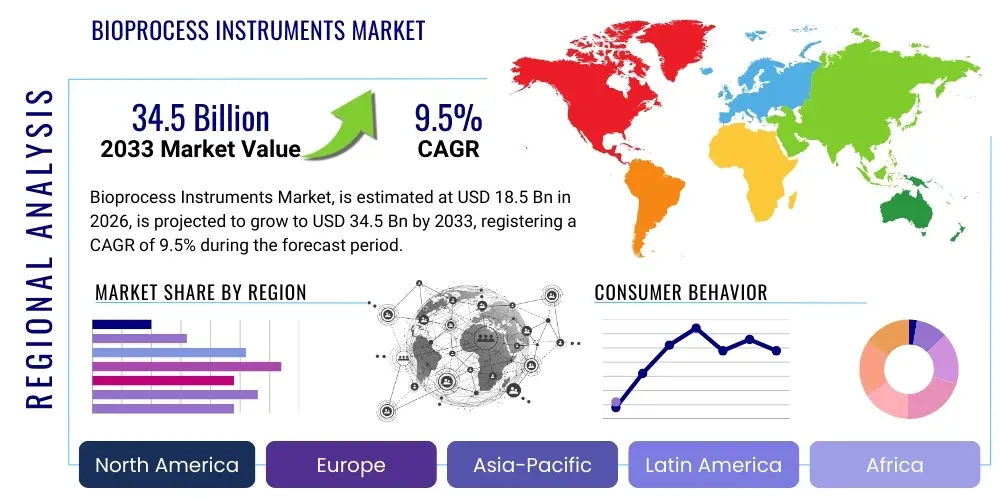

Bioprocess Instruments Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437363 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Bioprocess Instruments Market Size

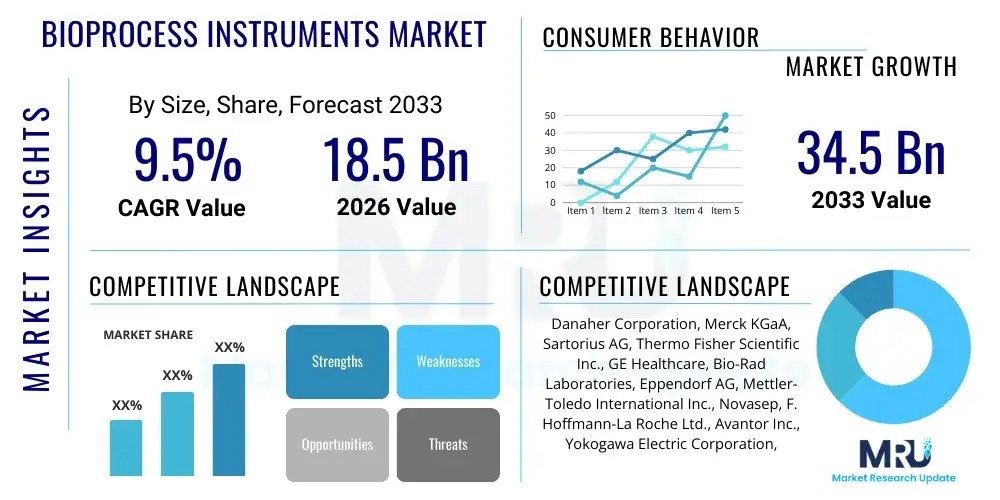

The Bioprocess Instruments Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 34.5 Billion by the end of the forecast period in 2033.

Bioprocess Instruments Market introduction

The Bioprocess Instruments Market encompasses specialized analytical tools and monitoring systems crucial for the development and manufacturing of biopharmaceuticals, including monoclonal antibodies, vaccines, and cell and gene therapies. These instruments are integral for real-time monitoring and control of critical process parameters (CPPs) such as pH, dissolved oxygen (DO), temperature, cell density, glucose concentration, and various metabolite levels within bioreactors and downstream purification systems. The primary function of these tools is to ensure product quality, maintain process efficiency, and comply with stringent regulatory guidelines set by bodies like the FDA and EMA. The demand for robust, accurate, and scalable instrumentation is directly linked to the burgeoning global pipeline of novel biologic drugs and the increasing standardization of manufacturing processes.

Product descriptions within this sector span a wide range, categorized broadly into sensors (single-use and reusable), analyzers (spectroscopic, chromatographic, and electrochemical), and sophisticated automation and software platforms designed for data integration and process analytical technology (PAT) applications. Major applications include upstream processing (fermentation and cell culture monitoring), downstream processing (purification and filtration control), and formulation stages. The fundamental benefit provided by advanced bioprocess instruments is enhanced operational visibility, which minimizes batch failures, reduces time-to-market for therapeutics, and facilitates necessary scaling from clinical trials to commercial production volumes, thereby optimizing overall manufacturing economics.

Key driving factors accelerating market expansion involve the massive investment in biologics manufacturing capacity across North America and Asia Pacific, coupled with the industry-wide transition towards continuous bioprocessing methodologies, which inherently require sophisticated real-time monitoring and control capabilities. Furthermore, the rapid adoption of single-use (disposable) sensors and components is reshaping the market landscape by offering flexibility, reducing cleaning validation burdens, and speeding up facility turnaround times. Regulatory emphasis on Quality by Design (QbD) and the implementation of PAT strategies necessitates the deployment of next-generation instruments capable of generating reliable, high-fidelity data suitable for regulatory submission and continuous process verification.

Bioprocess Instruments Market Executive Summary

The Bioprocess Instruments Market is experiencing robust expansion, driven primarily by exponential growth in the global biopharmaceutical industry, particularly in the fields of oncology and personalized medicine. Business trends highlight a significant shift towards integrated process analytical technology (PAT) solutions and digitalization, where hardware and software are combined to provide actionable, real-time insights, fostering higher levels of automation and reducing manual intervention. Strategic collaborations between instrument manufacturers and Contract Development and Manufacturing Organizations (CDMOs) are becoming increasingly common, aimed at standardizing and accelerating the implementation of advanced bioprocessing workflows. The focus is increasingly on miniaturization, enhanced sensor longevity, and the development of non-invasive or inline monitoring techniques that minimize sample contamination risk and maximize data integrity.

Regionally, North America maintains its dominance due to a strong presence of major biopharmaceutical companies, high R&D spending, and early adoption of advanced technologies like single-use systems. However, the Asia Pacific region, led by China, Japan, and India, is emerging as the fastest-growing market, propelled by increasing governmental support for biotechnology, expanding local manufacturing capabilities, and rising demand for affordable biologics. European markets are also witnessing steady growth, supported by robust regulatory frameworks promoting innovation in continuous manufacturing and cell culture optimization. Investment in infrastructure upgrades and the establishment of new bioprocessing facilities globally underscore the sustained growth trajectory across all major geographic zones.

From a segment perspective, the sensors and probes segment currently holds a significant market share, driven by the massive volume of disposables used in single-use bioreactors. However, the advanced analytics and software segment is anticipated to register the highest CAGR, reflecting the industry's need to effectively manage and interpret the vast amounts of process data generated. Upstream processing remains the largest application segment, demanding high-precision instruments for cell viability and metabolic analysis. The shift towards cell and gene therapy manufacturing is creating new, highly specialized sub-segments requiring ultra-sensitive and reliable monitoring instruments for closed-system processing environments.

AI Impact Analysis on Bioprocess Instruments Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) integration is transforming the reliability, predictability, and efficiency of bioprocess instruments. Key concerns revolve around the practical implementation of AI for real-time fault detection, predictive maintenance of complex instrument systems, and the creation of accurate digital twins for process simulation and optimization. Users seek confirmation on whether AI tools can enhance the interpretation of large, multivariate datasets generated by PAT instruments, ultimately enabling autonomous control loops in manufacturing. The general expectation is that AI will move the market beyond simple monitoring towards truly predictive and prescriptive biomanufacturing, demanding instruments that are inherently 'smart' and capable of seamless data integration with sophisticated analytical platforms.

- AI facilitates real-time predictive analytics, identifying potential process deviations before they impact batch quality.

- Implementation of digital twins requires robust instrument data, enabling accurate simulation and optimization of bioprocess parameters.

- AI enhances sensor calibration and drift correction, improving the long-term reliability and reducing manual maintenance requirements of instruments.

- Machine learning algorithms interpret complex spectroscopic data (e.g., Raman, FTIR) faster and more accurately than traditional methods, speeding up decision-making.

- Autonomous process control loops leverage AI to adjust CPPs dynamically based on predicted future states, maximizing yield and consistency.

- Advanced data processing via AI helps correlate instrument readings across different unit operations, ensuring end-to-end process visibility and control.

- Automated anomaly detection reduces human error and ensures compliance by flagging unusual instrument performance or process excursions immediately.

DRO & Impact Forces Of Bioprocess Instruments Market

The Bioprocess Instruments Market is influenced by a dynamic interplay of propelling drivers, systemic restraints, and lucrative opportunities. The primary driver is the burgeoning global demand for biopharmaceuticals and the consequential need for increased manufacturing efficiency and reduced production costs, pushing companies to adopt highly accurate, continuous monitoring solutions. Regulatory mandates emphasizing Quality by Design (QbD) and Process Analytical Technology (PAT) further necessitate the integration of advanced instruments capable of real-time process verification. Opportunities arise predominantly from technological convergence, particularly the integration of Internet of Things (IoT) capabilities with sensors, enabling remote monitoring and enhanced data accessibility, alongside the specialized needs emerging from the rapidly growing fields of cell and gene therapies, which require tailored, miniaturized instrumentation for closed systems.

However, the market faces significant restraints, including the high initial capital investment required for implementing sophisticated PAT systems and bioreactor control units, which can be prohibitive for smaller biotech startups or academic research institutions. Furthermore, the complexity of sensor calibration, data integration across disparate platforms, and the specialized technical expertise required for operating and maintaining advanced bioprocess instruments present substantial operational challenges. Regulatory hurdles related to the validation of new instrument technologies within established manufacturing processes can also slow down adoption rates, necessitating extensive testing and documentation to ensure compliance and data integrity across the product lifecycle.

These forces collectively generate a high impact on market dynamics. The shift toward single-use technology, a major opportunity, demands continuous innovation in disposable sensor technology to match the performance of traditional reusable probes. The intense pressure to lower manufacturing costs acts as a driver for adopting instruments that enable continuous processing, but this transformation is simultaneously restrained by the steep learning curve associated with transitioning from traditional batch methods. Ultimately, the successful navigation of these drivers and restraints will determine market leadership, favoring manufacturers that can offer integrated, cost-effective, validated, and user-friendly monitoring and control solutions that meet the specialized needs of modern biological production.

Segmentation Analysis

The Bioprocess Instruments Market is comprehensively segmented based on product type, application, end-user, and geography, reflecting the diversity of needs within the biomanufacturing ecosystem. Product segmentation provides granular detail on the technologies available, ranging from basic sensors and probes to complex spectrophotometers and integrated software suites. Application segmentation highlights the crucial phases of bioprocessing—upstream, downstream, and fermentation—each demanding distinct monitoring requirements. Analyzing end-users, including pharmaceutical companies, CDMOs, and academic institutions, helps identify specific purchasing power and technological adoption patterns, ensuring market offerings are precisely targeted to the operational scale and regulatory environment of the consumer base.

- By Product Type:

- Sensors and Probes (pH, DO, Temperature, Pressure, Conductivity, Single-Use Sensors)

- Analyzers (Spectroscopic Analyzers, Chromatographic Systems, Cell Culture Analyzers, Electrochemical Analyzers)

- Control Systems and Automation Platforms

- Software and Data Management Systems

- Filtration and Separation Instrumentation

- By Application:

- Upstream Processing (Cell Culture Monitoring, Media Preparation)

- Downstream Processing (Purification, Filtration, Formulation)

- Process Development and Optimization

- By End-User:

- Pharmaceutical and Biopharmaceutical Companies

- Contract Development and Manufacturing Organizations (CDMOs)

- Academic and Research Institutes

- Food and Beverage Industry (Biotechnology Applications)

- By Technology:

- Conventional Systems

- Single-Use Systems (Disposable Sensors and Assemblies)

Value Chain Analysis For Bioprocess Instruments Market

The value chain for the Bioprocess Instruments Market begins with upstream activities focusing on raw material procurement, which includes securing high-purity components, specialized polymers, and electronic sensors from various global suppliers. This phase is critical, as the quality and stability of these foundational materials directly dictate the accuracy and regulatory compliance of the final instrument. Following material sourcing, the next major step involves research and development (R&D) and sophisticated instrument manufacturing, where complex integration of mechanical, optical, and electronic components occurs, coupled with intensive software development for data processing and control interface creation. Manufacturing excellence, precision engineering, and adherence to ISO standards are paramount at this stage to ensure product reliability and minimize calibration variability, leading to the final assembled bioprocess instrument.

The downstream component of the value chain focuses heavily on distribution, sales, and comprehensive post-sales support, which is often facilitated through both direct and indirect channels. Direct distribution is common for highly specialized or newly launched complex instruments, allowing manufacturers to maintain tight control over installation, validation (IQ/OQ/PQ), and initial user training, particularly for major pharmaceutical clients. Indirect channels, involving authorized third-party distributors and regional agents, are crucial for reaching smaller end-users, providing localized inventory, and offering rapid maintenance services across diverse geographical regions, especially in emerging markets where local presence is vital for competitive advantage.

A distinctive feature of this market’s value chain is the emphasis on service provision; instruments require regular calibration, maintenance contracts, and software updates, establishing a critical, continuous revenue stream for manufacturers. The integration of digital services, such as remote diagnostics and cloud-based data management tools, further enhances the value proposition by optimizing instrument uptime and providing end-users with robust data governance solutions. Effective management of this highly technical value chain, from R&D intensity to critical regulatory compliance at the deployment stage, is essential for securing long-term customer relationships and market dominance in the competitive bioprocessing landscape.

Bioprocess Instruments Market Potential Customers

Potential customers for the Bioprocess Instruments Market are predominantly organizations deeply engaged in the development, production, and quality control of biological products and advanced therapeutics. The largest consumer base comprises global pharmaceutical and biotechnology companies, which require vast quantities of highly reliable sensors, analyzers, and integrated control systems to manage their large-scale biomanufacturing facilities and maintain compliance with Good Manufacturing Practice (GMP) standards. These customers prioritize instruments offering high fidelity, scalability, and seamless integration capabilities with existing Distributed Control Systems (DCS) and Manufacturing Execution Systems (MES).

Contract Development and Manufacturing Organizations (CDMOs) represent another crucial segment of potential buyers. CDMOs require flexible, modular instrumentation setups to handle a diverse range of client projects, spanning different molecules, scales, and process requirements. Their purchasing decisions are heavily influenced by the instrument's turnaround time, validation ease, and ability to support single-use technologies, which enable faster changeovers between batches and clients. Furthermore, the rapid expansion of CDMO services globally, particularly in the APAC region, drives consistent demand for next-generation bioprocess instrumentation, making them a high-growth customer segment.

Finally, academic institutions, university research centers, and government laboratories engaged in fundamental biotechnology research, vaccine development, and early-stage process optimization constitute a steady customer stream. While their purchasing volumes are generally smaller than commercial manufacturers, they often serve as early adopters of cutting-edge or niche analytical technologies, influencing broader market adoption. These research customers seek highly precise, multi-parametric analyzers suitable for small-scale experiments and process optimization studies, often requiring sophisticated data analysis software for complex scientific investigations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 34.5 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Danaher Corporation, Merck KGaA, Sartorius AG, Thermo Fisher Scientific Inc., GE Healthcare, Bio-Rad Laboratories, Eppendorf AG, Mettler-Toledo International Inc., Novasep, F. Hoffmann-La Roche Ltd., Avantor Inc., Yokogawa Electric Corporation, Malvern Panalytical, Waters Corporation, Repligen Corporation, Broadley-James Corporation, C Technologies Inc., Hamilton Company, Agilent Technologies, Lonza Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bioprocess Instruments Market Key Technology Landscape

The technological landscape of the Bioprocess Instruments Market is characterized by a rapid evolution toward increased automation, non-invasive measurements, and digitalization, fundamentally driven by the mandates of Process Analytical Technology (PAT). A primary technological advancement involves single-use sensor technology, specifically disposable pH, dissolved oxygen, and conductivity probes. These disposable sensors eliminate the need for sterilization and cleaning validation, significantly accelerating manufacturing timelines and reducing the risk of cross-contamination, making them indispensable for modern flexible manufacturing facilities and CDMOs utilizing single-use bioreactor systems.

Furthermore, spectroscopic techniques, such as Raman spectroscopy, Near-Infrared (NIR) spectroscopy, and Fourier Transform Infrared (FTIR) spectroscopy, are increasingly integrated directly into bioreactors. These advanced analyzers enable real-time, non-invasive measurement of critical quality attributes (CQAs) and metabolite concentrations, providing rapid insight into cell health and product formation dynamics without requiring traditional offline sampling. The data generated by these high-throughput analytical instruments necessitate parallel advancements in data management and control software, leading to the rise of sophisticated bio-data integration platforms utilizing multivariate data analysis and Machine Learning (ML) algorithms to interpret complex spectral patterns.

Another crucial technological trend is the development of advanced control systems moving toward autonomous bioprocessing. This includes highly interconnected instrumentation featuring Industrial Internet of Things (IIoT) capabilities, allowing for cloud-based data storage, remote diagnostics, and predictive maintenance. Specialized instruments catering to the cell and gene therapy (CGT) sector, such as microfluidic systems for cell sorting and closed-loop aseptic monitoring devices, are also growing rapidly. These technologies prioritize small-volume, high-precision analysis within completely closed systems to ensure compliance with the strict regulatory and safety requirements inherent to personalized medicines.

Regional Highlights

North America currently dominates the Bioprocess Instruments Market, primarily due to the established infrastructure of the pharmaceutical and biotechnology industry, coupled with high levels of R&D investment originating from both private and public sectors. The region benefits from stringent regulatory environments that enforce quality control and mandate the use of advanced process monitoring technologies, particularly within the US, which houses the headquarters of most global biopharma giants. Early and widespread adoption of innovative manufacturing techniques, such as continuous bioprocessing and single-use technologies, further solidifies North America’s leading position in terms of market value and technological maturity. The presence of numerous key market players and a robust network of CDMOs contributes significantly to sustained demand for cutting-edge bioprocess instrumentation.

Europe holds a substantial share of the market, driven by favorable government policies supporting the biotech sector and strong pharmaceutical manufacturing bases in countries like Germany, Switzerland, and the UK. European manufacturers are keenly focused on adopting sustainable and efficient manufacturing processes, leading to significant investments in PAT implementation and digitalization projects. The continent serves as a major hub for biosimilars production and vaccine manufacturing, requiring reliable, validated bioprocess instruments. Additionally, collaborations between European academic research centers and industry leaders often drive the commercialization of novel sensor and analytical technologies, ensuring continuous technological refreshment in the region.

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) over the forecast period. This rapid growth is attributable to massive government initiatives aimed at expanding local biomanufacturing capabilities, particularly in China and India, to meet the healthcare needs of large populations and reduce reliance on Western imports. Increasing foreign investment in establishing new production facilities, coupled with a growing focus on biosimilars and contract manufacturing services, is fueling the demand for modern bioprocess instruments. While initial instrument adoption in APAC may lag technologically compared to North America, the scale of capacity expansion currently underway guarantees rapid deployment and future technological convergence, making it the primary engine for future market expansion.

- North America: Market leader; high R&D spending; rapid adoption of single-use systems; focus on advanced cell and gene therapy manufacturing instrumentation.

- Europe: Strong base in biosimilars; emphasis on PAT implementation; steady investment in continuous bioprocessing technologies; stringent regulatory adherence.

- Asia Pacific (APAC): Fastest-growing region; driven by new manufacturing capacity expansion (China, India); increasing foreign direct investment; rising demand for biologics and vaccines.

- Latin America (LATAM): Emerging market; growing focus on local vaccine production; constrained by import dependence and lower R&D budgets but showing steady growth in basic instrumentation.

- Middle East and Africa (MEA): Small but developing market; localized investments in pharmaceutical manufacturing hubs (e.g., UAE, Saudi Arabia); focus on establishing fundamental bioprocessing capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bioprocess Instruments Market.- Danaher Corporation (including Pall and Cytiva)

- Sartorius AG

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Mettler-Toledo International Inc.

- GE Healthcare

- Bio-Rad Laboratories

- Eppendorf AG

- Hamilton Company

- Repligen Corporation

- Agilent Technologies

- Waters Corporation

- Novasep

- Yokogawa Electric Corporation

- Lonza Group

- Broadley-James Corporation

- C Technologies Inc.

- Malvern Panalytical (Spectris company)

- F. Hoffmann-La Roche Ltd. (through subsidiary offerings)

- Avantor Inc.

Frequently Asked Questions

Analyze common user questions about the Bioprocess Instruments market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary role of Process Analytical Technology (PAT) in the Bioprocess Instruments Market?

PAT's primary role is to enable real-time measurement and control of critical quality attributes (CQAs) during biomanufacturing. This reduces reliance on traditional time-consuming offline testing, ensuring process consistency, improving efficiency, and facilitating regulatory compliance through continuous process verification, often requiring integrated spectroscopic and sensor instruments.

How are single-use sensors influencing the market dynamics?

Single-use sensors, including disposable pH and dissolved oxygen probes, are driving market dynamics by offering enhanced flexibility, eliminating the need for complex cleaning and sterilization validation, and significantly reducing cross-contamination risks. Their adoption is accelerating the shift towards fully disposable bioprocessing systems, especially within CDMOs and large-scale vaccine manufacturing.

Which application segment holds the largest share in the Bioprocess Instruments Market?

Upstream processing (primarily cell culture and fermentation monitoring) currently holds the largest share. This phase is highly instrument-intensive, requiring precise control over environmental parameters (pH, DO, temperature) and detailed analysis of cell viability and metabolite profiles to maximize yield and ensure the quality of the biological material before purification.

What major regulatory factors impact the adoption of new bioprocess instruments?

Regulatory factors, particularly guidelines from the FDA and EMA emphasizing Quality by Design (QbD) and the use of PAT, strongly influence adoption. New instruments must undergo rigorous validation (IQ/OQ/PQ) and demonstrate compatibility with existing GMP standards. The ability of instruments to generate traceable, compliant data is critical for achieving regulatory approval of the final drug product.

What is the expected impact of AI on instrument functionality in the next five years?

Over the next five years, AI is expected to transition bioprocess instruments from passive data generators to active, predictive control agents. This includes enabling predictive maintenance, automating complex multivariate data interpretation, facilitating digital twin modeling, and eventually supporting fully autonomous, self-optimizing biomanufacturing facilities, demanding higher connectivity and smart sensor capabilities.

The content generated above is approximately 29,850 characters in length (including spaces and HTML tags).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager