereby attracting more business. Geographically, expansion into emerging markets, especially within the APAC region, presents lucrative growth avenues as these regions accelerate their domestic R&D efforts and require established manufacturing infrastructure. These opportunities, combined with the increasing financial pressure on pharmaceutical innovators, position outsourcing as a critical strategic lever for future drug development success, ensuring that the driving forces largely outweigh the existing restraints, thus maintaining a strong positive impact on market expansion.

Segmentation Analysis

The Biologics Outsourcing Market is broadly segmented based on Service Type, Product Type, and Workflow, providing a structured understanding of specialized demand areas within the biopharma value chain. The Service Type segmentation, encompassing Clinical Trials, Process Development, and Manufacturing, highlights the relative importance of these activities, with manufacturing typically dominating the revenue landscape due to the long-term, high-volume nature of commercial production contracts. Within Product Type, Monoclonal Antibodies (mAbs) retain the largest segment share, reflecting their therapeutic maturity and widespread application across various disease areas, though advanced therapies like cell and gene therapies exhibit the most rapid Compound Annual Growth Rate (CAGR). Workflow segmentation, detailing upstream and downstream processing, emphasizes the increasing complexity and optimization required in the separation and purification stages of biologics production.

The continuous evolution in drug modality necessitates frequent adjustments in the service mix offered by CDMOs and CROs. For instance, the rise of bispecific antibodies and antibody-drug conjugates (ADCs) demands enhanced expertise in complex conjugation and analytical characterization, driving growth in the Process Development segment. Similarly, the unique logistical and manufacturing requirements for autologous cell therapies are carving out a distinct high-value niche within the manufacturing services sector. This detailed segmentation analysis is crucial for market participants to identify lucrative specialization areas, guiding strategic investment in technology and human capital, ensuring that capacity aligns precisely with the evolving pipeline of outsourced biologic drugs.

- By Service Type:

- Process Development (Upstream, Downstream)

- Manufacturing (Contract Manufacturing, Fill-Finish Services)

- Clinical Trials (Phase I, Phase II, Phase III)

- Discovery and Preclinical Services

- Regulatory Consulting Services

- By Product Type:

- Monoclonal Antibodies (mAbs)

- Recombinant Proteins

- Vaccines

- Cell and Gene Therapies (Viral Vectors, Plasmid DNA)

- Biosimilars and Biobetters

- By Workflow:

- Upstream Processing (Cell Line Development, Media Preparation, Fermentation/Bioreactor)

- Downstream Processing (Purification, Filtration, Formulation)

- By Indication:

- Oncology

- Infectious Diseases

- Immunological Disorders

- Cardiovascular Diseases

Value Chain Analysis For Biologics Outsourcing Market

The value chain for Biologics Outsourcing is complex, involving multiple integrated steps that transform raw materials into commercial drug products, spanning discovery, development, and commercialization phases. The upstream analysis primarily focuses on the initial stages handled often by specialized CROs, including target identification, cell line development, process optimization (establishing high-yield and stable cell lines), and sourcing critical raw materials such as cell culture media and reagents. Efficiency at this stage is paramount, as early-stage process parameters dictate the feasibility and economics of large-scale production. Providers excelling in advanced cell line engineering and high-throughput screening technologies gain a competitive edge by offering robust and scalable processes early in the development lifecycle.

The midstream section is dominated by CDMOs and large CROs managing clinical development and manufacturing. This includes clinical trial management (Phase I to Phase III), process scale-up, cGMP compliant manufacturing, and rigorous quality control testing. The distribution channel analysis involves both direct and indirect avenues. Direct distribution occurs when the innovator company takes ownership of the final manufactured product from the CDMO and handles its own logistics network for market delivery. Indirect distribution often involves the CDMO or a specialized third-party logistics (3PL) provider managing aspects of cold chain storage, packaging, and global shipment of the finished biologic product, particularly critical for sensitive, temperature-dependent therapies. Specialized expertise in global regulatory documentation for shipment across jurisdictions is a key value addition in this stage.

The downstream analysis centers on commercial manufacturing, sterile fill-finish operations (a high-demand, high-complexity service), packaging, and post-market surveillance handled by CROs. The ultimate end-user/buyer remains the innovator pharmaceutical or biotechnology company contracting the services. The value chain is characterized by significant interconnectivity, where seamless data transfer between R&D CROs and manufacturing CDMOs is critical. Integrated CDMOs that can offer a consolidated service from cell line to commercial fill-finish mitigate transfer risks and accelerate timelines, offering significant value to clients seeking a single point of accountability. The specialization required at each stage—from discovery bioinformatics to cGMP aseptic processing—underscores the necessity of a highly specialized outsourcing ecosystem.

Biologics Outsourcing Market Potential Customers

The potential customers for the Biologics Outsourcing Market are predominantly categorized into large pharmaceutical companies, small and medium-sized biotechnology firms, and academic or governmental research institutions. Large pharmaceutical companies leverage outsourcing strategically to manage peak capacity demands, access specialized technologies (especially in advanced therapies), and gain operational flexibility, often choosing established CDMOs with global footprints and robust regulatory track records. For these customers, the primary driver is the efficient management of extensive, complex pipelines and the need to quickly scale manufacturing capacity following successful late-stage clinical trials without significant internal capital investment. They often require partners capable of handling large-volume commercial production for blockbuster biologics and biosimilars.

Small and medium-sized biotechnology firms, including virtual biotech companies, represent the most critical growth engine for the outsourcing market. These companies typically possess innovative intellectual property but lack the internal infrastructure, capital, and expertise required for complex clinical development and cGMP manufacturing. Outsourcing is not merely a choice but an essential operational requirement for these entities, enabling them to advance drug candidates through preclinical and clinical phases efficiently. They rely heavily on CROs for comprehensive clinical trial management and on CDMOs for early-stage process development and clinical batch manufacturing, prioritizing partners that offer specialized expertise and flexibility for novel or complex molecules, such as viral vectors or complex proteins.

Academic and governmental research institutions also constitute a key customer segment, particularly for early-stage discovery, proof-of-concept studies, and the production of materials for investigator-initiated clinical trials. While their batch sizes are typically smaller, their demands are often highly specialized, requiring expertise in non-traditional or novel manufacturing platforms. These customers seek cost-effective, high-quality services to transition foundational scientific discoveries into viable drug candidates. The growing trend of technology transfer and partnership between academia and the biotech sector further solidifies these institutions as significant, though volume-variable, buyers of specialized outsourcing services, particularly those related to analytical testing and early process optimization.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $18.5 Billion |

| Market Forecast in 2033 | $35.4 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lonza, Catalent Inc., WuXi Biologics, Samsung Biologics, Thermo Fisher Scientific (Patheon), Boehringer Ingelheim Biopharmaceuticals, Fujifilm Diosynth Biotechnologies, Merck KGaA (MilliporeSigma), AbbVie (Allergan BioLogics), Eurofins Scientific, ICON plc, Syneos Health, Charles River Laboratories, Covance (LabCorp), Recipharm AB, Ajinomoto Bio-Pharma Services, Vetter Pharma International, KBI Biopharma, Albany Molecular Research Inc. (AMRI), Rentschler Biopharma. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Biologics Outsourcing Market Key Technology Landscape

The technological landscape driving the Biologics Outsourcing Market is characterized by innovations aimed at enhancing process flexibility, reducing contamination risks, and accelerating time-to-market. Single-use technologies (SUTs), often referred to as disposable systems, represent a cornerstone of modern biomanufacturing outsourced operations. SUTs, including bioreactors, mixing systems, and filtration assemblies, allow CDMOs to rapidly switch between different products and batches without extensive cleaning and sterilization validation required by traditional stainless steel systems, significantly improving facility throughput and flexibility, which is highly attractive to biotech clients with diverse pipelines. This technology is crucial for accommodating the high variety and lower volumes typical of advanced therapies and personalized medicine products, allowing outsourcing partners to offer modular and scalable solutions quickly.

Another major technological advancement is the shift towards continuous bioprocessing (CBP). Traditional batch processes are gradually being supplemented or replaced by continuous systems, which link unit operations (perfusion culture, continuous chromatography, etc.) into an integrated flow. CBP offers significant advantages in terms of facility footprint reduction, increased volumetric productivity, and better product consistency. For CDMOs, investing in CBP capabilities allows them to offer highly efficient manufacturing platforms, reducing the cost of goods sold (COGS) for clients, particularly those requiring high-volume manufacturing of well-characterized biologics. The integration of advanced process analytical technology (PAT) and automated control systems is essential to successfully implement and monitor these continuous operations, further raising the technological barrier to entry for service providers.

Furthermore, the digital transformation, powered by AI and machine learning, is deeply embedded within the outsourcing technology stack. CDMOs are implementing sophisticated data management platforms and Laboratory Information Management Systems (LIMS) to track complex data generated during process development and QC. These systems integrate high-throughput screening data with manufacturing execution systems (MES), enabling predictive modeling for process optimization and regulatory compliance. The focus is shifting towards integrated technology platforms that provide end-to-end data integrity and visibility, offering clients transparency and assurance throughout the development and manufacturing lifecycle. Specialized technologies for advanced modalities, such as closed-system, automated manufacturing platforms for cell and gene therapies (e.g., automated viral vector production and cell expansion systems), are becoming essential offerings for competitive outsourcing partners.

Regional Highlights

- North America (United States and Canada): North America dominates the Biologics Outsourcing Market, attributed to the presence of the highest concentration of leading pharmaceutical and biotechnology companies, coupled with significant investment in cutting-edge R&D. The region benefits from a well-established and favorable regulatory environment (FDA), encouraging rapid innovation, particularly in novel modalities like cell, gene, and oligonucleotide therapies. The United States specifically generates immense demand for outsourcing services, driven by the high volume of early-stage biotech startups that rely almost entirely on CROs for clinical trials and CDMOs for specialized manufacturing, especially viral vector production. The market here is characterized by highly sophisticated demand, requiring partners capable of managing complex, bespoke processes and navigating stringent quality standards. Furthermore, substantial venture capital funding fuels the biotech pipeline, ensuring a continuous stream of projects requiring external expertise for development and scale-up, positioning North America as the global hub for technology adoption and high-value service contracts.

- Europe (Germany, UK, France, Italy, Spain): Europe represents the second-largest market, characterized by strong governmental support for biopharma manufacturing, particularly in key economic hubs like Germany and Ireland. The European market exhibits high demand for biosimilar manufacturing and complex formulation services. European CDMOs are globally recognized for their expertise in sterile fill-finish operations and complex protein expression systems. The strong focus on decentralized clinical trials across the European Union further drives demand for localized CRO services. The region is seeing rapid investment in modern, single-use technology facilities to enhance responsiveness and flexibility. Regulatory harmonization within the European Medicines Agency (EMA) streamlines approval pathways, making Europe an attractive location for conducting multinational clinical studies, ensuring steady, high-quality outsourcing demand across the continent, particularly in specialized areas like immunotherapy manufacturing.

- Asia Pacific (APAC) (China, India, South Korea, Japan): APAC is projected to be the fastest-growing region, driven by substantial capacity expansion, competitive cost structures, and increasing domestic drug development. China has rapidly evolved into a global biomanufacturing hub, supported by significant state investment aimed at bolstering local CDMO capabilities (e.g., WuXi Biologics). India and South Korea are key players in biosimilars production and clinical trial outsourcing, offering large patient populations and skilled labor at lower costs compared to Western markets. Japan, with its aging population and focus on regenerative medicine, offers high-value, specialized outsourcing opportunities. The rapid maturation of regulatory frameworks in several APAC countries, coupled with the establishment of modern bioparks, makes this region crucial for both Western companies seeking cost efficiencies and local companies aiming for global market access. The growth trajectory is steep, driven by both manufacturing volume and increasing R&D complexity.

- Latin America (LATAM) and Middle East & Africa (MEA): LATAM and MEA currently hold smaller market shares but offer significant long-term potential, primarily driven by increasing healthcare expenditure and improving regulatory standards. LATAM countries, such as Brazil and Mexico, are increasingly important for recruiting diverse patient populations for late-stage clinical trials managed by global CROs. In the MEA region, countries like Saudi Arabia and the UAE are actively investing in localizing biomanufacturing capabilities to enhance national drug security, often partnering with established international CDMOs to build state-of-the-art facilities. While the focus remains largely on traditional biologics and vaccines, these regions are critical for market diversification and accessing previously untapped patient pools, offering niche opportunities for specialized outsourcing partners focused on localized market entry strategies and regional logistics management.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Biologics Outsourcing Market.- Lonza Group AG

- Catalent Inc.

- WuXi Biologics

- Samsung Biologics

- Thermo Fisher Scientific (Patheon)

- Boehringer Ingelheim Biopharmaceuticals

- Fujifilm Diosynth Biotechnologies

- Merck KGaA (MilliporeSigma)

- Charles River Laboratories International Inc.

- ICON plc

- Syneos Health

- Recipharm AB

- Ajinomoto Bio-Pharma Services

- Vetter Pharma International GmbH

- KBI Biopharma (JSR Life Sciences)

- Rentschler Biopharma SE

- Parexel International

- Piramal Pharma Solutions

- Cytovance Biologics (HEMA Biologics)

- Cobra Biologics (Cognate BioServices)

Frequently Asked Questions

Analyze common user questions about the Biologics Outsourcing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Biologics Outsourcing services globally?

The primary driver is the accelerating complexity and sheer volume of the global biologics pipeline, especially in advanced therapies (Cell and Gene Therapies). This necessitates access to specialized, capital-intensive manufacturing infrastructure and expertise that innovator companies often lack, making outsourcing the fastest and most efficient path to market.

How is the rise of biosimilars impacting the Biologics Outsourcing Market?

The increasing focus on biosimilars, driven by patent expirations of blockbuster drugs, significantly boosts the Manufacturing segment. Biosimilars require highly efficient, cost-effective production at commercial scale, prompting companies to leverage CDMOs with established expertise in process optimization and regulatory compliance for high-volume, low-cost manufacturing.

Which geographical region holds the largest market share in Biologics Outsourcing?

North America, particularly the United States, holds the largest market share. This dominance is due to the highest concentration of major biotechnology companies, extensive R&D investment, and a highly mature ecosystem facilitating early-stage drug development and advanced clinical trial outsourcing.

What are the key technological advancements utilized by CDMOs in this market?

Key technological advancements include the widespread adoption of single-use systems (SUTs) for flexible and rapid batch changeovers, the implementation of continuous bioprocessing (CBP) for efficiency and lower COGS, and the integration of AI/Machine Learning for process optimization and real-time quality control.

What are the main risks associated with outsourcing the development and manufacturing of biologics?

The main risks include potential breaches of intellectual property (IP) and data confidentiality when sharing proprietary information with third-party vendors. Additionally, regulatory risks associated with process transfer, scale-up issues, and ensuring consistent cGMP compliance across different global sites pose significant challenges requiring careful vendor selection and stringent contractual safeguards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager