Biometrics for Banking and Financial Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435403 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Biometrics for Banking and Financial Services Market Size

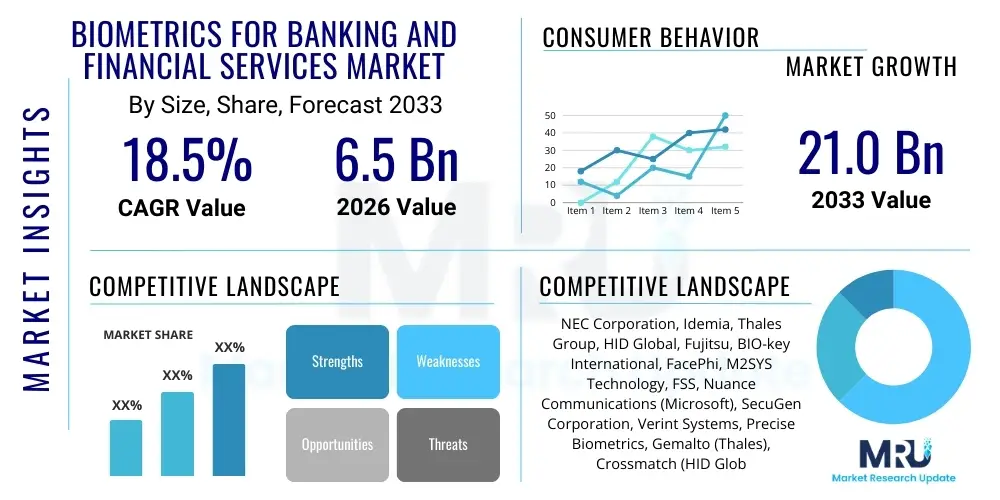

The Biometrics for Banking and Financial Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 21.0 Billion by the end of the forecast period in 2033.

Biometrics for Banking and Financial Services Market introduction

The Biometrics for Banking and Financial Services Market encompasses the implementation of physical and behavioral characteristics for verifying the identity of customers and employees within financial institutions. This advanced technology serves as a critical replacement or supplement to traditional authentication methods like passwords and PINs, offering significantly enhanced security, improved customer experience, and streamlined operational efficiency. The primary product scope includes hardware components such as fingerprint scanners, facial recognition cameras, and iris sensors, integrated with sophisticated software platforms capable of managing biometric templates, performing real-time matching, and ensuring compliance with global data protection regulations.

Major applications of biometric systems in finance span across several critical areas, including digital account onboarding (e-KYC), mobile and online transaction verification, ATM access authentication, and securing physical branch access for high-security areas. These systems directly address the escalating threat of cyber fraud and identity theft, which cost the global financial sector billions annually. The core benefit derived from biometric adoption is the elevation of trust and security, allowing banks to meet stringent regulatory requirements while simultaneously providing frictionless user journeys. The inherently unique nature of biometric identifiers minimizes the risk associated with shared, forgotten, or stolen credentials, thus strengthening the integrity of the financial ecosystem.

Driving factors for this market include the global shift towards cashless and digital banking, particularly the explosive growth of mobile banking applications where biometrics offer the quickest and most secure access. Furthermore, global regulatory pressures, such as PSD2 in Europe and similar mandates worldwide, are pushing financial institutions to adopt stronger Customer Authentication (SCA) methods, making multi-factor authentication centered on biometrics an essential requirement. The continuous advancements in sensor technology and the decreasing cost of hardware components, coupled with improved accuracy rates (lower False Acceptance Rate - FAR and False Rejection Rate - FRR), further accelerate the widespread deployment of these identity solutions across retail and corporate banking environments.

Biometrics for Banking and Financial Services Market Executive Summary

The Biometrics for Banking and Financial Services Market is currently experiencing robust expansion, driven primarily by evolving digital business models and the necessity for robust fraud prevention measures. Key business trends indicate a strong move toward passive and continuous authentication, utilizing behavioral biometrics alongside physical traits like facial and voice recognition to create a holistic security posture. Financial institutions are increasingly prioritizing solutions that integrate seamlessly into existing core banking infrastructure, favoring modular and cloud-based deployment models. The investment focus has shifted from simple endpoint verification to enterprise-wide identity platforms capable of managing authentication across channels—mobile, web, and physical branches. This transformation reflects the market’s maturity, moving beyond novelty to essential infrastructure.

Regionally, North America and Europe remain the dominant markets due to high technology adoption rates, the presence of major financial hubs, and stringent regulatory environments demanding advanced security solutions. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth trajectory, fueled by rapid digitalization, massive unbanked populations entering the formal financial sector via mobile platforms, and supportive government initiatives promoting digital identity schemes. Latin America and the Middle East and Africa (MEA) are also showing promising growth, particularly in areas focusing on mobile payment biometrics and enhanced KYC processes for remote customer acquisition. The varying regulatory landscapes across regions significantly influence the preferred biometric modalities and deployment strategies.

Segment trends highlight the accelerated adoption of facial recognition and voice biometrics, driven by their suitability for remote mobile authentication and call center security, respectively. While fingerprint biometrics remain foundational for physical access and point-of-sale verification, behavioral biometrics is rapidly emerging as a critical segment. Behavior tracking offers a continuous, non-intrusive layer of security, verifying the legitimate user based on typing speed, navigation patterns, and device usage context, which dramatically reduces the efficacy of deepfake and sophisticated account takeover attacks. The software segment, encompassing sophisticated matching algorithms and template management systems, is expected to grow faster than the hardware segment, reflecting the increasing importance of robust, scalable identity management platforms.

AI Impact Analysis on Biometrics for Banking and Financial Services Market

User queries regarding the impact of Artificial Intelligence (AI) on the Biometrics for Banking sector center heavily on enhancing accuracy, detecting sophisticated fraud (such as deepfakes and presentation attacks), and enabling truly continuous authentication. Users often ask how AI improves template security, reduces False Positive Rates (FPRs) in large-scale databases, and supports the deployment of behavioral biometrics. The primary concern is balancing the improved security offered by AI algorithms—specifically Machine Learning (ML) used for pattern recognition and anomaly detection—with data privacy implications and the potential for algorithmic bias. Users expect AI to move biometrics beyond simple 1:1 matching to a dynamic, risk-based authentication engine that adapts in real-time to evolving threat landscapes and user behavior.

AI's fundamental role is transforming static biometric systems into intelligent, adaptive security frameworks. ML algorithms are essential for processing the vast, complex datasets generated by behavioral biometrics, identifying subtle anomalies that indicate compromised accounts or non-human interactions. This continuous learning capability allows financial institutions to deploy risk-based authentication, wherein the required authentication rigor (e.g., face scan vs. fingerprint scan plus a one-time password) is dynamically adjusted based on the assessed risk profile of the transaction and user context. AI is also crucial in improving the robustness of Presentation Attack Detection (PAD) mechanisms, helping systems differentiate between a live human being and high-quality spoofs like silicon masks or deepfake videos.

Furthermore, AI significantly enhances data management and security within biometric systems. It facilitates the use of advanced encryption and homomorphic encryption techniques, ensuring that biometric templates stored are highly secure and unusable if stolen. In customer service, AI-powered voice biometrics enable rapid and secure verification in call centers, replacing lengthy knowledge-based authentication questions, thereby reducing call handling times and improving the customer experience. The integration of AI/ML is accelerating the shift toward multi-modal biometric fusion, where data from several modalities are combined and analyzed by ML to achieve near-perfect accuracy and resilience against single-point failures.

- AI enhances biometric accuracy by optimizing matching algorithms and reducing False Rejection Rates (FRR) and False Acceptance Rates (FAR).

- Machine Learning is indispensable for enabling and refining behavioral biometrics, detecting deviations in user interaction patterns indicative of fraud.

- AI algorithms significantly improve Presentation Attack Detection (PAD) capabilities, countering deepfake videos, high-resolution prints, and synthetic voice spoofs.

- Risk-based authentication models, powered by AI, dynamically adjust security requirements based on transaction context and assessed threat level.

- AI aids in secure template management through sophisticated cryptographic hashing and privacy-enhancing technologies like federated learning.

DRO & Impact Forces Of Biometrics for Banking and Financial Services Market

The market is highly influenced by potent driving forces, chief among them being the escalating threat of cyber fraud and identity theft in digital banking channels, necessitating superior authentication methods. Restraining factors include high initial implementation costs, interoperability challenges with legacy banking systems, and significant public and regulatory concerns regarding data privacy and the security of stored biometric templates. However, substantial opportunities exist through the synergistic integration of biometrics with AI/ML to develop continuous authentication protocols and the proliferation of biometric-enabled mobile devices and contactless payment systems. These dynamics collectively exert a strong impact force, compelling financial institutions to adopt biometric security as a standard requirement for maintaining trust and regulatory compliance in a hyper-digitalized environment.

Segmentation Analysis

The Biometrics for Banking and Financial Services Market is intricately segmented across various dimensions, including the type of biometric modality utilized, the components involved in the system architecture, the deployment model favored by institutions, and the diverse range of applications within the financial ecosystem. Analyzing these segments provides a clear understanding of investment priorities and technological maturity across the sector. Modality segmentation is crucial, determining the primary means of user verification, while component analysis differentiates between the capital expenditure (hardware) and operational expenditure (software and services) portions of market spending. Deployment models (cloud vs. on-premise) reflect institutional strategies concerning scalability and data governance, whereas application segmentation highlights the most critical use cases driving current biometric adoption.

Within modality segmentation, fingerprint and facial recognition currently hold the largest market share due to their maturity, cost-effectiveness, and integration into standard consumer hardware (smartphones, tablets). However, voice recognition is experiencing rapid growth, driven by the need to secure customer interactions in call centers and voice-activated banking services. Behavioral biometrics represents a significant area of innovation, offering non-intrusive, continuous authentication that mitigates risks associated with static biometric data breaches. Financial institutions are increasingly adopting multi-modal systems, which combine two or more modalities (e.g., face and voice) to maximize accuracy and resilience against single-modality attacks.

The services component segment, which includes integration, consulting, maintenance, and managed services, is projected to grow at the highest CAGR. This growth is attributable to the complexity of integrating new biometric systems with decades-old core banking systems, requiring specialized expertise. Furthermore, the shift towards cloud-based deployment models is facilitating greater scalability and quicker time-to-market for biometric solutions, particularly appealing to smaller financial institutions and FinTech startups. Understanding these diverse segments is vital for vendors developing targeted solutions that address specific industry pain points, such as digital onboarding friction or sophisticated internal fraud.

- By Modality:

- Fingerprint Recognition

- Facial Recognition

- Iris Recognition

- Voice Recognition

- Palm Vein Recognition

- Behavioral Biometrics

- By Component:

- Hardware (Sensors, Scanners, Cameras)

- Software (Matching Algorithms, Template Management)

- Services (Integration, Consulting, Maintenance)

- By Deployment Model:

- On-Premise

- Cloud

- By Application:

- Authentication and Verification (Mobile/Web Access)

- Fraud Prevention and Risk Management

- Physical Access Control and Workforce Management

- Digital Onboarding and e-KYC

- ATM/Kiosk Authentication

Value Chain Analysis For Biometrics for Banking and Financial Services Market

The value chain for the Biometrics for Banking and Financial Services Market starts with the upstream segment, dominated by hardware manufacturers (producing sensors, cameras, and scanners) and specialized algorithm developers who create the core intellectual property for matching and verification. These components and algorithms form the fundamental technology stack. A strong focus on R&D in this stage drives improvements in sensor miniaturization, accuracy (lowering FAR/FRR), and anti-spoofing capabilities. Competition in the upstream market centers on cost-efficiency and technological superiority, particularly in biometric fusion capabilities and advanced encryption standards necessary for template security.

Midstream activities involve solution integrators and software providers who bundle the core technology into enterprise-grade platforms tailored for financial services. This stage includes developing middleware for seamless integration with legacy banking platforms, compliance assurance tools (for GDPR, CCPA, etc.), and specialized APIs for mobile banking applications. The distribution channel is bifurcated: Direct sales are common for large-scale enterprise deployments requiring extensive customization and high-touch support, typically involving top-tier system integrators working directly with global banks. Indirect channels, involving specialized value-added resellers (VARs) and partnerships with core banking software vendors, are crucial for reaching regional banks and credit unions.

Downstream analysis focuses on the end-users—the banks, credit unions, and FinTech companies—and the managed services that support them. This stage involves deployment, continuous monitoring, and ongoing maintenance to ensure system uptime and performance metrics are met. The indirect impact of the value chain is seen in the enhanced security offered to the end consumer. Effective downstream operations require robust Service Level Agreements (SLAs) and expert support to manage the evolving regulatory and fraud landscape. The profitability margins tend to be higher in the specialized software and integration services segments compared to the highly commoditized hardware production segment.

Biometrics for Banking and Financial Services Market Potential Customers

The primary potential customers and buyers of biometrics solutions within this market are any entities involved in handling financial transactions, managing sensitive customer data, or requiring secure physical access control. This includes a broad spectrum of financial institutions, ranging from large, multinational Tier 1 banks that deploy enterprise-wide, multi-modal systems across all their services, to smaller, regional credit unions that typically adopt targeted, cloud-based solutions for mobile onboarding and ATM access. The adoption trajectory often correlates with the institution's size and geographic spread, as well as the intensity of local regulatory scrutiny concerning digital authentication.

Beyond traditional banks, the customer base includes a rapidly expanding category of non-traditional financial service providers. FinTech companies, digital-only banks (neobanks), and specialized payment processors are highly receptive to biometric technology because they prioritize frictionless user experience and low operational overhead associated with credential management. These entities often leverage biometrics as a core differentiator, integrating it natively into their app interfaces from inception. Furthermore, regulatory bodies and central banks sometimes act as influential customers or drivers, mandating certain security standards that require biometric capabilities across the national financial infrastructure.

The specific purchasing decision often sits within the Chief Information Security Officer (CISO) and Chief Digital Officer (CDO) departments, reflecting the duality of biometrics as both a security measure and a customer engagement tool. Potential customers are seeking solutions that offer strong return on investment (ROI) by reducing fraud losses, minimizing operational costs related to password resets, and improving customer satisfaction through faster, more convenient interactions. The demand for robust, scalable solutions that can handle millions of unique users securely remains the most critical purchasing criterion across all potential customer segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 21.0 Billion |

| Growth Rate | CAGR 18.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | NEC Corporation, Idemia, Thales Group, HID Global, Fujitsu, BIO-key International, FacePhi, M2SYS Technology, FSS, Nuance Communications (Microsoft), SecuGen Corporation, Verint Systems, Precise Biometrics, Gemalto (Thales), Crossmatch (HID Global), Daon, Innovatrics, Iris ID, Suprema, Validated ID |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Biometrics for Banking and Financial Services Market Key Technology Landscape

The technology landscape in the Biometrics for Banking and Financial Services market is characterized by rapid evolution across several core domains, moving significantly beyond simple contact-based fingerprint reading. A primary technological focus is on enhancing presentation attack detection (PAD) using infrared sensors, 3D imaging, and liveness detection algorithms to thwart sophisticated spoofing attempts like deepfakes and high-fidelity molds. Multi-modal biometrics, which fuse data from different sources (e.g., combining facial structure and voice cadence) using advanced fusion algorithms, are becoming standard to increase both accuracy and system robustness, offering failover mechanisms if one modality cannot be reliably captured.

Two critical technological shifts dominate the current market. Firstly, the proliferation of behavioral biometrics technology, which analyzes thousands of passive data points related to user interaction—such as device orientation, swipe patterns, pressure applied, and navigational speed—to build a unique behavioral profile. This continuous monitoring capability offers proactive fraud detection rather than relying solely on single point-in-time authentication. Secondly, the deployment architecture is leaning heavily towards decentralized and encrypted template storage, often utilizing biometric on the card (BOC) technology or sophisticated template obfuscation techniques, such as secure hashing and encryption, to ensure that the raw biometric data is never stored in a way that could be reverse-engineered or compromised in a central database breach.

Furthermore, technology enabling interoperability and standardization is crucial. Solutions must integrate seamlessly with various mobile operating systems (iOS, Android), comply with FIDO standards for secure authentication, and be scalable to handle global transaction volumes. The ongoing advancements in AI and Machine Learning are paramount, driving the intelligence behind risk scoring engines that assess transactional risk in milliseconds, dynamically adjusting authentication requirements. This convergence of passive identity verification, advanced liveness detection, and secure, distributed data storage defines the competitive technological edge in the financial biometrics sector today.

Regional Highlights

Regional dynamics within the Biometrics for Banking and Financial Services Market reflect varying levels of digital infrastructure maturity, regulatory imperatives, and consumer acceptance of new technologies. North America, specifically the United States, represents a leading market characterized by high investment in FinTech innovation and a proactive stance toward reducing credit card and digital fraud. Major banks in this region have pioneered large-scale deployments of multi-modal systems for mobile banking and internal workforce management. The continuous need for compliance with financial security standards drives consistent R&D spending on cutting-edge biometric solutions.

Europe demonstrates high adoption, strongly influenced by regulatory mandates like the Payment Services Directive (PSD2), which requires Strong Customer Authentication (SCA). This regulation has accelerated the deployment of biometrics for transaction confirmation and remote onboarding. Western European countries, particularly the UK and Germany, are mature markets, while Eastern Europe is catching up rapidly. The focus here is heavily skewed towards solutions that ensure strict GDPR compliance regarding the handling and storage of biometric data, promoting decentralized storage models and explicit user consent mechanisms.

Asia Pacific (APAC) is the fastest-growing market, driven by massive mobile banking adoption and governmental initiatives promoting digital identity systems (e.g., India’s Aadhaar system). Countries like China, India, and Southeast Asian nations are deploying biometrics at an unprecedented scale, often integrating facial and voice recognition directly into national payment systems and digital wallets. The high volume of transactions, coupled with less developed traditional banking infrastructure in some areas, makes mobile biometrics the preferred method of establishing secure financial access for vast populations.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets showing significant potential. In LATAM, biometrics are crucial for combating identity fraud, particularly in countries like Brazil and Mexico, where fingerprint and facial recognition are increasingly used for both ATM transactions and government identification linked to financial services. The MEA region is seeing increased adoption, primarily driven by Gulf Cooperation Council (GCC) countries investing heavily in smart city infrastructure and secure digital government services that intersect with the banking sector, particularly utilizing iris and facial biometrics for premium customer services and high-security installations.

- North America: Leading market for digital fraud prevention; strong adoption of multi-modal systems and behavioral biometrics in Tier 1 banks.

- Europe: Driven by regulatory compliance (PSD2, GDPR); high focus on secure, privacy-preserving solutions, especially decentralized template storage.

- Asia Pacific (APAC): Highest growth rate; propelled by massive mobile banking penetration, e-KYC initiatives, and large-scale government ID projects.

- Latin America (LATAM): High demand driven by the need to combat pervasive identity fraud, heavy usage of biometrics for physical and ATM security.

- Middle East & Africa (MEA): Growing market fueled by investment in digital infrastructure and premium banking services utilizing advanced iris and facial recognition.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Biometrics for Banking and Financial Services Market.- NEC Corporation

- Idemia

- Thales Group

- HID Global

- Fujitsu

- BIO-key International

- FacePhi

- M2SYS Technology

- FSS

- Nuance Communications (Microsoft)

- SecuGen Corporation

- Verint Systems

- Precise Biometrics

- Gemalto (Thales)

- Crossmatch (HID Global)

- Daon

- Innovatrics

- Iris ID

- Suprema

- Validated ID

Frequently Asked Questions

Analyze common user questions about the Biometrics for Banking and Financial Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What types of biometrics are most commonly used in the financial services industry today?

The most common biometrics used are Fingerprint Recognition for physical devices and ATMs, and Facial Recognition for mobile banking authentication and digital onboarding (e-KYC). Voice Biometrics is rapidly gaining traction for securing call center interactions and reducing Account Takeover (ATO) fraud.

How does biometric technology ensure data privacy and regulatory compliance in banking?

Biometric systems ensure privacy by avoiding the storage of raw biometric images. Instead, they store encrypted, irreversible mathematical templates (secure hashes). Compliance with regulations like GDPR and CCPA is achieved through explicit consent mechanisms and decentralized storage models, such as Biometric On the Card (BOC).

What is the role of behavioral biometrics in mitigating sophisticated financial fraud?

Behavioral biometrics analyzes passive user patterns, such as typing cadence, mouse movements, and navigation speed, to create a continuous identity profile. This allows for real-time, non-intrusive authentication, effectively detecting automated bot attacks, malware infiltration, and sophisticated deepfake-driven account takeover attempts by flagging deviations from the established norm.

What are the key differences between static and continuous authentication methods?

Static authentication (e.g., fingerprint scan at login) verifies identity at a single point in time. Continuous authentication, primarily utilizing behavioral biometrics and AI, monitors the user's interaction throughout the entire session, ensuring the legitimate user remains in control, significantly increasing security post-login.

What challenges are currently restraining the widespread adoption of biometrics in banking?

Key restraints include the high initial capital expenditure required for implementation, integration difficulties with older, legacy core banking systems, and overcoming consumer skepticism regarding the potential misuse or data breach of personal biometric information, despite advanced security measures implemented by providers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager