Biomedical Plasma Freezers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433092 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Biomedical Plasma Freezers Market Size

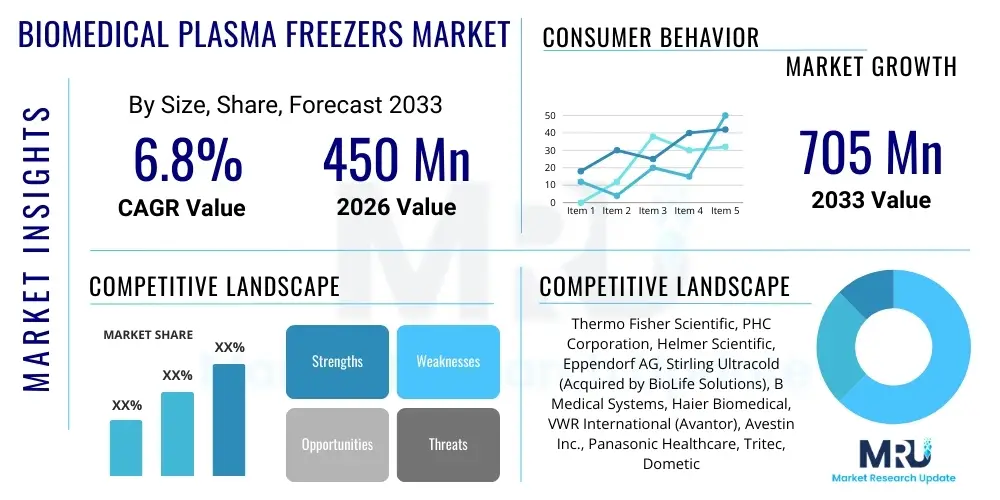

The Biomedical Plasma Freezers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 705 Million by the end of the forecast period in 2033.

Biomedical Plasma Freezers Market introduction

The Biomedical Plasma Freezers Market encompasses specialized ultra-low temperature (ULT) refrigeration equipment designed specifically for the safe, long-term storage of Fresh Frozen Plasma (FFP) and related biological samples, such as cryoprecipitate and pooled plasma components. These freezers are critical infrastructure within the healthcare ecosystem, utilized primarily by blood banks, clinical laboratories, hospitals, and pharmaceutical manufacturers to maintain plasma viability and therapeutic efficacy according to stringent medical guidelines. The primary product feature is the ability to achieve and consistently maintain temperatures typically ranging from -30°C to -86°C, utilizing advanced cooling technologies, including cascade refrigeration systems and specialized insulation methods like Vacuum Insulation Panels (VIP). The proper functioning of these freezers directly impacts patient safety and the supply chain integrity of lifesaving blood products. Major applications include routine blood transfusion services, support for complex surgical procedures, manufacturing of plasma-derived therapeutics (e.g., immunoglobulins, clotting factors), and long-term biobanking initiatives for research and development.

Biomedical Plasma Freezers Market Executive Summary

The Biomedical Plasma Freezers Market is characterized by robust growth driven by escalating global demand for blood and blood components, coupled with substantial regulatory emphasis on plasma product quality and storage compliance. Key business trends include the consolidation of cold chain logistics, increased investment in energy-efficient and environmentally sustainable cooling solutions (e.g., natural refrigerants), and the rapid adoption of smart freezer technologies featuring IoT connectivity for enhanced remote monitoring and data logging capabilities. Regionally, North America and Europe currently dominate the market due to established healthcare infrastructure and high blood donation rates, but the Asia Pacific region is rapidly emerging as the primary growth engine, fueled by expanding healthcare access, rising surgical volumes, and government initiatives focused on improving blood safety standards. Segment trends highlight a growing preference for ultra-low temperature (ULT) freezers capable of reaching -80°C, particularly in research and advanced therapeutic manufacturing, while the hospital and blood bank sectors continue to prioritize high-capacity, reliable chest and upright freezers compliant with AABB and FDA storage requirements. The market environment remains competitive, with a focus on product differentiation through precise temperature uniformity, reduced operational noise, and integration with hospital information systems (HIS).

AI Impact Analysis on Biomedical Plasma Freezers Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Biomedical Plasma Freezers Market frequently revolve around optimizing cold chain logistics, predicting equipment failure, and enhancing energy efficiency in large-scale biobanks. Users are highly concerned about minimizing plasma waste due to temperature excursions and ensuring maximum uptime for critical storage units. The analysis reveals that key expectations center on AI’s ability to move plasma storage from reactive maintenance models to proactive, predictive failure analysis. Furthermore, users seek AI algorithms capable of optimizing freezer defrost cycles based on real-time usage patterns and environmental factors, thereby significantly reducing energy consumption without compromising sample integrity. There is also substantial interest in using machine learning to forecast future plasma demand, informing inventory management strategies and optimizing freezer capacity utilization across networked laboratory systems. This shift towards intelligent monitoring systems is fundamentally changing the criteria for procurement, making integrated AI capabilities a crucial competitive differentiator.

- AI facilitates predictive maintenance by analyzing sensor data (temperature, door opening frequency, compressor run time) to forecast potential component failure, preventing catastrophic sample loss.

- Machine learning algorithms optimize energy consumption by dynamically adjusting compressor cycles and defrost schedules based on load profiles and ambient conditions.

- AI-driven inventory systems improve plasma traceability and utilization efficiency, minimizing waste by providing real-time location and usage analytics for stored samples.

- Advanced anomaly detection algorithms utilize AI to instantly flag minor temperature variations that may precede regulatory non-compliance, enabling immediate corrective action.

DRO & Impact Forces Of Biomedical Plasma Freezers Market

The Biomedical Plasma Freezers Market is shaped by a complex interplay of clinical necessity, technological innovation, and regulatory oversight, creating both significant growth drivers and substantial barriers to entry. The primary market forces involve the increasing global need for blood products, technological advancements aimed at maximizing sample integrity, the high costs associated with specialized cooling infrastructure, and the necessity of strict adherence to international quality standards. These factors collectively determine the investment lifecycle for storage equipment and influence procurement decisions across healthcare and life science sectors. The market dynamics are highly sensitive to public health crises, such as pandemics, which necessitate rapid expansion of ultra-low temperature storage capacity for vaccines and therapeutic plasma, underscoring the strategic importance of reliable freezer technology.

Drivers: A primary driver is the accelerating prevalence of chronic diseases, including cancer, cardiac conditions, and autoimmune disorders, which necessitate regular blood transfusions and access to plasma-derived therapies. Simultaneously, the global expansion of surgical procedures, particularly in emerging economies, has amplified the demand for readily available Fresh Frozen Plasma (FFP). Furthermore, significant technological breakthroughs, such as the introduction of environmentally friendly refrigerants (hydrocarbons) and the integration of advanced vacuum insulation technology, are driving the replacement cycle for older, less efficient units, pushing market expansion. The continuous growth of the global biobanking sector, supporting personalized medicine and cell and gene therapy research, also requires extensive, high-reliability plasma storage capacity, further stimulating market growth.

Restraints and Opportunities: Key restraints include the substantial initial capital investment required for high-capacity, ultra-low temperature freezers, which can be prohibitive for smaller hospitals or facilities in resource-constrained regions. Additionally, the operational cost associated with maintaining these units—specifically high energy consumption and specialized maintenance requirements—poses a continuous challenge. Moreover, the industry faces strict regulatory hurdles imposed by bodies like the FDA, EMA, and AABB, which demand rigorous qualification, validation, and continuous monitoring, increasing complexity and compliance costs. Conversely, major opportunities arise from the increasing adoption of automated cold chain systems, the unmet demand for standardized plasma storage in developing regions, and the continuous innovation in refrigeration technology, specifically focusing on portable or mobile plasma freezing solutions tailored for remote emergency response and disaster relief scenarios. The development of modular, scalable freezer solutions also represents a significant opportunity for market penetration in varied institutional settings.

- Drivers:

- Increasing demand for blood transfusions driven by rising surgical volumes and trauma cases globally.

- Expansion of the global biopharmaceutical industry and therapeutic plasma fractionation activities.

- Strict regulatory mandates (e.g., FDA, AABB) requiring specific temperature profiles for plasma storage, driving equipment upgrades.

- Technological advancements in energy efficiency and temperature uniformity (e.g., VIP technology).

- Restraints:

- High initial capital cost and subsequent maintenance expenses associated with ultra-low temperature equipment.

- Significant power consumption and operational sustainability concerns related to older refrigeration technologies.

- Complex and time-consuming compliance requirements for validation and qualification processes in regulated environments.

- Opportunity:

- Growing investment in biobanking infrastructure across emerging economies (APAC, Latin America).

- Development and adoption of IoT-enabled smart freezers for remote data logging and predictive failure analysis.

- Transition to natural, environmentally sustainable refrigerants mandated by global climate agreements.

- Impact Forces:

- Force of Innovation: Rapid adoption of high-reliability, maintenance-free cooling systems.

- Force of Regulation: Continuous tightening of temperature monitoring and documentation standards for biological products.

- Force of Economics: Sensitivity to operational expenditure (OpEx) related to energy consumption.

Segmentation Analysis

The Biomedical Plasma Freezers Market is highly diversified, segmented primarily based on the technology utilized, the temperature range offered, the physical configuration of the unit, and the end-user application. Understanding these segments is crucial for manufacturers to tailor product specifications to specific regulatory needs, such as the stringent requirements for hospital blood banks versus the high throughput demands of pharmaceutical plasma fractionation centers. Configuration segmentation—Upright vs. Chest—is driven by facility space constraints and the frequency of sample access. Temperature range segmentation (-30°C to -40°C vs. -60°C to -86°C) differentiates standard FFP storage from high-level research and specialized biological storage requirements. The fastest-growing segment is expected to be ultra-low temperature freezers due to the proliferation of complex biotherapeutics that require deep freezing.

- By Product Type:

- Chest Plasma Freezers

- Upright Plasma Freezers

- By Temperature Range:

- Freezers below -40°C (Standard Plasma Freezers)

- Ultra-Low Temperature (ULT) Freezers (-60°C to -86°C)

- By Capacity/Volume:

- Small Capacity (100–300 Liters)

- Medium Capacity (301–600 Liters)

- Large Capacity (601 Liters and above)

- By End-User:

- Blood Banks and Transfusion Centers

- Hospitals and Clinics

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutions

- Diagnostic and Clinical Laboratories

Value Chain Analysis For Biomedical Plasma Freezers Market

The value chain for biomedical plasma freezers begins with the sourcing of highly specialized raw materials and components, including high-grade stainless steel for corrosion resistance, sophisticated compressors, advanced cooling coils, and highly effective thermal insulation materials such as Vacuum Insulation Panels (VIP). The upstream analysis highlights that manufacturers are heavily reliant on specialized suppliers for cascade refrigeration components and environmentally compliant, non-CFC refrigerants, which often dictates the final product cost and compliance profile. Quality control at this stage is paramount, as component failure directly translates to compromised biological samples and substantial financial and regulatory penalties for end-users. Strategic partnerships with key component suppliers are essential for maintaining supply chain resilience and minimizing production delays, particularly given the global shift toward natural refrigerant technologies.

The manufacturing and assembly phase involves complex engineering processes, including the integration of precise temperature control systems, electronic monitoring interfaces, and redundant cooling mechanisms to ensure maximum reliability—a non-negotiable requirement for biomedical storage. Direct and indirect distribution channels play a critical role in market access. Direct channels are often utilized for large-scale institutional clients (major hospital networks, national blood services) requiring extensive customization, installation, and validation services, where the manufacturer provides full turnkey support. Conversely, indirect channels, involving specialized medical equipment distributors and regional resellers, are crucial for reaching smaller clinical laboratories, regional hospitals, and academic research units, offering localized support and faster fulfillment.

Downstream analysis focuses heavily on post-sale services, including installation qualification (IQ), operational qualification (OQ), performance qualification (PQ), and ongoing calibration, maintenance, and validation services. Given the regulatory requirements, the service contracts segment of the value chain is highly profitable and crucial for maintaining customer retention. End-users demand comprehensive service level agreements (SLAs) that guarantee minimal downtime and rapid response to mechanical failures. The entire value chain is currently being optimized through digital transformation, utilizing IoT sensors throughout the supply and distribution phases to maintain continuous, verifiable temperature records, ensuring integrity from the point of manufacture through to final installation and operational life.

Biomedical Plasma Freezers Market Potential Customers

The primary customers for biomedical plasma freezers are institutions within the regulated healthcare and life sciences sectors that require certified ultra-low temperature storage for therapeutic blood components. The largest cohort of end-users comprises Blood Banks and Transfusion Centers, which utilize these freezers as essential storage infrastructure to maintain large inventories of Fresh Frozen Plasma (FFP), typically stored at -30°C or below, ensuring products meet transfusion standards and have a maximum shelf life. These customers prioritize high capacity, impeccable temperature uniformity across the chamber, comprehensive data logging capabilities, and adherence to accreditation standards set by organizations like the AABB (Association for the Advancement of Blood & Biotherapies). Their purchasing decisions are heavily influenced by regulatory compliance and proven reliability.

Hospitals and Clinics form the second major customer base, particularly those with trauma centers, large surgical departments, or specialized clinical trial units. While smaller in scale compared to major blood banks, hospitals require localized access to plasma for emergency transfusions and support during complex surgeries. Their needs often lean towards medium-capacity, upright freezers that offer ergonomic access and integrate seamlessly with existing laboratory information management systems (LIMS). Beyond immediate clinical care, Pharmaceutical and Biotechnology Companies represent a high-growth customer segment. These entities utilize plasma freezers extensively for manufacturing plasma-derived medicinal products (PDMPs) and for storing critical cell lines, advanced therapy raw materials, and finished biopharmaceuticals, demanding the most stringent ULT capabilities (-80°C).

The third significant customer segment includes Academic and Research Institutions, alongside Diagnostic and Clinical Laboratories, which require reliable long-term storage for research biobanks and epidemiological sample collections. These customers often require flexibility in temperature ranges and capacities, ranging from small benchtop units to large-scale, automated biorepositories. The purchasing criteria for this segment often emphasize advanced monitoring features, environmental sustainability (lower energy consumption), and specialized configurations suitable for research protocols, such as compartmentalization and specialized racking systems. The increasing funding for gene therapy research and personalized medicine initiatives continues to expand the need for these specialized storage solutions within the academic ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 705 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, PHC Corporation, Helmer Scientific, Eppendorf AG, Stirling Ultracold (Acquired by BioLife Solutions), B Medical Systems, Haier Biomedical, VWR International (Avantor), Avestin Inc., Panasonic Healthcare, Tritec, Dometic Group, Remi Group, Lec Medical, Arctiko, Fiocchetti, Pol-Eko-Aparatura, Cryotherm, Sanyo Biomedical, Binder GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Biomedical Plasma Freezers Market Key Technology Landscape

The technological evolution of biomedical plasma freezers is centered on achieving ultra-precise temperature control, maximizing energy efficiency, and ensuring data integrity through advanced monitoring systems. Ultra-Low Temperature (ULT) technology, particularly freezers capable of reaching -80°C, remains foundational, increasingly relying on highly efficient, non-HCFC/CFC based cascade refrigeration systems or, more recently, highly reliable single-compressor systems that use environmentally benign hydrocarbon (HC) refrigerants like R290 or R170. Manufacturers are aggressively incorporating sophisticated thermal management strategies, such as the use of Vacuum Insulation Panels (VIP), which offer superior insulation properties compared to traditional foam, allowing for thinner walls, increased internal storage capacity, and significantly reduced heat transfer, resulting in substantial energy savings and a smaller physical footprint.

A major technological driver is the integration of digital connectivity and smart features. Most modern plasma freezers are equipped with Internet of Things (IoT) sensors that provide real-time data logging, remote monitoring, and automated alarm systems accessible via cloud platforms. This connectivity is essential for regulatory compliance, allowing institutions to maintain an unbroken temperature record (21 CFR Part 11 compliant) and receive immediate alerts in case of power failure or temperature excursions. Furthermore, integrated predictive maintenance software, often leveraging AI analytics, is becoming standard, shifting maintenance practices from reactive repair to proactive intervention, ensuring maximum uptime and protecting valuable biological inventory. Advanced controllers also feature enhanced security protocols, including biometric access control, to limit unauthorized access to critical samples.

Current research and development efforts are focused on refining Stirling engine technology for ULT applications, offering a quieter, potentially maintenance-free, and highly energy-efficient alternative to conventional compressors, particularly appealing for distributed storage networks and remote sites. Furthermore, advancements in specialized cooling technologies, such as directional airflow systems and specialized internal baffling, are critical for minimizing temperature variation (uniformity) within the chamber, especially when the unit is frequently accessed. The continuous pressure from sustainability goals is accelerating the phase-out of legacy HFC refrigerants, solidifying hydrocarbon and other natural refrigerant technologies as the future standard for all new plasma freezer installations globally, influencing design requirements for heat dissipation and operational noise levels.

- Ultra-Low Temperature (ULT) Technology: Utilization of advanced cascade or single-compressor hydrocarbon refrigeration systems (-60°C to -86°C capability).

- Vacuum Insulation Panels (VIP): High-efficiency insulation material maximizing interior volume while minimizing energy consumption and exterior heat loss.

- IoT and Remote Monitoring: Integration of Wi-Fi/Ethernet connectivity for real-time data logging, automated alert systems, and cloud-based performance tracking.

- Hydrocarbon (HC) Refrigerants: Adoption of natural, environmentally friendly refrigerants (R290, R170) to comply with environmental sustainability regulations and improve efficiency.

- Predictive Diagnostics: Incorporation of sensors and software to analyze operational metrics (compressor cycles, temperature stability) and predict potential mechanical failures before they occur.

Regional Highlights

- North America: Dominates the market share due to highly mature healthcare and blood banking infrastructure, stringent regulatory requirements (FDA, AABB) necessitating constant equipment upgrades, high expenditure on biomedical research, and the presence of numerous key market players and major pharmaceutical research hubs. The adoption of advanced, energy-efficient ULT freezers is exceptionally high.

- Europe: Represents a substantial and stable market driven by established national health services (NHS, etc.), high rates of blood donation, and increasing focus on biobanking activities. Regulatory push (e.g., EU F-Gas regulation) favoring natural refrigerants is a significant market catalyst, driving equipment replacement cycles across the region, particularly in Germany, France, and the UK.

- Asia Pacific (APAC): Projected to be the fastest-growing region driven by rapidly expanding healthcare access, increasing governmental investment in public health infrastructure (especially in China and India), rising prevalence of complex surgeries, and the emergence of regional pharmaceutical and biotech manufacturing centers. Demand is high for both standard and ULT freezers to establish new blood centers and large-scale biobanks.

- Latin America: Characterized by increasing demand for reliable cold chain solutions, particularly in Brazil and Mexico, fueled by improvements in clinical services and the gradual modernization of public hospitals. Market growth is moderately strong but constrained by fluctuating capital investment capacity and dependence on imported technology.

- Middle East and Africa (MEA): Currently holds the smallest market share but is expected to show promising growth, particularly in the GCC countries (Saudi Arabia, UAE), driven by ambitious national healthcare development visions, investment in specialized clinical facilities, and efforts to establish regional hubs for pharmaceutical logistics and storage.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Biomedical Plasma Freezers Market.- Thermo Fisher Scientific

- PHC Corporation (formerly Panasonic Healthcare)

- Helmer Scientific

- Eppendorf AG

- Stirling Ultracold (Acquired by BioLife Solutions)

- B Medical Systems

- Haier Biomedical

- VWR International (Avantor)

- Avestin Inc.

- Tritec

- Dometic Group

- Remi Group

- Lec Medical

- Arctiko

- Fiocchetti

- Pol-Eko-Aparatura

- Cryotherm

- Sanyo Biomedical

- Binder GmbH

- Custom BioGenic Systems

Frequently Asked Questions

Analyze common user questions about the Biomedical Plasma Freezers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the mandatory temperature requirements for storing Fresh Frozen Plasma (FFP)?

Regulatory bodies, including the FDA and AABB, mandate that Fresh Frozen Plasma (FFP) must be stored at or below -18°C. However, for maximum stability and extended shelf life (typically up to seven years), most blood banks and clinical centers prefer storage at ultra-low temperatures, usually between -30°C and -40°C, utilizing dedicated biomedical plasma freezers to ensure strict temperature uniformity and minimize therapeutic degradation.

How does the shift to natural refrigerants impact the performance and cost of new plasma freezers?

The transition to natural hydrocarbon (HC) refrigerants, such as R290 and R170, significantly improves the energy efficiency of new plasma freezers, leading to lower operational costs over the equipment lifecycle. While the initial cost of HC-based freezers might be slightly higher due to necessary system redesigns, the improved thermal performance and regulatory compliance (avoiding high GWP gases) provide substantial long-term value, aligning with global sustainability goals.

What is the significance of Vacuum Insulation Panel (VIP) technology in modern biomedical freezers?

Vacuum Insulation Panel (VIP) technology is crucial for modern biomedical freezers because it provides superior thermal resistance compared to traditional polyurethane foam. This allows manufacturers to construct thinner freezer walls, dramatically increasing the internal storage capacity without enlarging the exterior footprint, while simultaneously ensuring exceptional temperature retention during power outages and reducing energy consumption during routine operation, thereby preserving sample integrity.

What role does IoT connectivity play in optimizing the operation of large blood bank freezers?

IoT connectivity optimizes large blood bank operations by enabling continuous, real-time remote monitoring of critical parameters like internal temperature, door opening frequency, and power status. This data is used to trigger automated alerts for temperature excursions, facilitates mandatory electronic documentation for regulatory audits, and feeds into predictive maintenance systems, ensuring the maximum operational uptime and compliance required for lifesaving biological products.

Which end-user segment is experiencing the fastest growth in demand for ULT biomedical freezers?

The Pharmaceutical and Biotechnology Companies segment is currently experiencing the fastest growth in demand for Ultra-Low Temperature (ULT) biomedical freezers. This surge is driven primarily by the escalating research and manufacturing needs associated with advanced therapeutics, including cell and gene therapies (ATMPs), which necessitate highly stable, -80°C storage environments for raw materials, intermediate products, and specialized research biobanks, requiring superior freezers beyond standard clinical needs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager